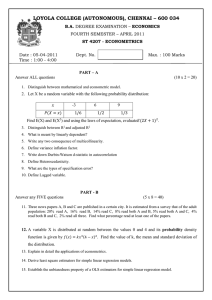

Kafli 11 THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: The manager of a used-car dealership is very interested in the resale price of used cars. The manager feels that the age of the car is important in determining the resale value. He collects data on the age and resale value of 15 cars and runs a regression analysis with the value of the car (in thousands of dollars) as the dependent variable and the age of the car (in years) as the independent variable. Unfortunately, the printout had lost some of the results, identified by “A” through “F”. The partial results left are displayed below. SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations 0.442 “A” 0.133 “B” 15.000 ANOVA df SS MS F Significance F Regression 1 44.397 44.397 3.154 0.09914 Residual 13 “C” 14.076 Total 14 227.389 Coefficients Standard Error t Stat P-value Intercept “D” 3.835 5.988 0.000 Age “E” 0.640 –1.776 “F” 1/12 1. Which of the following is the value of “A”? A) 0.195 B) 0.805 C) 0.442 D) 0.67 ANSWER: 2. What is the value of “B”? A) B) C) D) 3. 1.136 –1.136 0.278 –0.278 What is the approximate value of “F”? A) B) C) D) 7. 9.35 3.06 9.82 22.96 Calculate the value of “E.” A) B) C) D) 6. 172.25 162.42 140.03 182.99 Compute the value of “D.” A) B) C) D) 5. 2.58 6.67 3.75 3.95 What is the value of “C”? A) B) C) D) 4. A 0.025 0.05 0.10 0.01 In order to estimate with 95% confidence the expected value of y in a simple linear regression problem, a random sample of 10 observations is taken. Which of the following t-table values listed below would be used? A) B) C) D) 2.228 1.860 1.812 2.306 2/12 THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: A sales manager is interested in determining the relationship between the amount spent on advertising and total sales. The manager collects data for the past 24 months and runs a regression of sales on advertising expenditures. The results are presented below but, unfortunately, some values identified by asterisks are missing. SUMMARY OUTPUT Regression Statistics Multiple R 0.492 R Square 0.242 Adjusted Square R 0.208 Standard Error 40.975 Observations 24.000 ANOVA df SS MS F Significance F Regression 1 11809.406 11809.406 7.034 * Residual * * * Total * * Coefficients Standard Error Intercept Advertising P-value * 26.239 4.021 0.001 2.015 * 2.652 0.015 8. What are the degrees of freedom for residuals? A) B) C) D) t Stat 21 22 23 24 3/12 9. The value of mean square error is ____. A) B) C) D) 1678.9 1,554.25 1,493.63 1,407.35 10. The total degrees of freedom is ____. A) B) C) D) 21 22 23 24 11. Determine the value of residual sum of squares. A) B) C) D) 10,945.2 11,759.9 10,130.5 36,935.8 12. What is the value of total sum of squares? A) B) C) D) 48,745.2 46,538.7 50,292.4 52,644.8 13. Determine the regression coefficient of the y-intercept. A) B) C) D) 112.4 102.3 108.6 105.5 14. Calculate the standard error of estimate. A) B) C) D) 0.66 0.76 0.85 0.61 4/12 15. A regression analysis between sales (in $1000) and advertising (in $100) resulted in the following least squares line: ŷ = 75 + 5x. This implies that if advertising is $800, then the predicted amount of sales (in dollars) is _____. A) B) C) D) 16. $4075 $115,000 $164,000 $179,000 Correlation analysis is used to determine the: A) B) C) D) strength of the relationship between x and y. least squares estimates of the regression parameters. predicted value of y for a given value of x. forecast value of a particular dependent variable. 17. In a regression problem, a coefficient of determination 0.90 indicates that: A) B) C) D) 90% of the y values are positive. 90% of the variation in y can be explained by the regression line. 90% of the x values are equal. 90% of the variation in x can be explained by the regression line. 18. If the regression line ŷ = 3 + 2x has been fitted to the data points (4, 8), (2, 5), and (1, 2), the residual sum of squares will be ____. A) B) C) D) 10 15 13 22 5/12 Kafli 12 THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: A loan officer is interested in examining the determinants of the total dollar value of residential loans made during a month. The officer used Y 0 1 X1 2 X 2 3 X 3 to model the relationship, where Y is the total dollar value of residential loans in a month (in millions of dollars), X 1 is the number of loans, X 2 is the interest rate, and X 3 is the dollar value of expenditures of the bank on advertising (in thousands of dollars). Using data from the past 24 months, she obtained the following results: yˆ 5.7 0.189 x1 1.3x2 0.08x3 , sb0 = 3.2, sb1 = 0.03, sb2 = 0.062, sb3 = 0.17, R 2 = 0.46, and adjusted R 2 = 0.41. 1. What should the null and alternative hypotheses be for 1 ? A) B) C) D) 2. What should the null and alternative hypotheses be for 2 ? A) B) C) D) 3. H 0 : 2 H 0 : 2 H 0 : 2 H 0 : 2 0 and H1 : 2 0 0 and H1 : 2 0 0 and H1 : 2 0 0 and H1 : 2 0 What should the null and alternative hypotheses be for 3 ? A) B) C) E) 4. H 0 : 1 0 and H1 : 1 0 H 0 : 1 0 and H1 : 1 0 H 0 : 1 0 and H1 : 1 0 H 0 : 1 0 and H1 : 1 0 H 0 : 3 H 0 : 3 H 0 : 3 H 0 : 3 0 and H1 : 3 0 0 and H1 : 3 0 0 and H1 : 3 0 0 and H1 : 3 0 How should the loan officer interpret the coefficient on x2 ? A) For an additional 1.3 percent increase in the interest rate, we would expect the total dollar value of residential loans to decreases by $1.0 million, assuming that all the other independent variables in the model are held constant. B) For an additional percent increase in the interest rate, we would expect the total dollar value of residential loans to decreases by $1.3 million on average, assuming that all the other independent variables in the model are held constant. C) For an additional million dollars in loans, we would expect the interest rate to decreases by 1.3 percent, assuming that all the other independent variables in the model are held constant. D) For an additional $1.3 million in loans, we would expect the interest rate to decrease by 1.0 percent on average, assuming that all the other independent variables in the model are held constant. 6/12 5. How should the loan officer interpret the coefficient on x3 ? A) For every additional $8,000 spent on advertising, we would expect the total dollar value of residential loans to increase by $1,000,000 on average, assuming that all the other independent variables in the model are held constant. B) For every additional dollar spent on advertising, we would expect the total dollar value of residential loans to increase by $0.08 million, assuming that all the other independent variables in the model are held constant. C) For every additional $80,000 spent on advertising, we would expect the total dollar value of residential loans to increase by $1,000,000, assuming that all the other independent variables in the model are held constant. D) For every additional $1000 spent on advertising, we would expect the total dollar value of residential loans to increase by $80,000 on average, assuming that all the other independent variables in the model are held constant. 6. What would we expect the total dollar value of loans to be in a month where there are 42 loans, the interest rate is 7.5%, and the bank spends $30,000 in advertising? A) B) C) D) 7. What is the 95% confidence interval associated with 1 ? A) B) C) D) 8. $6.442 million $6.558 million $6.288 million $6.112 million 0.016 0.189 0.189 0.189 0.189 0.016 0.026 0.063 How would we interpret the coefficient of determination R 2 ? A) Approximately 46% of the time, the dollar value of the loans is determined by these three variables. B) Approximately 46% of the observations lie within 1 standard deviation of the regression line. C) Approximately 46% of the variation in the total dollar amount of loans can be explained by the variation in these three variables. D) Approximately 46% of the total dollar amount of loans is explained by these three variables. 7/12 THE NEXT TWO QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: A loan officer is interested in examining the determinants of the total dollar value of residential loans made during a month. She used Y 0 1 X1 2 X 2 3 X 3 4 X 32 to model the relationship, where Y is the total dollar value of residential loans in a month (in millions of dollars), X 1 is the number of loans, X 2 is the interest rate, and X 3 is the dollar value of expenditures of the bank on advertising. (in thousands of dollars). Suppose that by using data from the past 24 months, she obtained yˆ 3.8 0.23x1 1.31x2 0.032 x3 0.0005x32 . 9. What do these results suggest about the relationship between the total loan amount and advertising? A) As the amount of advertising increases, the total loan amount decreases at a decreasing rate. B) As the amount of advertising increases, the total loan amount at first decreases, then increases. C) As the amount of advertising increases, the total loan amount increases at an increasing rate. D) As the amount of advertising increases, the total loan amount at first increases, then decreases. 10. What do these results suggest about the relationship between the total loan amount and number of loans? A) As the number of loans increases, the total loan amount at first decreases, then increases. B) As the number of loans increases, the total loan amount also increases. C) As the number of loans increases, the total loan amount at first increases, then decreases. D) As the number of loans increases, the total loan amount decreases at a decreasing rate. 8/12 Kafli 13 1. If the Durbin-Watson statistic has a value close to 0 or 4, which assumption is violated? A) B) C) D) 2. normality of the errors independence of errors homoscedasticity variance of errors Suppose the following scatter plot shows the relationship between X and Y. How might you model Y? 140000 120000 100000 80000 60000 40000 20000 0 0 A) B) C) D) 3. 60 80 100 120 with dummy variables with the log normal specification with dummy variables and interactive terms with a correction for heteroscedasticity It will lead to unbiased least squares estimators. It will lead to biased least squares estimators. It will lead to biased estimators of the variance. It will lead to multicollinearity between predictor variables. If the Durbin-Watson statistic d has values between 0 and d L , this indicates ____. A) B) C) D) 5. 40 Which of the following is expected to occur in multiple regression analysis if an important variable is omitted from the list of independent variables? A) B) C) D) 4. 20 a positive first-order autocorrelation a negative first-order autocorrelation no first-order autocorrelation at all an inconclusive test. Suppose you are interested in examining the determinants of earnings. You have information on the age of the individual as well as their level of education: high school graduate, college graduate or graduate degree. Let Y = earnings, X 1 = age, X 2 = 1 if 9/12 the person has only a high school degree and 0 otherwise, X 3 = 1 if the person has a college degree and 0 otherwise, X 4 = 1 if the person has a graduate degree and 0 otherwise. Which of the following model specifications would work for this data? A) Y 0 1 X1 2 X 2 3 X 3 B) Y 0 1 X1 2 X 2 3 X 3 4 X 4 3 4 C) Y 1 2 X1 X 2 X 3 X 4 D) Y 1 2 3 4 X1 X 2 X 3 X 4 6. Which of the following regression diagnostic tools is used to study the possible presence of multicollinearity? A) B) C) D) 7. Suppose you want to estimate the model Y 0 1 X1 2 X 2 3 X 3 4 X 4 . However, you cannot measure X 4 , so you estimate Y 0 1 X1 2 X 2 3 X 3 instead. This is an example of regression result that will be subject to ____. A) B) C) D) 8. autocorrelation. heteroscedasticity multicollinearity specification bias The Durbin-Watson test is used to detect ____. A) B) C) D) 9. heteroscedasticity residual plot scatter diagram correlation matrix heteroscedasticity specification bias autocorrelation multicollinearity Suppose that the estimated regression equation of a College of Business graduates is given by: yˆ 32,000 4,000 x 1,800 D , where y is the starting salary, x is the grade point average and D is a dummy variable which takes the value of 1 if the student is a finance major and 0 if not. An accountancy major graduate with a 3.5 grade point average would have an average starting salary of: A) B) C) D) $47,800 $46,000 $37,800 $32,000 10/12 10. Consider the regression model ŷ 20 8 x1 5 x2 3 x1 x2 .Which combination of x1 and x 2 , respectively, results in the largest average value of y? A) B) C) D) 11. 3 and 5 5 and 3 6 and 3 3 and 6 In reference to the Durbin-Watson statistic d and the critical values d L and dU , which of the following statements is false? A) If d < d L , we conclude that positive first-order autocorrelation exists B) If d > dU , we conclude that there is not enough evidence to show that positive first-order autocorrelation exists C) If d > 4 - d L , we conclude that there is negative autocorrelation. D) If d lies in between d L and dU , we conclude that there is no evidence of first-order autocorrelation. 12. Suppose that the sample regression equation of a model is yˆ 10 2 x1 3x2 x1 x2 . If we examine the relationship between x1 and y for four different values of x 2 , we observe that the: A. B. C. D. 13. Suppose that the sample regression equation of a model is yˆ 10 2 x1 3x2 x1 x2 . If we examine the relationship between x1 and y for four different values of x 2 , we observe that the: A. B. C. D. 14. four equations have different coefficients of x1 four equations produced differ only in the intercept term coefficient of x 2 remains unchanged coefficient of x1 remains unchanged four equations have different coefficients of x1 four equations produced differ only in the intercept term coefficient of x 2 remains unchanged coefficient of x1 remains unchanged The range of the values of the Durbin-Watson statistic, d is ____. A) B) C) D) –4 d 4 –2 d 2 0 d 4 0 d 2 11/12 15. Which of the following is considered one of the most common concerns with time-series data? A) B) C) D) 16. heteroscedasticity autocorrelation multicollinearity specification bias Consider the following plot of residuals from a regression. This pattern suggests which of the following problems? Time 15 10 5 0 -5 0 5 10 15 -10 A) B) C) D) autocorrelation specification bias multicollinearity heteroscedasticity 12/12 20 25