Federal State Educational Institution

state-funded institution of higher education

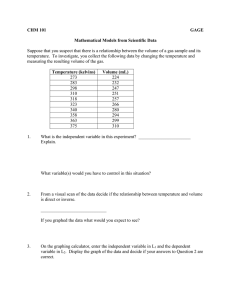

"FINANCIAL UNIVERSITY AT

GOVERNMENT OF THE RUSSIAN FEDERATION"

(Financial University)

Department of Mathematics

Viktor A. Byvshev

Mathematical modeling and quantitative research methods in management

Syllabus

For students studying under the

in the field of training 38.04.02 "Management",

Orientation of master’s degree programs:

"Corporate Governance",

Management and International Business"

1. Name of the discipline - Mathematical modeling and quantitative research

methods in management.

2. Mapping of learning outcomes (list of competences), with the relevant indicators described and subject learning outcomes indicated

The section lists the graduates’ coded competencies that are to be developed during

the learning process, indicators that show their development (generalized descriptions of specific actions performed by the graduate that clarify and reveal the competence content), learning outcomes (knowledge, skills) with indicators of competence development (in the form of a table):

Table 1

Competence

code

PKN-2

Competence

Ability toapply modern methods and

techniques of data

collection and analysis, as well as identification and forecasting of the main socio-economic objects

of management.

Learning outcomes (skills2,

Competence development in- and knowledge) and indicadicators1

tors that show competence

development

1. Develops methods, techKnow modernmethods and

niques and tools for analyzing tools for analyzing and preand predicting trends and so- dicting trends in time series of

cio-economic indicators.

socio-economic indicators.

Be able to build econometric

models of time series of socio-economic indicators.

2.They use tools for diagnos- Know the tools for diagnosing changes in the state of

ingя the state of management

management objectsat an

objectsя.

early stage in order to predict Be able to choose tools forя

the results of their activities

predicting the performance of

and prevent negative consemanagement objectsя.

quences.

3.Has the ability to analyze

Know the tools for predicting

the problems of the financial- theя financial- and economand economic state of organi- icя state of an organization.

zations and predict their con- Be able to build models for

sequences.

predicting the financial- and

economic state of an organization.

1

To be filled in when the updated Financial University educational standards and federal state educational standards of higher education

“3++” are implemented.

2 Skills are described when the Financial University educational standards of the 1st generation and federal state educational standards

of higher education “3+” are implemented.

2

UK-6

Ability tomanage a

project at all stages

of its life cycle.

4.Intelligentеinformation

technologies are used to improve the efficiency of

knowledge management.

Know intelligent information

technologies for predicting

the state of an organization.

Уметь выбирать Be able to

choose the application software depending on the tasks

being solved.ное программное обеспечение в зависимости от решаемых задач.

1.Applies basicproject planning tools проекта; in particular, forms a hierarchical structure of work, project schedule,

necessary resources, cost and

budget, plans procurement,

communications, project quality and risk management, and

more.

Know the basic mathematical

programming tools, used in

project planning.

Be able to use software products for project planning and

project risk management.

2.Manage project executors,

apply tools for monitoring,

maintainingя and managing

project changes, implement

measures to provide resources, distribute information, prepareе reports,

monitor and manage project

timing, cost, quality and risks.

Know the tools for preparing

project implementation reportsреализацииproject implementation reports.

Be able to apply tools for

preparing reports on реализации project implementation.

3. Place of the subject in the curriculum

Discipline "Mathematical modeling and quantitative research methods in management" refers to the third module B. 1. 1. 3 of disciplines that are invariant for the

direction of training, reflecting the specifics of the University. Discipline "Mathematical modeling and quantitative research methods in management" is based on the

knowledge gained in the framework of the basic disciplines:"Economic Theory and

Business Management", "Mathematics", "Economic Statistics", "Microeconomics",

"Macroeconomics","Strategic Financial Management".

4. Workload in credits and academic hours, with class work (lectures and

seminars) and self-study indicated

3

The data are presented in the form of the table 2.

Table 2

Total

(in credits and

hours)

3/108

32

8

24

76

Control work

Exam

Type of work

Overall workload

Class work

Lectures

Seminars, practicals

Self-study

Formative assessment

Summative assessment

Module 3

(in hours)

108

32

8

24

76

Control work

Exam

5. Subject content (with the thematic components indicated)

1. Mathematical modeling method in management, economics, and finance.

Financialand economic object and its mathematical model. Exogenous and endogenous variables of the economic and mathematicalой model. Descriptive and

optimization models. Optimizationproblems were presented in the form of linear

and nonlinear programming problems. The Lagrange method. Structural and reduced form of the model. Limit values and elasticity of endogenous variables of

the model.

2. Leontiev's input-output model for managing the production sector of the national economy.

CFinal, intermediate and final products. Technological coefficients. Cross-industry delivery model. Structural and reduced form of the Leontiev model. Leontiev's animator. Identity and cross-industry balance sheet table.

3. Game-theoretic models making managerial decisions.

Participants in the game (conflict) and their strategies. Situation and outcome of

the game. A zero-sum game. Payment matrix of the game. Normal form of the

game. Axiom of player behavior and algorithm for choosing their optimal strategies. The saddle point game and its solution. Non-zero-sum game and Nash equilibrium. Playing with nature in a situation of uncertainty and risk.

4. Regression models of financial-and economic objects and their construction scheme.

4

Regression model of a financial and economic object and its construction

scheme. Linear multiple regression model (basic model) and modelb as a system of simultaneous equations. Evaluation ofthe linearоmodel of multiple aggressions by the least squares method. Onthe estimation of a model as a system

of linear simultaneous equations by the two-step least squares method.

Forecasting based on the estimated regression model.

5. Structural models of time series and their useе for forecasting financial-and

economic indicators of management objects.

Time series and the structure of its levels. Additive and multiplicative time series

models. Models of t-rendsofthe oth and seasonal component. Estimationof the

structuralой model of a time series by the least squares method. Forecasting of

financial - and economic indicators of management objects using structural time

series models.

6. List of educational and methodological support for independent work of students in the discipline

6.1. List of questions assigned for independent mastering of the discipline,

forms of extracurricular independent work

Table 3

Itemized subject

content

Questions the students should answer within

the self-study process

Types of outof-class activities

Work with edTopic 1. Mathemati- 1. The object and itsmathematical model.

cal modeling method 2. Specification of the model, itsexogenous and en- ucational literature and disin management, eco- dogenous variables.

cuss questions

3. Optimization and descriptive models.

nomics and finance.

on the topic of

4. Structural and reduced form of the model.

Descriptive and opti- 5. Limit values of endogenous variables of the the

lesson.

Performing

mization models.

model and the rule for calculating them.

Limit values and elas- 6. Elasticity of endogenous model variablesли and home work on

the topic of the

ticity of endogenous a rule for calculating elasticity values.

lesson.

7. Lagrange method of transformation of the optivariables of the

mization model to the reduced form.

model.

8. The economic meaning of Lagrange multipliers.

Topic 2. Leontiev's input-output model for

managing the production sector of the

1. Gross, intermediate and final products of the industry.

2. Technological coefficients. 3. Modelof cross-industry deliveries. 4. Structural and reduced form of

5

Work with educational literature and discuss questions

on the topic of

economy.

Calcula- the Leontiev model. Leontiev's animator.

tions based on the Le- 5. Identity of intersectoral balance.

ontiev model for a 6. Cross-industry balance sheet table.

fragment of the manufacturing sector of

the Russian economy.

the lesson.

Performing

homework on

the topic of the

lesson.

Topic 3. Game-theoretic models of managerial decision-making.

1. Participants in the game (conflict) and their strategies.

2. Situation and outcome of the game.

3. A zero-sum game.

4. Payment matrix of the game and нnormal form

of the game.

5. Axiom of player behavior and algorithm for

choosing their optimal strategies.

6. The saddle point game and its solution.

7. Playing with nature in a situation of uncertainty

and risk.

Work with educational literature and discuss questions

on the topic of

the lesson.

Performing

homework on

the topic of the

lesson.

Topic 4. Regression

models of financial

and economic objects and their construction scheme.

1. Regression model of a financial and economic

object and its construction scheme.

2. Linear multiple regression model (basic model)

3. Model in the form of a system of simultaneous

equations.

4. Estimation of the linear model of multiple aggression by the least squares method.

5. Estimation of the model as a system of linear

simultaneous equations using the two-step least

squares method.

6.Forecasting based on the estimated regression

model.

1. Time series and the structure of its levels.

2. Plotting a time series.

3. Structuraladditive and multiplicative modelsь of

time series.

4. Models of the trend and seasonal components. 5.

Estimation of the structural model of a time series

by the least squares method.

6. Forecasting of financial and economic indicators

of management objects using structural time series

models.

Work with educational literature and discuss questions

on the topic of

the lesson.

Performing

homework on

the topic of the

lesson.

Topic 5. Structural

models of time series and their use

for forecasting financial and economic indicators of

management objects.

6

Work with the

educationalliterature

and

discuss questions on the

topic of the lesson.

Performing

home work on

the topic of the

lesson.

6.2. List of questions, tasks, and topics to prepare for the current control

1. Financialand economic object and itsmathematical model.

2. Exogenous and endogenous variables of the mathematical model.

3. Optimization and descriptive models.

4. Example of a model in the form of a linear programming problem.

5. Example of a model in the form of a nonlinear programming problem.

6. Structural and reduced form of the model.

7. Limit values of endogenous variables of the model and their calculation rule.

8. Elasticity of endogenous variables of the model and the rule for calculating elasticity values.

9. The economic meaning of Lagrange multipliers.

10. Leontiev's task is to manage the production sector of the national economy.

Gross, intermediate and final products of the industry.

11. Technological coefficients.

12. Cross-industry delivery model.

13. Structural form of the Leontiev model.

14. Thegiven form of the Leontiev model. The Leontiev multiplier and the economic

meaning of its elements.

15. Identity and cross-industry balance sheet table.

16. The concept of a game (conflict),in private players of the game and their strategies.

17. Situation and outcome of the game.

18. A zero-sum game.

19. Payment matrix of the game and the normal form of the game.

20. Axiom of player behavior and algorithm for choosing their optimal strategies.

21. The saddle point game and its solution.

22. Non-zero-sum game and Nash equilibrium.

23. Playing with nature in a situation of uncertainty.

24. Playing with nature in a risky situation.

25. Regression model of a financial and economic object and its construction

scheme.

26. Linear multiple regression model (basic model).

7

27.Estimation of a linear modelusing the least squares regression method.

28. Investigation of the properties of the residues of the linear regression model.

29. Checking the significance of the explanatory variables of the evaluated model.

30. Quality characteristics of the linear model of multiple regression.

31. Forecasting based on the estimated regression model.

31. Time series and the structure of its levels.

32. Plotting a time series.

33. Structural additive and multiplicative time series models.

34. Models of the trend component.

35. Seasonal component model. The concept of fictitious variables.

36. Estimation of the structural model of a time series by the least squares method.

37. Forecasting of financial and economic indicators of management objects using

structural time series models.

6.3. Examples of control work tasks

Example 1. The structural form of the Baumol-Tobin model for managing a firm's

current account is as follows:

𝑟

𝜑 = 𝑐 ∙ 𝑛 + ∙ 𝑚 → 𝑚𝑖𝑛

2

{

𝑚∙𝑛=𝑀

𝑚 ≥ 0, 𝑛 ≥ 0.

Here 𝜑 - total costs of the company for the maintenance of accounts, 𝑚 - value of

the balance of monetary funds on the account after its replenishment, 𝑛 - number

of refills account in the year, 𝑀 - required level of cash funds in the year (exogenous

variable), 𝑐 - value transaction costs in the replenishing of account (exogenous variable), r - norm alternative cost (exogenous variable).

It is required to determine the level of optimal costs of the company at c=0.1,

M=520, r=0.06.

Example 2. Using the data from Table 4, plot the quarterly levels of Russia's real

GDP (billion rubles in 2008 prices). Like the component is present in quarterly levels

Russia’s GDP? Make a specification of the structural model of this time series and

evaluate this model using the least squares method.

See Table 4. Quarterly levels of Russian GDP

Year

1995

I quarter

5355,0

II quarter

5523,1

8

III quarter

6030,0

IV quarter

6000,2

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

5235,1

5212,0

5134,7

5041,7

5617,6

5880,8

6104,2

6567,4

7042,9

7435,6

7978,3

8622,1

9413,2

8547,0

8894,9

9186,1

9620,6

9690,9

9745,8

9527,5

9275,3

9628,8

9758,0

5333,8

5289,7

5237,6

5402,6

5955,4

6256,1

6531,8

7052,3

7618,6

8076,7

8729,5

9481,8

10231,0

9090,1

9544,6

9859,0

10271,4

10390,6

10464,6

9978,4

9921,5

10490,3

10580,9

5698,1

5860,1

5343,0

5955,5

6583,6

6980,5

7289,7

7742,7

8309,8

8805,1

9526,3

10304,9

10965,6

10020,5

10403,9

10930,5

11265,6

11407,0

11504,7

10810,7

10763,5

11261,0

11281,8

5814,7

6024,9

5474,9

6136,3

6643,4

6945,0

7373,2

7942,6

8436,6

9093,0

9900,5

10809,9

10667,0

10391,0

10918,8

11482,2

11712,0

11956,0

12007,5

11284,3

11562,6

11578,9

Example 3. A farmer (player A) can sow one of three crops on his plot of land in

the current year: A1 - oats, A2 - rye, A3 – rice. The yield of each of these crops

depends on the weather (player B – nature), which can be in one of three states: B1

- dry, B2 - normal, B3 – rainy.

Average grain prices and their yield levels (yij) for each weather condition are

known and given in the following table.

9

Is required: choose the optimal sowing strategy of the farmer, assuming that there

is no additional information about possible weather conditions.

A note. A farmer's sowing strategy is considered optimal if it brings the farmer the

highest income in a certain sense.

7. Mandatory and optional reading list

7.1. Mandatory

1. Mathematical modeling and quantitative methods of research in management: a

textbook / M. Yu. Mikhaleva.М. Ю. Mikhaleva, I. V. Orlova Street. - Moscow: University textbook: INFRA-M, 2018 – - EBS Znanium.com. - URL: http://znanium.com/catalog/product/948489 (accessed: 05.11.2019). - Text: electronic.

2. Mikhaleva M. Yu., Orlova I. V. Practicum on the discipline "Mathematical modeling and quantitative methods of research in management". - Moscow: Financial

University, Departmentof Data Analysis, Decision-making and Financial Technologies, 2018. - 213 p. - IOP of the Financial University. - URL: https://portal.fa.ru/Files/Data/fe05984c-32da-4b53-9efc-f6fc1ec51bb1/Pract_Matmodelir_mMen_18.pdf (дата обращения: 05.11.2019). - Text: electronic.

3. Byvshev V. A., Mikhaleva M. Yu. Practicum on the discipline "Modeling of microeconomic processes", Moscow: Financial University, Department of Data Analysis, Decision-making and Financial Technologies, 2019, 51 p.

4. Babeshko L. O., Beach M. G., Orlova I. V. Econometrics and econometric modeling: Moscow, University textbook: INFRA-M, 2018, 385 p –

10

5. Byvshev V. A. Workshop Econometrics in R: Time Series Models: Collection of

exercises and tasks for independent work of students in the disciplines "Econometrics", "Econometric research", "Applied methods and models of regression analysis"

for students studying in the areas of training 01.03.02. "Applied Mathematics and

Computer Science" (bachelor's degree program), 38.03.01 "Economics" (master's

degree program), 01.04.02 "Applied Mathematics and Computer Science" (master's

degree program). Moscow: Financial University, Department of Data Analysis, Decision making and Financial Technologies, 2019. - 110 p.

7.2. Optional

1. Fundamentals of mathematical modeling of socio-economic processes. Practicum

/ M. G. Beach, I. V. Orlova, G. V. Ross [et al.]. – MOSCOW: Kompany KnoRus,

2019. – 292 p. – ISBN 9785406070345.

8. List of IT resources, incl. the list of software, information and reference systems (as appropriate)

8. 1. Software:

1. Windows OS.

2. Microsoft Office software.

8.2. Databases and information and reference systems

1. Information and educational portal of the Financial University http://portal.ufrf.ru/.

2. Digital Resources Library of the Financial University: http://elib.fa.ru/

8.3. Certified software/hardware used for data protection

ESET Endpoint Security antivirus software.

11