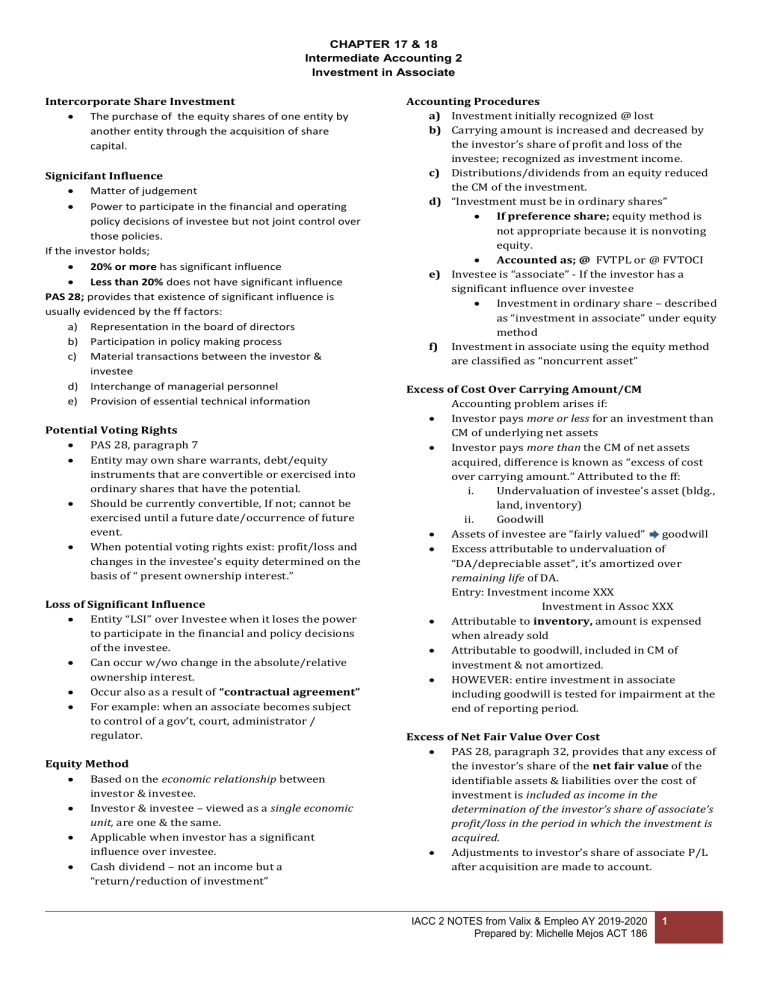

CHAPTER 17 & 18 Intermediate Accounting 2 Investment in Associate Intercorporate Share Investment The purchase of the equity shares of one entity by another entity through the acquisition of share capital. Signicifant Influence Matter of judgement Power to participate in the financial and operating policy decisions of investee but not joint control over those policies. If the investor holds; 20% or more has significant influence Less than 20% does not have significant influence PAS 28; provides that existence of significant influence is usually evidenced by the ff factors: a) Representation in the board of directors b) Participation in policy making process c) Material transactions between the investor & investee d) Interchange of managerial personnel e) Provision of essential technical information Potential Voting Rights PAS 28, paragraph 7 Entity may own share warrants, debt/equity instruments that are convertible or exercised into ordinary shares that have the potential. Should be currently convertible, If not; cannot be exercised until a future date/occurrence of future event. When potential voting rights exist: profit/loss and changes in the investee’s equity determined on the basis of “ present ownership interest.” Loss of Significant Influence Entity “LSI” over Investee when it loses the power to participate in the financial and policy decisions of the investee. Can occur w/wo change in the absolute/relative ownership interest. Occur also as a result of “contractual agreement” For example: when an associate becomes subject to control of a gov’t, court, administrator / regulator. Equity Method Based on the economic relationship between investor & investee. Investor & investee – viewed as a single economic unit, are one & the same. Applicable when investor has a significant influence over investee. Cash dividend – not an income but a “return/reduction of investment” Accounting Procedures a) Investment initially recognized @ lost b) Carrying amount is increased and decreased by the investor’s share of profit and loss of the investee; recognized as investment income. c) Distributions/dividends from an equity reduced the CM of the investment. d) “Investment must be in ordinary shares” If preference share; equity method is not appropriate because it is nonvoting equity. Accounted as; @ FVTPL or @ FVTOCI e) Investee is “associate” - If the investor has a significant influence over investee Investment in ordinary share – described as “investment in associate” under equity method f) Investment in associate using the equity method are classified as “noncurrent asset” Excess of Cost Over Carrying Amount/CM Accounting problem arises if: Investor pays more or less for an investment than CM of underlying net assets Investor pays more than the CM of net assets acquired, difference is known as “excess of cost over carrying amount.” Attributed to the ff: i. Undervaluation of investee’s asset (bldg., land, inventory) ii. Goodwill Assets of investee are “fairly valued” goodwill Excess attributable to undervaluation of “DA/depreciable asset”, it’s amortized over remaining life of DA. Entry: Investment income XXX Investment in Assoc XXX Attributable to inventory, amount is expensed when already sold Attributable to goodwill, included in CM of investment & not amortized. HOWEVER: entire investment in associate including goodwill is tested for impairment at the end of reporting period. Excess of Net Fair Value Over Cost PAS 28, paragraph 32, provides that any excess of the investor’s share of the net fair value of the identifiable assets & liabilities over the cost of investment is included as income in the determination of the investor’s share of associate’s profit/loss in the period in which the investment is acquired. Adjustments to investor’s share of associate P/L after acquisition are made to account. IACC 2 NOTES from Valix & Empleo AY 2019-2020 Prepared by: Michelle Mejos ACT 186 1 CHAPTER 17 & 18 Intermediate Accounting 2 Investment in Associate Journal entries 1. To record investment: Investment in associate XXX Cash XXX 2. To record the share in net income: Investment in associate XXX Investment income XXX 3. To record the share in cash dividend Cash XXX Investment in associate XXX 4. To record amortization of excess attributable to the equipment: Investment income XXX Investment in associate XXX 5. To record amortization of excess attributable to inventory: Investment income XXX Investment in associate XXX Excess is fully “expensed” because all the inventory was already sold during the year. 6. To record “excess in net fair value” as investment income: Investment in associate XXX Investment income XXX Investee with Heavy Losses PAS 28, paragraph 38, if an investor’s share of losses of an associate equals or exceeds the CM of an investment, investor discontinues recognizing its share of further losses. Investment is reported at nil/zero value CM includes other long-term interest (long-term receivables, loans & advances, investment in preference shares.) If associate reports income; investor resumes including its share of income equals the share of losses not recognized. Loss to be recognized cannot exceed the CM of investment reduced to zero. ii. Present value expected to arise from dividends to be received from the investment and ultimate disposal. Both methods give the same result. PAS 28, paragraph 42, goodwill is not separately recognized from the investment amount, impairment loss recognized is applied to the investment as a whole. Investee with Preference Share When an associate has outstanding; Cumulative preference shares – investor compute its share of earnings/losses after deducting the preference dividends, whether/not such dividends are declared Noncumulative PS – investor compute its share of earnings after deducting the preference dividends only when declared. Other Changes in Equity Arising from revaluation of PPE and foreign exchange translation differences. Journal entries: 1. Share in net income: Investment in associate XXX Investment income XXX 2. Share in dividend paid: Cash XXX Investment in associate XXX 3. Share in Revaluation surplus: Investment in Associate XXX Revaluation Surplus – investee X Impairment Loss PAS 28, paragraph 40, requires that an impairment loss shall be recognized whenever the carrying amount of the investment in associate exceeds recoverable amount. Recoverable amount – measured as the higher between fair value less cost of disposal and value in use. Assessed for each individual associate. Value in use – the present value of estimated future cash flows expected to arise from the continuing use of an asset and from its ultimate disposal. i. Present value expected to be generated by investee, (cash flows from operations & proceeds on the ultimate disposal of investments) IACC 2 NOTES from Valix & Empleo AY 2019-2020 Prepared by: Michelle Mejos ACT 186 2