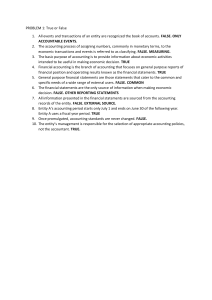

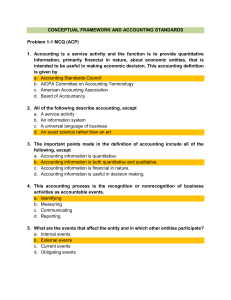

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS & MANAGEMENT 1 Overview of Accounting (Accounting Concepts and Principles) OBJECTIVES At the end of the lesson, students should be able to: 1.Define accounting and state its basic purpose 2. Explain the basic concepts applied in accounting SCENARIO ANALYSIS Assume we are looking into two companies- Company A and Company B. Suppose you have PHP 100,000 and are planning to invest your money and receive annual returns from share in profits. In which company would you invest? (Cite the possible basis in making the investment decision) DEFINITION OF ACCOUNTING 01 Accounting Standards Council (ASC) 02 American Institute of Certified Public Accountant (AICPA) Accounting is the art of recording, classifying and summarizing in a significant manner in terms of money, transactions and events which are in part at least of a financial character and interpreting the results thereof. 03 Accounting is a service activity. The accounting function is to provide quantitative information, primarily financial in nature, about economic entities, that is intended to be useful in making economic decisions. American Accounting Association (AAA) Accounting is the process of identifying, measuring and communicating economic information to permit informed judgment and decision by users of the information. COMPONENTS OF ACCOUNTING Identifying • analytical component • recognition or nonrecognition of business activities as “accountable events or transactions” -accountable if it has an effect to the assets, liabilities, equity, income or expenses of an entity TYPES OF EVENTS OR TRANSACTIONS External transactions- involves another entity a. Exchange (reciprocal transfer) b. Non-reciprocal transfer ( “one way” transaction) c. External event other than transfer Internal transactions - involves the entity only a.Production b.Casualty Measuring • technical component • assigning of peso amounts to the accountable economic transactions or events • Historical cost - most common measure of financial transactions • financial statements are said to be prepared using a MIXTURE OF COSTS AND VALUES -COSTS - historical costs and current costs - VALUES- other measurement basis (realizable value, present value) • financial statements are said to be a MIXTURE OF FACT AND OPINION -FACT- unaffected by estimates -OPINION - affected by estimates Communicating • Formal component • process of transforming economic data into useful accounting information (accounting reports) ASPECTS INVOLVE IN COMMUNICATING PROCESS 1. Recording/ Journalizing - committing into writing identified and measured accountable events in the journal through journal entries 2. Classifying- accomplished by posting to the ledger similar and interrelated items 3. Summarizing- preparation of financial statements and other accounting reports Overall Objective of Accounting t o p ro v i d e q u a n t i ta t i ve f i n a n c i a l i n fo r m a t i o n a b o u t a b u s i n e s s that is useful in making economic decisions. Types of Accounting Information 1. General purpose accounting information - designed to meet the common needs of most statement users -provided under financial accounting - governed by Generally Accepted Accounting Principles (GAAP) 2. Special purpose accounting information - designed to meet the specific needs of particular statement users - provided under management accounting ACCOUNTING AS a body of knowledge which has been systematically gathered, classified and organized identifies and measures economic activities, processes information into financial reports and communicate these reports to decision makers Social Science Practical Art requires the use of creative skills and judgment (Creative thinking & critical thinking) Information System Language of business fundamental to the communication of financial information Accounting Concepts refer to the principles upon which the process of accounting is based 1. Going concern - entity does not expect to end its operations in the foreseeable future 2. Accounting entity/Separate entity/Business entity concept/Entity concept - the entity is viewed separately from its owners 3. Time period/Periodicity/Accounting Period - the life of the entity is divided into series of reporting periods - accounting period is usually 12 months and may either be a calendar year or a fiscal year period 4. Stable Monetary Unit/Monetary unit assumption - assets, liabilities, equity, income and expenses are stated in terms of a common unit of measure (Philippine peso) - the purchasing power of the peso is regarded as stable or constant and that its instability is insignificant and therefore ignored 5. Double-entry system - each accountable event is recorded in two parts - debit and credit 6. Materiality concept - information is material if its omission or misstatement could influence economic decisions - matter of professional judgment and is based on the size and nature of an item being judged - also known as doctrine of convenience 7. Cost-benefit/Cost constraint/Reasonable assurance 8. Accrual basis of accounting - the effects of transactions and other events are recognized when they occur ( and not as cash is received or paid) and are recorded in the accounting records and reported in the FS of the periods to which they relate 9. Historical cost concept - value of an asset is determined on the basis of acquisition cost 10. Full disclosure principle - requires that all relevant information that would affect the user’s understanding and assessment of the accounting entity be disclosed in the financial statements 11. Consistency concept - financial statements are prepared on the basis of accounting principles that are applied consistently from one period to the next - changes in accounting policies are made only when required or permitted by the PFRS or when the change results to more relevant and reliable information 12. Matching/Association of cause and effect - costs are recognized as expense when the related revenue is recognized 13. Prudence/Conservatism -the use of caution when making estimates under conditions of uncertainty, such that assets or income are not overstated and liabilities or expenses are not understated 1. All of the following describe accounting, except A.a service activity B. an information system C. A universal language of business D. An exact science rather than an art ANSWER: D. An exact science rather than an art 2. This accounting process is the recognition or nonrecognition of business activities as accountable events A. Identifying ANSWER: A. Identifying B. Measuring C. Communicating D. Reporting 3.The events that affect the entity and in which other entities participate are known as A.Internal events ANSWER: B. External events B. External events C. Current events D. Obligating events 4.Which of the following statements is incorrect in relation to accountable event? A.An event is accountable when it has an effect on asset, liability or equity B.The subject matter of accounting is the measurement of economic resources and obligations C.Only economic activities are emphasized and recognized in accounting D.Sociological and psychological matters are quantifiable ANSWER: D.Sociological and psychological matters are quantifiable 5.Which accounting concept states that omitting or misstating this information could influence users of the financial statements? A. Consistency concept B. Accrual concept C. Materiality concept D. Going concern concept ANSWER: C. Materiality concept 6.Which of the following accounting concepts means that similar items should receive a similar accounting treatment? A.Going concern B. Accrual C. Prudence D. Consistency ANSWER: D. Consistency 7.Assets are usually valued under which basis? A.Replacement cost B. Historical cost C. Net realizable value D. Fair market value ANSWER: B. Historical cost 8. What is the only underlying assumption mentioned in the Conceptual Framework for Financial Reporting? A.Going concern B. Accounting entity C. Time period D. Monetary unit ANSWER: A.Going concern 9.Which basic assumption may not be followed when an entity in bankruptcy reports financial results? A.Economic entity B. Going concern C. Time period ANSWER: B. Going concern D.Monetary unit 10.Which underlying assumption serves as the basis for preparing financial statements at regular arbitrary or artificial points in time? A.Accounting entity B. Going concern C. Accounting period D. Stable monetary unit ANSWER: C. Accounting period “ THANK YOU ”