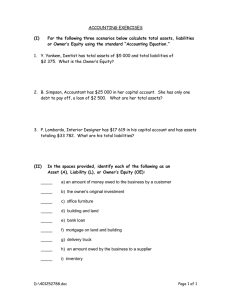

CH 9 練習題 24. The balance sheet for Gotbucks Bank, Inc. (GBI), is presented below ($ millions): (duration 請計算至小數點以下第四位;金額請計算至元,請勿回答以百萬元為單 位) Assets Cash Federal funds Loans (floating) Loans (fixed) Total assets Liabilities and Equity Core deposits $20 Federal funds 50 Euro CDs 130 Equity 20 Total liabilities and equity $220 $30 20 105 65 $220 Notes to the balance sheet: The fed funds rate is 8.5 percent, the floating loan rate is LIBOR (London Interbank Offered Rate) + 4 percent, and currently LIBOR is 11 percent. Fixed-rate loans have four-year maturities, are priced at par, and pay 12 percent semiannual interest. The principal is repaid at maturity. Core deposits are fixed rate for two years at 8 percent paid annually. The principal is repaid at maturity. Euro CDs currently yield 9 percent. a. What is the duration of the fixed-rate loan portfolio of Gotbucks Bank? Five-year Loan (values in millions of $s) Par value = $65 Coupon rate = 12% R = 12% Maturity = 4 years t CFt DFt CFt x DFt Annual payments 1 3.9 1.06 CFt x DFt x t 3.679245 1.839622642 2 3.9 1.1236 3.470986 3.470986116 3 3.9 1.191016 3.274515 4.911772806 4 3.9 1.262477 3.089165 6.178330573 5 3.9 1.338226 2.914307 7.285767185 6 3.9 1.418519 2.749346 8.248038323 7 3.9 1.50363 2.593723 9.078029601 8 68.9 1.593848 43.22871 172.9148495 65 213.9273968 Duration = $213.9273968/$65.000 = 3.2912 1 3.29119072 b. If the duration of the floating-rate loans and fed funds is 0.36 year, what is the duration of GBI’s assets? DA = [$30(0) + $20(0.36) + $105(0.36) + $65(3.2912)]/$220 = 258.928/220 = 1.1769 years c. What is the duration of the core deposits if they are priced at par? Two-year Core Deposits (values in millions of $s) Par value = $20 Coupon rate = 8% Annual payments R = 8% Maturity = 2 years t CFt DFt CFt x DFt CFt x DFt x t 1 1.6 0.9259 1.481 1.481 2 21.6 0.8573 18.519 37.037 20.000 38.519 Duration = $38.519/$20.000 = 1.9259 d. If the duration of the Euro CDs and fed funds liabilities is 0.401 year, what is the duration of GBI’s liabilities? DL = [$20(1.9259) + $50(0.401) + $130(0.401)]/$200 = 0.5535 years e. What is GBI’s duration gap? What is its interest rate risk exposure? GBI’s leveraged adjusted duration gap is: 1.1769 - 200/220 x (0.5535) = 0.6737 years Since GBI’s duration gap is positive, an increase in interest rates will lead to a decrease in the market value of equity. f. What is the impact on the market value of equity if the relative change in all interest rates is an increase of 1 percent (100 basis points)? Note that the relative change in interest rates is ∆R/(1+R) = 0.01. For a 1 percent increase, the change in equity value is: ΔE = -0.6737 x $220,000,000 x (0.01) = -$1,482,140 g. What is the impact on the market value of equity if the relative change in all interest rates is a decrease of 0.5 percent (-50 basis points)? 2 For a 0.5 percent decrease, the change in equity value is: ΔE = -0.6737 x $220,000,000 x (-0.005) = $741,070 h. What would the duration of its assets need to change to get DGAP equal to zero? What would the duration of its liabilities need to change to get DGAP equal to zero? Immunization requires the bank to have a leverage adjusted duration gap of 0. Therefore, GBI could reduce the duration of its assets to 0.5032 (0.5535 x 200/220) years by using more fed funds and floating rate loans. Or GBI could increase the duration of its liabilities to 1.2946 (1.1769 x 220/200) years. 26. The following balance sheet information is available (amounts in thousands of dollars and duration in years) for a financial institution: (duration 請計算至小數點以下第四 位;金額請計算至千元) Amount $90 55 180 2,724 2,092 242 715 T-bills T-notes T-bonds Loans Deposits Federal funds Equity Duration 0.50 0.90 x 7.00 1.00 0.01 Treasury bonds are five-year maturities paying 6 percent annually and selling at par. a. What is the duration of the T-bond portfolio? 4.4651 Five-year Treasury Bond Par value = $176 Coupon rate = 6% Semiannual payments R = 6% Maturity = 5 years t CFt DFt CFt x DFt CFt x DFt x t 1 10.8 1.06 10.18868 10.18867925 2 10.8 1.1236 9.611962 19.2239231 3 10.8 1.191016 9.067888 27.20366477 4 10.8 1.262477 8.554612 34.21844625 5 190.8 1.338226 142.5769 712.8842969 3 180 803.7190103 4.46510561 Duration = $803.7190103/$180.00 = 4.4651 b. What is the average duration of all the assets? [(0.5)($90) + (0.9)($55) + (4.4651)($180) + (7)($2,724)]/$3,049 = 6.5484years c. What is the average duration of all the liabilities? [(1)($2,092) + (0.01)($242)]/$2,334 = 0.8974 years d. What is the leverage adjusted duration gap? What is the interest rate risk exposure? DGAP = DA - kDL = 6.5484 - ($2,334/$3,049)(0.8974) = 5.8614 years The duration gap is positive, indicating that an increase in interest rates will lead to a decrease in the market value of equity. e. What is the forecasted impact on the market value of equity caused by a relative upward shift in the entire yield curve of 0.5 percent [i.e., ∆R/(1+R) = 0.0050]? The market value of the equity will change by: ΔE = -DGAP x A x ΔR/(1 + R) = -5.8614 x $3,049 x (0.0050) = -$89.3570 f. If the yield curve shifts downward by 0.25 percent [i.e., ∆R/(1+R) = -0.0025], what is the forecasted impact on the market value of equity? The change in the value of equity is ΔMVE = -5.8614 x $3,049 x (-0.0025) = $44.6785 g. What variables are available to the financial institution to immunize the balance sheet? How much would each variable need to change to get DGAP equal to 0? Immunization requires the bank to have a leverage adjusted duration gap of 0. Therefore, the FI could reduce the duration of its assets to 0.6870 years by using more T-bills and floating rate loans. Or, the FI could try to increase the duration of its deposits possibly by using fixedrate CDs with a maturity of 3 or 4 years. Finally, the FI could use a combination of reducing asset duration and increasing liability duration in such a manner that DGAP is 0. This 4 duration gap of 5.8614 years is quite large and it is not likely that the FI will be able to reduce it to zero by using only balance sheet adjustments. For example, even if the FI moved all of its loans into T-bills, the duration of the assets still would exceed the duration of the liabilities after adjusting for leverage. This adjustment in asset mix would imply foregoing a large yield advantage from the loan portfolio relative to the T-bill yields in most economic environments. CH 10 練習題 23. MNO Inc., a publicly traded manufacturing firm in the United States, has provided the following financial information in its application for a loan. All numbers are in thousands of dollars. (回答以千元為單位)解答有錯 Assets Cash Accounts receivables Inventory Plant and equipment Total assets Liabilities and Equity Accounts payable $ 30 Notes payable 40 Accruals 30 Long-term debt 150 Equity (ret. earnings = $300) 450 Total liabilities and equity $700 $ 20 90 90 500 $700 Also assume sales = $500,000; cost of goods sold = $360,000; and the market value of equity is equal to the book value. a. What is the Altman discriminant function value for MNO Inc.? Recall that: Net working capital = Current assets - Current liabilities. Current assets = Cash + Accounts receivable + Inventories. Current liabilities = Accounts payable + Accruals + Notes payable. EBIT = Revenues - Cost of goods sold. Altman’s discriminant function is given by: Z = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + 1.0X5 All numbers are in $000s. X1 = (20 + 90 + 90 – 30 – 40 – 30) / 700 = 0.1429 (TA) X2 = 300 / 700 = 0.4286 X3 = (500 – 360) / 700 = 0.20 5 X1 = Working capital/total assets X2 = Retained earnings/TA X3 = EBIT/TA X4 = 450 / (30+40+30+150) = 1.80 X5 = 500 / 700 = 0.7143 Z X4 = Market value of equity/Book value of liab X5 = Sales/TA = 1.2(0.1429) + 1.4(0.4286) + 3.3(0.20) + 0.6(1.80) + 1.0(0.7143) = 3.2258 = 0.17148 + 0.60004 + 0.6600 + 1.0800 + 0.7143 = 3.2258 b. Based on the Altman’s Z score only, should you approve MNO Inc.'s application to your bank for a $500,000 capital expansion loan? Since the Z score of 3.2258 is greater than 2.99, ABC Inc.’s application for a capital expansion loan should be approved. c. If sales for MNO were $250,000, the market value of equity was only half of book value, and all other values are unchanged, would your credit decision change? ABC’s EBIT would be $300,000 - $360,000 = -$60,000. X1 = (20 + 90 + 90 - 30 - 40 - 30) / 700 = 0.1429 X2 = 300 / 700 = 0.4286 X3 = (250-360) / 700 = -0.1571 X4 = 225 / (30+40+30+150) = 0.9 X5 = 250 / 700 = 0.3571 Z = 1.2(0.1429) + 1.4(0.4286) + 3.3(-0.1571) + 0.6(0.9000) + 1.0(0.3571) = 1.1502 Since ABC's Z-score falls to 1.1502 < 1.81, credit should be denied. d. Would the discriminant function change for firms in different industries? Would the function be different for manufacturing firms in different geographic sections of the country? What are the implications for the use of these types of models by FIs? Discriminant function models are very sensitive to the weights for the different variables. Since different industries have different operating characteristics, a reasonable answer would be yes with the condition that there is no reason that the functions could not be similar for different industries. In the retail market, the demographics of the market play a big role in the value of the weights. For example, credit card companies often evaluate different models for different areas of the country. Because of the sensitivity of the models, extreme care should be taken in the process of selecting the correct sample to validate the model for use. 6 31. Calculate the term structure of default probabilities over three years using the following spot rates from the Treasury strip and corporate bond (pure discount) yield curves. Be sure to calculate both the annual marginal and the cumulative default probabilities. (計 算至 % 小數點以下第二位) Treasury strips BBB-rated bonds Spot 1 Year 5.0% 8.0 Spot 2 Year 6.1% 9.2 Spot 3 Year 7.0% 10.3 The notation used for implied forward rates on Treasuries is f1 = forward rate from period 1 to period 2 and on corporate bonds is c1 = forward rate from period 1 to period 2. Treasury strips BBB-rated debt (1.061)2 = (1.05)(1 + f1) (1.092)2 = (1.08)(1 + c1) f1 = 7.21% c1 = 10.41% (1.07)3 = (1.061)2(1 + f2) (1.103)3 = (1.092)2(1 + c2) f2 = 8.82% c2 = 12.53% Using the implied forward rates, estimate the annual marginal probability of repayment: p1(1.08) = 1.05 p2(1.1041) = 1.0721 p3 (1.1253) = 1.0882 => p1 = 97.22% => p2 = 97.10% => p3 = 96.70 % => 1-p1 = 2.78% => 1-p2 = 2.90% => 1-p3 = 3.30% Using marginal probabilities, estimate the cumulative probability of default: Cp2 = 1 - (p1)(p2) Cp3 = 1 - (0.9722)(0.9710) = 5.60 percent = 1 - (p1)(p2)(p3) = 1 - (0.9722)(0.9710)(0.9670) = 8.71 percent 34. The following is a schedule of historical defaults (yearly and cumulative) experienced by an FI manager on a portfolio of commercial and mortgage loans. (計算至 % 小數 點以下第二位) 7 Loan Type Commercial: Annual default Cumulative default Mortgage: Annual default Cumulative default 1 Year Years after Issuance 2 Years 3 Years 4 Years 5 Years 0.02% ______ ______ 0.03% ______ 0.09% ______ 0.23% 0.15% ______ 0.30% ______ 0.61% ______ 0.72% ______ ______ 2.47% 0.82% ______ a. Complete the blank spaces in the table. Commercial: Annual default Cumulative default: Mortgage: Annual default Cumulative default 0.02%, 0.01%, 0.06%, 0.14%, and 0.15% 0.02%, 0.03%, 0.09%, 0.23%, and 0.38% 0.30%, 0.61%, 0.72%, 0.86%, and 0.82% 0.30%, 0.91%, 1.62%, 2.47%, and 3.27% The annual survival rate is pt = 1 – annual default rate, and the cumulative default rate for: CP2 = 1 – (p1 x p2) = 1 - (0.9998 x P2) = 0.03% , P2= 0.9999, 1-P2 = 0.01% CP3 = 1 – (p1 x p2 x p3) = 1 - (0.9998 x 0.9999 x P3) = 0.09%, P3= 0.9994, 1-P3 = 0.06% CP4 = 1 – (p1 x p2 x p3 x p4) = 1 - (0.998 x 0.9999 x 0.9994 x P4) = 0.0023, P4= 0.9986, 1P4 = 0.14% CP5 =1 – (p1 x p2 x p3 x p4 x p5) = 1 - (0.9998 x 0.9999 x 0.9994 x 0.9986 x 0.9985) = 0.003795 = 0.38% CP2 = 1 – (p1 x p2) = 1 - (0.997 x 0.9939) = 0.00908 = 0.91% CP3 = 1 – (p1 x p2 x p3) = 1 - (0.997 x 0.9939 x 0.9928) = 0.01622 = 1.62% CP4 = 1 – (p1 x p2 x p3 x p4) = 1 - (0.997 x 0.9939 x 0.9928 x P4) = 0.0247, P4= 0.9914, 1P4 = 0.86% CP5 =1 – (p1 x p2 x p3 x p4 x p5) = 1 - (0.997 x 0.9939 x 0.9928 x 0.9914 x 0.9918) = 0.03267 = 3.27% b. What are the probabilities that each type of loan will not be in default after five years? The cumulative survival rate is = (1 - MMR1) x (1 - MMR2) x (1 - MMR3) x (1 - MMR4) x (1 MMR5) where MMR = marginal mortality rate 8 Commercial loan = (1 - 0.0002) x (1 - 0.0001) x (1 - 0.0006) x (1 - 0.0014) x (1 - 0.0015) = 0.9962 or 99.62%. Mortgage loan = (1 - 0.003) x (1 - 0.0061) x (1 - 0.0072) x (1 - 0.0086) x (1 - 0.0082) = 0.9673 or 96.73%. c. What is the measured difference between the cumulative default (mortality) rates for commercial and mortgage loans after four years? Looking at the table, the cumulative rates of default in year 4 are 0.23% and 2.47%, respectively, for the commercial and mortgage loans. Another way of estimation is: Cumulative mortality rate (CMR) For commercial loan = 1- (1 - MMR1)(1 - MMR2)(1 - MMR3)(1 - MMR4) = 1- (1 - 0.0002)(1 - 0.0001)(1 - 0.0006)(1 - 0.0014) = 0.002299 or 0.23% For mortgage loan = 1- (1 - 0.0003)(1 - 0.0061)(1 - 0.0072)(1 - 0.0086) = 0.02468 or 2.47% The difference in cumulative default rates is 2.47% - 0.23% = 2.24%. CH 11 練習題 7. Suppose that an FI holds two loans with the following characteristics: (請計算至%小數點 以下第三位) Loan i 1 2 Xi 0.55 0.45 Ri 8% 10 σi 8.55% 9.15 σi2 0.731025% 0.837225% a. If the correlation coefficient between the returns on loans A and B is 0.15, what are the expected return and standard deviation of this portfolio? b. What is the standard deviation of the portfolio if the correlation is -0.15? c. What role does the covariance, or correlation, play in the risk reduction attributes of modern portfolio theory? 解答: a.The return on the loan portfolio is: Rp = 0.55 (8%) + 0.45 (10%) = 8.90% The risk of the portfolio is: 9 σp2 = (0.55)2 (0.00731025) + (0.45)2 (0.00837225) + 2 (0.55) (0.45) (0.15) (8.55%) (9.15%) = 0.004487607 and σp = 6.699% b. Rp = 0.55 (8%) + 0.45 (10%) = 8.90% σp2 = (0.55)2 (0.00731025) + (0.45)2 (0.00837225) + 2 (0.55) (0.45) (-0.15) (8.55%) (9.15%) = 0.003325855 and σp = 5.767% c. What role does the covariance, or correlation, play in the risk reduction attributes of modern portfolio theory? The risk of the portfolio as measured by the standard deviation is reduced when the covariance is reduced. If the correlation is less than +1.0, the standard deviation of the portfolio will always be less than the weighted average of the standard deviations of the individual assets. 13. Suppose that an FI holds two loans with the following characteristics. Annual Spread between Loan Loan Xi Loss to FI Expected Rate and FI’s Annual Given Default Cost of Funds Fees Default Frequency 1 0.40 4.0% 1.5% 18.75% 4% 2 0.60 2.5% 1.15% 15% 1.5% ρ12 = -0.10 Calculate of the return and risk on the two-asset portfolio using Moody’s Analytics Portfolio Manager. (請計算至%小數點以下第二位) 解答: The return and risk on loan 1 are: R1 = (0.04 + 0.015) - [0.04 x 0.1875] = 4.75% σ1 = [0.04 x (1 - 0.04)]1/2 x 0.1875 = 3.674% The return and risk on loan 2 are: R2 = (0.025 + 0.0115) - [0.015 x 0.15] = 3.425% σ2 = [0.015 x (1 - 0.015)]1/2 x 0.15 = 1.823% The return and risk of the portfolio is then: Rp = 0.4 (4.75%) + 0.6 (3.425%) = 3.955% 10 σp2 = (0.4)2 (3.674%)2 + (0.6)2 (1.823%)2 + 2 (0.4) (0.6)(-0.1)(3.674%)(1.823%) = 0.000302688 and, σp = (0.000302688)1/2 = 1.742% 17. WallsFarther Bank has the following balance sheet (in millions of dollars). (金額與 LCR%計算至小數點以下第二位) Cash inflows over the next 30 days from the bank’s performing assets are $5.5 million. Calculate the LCR for WallsFarther Bank. The liquidity coverage ratio for WallsFarther Bank is calculated as follows: Level 1 assets = $12 + $19 + $125 = Level 2A assets = ($94 + $138) x 0.85 = $197.20 Capped at 40% of high-quality liquid assets = $156 x 0.40 = Stock of high-quality liquid assets Level 2B assets = $106 x 0.50 = $53.00 40% cap on Level 2 assets already met Stock of high-quality liquid assets Cash outflows: Stable retail deposits $55 x 0.03 = $ 1.65 Less stable retail deposits $20 x 0.10 = 2.00 Stable small business deposits $80 x 0.05 = 4.00 Less stable small business deposits $49 x 0.10 = 4.90 Non-financial corporates $250 x 0.75 = 187.50 Total cash outflows over next 30 days $200.05 Total cash inflows over next 30 days Total net cash outflows over next 30 days 156 62.4 $218.4 0.0 $218.4 5.50 $194.55 Liquidity coverage ratio = $218.4m/$194.55m = 112.26%. The bank is in compliance with liquidity requirements based on the LCR. 11