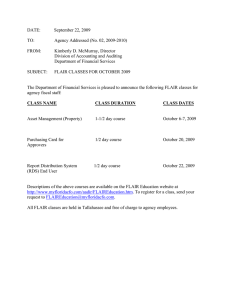

2 Flair Airlines Overview1 Company Profile • • • • • Canada’s first independent ultra-low-cost carrier (ULCC), headquartered in Edmonton, Alberta Launched in 2017 Destinations across Canada, USA, and Mexico Focused on providing affordable air travel to Canadians by unbundling baggage and add-ons from a ticket’s price Growth oriented; focused on developing the fleet to 50 aircraft over the next 5 years Chief Executive Officer Stephen Jones Chief Financial Officer Joseph Lee Chief Commercial Officer Garth Lund Destinations The Fleet Boeing 737 MAX 8 13 aircraft total Management Boeing 737-800 3 aircraft Chief Pilot Brian Stokes 3 The Problem at Hand Initial Objective Statement Define a price-sensitive target market within age demographics and develop a corresponding marketing strategy and implementation plan to drive demand and boost sales, for September 2022. 1 Target Ages 18-24 2 3 Drive Demand in Off Peak Periods Capture and Retain Customers through Targeted Marketing Initiatives Revised Objective Statement Define a price-sensitive target market factoring demographic and psychographic attributes to develop a corresponding marketing strategy and implementation plan to drive demand by addressing Flair's off-peak load factor, beginning September 2022. 4 Consumer Research23 Phase 1 Phase 2 2017 Travel Expenditure demonstrates sizable markets in the selected segments Using consensus data, the price sensitive market was divided into married travelers, travelers aged 18-24, and senior travelers to screen for targetability. Married couples removed from target demographic Seniors removed from target demographic 18 – 24-year-old demographic Note: Omitted traveller characteristics because of inability to hyper-target: (1) Educational Attainment; (2) Profession; (3) Gender Specific; (4) Age-specific where stage of life varies a lot; Income > $50,000 Removed due to unpredictable travel patterns Removed due to inability to trade amenities and comfort 24 Travelers aged 18-24 aligned will with the high price sensitivity since many have lower income and less disposable income. They also tend to fly during the off-peak season (returning home for school breaks). 5 Target Segment Primary Research To confirm the segmentation given by the research, interviews were conducted with participants to provide concrete evidence. Once the demographic was determined to be a lucrative choice, further surveys were distributed to gain more relevant and specific data. Interviews Surveys Process Process 30 18–24-year-old individuals interviews Interview Findings Annual average expenditure: $980 Price was the most important factor to this group of travellers. With plans to have a pilot operation, investigations were required on the buying and traveling habits of Western students. Online Survey Survey Findings 7 additional factors 84.7% of students 69.3% of students couldn’t just be captured by age and needed to be further examined. would be somewhat responsive or very responsive to student discounts would be somewhat likely or very likely to use an alternative airport if the cost of the flight included transportation 6 The Ideal Flair Client Using primary and secondary research, a persona of Flair’s most beneficial consumer was produced. Age Income Occupation Brand Loyalty Trip Motivation 18-24 year olds 93% of Gen Z are price conscious and willing to fly when it’s perceived as good deal25 Full-time student Income: Negative correlation between income and magnitude of price elasticity26 Occupation: Students’ travel choices are primarily driven by costs paid for transportation.27 Cost considerations played a major role in influencing decisions. Lifetime Students start university with their minds most open to trying new brands as they experience financial independence = where they make their first and last brand choices.28 Leisure Factors Influencing Choice of Air Carrier for Students 29 Carrier Attributes Destination & Length Frequency Short-haul domestic30 Seasonally Flight Preference3 Carrier Pricing Traveler Attributes Carrier Choice Most important factor Service Quality Short-haul flights- service quality is similar for legacy and low-cost carriers Market Presence Minimal impact on choice, suggests big names have little advantage 1 Back to Agenda 7 Option 1: The Bus Convenience Survey Results Interview Results Smaller airports may have less transportation options and may be further away from major cities, making them inconvenient Over 50% of students surveyed stated cost of getting to airport being a deciding factor in airport choices Most interviewees stated door-to-door costs as being the most important factor when making travel plans Fixed Costs Secondary airports give ULCCs an advantage over legacy carriers as they have lower fixed costs Option 1: Offer a shuttle bus that would take students from the university to the airport that is included in the price of the flight 8 Option 2: Buy-One-Get-One Free Student Promo Option 2: Offer a 2-for-1 promotion exclusive to students: purchase a higher priced ticket during peak season and receive a free ticket during the off-season “College kids love free stuff ” 34 New Customers Operational Advantages Brand Enthusiasts 35 According to The Pollack Group, providing students with discounts can be a great way to attract new college customers and maintain existing ones 94% said an exclusive offer would get them to shop at a brand more frequently Survey Results 36 Addresses core issue High fixed costs to fly so adding a free passenger costs little Customers will need to pay for luggage=pure revenue 86% of university students tell their friends about student discounts they had received 97% of the students with a student discount will try out a specific business Over 75% of students feel loyal to specific businesses after graduating if they were provided a student discount 84.7% are highly responsive to student discounts 57% are responsive to 2-for-1/ BOGO promotions 9 Marketing Overview I Western University students contain a sizeable market48 Market penetration can be done via two alternatives BOGO Bus Promo I. See: Slide 27 for detailed marketing analysis and sources Note: Booth and Swag indirectly convert customers and pads other conversion rates 10 Financial Analysis of Marketing Initiatives I 2021-22 Pilot Conversion BOGO Promo – Revenue /Converted Customer $382 ROMIII: 1099% Additional Trips Marketing Spend/Customer: $32 On-Peak: 1768 Off-Peak: 1768 Exclusive Options: Marketing will be catered to BOGO or Bus Promo 884 Customers Bus Promo – Revenue /Converted Customer $300 ROMIII: 842% Additional Trips Marketing Spend/Customer: $32 On-Peak: 0 Off-Peak: 1768 Pilot Expansion Offers Lucrative Returns Canadian University landscape offers lucrative expansion opportunities of pilot initiative I 23 Universities in Canada with 10,000+Students 29664 Students/University (Average) See: Slide 28 for detailed marketing analysis and sources | II Return substantially high due to Flair's ability to leverage existing load capacity III Pilot Expansion Multiple is the number of times Flair can expand this marketing initiative assuming the same mix of geographical origins as Western University 16.3x Pilot Expansion MultipleIII