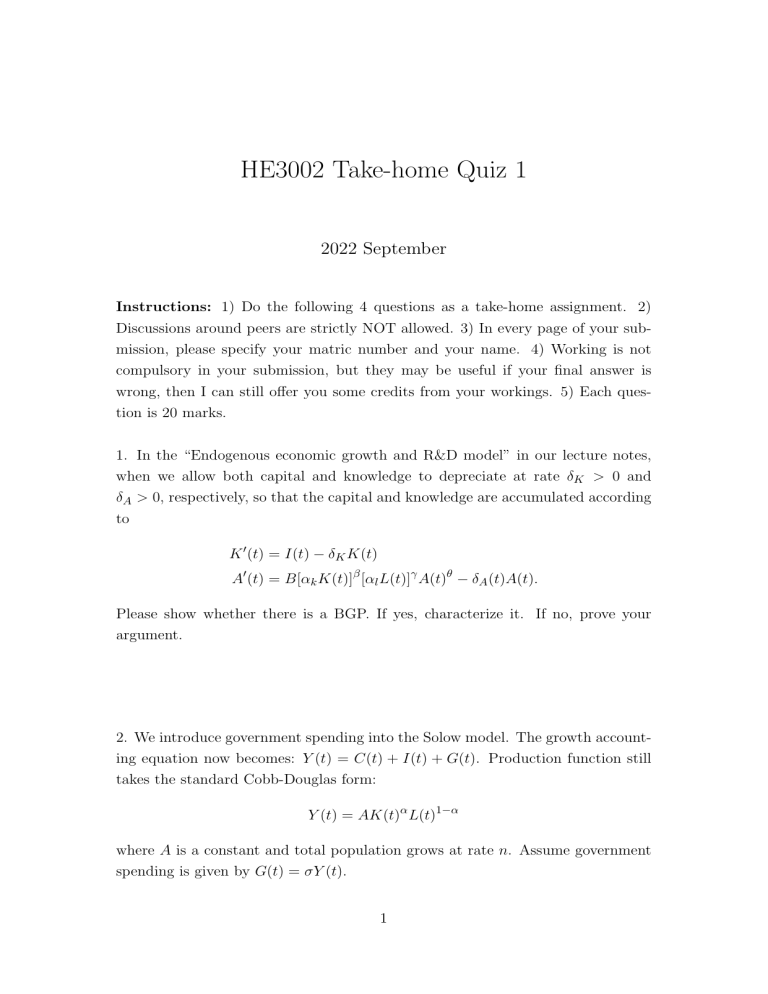

HE3002 Take-home Quiz 1 2022 September Instructions: 1) Do the following 4 questions as a take-home assignment. 2) Discussions around peers are strictly NOT allowed. 3) In every page of your submission, please specify your matric number and your name. 4) Working is not compulsory in your submission, but they may be useful if your final answer is wrong, then I can still offer you some credits from your workings. 5) Each question is 20 marks. 1. In the “Endogenous economic growth and R&D model” in our lecture notes, when we allow both capital and knowledge to depreciate at rate δK > 0 and δA > 0, respectively, so that the capital and knowledge are accumulated according to K 0 (t) = I(t) − δK K(t) A0 (t) = B[αk K(t)]β [αl L(t)]γ A(t)θ − δA (t)A(t). Please show whether there is a BGP. If yes, characterize it. If no, prove your argument. 2. We introduce government spending into the Solow model. The growth accounting equation now becomes: Y (t) = C(t) + I(t) + G(t). Production function still takes the standard Cobb-Douglas form: Y (t) = AK(t)α L(t)1−α where A is a constant and total population grows at rate n. Assume government spending is given by G(t) = σY (t). 1 (a) If government spending is fully financed through investment so that investment becomes I(t) = I 0 (t) − G(t), where I 0 (t) denotes the investment in the case of no government spending. Derive the physical capital accumulation equation. Characterize the steady-state of the economy. Is it possible to have multiple steady-state equilibrium? (Hint: I 0 (t) is essentially sY (t)). (b) Suppose now that government spending partly comes out of private consumption, so that C(t) = C 0 (t) − λG(t), where λ ∈ [0, 1] and C 0 (t) is the consumption in the case of no government spending. The remaining (1 − λ) of G(t) is still financed by investment: I(t) = I 0 (t) − (1 − λ)G(t). Discuss how the value of σ affects your answer to part (a)? (c) Now suppose that a fraction φ of G(t) is invested in the capital stock, so that total investment at t is given by: I(t) = (s − (1 − λ)σ + φσ)Y (t) show that if φ is sufficiently high, the steady-state level of capital-labor ratio will increase as a result of higher σ. 3. Consider the following production function: Y = A[αK 1/2 + (1 − α)L1/2 ]2 , α ∈ (0, 1) where K and L are capital and labor inputs respectively. A denotes total factor productivity. (a) Prove that the production function (1) has positive marginal product of capital (MPK) and labor (MPL). (2) MPK is decreasing in K and MPL is decreasing in L. (3) constant return to scale in K and L. (b) When time is continous and infinite, assume population growth rate is n and capital depreciation rate is δ > 0. Characterize the steady-state of a Solow economy. (c) When utility function takes form u(c) = c1−σ −1 1−σ , characterize the balanced growth path in a neoclassical growth economy. (σ > 0) 2 4. We introduce the notion of subsistence consumption into both Solow and neoclassical growth economy. The idea is that “normal” consumption and investment decision will be made when subsistence consumption is met. Denote c to be the subsistence consumption per-individual. Therefore, in any time t normal consumption (c(t)) and investment (I(t)) satisfy c(t)L(t) + I(t) = Y (t) − cL(t), where L(t) is population size in t. Assume production function take form Y (t) = AK(t)α L(t)1−α and capital depreciation rate is δ > 0. In addition, assume population growth rate is n > 0. (a) Discuss steady-state and balanced growth path in a Solow economy. (c−c)1−σ −1 (b) When utility function takes form u(c) = , discuss steady-state and 1−σ balanced growth path in a neoclassical growth economy. 3