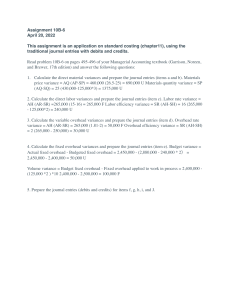

Budgeting Exercises: Profit Planning & Financial Statements

advertisement