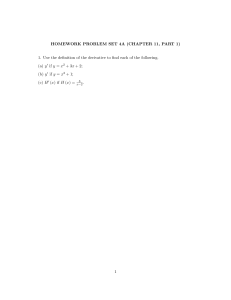

Basics on CVA and DVA Chapter 9 J. Hull: Options, Futures, and Other Derivatives (10th ed) Credit risk in derivatives Derivatives valuation assumes that neither side of the contract will default Credit risk is generally taken into account by a separate calculation The default of the counterparty in a derivative contract may cause a loss if the early termination happens when the derivative has a positive value The no-default value of a derivative is adjusted to take into account the default probability of the two parties involved in the contract AB2022 D&I_16 1 CVA Consider a derivative contract between party A and the counterparty B with maturity Tn Assume that Ci, i = 1, 2, …, n, is the present value of the expected loss to A if counterparty B defaults at time Ti Assume that πB is the (constant) probability of default of B The Credit Value Adjustment (CVA) is the estimate of the present value of the expected cost to A of a B default n CVA B Ci i 1 T0 CVA AB2022 D&I_16 T1 C1 T2 C2 ……… ……… Tn Cn 2 DVA However, party A itself might default before maturity Tn and, in that case, counterparty B will incur a loss Assume that Di, i = 1, 2, …, n, is the present value of the expected loss to counterparty B if A defaults at time Ti Assume that πA is the (constant) probability of default of A The Debit Value Adjustment (DVA) is the estimate of the present value of the expected gain to A from its own default n DVA A Di i 1 T0 DVA AB2022 D&I_16 T1 D1 T2 D2 ……… ……… Tn Dn 3 Adjusted value of derivative Define fnd as the no-default value of the derivative to A, i.e., the value of the derivative to A under the assumption that neither side will default Therefore, the value of the derivative to A adjusted for credit risk is f adj f nd CVA DVA T0 CVA DVA AB2022 D&I_16 T1 C1 D1 T2 C2 D2 ……… ……… ……… Tn Cn Dn 4