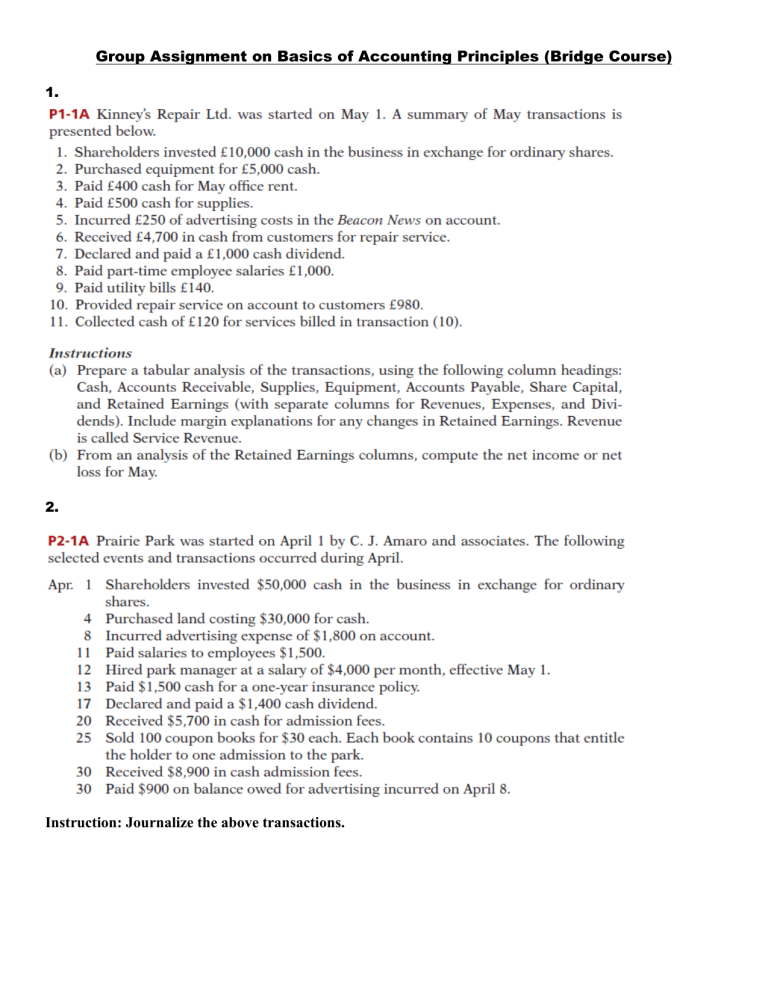

Group Assignment on Basics of Accounting Principles (Bridge Course) 1. 2. Instruction: Journalize the above transactions. 3. 4. 5. Discuss briefly about the details of the following financial statements when they are prepared for service, merchandising and manufacturing firms respectively: i. Income statement (Statement of Profit/Loss). ii. Statement of Financial position. 6. Discuss about accounting cycle exhaustively. 7. Discuss briefly about accounting for partnership and corporation. 8. On August 31, 2010, the following data were accumulated to assist the accountant in preparing the adjusting entries for Cobalt Realty: a. Fees accrued but unbilled at August 31 are $9,560. b. The supplies account balance on August 31 is $3,150. The supplies on hand at August 31 are $900. c. Wages accrued but not paid at August 31 are $1, 200. d. The unearned rent account balance at August 31 is $9, 375, representing the receipt of an advance payment on August 1 of three months’ rent from tenants. e. Depreciation of office equipment is $1, 600. Instructions: Journalize the adjusting entries required at August 31, 2010. 9. In preparing the financial statements, adjustments for the following data were over looked: a. Unbilled fees earned at July 31, $6,700. b. Depreciation of equipment for July, $3,000. c. Accrued wages at July 31, $2,150. d. Supplies used during July, $1,975. Instructions: Journalize the entries to record the omitted adjustments. 10. Compare and contrast financial and managerial (management) accounting. Submission Date: December 11, 2022. The End!