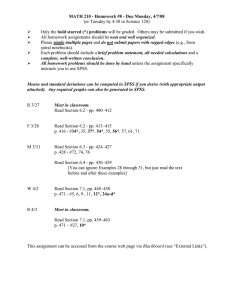

Joshua Brown Chad Hicks Andrew Lamb Mark Stowe Xiqi Zheng Outline Introduction External Assessment Competitive Analysis Internal Assessment Strategic Analysis Recommendation Questions Business Case Operates in the Web Analytics Industry Headquarters in Orem, Utah President and CEO Joshua G. James Shares traded on NASDAQ 2006 Revenues: $79,750,000 Over 500 employees Over 2,000 customers worldwide Customers in over 35 countries Operations in 9 countries Business Case Continued Fastest organically growing public software company #1 aftermarket return technology IPO of 2006 1.4 Trillion transactions in 2006 Leading on-demand Web analytics provider by revenue Omniture products available in English, Chinese, French, German, and Japanese History of Industry Early 1990’s – Web analytic industry begins 1993 – Web Trends and WebsideStory are industry’s first analytic firms 1994 – IPRO launches first Log Analyzer program 2001-2003 – 60 suppliers shrinks to 35 suppliers 2004-Current – Coremetrics and Omniture are industry leaders History of Omniture 1996 – JP Interactive was founded 1998 – Changed name to SuperStats.com 1999 – Changed name to MyComputer, Inc. 2002 – Omniture is born from MyComputer, Inc. Announces release of SiteCatalyst 2004 – Forrester names Omniture industry leader 2006 – Omniture went public 2007 – Omniture acquires Instadia, TouchClarity, Offermatica and Visual Sciences Mission Statement “To help online organizations achieve success through analytics based optimization.” Vision Statement “ To deliver an integrated, comprehensive online marketing services with a suite of solutions that allow companies to automate, measure, manage and optimize marketing results in real-time.” Problem Statement What will it take for Omniture to distance themselves from competitors as the Web Analytic’s Industry leader? General Environment Industry Overview What is Demand? Economic Demographic Soci-cultural Technological Regulatory/Political Global Industry Overview Major competitors Coremetrics Omniture Google WebTrends SPSS 16.9 billion dollar industry Growing Relatively new What is Demand? Small fraction of business are utilizing web analytics Huge potential for growth 21% growth in online advertising revenues for 2007 Positive financial results experienced Regulatory/Political Opportunities Self induced privacy standards Municipal internet investments Government supports internet Threats Privacy Regulations Economic Opportunities Online video market to reach 6.5 billion by 2011 Attractive interest rates Mobile internet growth Threats Low consumer confidence High chance of recession Social-cultural Opportunities MySpace and Facebook Online gaming Lack of communication barriers Threats Privacy Click Fraud Technological Opportunities Increase in global technology usage Increased availability of broadband and WiFi PDA’s and SmartPhone’s Worldwide mobile gaming Online Video Threats Click fraud Viruses Blackouts Global Opportunities Expansion Online shopping International brand recognition China restructured internet laws Threats Lack of infrastructure Exchange rates Demographic Opportunities Low PC cost 72% of 40+ year olds using internet at home Municipal WiFi Increase computer science degrees Global internet growth Threats Cultural differences Privacy Competitive Environment Industry Characteristics Life Cycle Stage Five Forces Model Strategic Group Analysis Industry Characteristics Loose oligopoly Growth opportunities Increased competition for market share Expected advertising and retail sales online Internet Software & Services Industry grew 28.9% in 2006 Expected increase in advertising revenues over 20% through 2008 Omniture Industry Life Cycle Porter 5 Forces Model Threat of New Entrants Power of Suppliers Power of Buyers Threat of Substitutes Level of Rivalry Threat of New Entrants Relatively low for pre-existing internet based companies Constantly changing environment Increased growth and competition HIGH Power of Suppliers Technological infrastructure Choice of suppliers is high Industry companies control the supplier base LOW Intellectual capital Human resources has high control Employees provide high levels of innovation HIGH Power of Buyers High demand for Web Analytics from few providers High customer retention from software LOW Threat of Substitutes Google’s free Web Analytics Highly customized software with high switching costs LOW Level of Rivalry Increasing growth and competition Similar products and services High switching costs Minor exit barriers MODERATE Industry Attractiveness Industry revenues are rising Market is open for new entrants – not crowded Growth and competition are increasing HIGH Medium Low Market Share High Strategic Group Analysis Low Moderate Number of Employees High Competitive Analysis Goals Assumptions Capabilities Strategies Satisfied Vulnerabilities Retaliation Next Move Coremetrics Goals Expand European operations Maintain high service levels IPO or merger? Promote brand recognition Foster innovation Assumptions High global demand Increased online shopping (retail) Customer loyalty Coremetrics Capabilities Flexible packages Reputable partnerships IBM Custom solutions Strong leadership Venture capitalists Retail Market Strategies Expand European market Aggressive sales and marketing campaign Concentrated growth Coremetrics Satisfied Yes Looking to grow Vulnerabilities Lack of competitive scope No clear vision High subscription fees Limited low end solutions (SMB) Coremetrics Retaliation Increasing customer base Expanding into new markets Promoting customer satisfaction Next Move Develop clear vision Enhance competitive scope IPO Google Goals Best in search Push their ad-system Global implementation Assumptions Continually improve Release new products Continue to grow Google Capabilities Very innovative Strong brand Cash Strategies Focused differentiation Growth through acquisition YouTube Expand Chinese markets Currently Own 2.6% of Baidu Google Satisfied Yes Looking to increase growth Vulnerabilities Revenue linked to one side ad posting Lawsuits Book search – Copyright infringement Google Retaliation Innovation Free web analytics Next Move Mobile phone market Expand innovative product base Key Success Factors Leadership (.2) Brand (.2) Innovation (.25) Partnerships Acquisitions (.2) Adaptability (.15) Total 4 4 4 5 4 4.2 5 4 3.5 4 4 4.1 5 5 5 5 2 4.3 1=Worst 5=Best Internal Assessment Culture Leadership Organizational Structure Value Chain Analysis Core Competencies Financial Ratio Analysis Culture Highly intellectual and emotionally smart employees Innovative fast-paced environment Hypercompetitive and driven employees Embrace nice people – “mean people suck” Fun environment – work hard, play hard Leadership Josh James CEO Co-founder Started Omniture in 1998 Brigham Young University Fun – Top priority John Pestana Executive VP Co-founder President ’98 – ’04 Brigham Young University Leadership President Chris Harrington – ‘03 CFO and Executive VP Mike Herring – ‘04 CTO and Executive VP Brett Error – ‘99 Corporate Development Michael Dodd – ‘06 Worldwide Marketing Gail Ennis – ‘05 CLO and Senior VP Shawn Lindquist – ‘05 Business Development John Mellor – ‘03 General Manager Neil Weston – ‘05 Leadership Increased acquisitions Offermatica Instadia TouchClarity Visual Sciences Innovation Organizational Structure OMNITURE Josh James CEO Brett Error CTO Mike Herring CFO Chris Harrington President, Sales John Pestana EVP, Customers Shawn Lindquist CLO Michael Dodd SVP, Corp Devel Gail Ennis SVP, Marketing John Mellor SPV, Bus Devel Neil Weston SVP, Gen Mgr Value Chain Analysis Infrastructure Strong culture Innovation Brand name Inbound Logistics Services based company Technology is critical HR hiring process: High volume of requests Hiring the “best fit” Innovative Customer oriented Motivated Operations High operation costs Delivering high performance IT services Sales & General Administration Focusing on services and product base Omniture University Regional and Web-based training Omniture Certified Professional Program Public and Partner Certifications (SiteCatylist, Implementation, Sales, Support) Outbound Logistics Strong alliances with partners Partner types Partner levels Application, Platform, Services, Value-added Resellers Strategic, Platinum, Gold, Silver Customer focused “No Web analytics company has more Fortune 200 companies, and Omniture has the highest customer retention rate in the industry” Marketing and Sales High Cost Products; High Performance B2B Market focused High revenues Web Analytics market share leader (2006) Investing globally through acquisitions Building brand name Services Web Analytics Online business optimization Marketing integration Search marketing SearchCenter Consulting Genesis Implementation Best practices Building customer relations Core Competencies Innovation Acquisitions Customer relations and loyalty Financial Analysis NET INCOME (in millions) Twelve Months Ending 12/31/06 OMTR $-7.73 GOOG $3,953.91 SPSS $15.14 REVENUES (in millions) Twelve Months Ending 12/31/06 OMTR $79.75 GOOG $ 10,604.92 SPSS $261.53 Net Income Growth Rate (%) 1500 1000 500 OMTR 0 GOOG -500 SPSS -1000 -1500 -2000 2004 2005 2006 OMTR -1400 -1238 58 GOOG 276 267 1100 SPSS -40 190 -6 Revenue Growth Rate (%) 2006 SPSS 2005 GOOG OMTR 2004 0 20 40 60 80 100 120 140 2004 2005 2006 SPSS 58 68 48 GOOG 117 92 72 OMTR 137 108 86 160 Financial Ratio Analysis ROA (from previous year) ROE (from previous year) 12/31/04 12/31/05 12/31/06 12/31/04 OMTR -5.36% -21.72% -5.31% OMTR 9% -22% -8% GOOG 14.25% 21.60% 21.41% GOOG 13% 15% 23% SPSS 2.81% 7.37% 5.63% SPSS 4% 9% 7% CURRENT RATIO (from previous year) 12/31/04 12/31/05 12/31/06 OMTR 0.92 2.42 2.24 GOOG 7.91 12.08 10.00 SPSS 1.14 1.35 1.80 12/31/05 12/31/06 Financial Analysis AVG REVENUE PER EMPLOYEE 2006 OMTR $138,000 GOOG $666,000 SPSS $219,000 SPSS Stock Google Stock Omniture Stock Strategic Assessment SWOT BCG General Strategic Orientation Grand Strategy Clusters Grand Strategy Selection Matrix Recommendations Corporate Strategy Business Strategy SWOT Strengths -Strong brand awareness -Culture -Innovation -Customer service -Organizational structure -Increasing revenues -Market share -Distribution channels -Strategic alliances -CASH Opportunities -Leadership -Acquire technology -Foreign market growth -Strategic alliances -Demand -Brand equity -Product breadth Weaknesses -Uncontrolled cost -No economies of scale -Vision Threat -Google, Yahoo, Coremetrics -Emerging US recession -Click Fraud -Government regulations -New entrants -Fast product cycle SiteCatalyst Discover Datawarehouse Web 2.0 Optimization General Strategic Orientation Weaknesses Turnaround Defensive Opportunities Threats Aggressive Diversification Strength Grand Strategy Clusters Weakening Competitive Position Turnaround Merge With Competitors Liquidation Rapid Growth Slow Growth Concentrated Growth Vertical Integration Strategic Alliances Improving Competitive Position Grand Strategy Selection Matrix Weaknesses Turnaround Divestiture Strategic Alliances Opportunities Threats Integration Diversification Concentrated Growth Innovation Strength Corporate Level Strategy Remain in web-analytics industry Focus on expansion Gain market share through global acquisitions Possible mergers and acquisitions of competitors Economies of scope Business Level Strategy Focused differentiation Invest in engineering to attract and retain customers Hire employees based on the following factors Proven professionalism Competitiveness Intelligence Excellence Fun Build upon strong brand Omniture’s Future Expansive growth in industry Increase market share through acquisition Create clear vision and mission Expand business operations globally Strategic partnership with consulting firm Once you go Omniture you never go back! DRINKS?