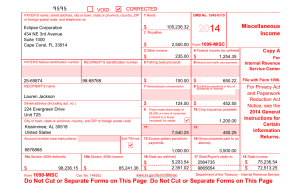

AC 371 Tax Return Project Fall 2022 Student Handout 2: Current Year PBC Manual Documents Kourtney Smith 4646 19th St. Lubbock, TX 79400 March 21, 2023 Dear CPA, I can’t believe that it’s tax time again! Hopefully I have sent everything you need. Things have been a little hectic around our house with the new baby and everything. I’m still teaching for Lubbock ISD. I did some tutoring this summer so you will see the new W-2. The extra income helps! I’ve attached the income statement for Scott’s landscaping business. Smith Landscaping is still doing well, but we had a minor setback with the EPA in July over some pollution issues. Scott used the wrong kind of fertilizer when trying to clean up the front yard of a house his client was trying to sell, and it contaminated the water table. The EPA fined Smith Landscaping $6,400, all for a little bit of curb appeal! Scott recorded the fine as a legal expense on his books, but I hope we can at least get some of it back on our taxes. Scott was in a car accident in late October. He was hit by a drunk driver on his way home from work. Luckily he wasn’t hurt too bad but it totaled his car, which was sad because we spent $49,000 on that thing just three years ago. The judge ordered the drunk driver to pay us $8,500 for medical expenses related to Scott’s minor injuries and another $8,500 for the emotional trauma he suffered. Scott still doesn’t like getting in the car. The judge also awarded us $12,000 in punitive damages. It was the guy’s second DWI in 3 months. We finally sold the rental house. YAY! I thought it would never sell. Sam Johnston, who had already been renting from us, was the buyer. In January, Scott’s father passed away. He had a life insurance policy issued by Liberty Mutual with a maturity value of $400,000. Scott was the designated beneficiary of the policy and picked a settlement option of $82,500 annually, payable over five years. We received a check for $82,500 in December. In August, I fell off a desk in my classroom trying to hang decorations. I wasn’t able to work for 12 weeks so I went on short-term disability. I received a total of $7,200 in disability benefits. In June, Scott and I went to the Bahamas. It was amazing! We stayed at a fabulous all-inclusive resort that had 7 swimming pools and 10 different restaurants. We went snorkeling, took a sunset cruise and even swam with the dolphins. And the best part was it was free! Scott won the trip for being the 12th caller to a local radio show. I’ll have to show you pictures next time I see you. In March (3/18/2022), my grandmother gave me 1,000 shares of LMN Inc. stock for my birthday. I sold the stock later in the year because we had to buy a new car and wanted the cash to make a down payment. My grandmother told me that she purchased the stock in 2003 (7/1/2003) for $1 per share, which is crazy because it was worth $8.10 per share when I received it in March. My dad also gave me another $3,000 in cash to help with the new car. I hope everything is going well for you and your family. We need to get together for lunch soon. Please let me know if you have any questions or need any more information. All the best, Kourtney Smith PBC Business - Student Copy Smith Landscaping Income Statement For the Year Ended December 31, 2022 Revenue 142,500.00 Advertising Insurance - professional Insurance - Health (Scott) Legal fees Office chair Office expense Repairs and Maintenance Payroll tax Meals with Clients Cell phone Wages - landscape assistant Draw Supplies Professional journals New computers (2) & printer License renewal Conference in Denver Registration Hotel Airfare Meals Total Expense 5,200.00 6,500.00 6,320.00 8,900.00 590.00 1,340.00 2,600.00 3,101.00 980.00 3,760.00 44,300.00 58,000.00 31,950.00 365.00 2,980.00 720.00 650.00 1,455.00 535.00 490.00 180,736.00 Net Income (38,236.00) PBC Personal Exp - Student Copy Scott & Kourtney Smith 2022 Expenses Personal Expenses Mortgage interest - Primary Residence Real estate tax Insurance Repairs & maintenance Utilities Doctor Hospital Dentist Prescription drugs Over the counter drugs Cosmetic surgery Scott's dad's funeral cost Donations: United Way St. Matthew's Church Texas Tech University CPA fee Investment expense Daycare School supplies Goodwill $ $ $ $ $ $ $ $ $ $ $ $ 9,540.00 6,780.00 4,600.00 3,200.00 8,670.00 5,120.00 4,540.00 350.00 275.00 210.00 16,500.00 9,400.00 $ $ $ $ $ $ $ ??? 1,450.00 6,200.00 2,000.00 2,600.00 145.00 8,300.00 375.00 Supplies purchased for Kourtney's classroom Donated 10 bags of clothes Expenses for Rental Property Cleaning Fee to property management co. Mortgage interest Property Insurance Property taxes Repairs $ $ $ $ $ $ 630.00 850.00 1,020.00 485.00 655.00 1,700.00 Expense for Oil & Gas Property Property tax $ 1,540.00 PBC 1099-B 1 Student Copy 1a Date of sale or exchange PAYER's name, street address, city , state, ZIP code, and telephone no. 12/15/2022 1b Date of acquisition 2/18/2022 XYZ Company 123 ABC Drive Indianapolis, IN 46254 1c Type of gain or loss Short-term Long-term (317) 407-2393 PAYER's federal identification number RECIPIENT'S identification number 111-22-3333 RECIPIENT'S name Scott Smith Street address (including apt. no) x 2a Stocks, bonds, etc. A $ B $ 3 Cost or other basis 5 Wash sale loss disallowed 6,580.00 3,565.00 7 Bartering 4646 19th St. City, state, and ZIP code 2022 Form 1099-B 1d Stock or other symbol Reported to IRS x Proceeds From Broker and Barter Exchange Transactions Gross proceeds Gross proceeds less commissions and option premiums 1e Quantity sold 2b Check if loss not allowed based on amount in box 2a Copy A 6 Check if: a b Noncovered security Basis reported to IRS 8 Description Lubbock, TX 79401 Account number (see instructions) CUSIP number 2nd TIN not. 9 Profit or (loss) realized in 2022 on closed contracts 11 Unrealized profit or (loss) on open contracts - 12/31/2022 Form 1099-B For Instructional Purposes only - Not an official tax form A 6580 Sch D Line 8d, D-1 B (3565) Sch D Line 8e, D-1 3015 Sch D Line 8h, D-1 10 Unrealized profit or (loss) on open contracts - 12/31/2021 12 Aggregate profit or (loss) on contracts PBC 500 4 Federal income tax withheld 13 State 14 State identification no. 15 State tax withheld D1.1 PBC 1099-B 2 Student Copy 1a Date of sale or exchange PAYER's name, street address, city , state, ZIP code, and telephone no. 11/2/2022 1b Date of acquisition LMN Inc. 2505 Mavis Ct. Louisville, KY 40216 1c Type of gain or loss Short-term Long-term (502) 888-2939 PAYER's federal identification number RECIPIENT'S identification number 222-33-4444 RECIPIENT'S name Kourtney Smith Street address (including apt. no) Form 1099-B 1d Stock or other symbol 2a Stocks, bonds, etc. $ 8,100.00 Reported to IRS Gross proceeds 4 Federal income tax withheld 5 Wash sale loss disallowed 6 Check if: 7 Bartering a b Proceeds From Broker and Barter Exchange Transactions Gross proceeds less commissions and option premiums 3 Cost or other basis 4646 19th St. City, state, and ZIP code 2022 1e Quantity sold 2b 1000 Check if loss not allowed based on amount in box 2a Copy A Noncovered security Basis reported to IRS 8 Description Lubbock, TX 79401 Account number (see instructions) CUSIP number Form 1099-B For Instructional Purposes only - Not an official tax form 2nd TIN not. 9 Profit or (loss) realized in 2022 on closed contracts 11 Unrealized profit or (loss) on open contracts - 12/31/2022 10 Unrealized profit or (loss) on open contracts - 12/31/2021 12 Aggregate profit or (loss) on contracts 13 State 14 State identification no. 15 State tax withheld D1.2 PBC PBC 1099-DIV 1 Student Copy PAYER's name, street address, city or town, province or state, country, ZIP or foreign postal code, and telephone no. Acme Clothing Company 355 Looney Ave. Hershey, PA 17033 USA (717) 123-4589 PAYER's federal identification number 1a Total ordinary dividends A $ 347.00 1b Qualified dividends $ RECIPIENT'S identification number 347.00 2022 2a Total capital gain distr. Form 1099-DIV 2b Unrecap. Sec. 1250 gain 2c Section 1202 gain 2d Collectibles (28%) gain 3 Nondividend distributions 4 Federal income tax withheld Dividends and Distributions Copy A 111-22-3333 RECIPIENT'S name Scott Smith 5 Investment Expenses Street address (including apt. no) 4646 19th St. City or town, province or state, country, and ZIP or foreign postal code Lubbock, TX 79401 Account number (see instructions) 6 Foreign tax paid 7 Foreign country or U.S. possession 8 Cash liquidation distributions 9 Noncash liquidation distributions 10 Exempt-interest dividends 11 Specified private activity bond interest dividends 2nd TIN not. 12 State 13 State identification no. 14 State tax withheld Form 1099-DIV For Instructional Purposes only - Not an official tax form A B2.2 B2.3 Ordinary Dividends Qualified Dividends 347 139 241 727 1040 Line 3a, Sch B Line 6, 1040-1 727 1040 Line 3b, 1040-1 B2.1 PBC PBC 1099-DIV 2 Student Copy PAYER's name, street address, city or town, province or state, country, ZIP or foreign postal code, and telephone no. Maple Incorporated 258 Maple Avenue Montpelier, VT 05602 USA (802) 999-8389 PAYER's federal identification number 1a Total ordinary dividends B2.1 $ 139.00 1b Qualified dividends $ RECIPIENT'S identification number 139.00 2022 2a Total capital gain distr. Form 1099-DIV 2b Unrecap. Sec. 1250 gain 2c Section 1202 gain 2d Collectibles (28%) gain 3 Nondividend distributions 4 Federal income tax withheld Dividends and Distributions 222-33-4444 RECIPIENT'S name Kourtney Smith Street address (including apt. no) 4646 19th St. City or town, province or state, country, and ZIP or foreign postal code Lubbock, TX 79401 Account number (see instructions) Form 1099-DIV For Instructional Purposes only - Not an official tax form 5 Investment Expenses 6 Foreign tax paid 7 Foreign country or U.S. possession 8 Cash liquidation distributions 9 Noncash liquidation distributions 10 Exempt-interest dividends 11 Specified private activity bond interest dividends 2nd TIN not. 12 State 13 State identification no. 14 State tax withheld Copy A B2.2 PBC PBC 1099-DIV 3 Student Copy PAYER's name, street address, city or town, province or state, country, ZIP or foreign postal code, and telephone no. Brinker Corporation 6890 Mesa Street Laredo, TX 78040 USA (956) 890-2356 PAYER's federal identification number 1a Total ordinary dividends B2.2 $ 241.00 1b Qualified dividends $ RECIPIENT'S identification number 241.00 2022 2a Total capital gain distr. Form 1099-DIV 2b Unrecap. Sec. 1250 gain 2c Section 1202 gain 2d Collectibles (28%) gain 3 Nondividend distributions 4 Federal income tax withheld Dividends and Distributions 111-22-3333 RECIPIENT'S name Scott Smith Street address (including apt. no) 4646 19th St. City or town, province or state, country, and ZIP or foreign postal code Lubbock, TX 79401 Account number (see instructions) Form 1099-DIV For Instructional Purposes only - Not an official tax form 5 Investment Expenses 6 Foreign tax paid 7 Foreign country or U.S. possession 8 Cash liquidation distributions 9 Noncash liquidation distributions 10 Exempt-interest dividends 11 Specified private activity bond interest dividends 2nd TIN not. 12 State 13 State identification no. 14 State tax withheld Copy A B2.3 PBC PBC 1099-INT 1 Student Copy PAYER's name, street address, city or town, province or state, country, ZIP or foreign postal Payer's RTN (optional) code, and telephone no. First State Bank of Lubbock 2432 Quaker Ave. Lubbock, TX 79409 USA (806) 888-2222 PAYER's federal identification number 2022 1 Interest Income A $ 275.00 2 Early Withdrawal Penalty Form Interest Income 1099-INT Copy A B1.1 PBC RECIPIENT'S identification number 232343 111-22-3333 RECIPIENT'S name 3 Interest on U.S. Savings Bonds and Treas. Obligations B $ 74.00 4 Federal income tax withheld 5 Investment expenses 6 Foreign tax paid 7 Foreign country or U.S. possession 8 Tax-exempt interest 9 Specified private activity bond interest Scott Smith Street address (including apt. no) 4646 19th St. City or town, province or state, country, and ZIP or foreign postal code Lubbock, TX 79401 2nd TIN not. 10 Tax-exempt bond CUSIP no. Account number (see instructions) 11 State 12 State identification no. 13 State tax withheld Form 1099-INT For Instructional Purposes only - Not an official tax form A B B1.2 K1.1 Taxable Interest 275 74 400 4320 5,069 Sch B Line 1 Sch B Line 1 Sch B Line 1 Sch B Line 1 1040 Line 2b, Sch b Line 2, 1040-1 PBC 1099-INT 2 Student Copy PAYER's name, street address, city or town, province or state, country, ZIP or foreign postal code, and telephone no. State Bank of Texas 4890 Cowboy Way Dallas, TX 75001 USA (800) 123-4567 PAYER's federal identification number Payer's RTN (optional) 2022 1 Interest Income B1.1 $ 2 Early Withdrawal Penalty 400.00 Form Interest Income 1099-INT Copy A RECIPIENT'S identification number 222-33-4444 RECIPIENT'S name 3 Interest on U.S. Savings Bonds and Treas. Obligations 4 Federal income tax withheld 5 Investment expenses 6 Foreign tax paid 7 Foreign country or U.S. possession 8 Tax-exempt interest 9 Specified private activity bond interest Kourtney Smith Street address (including apt. no) 4646 19th St. City or town, province or state, country, and ZIP or foreign postal code Lubbock, TX 79401 Account number (see instructions) Form 1099-INT For Instructional Purposes only - Not an official tax form 2nd TIN not. 10 Tax-exempt bond CUSIP no. 11 State 12 State identification no. 13 State tax withheld B1.2 PBC PBC 1099-INT 3 Student Copy PAYER's name, street address, city or town, province or state, country, ZIP or foreign postal code, and telephone no. City of Lubbock 1234 Main Street Lubbock, TX 79407 USA (806) 458-9890 PAYER's federal identification number Payer's RTN (optional) 2022 1 Interest Income Form 2 Early Withdrawal Penalty Interest Income 1099-INT Copy A RECIPIENT'S identification number 3 Interest on U.S. Savings Bonds and Treas. Obligations 222-33-4444 RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses 6 Foreign tax paid 7 Foreign country or U.S. possession Kourtney Smith Street address (including apt. no) 4646 19th St. City or town, province or state, country, and ZIP or foreign postal code Lubbock, TX 79401 Account number (see instructions) 8 Tax-exempt interest A $ 2nd TIN not. 10 Tax-exempt bond CUSIP no. 9 Specified private activity bond interest 198.00 11 State 12 State identification no. Form 1099-INT For Instructional Purposes only - Not an official tax form A 198 1040 Line 2a 13 State tax withheld B1.3 PBC PBC 1099-MISC 1 Student Copy PAYER's name, street address, city or town, province or state, country, ZIP or foreign postal code, and telephone no. Sam Johnston 602 East 19th Street Lubbock, TX 79404 USA (575) 989-0323 PAYER's federal identification number 1 Rents E-1 $ 7,800.00 2 Royalties RECIPIENT'S identification number 2022 Miscellaneous Income 3 Other income Form 1099-MISC 4 Federal income tax withheld 5 Fishing boat proceeds 6 Medical and health care payments 7 Nonemployee compensation 8 Substitute payments in lieu of dividends or interest 9 Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale 10 Crop insurance proceeds 11 Foreign tax paid 12 Foreign country or U.S. possession 13 Excess golden parachute payments 14 Gross proceeds paid to an attorney 16 State tax withheld 17 State/Payer's state no. Copy A 111-22-3333 RECIPIENT'S name Scott Smith Street address (including apt. no) 4646 19th St. City or town, province or state, country, and ZIP or foreign postal code Lubbock, TX 79401 Account number (see instructions) 15a Section 408A deferrals 15b Section 409A income Form 1099-MISC For Instructional Purposes only - Not an official tax form 18 State income E1.1 PBC PBC 1099-MISC 2 Student Copy PAYER's name, street address, city or town, province or state, country, ZIP or foreign postal code, and telephone no. HP Oil Company 2185 Ranger Parkway Arlington, TX 76001 USA (800) 123-4567 PAYER's federal identification number 1 Rents 2 Royalties E-1, A$ RECIPIENT'S identification number 8,675.00 2022 Miscellaneous Income 3 Other income Form 1099-MISC 4 Federal income tax withheld 5 Fishing boat proceeds 6 Medical and health care payments 7 Nonemployee compensation 8 Substitute payments in lieu of dividends or interest 9 Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale 10 Crop insurance proceeds 11 Foreign tax paid 12 Foreign country or U.S. possession 13 Excess golden parachute payments 14 Gross proceeds paid to an attorney 16 State tax withheld 17 State/Payer's state no. Copy A 111-22-3333 RECIPIENT'S name Scott Smith Street address (including apt. no) 4646 19th St. City or town, province or state, country, and ZIP or foreign postal code Lubbock, TX 79401 Account number (see instructions) 15a Section 408A deferrals 15b Section 409A income Form 1099-MISC For Instructional Purposes only - Not an official tax form A 8675 Depletion % 15% 1301 SALY E-1 18 State income E1.2 PBC PBC W-2 1 Student Copy 22222 a Employee's social security number 222-33-4444 b Employer identification number (EIN) 1 Wages, tips, and other compensation 75-1111111 $ c Employer's name, address, and ZIP code 55,400.00 3 Social security wages 55,400.00 5 Medicare wages and tips $ d Control number Last name Suff. 5,540.00 $ 3,434.80 6 Medicare tax withheld 55,400.00 $ 803.30 7 Social security tips 8 Allocated tips 9 10 Dependent care benefits 11 Nonqualified plans 12a Code e Employee's first name and Initial $ 4 Social security tax withheld $ Lubbock ISD 1628 19th Street Lubbock, TX 79401 Statutory Retirement Third-party employee plan sick pay 12c Code 14 Other 12b Code 13 Kourtney Smith 4646 19th St. Lubbock, TX 79401 Code 12d f Employee's address and ZIP code 15 State Employer's state ID number W-2 16 State wages, tips, etc. Wage and Tax Statement Form For Instructional Purposes only - Not an official tax form 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 2022 A 55400 B Fed W/H W1.1 2 Federal income tax withheld 1040 Line 1, 1040-1 5540 5540 1040 Line 17, 1040-1 20 Locality name PBC PBC W-2 2 Student Copy 22222 a Employee's social security number 222-33-4444 b Employer identification number (EIN) 1 Wages, tips, and other compensation 75-3433434 $ c Employer's name, address, and ZIP code 3 Social security wages 16,800.00 5 Medicare wages and tips $ d Control number Suff. 1,680.00 $ 1,041.60 6 Medicare tax withheld 16,800.00 $ 243.60 7 Social security tips 8 Allocated tips 9 10 Dependent care benefits 11 Nonqualified plans 12a Code Last name $ 4 Social security tax withheld $ Kids 'R Smart Tutoring 608 N Brentwood Ave Lubbock, TX 79416 e Employee's first name and Initial 2 Federal income tax withheld 16,800.00 Statutory Retirement Third-party employee plan sick pay 12c Code 14 Other 12b Code 13 Kourtney Smith 4646 19th St. Lubbock, TX 79401 Code 12d f Employee's address and ZIP code 15 State Employer's state ID number W-2 16 State wages, tips, etc. Wage and Tax Statement Form For Instructional Purposes only - Not an official tax form 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 2022 A 16800 B Fed W/H 1040 Line 1, 1040-1 1680 1680 1040 Line 17, 1040-1 20 Locality name