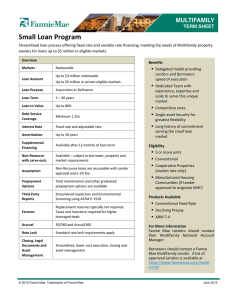

Multifamily DUS® MBS & Fannie Mae GeMS™ Overview March 2022 © 2022 Fannie Mae 1 1 Go to "Insert > Header & Footer to update" presentation footer Table of contents Fannie Mae Overview Page 3 Multifamily Overview Page 7 Multifamily Programs Page 10 Multifamily Green Bonds Page 22 Multifamily Social Bonds Page 36 Appendix Page 42 © 2022 Fannie Mae 2 Fannie Mae Overview © 2022 Fannie Mae 3 Who We Are We help create opportunities for people to buy, refinance, or rent a home. Fannie Mae sits at the very heart of the U.S. housing industry. We purchase qualifying mortgages from lenders and bundle them into mortgage-backed securities that we guarantee and sell to investors. Lenders use their replenished cash to originate new mortgages, and we use ours to start the process again. This continuous flow of money promotes a healthy housing market. We partner with lenders to create home purchase and refinance (single-family) and rental (multifamily) opportunities for millions of borrowers and renters across the country. © 2022 Fannie Mae 4 We provided $69.5 billion in financing to support 694,000 units of multifamily housing in 2021. Our Conservatorship In September 2008, the Federal Housing Finance Agency (FHFA) placed Fannie Mae into conservatorship. As conservator and acting on our behalf, FHFA entered into a Senior Preferred Stock Purchase Agreement (SPSPA) with the U.S. Treasury (Treasury). Under the SPSPA: • Fannie Mae issued senior preferred stock and a warrant to Treasury to purchase up to 79.9% of Fannie Mae’s common stock. • Treasury committed to provide financial support to Fannie Mae under certain circumstances if Fannie Mae has a negative net worth as of the end of a quarter. Upon entering into the SPSPA, Treasury stated that current holders of senior debt, subordinated debt, and MBS issued or guaranteed by Fannie Mae are protected by the agreement. FHFA Serves as conservator and regulator of the Enterprises © 2022 Fannie Mae 5 We are not obligated to pay dividends to Treasury on our senior preferred stock until our adjusted total capital meets the capital requirements and buffers under FHFA’s enterprise regulatory capital framework. $113.9 billion $47.4 billion Amount remaining under SPSPA commitment as of December 31, 2021 Fannie Mae’s net worth as of December 31, 2021 Fannie Mae Fannie Mae is a shareholder-owned corporation and is federally chartered. Treasury has a warrant to purchase 79.9% of the common stock of Fannie Mae. U.S. Treasury Provides financial support under the terms of the SPSPA. Our Business Lines We support the U.S. mortgage market through two distinct business lines. Number of Units Single-Family Many more loans, smaller, less complex Multifamily Smaller number of loans, larger, and more complex 1As 1 to 4 residential units, generally homes or condominiums owned by individuals 5 or more residential units, including affordable, senior, student, military, and manufactured housing communities General Borrower Individual Public or private owner / operator Collateral Single-Family residential property Income-producing Multifamily rental property of December 31, 2021 2As of December 31, 2021 1% of Fannie Mae's single-family conventional guaranty book of business was comprised of ARMs. Source: 2021 Form 10-K for the Quarter Ended December 31, 2021. © 2022 Fannie Mae 6 Average Loan Size¹ Typical Term and Rate UPB of Loans Acquired in Q4 2021 $198,865 30 years, fixed-rate fully amortizing. Other terms include 20, 15, 10 and other fixedrate mortgages as well as ARMs2 $284.8 billion $14 million 5, 7, 10 years, payable on a 25-, 30-, or 40-year amortization schedule with a balloon payment at maturity. Other terms include ARMs $20.7 billion Multifamily Overview © 2022 Fannie Mae 7 Our Size and Scale: Multifamily Fannie Mae Multifamily continues to issue predominately 10-year fixed-rate DUS® MBS to meet investor demand. As of Q3 2021, U.S. multifamily mortgage debt outstanding totaled $1.84 trillion. Fannie Mae’s share stood at approximately $399 billion, representing a 22% share of the market. * Fannie Mae $2,000 Total Billions $1,500 $1,000 $500 $- Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 2015 2016 2016 2017 2017 2018 2018 2019 2019 2020 2020 2021 2021 Fannie Mae issued $48.8 billion in multifamily MBS through Q3 2021, comprising 17.1% of the market. ** *Source: Federal Reserve’s Flow of Funds ** Mortgage-related Securities Issuances Market Share 8 © 2022 Fannie Mae Conduits 4% Depository Institutions Other 6% 17% Fannie Mae 17% NonTraditional MF Lenders 19% Life Insurers 8% Ginnie Mae 13% Freddie Mac 16% Through Q4 2021, Fannie Mae provided $69.5 billion in mortgage liquidity across the country through multifamily acquisitions. >$500M $100M-$500M <$100M Estimated Competitive Multifamily Market Acquisitions by Participant¹ Notes: 1. Estimated competitive market size is Fannie Mae’s internal estimate of multifamily originations activity. 2. Non-Traditional MF Lenders are non-institutional lenders that generate 1-2 multifamily loans a year with a typical size of less than $1M 3. Other includes state and local credit agencies, FHLBs and other financial institutions. 4. Loans securitized by Ginnie Mae include non-dedicated multifamily housing (e.g. healthcare and new construction.) 5. Excludes purchases of loans from others’ portfolios and Treasury HFA New Issue Bond program volume in 2009 and 2010; therefore amounts may not tie to Fannie Mae 10-Qs or 10-Ks. 9 © 2022 Fannie Mae Fannie Mae Multifamily Programs © 2022 Fannie Mae 10 Fannie Mae Multifamily Stakeholder Interests & Risk Sharing For over 30 years, Fannie Mae Multifamily has relied on its Delegated Underwriting and Servicing (DUS®) program to finance multifamily rental housing. DUS is a unique program that relies on three core principles: • Leveraging private capital • Aligning interests through risk-sharing • Providing superior asset management Risk Sharing Interests Borrower DUS Lender Fannie Mae Investor • Competitive pricing Delegated authority Steady guaranty fee income Highly rated credit strength • Broad range of financing products Scalable Enhanced liquidity • Standardized loan documents Consistent underwriting and servicing standards Shorter timelines to loan closing Higher servicing fee income Strong legal protections • Provides financing through economic cycles Superior call (prepayment) protection* Lower spread volatility Stable cash flows Contributes 20% or more in equity Shares 1/3 of the credit risk over life of the loan * Not all DUS loans require payment of a prepayment premium. **Fannie Mae’s guaranty of timely payment of interest and principal. © 2022 Fannie Mae 11 Shares 2/3 of credit risk over the life of the loan Manages interest rate risk but protected from credit losses** Delegated Underwriting and Servicing (DUS®) Lenders DUS lenders adhere to rigorous credit and underwriting standards and submit to Fannie Mae's ongoing credit review and monitoring. They underwrite, close, deliver, and service Fannie Mae loans on multifamily properties and typically retain one-third of the risk on every loan. Arbor Commercial Funding, LLC Greystone Servicing Company LLC Newpoint Real Estate Capital LLC Bellwether Enterprise Real Estate, LLC HomeStreet Capital Corporation NorthMarq Berkadia Commercial Mortgage, LLC JLL Real Estate Capital, LLC PGIM Real Estate Capital One, National Association JPMorgan Chase Bank PNC Real Estate CBRE Multifamily Capital, Inc. KeyBank National Association Regions Bank Citi Community Capital Lument Walker & Dunlop, LLC Colliers Mortgage LLC M&T Realty Capital Corporation Wells Fargo Multifamily Capital Grandbridge Real Estate Capital, LLC Newmark As of March 31, 2022 Fannie Mae executes its multifamily business through the DUS network of 23 financial institutions and independent mortgage lenders. 12 © 2022 Fannie Mae DUS Risk Sharing Model Fannie Mae’s DUS model serves as an example of the successful large-scale application of risk-sharing with a network of lenders based on strict guidelines. It encourages conservative underwriting, which improves investment quality. Note Borrower Loan DUS lenders $ Servicing Fee (with fee for credit risk) MBS Sell MBS to 3rd party- investor Fannie Mae Capital Markets Market MakingActivity Sell MBS to 3rd partyInvestor Fannie Mae If loan defaults Fannie Mae securitizes loan as MBS Package MBS into structured security Sell security to 3rd partyinvestor Note: The risk-sharing model represents the most common form of risk-sharing, pari-passu loss sharing. Other loss-sharing arrangements are possible. © 2022 Fannie Mae 13 Risk-Sharing Fannie Mae 2/3 credit loss DUS lender 1/3 credit loss Fannie Mae’s DUS MBS Underwriting History Monthly Multifamily Serious Delinquency Rate • Serious delinquency rate of multifamily book of business as of December 31, 2021: 42 bps (0.42%) 1.20% 1.00% 0.80% 0.60% 0.40% 0.20% 0.00% • As of Q4 2021, CMBS SDQ stands at 4.57%.* • Serious delinquency rate of Fannie Mae's multifamily guaranty book of business excluding loans that have received forbearance was 4 bps (0.04%) as of December 31, 2021.** • Annual average credit characteristics have remained relatively consistent over time Average Underwritten Net Cash Flow Debt Service Coverage Ratio Average Underwritten LTV Ratio 2.00 100% 1.50 75% 1.00 0.50 0.00 50% 25% 0% Reflects UW DSCR per Guide Requirements for periods prior to 2017 and UW NCF DSCR after 2017. *CMBS SDQ based on 30+ day delinquency rates **Fannie Mae’s multifamily loans are classified as seriously delinquent when payment is 60 days or more past due. 14 © 2022 Fannie Mae Our Response to the COVID-19 Pandemic We strengthened our underwriting criteria, instituted renter protection, and enhanced transparency to investors. Multifamily MBS COVID-19 Forbearance Activity • Alternative inspection protocols to ensure safety • Flexibility to allow tenants to repay back rent over time and not in a lump sum 4,000 1.20% 3,000 0.80% 2,000 0.40% In Repayment Jan-22 Feb-22 Dec-21 Oct-21 Nov-21 Sep-21 Jul-21 Aug-21 Jun-21 Apr-21 May-21 Mar-21 Jan-21 Feb-21 Dec-20 Oct-20 Nov-20 Sep-20 0 Jul-20 1,000 Aug-20 • Evictions suspended that • New weekly are solely for non-payment disclosures made of rent and assess no available to provide tenant late fees or transparency of loans Pre-approval required penalties in a COVID-19-related for seniors and forbearance student housing © 2022 Fannie Mae 15 • Fannie Mae continues to advance timely payment of principal and interest in the event the loan becomes delinquent 1.60% Jun-20 • New increased escrow requirements for Tier 2 and Tier 3 mortgage loans • Borrowers required to inform residential tenants in writing about tenant protections during the forbearance and repayment periods 5,000 Apr-20 • Forbearance policy extended for a total of up to six months INVESTORS May-20 • RENTERS Total UPB in $ millions PROPERTY OWNERS 0.00% Typical Multifamily DUS Loan Most DUS MBS are backed by a single loan on a standard multifamily asset. A typical deal is a “10/9.5/30” with terms: $5.025.0MM Loan size* 10-year 30-year 1.25X 80% Balloon term with 9.5 years of call protection Amortization Debt service coverage ratio Loan-to-value ratio *Loan size describes 53% by loan count and 36% by UPB © 2022 Fannie Mae 16 Key Features of Fannie Mae Multifamily Securities GeMS are comprised of numerous DUS MBS. GeMS maintains the characteristics of DUS MBS with additional benefits, outlined below: Fannie Mae GeMS DUS MBS • Backed by previously issued DUS MBS • Generally backed by a single multifamily loan • Collateral selected with consistent credit quality and tight maturity profile • Guaranty of timely payment of principal and interest • Structures offering block size, collateral diversity, and pricing close to par • Lower spread volatility relative to other products with similar collateral • A1 and A2 sequential classes offer customized cash flows protected by AB class • Liquidity enhanced by the large number of dealers engaged in market making • A3 classes offer greater prepayment protection • Stable cash flows that are easy to model • Floaters carry hard final maturities and no extension risk when compared to agency CMO Floaters • Superior call protection • Readily customized to accommodate reverse inquiry • Positive convexity • Share the same weighting of 20% for bank risk-based capital requirements as Fannie Mae single-family MBS • Definitive final maturities of 5, 7, and 10 years © 2022 Fannie Mae 17 Fannie Mae’s Multifamily MBS Issuance 80 Fannie Mae MBS Issuance1 60 40 20 34.1 37.7 31.4 32.0 2011 2012 2013 2014 55.0 43.9 64.3 65.4 69.9 75.7 400 69.5 300 200 100 0 2015 2016 2017 Issuances 2018 2019 2020 2021 ** 0 Outstanding Outstanding $B 500 Daily Issuance Typical Deal Terms:* Single loan backs each pool $3-$10 million Loan Size 10-year Balloon 9.5 Years of Call Protection 30-year Amortization No more than 80% LTV Not less than 1.25 DSCR *The terms of individual DUS may vary from the terms listed below. 1 Reflects unpaid principal balance of multifamily Fannie Mae MBS issued during the period. The number includes Fannie Mae portfolio resecuritization transactions and conversions of adjustable-rate loans to fixed-rate loans and DMBS securities to MBS securities. Bond Credit Enhancements and Cash Credit Enhancements are excluded. Issuances $B 15 9.5 5 Fannie Mae GeMSTM Issuance 0.3 0.6 10 10.1 12.0 11.4 10.6 12.0 9.6 9.1 8.5 2019 2020 2021 7.5 2.0 4.4 0 2011 2012 2013 2014 2015 2016 GeMS REMICs 2017 2018 GeMS Megas ** DUS MBS Collateral Executed via REMIC or Mega Structures Monthly Issuance Collateral Diversification Customizable Cash Flows Block Size Par Pricing Dealer Syndicate Distribution ** Through December 31, 2021 © 2022 Fannie Mae 18 © 2022 Fannie Mae Fannie Mae GeMS and DUS MBS offer different options for investing in the same multifamily collateral, providing similar cash flows, variations on structure, and slightly different risk profiles. GeMS REMIC Transaction: FNA 2022-M1G GeMS REMIC STRUCTURE Original Face APT $263,420,425 WAL Coupon Type Spread Offer Price 6.63 WAC S+50 96.07 A1 $38,692,000 5.98 WAC S+31 97.51 A2 $478,657,084 9.11 WAC S+62 93.40 Total Fully Guaranteed $780,769,509 Structure Group 2 Structure Group 1 WAC Class A1 $38.7MM 5.98y WAL APT $263.4MM 6.63y WAL WAC COLLATERAL CHARACTERISTICS UPB Currency $780,769,509 USD Collateral Group 1 6 Fannie Mae DUS Green MBS Geographic Distribution Group 1: Top 3 – CA (31.08%), NV (28.89%), TX (26.95%) Group 2: Top 3 – CA (27.32%), TX (17.93%), AZ (13.78%) Weighted Average DSCR Group 1: 2.25x Group 2: 1.83x Weighted Average LTV Group 1: 61.8% Group 2: 64.3% Settlement Date Managers February 28, 2022 Lead Manager: BofA Securities Co-Managers: Citigroup, Academy Securities, Morgan Stanley Group 2 28 Fannie Mae Green DUS MBS Additional information on GeMS deals can be found on the Fannie Mae GeMS Archive website page: https://capitalmarkets.fanniemae.com/mortgage-backed-securities/multifamily-mbs/fannie-mae-gems-archives © 2022 Fannie Mae 19 A2 $478.7MM 9.11y WAL GeMS REMIC Investor Summary DUS MBS and GeMS investors vary in size and type across the spectrum of institutional investors. 5.41% 27.14% 56.52% 10.94% Bank March 2021 through Feb 2022 GeMS Deal Original Balance ($M) Deal Characteristics FNA 2021-M1G $715.4 G1: 10-yr Fixed with 9.5 YM FNA 2021-M11 $878.5 G1: 10-yr Fixed with 9.5 YM FNA 2021-M13 $691.3 G1: Adjustable 7/6YM SOFR G2: 10-yr Fixed with 9.5 YM G3: 12-yr Fixed with 11.5 YM FNA 2021-M2G $879.0 G1: 10-yr Fixed with 9.5 YM, GBC Only FNA 2021-M17 $802.1 G1: 10-yr Fixed with 9.5 YM FNA 2021-M18 $210.3 G1: Hybrid ARM G2: Hybrid ARM G3: Hybrid ARM FNA 2021-M3G $796.3 G1: 10-yr Fixed with 9.5 YM FNA 2021-M19 $736.3 G1: 10-yr Fixed with 9.5 YM FNA 2021-M2S $639.8 FNA 2022-M1 $1,002.2 FNA 2022-M1G $780.8 G1: 10-yr Fixed with 9.5 YM G2: 15-yr Fixed with 14.5 YM G1: 10-yr Fixed with 9.5 YM G1: 7-yr Fixed with 6.5 YM G2: 10-yr Fixed with 9.5 YM Insurance Our GeMS program has seen participation from nearly 350 unique investors. © 2022 Fannie Mae 20 Fannie Mae GeMS REMIC Deal Timeline The Multifamily Capital Markets trading desk aims to bring a GeMS REMIC deal to market each month based on market conditions. Our issuance calendar is flexible each month in order to maximize investor focus. GeMS REMIC Deal Calendar (Simple) Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Factors for current month are released Announce, Launch, and Price the deal in the market (2-3 days) Final Structure Due Date for Fannie Mae issuance Print Disclosure Date deadline to finalize disclosure materials Settlement Date for GeMS usually set for day before the end of month Notes: • GeMS REMICs are typically brought to market in the second week, but this can occur anytime prior to the print disclosure date deadline. • Final structure due date is when the REMIC deal’s structure is due to the Fannie Mae Structured Transactions team. © 2022 Fannie Mae 21 Multifamily Green Bonds 22 © 2022 Fannie Mae Fannie Mae Green Bond Framework Financial Benefits Social Environmental • Lower credit risk • Greater affordability for tenants • Lower energy use • Higher cash flows • Higher quality, more durable housing • Lower water use • Higher property value • Generate clean energy • Greater resiliency to natural disasters As a result of Green Mortgage Loan financing, through 2020, Fannie Mae’s portfolio projected to: • Contribute $9.5 billion in workers’ income and $19.9 billion in gross domestic product (GDP) • Produce $2.83 of economic output for every $1.00 spent in constructing or retrofitting multifamily properties* Impact • Invest $410 million committed by borrowers for energy and water efficiency upgrades at 3,696 properties • Convert approximately 792,000 units into improved, more comfortable homes • Save approximately 8.5 billion gallons of water annually • Reduce tenant energy and water expenditures by an average of $184 annually per family • Save 9.5 billion kBTU of source energy annually • Support 224,000 well-paying jobs for construction or renovation of properties with green building certifications or installation of energy- and water-efficient property improvements • Reduce greenhouse gas emissions by 634,000 metric tons annually *Also includes the projected impact from 12 Fannie Mae Single-Family Green MBS issuances for a total of approximately $94 million 23 © 2022 Fannie Mae Deep Investments, Long-Term Commitment to Green Financing 2010 Launched in 2010 Piloted Green Financing products Launched first commercial Agency Green MBS Helped create industry tools with US EPA: 2021 Milestones through 2021 Surpassed $100 billion in Multifamily Green Bonds MBS Issuance since program inception Included in Bloomberg Barclay’s MSCI Green Bond Index ENERGY STAR® 1 to 100 Score Largest Global Green Bond Issuer Over the Last 10 Years 2020 and Largest Issuer of Green Bonds globally by Climate Bonds Initiative in 2017, 2018, 2019, and 2020 Water 1 to 100 Score Environmental Finance 2018 Green Bond Award for Biggest Issuer – SSA Developed energy audit standard used nationally (2015) Global Capital CMBS Deal of the year for FNA 2017-M15 Global Capital Most Impressive SRI/ABS Issuer 2018 24 © 2022 Fannie Mae EPA ENERGY STAR® Partner of the Year 2015-16; Sustained Excellence Award 2017-20 Global Capital CMBS Deal of the year for FNA 2020-M14 CICERO Second Opinion on Fannie Mae Framework CICERO, Center for International Climate and Environmental Research at Oslo University, provided a second opinion on Fannie Mae’s Green Bond framework. CICERO recognized the following strengths in Fannie Mae’s Green Bond framework: • Well-established governance and risk management procedures • Internal annual review and revision by the Green Financing Business team • Transparent reporting procedures • In-house technical expertise and tools CICERO Second Opinion is available at: www.fanniemaegreenfinancing.com 25 © 2022 Fannie Mae Fannie Mae Multifamily Green Bond Framework provides a structured, sound and innovative approach to green financing for energy and water efficiency investments in the multifamily rental property market in the United States. . . . The Framework is aligned with the recommendations laid out in the Green Bond Principles and uses established green building certifications (GBCs) to inform its selection criteria for Green Mortgage Backed Securities (MBS).” CICERO Growth of Fannie Mae Green Financing Fannie Mae Green MBS Issuance and Cash Loans Fannie Mae Green MBS issuances increased to over $100 billion since the program’s inception, as the program developed incentives, aligned processes, and attracted more borrowers to the products. Green MBS Issuance (mm) 2012 $56 4 2013 $58 4 2014 $20 3 2015 $247 * 7 2016 $3,624 111 2017 $27,756 2018 $20,168 2019 1,383 1,258 $22,780 2020 $12,999 2021 $13,467 * 2015 26 # of loans 1,021 586 527 includes one cash loan and does not include one Green Bond Credit Enhancement of $136 million. © 2022 Fannie Mae $1 6.6 B Growth of Green GeMS REMIC Issuance Issuance Month • • • 27 February-17 FNA 2017-M2 A1, A2 Green Collateral Group Group 2 August-17 FNA 2017-M10 AV1, AV2 Only group $873.0 November-17 FNA 2017-M13 A1, A2, X Group 3 $764.1 December-17 FNA 2017-M15 ATS1, ATS2, X2 Group 2 $587.9 December-17 FNA 2017-M15 A1, A2 Group 3 $559.0 February-18 FNA 2018-M2 A1, A2, X Only group $904.5 Created over $14 billion in new investment opportunities for the Socially Responsible Investment (SRI) community through February 2022. April-18 FNA 2018-M4 A1, A2, X Only group $705.9 June-18 FNA 2018-M8 A1, A2 Only group $535.2 October-18 FNA 2018-M13 A1, A2 Group 2 $596.2 January-19 FNA 2019-M1 A1, A2, X Group 1 $996.5 June-19 FNA 2019-M9 A1, A2, A3, X, X3 Group 1 $805.3 Oct-19 FNA 2019-M22 A1, A2, A3, X1, X3 Group 1 $1,108.1 Fannie Mae became the first Agency CMBS included in the Bloomberg Barclays MSCI Green Bond Index with the FNA 2017-M15 A2 tranche. Jan-20 FNA 2020-M1 A1, A2, A3, X1, X3 Group 1 $873.0 May-20 FNA 2020-M20 A1, A2, X Group 1 $529.4 Oct-20 FNA 2020-M46 A1, A2, A3, X1, X3 Group 1 $455.5 Oct-20 FNA 2020-M46 AL, X2 Group 2 Mar-21 FNA 2021-M1G A1, A2, X Only group $715.4 Jun-21 FNA 2021-M2G A1, A2, A3, X, X3 Only group $879.0 Sep-21 FNA 2021-M3G A1, A2, X Only group $796.3 Feb-22 FNA 2022-M1G APT Group 1 $263.4 Feb-22 FNA 2022-M1G A1, A2 Group 2 Fannie Mae began resecuritizing a portion of the Green MBS through its GeMS program in 2017. © 2022 Fannie Mae TOTAL Deal Name Tranches Green Deal Size ($M) $611.7 $80.2 $517.3 $14,157.3 Fannie Mae Green Bond Framework Use and Management of Proceeds 28 © 2022 Fannie Mae Green Mortgage Loans Backing Green Bonds Fannie Mae offers multiple Green Mortgage Loan products for the acquisition or refinance of existing multifamily properties in the U.S. Both types of Green Mortgage Loans result in a Green MBS. Green Mortgage Loan Product Green Rewards Green Building Certification (GBC) % of Multifamily Green Portfolio* 85% 15% Use of Proceeds Mortgage includes energy and water efficiency retrofits or renewable energy generation installations Mortgage for property constructed or renovated to meet Green Building Certification standards Eligibility Owner will install equipment projected to reduce energy and/or water consumption by 30%, of which 15% is from energy efficiency and/or renewable energy generation (solar) Property must have one of the GBC’s recognized by Fannie Mae before locking interest rate CICERO Shades of Green Rating Light to Medium Green Light Green Bond Green Bond Green Bond *Multifamily Green bonds from 2012-2020. 29 © 2022 Fannie Mae Green Rewards Eligibility: High Performance Building Report HPB Report identifies and quantifies energy and water savings opportunities Sample Improvement Opportunities Energy Audit is ordered by lender, completed by an energy auditor, and requires a site visit. High Efficiency Lighting in Units and Common Areas Borrower selects final scope of work by selecting from list of energy- and water-saving opportunities from the HPB Report. HPB Report can be completed up to 6 months prior to rate lock. Low-flow Faucets & Showerheads Estimated Project Cost $144,000 6% - $6,000 $3,000 $5,000 4% 14% $18,000 - Install Programmable Thermostats $25,000 4% - - $4,000 ENERGY STAR© rated dishwashers $100,000 3% 2% $2,000 $3,000 17% 16% $26,000 $10,000 Total $274,000 Escrow at 100% *ASHRAE: American Society of Heating, Refrigerating and Air-Conditioning Engineers. 30 © 2022 Fannie Mae Projected Projected Tenant Owner Annual Annual Energy Water Cost Cost Savings Savings Savings Savings Consumption Property must have a High Performance Building (HPB) Report completed meeting ASHRAE* Level II requirements and additional Fannie Mae standards. Save at least 30% energy and water combined, with at least 15% energy savings to be eligible Underwrite a portion of projected savings Green Building Certification Eligibility Fannie Mae publishes annually a list of the accepted Green Building Certifications Owner must provide proof of the award to the Lender prior to locking in interest rate Fannie Mae does not accept “interim” or “pending” Detailed list of certifications available at: www.fanniemaegreenfinancing.com 31 © 2022 Fannie Mae Fannie Mae accepts select certifications from the following organizations: Use and Management of Proceeds • Fannie Mae manages use of proceeds through its network of DUS Lenders • DUS Lenders follow documented processes to release escrows only upon completion of the capital improvement No greater than 12 months post loan closing At loan closing Borrower Fannie Mae Lender Loan proceeds for energy and water improvements Verifies green improvement s Releases green improvement escrow Lender-managed Escrow Account 32 © 2022 Fannie Mae Reporting on Green Bonds Fannie Mae is committed to reporting on the performance of its Green Bonds. Fannie Mae offers two methods to access data: 1. Annual reporting through the Fannie Mae Multifamily Green Bond Impact Report, published online Data available per CUSIP: • Greenhouse Gas Reduction (MT) • Energy Consumption Reduction (kBtu) • Water Consumption Reduction (gallons) 2. At issuance disclosure through DUS Disclose, an online web-based system Data available per CUSIP: • Source Energy Use Intensity • ENERGY STAR 1 to 100 Score • ENERGY STAR Portfolio Manager ID • Year Ending Date for the data • Water Use Intensity • EPA Water 1 to 100 Score • Energy Generated (kBtu) – applies to properties with solar improvements 33 © 2022 Fannie Mae Fannie Mae Impact Reporting Fannie Mae published its third Green Bond Impact Report in June 2021. The Impact Report describes Fannie Mae’s Multifamily Green Bond Business and the triple bottom line – environmental, social, and financial – impact of the Green MBS issued by Fannie Mae from 2012 through 2020. This is the first Green Bond Impact Report that also includes our Single-Family Green Bond Business. The Impact Report is accompanied by a file that details the MBS-level environmental impacts and includes a roll up to the GeMS REMIC tranche level to enable investors to quantify the impact of their investments. Check out the 2020 Green Bond Impact Report and the Environmental Impact per CUSIP at: www. fanniemae.com/greenimpact 34 © 2022 Fannie Mae DUS Disclose® At-Issuance and Ongoing Reporting Fannie Mae’s DUS Disclose website provides investors access to loan- and property-level reporting, including the type of Green financing, the ENERGY STAR Score, Source Energy Use Intensity, EPA Water Score, and Water Use Intensity. At-issuance disclosures identify the Fannie Mae green loan product and provides green measurements for properties under our Green Reward program. At-issuance data is developed from each property’s trailing 12-month historical energy and water usage, as collected and reported by the initial energy and water audit. 35 © 2022 Fannie Mae Ongoing disclosures enables investors to understand the energy and water performance over time and is provided for properties under both our Green Rewards program and our Green Building Certification program. Multifamily Social Bonds 36 © 2022 Fannie Mae Sustainable Bond Framework Under Fannie Mae’s Sustainable Bond Framework, we could issue green bonds, social bonds, or sustainable bonds, which are a combination of green and social. Corporate Debt • Supports financing for vulnerable groups, such as those impacted by natural disaster or global pandemics • Finances sustainable assets that align to the ICMA project categories and UN Sustainable Development Goals • Eligible Assets may include existing assets within Fannie Mae’s general accounts funded up to 36 months prior to the issuance date and new assets acquired post-issuance • Proceeds generally fully allocated within 24 months of issuance Single-Family MBS Multifamily MBS • Single-Family affordable housing, with an area median income (AMI) limitation of 120% or less for primary residence loans • Multifamily restricted and unrestricted affordable housing and manufactured housing communities • Single-Family Green MBS include only mortgage loans backed by newly constructed single-family residential homes with ENERGY STAR® certifications that meet or exceed the national program requirements for ENERGY STAR certified homes • Multifamily Green MBS offered through our Delegated Underwriting and Servicing (DUS®) business, each MBS is generally secured by a single Green loan • Green Guaranteed Multifamily Structures (GeMS™) backed by blocks of previously issued Green DUS MBS Sustainalytics’ Second Party Opinion for Fannie Mae’s Sustainable Bond Framework noted: “Sustainalytics is of the opinion that the Fannie Mae Sustainable Bond Framework is credible, impactful and aligns with the four core components of the Green Bond Principles 2018 (GBP) and Social Bond Principles 2020 (SBP).” 37 © 2022 Fannie Mae Multifamily Social Bonds Our Multifamily social bonds support initiatives to preserve affordable housing. 38 © 2022 Fannie Mae Restricted Affordable Housing Fannie Mae’s Restricted Affordable Housing offering finances properties that provide rent-restricted housing subsidized by various government programs including Low-Income Housing Tax Credits (LIHTC), the U.S. Department of Housing and Urban Development’s Section 8 program, and state and local housing incentive initiatives. Unrestricted Affordable Housing Fannie Mae provides financing for market-rate units that do not receive support from government housing programs, but still offer affordable rents in their local markets. These units are generally in class B or C properties that may provide affordable rents due to the age, condition, or location of the asset. Manufactured Housing Communities Fannie Mae has been a leading source of liquidity for Manufactured Housing Community (MHC) transactions with staff dedicated to the product since 2000. Healthy Housing Rewards™ Our Healthy Housing Rewards™ initiative provides financial incentives for borrowers who incorporate healthpromoting design features and practices or resident services in their newly constructed or rehabilitated multifamily affordable rental properties. Use and Management of Proceeds • • • Fannie Mae manages use of proceeds through its network of DUS Lenders The proceeds from each DUS bond finance the acquisition or refinancing of an affordable housing property or manufactured housing community Fannie Mae Compliance with Regulatory Agreement Loan proceeds for acquisition or refinance Underwrites rent restrictions The Restricted Affordable property includes either government or third-party compliance Releases proceeds Lender 39 © 2022 Fannie Mae Government/Third Party Borrower Reporting on Social Bonds Fannie Mae is committed to reporting on the performance of its Social Bonds by offering multiple methods to access the data. At-issuance disclosure through DUS Disclose, an online webbased system Fannie Mae provides a “Social” flag for each Restricted Affordable Housing and MHC MBS for loans acquired on or after January 1, 2021, in order to increase transparency for investors. Annual reporting, published online. Per CUSIP impact metrics will be disclosed. Current Green Bond Impact Reports are available here as an example. Data available per Restricted Affordable CUSIP: • Nature of rent restrictions at property • % of units affordable to 50% AMI • % of units affordable to 60% AMI • % of units affordable to 80% AMI Data available per Manufactured Housing CUSIP: • Nature of property type In 2021, Fannie Mae issued 829 multifamily social MBS for a total of approximately $10,456 million and brought to market two multifamily social GeMS for a total of approximately $955 million. © 2022 Fannie Mae 40 Social GeMS REMIC Transaction: FNA 2021-M1S GeMS REMIC STRUCTURE Original Face WAL Coupon Type Spread Offer Price A1 $33,500,000 6.06 FIX S+15 100.00 A2 $281,280,738 9.62 WAC S+21 100.93 X $33,500,000 N/A WAC/IO Not Offered Not Offered Total Fully Guaranteed $314,780,738 Structure Group 1 WAC I/O Class A1 $33.5 MM 6.06y WAL COLLATERAL CHARACTERISTICS UPB Currency GROUP 1 $314,780,738 USD Collateral 26 Fannie Mae DUS MBS pools 10-year term 9.5-year yield maintenance Affordability 23 properties with rent restrictions, average 88% of units restricted 3 MHC properties Top 3 – Washington (18.2%), California (14.5%), and Florida (11.4%) Mortgaged properties located in 14 states 1.85x 71.5% January 29, 2021 Lead Manager: Morgan Stanley Co-Managers: BMO Capital Markets, JP Morgan, Ramirez Geographic Distribution Weighted Average DSCR Weighted Average LTV Settlement Date Managers *Preliminary; Subject to change. Additional information on GeMS deals can be found on the Fannie Mae GeMS Archive website page: http://www.fanniemae.com/portal/jsp/mbs/mbsmultifamily/gems_archive.html. 41 © 2022 Fannie Mae A2 $281.3 MM 9.62y WAL Appendix 42 © 2022 Fannie Mae Fannie Mae Multifamily Disclosure Websites Name Description Web Link DUS Disclose Provides pool information, loan information, collateral information, and at-issuance documents for a specific pool or CUSIP. Downloadable spreadsheets with all active DUS securities. https://mfdusdisclose.fanniemae.com/#/home Sustainable Bonds Access to our green and social bond offerings https://capitalmarkets.fanniemae.com/sustainabl e-bonds Green MBS Provides an excel file of all Green MBS issuances and additional information on green financing. https://www.fanniemae.com/multifamily/greeninitiative-green-mbs Green Bond Impact Report Provides a link to the Multifamily Green Bond Impact Report as well as a link to the Environmental Impact per CUSIP. https://www.fanniemae.com/greenimpact Corporate ESG Allows accessibility to the Sustainable Bond Framework, Single-family and Multifamily Green Bond Frameworks, and the third-party Second Party Opinions (SPOs) https://www.fanniemae.com/about-us/esg MBSenger References documents on Fannie Mae products and programs, including DUS MBS and Multifamily structured products. https://capitalmarkets.fanniemae.com/mortgagebacked-securities/multifamily-mbs/celebrating30-years-fannie-mae-delegated-underwritingservicing-dus-program Multifamily DUS Prepayment History Report Provides prepayment activity by original balance and loan count presented in several different data categories. The report shows active loans and liquidated loans acquired from January 2000 to the stated calendar quarter for each given category. It also includes the type of prepayment, including voluntary and involuntary prepayment, as well as loans that have paid at maturity. http://www.fanniemae.com/portal/funding-themarket/mbs/multifamily/dusprepaymenthistory.html MBS Prospectuses Provides a link to all Fannie Mae MBS Prospectuses, both single-family and multifamily. http://www.fanniemae.com/portal/jsp/mbs/docu ments/mbs/prospectus/index.html Multifamily Master Trust Agreement Provides a link to the Trust Agreements for Fannie Mae MBS, both single-family and multifamily. http://www.fanniemae.com/portal/jsp/mbs/docu ments/mbs/trustindentures/index.html 43 © 2022 Fannie Mae Eligibility: Sample HPB Report 44 © 2022 Fannie Mae Yield Maintenance Prepayment Protection in Fannie Mae Multifamily Securities A majority of fixed-rate DUS MBS use yield maintenance as the form of prepayment protection. If a borrower voluntarily prepays during the Yield Maintenance term, the following process is initiated: Borrower notifies Servicer of prepayment Servicer and Fannie Mae compare Yield Maintenance calculation results Servicer notifies Fannie Mae of prepayment Prepayment is processed and reported Investor’s portion of Prepayment Premium (if collected) is passed through to the investor Borrower Yield Maintenance Payment Calculation THE GREATER OF…. Amount of principal being repaid * [(Interest rate – CMT yield rate) * PV Factor] 1% of the amount of principal being prepaid Amount Received by Investor1 Fannie Mae calculates the share of the prepayment fee to be retained by the company and the share of prepayment fee to be passed on to the investor. The investor portion will equal: Amount of principal being prepaid * (pass through rate – CMT yield rate) * PV factor Note: A detailed explanation and a numerical example of yield maintenance prepayment protection calculation can be found in Fannie Mae’s DUS Program Overview entitled “Celebrating 30 Years of the Fannie Mae Delegated Underwriting & Servicing (DUS) Program” available at the following link: https://capitalmarkets.fanniemae.com/media/4046/display. 1 Fannie Mae does not guarantee prepayment premiums. ** This Yield Maintenance formula is applicable for all new fixed rate loans acquired by Fannie Mae. Not all existing Fannie Mae multifamily loans have the same or any yield maintenance formula and not all MBS provide that investors receive a portion of any yield maintenance premiums. The offering documents for each Fannie Mae Multifamily MBS or GeMSTM security will describe the yield maintenance formula, if any, applicable to the underlying mortgage loans and the portion of any yield maintenance premiums to be passed through to investors. 45 © 2022 Fannie Mae Multifamily DUS Prepayment History To provide market participants transparency into the performance of our loans, Fannie Mae provides historical prepayment information for its multifamily Delegated Underwriting and Servicing (DUS®) loans. The prepayment information offers performance details to help investors analyze DUS prepayment behavior, credit performance, and other multifamily market trends to determine some of the risks associated with an investment in multifamily MBS. Loans Included Loans Excluded Standard: DUS Fixed Rate MBS and cash loans with yield maintenance terms ending six months prior to maturity • • • SARM: DUS Structured Adjustable Rate (SARM) MBS and cash loans with an initial 12-month lockout followed by 1% prepayment premium Non-Standard: DUS fixed rate MBS and cash loans with other yield maintenance terms (5/3, 7/5, 10/7, 18/15, 30/15) ARM 7-6: DUS 7-Year Adjustable-Rate MBS and cash loans with a maximum lifetime interest rate capped at 6% and an initial 12-month lockout followed by 1% prepayment premium Fixed Rate, Declining Premium: 10 Year DUS fixed rate MBS and cash loans with a percentage of UPB prepayment provision of 5%-5%-4%-4%-3%-3%-2%2%-1%-1% • • • • • • • • Aggregation Bulk Deliveries Credit Enhancements Credit Facilities DMBS Funded Forwards Hybrid ARMs Inactive Non-DUS Lenders Negotiated Transactions New Prior Approval Whole Loan REMICs Access the multifamily prepayment history information through Data Dynamics®, our free analytical tool: fanniemae.com/data-dynamics Additional information, including prepayment content, update frequency, and additional resources, such as a User Guide and Video Demo, is available here: http://fanniemae.com/portal/funding-the-market/mbs/multifamily/dusprepayment-history.html. 46 © 2022 Fannie Mae 2022 Multifamily Caps Multifamily Cap Highlights • • • • • Multifamily loan purchases cap of $78 billion for Fannie Mae (and $78 billion for Freddie Mac for a combined total of $156 billion) during the calendar year of 2022 To prevent market disruption, FHFA will not reduce the caps even if FHFA determines that the actual size of the 2022 market is smaller than was initially projected Minimum of 50% of the multifamily business must be mission-driven affordable housing Minimum of 25% of the multifamily business must be affordable to residents at 60% of area median income (AMI) or below Loan purchases that meet the 25% requirement also count as loan purchases toward the 50% requirement Multifamily Property Type Mission-Driven Affordable Requirements/Portion of Loan that Qualifies as Mission-Driven Targeted affordable housing properties Properties encumbered by a regulatory agreement or a recorded use restriction • 100% of loan amount qualifies if 50% or more of the units have rent restrictions • 50% of loan amount qualifies if less than 50% of the units have rent restrictions Other affordable units Properties that are not subject to a regulatory agreement or recoded use restriction • In standard markets (those not located in rural areas or in designated cost- or very cost-burdened renter markets), pro rata portion of the loan amount qualifies based on the percentage of units affordable at or below 80% of AMI • In cost-burdened renter markets, pro rata portion of the loan amount qualifies based on the percentage of units affordable at or below 100% of AMI • In very cost-burdened renter markets, pro rata portion of the loan amount qualifies based on the percentage of units affordable at or below 120% of AMI Rural area properties Pro rata portion of the loan amount qualifies based on % units affordable at 100% of AMI or below Small multifamily properties (5 to 50 units) • • • Manufactured housing rental community blanket loans The portion of the loan amount qualifies that reflects the share of units that receives credit under the Duty to Serve regulation Seniors housing assisted living properties Pro rata portion of the loan amount qualifies based on the percentage of units affordable at 80% of AMI or below Loans to finance energy or water efficiency improvements Pro rata portion of the loan amount qualifies based on % affordable units at or below 80% AMI in standard renter markets Pro rata portion of the loan amount qualifies based on % affordable units at or below 100% AMI in cost-burdened renter markets Pro rata portion of the loan amount qualifies based on % affordable units at or below 120% AMI in very cost-burdened renter markets Under the Fannie Mae Green Rewards/Green Building Certification programs: • 50% of the loan amount qualifies if at least 20% but less than 50% of the unit rents are affordable at or below 60% AMI • 100% of the loan amount qualifies if the percentage of affordable units is equal to or more than 50% Additionally, under the Fannie Mae Green Rewards program: • Renovations must project a minimum 15% reduction in annual whole property energy consumption and a minimum 15% reduction in annual whole property water and/or energy consumption Source: https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Announces-2022-Multifamily-Loan-Purchase-Caps-for-Fannie-Mae-and-Freddie-Mac.aspx • Must have a third-party data collection firm engaged for ongoing data collection for the life of the loan © 2022 Fannie Mae 47 Fannie Mae Securities Compared to Covered Bonds FNMA MBS FNMA GeMS Asset Pool Generally one loan – one pool Asset Type MBS Liquidity Regulatory Treatment Covered Bonds EUR RMBS Fixed group of MBS Dynamic Static / Revolving REMIC Mortgage Loans (may include commercial assets) Mortgage Loans High High High Limited High degree of standardization High degree of standarization High degree of standardization* Limited degree of standardization No Yes, time tranched classes No Yes Tranching Extension Risk None, hard final None, hard final Soft/hard bullet Yes Accounting Treatment On balance sheet On balance sheet On Balance Sheet On/Off Balance Sheet Underlying loan risk shared with lender Overcollateralization, ranges between 3%-25% depending on the bond Overcollateralization, subordination, 1st loss and excess spread Credit Enhancement Underlying loan risk shared with lender Loan-To-Value Limits ≤80% ≤80% Max 80% residential, max 60% commercial (Local differences may occur) No n/a Yes, time tranched classes Yes No, tranches with different seniority Yes, originator and collateral pool No, limited to asset pool and reserve fund Yes, linked to issuing bank Yes, not linked to originating bank Pari-Passu Dual Recourse Rating/Government Support Guaranteed payment of principal and interest Commitment of funds from U.S. Treasury Department under Senior Preferred Stock Purchase Agreement *Art. 52 (4) UCITS & Art. 129 (4), (5) CRR compliant. © 2022 Fannie Mae 48 Guaranteed payment of principal and interest Commitment of funds from U.S. Treasury Department under Senior Preferred Stock Purchase Agreement Multifamily Serious Delinquency Rates and Credit Losses Cumulative Total Credit Loss Rate, Net by Acquisition Year Through 2021(1) Serious Delinquency Rates(2) 49 © 2022 Fannie Mae 1. Cumulative net credit loss rate is the cumulative net credit losses (gains) through December 31, 2021 on the multifamily loans that were acquired in the applicable period, as a percentage of the total acquired unpaid principal balance of multifamily loans in the applicable period. Net credit losses include expected benefit of freestanding losssharing benefit, primarily multifamily DUS lender-risk sharing transactions. 2. Multifamily SDQ rate refers to multifamily loans that are 60 days or more past due, expressed as a percentage of the company’s multifamily guaranty book of business, based on unpaid principal balance. Multifamily SDQ rate for loans in a particular category (such as acquisition year, asset class or targeted affordable segment), refers to SDQ loans in the applicable category, divided by the unpaid principal balance of the loans in the multifamily guaranty book of business in that category. Certain Credit Characteristics of Multifamily Guaranty Book of Business (1/2) Certain Credit Characteristics of Multifamily Guaranty Book of Business by Acquisition Year, Asset Class, or Targeted Affordable Segment(1) As of December 31, 2021 4. 5. 6. 7. 50 Seniors Student Manufactured Privately Ow ned 2021 /Co-op(2) Housing(2) Housing(2) Housing(2) w ith Subsidy (3) $74.2 $69.2 $363.5 $16.8 $14.6 $18.2 $47.2 16% 18% 17% 88% 4% 4% 4% 11% 3,147 3,818 4,958 4,192 25,977 629 641 1,609 3,838 $18.6 $17.9 $17.5 $15.0 $16.5 $14.0 $26.6 $22.8 $11.3 $12.3 66% 65% 66% 64% 65% 65% 66% 66% 65% 68% 1.9 2.0 1.9 1.9 2.4 2.3 2.1 1.8 1.8 2.2 2.2 25% 92% 88% 93% 94% 94% 89% 92% 62% 82% 93% 85% Book Earlier 2009-2016 2017 2018 2019 2020 Total UPB (Dollars in billions) $413.1 $7.0 $87.6 $51.9 $56.3 $66.9 % of Multifamily Guaranty Book 100% 2% 21% 12% 14% Loan Count 28,856 2,784 7,169 2,788 Average UPB (Dollars in millions) $14.3 $2.5 $12.2 Weighted-Average OLTV Ratio 65% 69% 66% Weighted-Average DSCR(4) 2.1 3.1 % Fixed rate 91% % Full Interest-Only 33% 28% 23% 31% 35% 34% 38% 40% 35% 13% 30% 25% 25% % Partial Interest-Only (5) 51% 19% 48% 54% 53% 56% 50% 50% 50% 59% 63% 58% 44% % Small Balance Loans (6) 42% 91% 50% 31% 28% 35% 36% 26% 42% 14% 24% 50% 48% % DUS(1) 99% 91% 99% 98% 100% 100% 99% 99% 99% 98% 100% 100% 98% 0.42% 0.03% 0.80% 0.90% 0.47% 0.36% 0.08% 0.00% 0.30% 1.30% 2.87% 0.06% 0.13% Serious Delinquency Rate(7) 2. 3. Asset Class or Targeted Affordable Segment Conventional 2008 & Categories are not m utually exclusive 1. Acquisition Year Overall The multifamily guaranty book of business consists of: (a) multifamily mortgage loans of Fannie Mae; (b) multifamily mortgage loans underlying Fannie Mae MBS; and (c) other credit enhancements that the company provided on multifamily mortgage assets. It excludes nonFannie Mae multifamily mortgage-related securities held in the retained mortgage portfolio for which Fannie Mae does not provide a guaranty. Data reflects the latest available information as of December 31, 2021. See https://multifamily.fanniemae.com/financing-options/products for definitions. Loans with multiple product features are included in all applicable categories. The Multifamily Affordable Business Channel focuses on financing properties that are under an agreement that provides long-term affordability, such as properties with rent subsidies or income restrictions. The parameters to qualify under Privately Owned with Subsidy were expanded in Q3 2021, resulting in an increase in properties classified as targeted affordable volume. Weighted-average debt service coverage ratio, or "DSCR", is calculated using the latest available income information from annual statements for these properties. When operating statement information is not available, the DSCR at the time of acquisition is used. If both are unavailable, the underwritten DSCR is used. Although the company uses the most recently available results from their multifamily borrowers, there is a lag in reporting, which typically can range from three to six months, but in some cases may be longer. Accordingly, the financial information Fannie Mae has received from borrowers may not reflect the most recent impacts of the COVID-19 pandemic. Co-op loans are excluded from this metric. Includes any loan that was underwritten with an interest-only term less than the term of the loan, regardless of whether it is currently in its interest-only period. Small balance loans refers to multifamily loans with an original unpaid balance of up to $6 million nationwide. Multifamily SDQ rate refers to multifamily loans that are 60 days or more past due, expressed as a percentage of the company’s multifamily guaranty book of business, based on unpaid principal balance. Multifamily SDQ rate for loans in a particular category (such as acquisition year, asset class or targeted affordable segment), refers to SDQ loans in the applicable category, divided by the unpaid principal balance of the loans in the multifamily guaranty book of business in that category. © 2022 Fannie Mae Certain Credit Characteristics of Multifamily Guaranty Book of Business (2/2) UPB by Maturity Year as of December 31, 2021(1) Top 10 MSAs by UPB as of December 31, 2021(1) Share of Book of Business: 39.4% Total Top 10 UPB: $162.8B Total UPB: $413.1B 1. 51 Certain Characteristics of Guaranty Book 2022 2025 2023 2026 2024 Other New York Houston Los Angeles Chicago Dallas Phoenix Washington D.C. Seattle Atlanta San Francisco Weighted-Average DSCR(2) Weighted-Average OLTV Ratio The multifamily guaranty book of business consists of: (a) multifamily mortgage loans of Fannie Mae; (b) multifamily mortgage loans underlying Fannie Mae MBS; and (c) other credit enhancements that the company provided on multifamily mortgage assets. It excludes non-Fannie Mae multifamily mortgage-related securities held in the retained mortgage portfolio for which Fannie Mae does not provide a guaranty. Data reflects the latest available information as of December 31, 2021. 2. Weighted-average debt service coverage ratio, or "DSCR", is calculated using the latest available income information from annual statements for these properties. When operating statement information is not available, the DSCR at the time of acquisition is used. If both are unavailable, the underwritten DSCR is used. Although the company uses the most recently available results from their multifamily borrowers, there is a lag in reporting, which typically can range from three to six months, but in some cases may be longer. Accordingly, the financial information Fannie Mae has received from borrowers may not reflect the most recent impacts of the COVID-19 pandemic. Co-op loans are excluded from this metric. © 2022 Fannie Mae Certain Credit Characteristics of Multifamily Loan Acquisitions Certain Credit Characteristics of Multifamily Loans by Acquisition Period(1) 2017 $67.1 67% 3,861 100% 98% 26% 58% 70% 57% Categories are not m utually exclusive Total UPB (Dollars in billions) Weighted-Average OLTV Ratio Loan Count % Lender Recourse(2) % DUS(3) % Full Interest-Only Weighted-Average OLTV Ratio on Full Interest-Only Acquisitions Weighted-Average OLTV Ratio on Non-Full Interest-Only Acquisitions % Partial Interest-Only (4) Origination Loan-to-Value Ratio(1) % OLTV ratio less than or equal to 70% % OLTV ratio greater than 70% and less than or equal to 80% % OLTV ratio greater than 80% 1. 52 2. 3. © 2022 Fannie Mae 4. 2018 $65.4 65% 3,723 100% 99% 33% 58% 68% 53% 2019 $70.2 66% 4,113 100% 100% 33% 59% 69% 56% Top 10 MSAs by 2021 Acquisition UPB(1) Share of Acquisitions: 36% Total UPB: $25.3B 2020 $76.0 64% 5,051 99% 99% 38% 58% 68% 50% 2021 $69.5 65% 4,203 100% 99% 40% 59% 68% 50% Acquisitions by Note Type(1) New York Chicago Los Angeles Phoenix Dallas Denver Variable-rate Washington D.C Houston Fixed-rate Atlanta San Diego The multifamily guaranty book of business consists of: (a) multifamily mortgage loans of Fannie Mae; (b) multifamily mortgage loans underlying Fannie Mae MBS; and (c) other credit enhancements that the company provided on multifamily mortgage assets. It excludes non-Fannie Mae multifamily mortgage-related securities held in the retained mortgage portfolio for which Fannie Mae does not provide a guaranty. Data reflects the latest available information as of December 31, 2021. Represents the percentage of loans with lender risk-sharing agreements in place, measured by unpaid principal balance. Under the Delegated Underwriting and Servicing ("DUS") program, Fannie Mae acquires individual, newly originated mortgages from specially approved DUS lenders using DUS underwriting standards and/or DUS loan documents. Because DUS lenders generally share the risk of loss with Fannie Mae, they are able to originate, underwrite, close and service most loans without a pre-review by the company. Includes any loan that was underwritten with an interest-only term less than the term of the loan, regardless of whether it is currently in its interest-only period. Disclaimers Copyright© 2022 by Fannie Mae. Forward-Looking Statements. This presentation and the accompanying discussion contain a number of estimates, forecasts, expectations, beliefs, and other forward-looking statements, which may include statements regarding future benefits of investing in Fannie Mae products, future macroeconomic conditions, future actions by and plans of the Federal Reserve, Fannie Mae’s green and social bond issuance activity and its impact, Fannie Mae’s future business plans, strategies and activities and the impact of those plans, strategies and activities. These estimates, forecasts, expectations, beliefs and other forward-looking statements are based on the company’s current assumptions regarding numerous factors and are subject to change. Actual outcomes may differ materially from those reflected in these forward-looking statements due to a variety of factors, including, but not limited to, those described in “Forward-Looking Statements” and “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2021. Any forward-looking statements made by Fannie Mae speak only as of the date on which they were made. Fannie Mae is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events, or otherwise. No Offer or Solicitation Regarding Securities. This document is for general information purposes only. No part of this document may be duplicated, reproduced, distributed or displayed in public in any manner or by any means without the written permission of Fannie Mae. The document is neither an offer to sell nor a solicitation of an offer to buy any Fannie Mae security mentioned herein or any other Fannie Mae security. Fannie Mae securities are offered only in jurisdictions where permissible by offering documents available through qualified securities dealers or banks. No Warranties; Opinions Subject to Change; Not Advice. This document is based upon information and assumptions (including financial, statistical, or historical data and computations based upon such data) that we consider reliable and reasonable, but we do not represent that such information and assumptions are accurate or complete, or appropriate or useful in any particular context, including the context of any investment decision, and it should not be relied upon as such. Opinions and estimates expressed herein constitute Fannie Mae's judgment as of the date indicated and are subject to change without notice. They should not be construed as either projections or predictions of value, performance, or results, nor as legal, tax, financial, or accounting advice. No representation is made that any strategy, performance, or result illustrated herein can or will be achieved or duplicated. The effect of factors other than those assumed, including factors not mentioned, considered or foreseen, by themselves or in conjunction with other factors, could produce dramatically different performance or results. We do not undertake to update any information, data or computations contained in this document, or to communicate any change in the opinions, limits, requirements and estimates expressed herein. Investors considering purchasing a Fannie Mae security should consult their own financial and legal advisors for information about such security, the risks and investment considerations arising from an investment in such security, the appropriate tools to analyze such investment, and the suitability of such investment in each investor's particular circumstances. Fannie Mae securities, together with interest thereon, are not guaranteed by the United States and do not constitute a debt or obligation of the United States or of any agency or instrumentality thereof other than Fannie Mae. Opinions, analyses, estimates, forecasts, and other views of Fannie Mae's Economic & Strategic Research (ESR) group included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR group bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views, including assumptions about the duration and magnitude of shutdowns and social distancing, could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the ESR group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management. 53 © 2022 Fannie Mae Contact Information Email @fanniemae Fixedincome_markeing@fanniemae.com www.facebook.com/fanniemae or call 800-2FANNIE (800-232-6643) @fanniemae.com for more information. Dan Dresser Helen McNally Senior Vice President, Multifamily Capital Markets Director, Investor Relations & Marketing 202.752.6039 202.752.8738 Daniel_t_Dresser@fanniemae.com Helen_McNally@fanniemae.com Fannie Mae is headquartered in Washington, DC and operates regional offices in Chicago, Philadelphia, Plano, and the greater Washington, DC area. Headquarters 1100 15th Street NW Washington, DC 20005 54 © 2022 Fannie Mae