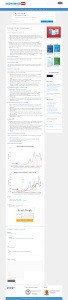

Sumbitted by-Amritansh Soni (IC181104) Nitin Jeendgar (IC181142) Aadarsh Jain (IC181144) Sanskar Tripathi(IC181154) Sammar Singhai(IC181158) Introduction FDI vs FPI History Recent Trends Steps taken by Government Advantages Every country requires capital or funds for its economic growth FDI ANF FPI are the two most important sources of funds In union Budget we commonly heard about these words in context to stock market and development However they refer to foreign investments but they are not interchangeable It is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. Thus it involves establishing a direct business and is mostly taken by large MNCs and Institutions. It involves transfer of funds, technologies etc. Example-Acquisition of stake in Flipkart by Walmart It refers to investing in the financial assets of a foreign country, such as stocks or bonds available on an exchange. These securities are more liquid It can be done for both i.e either short term and long term The history of Foreign Investments can be tracked with the establishment of EAST INDIA COMPANY. After Second World War, Japanese companies entered Indian market and enhanced their trade with India. The industrial policy of 1965, allowed MNCs to venture through technical collaboration in India After the 1990s the government opened the door for FDI INFLOWS and adopted a more liberal policies. Starting from an investments of less then 1billion usd dollar today India is the most important destination for the FDIs Telecommunication Construction Airlines 2005-Policy changes allowed 100% equity 2007- Increase due to increasing M&As like Tata steel and Corus 2008- Fall due to the Global Financial Crisis 2011-As share prices fell foreign investment was focused on sectors like oil and gas , pharmaceutical companies. Housing fell. 2012- Slowdown cased increased inflation 2013-Out of slowdown. 2016- Fall as startup India was introduced. 2019-Relaxsation in defense, psu sectors 2020-Fall due to lockdown but had some increase in investment in digital sector. Inc of 13 % while fall 42% RANK COUNTRY % OF INFLOW 1 Mauritius 38 2 Singapore 10 3 UK 9 4 Japan 7 5 U.S.A. 6 6 Netherland 4 7 Others 26 TOTAL 100 RANKS SECTORS Percentage 1 Service Sector 20 2 Telecommunication 8 3 Construction 7 4 IT Companies 7 5 Real estate 7 6 Pharma 6 7 Power 4 8 Automobile 4 9 Petroleum 3 Government has allowed to pick 100% stake in Air India Government allowed 26% investments in the digital sector 100% FDI was also allowed in Insurance intermediaries. Companies which set up their project in SEZ do not have to pay taxes for five years Renewal of FDI Policy in the defense sector. 100% FDI under automatic route in Coal mining Budget 19-20 also talked about opening FDI in Media and Animation FDI limit has been increased to 74% from 49% Amazon India announced an investment of US $1 Billion for digitalizing small business Jio sold 22% of its stake to the global investors. Mastercard planned to invest US$ 1 Billion over next 5 years Acquisition of 37% stake in Adani Gas by French and Oil and Gas Huge buying by the FIIs in the Indian Market Increase Employment Development of Backward areas Exchange rate stability Improved Capital flow Competitive Market Increase In Exports Provision of Finance and Technology India will be one of the countries attracting highest foreign investments in the coming year Though there was a setback due to Covid19 but now the demand has returned to pre Covid levels As per UBS India is going to attract US$75 billion over next 5 years.