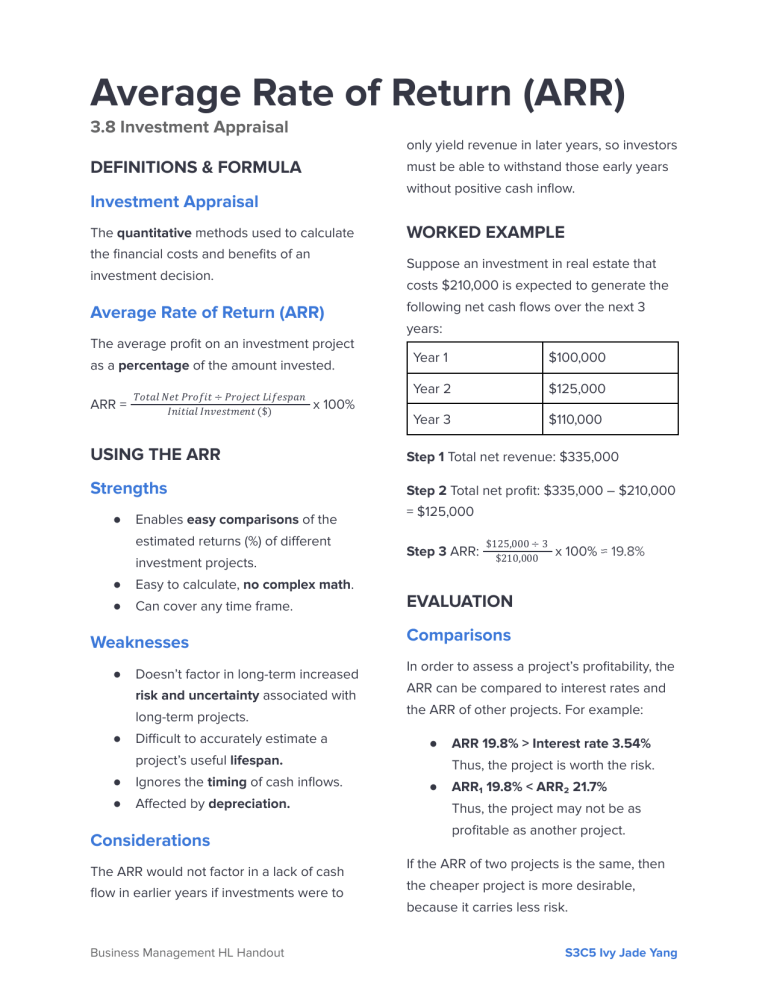

Average Rate of Return (ARR) 3.8 Investment Appraisal only yield revenue in later years, so investors DEFINITIONS & FORMULA must be able to withstand those early years without positive cash inflow. Investment Appraisal The quantitative methods used to calculate the financial costs and benefits of an Suppose an investment in real estate that investment decision. costs $210,000 is expected to generate the Average Rate of Return (ARR) The average profit on an investment project as a percentage of the amount invested. ARR = 𝑇𝑜𝑡𝑎𝑙 𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 ÷ 𝑃𝑟𝑜𝑗𝑒𝑐𝑡 𝐿𝑖𝑓𝑒𝑠𝑝𝑎𝑛 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 ($) WORKED EXAMPLE x 100% following net cash flows over the next 3 years: Year 1 $100,000 Year 2 $125,000 Year 3 $110,000 USING THE ARR Step 1 Total net revenue: $335,000 Strengths Step 2 Total net profit: $335,000 – $210,000 ● Enables easy comparisons of the estimated returns (%) of different investment projects. ● Easy to calculate, no complex math. ● Can cover any time frame. Weaknesses ● Doesn’t factor in long-term increased risk and uncertainty associated with long-term projects. ● Difficult to accurately estimate a = $125,000 Step 3 ARR: Ignores the timing of cash inflows. ● Affected by depreciation. Considerations The ARR would not factor in a lack of cash flow in earlier years if investments were to Business Management HL Handout x 100% ≈ 19.8% EVALUATION Comparisons In order to assess a project’s profitability, the ARR can be compared to interest rates and the ARR of other projects. For example: ● project’s useful lifespan. ● $125,000 ÷ 3 $210,000 ARR 19.8% > Interest rate 3.54% Thus, the project is worth the risk. ● ARR₁ 19.8% < ARR₂ 21.7% Thus, the project may not be as profitable as another project. If the ARR of two projects is the same, then the cheaper project is more desirable, because it carries less risk. S3C5 Ivy Jade Yang