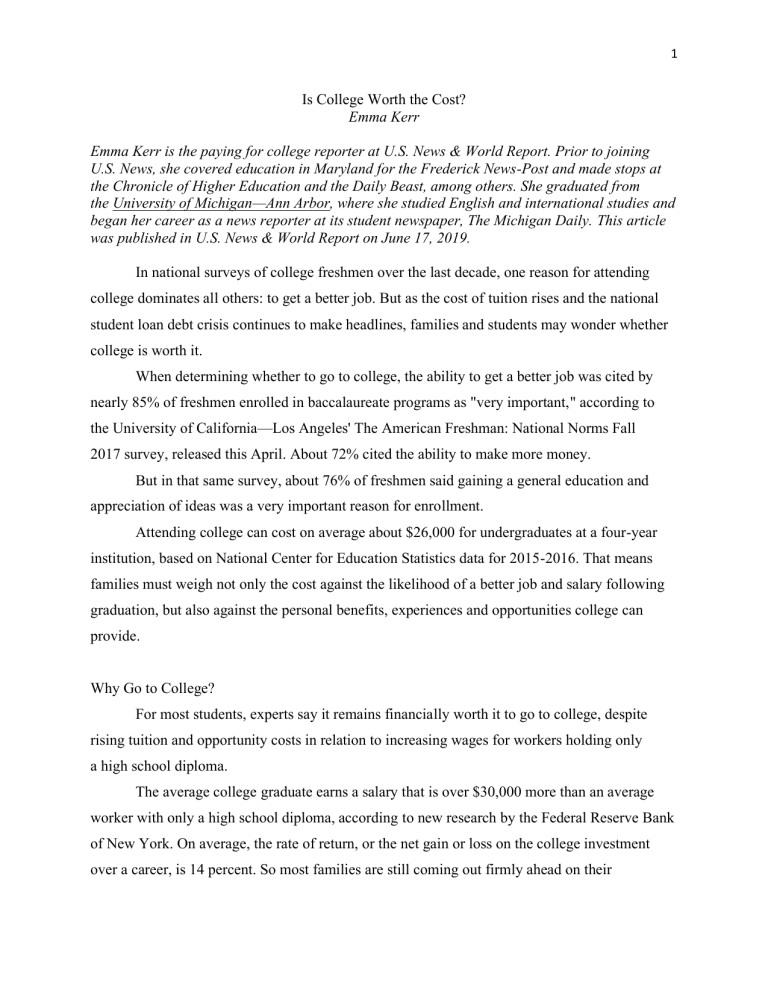

1 Is College Worth the Cost? Emma Kerr Emma Kerr is the paying for college reporter at U.S. News & World Report. Prior to joining U.S. News, she covered education in Maryland for the Frederick News-Post and made stops at the Chronicle of Higher Education and the Daily Beast, among others. She graduated from the University of Michigan—Ann Arbor, where she studied English and international studies and began her career as a news reporter at its student newspaper, The Michigan Daily. This article was published in U.S. News & World Report on June 17, 2019. In national surveys of college freshmen over the last decade, one reason for attending college dominates all others: to get a better job. But as the cost of tuition rises and the national student loan debt crisis continues to make headlines, families and students may wonder whether college is worth it. When determining whether to go to college, the ability to get a better job was cited by nearly 85% of freshmen enrolled in baccalaureate programs as "very important," according to the University of California—Los Angeles' The American Freshman: National Norms Fall 2017 survey, released this April. About 72% cited the ability to make more money. But in that same survey, about 76% of freshmen said gaining a general education and appreciation of ideas was a very important reason for enrollment. Attending college can cost on average about $26,000 for undergraduates at a four-year institution, based on National Center for Education Statistics data for 2015-2016. That means families must weigh not only the cost against the likelihood of a better job and salary following graduation, but also against the personal benefits, experiences and opportunities college can provide. Why Go to College? For most students, experts say it remains financially worth it to go to college, despite rising tuition and opportunity costs in relation to increasing wages for workers holding only a high school diploma. The average college graduate earns a salary that is over $30,000 more than an average worker with only a high school diploma, according to new research by the Federal Reserve Bank of New York. On average, the rate of return, or the net gain or loss on the college investment over a career, is 14 percent. So most families are still coming out firmly ahead on their 2 investment in higher education, though rising college costs have slightly lowered the rate of return for today's students. But not all college graduates experience these salary benefits. Annual wages for the bottom 25th percentile of college graduates are less than the median wages earned by a typical worker with a high school diploma, according to a 2014 study by the New York Fed. "While we can't be sure that the wages of this group wouldn't have been lower if they had never gone to college, this pattern strongly suggests that the economic benefit of a college education is relatively small for at least a quarter of those graduating with a bachelor's degree," economists Jaison R. Abel and Richard Deitz wrote in the study. Students go to college not only to pursue a career, but also an education, says Anthony P. Carnevale, research professor and director of the Georgetown University Center on Education and the Workforce, and the bachelor's degree is often best at achieving that. "We know that over the long term the combination of specific and general education you get in a bachelor's degree is more valuable than specific education alone in any particular field," Carnevale says. "The B.A. is still the gold standard." What Students Study Matters One way to weigh the costs of going to college against the financial benefits after graduation is to research median salaries for a student's expected college major. The Georgetown University Center on Education and the Workforce advises students to use these five rules when navigating the college process: Generally, more education is better; education level matters, but program of study and majors matter even more; there is great variation in earnings within majors; less education, such as certificates, can be worth more in some cases; and humanities and liberal arts majors never catch up with the highest-earning majors. Labor market outcomes of college graduates by major range widely. Graduates with majors like early childhood education and social services receive wages similar to those earned by workers with only a high school diploma. On the higher end, graduates with majors like pharmacy and computer engineering receive median midcareer salaries around six figures, according to the Federal Reserve Bank of New York's interactive updated in February 2019. 3 Alternatives to College Ultimately, earning a bachelor's degree may not be the right choice for everyone. Students often underestimate the long-term cost of college, according to a recent survey of recent and upcoming graduates by Cengage, an education and technology company based in Boston. The survey found that on average, near-graduates think it will only take six years to pay off their student loan debt, but other data shows it will likely take 20 years. Students also overestimate the likelihood they will land a job related to their education shortly after graduation. Students whose chosen career fields don't require a bachelor's degree, or those whose families determine the benefits do not outweigh the cost, might want to begin exploring alternatives to a four-year education. Ryan Craig, author of "A New U: Faster + Cheaper Alternatives to College" and cofounder and managing director of University Ventures, says the desire to conform to a social norm is what often pushes students to costly four-year colleges. "If it's a selective school and affordable, no one will be a bigger cheerleader than I will of that student going to college," Craig says. "But if it's a nonselective school, and the way I define it is does the institution admit less than 50% of their applicants, and high cost, if you're in that bottom left quadrant, less selective, less affordable, there should be a bright flashing red light." Community colleges offer vocational training and short-term certificates that can help high school graduates land jobs or ultimately earn inexpensive credits to later transfer to a fouryear college. Students interested in fields like nursing, welding, cosmetology, or medical assistant positions might consider certificate programs to cut costs. Other alternatives to college are popping up as well. Startups like Make School in San Francisco, an accredited skills-based program in applied computer science, offer unique options for job training outside of the traditional higher education model. At Make School, most students only pay tuition for a two-year bachelor's degree if they get a job paying $60,000 or more after graduation. 4 "A lot of folks in academia will say the beauty of college is you learn how to learn, you learn to be a critical thinker, you learn to be an engaged member of society, and that it almost cheapens it to be focused on a career outcome. But that's an incredibly false choice," says Jeremy Rossmann, co-founder of Make School. "You can do skills and a degree. You can do wellrounded and a career." Ultimately, the choice may come down to individual fit. Luis Talavera, a rising junior at Arkansas State University and member of the Bill and Melinda Gates Foundation Postsecondary Value Commission, is a first-generation student and first-generation American. He easily lists the costs and challenges associated with attending college but struggles to put into words the immense value of his college experience. "Knowing that sometimes you have to sacrifice a little to get where you want to go, I still would choose this route," Talavera says. "We are at a state in the world where you can look up anything with a simple cellphone. You have everything at your disposal now. Step out of that idea of being scared of what's next and look into what's out there."