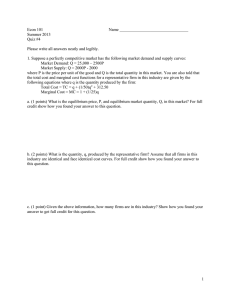

Micro Theory Quiz 8 Name: ______________________________ Notes: A. 15 minutes, 3 points. B. This is a closed book quiz. Calculators are permitted. 1. The short-run industry supply curve can be found by horizontally summing the short-run supply curves of all the individual firms in the industry. a. True b. False 2. The possibility of more firms entering an industry in the long run tends to make long-run industry supply curve flatter than short-run industry supply curve. a. True b. False 3. If a quantity tax is collected from competitive suppliers of a good, placing a tax on the good causes the price paid by consumers to increase more than if the tax had been collected directly from the buyers. a. True b. False 4. The market for a good is in equilibrium when the government unexpectedly imposes a quantity tax of $2 per unit. In the short run, the price will rise by $2 per unit so that firms can regain their lost revenue and continue to produce. a. True b. 5. If the supply curve is vertical, then the amount supplied is independent of price. a. True 6. In a certain industry, the supply curve of any firm is Si(p) = p/2. If a firm produces 5 units of b. False False output, what are its total variable costs? a. $50 b. $23 c. $37.50 d. $25 1 Micro Theory 7. The demand function for fresh strawberries is q = 200 - 5p and the supply function is q = 60 + 2p. What is the equilibrium price? a. $10 b. $20 c. $40 d. $50 8. The cheese business in Lake Fon-du-lac, Wisconsin, is a competitive industry. All cheese manufacturers have the cost function C = Q2 + 4, while demand for cheese in the town is given by Qd = 120 - P. The long-run equilibrium number of firms in this industry is a. 29. b. 58. c. 56. d. 120. 9. The inverse demand function for cigars is defined by p = 240 - 2q, and the inverse supply function is defined by p = 3 + q. Cigars are taxed at $4 per box. a. The after-tax price paid by consumers rises by more than $2, and the after-tax price received by suppliers falls by less than $2. b. The after-tax price paid by consumers goes up by less than $2, and the after-tax price received by suppliers rises. c. Consumers and suppliers share the cost of the tax equally. d. The after-tax price paid by consumers rises by $4, and the after-tax price received by suppliers stays constant. 10. The demand function for abalone is q = 30 - 9p and the supply function is q = 6p. Suddenly the yuppies discover abalone. The quantity demanded at every price doubles. The supply function, however, remains the same as before. What is the effect on the equilibrium price and quantity? a. The price doubles and the quantity remains constant. b. The quantity doubles and the price remains constant. c. Both price and quantity double. d. Both price and quantity increase but neither doubles. 2