Accounting Exam Review: Liabilities, Provisions, Deferred Taxes

advertisement

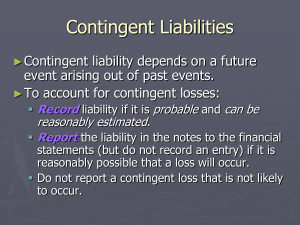

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. Part 2 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Choice (a), however, if this is not available then choice (b Choice (a), however, if this is not available then choice (b) Increase in equity Liability Choice (a), however, if this is not available then choice (b) Immediately as expense and as an increase in equity at grant date. Make a transfer from one component of equity to another Make a transfer from one component of equity to another Only if they are beneficial to the employee As additional expense over the remainder of the vesting perio Juice co- None Milk Co- April 1, 2017 Coffee Co- Dr., Equipment ₱12,000 Water Co- Mar. 1 Dr., Advertising expense, ₱900,000 ABC Co.-10,000 Jan. 1 Dr., Compensation expense ₱150,000 ABC Co. grants 1,000-share premium 1,000,000 Laser Co salaries.- ₱400,000 Salaries- ₱455,000 ABC Co., grants- ₱180,000 ABC Co. grants- 155,550 , ABC Co., grants 100- 4,250 Cash settled share-based payment transaction As liability The fair value of the share appreciation rights Measured at fair value on initial recognition, at the end of each subsequent period, and on settlement date A compound financial instrument Either a or b but not both Coke Co. granted- 4,400 Royal Co.- 131,360 Sprite Co.- 150,000 Mirenda Co- Credit, Accounts payable ₱110,000 - Credit, Share capital ₱100,000 Credit, Share premium 10,000 , Mountain Dew Co- 40,000 ₱10,000 1. Appropriately classifying them as regular liabilities in the statement of financial position 2. Customer loyalty program 3. Points 4. Fair value of the award credits 5. Shall be recognized initially as deferred revenue and subsequently recognized as revenue upon the redemption of the award credit 6. When the machines are sold 7. Decrease and DecreasE 8. A liability of uncertain timing or amount 9. All of the above 10. Midpoin 11. Reflects the weighing of all possible outcomes by their associated probabilities 12. Is the individual most likely outcome adjusted for the effect of other possible outcome 13. The reimbursement shall not be treated as separate asset and therefore “netted” against the estimated liability for the provision 14. Neither a nor 15. Provisions shall be recognized for future operating losseS 16. Future refurbishment costs due to introduction of a new computer system 17. Both a and b 18. Neither a and b 19. Be post-tax discount rate 20. Restructuring 21. Fundamental reorganization of an entity that has an immaterial and insignificant impact on its operation 22. Big bath provision 23. Contractually required costs of retraining staff being made redundant from the division being close 24. Possible obligation that arises from past event and whose existence will be confirmed only by the occurrence or nonoccurrence of one or more uncertain future events not wholly within the control of the entity 25. A contingent liability is both probable and measurable 26. Contingent asset 27. A contingent asset is only disclosed when the occurrence of the future event is possible or remote 28. Remote 29. Be accrued by debiting an expense account and crediting a liability account 30. Realized 31. A disclosure only 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. In the notes to the financial statement Uncertain as to timing or amount The occurrence of the future event is probable and the amount can be reasonably estimate A new product introduced by Eaut-54,000 lawsuit against Scruicer Company-750,000 Jekyll Company-550,000 Ethel Company’s-628,000 , Pains Company-135,000 Greco Company- 21,000 A court case decided- 0 lawsuit against Monica Company- 500,000 Mary Company plant- An accrued liability of ₱500,000 Gallery Department- ₱400,000 Goverance Inc- ₱70,248 , West Company- None Home Company- An accrued liability of ₱500,000 and would disclose a contingent liability Hope guarantee- Recognize a provision for liability of ₱200,000 and also disclose in the notes to financial statemen Milder Company- The contingent liability should be disclosed by way of note to the financial statements 1. Taxable profit 2. Taxable temporary difference 3. Deferred tax liability 4. Current tax expense 5. Increase in deferred tax liability less the increase in deferred tax asset 6. The entity has a legal enforceable right to offset a current tax asset against a current tax liability 7. Taxable temporary differences 8. When an entity makes a distinction between current and noncurrent assets and liabilities, it shall classify 9. Deductible temporary differences and carryforward of unused tax 10. Neither I nor 11. Expenses or losses that are deductible before they are recognized in accounting income 12. Excess of tax depreciation over accounting depreciation 13. Use of straight line depreciation for accounting purposes and an accelerated rate for income tax purposes 14. Unearned revenue 15. Warranty expenses are recognized on the accrual basis for financial accounting purposes but recognized for tax purposes 16. A noncurrent liability 17. Paying fines for violation of laws 18. Enacted tax rat 19. Tax expense shown in the income statement is equal to income taxes payable for the current year plus or minus the change in the 20. Associates tax effect with different items in the income statement 21. Hilton Company-₱1,770,000 22. Aris Company- 1,140,000 23. Tiger Company- 1,650,000 24. Canterbury Company- 1,290,000 25. Cascade Company- 4,400,000 26. Ankh Company- 0 27. West Company- 600,000 28. Caleb Company- 80,000 29. North Company- 0 30. Aloha Company- 156,000 31. Shin Company- 80,000 32. Bolton Company- 900,000 33. Glory’s December- ₱60,800 34. Toner Company-320,000 35. Mule Company- 1,750,000 36. ₱385,000 37. 2,100,000 38. 3,465,000 39. Easy Company acquired-1,750,000 40. 750,000 41. 2,700,000 42. 600,000 43. 2,550,000 44. 1,400,000