Accounting Principles Exam, Islamic University of Gaza

advertisement

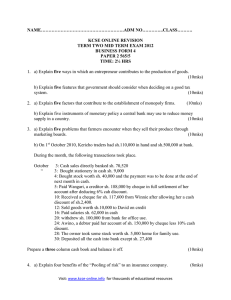

The Islamic University of Gaza Faculty of Commerce Accounting Department Accounting Principles (1) Mid Term Exam, First Semester 2016/2017 Time Allowed: ONE hour Answer Question one and Question two (required 1) on the exam paper: Prof. Salem A. Helles 29 October 2016 1 Question One (4 Marks) Each of these multiple choice questions has four suggested answers, (A), (B), (C) and (D). you should read each question and then decide which choice is best, either (A) or (B) or (C) or (D). 1. Which of the following statements is incorrect? a. Assets – Capital = Liabilities. b. Liabilities + Capital = Assets. c. Liabilities + Assets = Capital. d. Assets – Liabilities = Capital. 2. Which of the following is not an assets? a. Buildings. b. Cash. c. Accounts receivable. d. Accounts Payable . 3. Which of the following is a liability? a. Machinery. b. Creditors. c. Van. d. Cash at bank. 4. Given the following, what is the amount of capital? Shop $20,000, Inventory $8,500, Cash $100, Creditors $3,000, Bank Overdraft $4,000: a. $21,100 b. $21,600 c. $32,400 d. $21,400 2 Question Two: 2015 Oct. 1 Oct. 10 Oct. 25 (6 Marks) A/C Capital Sales R. Deeb Cash Account $ 2015 2500 Oct. 15 320 Oct. 19 180 Oct. 30 A/C Bank Purchases Salaries $ 200 1400 350 Required:1- Balance off Cash account at the end of the month . 2- Redraft Cash account in Three – Column Ledger style account. Question Three: (20 Marks) Record the following transactions for the month of January 2016 of a small finishing retailer, and Post to Bank Account Only. 1 2 3 4 5 6 8 10 11 13 14 15 16 18 21 24 26 29 30 30 Started in business with £10,500 cash. Put £9,000 of the cash into a bank account. Bought goods for cash £550. Bought goods on credit from: F Hood £930; M Smith £160. Bought stationery on credit from Buttons Ltd £89. Sold goods on credit to: R Tong £1170; M Singh £1326. Paid rent by cheque £220. Bought fixtures on credit from Chiefs Ltd £610. Paid salaries in cash £790. We return stationery for Buttons Ltd £39. Returned goods to: F Hood £30; M Smith £42. Bought van by cheque £6,500. Received loan from B Barclay by cheque £2,000. Goods returned to us by: R Tong £5; M Singh £20. Cash sales £145. The owner withdrew £150 cash for own use. We paid the following by cheque: F Hood £900; M Smith £118. Received cheque from: M Singh £500. Received £614 cash from R Tong. Received rent of £240 cash. Good Luck 3