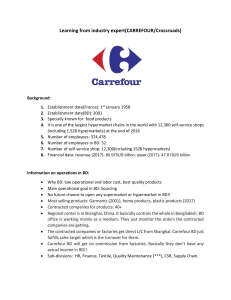

Chapter 5 Carrefour S.A. Teaching Note Version: May 2013 Introduction The Carrefour case is designed to teach students how to analyze the performance of a company using financial statements. Carrefour S.A. is one of the world’s largest retailers. Following a steady decline in company performance during the past three years, Carrefour has cut its dividends by more than fifty percent. Students are asked to analyze Carrefour’s financial statements and segment data to find explanations for the company’s recent dividend cut and assess whether further changes to the company’s dividend payout ratio can be expected. The case’s focus on current and near-term dividend decisions helps to steer students’ attention away from long-term trends in performance (i.e., avoiding conclusions that “anything can happen in the long run”), toward recent performance changes and the transitory versus persistent nature of such changes. The discussion of the financial analysis is preceded by a discussion of Carrefour’s strategy and accounting. The accounting analysis covers operating lease adjustments, (basic) pension adjustments, and the distinction between operating and investment assets. It also includes a discussion of how the financial analysis is affected by Carrefour’s spin-off of discount retailer Dia (and how to adjust for the spin-off using IFRS 5 footnote disclosures). The case can be taught in two sessions, first focusing on Carrefour’s strategy and accounting choices, then discussing the retailer’s financial performance and cash flows. An advantage of discussing the case in two sessions is that it allows the instructor to provide students with standardized and adjusted financial statements (and possibly a set of financial ratios) prior to the second session. Questions for students The following set of questions can help to provide structure to the discussion: 1. 2. 3. 4. Analyze Carrefour’s competitive and corporate strategy. What are the key risks of the company’s strategy? Analyze Carrefour’s accounting. Are any adjustments to Carrefour’s financial statements necessary? How would you account for the spin-off of Dia? Analyze Carrefour’s operating management, financial management and investment management during the years 2008 to 2011, making use of both financial statement data and segment data. What are the primary drivers of the company’s performance decline since 2008? How does Carrefour’s performance compare to the performance of Casino and Tesco? Summarize the key findings of the financial analysis. What explains Carrefour’s decision to cut its dividends in 2011? 5. Taking into account management’s outlook for 2012 (and making some simplifying assumptions about future margins and turnover), estimate Carrefour’s 2012 free cash flow. How likely is it that Carrefour will be able to pay out (at least) 52 cents in dividends in 2012? What actions could management take to improve the company’s ability to pay out dividends? Case analysis Question 1 Key characteristics of Carrefour’s strategy and the associated risks are the following: Competing on price and product. Carrefour follows a strategy that combines some elements of a differentiation strategy with elements of a cost leadership strategy, especially in its hypermarkets. Specifically, the hypermarkets differentiate themselves from competitor supermarkets (1) by offering a much broader assortment (more product categories (food and non-food) as well as a wider choice of brands within one product category (including its own brands)) and (2) investing in customer loyalty programs (e.g., the “Pass” card). This strategy is backed up by a strong marketing campaign. At the same time, however, Carrefour realizes that—especially during economic downturns—its customers have low switching costs and are relatively price sensitive. The company therefore wishes to keep the prices in its hypermarkets at economic levels. The way in which the company can achieve this is by: - Keeping a close eye on what consumers want (through customer surveys and building a “customer behavior database” using data gathered through, for example, the company’s customer loyalty card) and by timely adjusting its assortment and pricing to changes in consumers’ preferences. - Having a well-developed logistics network. This keeps turnover high and helps to control costs. - Benefiting from economies of scale, not only in logistics but also in purchasing of supplies (aggregation of purchasing; international negotiations with suppliers). - Selling low-priced products under Carrefour’s own brand name. An important risk of following a combination of strategies is that Carrefour’s hypermarkets become “stuck in the middle.” The planned changes that Jose Luis Duran—the new CEO— announced after replacing Daniel Bernard suggest that this happened during the first half of the 2000s. While many of Carrefour’s competitors, such as Leclerc, Auchan, Aldi, and Lidl, were able to aggressively lower their prices during the economic downturn, according to Duran Carrefour had focused too much on differentiation and improving its margins per square meter of store space (which mixes percentage margins and asset turnover). Consequently, the company lost its competitive edge to price discounters (by losing its reputation for low prices), which slowed down Carrefour’s growth and harmed its domestic market share. Some students may argue that the changes that CEO Olofsson implemented during the years 2009 till 2011 were also part of a combination of strategies. On the one hand Olofsson focused on increasing customers’ awareness of Carrefour’s price competitiveness and cutting costs; on the other hand the CEO attempted to revitalize the hypermarket concept by converting hypermarkets into Carrefour Planet stores. The spin-off of discount retailer Dia suggests, however, that Olofsson wanted to position Carrefour as a differentiator rather than as a cost leader. Nonetheless, at the end of 2011, several analysts argued that Carrefour should quickly adjust its pricing strategy (i.e., switching to an “every day low price” [EDLP] strategy) to improve performance. International growth. When large companies such as Carrefour start to obtain a dominant position in their domestic markets, they may be “forced” to expand overseas or enter other industries. Carrefour’s corporate strategy is to expand overseas rather than diversify. More importantly, as indicated above, achieving growth is an essential part of Carrefour’s strategy because (international) growth helps the company to obtain economies of scale in purchasing, logistics and the development of Carrefour-branded products. For example, Carrefour sells its own branded products in the same packaging worldwide (of course printed in different languages). The company’s overseas retailing operations are, however, more risky than its domestic operations. First, to some extent retailing remains a local business because consumers’ tastes differ substantially across countries. Profitable expansion outside Carrefour’s domestic market is only possible if the company has good knowledge about local customers’ preferences and tastes. Consequently, a slightly safer way to expand abroad is to acquire local supermarket chains. A disadvantage of this strategy is, however, that acquisition premiums have to be paid, which can also drive down profits. Second, many of Carrefour’s “intercontinental” hypermarkets are located in countries where the economic environment is risky: consumers in economically less developed countries are likely to be more price sensitive; East Asian and South American countries tend to have more bureaucracy and stronger government protection of local firms. Third, in several countries, Carrefour has to compete with other multinationals such as Tesco and Wal Mart, who are trying to gain a strong market position (mostly through severe price competition). In sum, Carrefour’s overseas operations tend to be in countries where consumers are likely more price sensitive, several multinationals engage in severe price competition, and the economy is less stable. Nonetheless, an important benefit of the retailer’s expansion into other geographical market is that it helps Carrefour to become less sensitive to local economic cycles, such as the European economic downturn. Note, for example, that in 2011 Carrefour earned close to 59 percent of its operating profit in Latin America and Asia even though the company generated 28 percent of its fiscal sales in these regions. At the end of 2011 analysts argued, however, that while Carrefour’s expansion into emerging markets had been a good choice, the company’s emerging markets portfolio was too diversified. Question 2 First, one of Carrefour’s key assets are the company’s stores, many of which it leases under operating leases. At the end of 2011, Carrefour had large operating lease commitments. Exhibit TN-1 estimates the net present value of these commitments. The estimated PV of Carrefour’s operating lease payments is approximately €3.15 billion, which is equivalent to slightly more than 31 percent of Carrefour’s non-current debt in 2011 (3,150/10,257) and implies an understatement of Carrefour’s non-current tangible assets by approximately 19 percent (3,150/[13,770 + 3,150). The calculation of operating lease commitments is based on the following assumptions: - New lease commitments in year t are equal to the sum of (a) PV of lease commitments in year t minus [1 + r]* PV of lease commitments in year t-1 and (b) actual lease payments in year t minus year t lease payment as anticipated at the end of year t-1. - The lease repayment is equal to the PV of lease commitments in year t-1 plus new lease commitments in year t minus the PV of lease commitments in year t. - Deprecation is set equal to the lease repayment. - The interest expense is equal to the difference between the actual lease payment and the lease repayment. Second, Carrefour has off-balance sheet pension liabilities (assets) in the years 2009 – 2011 (2006 – 2008). Exhibit TN-2 shows the annual differences between the funded status of Carrefour’s pension plans and the on-balance sheet pension liability, as well as the balance sheet adjustments that must be made to bring the off-balance sheet commitment to the balance sheet. Third, Carrefour combines (food and non-food) retail with financial (e.g., financial services and property rental) activities. To analyze the profitability of Carrefour’s retail business and be able to compare Carrefour, Casino and Tesco on the same basis, the analyst must remove financing components from Carrefour’s revenues, for example, by classifying financing fees and rental revenues as investment income (and investment property and consumer credit as investment assets). Finally, to improve comparability across years the analyst must assess how Carrefour’s 2010 performance and financial position would have been had the discount retailer been spun-off at the beginning of 2010. In accordance with the requirements of IFRS 5, Carrefour has disclosed restated 2010 income statements and cash flow statements (excluding Dia). Exhibit TN-3 shows Dia’s 2010 standardized balance sheet, which can be used to restate Carrefour’s 2010 balance sheet. This balance sheet has not been disclosed by Carrefour (as it is not required under IFRS 5) but comes from Dia’s 2011 financial statements. Questions 3 and 4 The key focus of the case is on understanding the reasons for why Carrefour cut its dividend and assessing whether further dividend changes can be expected. Therefore, the financial analysis will focus on understanding the short-term changes in performance and the transitory versus persistent nature of such changes. During the years 2008 through 2011, Carrefour’s return on equity (including other, one-time items) decreased from 14.4 percent to -29.0 percent, suggesting a dramatic decline in performance. The retailer’s income statements show, however, that negative one-time items such as impairment charges and restructuring costs had a significant impact on ROE, especially in 2011 when Carrefour recognized large impairment losses on goodwill in Italy and Greece. After removing these one-time items, return on equity becomes as follows: 2011 -4.2% 2010 excl Dia 2010 original 12.0% 13.0% 2009 10.8% 2008 16.8% Some students may argue that restructuring costs tend to be a persistent component of Carrefour’s operating performance and must therefore be classified as operating expense rather than other expense. When doing so, the retailer’s return on equity becomes: 2011 -6.1% 2010 9.7% 2010o 10.3% 2009 9.3% 2008 16.3% In the remainder of this analysis it is assumed that restructuring expenses are transitory items classified as other expenses. Exhibit TN-4 displays a set of ratios for Carrefour, Casino and Tesco. The ROE decomposition indicates that Carrefour has lower operating profit margins than Casino and Tesco but significantly higher operating asset turnover. Because over the past years Carrefour’s operating profit margins have been low—to the tune of one percent and eventually turning negative in 2011—the retailer’s returns on operating assets have been below that of its two peers. In 2009 and 2010 Carrefour outperformed Casino in terms of return on equity for two reasons: (1) Carrefour’s investment assets were more profitable than those of Casino and (2) Carrefour had higher leverage, helping the retailer to achieve a greater financial leverage gain. Tesco also has fewer and less profitable investment assets than Carrefour but has achieved higher ROE performance, primarily because of its superior operating performance. During the most recent years Carrefour’s operating asset turnover increased, from 3.39 to 3.51 (including Dia) between 2009 and 2010 and from 3.28 to 3.72 between 2010 and 2011. Carrefour’s NOPAT margin has been low and relatively stable, around 1 percent, until 2011, when the margin turned negative. The retailer’s financial leverage steadily increased, from 2.18 in 2008 to 3.14 in 2011. In sum, during the past years Carrefour’s operating asset turnover has been high and increasing. However, the retailer has not been able to generate sufficient margin to convert high asset turnover into high (or normal) operating performance. In 2008 through 2010 Carrefour’s high investment performance (i.e., performance in the company’s financial segment) and high leverage helped the retailer to achieve normal or above-normal returns on equity. However, in 2011 the retailer’s financial leverage effect turned negative, underlining the risks of Carrefour’s financial strategy. The following sections analyze the components of Carrefour’s and its peer’s ROE in further detail. Operating asset turnover Carrefour’s operating asset turnover increased in 2010 and 2011, which possibly leads some students to conclude that Olofsson’s actions to improve turnover indeed paid off. After having discussed the above ROE decomposition, the instructor can ask students to further decompose asset turnover, examine non-financial and segment data, and skim through Carrefour’s footnote disclosures to identify the drivers of the retailer’s asset turnover improvement. Further analysis of operating asset turnover reveals the following: - - Days’ inventories remained fairly constant between 2009 and 2010 but increased in 2011, in spite of Carrefour’s intention to reduce days’ inventories by seven days. This is worrisome as inventory turnover is one of the key profit drivers of a retailer. Carrefour makes much use of supplier financing, as evidenced by the retailer’s relatively high days’ payables. Between 2008 and 2010 days’ payables decreased by close to seven days (in total). This reduction in Carrefour’s reliance on supplier financing had a negative effect on operating asset turnover. - In 2011 Carrefour recognized a goodwill impairment charge of €1,938 million, thereby artificially improving its non-current asset turnover. When adding back the charge to non-current assets, Carrefour’s 2011 non-current asset turnover ratio changes from 3.00 to 2.80 (versus 2.67 in 2010). The goodwill charge thus explains about 60 percent of the increase in Carrefour’s non-current asset turnover ratio. Given the above observations, the primary driver of the improvements in operating asset turnover during 2009 – 2011 is the change in PP&E turnover. PP&E turnover increased from 4.38 to 4.77 in 2010 and from 4.65 (excluding Dia) to 4.76 in 2011. The instructor can ask students to make use of Carrefour’s non-financial and segment data (in Exhibit 1) to examine two questions: Which segments contributed most to the increase in non-current asset turnover? Did the increase in non-current asset turnover result from an increase in store productivity? The second question is relevant because non-operating factors such as asset write downs or sale-and-leaseback transactions (see e.g. Note 3 on page 234) can affect the carrying value of PP&E without changing Carrefour’s operating capacity. Between 2009 and 2011, net sales per 1,000 square meters of store space (in Carrefour’s non-discount division) was as follows: Non-discount total 2011 6.48 2010 6.50 2009 6.20 Percentage change -0.32% 4.93% These data illustrate that Carrefour’s store productivity improved by close to 5 percent in 2010 but remained constant during 2011. The first question is especially relevant given that Carrefour has recently spun off its discount division. Between 2009 and 2011, net sales to tangible and intangible fixed assets in Carrefour’s operating segments was as follows: 2011 2010 2009 France 7.52 7.58 7.64 Rest of Europe 4.64 4.71 4.67 Latin America 4.37 3.97 3.43 Asia 4.88 4.89 4.48 Hard discount 5.94 5.50 During these years, net sales per 1,000 square meters of store space was as follows: 2011 2010 2009 France 11.37 11.17 11.04 Rest of Europe 5.30 5.51 5.57 Latin America 6.45 6.04 4.81 Asia 2.77 2.82 2.56 Hard discount 4.92 4.50 The analysis of Carrefour’s segment data shows that store productivity improved only marginally in France and even worsened in the Rest of Europe. Thus, the observed increase in PP&E turnover is driven by store productivity improvements in Latin America, Asia, and Carrefour’s hard discount division. In sum, the picture that emerges from the detailed analysis of Carrefour’s operating asset turnover confirms that in spite of its many efforts, management has struggled (and failed) to improve store productivity and inventory turnover, especially in its (core) European segments. In 2011, the company’s operating asset turnover improvement appeared largely artificial. In 2010, operating asset turnover improved only in the company’s emerging market segments and its (discontinued) hard discount division. The instructor may conclude this discussion by asking students about the managerial implications of their observations. Two implications that will likely surface are: - Given the ineffectiveness of past efforts to improve turnover, it seems questionable whether management will succeed in improving turnover in the near future. This raises the question as to whether future performance improvements should instead result from improvements in the retailer’s margins (operating efficiency and pricing decisions)—a question that will be addressed next. - The analysis underlines the importance of the retailer’s Asian and Latin American operations as a source of growth. Operating margin1 During the past decade Carrefour has struggled to be price competitive. Consequently, the retailer has been perceived as relatively expensive by European consumers and its European market share has been under pressure (refer to the discussion of Carrefour’s operating asset turnover). The analysis of Carrefour’s operating margin shows, however, that the company has little room to cut prices, as its operating profit margin has approached zero during the past few years. The decomposition of Carrefour’s operating margins could therefore focus on identifying ways to reduce operating expenses and, consequently, increase Carrefour’s ability to compete on price. The instructor could start the discussion of Carrefour’s operating margin by asking students the following question: Given Carrefour’s operating asset turnover, at what operating margin would the retailer earn a “normal” return on its operating assets? Answering this question helps to determine a benchmark against which Carrefour’s current operating margins and its planned operating margin investments can be evaluated. Using the ratios of Casino and Tesco as a benchmark, the normal return on operating assets for a retailer such as Carrefour is likely between 6.5 – 8.5 percent. Given the retailer’s operating asset turnover of 3.5, an operating margin of around 2 – 2.5 percent would help Carrefour to earn a return on operating assets of between 7 and 8.75 percent. Next, the instructor could ask students how much Carrefour’s operating margin should improve to reach its “normal” level of 2 – 2.5 percent. In 2011, Carrefour’s NOPAT margin was -1.0 percent. However, because this margin was negatively affected by an unusually high tax expense (of 1.2 percent of sales) a more sensible approach would be to estimate an adjusted NOPAT margin using a normalized tax rate. In 2011, net operating expenses (excluding non-recurring items) amounted to 98.9 percent of sales, yielding a net operating margin before taxes of 1.1 percent. Given an average effective (and statutory) tax rate of about 35 percent, Carrefour’s 2011 normalized NOPAT margin (adjusted for 1 Note: cost of sales includes cost of financing products sold. This may have a (small) positive effect on the cost of sales-to-sales ratio and explain part of the differences in gross margins between Carrefour and its peers. exceptional taxes) can be estimated at close to 0.7 percent. This implies that Carrefour must increase its operating margin by approximately 1.3 – 1.8 percent of sales to reach its “normal” return on operating assets. The required percentage increase in operating margin is equivalent to an amount of €1.0 – €1.4 billion (after tax) based on Carrefour’s 2011 sales level. Hence, Carrefour’s planned cost savings of €400 million will be insufficient to help the retailer return to a normal level of profitability. The class discussion could focus on what other actions the retailer could take to increase the spread between its revenues and operating expenses by €1.0 – €1.4 billion: - Reduce price promotions. Between 2009 and 2011 Carrefour’s cost of sales as a percentage of sales increased by 0.9 percentage point. This increase reflects the effect of the retailer’s price promotions, aimed at maintaining asset turnover. Students may suggest that Carrefour could reduce the intensity of its price promotions, especially when the European economy recovers. Although this is a valid point to make, it is reasonable to expect that in such case Carrefour will replace its irregular price promotions with an “every-day-low-prices” strategy, thus making it unlikely that future pricing decisions will positively affect margins, at least not much in the near term. - Personnel cost. One of the primary components of Carrefour’s SG&A expenses is personnel expense. Despite Carrefour’s variable sales level, personnel expense as a percentage of sales remained flat during the past few years. This suggests that the company’s personnel expenses are relatively variable (rather than sticky) and/or keep pace with changes in employee productivity. The following three ratios provide more insight into the factors underlying recent changes in Carrefour’s personnel expense: Ratio Personnel expense per employee (thousands) Percentage change in personnel expense per employee Employee productivity (sales per employee) Percentage change in employee productivity Avg. number of employees per 1000 sq.m. of avg. store space Percentage change in employeeto-store space ratio 2011 2010 2010o 2009 18.86 18.36 18.19 17.48 4.1% -1.1% 191.31 178.69 7.1% -2.7% 32.43 33.56 2.7% 193.52 190.19 1.7% 33.40 -1.7% 33.98 -3.4% These ratios jointly illustrate that Carrefour has managed to increase employee productivity during the past two years, primarily through reducing the average number of employees per unit of store space. This increase in employee productivity has, however, not resulted in a significant reduction in the personnel expense to sales ratio because the personnel cost per employee has kept pace with the change in productivity. Overall, this example illustrates that one important factor affecting Carrefour’s profit margins (and reducing the effectiveness of Carrefour’s cost saving - programs) is cost inflation. Cost inflation may well be caused by factors that are beyond management’s control. Spin-offs. Carrefour’s operating margins vary significantly across geographic regions, as shown in the following table. Operating margin 2011 2010 2009 France Rest of Europe Latin America Asia Hard discount 2.45% 3.68% 3.16% 2.14% 2.95% 3.21% 3.67% 3.17% 4.45% 3.53% 4.17% 3.79% 2.38% 1.78% Carrefour’s margins tend to be lowest in Europe, especially in the Rest of Europe. Consistent with this observation, Carrefour recently recognized write-offs on its Italian and Greek operations. One possible strategy to improve profitability (and generate cash) is to spin off poorly performing European subsidiaries/stores. Summary and cash flows (Q4) Overall, the financial analysis shows that Carrefour has not been able to improve asset turnover and has limited possibilities to improve the margins of its current operations. One way to improve margins would be to spin off underperforming assets. To help students understand the relationship between Carrefour’s underperformance and the decision to cut dividends, the instructor could ask students to calculate Carrefour’s free cash flow to equity under the following (realistic) scenario: 1. Carrefour’s NOPAT margin is 1 percent (as in previous years). 2. Carrefour’s growth (in business assets) is zero and leverage is constant. 3. Finance costs and the return on investment assets remain equal to their historical levels. Under this scenario, Carrefour’s free cash flow to equity would be close to €1.3 billion: NOPAT x Sales: - Change in net assets: - Finance cost (after tax) + Return on investments: = FCF to equity 1% x 81,271 0 -666 x .66 10% x 9,410 813 0 -440 941 1,314 This amount is certainly sufficient to sustain a dividend payout of 740 million (i.e., as in previous years). However, Carrefour’s future investment and financing decisions put additional constraints on the company’s maximum cash dividends. That is: 1. Each percentage point growth in net assets reduces the company’s free cash flow by about 268 million (1% x 26,828 [net operating assets]). This decrease is partly offset by an increase in operating cash flow of 10 million (3.7 [asset turnover] x 1% [NOPAT margin] x 268). 2. Each percentage point decrease in leverage (debt to capital) that Carrefour wishes to realize decreases the company’s free cash flow by 310 million (1% x 31,028 [capital]). In other words, Carrefour may generate insufficient cash flow to sustain its pre-2011 dividend payout if the company wishes to grow its investment base (at a modest rate) and/or wishes to reduce leverage. Given the company’s high debt-to-capital ratio of 0.7 (which is close to the debt-to-capital ratios of speculative grade-rated companies), it is recommendable that Carrefour’s management undertakes actions to reduce leverage.2 One could thus conclude that at the company’s current profitability level, Carrefour’s dividend payout policy is not sustainable in the long run. As a follow up question the instructor could ask which decisions have helped Carrefour to sustain its dividend policy during the most recent years. This question helps to elicit alternatives ways of generating free cash flow: - Excess cash. In 2009, Carrefour used the excess cash balance that it created in previous years. - Debt financing. In 2010, Carrefour raised additional long-term debt (bonds) in the amount of 978 million. - Asset sales. In 2011, Carrefour sold assets (e.g., the spin-off of Dia). These alternative ways of generating cash could potentially help Carrefour to sustain its dividend policy also in the near future. A question that therefore remains to be answered is why Carrefour’s management decided to cut dividends at the beginning of 2012 rather than await possible future improvements in performance. A brief class discussion will likely result we may in an obvious conclusion: It is not unlikely that the dividend cut was stirred by the CEO notice that... change in January 2012. That is, the new CEO may be signaling that the current dividend is not sustainable in the near future and increase the cash flow available to fund corporate restructuring, but time Carrefour’s dividend cut such that it can be effectively blamed on the resigning CEO. Question 5 This final question asks students to think about how management’s recent or planned decisions may affect Carrefour’s near-term cash flows (and dividend policy). An easy approach in answering this question is to start from last year’s operating cash flow and make cash flow adjustments for, amongst other things, (a) expected changes in Carrefour’s operations, (b) planned capital expenditures, (c) expected asset disposals, and (d) expected financing decisions. Note that several issues discussed under the previous question are also relevant to this question. For example, the instructor may reiterate at the beginning of the discussion that excess cash or additional debt financing (i.e., ways to finance dividends in 2009 and 2010) are not (or not easily) available to Carrefour, thus increasing the relevance of operating cash flows and proceeds from asset disposals. Exhibit TN-5 shows one possible estimate of Carrefour’s 2012 free cash flow. The starting point of the calculation is last year’s operating cash flow of €2,529.9 million.3The following adjustments lead to a free cash flow estimate of €742.7 million: - The after-tax effect of expected and announced cost reductions is €262.4 million; - The after-tax effect of the expected and announced increase in inventory turnover is €234.0 million; 2 Early 2012, Carrefour’s debt was rated at BBB (investment grade). Note that the operating cash flow is different from that reported in Carrefour’s 2011 financial statements, primarily because of a reclassification of interest paid. 3 - Expected capital expenditures are €1,650.0 million; Interest paid is equal to its value in 2011. This calculation suggests that under the above scenario, Carrefour’s free cash flow to equity would be close to the amount needed to pay out a dividend of €1.08 and more than sufficient to pay out a dividend of €0.52. Various other scenarios are possible, however, including several under which the company’s free cash flow would not be sufficient to sustain the current dividend policy. Some factors that may reduce the free cash flow, for example, are: - The announced acquisition of Guyene and Gascogne; - Failure to reduce costs and/or increase inventory turnover (refer to the discussion on the ineffectiveness of management’s past efforts); - Reductions in leverage; - Cost inflation (cost inflation regularly offset cost reductions in previous years). It is therefore not unlikely that next year’s free cash flow will not be sufficient. The instructor can ask students what options are available for Carrefour, at least in the short run, to guarantee a dividend payout of €0.52. Students may think of the following alternatives: - Operating performance improvements - A reduction in taxes paid - New asset disposals (primarily focusing on the poorly performance segments) Whereas new asset disposals would help in the short run, Carrefour cannot continue to spin off divisions or segments. The above analysis shows that in the long run operating performance improvements are necessary to sustain the current dividend policy. Summary In summary, the above analysis illustrates that in the near future it is likely that Carrefour needs to rely on non-operating sources of cash to finance its dividends. In the long run, Carrefour must improve its operating performance if the company wishes to increase its dividends to their original level (or wishes to reduce leverage). Currently, Carrefour strongly relies on the cash flows generated by its non-operating activities (investment assets, asset disposals, increased borrowing). This does not seem to be a sustainable strategy for a retailer. Subsequent developments In 2012, Carrefour’s recurring operating income was €2,140 million, down from €2,197 million in 2011. Carrefour increased its dividends from 52 to 58 cents. The following cash flows contributed to Carrefour’s ability to pay out dividends: - The sale of operations, including those in Colombia, Indonesia, Malaysia and Greece, generated a cash flow of €1,833 million; - The company issued bonds for an amount of €1,250 million, while repaying bonds for an amount of €996 million; - Carrefour offered its shareholders the option to receive dividends in shares rather than cash. About 70 percent of the company’s shareholders made use of this option, which helped Carrefour to significantly reduce cash dividends. Exhibit TN-1 (1) Calculating the interest rate implicit in 2011 operating leases (implicit rate = 8.7%) and (2) calculating the 2006 – 2011 present values of operating lease payment using the implicit rate of 8.7%. Minimum operating lease payments Within one year In two to five years Over five years 2011 957 1,888 1,714 2010 1,081 1,850 2,231 2010o 1,081 1,850 2,231 2009 1,049 2,356 3,395 2008 937 2,483 3,328 2007 800 1,626 2,473 2006 788 1,905 2,704 8.70% 1,015 34.40% 8.70% 1,287 34.40% 8.70% 1,287 34.40% 8.70% 1,167 34.40% 8.70% 1,152 34.40% 8.70% 1,039 34.40% 8.70% 891 34.40% 957.0 472.0 472.0 472.0 472.0 1,407.4 1,081.0 462.5 462.5 462.5 462.5 1,754.1 1,081.0 462.5 462.5 462.5 462.5 1,754.1 1,049.0 589.0 589.0 589.0 589.0 2,597.0 937.0 620.8 620.8 620.8 620.8 2,587.7 800.0 406.5 406.5 406.5 406.5 1,863.5 788.0 476.3 476.3 476.3 476.3 2,071.6 3,149.7 2,269.3 3,445.4 2,450.9 3,445.4 2,450.9 4,306.4 3,341.4 4,293.0 3,431.0 3,085.2 2,349.2 3,409.6 2,684.6 New lease commitments Useful life 419.5 10.0 51.3 11.0 51.3 11.0 806.9 12.0 2,091.4 11.0 418.0 12.0 12.0 Depreciation expense Interest expense Lease repayment 715.2 299.8 715.2 912.3 374.7 912.3 912.3 374.7 912.3 793.5 373.5 793.5 883.6 268.4 883.6 742.4 296.6 742.4 Adjustments: Non-current tangible assets Non-current debt Deferred tax liability Equity 3,149.7 3,149.7 0.0 0.0 3,445.4 3,445.4 0.0 0.0 3,445.4 3,445.4 0.0 0.0 4,306.4 4,306.4 0.0 0.0 4,293.0 4,293.0 0.0 0.0 3,085.2 3,085.2 0.0 0.0 Cost of sales/SG&A (Lease expense) Cost of sales/SG&A (Lease expense) Interest expense Tax expense Net profit 1,015.0 -715.2 -299.8 0.0 0.0 1,287.0 -912.3 -374.7 0.0 0.0 1,287.0 -912.3 -374.7 0.0 0.0 1,167.0 -793.5 -373.5 0.0 0.0 1,152.0 -883.6 -268.4 0.0 0.0 1,039.0 -742.4 -296.6 0.0 0.0 Interest rate Actual lease payment Tax rate 1 2 3 4 5 6 Total present value Present value Yr 2 - 3,409.6 3,409.6 Exhibit TN-2 Adjustments to Carrefour’s balance sheet for differences between the funded status of the retailer’s pension plans and the carrying value of the retailer’s pension liability. Pension obligation Pension assets Funding status On-balance sheet asset On-balance sheet liability Tax rate Adjustments: Other Non-Operating Investments Non-current debt Deferred tax liabilities Equity 2011 1,119 214 -905 2010 1,105 228 -877 2010o 1,105 228 -877 2009 990 234 -756 2008 835 223 -612 2007 918 292 -626 2006 0 777 34.40% 0 734 34.40% 0 734 34.40% 0 689 34.40% 0 668 34.40% 0 674 34.40% 0 707 34.40% 0.0 128.0 -44.0 -84.0 0.0 143.0 -49.2 -93.8 0.0 143.0 -49.2 -93.8 0.0 67.0 -23.0 -44.0 0.0 -56.0 19.3 36.7 0.0 -48.0 16.5 31.5 0.0 -65.0 22.4 42.6 950 308 -642 Exhibit TN-3 Dia’s standardized 2010 balance sheet. STANDARDIZED BALANCE SHEET ASSETS Non-Current Tangible Assets Non-Current Intangible Assets Minority Equity Investments Other Non-Operating Investments Deferred Tax Assets Derivatives - Asset Total Non-Current Assets 2010 Inventories Trade Receivables Other Current Assets Cash and Marketable Securities Total Current Assets 539.3 179.0 76.7 316.8 1,111.9 Assets Held For Sale Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Ordinary Shareholders' Equity Minority Interest - Balance Sheet Preference Shares Non-Current Debt Deferred Tax Liabilities Derivatives - Liability Other Non-Current Liabilities (non interest bearing) Non-Current Liabilities Trade Payables Other Current Liabilities Current Debt Current Liabilities Liabilities Held For Sale Total Liabilities and Shareholders' Equity 1,597.4 459.8 0.1 54.9 29.3 0.0 2,141.5 0.0 3,253.4 430.3 -7.8 0.0 212.4 10.4 0.0 0.0 222.8 1,726.1 341.5 540.5 2,608.1 0.0 3,253.4 Exhibit TN-4 Carrefour, Casino and Tesco Carrefour PANEL A ROE decomposition (after excluding other income/expense) Ratio 2011 2010 2010o 2009 Net operating profit margin -1.0% 1.0% 1.1% 1.0% × Operating asset turnover 3.72 3.28 3.51 3.39 = Return on Operating Assets -3.7% 3.4% 3.8% 3.5% Return on Operating Assets x (Operating Assets/Business Assets) + Return on Investment Assets x (Investment Assets/Business Assets) = Return on Business Assets Casino Tesco 2008 1.8% 3.44 6.2% 2011 2.4% 2.61 6.3% 2010 2.4% 2.40 5.8% 2009 2.2% 2.38 5.3% 2011 5.0% 1.68 8.4% 2010 4.8% 1.73 8.4% 2009 4.6% 1.85 8.5% -3.7% 3.4% 3.8% 3.5% 6.2% 6.3% 5.8% 5.3% 8.4% 8.4% 8.5% 0.70 12.0% 0.71 10.2% 0.72 10.4% 0.73 10.1% 0.74 9.9% 0.65 6.1% 0.72 7.5% 0.71 6.3% 0.83 5.8% 0.81 5.5% 0.88 9.2% 0.30 1.0% 0.29 5.4% 0.28 5.7% 0.27 5.3% 0.26 7.2% 0.35 6.2% 0.28 6.3% 0.29 5.6% 0.17 8.0% 0.19 7.8% 0.12 8.6% Spread × Financial leverage = Financial leverage gain -1.7% 3.14 -5.3% 2.7% 2.44 6.5% 3.0% 2.41 7.3% 2.5% 2.21 5.5% 4.4% 2.18 9.6% 1.8% 1.19 2.1% 2.2% 1.10 2.5% 1.4% 1.10 1.5% 5.4% 1.75 9.5% 5.3% 2.01 10.6% 5.1% 1.70 8.6% ROE = Return on Business Assets + Financial leverage gain -4.2% 11.9% 13.0% 10.8% 16.8% 8.4% 8.7% 7.1% 17.4% 18.5% 17.2% Carrefour PANEL B Common-sized income statement and profitability ratios 2011 2010 2010o 2009 Line items as a percent of sales Sales 100.0% 100.0% 100.0% 100.0% Net operating expense -98.9% -98.0% -97.9% -97.9% Other income/expense -3.5% -1.4% -1.4% -1.3% Net operating profit before tax -2.4% 0.7% 0.7% 0.8% Investment income 2.0% 1.9% 1.7% 1.6% Interest income 0.1% 0.1% 0.1% 0.0% Interest expense -1.2% -1.2% -1.1% -1.2% Tax expense -1.2% -0.8% -0.8% -0.7% Net profit -2.7% 0.6% 0.6% 0.5% Operating expense line items as a percent of sales (by function) Cost of sales -80.7% -80.2% -80.2% -79.8% Selling, general, and admin. expense -19.1% -18.5% -18.5% -18.9% Operating expense line items as a percent of sales (by nature) Personnel expense -9.7% -9.7% -9.5% -9.8% Cost of materials -80.7% -80.2% -80.2% -79.8% Depreciation and amortization -3.0% -3.2% -3.2% -3.2% Other operating income/expense -5.4% -4.8% -5.0% -5.2% Key profitability ratios Gross profit margin 19.3% 19.8% 19.8% 20.2% EBITDA margin 2.8% 5.9% 5.6% 5.6% NOPAT margin -3.3% 0.2% 0.2% 0.2% Casino 2008 2011 2010 Tesco 2009 2011 2010 2009 100.0% -97.3% -0.5% 2.2% 1.5% 0.0% -1.1% -0.9% 1.8% -79.6% -18.4% -9.6% -79.6% -3.2% -4.9% 20.4% 7.0% 1.5% -12.1% -11.7% -11.7% -72.3% -73.4% -72.7% -10.6% -11.0% -10.9% -75.8% -74.7% -74.7% Net profit margin -2.7% 0.6% 0.6% 0.5% 1.8% Carrefour PANEL C Asset management ratios Ratio Operating working capital/Sales Net non-current assets/Sales PP&E/Sales Operating working capital turnover Net non-current asset turnover PP&E turnover Trade receivables turnover Days’ receivables Inventories turnover Days’ inventories Trade payables turnover Days’ payables PANEL D Debt and coverage ratios Ratio Liabilities-to-equity Debt-to-equity Debt-to-capital Interest coverage (earnings based) Interest coverage (cash flow based) 2010o -7.3% 35.7% 21.0% Casino 2009 -8.4% 37.9% 22.8% Tesco 2011 -6.5% 33.3% 21.0% 2010 -6.9% 37.4% 21.5% 2008 -7.7% 36.8% 22.1% 2011 -7.5% 45.9% 23.2% 2010 -6.9% 48.5% 25.5% 2009 -7.2% 49.1% 25.7% 2011 -5.4% 65.0% 58.7% 2010 -5.0% 62.8% 56.2% 2009 -5.0% 59.1% 54.6% -15.44 3.00 4.76 28.93 12.4 9.48 38.4 4.23 86.1 -14.41 -13.77 -11.94 -13.06 2.67 2.80 2.64 2.72 4.65 4.77 4.38 4.52 33.56 34.96 36.29 26.76 10.7 10.3 9.9 13.5 9.91 10.24 10.24 10.01 36.7 35.5 35.6 36.4 4.24 4.27 4.03 3.92 85.8 85.3 90.4 92.9 -13.33 2.18 4.31 -14.49 2.06 3.92 -13.89 2.04 3.89 -18.52 1.54 1.70 -20.00 1.59 1.78 -20.00 1.69 1.83 8.9 10.9 13.2 9.1 7.4 6.4 45.1 48.5 48.0 24.9 23.2 22.0 74.9 79.7 81.9 43.7 42.1 38.6 2011 5.81 3.14 0.76 -0.22 2010 4.39 2.44 0.71 2.10 2010o 4.49 2.41 0.71 2.22 2009 4.21 2.21 0.69 2.08 2008 4.26 2.18 0.69 3.32 2011 2010 2009 2011 2010 2009 1.19 0.54 2.32 1.10 0.52 2.77 1.10 0.52 2.58 1.75 0.64 4.78 2.01 0.67 4.46 1.70 0.63 3.98 7.63 9.30 9.21 8.71 10.04 Exhibit TN-5 Prediction of Carrefour’s 2012 Free Cash Flow 2011 2012E Assumption Operating Cash Flow before Investment in NonOCF 2011 is the starting point of the Current Assets 2,529.9 2,529.9 analysis Adjustments to cash flow from operations: Expected cost reductions(after tax) Effect of inventory turnover increase 262.4 234.0 Adjusted Operating Cash Flow before Investment in Non-Current Assets 3,026.3 Expected capital expenditures -1,650.0 Operating Cash Flow before Investment in Non-Current Assets See page 226 1,376.3 Interest -633.5 Free cash flow to equity estimate Assumed equal to interest paid in 2011 742.7 Factors that may reduce FCF to equity in 2012 Announced acquisition of Guyene & Gascogne Failure to reduce operating costs Failure to increase inventory turnover Reduction in leverage -400.0 Crude estimate of acquisition cost -262.4 See page 226 -356.7 ? = 2 days x daily cost of materials in 2011 Note that in 2009 - 2011, the effect cost inflation offset the effect of cost savings. Cost inflation Factors that may increase FCF to equity in 2012 Announced disposal of 49 percent stake in BSF (minus call option exercise price) Other disposals Lower taxes paid See page 226 (400 x (1-34.4%)) = 2 days x daily cost of materials in 2011 x (1 - tax rate) P 247 182.5 ? ? Taxes paid were unusually high in 2011. Future taxes paid may decrease by an amount up to 100 million euros. Operating performance improvements ? See conclusions drawn in the financial analysis.