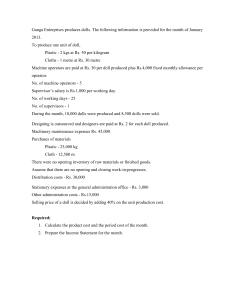

Hult International Business School – Group Case Analysis Assignment (“Managerial Accounting – G.G. Toys Case”) Course: MBA Financial Statement Analysis (London) Lecturer: Alek Grzeszczak Date: Fall 2022 Group / Names: This group case analysis is to be submitted via myCourses. Your submission will consist of concise answers to questions: 1, 2, 3, 4, and 6 (ignore question 5) listed in the G.G. Toys case document. Maximum length of submission: 3 pages of text (at least single line spacing, Arial 11 font, margins as in this document) plus 1 page for referenced (to your text) excel exhibits (if any). Best to use this document as template – add 3-4 pages. Question 1 (4 points) Do you recommend that G.G. Toys change its existing cost system in the Chicago plant? In the Springfield plant? Why or why not? We recommend that G.G. Toys change its existing cost system in the Chicago plant from the traditional cost based system to the activity-based system because they are producing more than one product. Producing a variety of products such as the Geoffrey Doll and Specialty-Branded Doll they will be able to get a more accurate depiction of which product is incurring a specific cost in the manufacturing overhead. With the manufacturing overhead at the Chicago facility being $268,666 they should switch to see exactly which product is causing the overhead to become so high. We believe this is the reason why they saw a decrease in production but the revenue was still higher than expected. They were using the same production method they used to product Geoffrey Dolls to produce Specialty-Branded Dolls when the Specialty dolls should have been allocated more cost. Doing this decreased their production by 900 units. They were able to sell the Specialty Doll at a higher price that is why their revenue beat their forecast by $21,000. The current traditional cost based system for the Springfield plant is perfect for the facility. They are only producing one product at the facility which is the cradles so they will not need to allocate cost to different products to see which product is taking up most the cost. If they used the activity-based cost method they will have similar numbers for the cost of the cradles because their will only be one product produced there. Question 2 (8 points) Calculate the cost of a Geoffrey doll, the specialty-brand doll #106, and a cradle using the cost study conclusions. 1 Calculating the cost of each individual doll separately we were able to get three different cost for each product. First we decided to breakdown each item that is in the manufacturing overhead and took all the totals of each item and divided it by the cost driver to get my pool rate for each expense. We read through the cost study and analysed which cost driver goes to which cost pool. Understanding that allowed us to accurately place the cost driver in each pool to come up with for my pool rates. Once we determined the pool rates we used it to come up with the numbers for each specific product. Question 3 (5 points) Compare and contrast the profitability of each doll under the new and old systems. Based on your recomputed product costs, what actions would you recommend the company consider to enhance its profitability? What additional information would you like to have to make these recommendations? The Geoffrey doll will be more profitable under the activity-based cost system than the traditional one. The profit margin under the new system would be 27% rather than 9% on the old system. The SpecialtyBranded Doll will be more profitable under the old system than the new one. It is more profitable under that system because the product cost drivers are not appropriately allocated. Under the old system, the product costs $23.74 to make, but when we use the activity-based costing, it will cost us $34.43. This is a drastic difference that management must look at and see where they can cut costs for this product to become more profitable. Regarding the cradles, the profit margin will be the same because only one product is produced in that facility. In the future, if another product is made where the cradles are, they may have to consider switching to the activity-based system. There are some things that management could change with its cost drivers to reduce cost. The machine-related cost is taken up a lot by the Geoffrey doll, with it costing $37,500 to produce them. They should look into not having their machines sit idle from October through June because it will raise their machine-related expenses for the year. This will also affect their plant management and facility-related costs because they will have the facility sitting idle while not producing any products for those months. The setup cost for the Specialty-Branded Doll was so high using the activity-based cost system because a lot of customers like to get the doll customized and have to charge a setup cost every time doll is changed. The setup cost for it is $8,333. Management should consider charging a higher price for the doll or figuring out a way to minimize the setup cost by limiting the number of changes that can be made to the product. The receiving and production control was also high for the Specialty-branded dolls. They had a high cost at $39,130 for that product alone. Since this cost requires the same amount of time regardless of the production length, management should consider increasing the batch sizes of raw materials so that they can cut costs in the future. Management should use this same method for their packaging and shipping cost. The Specialty2 Branded dolls cost $33,314 for their shipping and packaging cost. Since it doesn’t matter how many items are in the shipment, management can add more items to the shipment to reduce the product cost. Additional information that we think we would need is financial statements from previous years. We would also like to know the cost of what the company has spent on products in the past so we can figure out trends. We also want an average of how often customers change their speciality-branded doll to know how we could reduce the setup cost. Question 4 (5 points) How should G.G. Toys account for the excess capacity created to produce the holiday reindeer dolls? Qualitatively, how will this impact your calculated cost of the Geoffrey doll and the specialty-branded dolls in question number 2? Explain your method and its impact. (Answer qualitatively. Do not recompute any of your product costs in question 2.) Question 6 (3 points) Do you recommend G.G. Toys produce the Romaine Patch doll? Why or why not ? (Ignore manufacturing overhead costs including packaging, shipping, and receiving and production control). 3