Supplier Involvement in NPD: A Quasi-Experiment at Unilever

advertisement

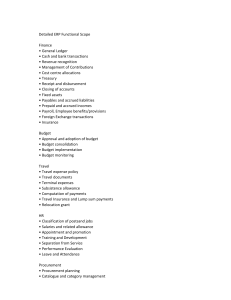

Industrial Marketing Management 58 (2016) 162–171 Contents lists available at ScienceDirect Industrial Marketing Management Supplier involvement in NPD: A quasi-experiment at Unilever Linda Nhu Laursen a,⁎, Poul Houman Andersen a,b a b Department of Business and Management, Aalborg University, Fibigerstræde 10, DK-9220 Aalborg E, Denmark Department of Operation Management, NTNU, Gløshaugen 2, 7865 Trondheim, Norway a r t i c l e i n f o Article history: Received 27 October 2015 Received in revised form 27 April 2016 Accepted 1 May 2016 Available online 26 May 2016 Keywords: Supplier involvement New product development Causal ambiguity Interaction Quasi-experiments a b s t r a c t Growing technological complexity makes it impossible for individual firms to be updated on all technologies relevant to new product development (NPD). Involving suppliers, who have knowledge of complementary technologies, in the early phases of NPD is therefore quite a common practice. However, the timing of involvement presents a management challenge. We explore how task ambiguity pertaining to NPD affects buyer-supplier interaction. We set up a quasi-experimental study, manipulating causal ambiguity to observe how this impacts buyer-supplier interactions over time. Our findings reveal that causal ambiguity influences the role expectations and resource mobilisation of the suppliers before interaction, the actors' mobilisation and their pattern of interaction, and the transformation of outcome and mobilisation of resources ex post interaction. We discuss the implications for managers and researchers in a buyer-supplier context. © 2016 Elsevier Inc. All rights reserved. 1. Introduction Firms in many industries realise the importance of involving external parties such as suppliers in new product development (NPD) activities (Song & Di Benedetto, 2008; Van Echtelt, Wynstra, Van Weele, & Duysters, 2008). In fact, a study suggests that innovation is not possible without the involvement of heterogeneous actors in the business network (such as suppliers), of which the firms are a part (Corsaro & Cantù, 2015). Overall, supplier involvement is linked to a number of development advantages, such as increased innovation ability, better product quality, reduced development costs and shorter development time (Johnsen, 2009; Petersen, Handfield, & Ragatz, 2003; Van Echtelt et al., 2008). However, the inclusion of suppliers is a means that should be employed selectively (King & Penleskey, 1992; Wagner & Hoegl, 2006). Possible detriments include increased costs, longer development time (Littler, Leverick, & Wilson, 1998) and a decline in product innovation capabilities (Koufteros, Vonderembse, & Jayaram, 2005). The mixed results of early supplier involvement suggest that despite its high potential value, knowledge about involvement processes is limited (Kopecká, 2013; Wagner, 2012). More insight is needed on when and how to involve suppliers in the early phases of NPD (Johnsen, 2009). One distinctive characteristic of supplier involvement in the early phases of NPD is that it unfolds as ‘a very uncertain path through foggy and shifting markets and technologies’ (cf. Eisenhardt & Tabrizi, 1995, p.88). An important question in this context is how to manage supplier involvement to support ideation (Johnsen, 2009). Studies suggest a ⁎ Corresponding author. E-mail addresses: lindal@business.aau.dk (L.N. Laursen), poa@business.aau.dk (P.H. Andersen). http://dx.doi.org/10.1016/j.indmarman.2016.05.023 0019-8501/© 2016 Elsevier Inc. All rights reserved. trade-off between not pre-specifying solutions to allow for supplier inputs and quickly establishing a manageable development process in an inter-organisational team (Hansen, 1999; Knudsen & Srikanth, 2015). In this study, we explore how buyers and suppliers interact, when suppliers are involved in the early phases of NPD. We examine earliness characterised by various degrees of causal ambiguity. Specifically, we are interested in determining the following: How do varying degrees of causal ambiguity in NPD tasks influence supplier interaction? Supplier collaboration in highly uncertain NPD projects is a challenging governance task (Melander & Lakemond, 2015). Articulating the precise nature of connections between knowledge, technology and outcome is often difficult (Bstieler & Hemmert, 2010). Causal ambiguity is a concept frequently used to characterise this difficulty in NPD processes. It concerns unclear or multiple conceptualisations of the relationship between actions and results (Daft & Macintosh, 1981; Lippman & Rumelt, 1982). Early on, new product developers typically experience great causal ambiguity. A broad range of decisions need to be made with little information to base them upon (Ulrich & Eppinger, 2005). However, as development progresses and more options are interlocked, causal ambiguity decreases (Tidd, Pavitt, & Bessant, 2001). On the one hand, having multiple possible interpretations of the same phenomenon creates ambiguity about the causality of relations and interrelations (Daft & Macintosh, 1981; Weick & Roberts, 1993). On the other, a high degree of causal ambiguity provides greater opportunities for applying supplier knowledge. Causal ambiguity may lead to non-routine exploration and the discovery of radically new innovation possibilities. Little is known about the interaction processes associated with supplier involvement in NPD (Wagner, 2012). In order to study this, we use a comparative quasi-experimental setup, where the causal ambiguity in the projects differs. Quasi-experiments are a non-intrusive intervention L.N. Laursen, P.H. Andersen / Industrial Marketing Management 58 (2016) 162–171 in the field, which makes it possible to focus on and manipulate a specific aspect in order to observe and better understand it (Shadish, Cook, & Campbell, 2002). In the experiments, we collaborate with the case company, Unilever, for designing three different supplier tasks, where the degree of causal ambiguity differs. 2. Supplier involvement and interaction We conceptualise interaction in order to better understand suppliers' involvement under different degrees of causal ambiguity. From an IMP perspective, interfirm interaction in NPD relates to exchange, coordination and adaptation processes (Johanson & Mattsson, 1987; Miettilä & Möller, 1990). IMP researchers interpret interaction as a process, which both changes and transforms resources and activities for the actors involved (Håkansson, Ford, Gadde, Snehota, & Waluszewski, 2009). It occurs in the in between – as actors link activities and combine resources. Repeated interaction shapes the context of the interacting parties. It is manifested through the formation of operational bonds and mutual expectations, which act on the mobilised resources and activities – permitting certain interactions but also precluding others. Several researchers within the IMP domain have used role theory to further examine how interaction constitutes activity patterns and resource flows (Anderson, Havila, Andersen, & Halinen, 1998; Wynstra, Spring, & Schoenherr, 2015). A role is a set of behaviours that others expect an individual in a certain position to take in a social context such as a group or a team (Floyd & Lane, 2000). Roles exist in the minds of those involved and prescribe how they evaluate interaction (Katz & Kahn, 1978). Members of a role communicate their role expectations by externalising them in a role sent to the role taker. However, the role received may correspond more or less, depending on the clarity of communication, the content of what was sent and the cognitive faculties of the sender and receiver. In the interplay between role expectations, role sent and role received, ‘the taking of roles may be aided by the nature of the task and the previous experience of the individual with respect to similar tasks’ (Katz & Kahn, 1978: 193). In accordance with role theory, supplier involvement in NPD is characterised by the responsibility suppliers assume, the activities they perform and the resources they supply, all of which are influenced by the task they are asked to carry out. Activities are standardised procedures of operation carried out in an organisational context and typically belonging to a larger faculty of possible procedures. Resources are entities, providing a value (rendering a service for the user) not free in supply (Håkansson & Snehota, 1995). In this sense, the value of resource entities depends on the knowledge of the user, and a resource may come into existence or transform as a consequence of a change in the user's knowledge. Likewise, new combinations of resources and activities are both sources of innovation and value creation. The perceived task is an articulation of the problem, which serves as a critical component in guiding suppliers' role expectations. Setting the task communicates assumptions about relevant issues, priorities and evaluation criteria. The task structure sets the rules of the game, which influence the subsequent interaction (Abdel-Halim, 1983). Accordingly, we propose a conceptual model of interaction where the causal ambiguity of the task can evoke more or less explicit role expectations among suppliers and other actors in the NPD team. Then we examine how these influence the activity of mobilisation and transformation of resources in the process. We observe how the role suppliers expect to fulfil affect interactions: which resources they mobilise in advance and what activities they carry out as well as how their interaction pattern unfolds and resources are transformed. 3. Methodology We use a quasi-experimental research design to understand how specific interpretations of the role expectations may influence interaction patterns and resource mobilisation. A quasi-experiment has been 163 defined as a form of observation study that takes place in a field setting and involves changing a key independent variable (Grant & Wall, 2009). One particular and poignant benefit is that it sheds light on interaction in a systematic and controlled way that rarely is available for research scrutiny. Since it calls for an extended willingness to collaborate from the firms involved, it is only seldom possible. Organisational researchers have for some time shown an interest in constructing experimental research designs that involve careful manipulation of independent variables in order to observe the effect on dependent variables (Luthans & Davis, 1982; Salancick, 1979). Quasiexperiments aim to identify and use manipulanda that (presumably) can make a difference to outcomes and/or the processes investigated, and thus provide learning possibilities. In this sense, business researchers, who otherwise acknowledge that the complex social reality under study cannot be subjected to a set of laws, use a quasiexperiment to focus on and observe a small slice of that reality. Quasiexperiments may enhance the researchers' ability to scrutinise and explore the explanatory power of theoretically derived assumptions. By not only observing but also manipulating the reality under study, more of its secrets may be learned (Shadish et al., 2002). A quasi-experiment differs from the conventional scientific notion of experiments on a number of aspects. They do not take place in the controlled environment of a laboratory nor do they involve random assignments to control groups. Sometimes they include naturally occurring changes (such as an event impacting an organisation) rather than deliberately introduced stimulations (Grant & Wall, 2009). For this reason, quasi-experiments are not ideal for rigorous testing of causality (Cook, 1983). 3.1. Experiment setup in Unilever Unilever was considered an appropriate setting for the quasiexperiments, as their size and innovation activities allowed for simulations in different branches of the company. Furthermore, as an industry leader, it is a company whose managerial practices inspire many other firms. Thus, the case company was chosen for its accessibility and probability to offer interesting insights, rather than for its ability to represent a broader population (Stake, 2006). To study how varying degrees of causal ambiguity influence interaction with suppliers, three quasi-experiments were designed. Suppliers within different areas – namely, formulation, ingredients, processing and packaging – were invited to participate. All of them were identified as strategic suppliers and their relationship with the company was described as mutually close (across several levels) and mutually important (involving a significant size of business). Some suppliers participated in all three experiments. This increased the comparability in terms of context characteristics, including industry, supplier base, relational characteristics, reputation etc., which have been previously identified as important for buyer-supplier knowledge exchange (Lawson & Potter, 2012). The study was designed in collaboration with the director of open innovation at Unilever and his team of four managers. Through their global support function, they serve as knowledgeable and important boundary spanners and partners for identifying and influencing relevant projects. In terms of their internal outlook, they possessed a rare overview of ‘…what was happening with individual projects, what learning we could take from it. What was going on that might fit our experiments model so we could learn on behalf of Unilever from someone else's activity’ (Unilever, senior manager). The interventions involved three real-life projects implemented at different Unilever branches. The degrees of causal ambiguity of the tasks were specified by the clarity in the target and path (Robillard, 1999). Clarity of target refers to awareness of the end state to be achieved. Clarity of path refers to awareness of the direction to achieve the target. To further scrutinise this, we developed three different types of supplier briefs (Fig. 1): (i) an open-ended task with considerable level of causal ambiguity (open target, open path), (ii) a next generation task 164 L.N. Laursen, P.H. Andersen / Industrial Marketing Management 58 (2016) 162–171 Fig. 1. Overview of supplier involvement points: three degrees of causal ambiguity in the tasks presented to the suppliers. with a moderate level of causal ambiguity (specified target, open path) and (iii) a decomposed task with low level of causal ambiguity (specified target, specified path). The default supplier involvement task within Unilever can be characterised as decomposed tasks. Thus to setup experiments that vary in the degree of causal ambiguity (considerable, moderate and low), the intervention primarily focused on manipulating two of the three projects. The open innovation team was deeply involved in developing and setting up the open-ended task from scratch. The team was also involved in setting up the next generation task, but had a more guiding role. For the decomposed task, the team was only involved at a later stage and to a lesser degree, providing comments, advice and facilitation. 3.2. Brief description of the experiments Beyond the task definition, the initial organisational and temporal setting of the three projects were identical. All the workshops were conducted on the same day. The three tasks chosen were within Unilever's core business area; hence, the final market need and the potential business case, which may affect suppliers' interaction, can be considered as relevant and comparable in all three cases. The tasks were sent out around 2 months prior to the introductory supplier innovation workshop. The setting of the workshop was identical in terms of time frame (4 h), location (Wembley Stadium, UK) and type of Unilever attendees. Internal specialists from different departments and divisions (R&D, open innovation, procurement and in some instances marketing and supply chain) together with a mix of top management and senior operational people (VPs, Directors, Project Leaders and Senior Managers) participated in all three cases. In total 105 people participated in the workshops: 33 of the participants were from within Unilever and 72 participants were from 27 different strategic supplier companies. In all of the experiments, suppliers were divided into groups of non-competitors, and all the participating supplier organisations were from Unilever's top strategic suppliers, except in two cases. In the description of the experiments, the topics of the projects have been disguised to prevent the sharing of confidential information with respect to Unilever's currently running innovation projects. They still represent the nature and characteristics of the original tasks (Table 1). 3.2.1. Experiment: project natural cleaners* Project natural cleaners concerned the development of cleaners (soap, cleaning agents, etc.) containing only natural ingredients. Unilever R&D developed an open-ended supplier task to mobilise supplier knowledge in developing the content of the project. The aim was simply to devise a natural way of cleaning, without any further details as to the market, product, technology, etc. The target and the path to achieving the target were open-ended in the framing of the task. The brief was sent out to selected strategic suppliers, and they were asked to indicate their interest in participating in an initial buyer-supplier workshop. At the workshop, representatives from 15 strategic suppliers participated. The top management from R&D conducted a plenary presentation, outlining the vision and strategic content of the natural cleaners, without detailing commercial or technical issues. Subsequently, the suppliers were divided into 4 groups of non-competitors for further discussions. 3.2.2. Experiment: project shampoo* The aim of the project was to develop a dramatically cost-reduced product to capture a specific emerging market – a next generation task. The intention was to utilise supplier knowledge to define novel ways of reaching the goal. The task was developed cross-functionally Table 1 The three experimental setups included a total of 8 workshops. Project brief Content of presentation Number of workshops + suppliers Open-ended task Project natural cleaners⁎ Next generation task Project shampoo⁎ Decomposed task Project shaving cream⁎ Develop natural cleaners, which contain only natural clean label materials. Natural cleaners of the future. Theme and vision focused presentation. Develop a shampoo to capture emerging markets through radical cost reduction. Shampoo for women in emerging markets. Market and target group understanding. Overview of product in its supply chain. 3 workshops 3–4 supplier companies in each workshop Develop a shaving cream product with increased foam stability, which enhances the experienced foam thickness. Technology and features of a shaving cream foam product. Dissemination of technological components and their systemic interrelation. Overview of technological challenges. 1 workshop 6 supplier companies 4 workshops 3–4 supplier companies in each workshop ⁎ For reasons of confidentiality, the exact focus of the projects has been replaced by a fictional example. L.N. Laursen, P.H. Andersen / Industrial Marketing Management 58 (2016) 162–171 within Unilever, and the product supply chain was divided into parts and strategic suppliers from each part were invited to participate in an initial workshop. The workshop began with a briefing which included two main elements: a strategic presentation and a marketing presentation. The aim was to outline a target and provide market understanding about this target, while showing top management support and crossfunctional alignment around the innovation challenge. After the plenary presentations, the 11 suppliers were divided into 3 groups for discussions, according to their position in the supply chain. 3.2.3. Experiment: project shaving cream* The project shaving cream foam stability pertained to foam technology. A core business unit within Unilever R&D developed a decomposed project task. The aim of the project was to utilise supplier knowledge in order to understand important technological elements. As with the two other projects, an initial supplier innovation workshop was set up for a supplier innovation summit. Prior to the workshop, a selected group of strategic suppliers received a detailed project task. The decomposed task aimed to improve different technological aspects related to how shaving cream foam technologies work. To elicit specific supplier knowledge at the workshop, the briefing presentation was equally decomposed in terms of technology. It contained systemic knowledge of how different technological components influence each other, detailed information on how the different components work and challenges they still present. Six strategic suppliers attended. 165 Table 2 Interview overview. Dataset overview — 26 interviews Interview # Task Workshop (group #) Company Duration (min) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 5 8 4 2 6 7 1 1 2 8 1 4 8 4 5 8 1 2 6 8 3 5 2 2 2 3 Next generation Decomposed Open-ended Open-ended Next generation Next generation Open-ended Open-ended Open-ended Decomposed Open-ended Open-ended Decomposed Open-ended Next generation Decomposed Open-ended Open-ended Next generation Decomposed Open-ended Next generation Open-ended Open-ended Open-ended Open-ended Unilever Unilever Unilever Unilever Unilever Unilever Unilever Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier Supplier 52 74 48 54 74 55 48 35 27 42 25 31 45 42 48 38 37 60 36 41 49 48 34 41 49 48 3.3. Data collection To increase the validity of insights, we collected data from several workshops within each project (with the exception of project shaving cream) through semi-structured interviews with key people within Unilever and participating suppliers. For each experiment, we interviewed key people within Unilever, who acted as participant observers at the workshops and managed the inter-organisational knowledge-sharing process. The respondents all had 15+ years of experience at Unilever. All interviewees acted as facilitators at their respective workshop session. They had an overview of the knowledgesharing process, apart from their own reflections on the matter, as they were responsible for facilitation and takeaways. In each of the experiments different suppliers were interviewed to enhance the reliability of the study. Unilever project leaders were asked to indicate key individuals from different supplier organisations, who were relevant to the project. This enabled us to avoid peripherally involved participants, who for example had not read the brief beforehand. The supplier participants were selected from different firms and held different positions, but all were engaged in and responsible for the interaction. All the interviews were conducted using a semi-structured interview guide, which contained three parts that reflected the facilitation process: questions on preparation and expectations before the workshop, questions about their experience of the actual interaction during the workshop and questions on their understanding and process ex post the workshop. The interviews were recorded and transcribed. New and surprising insights were validated against the previous interviews. In total 26 interviews were conducted in 2014 and 2015, with an average duration of 45 min (for details see Table 2). To enhance the validity of the study, the interviews were supplemented by direct participant observations. One of the researchers attended a workshop as a fly-on-the-wall observer, in order to unobtrusively gather information. The insights were gathered in detailed field notes, and the information from the observation was compared with the insights from the interviews. The researcher additionally participated in an internal Unilever de-brief meeting, where the progress, procedure, and takeaways of all the three cases were discussed and evaluated. This made it possible to compare how the insights altered the internal Unilever perception and evaluation. Other data sources included external and internal documentation in the form of project briefs, PowerPoint presentations, daily programmes, facilitation guidelines, minutes, internal summaries of takeaways and communication with suppliers. All accessible project documentations from 3 months before and 6 months after the workshop, were collected. For an accurate understanding of the meanings communicated in the interviews, we listened to the recordings and read the transcripts several times, while noting and coding emerging insights. Through an iterative process of studying concrete detailed quotes to deriving general theoretical topics, we continuously developed and sharpened our insights (Strauss & Corbin, 1990). We compared and contrasted the interaction of the three situations before, during and after the workshop. Contrasting and comparing cases enhance the identification of patterns and dimensions that are common or unique to each case, while relating them to the context (Miles & Huberman, 1994). Moreover, in order to follow our line of reasoning, we opened up the analytical process, making it as transparent as possible through the tabular display of the entire dataset, quotes from the interviews and narrative description of the three experiments researched (Miles & Huberman, 1994). Accordingly, our findings are presented in a tabular format, as quotes and as categorised discussions in the subsequent section. 4. Analysing the experiments In the following section we compare and contrast the interactions before, during, and ex post the workshop in the three field experiments. We determine how varying degrees of causal ambiguity in a task influence the role expectations and resource mobilisation of the suppliers before the workshop, the actors' mobilisation and their interaction pattern during the workshop, and the transformation of outcome and resources mobilisation ex post the workshop. 4.1. Before the workshop: role expectations and resource mobilisation When a problem is posed to a supplier, it triggers a reaction within the supplier organisation, regardless of the nature of the problem. The 166 L.N. Laursen, P.H. Andersen / Industrial Marketing Management 58 (2016) 162–171 And you superimpose that or compare that to internal briefs about different products, there are many commonalities. So that is why we thought, that brief was very well written. It was as we wrote it ourselves. It described the challenge or product at hand, and as a close match we thought it was an excellent opportunity.’ [(Supplier, project shaving cream)] following quote provides an illustration of the typical response in the interviewed supplier firms: ‘Suppliers or at least we did, when we get this kind of invitation, you really, you do a lot of thinking and quite some preparation for this behind the scenes, and even if what you do, is turn up on the day, and you speak to your very nice Unilever colleagues, behind all of this are quite a few email exchanges and idea sharing things.’ [(Supplier, project natural cleaners)] The contact persons in the supplier organisations are typically able to initiate organisation-wide preparations and search activities, reflecting their understanding of the task at hand, and bringing relevant people within their organisation in contact with Unilever prior to the workshop. This also concerns how and to what extent suppliers have mobilised their own network of relationships. The nature of these conversations depended on the degree of causal ambiguity, from simple confirmation of expectations to struggling to grasp the task (Table 3). We elaborate this further below, in relation to the three different experimental setups. 4.1.1. Open-ended task In the project on natural cleaners, the high degree of flexibility with respect to the goal and path, affected the suppliers' preparation efforts prior to the workshop. The suppliers were generally unsure of their task, and their communication with Unilever revolved around this. The high degree of causal ambiguity made the suppliers unsure of the role they were expected to play, as illustrated in the following supplier quote: ‘Our expectations… I didn't quite know what to expect. […] So there was a lot of internal discussion along the lines of: What is going on and what is this? And how do we do it? And how do we need to respond? And what do they want us to do? Do we want to engage in that? Can we engage with that? […] There was not enough detail in the brief to build our response on. So in a sense it opens more questions than it answers.’ [(Supplier, natural cleaners project)] The open-ended task presented a vague role script and suppliers struggled with selecting the manager to participate in the workshop and the mandate for the person. For similar reasons, suppliers had little direction with respect to identifying and engaging relevant actors, resources and activities in their network. 4.1.2. Decomposed task On the other end of the spectrum, the shaving cream project presented the suppliers with the most detailed briefing. The content was clear and unambiguous and easily linked to the suppliers' respective technical knowledge domains. This made it easy for the suppliers to recognise and interpret role expectations. ‘When we read the brief, we felt that it was almost written for us […]. If you took all of the components of the brief and you compared the wording, the statements, the theories, the goals or targets and you take that. In this task, prior experience guided suppliers in framing and preparing for the workshop. Preparation revolved around gathering state-ofthe-art knowledge within their organisation, e.g. through discussion with different technical experts and reviews of documents from similar R&D projects. Suppliers typically prepared by identifying the right experts and equipping them with the necessary knowledge to fill the expected role. The clarity of role script, defined as the alignment between the role sent and the role received, triggered internal mobilisation of explicit technical knowledge. The clarity of the task also meant that the role was seen as an issue of applying a technology, developed for other purposes. Including the technology in this case would change its status and reduce the possibilities for engaging it in other relationships in its current form. For this reason, interaction with Unilever for resource development was not considered. Rather, it was seen as a deployment of an already ‘back-boxed’ technological resource. In one of the interviews, the suppliers explained that they simply browsed previous sales pitches on the application of this technology to find the pitch with the strongest technological similarity to the one sought by Unilever. 4.1.3. Next generation task In terms of task ambiguity, the shampoo project falls between the other two, with a specified goal and an unclear path. The task triggered a focused knowledge mobilisation of possible paths to reach the goal. Suppliers offered suggestions based on their capabilities of how they could contribute to reaching the goal: ‘They had the information available, Even if it was just on a basic level. They had thoughts on ideas or they brought concepts or products they could share with the group.’ [(Unilever, project shampoo)] Overall, the suppliers understood the target of the project, but were unsure of their role in it. There was an incentive to influence the other actors in the project by presenting development paths that matched the suppliers' capabilities and competences. The suppliers started with a broad search for ideas, which had some degree of similarity with the task given by Unilever. This led to the identification of similar customer problems in the suppliers' network and how these problems linked to specific contexts. In one particular case, a supplier identified a conceptual solution, in which they had radically reduced costs by changing production, distribution and packaging rather than the actual product. 4.2. During the workshop: actors mobilisation and pattern of interaction Different types of attendees at the workshops echoed the differences in the role interpretations. In the most open-ended workshops, Table 3 Role expectations and resource mobilisation before the workshop. Before Open-ended task Project natural cleaners Role Low clarity of role: expectations Suppliers struggled to grasp the task and role expectations in order to properly prepare for the meeting. Little, if any, mobilisation of external resources and Resource mobilisation activities because of perceived task ambiguity. Next generation task Project shampoo Decomposed problem Project shaving cream High clarity of role: Medium clarity of role: Supplier preparation varied from attempts to interpret Suppliers prepared by gathering state-of-the-art technological know-how. their role to more focused resource deployment. Mobilising internal resources as well as drawing on activities and solutions from the supplier network. Activating knowledge assets and specialists close to the core activities of the supplier. L.N. Laursen, P.H. Andersen / Industrial Marketing Management 58 (2016) 162–171 167 generalists and senior managers participated, seconded by commercial and technical specialists. In the shaving cream task, the role expectations were clearer, and participants were leading technical specialists, who saw the workshop as an opportunity to discuss and clarify technical issues as well as showcase their core capabilities. In the shampoo project, suppliers' participants typically performed business and commercial functions rather than technical. Below, we further explain the different motives for participation and how this influenced the content and pattern of the interaction (Table 4). 4.2.2. Decomposed task The decomposed task elicited clear and directional role expectations. The interaction between the participants was open, confident and immediate, reflecting a shared assumption of the purpose and direction of the meeting. The clarity of the role script ensured that the people attending had great certainty regarding role sets: ‘We did an introduction and it was pretty clear to us, what roles the others would play in that type of product development’ (Supplier, project shaving cream). The transparency on roles resulted in a focused session, where suppliers were ‘trying to do the bits about solving the technical aspects’ (Unilever, project shaving cream). A supplier participant describes his experience of the interaction: 4.2.1. Open-ended task Interactions during the open-ended task mainly consisted of clarifying questions and answers towards the brief between the individual suppliers and Unilever. Whether the interaction was able to transform from a bilateral question-and-answer session to knowledge sharing seemingly depended on the actors' understanding of the role sent and their confidence and experience in taking it on. ‘Well, I say it is open only compared to how we felt. […] there is a certain amount of information we are willing to share. Then there are topics, which we will absolutely not discuss, because we know it is trade secrets. So most of the discussions were clearly within the grey area, where you could say common knowledge or anticipated knowledge within the industry, but just to the edge of where people would get into confidential information. […] I think it was really due to how the Unilever staff handled did it, they were upfront and transparent, so that openness, openminded and honest approach set the tone for everybody.’ [(Supplier, project shaving cream)] ‘You could see some people taking the space trying to lead the conversation by doing that. And others were kind of I don't know what is going on here […]. So I listen and started by making comments here and there a bit, because they didn't want to look stupid. You could almost map them from reactive to proactive.’ [(Unilever, project natural cleaners)] The suppliers' confidence in their role and in their understanding of the task at hand influenced their knowledge contribution strategy. Their reading and interpretation of roles may be dependent on their previous experience with the prevailing situation. Since most of the discussion centred on understanding the role and the task, Unilever gained knowledge on the suppliers' readiness to partake in such a role. A Unilever participant elaborates on his experience: ‘I came out of the meeting, knowing exactly from those four suppliers, who could be in the team and who couldn't. Based on what they said, based on the interaction level and my gut feel. […] So based on this we then had an alignment session, on where do we move next?’ [(Unilever, project natural cleaners)] The open-ended task thus revealed the suppliers' ability to handle such a task. Because of the different viewpoints, an interaction that the suppliers deemed confusing proved to be quite informative for Unilever. Unilever exemplified the role script they wanted participants to follow at the beginning of the meeting. They ‘set the tone’ by openly presenting and revealing how they decomposed the problem and in which areas they lacked knowledge. Thus, they tacitly established the rules of interaction through their enactment. 4.2.3. Next generation task In the next generation experiment, suppliers took turns to suggest solutions, based on their own experiences and those of their network. However, they did not spend much time commenting on each other's solutions. Suppliers saw a defined opportunity for business without the certainty of getting a share in it and typically directed the focus of the suppliers towards value appropriation. ‘Some of them gave verbal feedback, in terms of: we can work in this type of way or that type of way. We got that type of activities. […] And others have brought samples, to say we can make this type of product, of this type of shape or format. […] It was definitely an opportunity to showcase themselves. To demonstrate they are positive and proactive in participating, but also to demonstrate their capabilities.’ [(Unilever, project shampoo)] Table 4 Participants attending and interaction observed during the workshop. During Attending actors Content of interaction (resource transformation) Pattern of interaction (mobilisation) Open-ended task Project natural cleaners Next generation task Project shampoo Decomposed task Project shaving cream Key senior decision makers, seconded by commercial and technical roles. Clarification of the task and organisational arrangement. Cautious stance. Dominantly bilateral conversation between buyer and supplier. Business and commercial functions with a broad overview of opportunities for business and application of technology. Suggestions and discussions based on activities and solutions from the suppliers' network. Pitching approach. Technical experts ‘…somebody who has their finger on the technical pulse…’ (Supplier, project shaving cream). Open sharing of suppliers' core technical knowledge to advance product development. Plenum dialogue based on suggestions from suppliers on the possible ways in which the goal could be reached. Joint multi-way development with open sharing and discussion of suppliers' technological knowledge. 168 L.N. Laursen, P.H. Andersen / Industrial Marketing Management 58 (2016) 162–171 The Unilever management acknowledged the suppliers' unclear position in the project: ‘They were all getting the same brief, they would all understand it from a different angle or a different perspective, but the final solution might not include all’ (Unilever, project shampoo). Whether the discussion was able to transform from a demonstration of capabilities to an open interaction and multi-way knowledge-sharing session depended on whether such role expectations were facilitated during the meeting. A Unilever facilitator describes such facilitation: ‘…then again, we actively looked to the entire group engaged in a discussion about that sample or that approach. Do you think it would be useful, could it be something to engage in? How would they see it themselves?’ [(Unilever, project shampoo)] This highlights that tasks with a moderate level of causal ambiguity call for facilitation and support of roles during the workshops. In the groups where facilitators provided guidance and clues to role scripts during the meeting, openness and multi-way interaction were observed. 4.3. After the workshop: outcome transmission and resource mobilisation As the projects are still in progress, these aspects are still taking shape. However, considerable differences in the interactions have been observed following the workshops. Comparing the outcome and learning passed on after the project meeting also showed a significant difference with respect to the outcome transmission, the suppliers' resource mobilisation and the resource transformation (Table 5). 4.3.1. Open-ended task The open-ended ambiguous task seemed confusing to the supplier participants prior to and during the workshop. Consequently, the role scripts for the succeeding process were discussed in the workshop. This however, made the succeeding process somewhat straightforward. A Unilever project leader explained in the following words: ‘Because in Wembley we co-invented the next step. The follow-up that we just did last week, is actually extremely easy, because we had Wembley. If there hadn't been Wembley and we needed to start from scratch, just to explain and make sure everyone understands it. The good thing about Wembley was the senior leaders were there or they knew they were there, so by having that we immediately get basically, a go by everyone to move on to the next step.’ [(Unilever, director natural cleaners)] The open-ended task led the participants to jointly conceptualise the next step. This resulted in an alignment around the project and the roles with buy-in from the suppliers' decision makers. In short, this made the subsequent process straightforward. The workshop was followed by an immediate scoping and supplier selection. First, Unilever internally narrowed down the task to a particular product. Second, they sent out the specified task to interested suppliers. On the basis of the task, the suppliers mobilised core specialists within their organisation to develop a proposal that they could pitch for Unilever. ‘We have got the pitch mid February. Where they told us their solution. Is there a new approach they can take? What capabilities are needed? What capability can they bring? What experience do they have? And also are there specific partners they want to work with?’ [(Unilever, director natural cleaners)] For each of the suppliers, preparation efforts focused on applying core knowledge and activating their primary experience, gathered from prior projects with other customers or partners. The activation of core knowledge assets also meant that the subsequent process was governed by proper confidentiality agreements. On the basis of the suppliers' ability to develop a proposal for the project, Unilever effectively narrowed down and selected two suppliers to continue working with. The project is currently iterating between the ideation and assessment stage in the NPD model. 4.3.2. Decomposed task In the shaving cream project, the clear role scripts enabled an open interaction during the workshop. Concrete and multiple components of technical knowledge were shared among the participants. ‘Out of the presentation and the flow of conversation, there were probably… let us say 20 or 25 bullet points of what one might call ideas or capabilities or things to be looked at.’ [(Unilever, manager project shaving cream)] Unilever gained technical knowledge through the workshop. However, compared to the natural cleaners project, less time was spent on discussing the next steps of the collaboration. This meant that, after the workshop, the suppliers were uncertain of which role to assume, what kind of knowledge to mobilise, and accordingly how to progress. As a result, there was no direct input on how the next steps should be configured. Because of the character of the buyer-supplier relationship, everyone involved saw it as Unilever's responsibility to make a meaningful transformation of the outcome. A Unilever manager elaborates on how the project was left to Unilever to develop afterwards: ‘So we told the partners this, we need time to pull this all together […] The main point is to say, in terms of the construct of how we work together, to give Unilever's proposal and see if that would fit with the business needs of all our partners.’ [(Unilever, manager project shaving cream)] Table 5 Outcome passed ex post the workshop. Ex post Outcome transmission Resource mobilisation Open-ended task Project natural cleaners Next generation task Project shampoo Decomposed task Project shaving cream The workshop fostered alignment around the project and role expectations, which led to fast selection of both scope and supplier partners in the succeeding process. Activating specialists and core knowledge assets close to the central activities of the suppliers. Sharing of suppliers' basic capabilities did not support a subsequent supplier selection. However, it was a prelude to a subsequent knowledge-sharing session. Awaiting - No mobilisation of external resources and activities One group - Activating specialists and knowledge assets close to the central activities of the suppliers Practice provided several exploration opportunities with the potential of resource transformation Despite open knowledge sharing during the workshop, the project was subsequently put on hold due to uncertainty in the inter-firm alignment. Awaiting - No mobilisation of external resources and activities. Resource Lack of recognisable procedures for supplier transformation behaviour led to joint exploration and learning Drawing suppliers strongly on existing routines led to initial learning but lack of long- term progression L.N. Laursen, P.H. Andersen / Industrial Marketing Management 58 (2016) 162–171 Taking the shaving cream project to the next stage accordingly did not involve any resources from the suppliers. The limited input from suppliers on the next steps and their subsequent role expectations made it challenging for Unilever to further project collaboration. Unilever had little direction with respect to identifying and engaging relevant actors, resources and activities from their supplier network. Currently, the project is still in the process of ‘constructing how we work together’. 4.3.3. Next generation task While the open-ended experiment facilitated a co-invention of the next steps by senior decision makers and the decomposed experiment identified 20–25 ideas or capabilities by technical experts, the outcome from the next generation experiments with the commercial participants was perceived as limited: ‘I don't think there was a lot added in terms of knowledge or in terms of know-how’ (Unilever, manager shampoo project). Since the suppliers selected were Unilever's core strategic suppliers, the showcase of basic capabilities did not add any new knowledge to Unilever. Consequently, the learning was limited and the Unilever project team has not yet been able to select suppliers or define the scope of the project. There was apparently no direct progress of the project as a result of the workshop. The suppliers have not made any further resource contribution. ‘Unilever is still thinking about what it wants to do, and how it wants to do it.’ [(Unilever, manager shampoo project)] However, in one of the three groups, a second workshop has been recently conducted. The second workshop revealed the first workshop to be a prelude, influencing the role expectations of the suppliers: ‘We found the ones [suppliers] that brought people who had been on the initial event [first workshop], were immediately involved in the process. Because they had understood where we were and what was happening.’ [(Unilever, manager shampoo project)] From the supplier perspective, the initial workshop was clarifying in terms of role expectations. Clarified roles resulted in the suppliers' employing technical specialists and core knowledge to develop suggestions for solutions. The mobilisation of resources in the second workshop is thus comparable to the shaving cream project, which involved technical knowledge sharing. ‘We had a 120 ideas in October. So it was quite many. So as part of the session, half way through the session, we changed our tackle a little bit and discussed with them, how we might orientate the samples into groupings. […] So we actually, on the day, modified what we got, because of the real pro-activeness they had taken in preparing.’ [(Unilever, manager shampoo project)] Currently, this subgroup has advanced further in the process from ideation to assessment than the other next generation groups. 5. Discussion The quasi-experiments at Unilever contribute to the theoretical discussions on managing buyer-supplier interaction in NPD. By connecting NPD, IMP and supplier involvement literature, we propose that causal ambiguity is an important characteristic to consider for buyer-supplier interaction in early stages of NPD. Extant literature has already shown that casual ambiguity creates significant management challenges. Moreover, it is shown to influence the performance of supplier involvement in NPD (Potter & Lawson, 2013). By setting up experiments with different degrees of causal ambiguity, the study explores the influence 169 of causal ambiguities on buyer-supplier interaction and offers several important insights into the different stages of this process. First, these experiments demonstrate that variation in causal ambiguity creates different role expectations among the suppliers. High causal ambiguity creates low clarity of role and vice versa. Therefore, the relation between causal ambiguity and clarity of role expectations is an important issue for understanding the subsequent interaction process. Causal ambiguity is an important driver of joint search and exploration in innovation activities. Our study shows that high causal ambiguity may initially lead to low clarity of role and low mobilisation of resources and activities. It also leads to inter-firm clarification and alignment, prompting fast joint action. What may seem confusing and ineffective at first actually enables quick establishment of a manageable development process in an inter-organisational team. In contrast, clarity of task may provide clear role expectations, which initially leads to the mobilisation of core knowledge assets by the suppliers. However, these do not necessarily foster inter-firm alignment, which may be vital to the foundation of the project. The lack of this may subsequently slow down the project. Second, the study sheds light on the interaction processes following from early supplier involvement. A majority of extant literature on early supplier involvement has focused on performance, measuring the positive or negative effects of involving suppliers early in the process; our study complements these by exploring what expectations, acts and interactions actually constitute this process. The study reveals that the relationship between causal ambiguity and clarity of role expectations influences suppliers' focus during interactions. We find that low clarity of role and high causal ambiguity leads suppliers to focus on clarifying and advancing the project, so the project may reach a stage of maturity where the suppliers have a role to play. Contrary to this, when the level of causal ambiguity and clarity of role reach a moderate level, as in the next generation task, suppliers gauge what the project could concern and what value they could gain from it. However, since their role is still unclear, their main concern during interactions is appropriating value. Ideation manifests as suggesting (or selling) paths that favour the supplier's own capabilities and competences. On the other hand, in the decomposed task, where the level of causal ambiguity is low and clarity of role is high, suppliers are confident of their role in the project, and accordingly their focus is on advancing the project through knowledge contributions. Third, our experiments interestingly reveal that there is little correspondence between the suppliers' and the focal firms' perception of contribution – the two only correspond in the decomposed experiment (project shaving cream). This can be attributed to the finding that suppliers' perception of how much they can contribute to the project resembles the level of clarity of role expectations. Clarity in role expectations makes it easier for the suppliers to know how to contribute and their perception is accordingly aligned. Whereas the focal firms' evaluation of supplier contribution is linked to the supplier's focus on advancing the project in the interaction: when they contribute new knowledge gained, e.g. when new technical knowledge is shared (as in the decomposed experiment) or when suppliers' ability to handle such tasks is revealed (as in the open-ended experiment). Thus, when the suppliers have a large focus on value appropriation (e.g. displaying basic capabilities), the focal firm evaluates the suppliers' contribution as very low. In all, our analysis of the quasi-experiments at Unilever supports the notion that earliness of supplier involvement influences the role of suppliers in NPD and their interaction in NPD teams. The different degrees of causal ambiguity and its management impact suppliers' readiness to be involved in NPD activities and their subsequent interaction with the client firm and other suppliers. This interaction affects the project's continued development. From an IMP perspective, the experiments must also be seen as a critical event in the wider context of forming the course of a relationship. An interesting issue in this regard, is how participating in the different framings of interaction may impact future relationships 170 L.N. Laursen, P.H. Andersen / Industrial Marketing Management 58 (2016) 162–171 between the supplier and Unilever. This topic serves as an interesting avenue of future research. 6. Implications These findings have significant implications for both management and research. For managers of inter-organisational development activities, the findings provide an important lesson. We find that causal ambiguity of a task significantly influences how suppliers prepare, which participants attend, the content and character of the interaction and the flow of the subsequent process. The supplier's confidence in role expectations during the interaction is an important issue for understanding what will happen; thus, workshop leaders should not focus on the task alone. In the decomposed experiment, the details of the task generated some ideas from the participants. This highlights the role of the facilitators: it is not enough for facilitators to specify needs, they must also differentiate between role expectations and communicate those to the participants, in order to facilitate interactive knowledge sharing in early supplier involvement processes. For academics, we believe this study acts a starting point for a valuable discussion on the interaction process of early supplier involvement. The contribution of this study is that it is among one of the first to explore the black box of early supplier involvement (Wagner, 2012). Further, the study explicitly links the different forms of task ambiguity to resource mobilisation in the supplier network. Future research can expand our findings. Studies could examine the interesting dynamics of interaction in the early stages of supplier involvement in terms of the suppliers' focus (knowledge sharing vs. value appropriation) and project progress in relation to perceived contribution (buyer vs. supplier perspective) and relate this to the effect of involving suppliers early on. This can fuel a more in-depth discussion on project target (exploration vs. exploitation) and whether early supplier involvement is more effective for sourcing improvements (decomposed task) or for ambitious innovation (open-ended task). The study supports that designing causal ambiguity is a relevant means of managing supplier involvement in innovation. In order to reap its resource mobilisation and transformation benefits is necessary to understand further how it influences ideation processes. Acknowledgement The authors are grateful for financial support from the Danish Industry Foundation (Industriens Fond). Moreover, we would like to thank Dr. Graham Cross at Unilever for enabling the research process. Without his dedication and open innovation mind-set these quasi-experimental studies would not have been a possibility. Also, we wish to thank two anonymous reviewers of this journal for helpful comments. References Abdel-Halim, A. A. (1983). Effects of task and personality characteristics on subordinate responses to participative decision making. Academy of Management Journal, 26(3), 477–484. Anderson, H., Havila, V., Andersen, P., & Halinen, A. (1998). Position and roleconceptualizing dynamics in business networks. Scandinavian Journal of Management, 14(3), 167–186. Bstieler, L., & Hemmert, M. (2010). Increasing learning and time efficiency in interorganizational new product development teams. Journal of Product Innovation Management, 27(4), 485–499. Cook, T. D. (1983). Quasi-experimentation: Its ontology, epistemology, and methodology. Beyond Method: Strategies for Social Research, 74–94. Corsaro, D., & Cantù, C. (2015). Actors' heterogeneity and the context of interaction in affecting innovation networks. Journal of Business & Industrial Marketing, 30(3/4), 246–258. Daft, R. L., & Macintosh, N. B. (1981). A tentative exploration into the amount and equivocality of information processing in organizational work units. Administrative Science Quarterly, 26(2), 207–224. Eisenhardt, K. M., & Tabrizi, B. N. (1995). Accelerating adaptive processes: Product innovation in the global computer industry. Administrative Science Quarterly, 84–110. Floyd, S. W., & Lane, P. J. (2000). Strategizing throughout the organization: Managing role conflict in strategic renewal. Academy of Management Review, 25(1), 154–177. Grant, A. M., & Wall, T. D. (2009). The neglected science and art of quasi-experimentation: Why-to, when-to, and how-to advice for organizational researchers. Organizational Research Methods, 12(4), 653–686. Håkansson, H., & Snehota, I. (1995). Developing relationships in business networks. Routledge. Håkansson, H., Ford, D., Gadde, L. E., Snehota, I., & Waluszewski, A. (2009). Business in networks. John Wiley & Sons. Hansen, M. T. (1999). The search-transfer problem: The role of weak ties in sharing knowledge across organization subunits. Administrative Science Quarterly, 44(1), 82–111. Johanson, J., & Mattsson, L. G. (1987). Interorganizational relations in industrial systems: A network approach compared with the transaction-cost approach. International Studies of Management & Organization, 17(1), 34–48. Johnsen, T. E. (2009). Supplier involvement in new product development and innovation: Taking stock and looking to the future. Journal of Purchasing and Supply Management, 15(3), 187–197. Katz, D., & Kahn, R. L. (1978). The social psychology of organizations (2nd ed.). John Wiley & Sons: Canada. King, B. E., & Penleskey, R. J. (1992). Impediments to timely delivery of new products at an industrial product firm. International Journal of Operations and Production Management, 12, 56–65. Knudsen, T., & Srikanth, K. (2015). Coordinated exploration organizing joint search by multiple specialists to overcome mutual confusion and joint myopia. Administrative Science Quarterly, 59(3), 409–441. Kopecká, J. A. (2013). Why didn't they ask the supplier? The utilisation of supplier information and knowledge in the fuzzy front end of new product development. PhD Dissertation Technische Universiteit, Delft. Koufteros, X., Vonderembse, M., & Jayaram, J. (2005). Internal and external integration for product development: The contingency effects of uncertainty, equivocality, and platform strategy. Decision Sciences, 36(1), 97–133. Lawson, B., & Potter, A. (2012). Determinants of knowledge transfer in inter-firm new product development projects. International Journal of Operations & Production Management, 32(10), 1228–1247. Lippman, S. A., & Rumelt, R. P. (1982). Uncertain imitability: An analysis of interfirm differences in efficiency under competition. Bell Journal of Economics, 13, 418–453. Littler, D., Leverick, F., & Wilson, D. (1998). Collaboration in new technology based product markets. International Journal of Technology Management, 15(1/2), 139–159. Luthans, F., & Davis, T. R. (1982). An idiographic approach to organizational behavior research: The use of single case experimental designs and direct measures. Academy of Management Review, 7(3), 380–391. Melander, L., & Lakemond, N. (2015). Governance of supplier collaboration in technologically uncertain NPD projects. Industrial Marketing Management, 49, 116–127. Miettilä, A., & Möller, K. (1990). Interaction perspective into professional business services: A conceptual analysis. IMP conference (6th). IMP. Miles, M. B., & Huberman, A. M. (1994). Qualitative data analysis: An expanded sourcebook. Sage. Petersen, K. J., Handfield, R. B., & Ragatz, G. L. (2003). A model of supplier integration into new product development. Journal of Product Innovation Management, 20(4), 284–299. Potter, A., & Lawson, B. (2013). Help or hindrance? Causal ambiguity and supplier involvement in new product development teams. Journal of Product Innovation Management, 30(4), 794–808. Robillard, P. N. (1999). The role of knowledge in software development. Communications of the ACM, 42(1), 87–92. Salancick, G. R. (1979). Field stimulations for organizational behavior research. Administrative Science Quarterly, 24(4), 638–649. Shadish, W. R., Cook, T. D., & Campbell, D. T. (2002). Experimental and quasi-experimental designs for generalized causal inference. Boston: Houghton Mifflin. Song, M., & Di Benedetto, C. A. (2008). Supplier's involvement and success of radical new product development in new ventures. Journal of Operations Management, 26(1), 1–22. Stake, R. E. (2006). The art of case study research. Thousand Oaks, CA: Sage Publications. Strauss, A., & Corbin, J. (1990). Basics of qualitative research: Grounded theory procedures and techniques. Sage Publications. Tidd, J., Pavitt, K., & Bessant, J. (2001). Managing innovation, Vol. 3, Chichester: Wiley. Ulrich, K. T., & Eppinger, S. D. (2005). Product design and development. New York: McGraw-Hill Book Co. Van Echtelt, F. E. A., Wynstra, F., Van Weele, A. J., & Duysters, G. (2008). Managing supplier involvement in new product development: A multiple-case study. Journal of Product Innovation Management, 25, 180–201. Wagner, S. M. (2012). Tapping supplier innovation. Journal of Supply Chain Management, 48(2), 37–52. Wagner, S. M., & Hoegl, M. (2006). Involving suppliers in product development: Insights from R&D directors and project managers. Industrial Marketing Management, 35(8), 936–943. Weick, K. E., & Roberts, K. H. (1993). Collective mind in organizations: Heedful interrelating on flight decks. Administrative Science Quarterly, 357–381. L.N. Laursen, P.H. Andersen / Industrial Marketing Management 58 (2016) 162–171 Wynstra, F., Spring, M., & Schoenherr, T. (2015). Service triads: A research agenda for buyer–supplier–customer triads in business services. Journal of Operations Management, 35, 1–20. Linda Nhu Laursen is a doctoral candidate in the Department of Business and Management at Aalborg University in Denmark. Her current research focuses on innovation management, NPD and buyer-supplier relations. She has practical experience from design consulting and as an entrepreneur. 171 Poul Houman Andersen is B2B marketing Professor at Aalborg University, Denmark and Professor II in supply chain management at the Norwegian University of Science and Technology. His research interest covers the organising of market exchange processes as seen from buyers and sellers' perspective. He has published several journals, including Research Policy, Journal of Business Research, California Management Review and Journal of Purchasing and Supply Management.