UNIVERSITY OF GONDAR

COLLEGE OF AGRICULTURE AND RURAL TRANSFORMATION

DEPARTMENT OF AGRICULTURAL ECONOMICS

COURSE TITLE: AGRICULTURAL PROJECT PLANNING AND

ANALYSIS (532)

PROJECT PROPOSAL ON THE ESTABLISHMENT OF ANIMAL FEED

PRODUCING PLANT IN GONDAR ZURIYA WOREDA MAKSEGNIT

TOWN

SUBMITTED

BY

Endeshaw Gedefaw

SUBMITTED TO :- Abebe D (ass. prof. of agricultural economics)

JUNE 2018

GONDAR ETHIOPIA

Table of Contents

1. Executive Summary…………………………………………………………..2

2. Product Description and Application………………………………………..2

3. Market Study, Plant Capacity and Production Program…………………..3

3.1

Market Study .................................................................................................................... 3

3.1.1

Present Demand and Supply ..................................................................................... 3

3.1.2

Projected Demand ..................................................................................................... 5

3.1.3

Pricing and Distribution ............................................................................................ 7

3.2

Plant Capacity .................................................................................................................. 7

3.3

Production Program.......................................................................................................... 7

4. Raw Materials and Utilities…………………………………………………..8

4.1

Availability and Source of Raw Materials ....................................................................... 8

4.2

Annual Requirement and Cost of Raw Materials and Utilities ........................................ 8

5. Location and Site……………………………………………………………...9

6. Technology and Engineering…………………………………………………9

6.1

Production Process ........................................................................................................... 9

6.2

Machinery and Equipment ............................................................................................. 10

6.3

Size of the Project .......................................................................................................... 11

6.4

Alternative Technology .................................................................................................. 11

7. Human Resource and Training Requirement

………………………………11

7.1

Human Resource ............................................................................................................ 11

1

7.2

Training Requirement .................................................................................................... 13

8. Financial Analysis …………………………………………………………..13

8.1

Underlying Assumption ................................................................................................. 13

8.2

Investment ...................................................................................................................... 14

8.3

Production Costs ............................................................................................................ 16

8.4

Financial Evaluation ....................................................................................................... 17

9. Economic and Social Benefit and Justification……………………………18

ANNEXES………………………………………………………………………..19

1. Executive Summary

The project envisages production of 5000 tons or 50,000 quintals of assorted animal feed per

annum. The total investment requirement of the project is estimated at about Birr 18,403,122; of

which Birr 1.2 million is the cost of working capital. Based on the cash flow statement, the

calculated internal rate of return (IRR) and simple rate of return of the project are 25.9 % and

21.8, respectively. And the net present value (NPV) at 18 % discounting rate is Birr 818 millions.

The plant is expected to create employment opportunities for about 55 persons. The project uses

the local raw materials as the main ingredients of the products. Therefore it creates forward and

backward linkages to the different sectors of the economy.

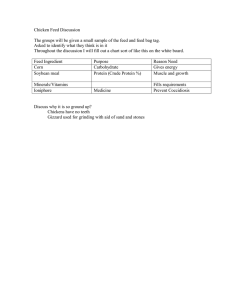

2. Product Description and Application

Assorted animal feed is used for feeding domestic animals like cattle, sheep and goats, poultry

and hogs.

The feed is prepared by modern industrial production method and the main

ingredients are maize, Milo, wheat, barley, mash, molasses, soybean oil lees, other vegetable oil

lees, crushed bones, oil and fat, and some other additives. Depending on the availability of

2

inputs, some of the above inputs could be substituted to each other without affecting the quality

of the animal feed.

3. Market Study, Plant Capacity and Production Program

3.1 Market Study

3.1.1

Present Demand and Supply

With a livestock and poultry population of 31.9 million, the ANRS has the second largest

livestock resources of the country. But, due decreasing size of grazing land caused by the

expansion of farmlands and lack of modern animal feeding system, the livestock population of

the region is increasing at a very low rate; and in some areas, there is an actual decline of the

livestock population. Besides, because of poor and inadequate feeding, the quality of the meat,

hides and skins of the livestock resources of the region has been declining during the past 25

years.

The estimated and reported animal feed deficit for the ANRS in 1984 is 28-40 percent. The data

is outdated by nearly two decades, but it is doubtful whether development activities implemented

have had a say in changing the figure. The traditional feeding of livestock by letting cattle and

other domestic animals to wander in an ever decreasing grazing land is no longer practical;

simply there is no enough grazing land for the animals.

If the ANRS has to maintain and further develop its livestock resources for domestic use and for

export, the system of feeding the animals should be modernized and at the same time

economical. One option for providing feed for the animals is the establishment of a number of

small to medium scale animal feed making factories in the major urban centers; and if

infrastructures allow, in the major cattle growing areas of the region. The animal feed from the

factories may not be the only source of feed for the animals; it can be used as supplementary but

important feed for livestock productivity.

3

Traditionally, Ethiopian dairy farmers as well as cattle fatteners prepared their own concentrated

feed from different ingredients such as milling and oil factory by-products. In other words, agroindustrial by-products are important rations in ruminant livestock feed. They are generally feeds

of high energy. If such products are mixed with cereals and some sorts of vitamins and minerals,

they are very useful for animal growth and health. However, despite the availability of various

agro-industrial by-products, most of them are under-utilized; mainly because of lack of

appropriate technologies for processing.

In connection to this, however, many inputs used to produce animal feeds have alternative uses,

either for human consumption or for industrial use. These competing demands are determined by

price and availability of the commodity. In country like Ethiopia, where there is shortfall in food

grains production, the availability of raw materials for animal feed plants could be the major

problem. In other words, there is a direct competition between human and livestock for cereal

grains.

To compute the demand for concentrated animal feed in ANRS, it is reasonable to start with the

utilization of agro-industrial by-products as animal feed in the region. Utilization of agroindustrial by products (millers’ by products, oil cakes, brewer’s spent grain, etc…) is a bit higher

in moisture deficit areas (4.1 percent for Dega, 7.0 percent for Woina-Dega and 4.5 percent for

Kola) as compared to sufficient rainfall areas (2.5, 4.3 and 2.3). Transport problem and higher

price prevent by-products from being utilized effectively.

Utilization of concentrated or improved animal feed in the ANRS is only 0.2 %. And, it is from

other regions that the feed is come. Like that of agro-industrial by-products, transport problem

and higher price prevent the use of industrially processed animal feed in the ANRS. Feed

resources for livestock in rural and urban holdings in ANRS are given in Table 3.1.

4

Table 3.1

Feed resources for livestock in rural and urban holdings in ANRS

Number of

%

Rural

Urban

households

Green fodder/.grazing

2,670,653

46,58

51.36

35.08

Crop residues

2,545,602

35.31

32.99

17.05

Improved feed (alfalfa)

22,475

0.18

0.16

0.38

Hay (grass, clover, etc)

1,433,118

13.08

11.43

16.05

By – products/others

277,131

1.31

1.02

8.96

617,411

3.54

3.04.

22.47

By – products: rapeseed cake, Noug

cake, safflower cake, brewing residue

and bran.

Source: CSA, 2010 G.C

3.1.2

Projected Demand

The following assumptions are made to project the future demand for industrially processed

animal feed:

5

In the year 2001 E.C., the cattle population in ANRS is estimated to be 11,026,549 and

estimated to grow at 1.2 % per annum in the coming years.

Of the total cattle population, it is conservative to say at least 0.5 %( which is two times

the current use) can be fed from industrially processed animal feed in the short-run while,

as awareness increases, it can grow at 10 % per annum in the coming years, if the supply

is available at a reasonable price.

The average consumption per head per day is assumed to be 2.7 K.G, which is taken from

the State Dairy Farms past record.

Based on the above facts and assumptions, the ANRS’s demand for industrially processed animal

feed can be projected as given in Table 3.2 below. By the year 2001 E.C, the projected demand

equals 54,333 tons; the figure is projected to reach 62,688 tons and 66,540 tons by the year 2005

E.C. and 2010 E.C.

TABLE 3.2

Processed animal feed demand projections in ANRS

Year (E.C.)

Quantity (in Ton)

2001

54,333

2002

60,484

2003

61,210

2004

61,944

2005

62,688

2006

63,440

2007

64,201

2008

64,971

2009

65,751

2010

66,540

6

3.1.3

Pricing and Distribution

Market prices of industrially processed animal feed depends upon the availability and value of

raw materials, number of processing units, number of processing firms and their production

efficiency, prevailing demand and etc. As discussed earlier, the demand for industrially

processed or concentrated animal feeds for ANRS’s alone surpasses the existing animal feed

supply in the country. The current producer’s prices of the product range between Birr 160 and

Birr 180 per quintal at industry gate. In this project profile, it is proposed to sell the product at

Birr 150 per quintal at the factory gate.

3.2 Plant Capacity

According to market study, the present demand supply gap of animal feed is very large. In this

study, a plant with a capacity of 5000 tons per annum is envisaged; which is a small fraction of

the projected demand of the region. The plant will operate 275 days a year. Sundays and national

holidays, amounting to 65 days a year, are registered holidays for the plant. For maintenance and

repair work as well as for contingence of unexpected work interruption additional 25 days are

assigned.

3.3 Production Program

The plant can start operation at 75 % of its capacity in the first year. It will then build up its

production capacity to 85 % and then 100 % in the second and third year, respectively. As the

plant is new and is equipped with new machinery, production build-up is made to start at reduced

capacity and gradually rise to full capacity. The low production level at the initial stage is also to

develop substantial market outlets for the product. Machinery operators will also get enough time

to develop the required skills and experience.

7

4. Raw Materials and Utilities

4.1 Availability and Source of Raw Materials

The main ingredients for the production of industrially processed animal feed are Milo, maize,

wheat bran, mash, molasses, soybean grounds, fish grounds (meal) and some vitamins.

Depending on the availability of other inputs, the above inputs could be substituted without

affecting the quality of the animal feed. All the raw materials, except molasses, can be obtained

within the region. Molasses can be brought from the existing sugar factories or from the region

if these factories are established.

4.2 Annual Requirement and Cost of Raw Materials and Utilities

The quantities and costs of raw materials required for the production of 5000 tons of

concentrated animal feed are indicated in Table 4.1.Utilities required by the plant consist of

electricity, water and fuel oil. The annual requirement and costs of these utilities is shown in

Table 4.2.

TABLE 4.1

Raw and auxiliary materials requirement

No

Description

Qty

Cost ('000 Birr)

(tons)

F.C

L.C

Total

1

Oil Cake

1150

-

555

555

2

Frushka (Bran of Cereals)

1235

-

573.6

573.6

3

Molasses

250

-

120.8

120.8

4

Low Quality Maize

2000

-

1200

1200

5

Salt

7

-

5

5

6

Limestone (ground)

8

-

4.3

4.3

8

7

Meal (bone or flesh or blood)

8

Sacks (150 kg capacity)

9

Twine Rope

10

Other

grains

(low

quality

200

-

36

36

100,000 pcs

-

600

600

lump sum

-

8.4

8.4

150

-

216

216

-

-

3,319.1

3,319.1

wheat, barely and etc)

Total Cost

UTILITIES REQUIREMENT AT FULL CAPACITY

No

Item

1

Electricity

2

Water

3

Fuel Oil

Annual Requirement

Cost ('000 Birr)

45,000 KWH

24.5

4800 m3

12.7

374,000 liter

2618

Total

2655.2

5. Location and Site

For its convenience for distribution, Gondar is an appropriate choice for the establishment animal

feed production plant in the region.

6. Technology and Engineering

6.1 Production Process

The major operations involved in the production of animal feed are:- raw materials preparation;

primary crushing; assorting and measuring; mixing; molasses mixing; fine crushing; pellet

making; packaging.

9

Raw and auxiliary materials are first charged into silos and tanks where they are made ready for

further processing. Then, they are processed by primary crusher. Crushed materials are further

separated by means of a sifter, and then stored to assorting tanks according to the kind of raw

materials.

In assorting and measuring operation, small amounts of additives are charged into the bins

containing different assortments of raw materials. The raw materials stored in the assorting tanks

are measured in accordance with their use (cattle feed, hog feed, etc).

The raw materials are then mixed by means of a mixer. In this process, fatty ingredients are

added to the materials in order to raise the nutrient value of the feed. The feed obtained from the

mixer is added with molasses. The product is next accommodated in the product tanks, then

weighed and packaged.

6.2 Machinery and Equipment

Machinery and equipment required by the plant together with auxiliary equipment and their costs

are given in Table 6.1.

TABLE 6.1

MACHINERY AND EQUIPMENT REQUIRED BY CATTLE FEED PRODUCING

PLANT

No

Description

Cost(In Birr)

1

Tanks And Silos for Raw and Auxiliary Materials

0

2

Metal Screen & Shaker

0

3

Mixer

0

4

Hammer Mill (Crusher)

0

5

Blender

0

6

Weighing Scale (5 Tons)

0

10

7

Bagging Equipment

0

8

Dust Collector

0

9

Product Tank

0

10

Tanks for Oil Cakes and Molasses

0

11

Boiler

0

12

Other Accessories

0

Sub-Total

5,680,000

Freight, Insurance, Banks, Charges, Inland Transport, etc.

Total Cost of Machinery and Equipment

550,000

6,230,000

6.3 Size of the Project

The total area required by the plant is estimated to be 5000 m2.

6.4 Alternative Technology

Alternatively, assorted animal feed can be produced using a capital intensive technology that

involves fine crushing and pellet making. In this case, after the feed is mixed with molasses, it is

further crushed by means of the second chamber, and the assorted animal feed that is crushed in

to fine particles is further formed in to pellets. The pellets, which are cylindrical type and come

in sizes measuring 6mm in diameter and 2 cm in length, are then dried.

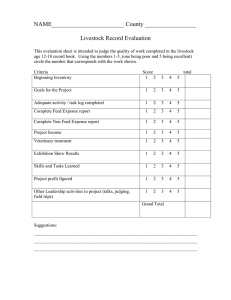

7. Human Resource and Training Requirement

7.1 Human Resource

11

The manpower requirement of the plant will be 55. In terms of annual expenditure a total of

437,400 Birr will be expended for salary and wages. The following Table 7.1 shows the details

of manpower requirement of the plant.

TABLE 7.1 Manpower requirement of animal feed producing plant

No

Description

Qt

Monthly

Annual

(no)

Salary/Wages

Expenditure

A. Administration

1

Plant Manager

1

2500

30000

2

Secretary

1

500

6000

3

Accountant

1

800

9600

4

Personnel Officer

1

800

9600

5

Salesman

1

800

9600

6

Cashier

1

600

7200

7

Clerks

2

250

6000

8

General Services

5

300

18000

B. Production

1

Production Supervisor

1

1200

14400

2

Electrical/Mechanical Eng.

1

1500

18000

3

Skilled Workers

10

600

72000

4

Unskilled Workers

30

400

144000

-

317400

Sub-total

Training Cost

-

-

120000

Total annual cost

55

-

437,400

12

7.2 Training Requirement

Training is required for key production personnel. For this purpose, one expert from the

technology suppliers can be sent.

8. Financial Analysis

8.1 Underlying Assumption

The financial analysis of milk powder producing plant is based on the data provided in the

preceding chapters and the following assumptions.

A. Construction and Finance

Construction period

2 years

Source of finance

40% equity and 60% loan

Tax holidays

2 years

Bank interest rate

12%

Discount for cash flow

18%

Value of land

Based on lease rate of ANRS

Spare Parts, Repair & Maintenance

3% of fixed investment

13

B.Depreciation

Building

5%

Machinery and equipment

10%

Office furniture

10%

Vehicles

20%

Pre-production (amortization)

20%

B. Working Capital (Minimum Days of Coverage)

Raw Material-Local

30 days

Raw Material-Foreign

120 days

Factory Supplies in Stock

30 days

Spare Parts in Stock and Maintenance

30 days

Work in Progress

10 days

Finished Products

15 days

Accounts Receivable

30 days

Cash in Hand

30 days

Accounts Payable

30 days

8.2 Investment

The total investment cost of the project including working capital is estimated at Birr 18,403,122

as shown in Table 8.1 below. The Owner shall contribute 40 % of the finance in the form of

equity while the remaining 60 % is to be financed by bank loan.

14

Table 8.1 Total initial investment

Items

Total

Land

3750

Building and Civil Works

7,200,000

Office Equipment

500,000

Vehicles

2,500,000

Plant Machinery & Equipment

6,230,000

Total Fixed Investment Cost

16,433,750

Pre production capital expenditure*

Total Initial Investment

750,000

17,183,750

Working Capital at Full Capacity

Total

1,219,372

18,403,122

*Pre-production capital expenditure includes - all expenses for pre-investment studies,

consultancy fee during construction and expenses for company‘s establishment, project

administration expenses, commission expenses, preproduction marketing and interest expenses

during construction.

The major components of the investment are building and civil works, plant and machinery

expenses and working capital which are accounting for 35.2 %, 24.4 % and 35.8 %, respectively.

The foreign component of the project accounts for 24.4 % of the total investment cost.

15

8.3 Production Costs

The total production cost at full capacity operation is estimated at Birr 6.7 million (See Table

8.2). Raw materials and utilities amounts Birr 89.8 % of the total production cost.

Table 8.2 production cost at full capacity

Raw Material Requirement

Cost

1.Local Raw Materials

3,319,100

2.Foreign Raw Materials

0

Total Production Cost at full Capacity

Items

Cost

1. Raw Materials

3,319,100

2.Utilities

2,655,200

3.Wages and Salaries

241,200

4.Spares and Maintenance

62,490

Factory costs

6,277,990

5. Depreciation

168,830

6.Financial Costs

204,391

Total Production Cost

6,651,211

16

8.4 Financial Evaluation

I.

Profitability

According to the projected income statement (See Annex 4) the project will generate profit

beginning from the first year of operation and increases on wards. The income statement and

other profitability indicators also show that the project is viable.

II.

Breakeven Analysis

The breakeven point of the projects is given by the formula:

BEP =

Fixed Cost

Sale –Variable Cost

at full capacity.

The project will break even at 21.8 % of capacity utilization

III.

Payback Period

Investment cost and income statement projection are used in estimating the project payback

period. The projects will payback fully the initial investment less working capital in three years.

IV.

Simple Rate of Return

The project’s simple rate of return is given by the formula:

SRR= (Net Profit + Interest)/ (Total Investment Outlay) at full capacity utilization.

17

The SRR would be 22.2 % at full capacity utilization.

V.

Internal Rate of Return and Net Present Value

Based on cash flow statement (Annex 2) the calculated internal rate of return (IRR) of the project

is 25.9 % and the net present value (NPV) at 18 % discount is Birr 818 thousand.

VI.

Sensitivity Analysis

The sensitivity test result which undertaken by increasing the cost of production by 5 % still

indicates that the project would be viable.

9. Economic and Social Benefit and Justification

Based on the foregoing presentation and analysis, we can learn that the proposed project

possesses wide range of benefits that complement the financial feasibility obtained earlier. In

general, the envisaged project promotes the socio-economic goals and objectives stated in the

strategic plan of the Amhara National Regional State, particularly in Gondar Zuriya woreda

maksegnit Town. These benefits are listed as follows:

A. Profit Generation

The project is found to be financially viable and earns on average a profit of Birr 621 thousands

per year and Birr 6.2 million within the project life. Such result induces the project promoters to

reinvest the profit which, therefore, increases the investment magnitude in the region.

B. Tax Revenue

In the project life under consideration, the region will collect about Birr 2.3 million from

corporate tax payment alone (i.e. excluding income tax, sales tax and VAT). Such result create

additional fund for the regional government that will be used in expanding social and other basic

services in the region

18

C. Employment and Income Generation

The proposed project is expected to create employment opportunity to several citizens of the

country. That is, it will provide employment to 55 staffs. This would be one of the commendable

accomplishments of the project.

D. Pro Environment Project

The proposed production process is environmentally friendly

ANNEXES

19

Annex 1: Total Net Working Capital Requirements (in Birr)

CONSTRUCTION

PRODUCTION

Year 1

Year 2

1

2

3

4

0

0

75%

85%

100%

100%

0.00

0.00

949113.26

1075661.70

1265484.35

1265484.35

0.00

0.00

271562.73

307771.09

362083.64

362083.64

Raw Material-Local

0.00

0.00

271562.73

307771.09

362083.64

362083.64

Raw Material-Foreign

0.00

0.00

0.00

0.00

0.00

0.00

Factory Supplies in Stock

0.00

0.00

5274.67

5977.96

7032.89

7032.89

Spare Parts in Stock and Maintenance

0.00

0.00

5112.82

5794.53

6817.09

6817.09

Work in Progress

0.00

0.00

131866.77

149449.01

175822.36

175822.36

Finished Products

0.00

0.00

263733.55

298898.02

351644.73

351644.73

2. Accounts Receivable

0.00

0.00

613636.36

695454.55

818181.82

818181.82

3. Cash in Hand

0.00

0.00

236978.18

268575.27

315970.91

315970.91

0.00

0.00

1528165.08

1731920.42

2037553.44

2037553.44

4. Current Liabilities

0.00

0.00

613636.36

695454.55

818181.82

818181.82

Accounts Payable

0.00

0.00

613636.36

695454.55

818181.82

818181.82

TOTAL NET WORKING CAPITAL REQUIRMENTS

0.00

0.00

914528.72

1036465.88

1219371.62

1219371.62

Capacity Utilization (%)

1. Total Inventory

Raw Materials in Stock- Total

CURRENT ASSETS

1

INCREASE IN NET WORKING CAPITAL

0.00

0.00

914528.72

121937.16

182905.74

0.00

2

Annex 1: Total Net Working Capital Requirements (in Birr)

(continued)

PRODUCTION

5

6

7

8

9

10

100%

100%

100%

100%

100%

100%

1265484.35

1265484.35

1265484.35

1265484.35

1265484.35

1265484.35

362083.64

362083.64

362083.64

362083.64

362083.64

362083.64

362083.64

362083.64

362083.64

362083.64

362083.64

362083.64

Raw Material-Foreign

0.00

0.00

0.00

0.00

0.00

0.00

Factory Supplies in Stock

7032.89

7032.89

7032.89

7032.89

7032.89

7032.89

Spare Parts in Stock and Maintenance

6817.09

6817.09

6817.09

6817.09

6817.09

6817.09

Work in Progress

175822.36

175822.36

175822.36

175822.36

175822.36

175822.36

Finished Products

351644.73

351644.73

351644.73

351644.73

351644.73

351644.73

2. Accounts Receivable

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

3. Cash in Hand

315970.91

315970.91

315970.91

315970.91

315970.91

315970.91

2037553.44

2037553.44

2037553.44

2037553.44

2037553.44

2037553.44

4. Current Liabilities

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

Accounts Payable

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

Capacity Utilization (%)

1. Total Inventory

Raw Materials in Stock-Total

Raw Material-Local

CURRENT ASSETS

3

TOTAL NET WORKING CAPITAL REQUIRMENTS

INCREASE IN NET WORKING CAPITAL

1219371.62

1219371.62

1219371.62

1219371.62

1219371.62

1219371.62

0.00

0.00

0.00

0.00

0.00

0.00

4

Annex 2: Cash Flow Statement (in Birr)

CONSTRUCTION

PRODUCTION

Year 1

Year 2

1

2

3

4

1093575.00

2312946.62

6238636.36

6456818.18

7622727.27

7500000.00

1093575.00

2312946.62

613636.36

81818.18

122727.27

0.00

Total Equity

437430.00

925178.65

0.00

0.00

0.00

0.00

Total Long Term Loan

656145.00

1387767.97

0.00

0.00

0.00

0.00

0.00

0.00

613636.36

81818.18

122727.27

0.00

2. Inflow Operation

0.00

0.00

5625000.00

6375000.00

7500000.00

7500000.00

Sales Revenue

0.00

0.00

5625000.00

6375000.00

7500000.00

7500000.00

Interest on Securities

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

TOTAL CASH OUTFLOW

1093575.00

1093575.00

6782477.24

6149905.03

7400266.33

7066018.53

4. Increase In Fixed Assets

1093575.00

1093575.00

0.00

0.00

0.00

0.00

1041500.00

1041500.00

0.00

0.00

0.00

0.00

52075.00

52075.00

0.00

0.00

0.00

0.00

0.00

0.00

1528165.08

203755.34

305633.02

0.00

TOTAL CASH INFLOW

1. Inflow Funds

Total Short Term Finances

3. Other Income

Fixed Investments

Pre-production Expenditures

5. Increase in Current Assets

5

6. Operating Costs

0.00

0.00

4732231.15

5360227.97

6302223.20

6302223.20

7. Corporate Tax Paid

0.00

0.00

0.00

0.00

247366.65

259630.13

8. Interest Paid

0.00

0.00

522081.01

245269.56

204391.30

163513.04

9.Loan Repayments

0.00

0.00

0.00

340652.16

340652.16

340652.16

10.Dividends Paid

0.00

0.00

0.00

0.00

0.00

0.00

Surplus(Deficit)

0.00

1219371.62

-543840.88

306913.15

222460.95

433981.47

Cumulative Cash Balance

0.00

1219371.62

675530.75

982443.90

1204904.84

1638886.31

6

Annex 2: Cash Flow Statement (in Birr): Continued

PRODUCTION

5

6

7

8

9

10

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

0.00

0.00

0.00

0.00

0.00

0.00

Total Equity

0.00

0.00

0.00

0.00

0.00

0.00

Total Long Term Loan

0.00

0.00

0.00

0.00

0.00

0.00

Total Short Term Finances

0.00

0.00

0.00

0.00

0.00

0.00

2. Inflow Operation

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

Sales Revenue

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

7037403.75

7015037.97

6986423.18

6617156.24

6617156.24

6617156.24

0.00

0.00

0.00

0.00

0.00

0.00

Fixed Investments

0.00

0.00

0.00

0.00

0.00

0.00

Pre-production Expenditures

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

TOTAL CASH INFLOW

1. Inflow Funds

Interest on Securities

3. Other Income

TOTAL CASH OUTFLOW

4. Increase In Fixed Assets

5. Increase in Current Assets

7

6. Operating Costs

6302223.20

6302223.20

6302223.20

6302223.20

6302223.20

6302223.20

7. Corporate Tax Paid

271893.61

290406.08

302669.56

314933.04

314933.04

314933.04

8. Interest Paid

122634.78

81756.52

40878.26

0.00

0.00

0.00

9. Loan Repayments

340652.16

340652.16

340652.16

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Surplus(Deficit)

462596.25

484962.03

513576.82

882843.76

882843.76

882843.76

Cumulative Cash Balance

2101482.57

2586444.60

3100021.42

3982865.18

4865708.94

5748552.70

10.Dividends Paid

Annex 3: DISCOUNTED CASH FLOW-TOTAL CAPITAL INVESTED

CONSTRUCTION

PRODUCTION

Year 1

Year 2

1

2

3

4

TOTAL CASH INFLOW

0.00

0.00

5625000.00

6375000.00

7500000.00

7500000.00

1. Inflow Operation

0.00

0.00

5625000.00

6375000.00

7500000.00

7500000.00

Sales Revenue

0.00

0.00

5625000.00

6375000.00

7500000.00

7500000.00

Interest on Securities

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

2. Other Income

8

TOTAL CASH OUTFLOW

1093575.00

1093575.00

5646759.87

5482165.13

6485128.94

6561853.33

3. Increase in Fixed Assets

1093575.00

1093575.00

0.00

0.00

0.00

0.00

Fixed Investments

1041500.00

1041500.00

0.00

0.00

0.00

0.00

52075.00

52075.00

0.00

0.00

0.00

0.00

4. Increase in Net Working Capital

0.00

0.00

914528.72

121937.16

182905.74

0.00

5. Operating Costs

0.00

0.00

4732231.15

5360227.97

6302223.20

6302223.20

6. Corporate Tax Paid

0.00

0.00

0.00

0.00

0.00

259630.13

-

-

1093575.00

1093575.00

-21759.87

892834.87

1014871.06

938146.67

-

-

-

-

1093575.00

2187150.00

2208909.87

1316075.00

-301203.94

636942.73

1093575.00

-926758.47

-15627.60

543406.86

523459.20

410072.56

-

-

-

-

1093575.00

2020333.47

2035961.07

1492554.21

-969095.01

-559022.45

Pre-production Expenditures

NET CASH FLOW

CUMMULATIVE NET CASH FLOW

Net Present Value (at 18%)

Cumulative Net present Value

Annex 3: DISCOUNTED CASH FLOW-TOTAL CAPITAL INVESTED (Continued)

PRODUCTION

9

5

6

7

8

9

10

TOTAL CASH INFLOW

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

1. Inflow Operation

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

Sales Revenue

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

6574116.81

6592629.28

6604892.76

6617156.24

6617156.24

6617156.24

3. Increase in Fixed Assets

0.00

0.00

0.00

0.00

0.00

0.00

Fixed Investments

0.00

0.00

0.00

0.00

0.00

0.00

Pre-production Expenditures

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

5. Operating Costs

6302223.20

6302223.20

6302223.20

6302223.20

6302223.20

6302223.20

6. Corporate Tax Paid

271893.61

290406.08

302669.56

314933.04

314933.04

314933.04

NET CASH FLOW

925883.19

907370.72

895107.24

882843.76

882843.76

882843.76

CUMMULATIVE NET CASH FLOW

1562825.92

2470196.64

3365303.88

4248147.64

5130991.40

6013835.16

Net Present Value (at 18%)

342976.34

284846.38

238132.69

199042.49

168680.07

142949.21

Cumulative Net present Value

-216046.11

68800.27

306932.95

505975.44

674655.51

817604.73

Interest on Securities

2. Other Income

TOTAL CASH OUTFLOW

4. Increase in Net Working Capital

Net Present Value (at 18%)

Internal Rate of Return

817,604.73

25.9%

10

Annex 4: NET INCOME STATEMENT ( in Birr)

PRODUCTION

1

2

3

4

5

75%

85%

100%

100%

100%

5625000.00

6375000.00

7500000.00

7500000.00

7500000.00

5625000.00

6375000.00

7500000.00

7500000.00

7500000.00

Other Income

0.00

0.00

0.00

0.00

0.00

2. Less Variable Cost

4637616.15

5255964.97

6183488.20

6183488.20

6183488.20

987383.85

1119035.03

1316511.80

1316511.80

1316511.80

17.55

17.55

17.55

17.55

17.55

263445.00

273093.00

287565.00

287565.00

287565.00

723938.85

845942.03

1028946.80

1028946.80

1028946.80

12.87

13.27

13.72

13.72

13.72

4. Less Cost of Finance

522081.01

245269.56

204391.30

163513.04

122634.78

5. GROSS PROFIT

201857.84

600672.47

824555.50

865433.76

906312.02

0.00

0.00

247366.65

259630.13

271893.61

201857.84

600672.47

577188.85

605803.63

634418.42

Capacity Utilization (%)

1. Total Income

Sales Revenue

VARIABLE MARGIN

(In % of Total Income)

3. Less Fixed Costs

OPERATIONAL MARGIN

(In % of Total Income)

6. Income (Corporate) Tax

7. NET PROFIT

RATIOS (%)

11

Gross Profit/Sales

3.59%

9.42%

10.99%

11.54%

12.08%

Net Profit After Tax/Sales

3.59%

9.42%

7.70%

8.08%

8.46%

Return on Investment

23.34%

26.24%

22.94%

22.58%

22.22%

Return on Equity

14.81%

44.08%

42.36%

44.46%

46.56%

12

Annex 4: NET INCOME STATEMENT (in Birr):Continued

PRODUCTION

6

7

8

9

10

100%

100%

100%

100%

100%

1. Total Income

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

Sales Revenue

7500000.00

7500000.00

7500000.00

7500000.00

7500000.00

0.00

0.00

0.00

0.00

0.00

2. Less Variable Cost

6183488.20

6183488.20

6183488.20

6183488.20

6183488.20

VARIABLE MARGIN

1316511.80

1316511.80

1316511.80

1316511.80

1316511.80

17.55

17.55

17.55

17.55

17.55

3. Less Fixed Costs

266735.00

266735.00

266735.00

266735.00

266735.00

OPERATIONAL MARGIN

1049776.80

1049776.80

1049776.80

1049776.80

1049776.80

14.00

14.00

14.00

14.00

14.00

4. Less Cost of Finance

81756.52

40878.26

0.00

0.00

0.00

5. GROSS PROFIT

968020.28

1008898.54

1049776.80

1049776.80

1049776.80

6. Income (Corporate) Tax

290406.08

302669.56

314933.04

314933.04

314933.04

7. NET PROFIT

677614.20

706228.98

734843.76

734843.76

734843.76

Capacity Utilization (%)

Other Income

(In % of Total Income)

(In % of Total Income)

13

RATIOS (%)

Gross Profit/Sales

12.91%

13.45%

14.00%

14.00%

14.00%

Net Profit After Tax/Sales

9.03%

9.42%

9.80%

9.80%

9.80%

Return on Investment

22.29%

21.93%

21.57%

21.57%

21.57%

Return on Equity

49.73%

51.83%

53.93%

53.93%

53.93%

14

Annex 5: Projected Balance Sheet (in Birr)

CONSTRUCTION

PRODUCTION

Year 1

Year 2

1

2

3

4

1093575.00

3406521.62

4222015.83

4563854.32

4923118.28

5188269.75

1. Total Current Assets

0.00

1219371.62

2203695.83

2714364.32

3242458.28

3676439.75

Inventory on Materials and Supplies

0.00

0.00

281950.22

319543.58

375933.62

375933.62

Work in Progress

0.00

0.00

131866.77

149449.01

175822.36

175822.36

Finished Products in Stock

0.00

0.00

263733.55

298898.02

351644.73

351644.73

Accounts Receivable

0.00

0.00

613636.36

695454.55

818181.82

818181.82

Cash in Hand

0.00

0.00

236978.18

268575.27

315970.91

315970.91

Cash Surplus, Finance Available

0.00

1219371.62

675530.75

982443.90

1204904.84

1638886.31

Securities

0.00

0.00

0.00

0.00

0.00

0.00

1093575.00

2187150.00

2018320.00

1849490.00

1680660.00

1511830.00

0.00

1041500.00

2083000.00

2083000.00

2083000.00

2083000.00

1041500.00

1041500.00

0.00

0.00

0.00

0.00

52075.00

104150.00

104150.00

104150.00

104150.00

104150.00

0.00

0.00

168830.00

337660.00

506490.00

675320.00

TOTAL ASSETS

2. Total Fixed Assets, Net of Depreciation

Fixed Investment

Construction in Progress

Pre-Production Expenditure

Less Accumulated Depreciation

15

3. Accumulated Losses Brought Forward

0.00

0.00

0.00

0.00

0.00

0.00

4. Loss in Current Year

0.00

0.00

0.00

0.00

0.00

0.00

1093575.00

3406521.62

4222015.83

4563854.32

4923118.28

5188269.75

5. Total Current Liabilities

0.00

0.00

613636.36

695454.55

818181.82

818181.82

Accounts Payable

0.00

0.00

613636.36

695454.55

818181.82

818181.82

Bank Overdraft

0.00

0.00

0.00

0.00

0.00

0.00

6. Total Long-term Debt

656145.00

2043912.97

2043912.97

1703260.81

1362608.65

1021956.49

Loan A

656145.00

2043912.97

2043912.97

1703260.81

1362608.65

1021956.49

Loan B

0.00

0.00

0.00

0.00

0.00

0.00

7. Total Equity Capital

437430.00

1362608.65

1362608.65

1362608.65

1362608.65

1362608.65

Ordinary Capital

437430.00

1362608.65

1362608.65

1362608.65

1362608.65

1362608.65

Preference Capital

0.00

0.00

0.00

0.00

0.00

0.00

Subsidies

0.00

0.00

0.00

0.00

0.00

0.00

Forward

0.00

0.00

0.00

201857.84

802530.31

1379719.17

9.Net Profit After Tax

0.00

0.00

201857.84

600672.47

577188.85

605803.63

Dividends Payable

0.00

0.00

0.00

0.00

0.00

0.00

Retained Profits

0.00

0.00

201857.84

600672.47

577188.85

605803.63

TOTAL LIABILITIES

8. Reserves, Retained Profits Brought

16

Annex 5: Projected Balance Sheet (in Birr): Continued

PRODUCTION

5

6

7

8

9

10

5482036.01

5818998.04

6184574.86

6919418.62

7654262.38

8389106.14

4139036.01

4623998.04

5137574.86

6020418.62

6903262.38

7786106.14

Inventory on Materials and Supplies

375933.62

375933.62

375933.62

375933.62

375933.62

375933.62

Work in Progress

175822.36

175822.36

175822.36

175822.36

175822.36

175822.36

Finished Products in Stock

351644.73

351644.73

351644.73

351644.73

351644.73

351644.73

Accounts Receivable

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

Cash in Hand

315970.91

315970.91

315970.91

315970.91

315970.91

315970.91

Cash Surplus, Finance Available

2101482.57

2586444.60

3100021.42

3982865.18

4865708.94

5748552.70

0.00

0.00

0.00

0.00

0.00

0.00

1343000.00

1195000.00

1047000.00

899000.00

751000.00

603000.00

2083000.00

2083000.00

2083000.00

2083000.00

2083000.00

2083000.00

0.00

0.00

0.00

0.00

0.00

0.00

104150.00

104150.00

104150.00

104150.00

104150.00

104150.00

TOTAL ASSETS

1. Total Current Assets

Securities

2. Total Fixed Assets, Net of Depreciation

Fixed Investment

Construction in Progress

Pre-Production Expenditure

17

Less Accumulated Depreciation

844150.00

992150.00

1140150.00

1288150.00

1436150.00

1584150.00

3. Accumulated Losses Brought Forward

0.00

0.00

0.00

0.00

0.00

0.00

4. Loss in Current Year

0.00

0.00

0.00

0.00

0.00

0.00

5482036.01

5818998.04

6184574.86

6919418.62

7654262.38

8389106.14

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

818181.82

0.00

0.00

0.00

0.00

0.00

0.00

681304.32

340652.16

0.00

0.00

0.00

0.00

Loan A

681304.32

340652.16

0.00

0.00

0.00

0.00

Loan B

0.00

0.00

0.00

0.00

0.00

0.00

7. Total Equity Capital

1362608.65

1362608.65

1362608.65

1362608.65

1362608.65

1362608.65

Ordinary Capital

1362608.65

1362608.65

1362608.65

1362608.65

1362608.65

1362608.65

Preference Capital

0.00

0.00

0.00

0.00

0.00

0.00

Subsidies

0.00

0.00

0.00

0.00

0.00

0.00

Forward

1985522.80

2619941.21

3297555.41

4003784.39

4738628.15

5473471.91

9. Net Profit After Tax

634418.42

677614.20

706228.98

734843.76

734843.76

734843.76

0.00

0.00

0.00

0.00

0.00

0.00

634418.42

677614.20

706228.98

734843.76

734843.76

734843.76

TOTAL LIABILITIES

5. Total Current Liabilities

Accounts Payable

Bank Overdraft

6. Total Long-term Debt

8. Reserves, Retained Profits Brought

Dividends Payable

Retained Profits

18

19