ASSESSMENT OF SHORT MESSAGE SERVICE (SMS ALERT) ON E-PAYMENT BANKING PLATFORM.

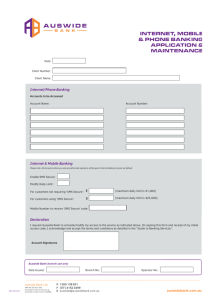

advertisement

TOPIC: ASSESSMENT OF SHORT MESSAGE SERVICE (SMS ALERT) ON E-PAYMENT BANKING PLATFORM. 1 Abstract The study is centered on the assessment of short message service (SMS Alert) on e-payment banking platform. The objectives of the study are to ascertain the awareness and customer perception on SMS alert on e-payment in Nigeria, find out which of the dimensions of SMS is adopted by commercial banks in Nigeria; and examine the effects of using SMS alert on organizational performance of commercial banks in Nigeria. The relevant literatures were reviewed as well as the theory aspects of the literature. A survey research design was adopted for the study while data for the study was gathered from distributed questionnaire and the analysis was done according to the data gathered. In analyzing the data collected, the researcher adopted the use of simple percentage. Also, their frequency tables representing the information based on each research question. The study concluded that customers who have subscribed to the SMS alert service considered the service beneficial because they perceived that the service saved them time and expenditure as well as relief them of unnecessary anxieties. It is also established that males dominate the clientele base of banks in Nigeria as compared to females probably due to their dominant in the formal sector compared to their female counterparts who are mostly in the informal sector. The study recommends that the Banking industry is therefore required to improve the use of SMS to customers. Customer satisfaction tools may be affected if the SMS tends to become a nuisance to the customers. Text messages which do not appear to be clearly defined may generate a negative responses from customers rather than what is expected to create satisfaction. 2 CHAPTER ONE INTRODUCTION 1.1 Background to the Study The background of electronic payments can be traced back to the 1870’s when Western Union (WU) introduced Electronic Fund Transfer (ETF). EFT is a system of transferring money from one bank account directly to another without any paper money changing hands. One of the most widely-used EFT programs is Direct Deposit, in which payroll is deposited straight into an employee's bank account. However, EFT refers to any transfer of funds initiated through an electronic terminal, including credit or debit card, Automatic Teller Machine (ATM), Wire Transfer done via an international banking network such as SWIFT and Point-Of-Sale (POS) transactions. It is used for both credit transfers, such as payroll payments and for debit transfers, Despite WU’s revolutionary on ETF, the method of transferring money electronically remained unchanged for close to sixty years. Then, in 1918, the Federal Reserve Bank of America began transferring money via telegraph. With the advancement in technology, banks and consumers became more reliant on computers to conduct transactions. The advent of Internet has initiated an electronic revolution in the global banking sector. The dynamic and flexible nature of this communication channel as well as its ubiquitous reach has helped in leveraging a variety of banking activities. Electronic payment, also known as EFT is simply the use of electronic means to transfer funds directly from one account to another, rather than by cheque or cash. 3 In the Nigeria context, electronic -payment is effecting payments from one end to another and through the medium of the computer without manual intervention beyond inputting the payment data, it is the ability to pay the suppliers, vendors and staff salaries electronically at the touch of a computer button (Agba, 2010). The mobile banking concept was propounded and presented in Europe since 1992 and was used in 1999 with the entry of WAP (Wireless Application Protocol).The use of mobile phone Short Messaging Service (SMS) in banking has been one of the first applications of mobile phone in banking. SMS banking is defined as a banking transaction through short messaging service (SMS) using mobile phone. Previously, SMS evolved among people as a key social memo to connect with family members, friends, and teachers. At present, SMS has evolved as a medium of disseminating banking information to make individual contact with banks better (Amin, 2007). SMS banking was first introduced in 2004 in Malaysia. Since then, SMS banking has become an interesting topic of research in other countries to establish factors that inform customers’ decision to adopt SMS banking services. This new channel has gained much popularity in the banking industry among customers probably due to reasons such as ease of access and use as well as usage without any special software or hardware (Lu et al, 2003). Mobile phones have clearly become omnipresent and a standard aspect of the daily lives of people. Ongoing innovations in mobile finance show some potential to change the way people conduct financial transactions by offering customers new services. Yet, many people remain skeptical of the benefit of mobile financial services and the 4 level of security provided along with such services (Federal Reserve Board Report, 2012). Critical examination of previous studies has revealed mixed outcomes with regards to the adoption of e-banking technologies by customers, making customers’ willingness to subscribe to future e-banking facilities or services inconclusive. This research therefore assesses short message service (SMS Alert) on e-payment banking platform 1.2 Statement of problem It is a straightforward presumption that business enterprises are adopting new communication technology to effectively and cordially relate with their employees and customers. One of such new communication trend is the use of business texting – short message services (SMS). From cosy survey, this trend appears to be used more often by businesses nowadays; and the banking sector has not been left behind. Banks now leverage on SMS to notify customers of transactions, products, value-added services, etc. The most common of these SMS are debit and credit alerts. Banks also send SMS to their customers on special days such as birthdays. With so many products and services to communicate with their customers, coupled with transaction notifications, the number of text messages sent by commercial banks to their customers is increasing. Almost every day customers of banks receive SMS alerts on their mobile phones from their respective banks. These text messages are forms of business communication between the banks and 5 their customers. But the question here is: do these text messages contribute to their overall organizational performance of commercial banks? Or are they merely communicative? This research therefore assesses short message service (SMS Alert) on e-payment banking platform 1. 3 Objectives of the study The main objective of this study is assessment of short message service (SMS Alert) on e-payment banking platform. The study also has the following specific objectives: i. ascertain the awareness and customer perception on SMS alert on e-payment in Nigeria ii. find out which of the dimensions of SMS is adopted by commercial banks in Nigeria; and, iii. examine the effects of using SMS alert on organizational performance of commercial banks in Nigeria. 1.4 Research Questions The following questions will be addressed in the course of this study: iv. What are the the awareness and customer perception on SMS alert on e-payment in Nigeria i. ? 6 ii. Which of the dimensions of SMS is adopted by commercial banks in Nigeria? iii. What are the effects of using SMS alert on organizational performance of commercial banks in Nigeria? 1.5 Significance of the Study This study is necessitated by the urge and the need for the research, reader and organizations in general to understand more about short message service (SMS Alert) on e-payment banking platform. This research will serve as reference materials for students who will wish to conduct similar studies on this topic and also serve as guide to corporate individuals, organization in furtherance to their research on the subject matter. 1.6 Scope of the Study The study is centered on the assessment of short message service (SMS Alert) on e-payment banking platform. 1.8 Operational Definition of Terms ATM: Automated Teller Machine (ATM) is a machine where cash withdrawal can be made over the machine without going in to the banking hall. It also be used to buy recharge cards, pay bills, make card less withdrawal and transfer funds. It can be accessed 24 hours/7 days with account balance enquiry, mini account 7 statements. Short Messaging Service (SMS): Text messaging, or texting, is the act of typing and sending a brief, electronic message between two or more mobile phones or fixed or portable devices over a phone network. E-Cheque: An e-Cheque is the electronic version or representation of paper cheque. The Information and Legal Framework on the E-Cheque is the same as that of the paper cheques. It can now be used in place of paper cheques to do any and all remote transactions. An E-cheque work the same way a cheque does, the cheque writer "writes"the e-Cheque using one of many types of electronic devices and "gives" the e- Cheque to the payee electronically. The payee "deposits" the Electronic Cheque receives credit, and the payee's bank "clears" the e-Cheque to the paying bank. The paying bank validates the e-Cheque and then "charges" the check writer's account for the check. Electronic Money: A generic name for plastic money and other forms of e-payments such as: Smart Card/Valu cards: Smartcard is already operational in Nigeria under the brand name of Valucard. The company (Smartcard Nigeria Plc.) acts as settlement agent as well as Coordinate hardware and software supply. Smartcard transactions are not yet online. Internet Banking: Internet banking allows customers of a financial institution to conduct financial transactions on a secure website operated by the institution, which can be a retail or virtual bank, credit union or society. It may include of any transactions related to online usage. Banks increasingly operate websites through 8 which customers are able not only to inquire about account balances, interest and exchange rates but also to conduct a range of transactions. Unfortunately, data on Internet banking are scarce, and differences in definitions make cross-country comparisons difficult. Mobile Banking: Mobile banking (also known as M-banking, ) is a term used for performing balance checks, account transactions, payments, credit applications and other banking transactions through a mobile device such as a mobile phone or Personal Digital Assistant (PDA). The earliest mobile banking services were offered over SMS, a service known as SMS banking. Mobile banking is used in many parts of the world with little or no infrastructure, especially remote and rural areas. This aspect of mobile commerce is also popular in countries where most of their population is un-banked. In most of these places, banks can only be found in big cities, and customers have to travel hundreds of miles to the nearest bank. The scope of offered services may include facilities to conduct, Bank and stock market transactions, to administer accounts and to access customized information. Mobile Payments: Although the number of transactions that can be carried out via a cell phone are limited, they can be used to facilitate some electronic transactions. Mobile phone manufacturers have enable their phones’ software to allow their customers to have a bank account on their cell phones numbers and can the funds in their accounts to carry out transactions. 9 CHAPTER TWO LITERATURE REVIEW 2.1 Conceptual Review 2.1.1 Mobile Banking Internet and mobile technologies are increasingly being adopted and utilized in the banking industry; this has reshaped the consumption of financial services (Laukkanen, 2005), In this research we analyze the security of electronic banking services with an emphasis on mobile commerce transactions with a focus on mobile banking using mobile devices specifically cell phones. Electronic banking is considered a way of delivering banking services through the internet to the consumer at a reduced cost to the banking industry and improved convenience to the customer (Pousttchi and Schurig, 2004), However there exists a low internet connectivity in the developing countries given the costs of connection especially in rural areas and yet banking services need to be brought closer to the population to enhance development (Kenny, 2000). A viable solution here is mobile banking. Here we are interested in what the implications are in the terms of security and also in the economic viability of these technologies in developing countries. Mobile commerce shall be defined as commercial transaction activities carried out via communication networks that interface wireless or mobile devices. A mobile device is a device used to connect to a mobile service for example cell phones and Personal Digital Assistants (PDA). The high diffusion rate of mobile phones 10 coupled with the stability of mobile communication technologies have greatly contributed to the enhancement of mobile banking solutions in the provision of financial services in the world (Mallat et al., 2004). Mobile banking is considered as a service that enables users to receive information regarding the status of their accounts, to transfer among bank accounts, to facilitate stock trading and direct payment confirmation using mobile devices. Mobile Banking (also known as M-Banking,) is a term used for performing balance checks, account transactions, payments etc. via a mobile device such as a mobile phone. Mobile banking today is most often performed via SMS or the Mobile Internet but can also use special programs downloaded to the mobile device (Riivari, 2005). The advance of the Internet has revolutionized the way the financial services industry conducts business, empowering organizations with new business models and new ways to offer 24x7accessibility to their customers. The ability to offer financial transactions online has also created new players in the financial services industry, such as online banks, online brokers and wealth managers who offer personalized services, although such players still account for a tiny percentage of the industry. Over the last few years, the mobile and wireless market has been one of the fastest growing markets in the world and it is still growing at a rapid pace. According to the GSM Association and Ovum, the number of mobile subscribers exceeded 2 billion in September 2005, and now exceeds 2.5 billion (Stephan, Herstat & Cornelius, 2006) Many believe that mobile users have just started to fully utilize the data capabilities in their mobile 11 phones. In Asian countries like India, China, Indonesia and Philippines, where mobile infrastructure is comparatively better than the fixed-line infrastructure, and in European countries, where mobile phone penetration is very high (at least 80% of consumers use a mobile phone), mobile banking is likely to appeal even more. This opens up huge markets for financial institutions interested in offering value added services. With mobile technology, banks can offer a wide range of services to their customers such as doing funds transfer while traveling, receiving online updates of stock price or even performing stock trading while being stuck in traffic. According to the German mobile operator Mobilcom, mobile banking will be the "killer application" for the next generation of mobile technology. Mobile devices, especially smart phones, are the most promising way to reach the masses and to create “stickiness” among current customers, due to their ability to provide services anytime, anywhere, high rate of penetration and potential to grow. Shipment of smart phones is growing fast, and should top 20 million units (of over 800 million sold) in 2006 alone (Stephan, Herstat & Cornelius, 2006) 2.1.2 Concept of Short Messaging Service (SMS) Text messaging, or texting, is the act of typing and sending a brief, electronic message between two or more mobile phones or fixed or portable devices over a phone network. The term originally referred to messages sent using the Short Message Service (SMS); it has grown to include messages containing image, 12 video, and sound content (known as MMS messages. The sender of a text message is known as a texter, while the service itself has different colloquialisms depending on the region. It may simply be referred to as a text in North America, the United Kingdom, Australia and the Philippines, an SMS in most of mainland Europe, and a TMS or SMS in the Middle East and Asia. Chaffey et al, (2009) define Short Messaging Service (SMS) generally called ‘texting’ as a form of e-mail but it creates communication between mobile phones rather than personal computers. Cheng et al (2009) argued that it is too fast communication service and it delivers with in a very short time. Cheng et al (2009) explain some of the benefits of SMS as a marketing communication tool as: high speed text message delivery, Interactivity, More customer reach (Mass communication) and response rate for SMS is five times more than direct postal mail. Dickinger et al. (2004) argued that SMS marketing is very much cost effective and the only cost which company has to bear is the cost of purchasing phone numbers which normally goes up to 30 U.S dollars for 1000 phone numbers however this cost seems very minor after the SMS reaches to its exact target customer. Furthermore, Menke (2007) argued that mobile phone technology is developing very rapidly and because of this great increase in the number of mobile users marketers have got more opportunity to use this channel effectively for the communication. According to Fill (2005) the financial industry can get benefits from this SMS service as it is same as e-mail and likewise sales promotion and brand awareness can be created by using mobile marketing. Furthermore, mobile 13 coupons for price discount can be sent through SMS for generating sales promotion (Carter, 2004). Text messages can be used to interact with automated systems to, for example, order products or services, or participate in contests. Advertisers and service providers use direct text marketing to message mobile phone users about promotions, payment due dates, instead of using mail, e-mail or voicemail. In a straight and concise definition for the purposes of this English Language article, text messaging by phones or mobile phones should include all 26 letters of the alphabet and 10 numerals, i.e., alpha-numeric messages, or text, to be sent by texter or received by the textee. 2.2 SMS in the Banking Environment SMS deployment in financial services closely aligns to the implementation of mobile banking. Tower Group projects that the base of mobile banking customers will grow from 18 million globally in 2010 to more than 53 million in 2013. Mobile banking transactions will surge to more than 14 billion globally during the same period. FSIs that deploy SMS strategies consistently reach three conclusions. First, opt-in customers, by their nature, are receptive to SMS communications. Second, FSIs can expect a reduction in call center contact once customers link balance alerts and event notifies to their banking habits. Finally, empowering the customer to calibrate the velocity and type of communications enhances loyalty and retention (Woodburn, 2002). Financial institutions continue to deploy mobile 14 banking and payments capabilities to a consumer base that is increasingly reliant on mobile devices. Some financial institutions choose a particular mobile modality to deploy mobile banking (typically mobile Web, a downloadable mobile application, or SMS) to minimize their investment and downside exposure; more robust programs cover multiple modalities. Regardless of the modality they deploy initially, financial institutions eventually realize that no single mobile banking modality best supports all users across all transactions. Tower Group continues to recommend that financial services institutions deploy mobile banking and payments across all available modalities, develop and deploy the mobile capabilities most aligned with each modality, and allow their customers to select their preferred modality based on their individual needs and preferences. The SMS mobile banking modality has the unique advantage of reach. The vast majority of handsets support SMS, whereas less than half support mobile Web and even fewer support mobile applications. This mix may change over time as advanced handsets become more widely available, but text messaging is and will continue to be the most used feature of a Smartphone. Further, performing mobile transactions is generally far quicker via SMS than via modalities that require multiple navigation steps for the consumer to find the correct Web page to execute a desired transaction (Suoranta & Mattila, 2004) 2.3 Dimensions of Short Messaging Service (SMS) 15 According to Rotimi et al (2007), there are two methods of SMS widely used by banks. They are the PUSH and PULL. i. Push SMS: Push SMS is sending a message from an application (that is, short message service (SMS) Server) to users. It is a one-way message. That is, the message is initiated by the mobile application (in this case, the SMS banking application). An example could be a deposit alert, which notifies the user when a deposit is made to his/her account. ii. Pull SMS: Pull SMS is sending a request and obtaining a reply. In pull SMS, a user sends a request to the SMS banking application and the application replies with the information requested. This is applicable when a bank customer requests for his or her bank account balance via SMS. Today, marketers use push and pull strategies when delivering text messaging to their clients (Scharl et al., 2005).While push strategy campaign, a predominant method, involves delivering unsolicited messages, pull strategies involve delivering messages based on customers’ requests (e.g., based on information they found via mobile applications or on banner ads). A study by Dickinger & Haghirian (2004) found that 50 percent of text messages were in a push mode, 45 percent in pull and 5percent in both. Even though push strategies are more economical to companies than that of pull strategies, customers may view the unsolicited contents as intrusive and unwelcome (Yunos et al., 2003). 2.4 SMS Convenience Factor to Customers 16 The convenience of executing simple transactions and sending out information or alerting a customers through text messages is often the overriding factor that dominates over the skeptics who tend to be overly bitten by security concerns. As a personalized end-user communication instrument, today mobile phones are perhaps the easiest channel on which customers can be reached on the spot, as they carry the mobile phone all the time no matter where they are. Besides, the operation of SMS banking functionality over phone key instructions makes its use very simple. This is quite different from internet banking which can offer broader functionality, but has the limitation of use only when the customer has access to a computer and the Internet. Also, urgent warning messages, such as SMS alerts, are received by the customer instantaneously; unlike other channels such as the post, email, Internet, telephone banking, etc. on which a bank's notifications to the customer involves the risk of delayed delivery and response. The SMS banking channel also acts as the bank’s means of alerting its customers, especially in an emergency situation; e.g. when there is an ATM fraud happening in the region, the bank can push a mass alert (although not subscribed by all customers) or automatically alert on an individual basis when a predefined ‘abnormal’ transaction happens on a customer’s account using the ATM or credit card. This capability mitigates the risk of fraud going unnoticed for a long time and increases customer confidence in the bank’s information systems (Grönroos, 1994). 2.5 SMS Banking in Nigeria and Mobile Phone Usage 17 The growth rate of mobile telephony in Nigeria is exceptional given that it started in 2001 while commercial banking operations date back to the 1950’s. In fact, over the past decade, more people in Nigeria have gained access to mobile phones than to banking services (Ssonko, 2010). The low financial services penetration compared with the exponential growth of mobile telephony in Nigeria is creating a unique niche for SMS banking to develop on the continent (Ondiege, 2008). The Nigeria Bureau of Statistics (NBS) 2012 statistical results reveal that information and communications technology (ICT) innovations have revolutionalized the financial sector in Nigeria resulting in novel delivery channels for financial products and services such as automated teller machines (ATMs), cell phone banking, personal computer (PC) banking and Internet banking. These developments are at par with the traditional banking services in other countries especially in the use of SMS Banking and Mobile Banking services to the extent that the SMS banking service is being used by all the commercial banks in Nigeria. In Nigeria, the model is dominated by the mobile operators, regulated by the Nigeria Communications Commission (NCC) that do most of the marketing as well as opening up and maintaining accounts for the subscribers who choose to register for the mobile money service (MMS). SMS usage grew by 28% in first quarter 2010 to about 176 million messages (compared to 138 million in fourth quarter 2009) as mobile network operators (MNOs) encourage use through campaigns and innovative services. To comply with financial services regulation, the MNOs have partnered with commercial banks in Nigeria supervised by 18 Central Bank of Nigeria (CBN, 2009). On the other hand, as at December 2009, the number of bank accounts in the country was estimated at slightly over 5 million representing a 16 percent penetration. 2.6 Theoretical Framework 2.6.1 Attitude In survey based research, the importance of attitude has been documented in many studies (Gopi and Ramayah, 2007; Ramayah and Suki, 2006; Ramayah et al., 2003). Specifically, attitude is meant as the evaluative effect of positive or negative feeling of individuals in performing a particular behavior (Fishbein and Ajzen, 1975). It is strongly asserted that, attitude and behavioral intention have significant relationship (Gopi and Ramayah, 2007; Amin, 2007; Ramayah and Suki, 2006; Nysveen et al., 2005; Ramayah et al., 2003). These studies indicated that attitude is an antecedent of behavioral intention. Gopi and Ramayah (2007) examined online trading system from a Malaysian perspective and found that attitude and intention to use were significantly related. This means, an increase of attitude will also lead to an increase of intention to use for that particular system. Ramayah and Suki (2006) examined the use of mobile personal computer among graduate students and found that attitude had a significant relationship with intention to use. An interesting paper written by Ramayah et al. (2003) which also produced the same trend of result as what the first two studies did. Attitude had a positive relationship with intention to use internet banking among Malaysian bank customers. Further, 19 Amin (2007) examined the factors affecting SMS banking use among young intellectuals in Malaysia. Further, both male and female respondents had positive attitudes for SMS banking use. In other words, attitude was significantly associated with SMS banking use among those students. Amin (2007) replicated Nysveen et al.’s (2005) study in Norway. Stated differently, Nysveen et al. (2005) examined Norwegian from mobile chat services viewpoint and found that both male and female respondent rated attitude as an influential determinant to indicate their intention to use mobile chat services. Worth to mention, attitude had a fairly equal effect on intention to use. The attitude was measured on the basis of “good/bad”, “wise/foolish”, “favourable/unfavourable” and “positive/negative”. This study finding is consistent to what was discovered by Amin (2007) in Malaysia. It is strongly asserted that attitude dimension is perhaps can be extended to SMS banking in order to explain what factors can influence the use of SMS banking. Attitude in this present study’s context includes a bank customer’s perception on the basis of “good idea”, “beneficial”, “wise”, “likeliness”, “best practice” as well as “positive idea”. Yuserrie et al. (2004) addressed the importance of the attitude dimension in explaining an individual’s use of Islamic banking products in Pulau Pinang, Malaysia. In a similar setting of study, Lada et al. (2009) asserted that attitude had a significant influence on one’s acceptance of halal products in restaurants in Labuan, Malaysia. Both of these studies agree that attitude can alter one’s intention to do a desired action as the end of such intention. 20 2.6.2 Subjective Norm This study also attempts to understand the role of social influence to explain how this construct helps to justify one’s decision to use SMS banking. Stated differently, this construct is also known as subjective norm as promoted by Theory of Reasoned Action (TRA) by Fishbein and Ajzen (1975). By definition, subjective norm can be defined as a person’s perception that most people who are important to her or him should or should not perform the behavior in question (Fishbein and Ajzen, 1975). Previous studies have explored the importance of such construct in social science studies including in banking studies (Amin et al. 2007; Nysveen et al., 2005; Kleijnen et al., 2004). Amin et al. (2007) alone found that subjective norm was a key predictor for mobile banking use from a Malaysian viewpoint. They conducted a study on the basis of convenience sampling. This effort is done owing to the fact that Bank and Financial Institutions Act (BAFIA) 1989 did not allow a researcher to acquire bank customers’ information as well as the bank customers’ population of any given banks. In a different setting of mobile use, Nysveen et al. (2005) examined mobile chatting usage in Norway, and found that subjective norm or subjective norm was found to be an important driver for mobile chatting usage among Norwegian. In supporting this, Nysveen et al. (2005) argued that users employed mobile chatting was due to the usage demonstrated their personal 21 value as well as the influence of others on them. Similarly, in a study by Kleijnen et al. (2004) on wireless finance in Netherlands, subjective norm was essential in the development of peoples’ intention to use wireless finance. It seems that people who surround an individual add value to the individual dealing with a bank. This, however provides an impact on consumer behavior which, on the other hand, impacting the use of wireless finance In view of these studies, it is important to examine whether this construct is able to provide a clear direction as a key predictor for SMS banking use. Ideally, reference groups such as family members, friends, teachers, and bank tellers make a necessary force to encourage an individual to perform a behavior which consistent with their identities. This is promoted through the use of word-of-mouth (WOM), which is imparted when someone tells about positive things about his bank to other people (Ndubisi and Igau, 2003). 2.6.3 Perceived Security and Privacy (PSP) This construct has been employed in several banking studies (Ndubisi and Sinti, 2006; Pikkarainen et al., 2004; Wang et al., 2003; Ramayah and Ling, 2002). The need to add this construct is owing to the two specific reasons. Firstly, there exists a hot issue relating to the “missing money” from a bank customer’s saving account that has an Internet banking facility. As such, SMS banking also encounters with this particular issue, which leads to reluctance of SMS banking use. Secondly, there exists a strong assertion that, people still have a weak 22 understanding of managing the use of e-banking facilities at the best conduct of practice (Pikkarainen et al., 2004; Roboff and Charles, 1998). This has on the other hand affected their account privacy as well as the security and tendency to be hacked by irresponsible parties. Essentially, this issue can also be found in the context of SMS banking. There is a credibility of service/product provider (Wang et al., 2003). Many studies have noted why this construct is important. Of these, Ndubisi and Sinti (2006) examined internet banking perception among bank customers in Malaysia, and found that the risk was a weak predictor because of the assurance of the banks over the security of their internet banking. They upheld that all the cyber banks in Malaysia promote this product as a fully secure option with 128-bit encryption technology. Pikkarainen et al. (2004), similarly, examined internet banking, but from Finnish perspectives. They found that perceived credibility was found to be not significantly related to Internet banking acceptance. Contrary to the above studies, Wang et al. (2004) who examined internet banking acceptance in Taiwan, found that PSP had a significant positive effect on behavioral intention of Internet banking. In a similar trend, Ramayah et al. (2006) examined users and non-users’ perceptions of internet banking and found that security was a key predictor to measure internet banking use by users. The same work by Ramayah and his colleagues also asserted the importance of PSP in internet banking acceptance. For instance, Ramayah and Ling (2002) found that the respondents placed security as one of the important factors when adopting 23 Internet banking. Generally speaking, bank customers have the tendency to simply avoid the use e-banking facilities if a bank disregards the need to provide proper measures to promote the PSP of Internet banking/SMS banking use. Owing to these studies, it is argued that people tend to utilize e-banking facilities when the bank management prioritizes the issue of PSP. What is more, there exist several studies which have addressed the importance of PSP in their scope of researches (Chiu et al., 2005; Yang and Jun, 2002; Salisbury et al., 2001). Out of these studies, Chiu et al. (2005) has employed “personal awareness of security” in order to explain its relationship to attitude, which in turn impacting online purchase intentions among Taiwanese. Evidently, Chiu et al. (2005) found that the effects of personal awareness of security on online purchase intentions were purely through attitudes indirectly, implying that attitudes were the key consideration with respect to personal awareness of security. The importance of PSP is further documented by Salisbury et al. (2001) and Yang and Jun (2002) who revealed that security was the most critical concern influencing the attitudes of internet users. It seems that bank customers have placed a greater importance on PSP when employing e-banking facilities, which also tells us about their attitudes toward the use of the facilities. Speaking on attitudes, many bank customers are unwilling to give private information over the telephone or the internet owing to their inability to control their personal data once such data transferred to a third party (Pikkarainen et al, 2004). 24 CHAPTER THREE RESEARCH METHODOLOGY 3.1 Introduction This chapter will focus on research methodology which includes research design, population of the study, sample size determination, sampling procedure, method of data collection, validity and reliability of data instrument and method of data analysis. 3.2 Research Design The two common research approaches utilized by most scholars are mainly qualitative and quantitative research approach. To achieve the objectives of this research, the qualitative research approach is employed. Qualitative research approach is primarily exploratory in nature. The use of qualitative research methods allows for adequate understanding of primary reasons, motivations, opinions, and it offers in-depth perceptions of the research problems and enabling the development of ideas. Qualitative research methods allow for a holistic understanding of key subjects which cannot be quantified (Sinkovics & Alfoldi, 25 2012). On the other hand, quantitative research methods employed in studies where the problem is quantified through a generation of numerical data that can be transformed into usable statistics. Different variables such as attitudes, opinions, behavior are quantified by a generalization of results for a large sample; data generalized is used to articulate facts. (DeFranzo, 2011). Taking into consideration that the elements this research is looking for are not of quantifiable nature, a qualitative research approach becomes the appropriate method which will aid an deep understanding of the topic researched. Furthermore, qualitative research approach is also employed in studies where there is inaccessibility or lack of sufficient data. (Patton, 2010). Qualitative research methods allow the research to enter a more natural setting as it pays attention to the situation, looking at different things such as experiences, behaviors, words etc., the natural settings enable the research to use cases as a source of data, thereby allow the researcher to interpret experiences of individuals in order to discover its meanings. On other hand quantitative research focuses specifically on number and is strictly structured to formulate facts and generalize it from the numerical data. This qualitative research approach attempts to understand the meaning of some phenomenon in a context (DeFranzo 2011). Qualitative data collection methods vary; typically, semi-structured or unstructured practices are utilized. The most common methods of data collection include case studies, individual interviews, participation and observations and focus groups. The size of the samples is typically small. On the contrary 26 quantitative research methods are much more structured and the data collections methods are commonly using surveys, longitudinal studies, questionnaires, online polls etc. (DeFranzo, 2011). 3.3 Sources of Data All necessary information for the success of this research project is gathered from Stakeholders, Advisors Books and Form, Publications, Journals, Article, Google and Textbooks. 3.4. Population and Determination of Sample In this study the sample population is 200 respondents in the selected study area. The population was representative because the whole population was made up of both male and female respondents. The sample size will be determined by use of the following formula. According to Neuman (2010), the size of a sample for a particular study will be calculated as follows: Where n = the required sample size Z = is standard normal deviate at the required confidence level (1.96) at 0.05 p = is the proportion of the target population estimated to have the characteristics being measured when one is not sure, so one takes middle ground (0.5) q = 1-p d is the level of statistical significance n = n0 / (1+ (n0 - 1) /N)) 27 n = 110 / (1 + (110 – 1) / 1000)) n = 110 / (1 + (109/1000)) n = 110 / (1 + 0.109) n = 110 / 1.109 n = 99.188 (approximately 100). Therefore n = 100 people 3.5 Sample and Sampling Technique The purposive (also known as judgmental or subjective) sampling technique was used in the sampling process of the population of the research. Purposive sampling is a non-probability sampling in which the decision concerning the individuals to be included in the sample was taken by the researcher based on the fact that these individuals have been around long enough to have the knowledge of the research issue and also the willingness to participate in the research. This technique was also chosen because the sample size was quite small when compared with probability sampling. 3.6 Instrumentation Information on the assessment of short message service (SMS Alert) on e-payment banking platform was collected using questionnaire. The questionnaire was used for the purpose of data collection as the data to be collected was quantitative and this was the most preferred instrument. A questionnaire is a document that consists 28 of a number of questions that is written or typed in a definite order or a form or set of forms. This instrument was preferred because it up holds confidentiality, save and on time, lack interviewer bias and enables collection of data from a large sample and from various regions of the study. The instrument was divided into two parts. The first part A gave the respondents demographic data while the second Part B had closed-ended questions to enable the respondents to express themselves in their own words. 3.7 Reliability of the Instrument Reliability of the instrument refers to a measure of how consistent the results from a test are. The instrument used was trial-tested in one of the sampled respondents which are nine (9) in numbers and their responses collected. The following were ensured during this process. All the initial conditions were kept constant and the same test was administered to the same subjects. The respondents were then given three weeks before the same test was administered again to the same respondents. Correlation was done on the scores from both testing periods to determine the coefficient of reliability. This was done on all the sub groups of the population and it was ensured that the results were consistent hence reliability of the instrument. In this research, the questionnaire was designed and given to three (3) experts in the similar field of study for validation. 3.8 Instrument Validation Validity is the extent to which differences found with a measuring instrument 29 reflect true differences among those being tested (Kothari, 2009). The researcher ensured that the questions in the questionnaire are framed in such a way that they bring out the answers to the research questions. Criterion-related validity relates to the ability to predict some outcome or estimate the existence of some current condition. The researcher will made a pre-visit to the study area in order to familiarize oneself with the location. On the other hand Construct validity is the degree to which scores on a test can be accounted for by the explanatory constructs of a sound theory. 3.9 Procedure for Data Collection The researcher will employ the services of two research assistants that will help to distribute the questionnaire to the 100 respondents that are involved in the study. Adequate information was provided to guide the respondents in responding to the items in the questionnaire. The assistants also helped to retrieved completed questionnaire. 3.10 Method of Data Analysis In analyzing the data collected, the researcher adopted the use of simple percentage. Also, their frequency tables representing the information based on each research question. 30 CHAPTER FOUR DATA PRESENTATION AND DATA ANALYSIS 4.1 Introduction This chapter is basically about the presentation analysis and interpretation of collected data in the course of this research and the test of hypothesis. The analysis of data for this research work will be in a tabulated form based on the number of questions on the questionnaire. Out of the 100 questionnaire distributed, 96 were dully filled and retrieved. The analysis of the questionnaire distributed is stated below. 4.2 Demographic Analysis This section contains a detailed analysis of our primary data. To facilitate our analysis tabular formats have been adopted in which responses are summarized and displayed. The demographic information of the respondents are provided below to depict the basis of the study: 31 TABLE 4.1: DEMOGRAPHIC INFORMATION OF THE RESPONDENTS FACTOR FREQUENCY PERCENTAGE Female 37 39.5 Sex of the Male 59 61.5 Respondents Total 96 100 Under 25 years 8 9 Age of the 25 – 34 years 48 49.5 Respondents 35 – 44 years 28 29.5 45 & Above 11 12 Total 96 100 Christian 64 65.5 Muslim 22 24 Traditional 10 11.5 Total 96 100 Formal 11 13.5 4 5 Religion of the Respondents Academic Qualification Education of the Respondents Secondary 32 Education Tertiary 80 81.5 96 100 Education Total Source: Field Survey, 2022 Table 4.1 above shows that 61.5% were males and 38.5% were females. This point out to the fact that there is more males in pay jobs than the female counterpart in Nigeria. The age distribution of the respondents reveals that 9% are within Under 25 years, 49.5% are within 25-34years, 29.5% are within 35-44years while 12.5% falls within 45years and above. This result indicates that majority of the respondent’s falls within the age 25- 34years; this is an indication that youths (between the ages of 20-40 years) constitute the greater proportion of the people (customers) who carry out business transaction with Nigerian banks. This might be due to their zeal to engage in work activities in order to actualize their goals and aspirations of life. The religion of the respondents shows that 64.5% are Christian, 24.0% are Muslim while 11.5% are traditional. Furthermore, the educational qualifications of the respondents depicts that 13.5% have Formal Education, 81.2% have Tertiary education while 5.3% have secondary education. This result reveals that majority of the respondents are HND/B.Sc (degree) holders which demonstrates that they are educated and experience people. 33 4.3 Analysis of Results TABLE 4.2: Perception of customers on the use of SMS in Nigerian banking system S/N Question SD D A SA Total F (%) F (%) F (%) F (%) The use of SMS has become vital tool 13 09 11 63 96 in rendering quality banking services (13.5) (9.4) (11.5) (65.6) (100.0) I have access to GSM and SMS 05 19 15 57 96 services (19.8) (15.6) (59.4) (100.0) I have benefited from the utilization of 02 21 10 63 96 SMS on your mobile phone or GSM (2.1) (21.9) (10.4) (65.6) (100.0) F (%) 1 in Nigeria 2 3 (5.2) As a customer, i get SMS from the 34 bank on every transaction I made with the bank 4 I use to get SMS notification of 04 07 08 77 96 technical (7.3) (8.3) (80.2) (100.0) I receive SMS security alert from my 11 19 12 54 96 bank through SMS and I also send (11.5) (19.8) (12.5) (56.3) (100.0) I am up-to-date on my account 10 23 08 55 96 activities through SMS alert (24.0) (8.3) (57.3) (100.0) I mostly use SMS banking to perform 09 21 15 51 96 most of financial transaction in my (9.4) (21.9) (15.6) (53.1) (100.0) difficulties or service (4.2) up-grading from the bank 5 security report to the bank through SMS 6 7 (10.4) bank 8 9 I do receive SMS alert Public educa- 07 11 14 64 96 tion and awareness on social issues (7.3) (11.5) (14.6) (66.6) (100.0) I am satisfied with the use of SMS in 03 14 06 73 96 Nigerian banking firms (3.1) (14.6) (6.3) (76.0) (100.0) Source: Field Survey, 2022 Flowing from the works of Gary and Izak (2001); Hausmann-Muela (2003); Yuji (2009) perception includes four basic variables. These are knowledge, attitude, practice, and belief [KAPB]. From table 4.2, it is evident that 86.5% of 35 the respondents agreed that they had knowledge of the use of SMS in Nigerian banking firms, while 13.5% indicated that they needed the knowledge. This shows that the large number of respondents know about the use of SMS as a strategic management tool in Nigerian banks. On the other hand, attitude is defined in terms of access to SMS services which is product of techno- logical advancement. Most often, attitude cannot be formed without external stimuli (in this case GSM). It then follows that access to GSM and SMS services sheds light on the respondents’ dimension of attitude. From the table 4.2, majority (94.8%) of the respondents indicated that they have access to GSM and SMS services has improved their access to SMS sent by Nigerian banks in the study area, while only 5.2% disputed this. Practice has to do with putting into use certain object or knowledge acquired to determine its desirability for continued utilization or otherwise. In this study, practice is measured in the benefits associated with the utilization of GSM and SMS services as a result of im- proved telecommunication sector. Hence, 97.9% of the respondents claimed to have benefitted from the utilization of GSM and SMS services, while 2.1% were critical about the benefits associated with the GSM and SMS services. Table 4.2 reveals the respondent’s distribution on the use of SMS in Nigerian banking industry. The result revealed that 65.6% of the respondents confirm that the use of SMS has become vital tool in rendering quality banking services in Nigeria, 20.9% were of the opinion that SMS is rarely used in rendering bank services while 13.5% strongly disagree with the assumption that SMS is a vital 36 tool in Nigerian banking industry. Hence, it can be concluded that SMS has become vital tool in rendering quality banking services in Nigeria. More so, majority of the respondents 80.2% stated that they always receive SMS alert from the bank on every transaction they carry out with the bank, 15.6% claimed that they somewhat get an SMS alert from the bank while 4.2% averted that they do not receive SMS alert from the bank on every financial transaction they. Nevertheless, we can infer that a majority of the respondents receive and read SMS alert on the transaction they engage with the bank. Also, most of the respondents 88.5% stated that the bank do send SMSes to remind them of special events, birthday or public holidays and 89.6% were of the opinion that SMSes are sent from their bank to notify them of technical difficulties or service upgrading while 90.6% submitted that their banks send them SMS to alert them of sales promotion, health tips and information about new products advertisement and 92.7% received SMSes from their banks on public enlightment or aware- ness on recent social issues. Above all, majority of the respondents 96.9% claimed that they are satisfied with the use of SMS as a strategic tool in Nigerian banks. To investigate the issue further, a thirty-one year old female customer claimed to have benefitted from the use of SMS as a strategic management tool in Nigeria Banks. She said: GSM technology brought the existence of SMS services in Nigeria. The technology is good for communication. Everybody now is using it for private and commercial 37 purposes. It has replaced and reduced the need for travelling for shopping, visitation, information, business etc. It does also reduce cost of living and risk associated with travelling, I think it is beneficial. It facilitates business without delay across locations and that is why Nigerian banks have been keen into the use of SMS services to render better and convenient banking practices for their customers. They send information about the status of their customers’ bank ac- count, financial transaction, exchange rate, and socio-economic condi- tion as well as health and security alertness to their customers through SMS (IDI/customer/GTB/Abeokuta/2022). Also, another beneficiary, a forty year old male respondent said: The use of SMS as a strategic management tool to achieve desired objectives by Nigerian banks is a welcome idea. I so much appreciate it because it keeps me update on vital information which I needed to keep my business moving. I get latest news on forex trading; exchange rate, fund transfer, purchase of online products and payment of bills like electricity, water, airtime, DStv subscription etc. I believe that the use of SMS as a strategic business management tool has improved my trust and confidence in 38 modern day banking system particularly Nigerian banks (IDI/Customer/FCMB/Abeokuta/2022). More interestingly, a sixty-nine year old female respondent, a retiree of an insurance firm subtly expressed some remarks about the use of SMS for customer relations in Nigerian banks and said: Although the use of GSM in Nigeria has fast spread. Almost every Nigerians (including children) have access to GSM and SMS services either on their own personal phones or the one owned by other people. Hence, the adoption and utilization of SMS for customer relations is highly good for businesses and organizations that aim to survive in today’s competitive business world. This is because is the easiest and fastest way to disseminated information and maintain constant relationship with large number of people (customers) without spending so much. I think the use of SMS is also good for Nigerian banks that are becoming strong financial institutions in the world and on Africa continent today. Because, I get so much and better information about my bank account, health tips, new products, training opportunities, special events and holidays most especially my birthday. They (Bank management) remind and congratulate me of my birthday 39 which I so much appreciate. To be sure, I got nothing less than 5 SMSes from my banks on my last birthday date which really made my day interesting and motivating. In fact, due to family and business responsibilities sometimes I don’t remember my date but now my banks do the reminder for me. And if I go to any of their (Bank) branches on my birthday I do receive gifts from some of the staff who have become my friends…(IDI/Customer/First Bank of Nigeria/ Abeokuta/2022). Also, another respondent provided additional dimension of benefits of SMS utilization in Nigerian banks and said: Honestly speaking, the emergence of ICT, GSM and SMS services in Nigerian banking sector has been a blessing and a vital tool that make the aspiration to improve customer’s satisfaction and patronage possible in Nigeria. Because, they provide opportunities for dealing effectively with sophisticated business transactions and customers’ relation matters. As such, the use of SMS has given many banks an edge or competitive advantage in areas like company’s mission, corporate im- age as well as development of new services and products based on SMS survey report and feedback from their customers 40 and the general to public (IDI/Customer/Diamond/Abeokuta/2022). From the responses above, it is evident that the use of SMS as strategic management tool by Nigerian banks has helped to improve the level of customer-management relationships. It has equally enhanced the rate at which customers perceive the quality of services provided by the Nigerian banking firms. The finding further established that prior to the adoption of mobile SMS service which tends to notify bank customers on transactions such as withdrawal, payment due and accounts credit information, bulk of the customers had to either go to the bank or ask their friends to help them obtain such information from the bank. For the majority of the customers who go to the bank for information spent an average of NGN 50 to get to the bank. While, those customers who ask their friends to help them obtain such information had at least been disappointed once by those friends. However, in current dispensation, customers who subscribed to the SMS alert service and are now receiving SMS alert on the information they need to know from the bank on their accounts, new products and services consider SMS beneficial to them. This could be a reason for the majority of the respondent’s to remark the adoption SMS service in Nigerian banks a blessing and a vital tool that make the aspiration to improve customer’s satisfaction and patronage possible. This is unconnected with the costs and challenges associated with the use of GSM phones and SMS services. 41 TABLE 4.3: SMS Usage and Customer-Management Relationship in Nigerian Banking System S/N ITEM DETAILS 10 I believe SMS banking is SD D A SA Total 07 (7.3) 09 (9.4) 31 (32.3) 49 (51.0) 96 (100.0) 03 (3.1) 06 (6.3) 27 (28.1) 60 (62.5) 96 (100.0) 01 (1.0) 04 (4.2) 11 (11.5) 80 (83.3) 96 (100.0) 01 (1.0) 05 (5.2) 38 (39.6) 52 (54.2) 96 (100.0) 11 (11.5) 19 (19.8) 12 (12.5) 54 (56.3) 96 (100.0) fast and easy to use 11 I believe SMS banking is more reliable and secure 12 I believe SMS alert can prevent fraud and theft 13 The charges on SMS alert by my bank is fair 14 I believe SMS alert is timely over e-mail and 42 other banking service Source: Field Survey 2022 Table 4.3 shows the respondent’s view on how the use of SMS in banking firms has shaped the social relations between customers and bank staff in Nigeria. The result revealed that 83.3% of the respondents claimed that they believe SMS alert can prevent fraud and theft while just 5.2% disputed it. This means that majority of the respondents admit that the use of SMS in banking firms has shaped the facet of banking fraud in the banking industry . Flowing from this, 62.5% of the respondents affirmed that they believe SMS banking is more reliable and secure and use SMS to carry out business transactions as well as to track the status of the transaction so as to ensure that it is actually done without physically carrying money around. This view was buttressed by the majority 56.3% who claimed that sometimes they SMS alert is timely over e-mail and other banking service. As a result of the quick response, 54.2.8% of the respondents avow that they believe charges on SMS alert by my bank is fair. To advance the investigation, a bank customer who is also a spare part dealer was interviewed and He claimed to have been enjoying quality customer-management relationship since the adoption of SMS in Nigerian banking firms. He said: I must be sincere with you, I really like the way Nigerian banks are now operating. The use of SMS as a tool to communicate and trans- act business is of 43 great benefit to someone like me. I and my busi- nesses have benefited so much that I hardly make phone call for any information or assistance from the customer care desk like before. Before now I use to call customer care desk which often cost me so money and time trying to seek assistance from there. At times, they don’t pick up the call on time and when they eventually picked one may not grab the response clearly for quick articulation because of the incessant fluctuation of network services. However, the situation has change so much that what I do now is just to send an SMS and I got what I needed at almost immediately. (IDI/Customer/FCMB/Abeokuta/2022). An interviewee also affirmed that: The acceptance of customer-management SMS as relationship a in tool for Nigerian banking industry has significantly the level of competence, trust and social relations existing between bank customers and the management. For instance, in the past, I use to nurture the notion that when customers who came to withdraw huge amount of money are being robbed on their way from the bank, it 44 is the bank staff who give the information about those customers to the robbers. This assumption for a long period did not encourage me to have any serious interaction with bank staff particularly when I want to withdraw or save huge among of money. But now, the use of SMS has changed such notion about bank staff which has significantly improved the social relations between customers and bank staff in Nigeria (IDI/Customer/GTB/Abeokuta/2022). Still on how the SMS has promoted customer-management relationship, another interviewee stated that: The use of SMS as a strategic management tool in Nigerian banks reduces the stress of queuing, cost of calling and delay in response from customer care desk. It also makes the ongoing process of Customers’ Verification exercise and the issuance of Bank Verification Number (BVN) to bank customers in a bid to curb fraudulent activities in Nigerian banking firms and society at large much more easier. In the process, SMS was used as the tool to send the BV Number to every customer after being registered at the designated banks for the sake of privacy and security. Also, in a 45 situation where a customer operates more than one bank account SMS served as the tool to link the bank account together with the same BV Number given to the customer. In fact, it makes the BVN exercise very easy and convenient for customers. This led to increase customer’s satisfaction, trust and patronage in Nigerian banking firms (IDI/Customer/First Bank of Nigeria/Abeokuta/2022). From the responses above, it is evident that the use of SMS in Nigerian banks has produced positive social relations without any mixed reactions between the respondents and bank staff. This posture is a reflection of the level of knowledge and experience the customers has had with the use of SMS as a strategic management tool in Nigerian banking industry. It is equally an upshot of the advancement in mobile banking (mBanking) and electronic banking for business. All of these have positive effects on the lives and businesses of individuals as adduced by various scholars and confirmed by the respondents used in this study. 4.4 Discussion of Findings: The principal thrust of this study has been to investigate assessment of SMS alert on e-payment banking platform. The study established that customers’ perception towards the use of SMS services has been positive. A majority of the customers considered SMS adoption in banking firms beneficial because the service saved 46 them time and money as well as relief them of unnecessary anxieties. This finding is a reflection of the view that consumers like to have choices in the way they communicate with businesses and increasingly consumers are turning to SMS. The use of SMS services to communicate information about new products, policies and services by banks has enhances the reading habit of many young Nigerians who uses SMS as a means for conducting business trans- actions and personal development. The finding shows that majority of the customers who registered for SMS services with the banks engage in constant reading of text mes- sage or SMS that comes into their mobile phones. Aside this discovery, it was also found that SMS play a critical part in the ongoing Customers’ Verification exercise which the government authorized all banks in Nigeria to carry out. The majority of respondents affirmed that after the BVN registration, SMS or text message was sent to their (customers) mobile phones as reference check and completion of the exercise. Considering the outcomes of this study, Nigerian banking firms are therefore advised to improve on the use of SMS as a strategic management tool for promoting customer- management relationships. However, there is need to ensure that the contents of the message are well organized and structured in way that will entice the interest of targeted customers. This is very important because customer-management relationships may be affected if the SMS tends to become a nuisance to the customers. Text messages which do not appear to be clearly defined may generate a negative responses from customers rather than what is expected to create customer loyalty, retention and satisfaction. Like- wise, unsolicited SMS or 47 text messages may disturb the customers resulting in more negative perception about the products and services of the bank. This calls for banks to ensure that only relevant and interesting messages are sent to the customers. In this direction factors such as consumer permission, personalization and message content play critical role to develop positive m-users attitude towards the reception of text messages of SMS on their mobile phones as revealed by studies like Tripathi and Siddiqui (2008), Khraim et. al., (2011) and Imran (2011). Moreover, the finding of this study has point out the view that «just as food and water are essential for man’s survival so is communication central for fostering fruitful customer-management relationships» in a globalized world. 48 CHAPTER FIVE SUMMARY OF FINDINGS, CONCLUSION AND RECOMMENDATIONS 5.1 Summary of findings The study is centered on the assessment of short message service (SMS Alert) on e-payment banking platform. The objectives of the study are to ascertain the awareness and customer perception on SMS alert on e-payment in Nigeria, find out which of the dimensions of SMS is adopted by commercial banks in Nigeria; and examine the effects of using SMS alert on organizational performance of commercial banks in Nigeria. The relevant literatures were reviewed as well as the theory aspects of the literature. A survey research design was adopted for the study while data for the study was gathered from distributed questionnaire and the analysis was done according to the data gathered. In analyzing the data collected, the researcher adopted the use of simple percentage. Also, their frequency tables 49 representing the information based on each research question. 5.2 Conclusion The study established that customers who have subscribed to the SMS alert service considered the service beneficial because they perceived that the service saved them time and expenditure as well as relief them of unnecessary anxieties. It is also established that males dominate the clientele base of banks in Nigeria as compared to females probably due to their dominant in the formal sector compared to their female counterparts who are mostly in the informal sector. Banks in this region should roll out products that are tailored towards the informal sector to expand their clientele base. The study also found that customers’ perception of quality and value of the alert service as well as their loyalty to the bank grossly influenced their decision to subscribe to the mobile SMS alert service. This calls for banks in the region to invest on improving the quality of the SMS alert platforms as well building customer loyalty since these factors enhance customers’ subscription to the banks’ electronic services. Another perception of customers for subscribing to the mobile SMS alert banking services was that the service will provide them with timely and reliable alert information on payment. 5.3 Recommendations The following recommendations were made for the study; 50 i. The Banking industry is therefore required to improve the use of SMS to customers. Customer satisfaction tools may be affected if the SMS tends to become a nuisance to the customers. Text messages which do not appear to be clearly defined may generate a negative responses from customers rather than what is expected to create satisfaction. ii. In order to know what customers reaction and attitude towards SMS in banking industry, it is important to recommend to managers in the banking industry that SMS banking emerging tool for marketing communication, it broadens the theoretical foundations of direct marketing. Actually it is an interesting marketing tool which can reach the target customers. iii. On the other hand, SMS may disturb the customers resulting in more negative perception about the products and services of the bank. Therefore, the message must be the relevant and interesting to the customers. Unnecessary massage should therefore be avoided. Also massages should not be sent to customers at mid night and their account number should not be included in the massage because of security reasons. iv. Lastly, better procedures should be set against standards to measure the result and its impact on customer’s attitude. 51 REFERENCES Amin H., Extending TAM to SMS Banking: Analyzing the Gender Gap among Students, Int. J. Business and Society, 8(1), 45 (2007). Amin H. and Ramayah, T., SMS Banking: Explaining the Effects of Attitude, Social Norms and Perceived Security and Privacy, Elect. J. Info. Sys. in Developing Countries, 41(2), 15 (2010). Black, T.R. (1999) Doing Quantitative Research in the Social Sciences – An Integrated Approach to the Research Design: Measurement and Statistics, Sage Publications, London. Bajpai N. and Srivastava D. (2004) “sectorial comparison of factors influencing job staisfaction in Indian banking sector”, abstract retrieved on December 10, 2021 from http://www.highbeam.com/doc/1G1-119370569.html Buse et al., (2006) Strategic Implications of Mobile Banking for Banks and Financial Enterprises- pp. 522-529. Chaffey, D., Ellis-Chadwick, F., Mayer, R. and Johnston, K. (2009). Internet marketing: strategy, implementation and practice, 4th ed. Pearson 52 Education Ltd. Cheng, J. M., Blankson, C., Wang, E. S. and Chen, L. S. (2009). Consumer Attitudes and Interactive Digital Advertising. International Journal of Advertising, 28 (3), pp. 501-525. Chatfield, C. and Collins, A.J. (1992) Introduction to Multivariate Analysis, Chapman & Hall, London. Chiu, Y.B., Lin, C.P. and Tang, L.L. (2005) Gender Differs: Assessing a Model of Online Purchase Intentions in E-Tail Service, International Journal of Service Industry Management, 16, 416-435. Colgate, M. (1997) “Personal bankers and relationships marketing: A new Zealnd Case study” Journal of Financial services marketing, 2910, 84-96. David, M. (2006). “Customer satisfaction and loyalty for the global enterprise”, Customersat Inc., retrieved on December 10, 2021 from http://www.translate.com/technology/multilingual_standard/customersat_gl obal_customer_satisfaction.htm Faulhaber, G. (1995) “banking markets: productivity, Risk, and customer satisfaction”, abstract retrieved on December 10, 2021 form http://knowledge.wharton.upenn.edu/paper.cfm?paperID=377&CFID=2402 520&CFTOKEN=24429976 Fill, C. (2005). Marketing Communications: Engagements Strategies and Practice’, 4th ed. Pearson Education Ltd. Fornell C., Mithas S., Morgeson FV III., Krishnan MS. (2006) “Customer satisfaction and stock prices: high returns, lowrisk”, Journal of marketing, 70, 3-14 Federal Reserve Board Report, Consumers and Mobile Financial Services, Board of Governors of the Federal Reserve System March 2012 Report, Washington, DC (2012). Fishbein, M. and Ajzen, I. (1975). Belief, Attitude, Intention and Behavior: An Introduction to Theory and Research, Addison-Wesley: Reading, MA. 53 Gopi, M. and Ramayah, T. (2007) Applicability Of Theory Of Planned Behavior In Predicting Intention To Trade Online: Some Evidence From A Developing Country, International Journal of Emerging Markets, 2, 4, 348-360. Hernandez C. J. M. and Mazzon J. A., Adoption of Internet Banking: Proposition and Implementation of an Integrated Methodology Approach, Int. J. Bank Marketing, 25(2), 88 (2006). Hoppe R., Newman P. and Mugera, P., Factors Affecting the Adoption of Internet Banking in South Africa: A Comparative Study, An Empirical Research Paper Presented to the Department of Information Systems, University of Cape Town (2001). Jham V. and Khan KM. (2008). “Determinants of performance in retail banking: perspectives of customer satisfaction and relationship marketing”, retrieved on December 10, 2021 from http://www.thefreelibrary.com/Determinants+of+performance+in+retail+ba nking:+perspectives+of...-a0180402934 Johnson MD., Gustafsson A. (2000). “Improving Customer Satisfaction, Loyalty, and Profit: An Integrated Measurement and Management System, San Francisco: Jossey-Bass, 2. Kenny C. J., (2000), Expanding Internet Access to the Rural poor in Africa. The African Internet and Telecom Summit Banjul, Gambia; http://www.itu.int/africainternet2000/Documents/doc7e.htm Kleijnen, M., Wetzels, M. and de Ruyter, K. (2004) Consumer Acceptance Of Wireless Finance, Journal of Financial Services Marketing, 8, 206-217. Lada, S., Tanakinjal, G.H. and Amin, H. (2009) Predicting Intention To Choose Halal Products Using Theory Of Reasoned Action, International Journal of Islamic and Middle Eastern Finance and Management, 2,1, 66-76. Laforet, S. and Li, X. (2005) Consumers’ Attitudes Towards Online And Mobile Banking In China, International Journal of Bank Marketing, 23, 362-380. 54 Luarn, P. and Lin, H.H. (2005) Toward An Understanding Of The Behavioural Intention To Use Mobile Banking, Computers in Human Behaviour, 21, 873-891. Laukkanen T., (2005), Comparing Consumer Value Creation in Internet and Mobile Banking Proceedings of the International Conference on Mobile Business pg 655-658. Lu J., Yu C.S., Liu C. E. and Yao J., Technology Acceptance Model for Wireless Internet. Electronic Networking Applications and Policy, 13(3), 72 (2003). Mallat N., Rossi M, and Tuunainen V. K., (2004), Mobile Banking Services Communications of the ACM, 47, 5 pp 42-46 Menke, J. (2007). The UK Fast Moving Consumer Good (FMCG) Business. VDM Verlag Dr. Muller e. K, Lightning Source Inc. Mattila, M. (2003) Factors Affecting The Adoption Of Mobile Banking Services, Journal of Internet Banking and Commerce, 8. http://www.arraydev.com/commerce/JIBC/0306-04.htm. Ndubisi, N.O. and Igau, O.A. (2003) Can WOM Communication, Patronage Intention And Complaining Behaviour, Predict Customer Retention And Loyalty, Labuan Bulletin of International Business and Finance, 1, 1, 41-51. Ndubisi, N.O. and Sinti, Q. (2006) Consumer Attitudes, System’s Characteristics And Internet Banking Adoption In Malaysia, Management Research News, 29, 1/2, 16-27. Nunnally, J.C. (1978) Psychometric Theory, McGraw-Hill, New York. Nysveen, H., Pedersen, P.E. and Thorbjornsen, H. (2005) Explaining Intention To Use Mobile Chat Services: Moderating Effects Of Gender, Journal of Consumer Marketing, 33, 5, 247–256. Pousttchi K. and Schurig M., (2004), Assessment of Todays Mobile Banking Applications from the View of Customer Requirements, International 55 Conference on System Sciences, pp 1-10. Pikkarainen, T., Pikkarainen K., Karjaluoto, H. and Pahnila S. (2004) Consumer Acceptance Of Online Banking: An Extension Of The Technology Acceptance Model, Internet Research, 14, 3, 224-235. Ramayah T, Jantan, M., Noor M.N.M. and Ling, K.P. (2003) Receptiveness Of Internet Banking By Malaysian Consumers, Asian Academy of Management Journal, 8, 2, 1-29. Ramayah T, Taib, F. M. and Ling, K.P. (2006) Classifying Users And Non-Users Of Internet Banking In Northern Malaysia, Journal of Internet Banking and Commerce, 11, 2. http://www.arraydev.com/commerce/JIBC/0306-04.htm. Ramayah T. and Ling, K.P. (2002) An Exploratory Study of Internet Banking in rd Malaysia. Proceedings of the 3 International Conference on Management of Innovation and Technology, 25-27 October 2002, China. Ramayah, T. and Suki, N.M. (2006) Intention To Use Mobile PC Among MBA Students: Implications For Technology Integration In The Learning Curriculum, UNITAR e-Journal, 1, 2, 1-10. Reichheld, F.F. and W.E. Sasser, Jr. (1990). "Zero-Defections: Quality Comes to Services." Harvard Business Review (September-October): 105-111. Schay B.W., Gowing M.K., Caldwell J.A., Payne S.S. (2000) “A Model Customer Satisfaction Survey and Opportunity”, The Public Manager, 29(1), 30. Vavra, T.G. (1995) “Selling after the sale”, Banking Marketing, 27, 27-30. 56 APPENDICE NATIONAL OPEN UNIVERSITY OF NIGERIA. FACULTY OF ART AND SOCIAL SCIENCE ABUJA STUDY CENTRE, DEPARTMENT OF EDUCATION TOPIC: ASSESSMENT OF SHORT MESSAGE SERVICE (SMS ALERT) ON E-PAYMENT BANKING PLATFORM. Dear Respondent, 57 This questionnaire is designed to collect data on the above topic and is meant for academic exercise as well as to aid policy formulation on the subject matter. Kindly fill out your responses as frankly as possible and the information you provide will be treated in confidence. Thank you for your anticipated cooperation. Section A. Demographic characteristics of Respondents (Tick as appropriate) 1. Gender Male [ ] Female [ ] 2. Age Group Under 25 [ ] 25 – 34 [ ] 35 – 44 [ ] 45 – 54 [ 55 – 64 [ ] ] 3. Profession 4. Religion Trader [ ] Banker [ ] Islam [ ] Christianity [ ] 5. Level of Education Student [ ] Traditional [ ] No Formal Education [ ] Formal Education [ ] Secondary School [ ] Tertiary Level [ ] Other (specify)……………................... Section B. This section aim to finding out your opinions about the statements listed below. Please read the following statement and circle the number that best describes your opinion on the study. SA A SD 58 U D The use of SMS has become vital tool in rendering quality banking services in Nigeria I have access to GSM and SMS services I have benefited from the utilization of SMS on your mobile phone or GSM As a customer, i get SMS from the bank on every transaction I made with the bank I use to get SMS notification of technical difficulties or service up-grading from the bank I receive SMS security alert from my bank through SMS and I also send security report to the bank through SMS I am up-to-date on my account activities through SMS alert I mostly use SMS banking to perform most of financial transaction in my bank I believe SMS banking is fast and easy to use I believe SMS banking is more reliable and secure I believe SMS alert can prevent fraud and theft The charges on SMS alert by my bank is fair I believe SMS alert is timely over e-mail and other banking service 59 The use of SMS in supporting my banking spirit and prospect to quality service has been very effective. I am satisfied with the use of SMS in Nigerian banking firms 60