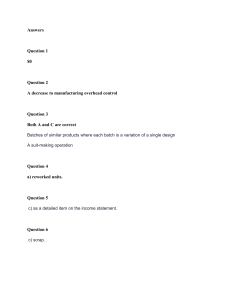

COST TERMS, CONCEPTS AND CLASSIFICATION WEEKS 1 - 2 Manufacturing Costs (Production Costs) - Manufacturing costs is the sum of three cost elements. Direct Material - Direct Labor- Manufacturing Overhead - Finished Goods Manufacturing Costs (Production Costs) Direct Materials - All materials that form an integral part of the finished product during the manufacturing process and can be physically and directly associated with the product. Direct Labor - Work of factory employees that can be physically and directly associated with converting raw materials into finished goods. Manufacturing Overhead Costs that are indirectly associated with manufacturing the finished product. Indirect Materials Insignificant part of finished product in terms of cost. its completion. Indirect Labor cost of the product, but must be allocated to the finished goods. Basic Cost Terminology Indirect costs cannot be traced (tracked) explicitly or conveniently to a particular cost object. Instead of being traced, these costs are allocated to a cost object in a rational and systematic manner. Direct costs can be conveniently and distinctly traced (tracked) to a particular cost object. Fixed Costs cost that remains constant in total within a relevant range of activity. Does not change in total as business activity increases or decreases. Variable costs increase in total proportionately with an increase in activity and decreases proportionately with a decrease in activity. Inventoriable costs - product manufacturing costs. These costs are capitalized as assets (inventory) until they are sold and transferred to Cost of Goods Sold. Period costs—have no future value and are expensed in the period incurred. Manufacturing Inventories Direct materials - resources in-stock and available for use Work-in-process – the stage in the production process where work has been started but not yet completed. Finished goods – the stage in the production process where the products are fully completed and ready for sale Schedule 1 – Raw materials used Raw materials inventory - beginning balance P40,000 Add: Purchases - raw materials 220,000 Raw materials available for use 260,000 Less: Raw materials inventory - End (60,000) Raw materials used P200,000 AMCAR CORPORATION Statement of Cost of Goods Manufactured and Sold December 31, 2019 Beginning work in process P 150,000 Raw materials used (Sched 1) P200,000 Direct labor 450,000 Variable overhead 115,500 Fixed overhead 95,000 Total manufacturing costs 860.500 Total costs of goods placed in process 1,010,500 Work in process - Eng (30,500) Cost of goods manufactured P 980.000 AMCAR CORPORATION Statement of Cost of Goods Manufactured and Sold December 31, 2019 Finished Goods - Beginning Add: Cost of Goods Manufactured Cost of Goods Available for Sale Less: Finished Goods - End Cost of Goods Sold AMCAR CORPORATION Income Statement December 31, 2019 Sales Less: Cost of Goods Sold Gross Profit Less: Operating Expenses Income from Operation P 85,400 980,000 P1,065,400 (91,400) P1,054,000 P 1,500,000 ( 980,000) 520,000 364,000 156,000 Activity-Based Costing Approach Volume is one major driver, measured either in output (units produced) or input (labor hours, machine hours, etc.) The two other major influences on cost are complexity and diversity of operations. Use Activity-Based Costing for 1. Product Variety and Process Complexity 2. Lack of Commonality in Overhead Costs 3. Problems with Current Cost Allocations 4. Changes in Business Environment 1. Identify and classify the activities involved in the manufacture of specific products, and allocate overhead to cost pools. 2. Identify the cost driver that has a strong correlation to the costs accumulated in the cost pool. 3. Compute the activity-based overhead rate for each cost driver. 4. Assign overhead costs to products, using the overhead rates determined for each cost pool (cost per driver).