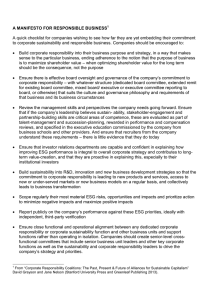

Strategy, sustainability and CSR: Has the pandemic caused a shift in perspective? Kunsch, David; Seifzadeh, Pouya . Rochester Business Journal ; Rochester Vol. 36, Iss. 29, (Oct 30, 2020): 40,43. ProQuest document link ABSTRACT (ENGLISH) Discussion of the impact of businesses on their social and natural environments has given way to more focus on topics such as sustainability and corporate social responsibility (CSR) and environmental, social and governance (ESG) factors have been proposed to ensure and measure commitments of organizations. The often used PESTEL (Political, Environmental, Social, Technological, Economic and Legal) analysis has been a mainstay of assessing a firm's environment for decades and a driver of a firm's strategy. Look at how financial markets are responding and that should present some clues. Since 2017 that the U.S. has withdrawn from the Paris Agreement and EPA has been more relaxed on implementing environmental protection policies. FULL TEXT A consequence of the COVID-19 pandemic is a shift in consumer attitudes toward the operations of businesses and a greater priority placed by them in receiving services and products from those that put safety and sustainability ahead of other things. This is also echoed in a recent report published by McKinsey &Co. The COVID19 pandemic has accelerated the rate of localization, has slowed down globalization and has highlighted the importance of conducting business in a more mindful way. Discussion of the impact of businesses on their social and natural environments has given way to more focus on topics such as sustainability and corporate social responsibility (CSR) and environmental, social and governance (ESG) factors have been proposed to ensure and measure commitments of organizations. Now, as economies prepare to bounce back from a devastating downturn after COVID-19, we're once again at crossroads: would too much focus on rapid economic recovery undermine the role of ESG in strategy, or is ESG already at the core of business strategy and the trajectory is set in the right direction? Pouya: It's undeniable that with COVID-19 our worldview of how business should be has been affected. If we take a look back at all of the tools and instruments that we use for strategic analysis and formulating strategy, there is very little to see about the impact of our societies and economies on the environment that surrounds them. This applies to both natural and social environments. Strategy and business have for too long focused on shortsighted quarterly/annual returns, but we now have received a wakeup call. We need to start taking steps to integrate ESG into how we define companies' strategic direction. Currently, ESG and what we've commonly known as sustainability or corporate social responsibility is absent from strategy performance in the practice of strategy. With what we've seen unwrap for the past few months it is quite clear that we have taken a onesided view and now businesses and economies are feeling the pain. David: I will have to disagree with you on the classic approach to strategy not taking environment, social and governance issues into consideration in setting and executing on strategy. The often used PESTEL (Political, Environmental, Social, Technological, Economic and Legal) analysis has been a mainstay of assessing a firm's environment for decades and a driver of a firm's strategy. I would also advocate that businesses know, maybe have always known, that taking care of their "stakeholders" such as employees, customers and suppliers is critical for economic success. I worked as senior counsel and business manager at a large U.S. multinational preCSR or PDF GENERATED BY PROQUEST.COM Page 1 of 4 pre-ESG and treating the people (customers, suppliers, employees, communities), the environment and the law respectfully was part of our lived core values. It was part of our decision-making process to do the right thing, irrespective of economic cost. So, I reject that these issues have been ignored. However, where we may find some common ground is whether these issues can be treated in a more effective and efficient manner. I agree that the quarter-by-quarter performance metric is not necessarily helpful and I concede that there have been mistakes, sometimes grave, in the treatment of the environment, society and in governance, but I maintain that is the exception not the rule. Pouya: Well, it is one thing to acknowledge social and environmental factors, but weaving them into strategy is certainly another. My question is, how much of the adoption of ESG factors by corporations has been in response to regulation and how much of it has been to lead the way? Look at how financial markets are responding and that should present some clues. Since 2017 that the U.S. has withdrawn from the Paris Agreement and EPA has been more relaxed on implementing environmental protection policies. Resulting tax cuts have only been met with enthusiasm by financial markets and there has been very little criticism of what's been given away in the exchange. One can argue that companies altogether are the source of less pollution in North America and Europe, but what about the main pollutants which happen to be China and India? And oddly enough, both China and India happen to host many of the manufacturing operations that were formerly elsewhere. Most of the businesses have only transported what they see as headaches to offshore locations where restrictions are far less, and they hardly ever acknowledge that they are a part of it. I have a hard time seeing that as strategic leadership, but rather adaptation to the 'L' in the 'PESTEL'. But I'm optimistic that things will have to change. One thing the pandemic has taught us is that in its current format the global economy is more connected than what once imagined and irresponsible behavior can cause irreparable damages for everyone. David: I have two reactions to your comments. The first is that corporations have led the way in ESG in many areas, and the second is that you are right - little of it has been altruistic. I am OK with that, and here is why. I believe that businesses are the best wealth and prosperity generating entities in the world. To the extent we believe prosperity is good, then businesses are good. Businesses are good at earning an economic return for their owners, but their interests should be directed to that end. The "L" in PESTEL are the guardrails/boundaries within which businesses have to stay in order to do what they do best. Legal and regulatory boundaries constrain basically the bounds of returns owners can get and we as a society feel that balance best serves us. Today, day of writing, the U.S. government and states have filed an anti-trust suit against Google, essentially saying we think you have crossed the legal/regulatory boundary and your earnings are to some extent ill gotten. There arguably will be new legislation and regulations constraining big tech - that is the balance we have politically and economically set in society. But to have businesses to start setting the guardrails sounds good at first but do we as a society want businesses doing that? Unelected businesses? Rich individuals who own a disproportionate amount of wealth in this country setting the rules? I think not. So yes, you are correct that we have offshored a lot of environmental problems to China and India (and soon Pakistan and Africa). China and India are different societies with different balances and in their own ways are addressing them - with varying success. We can try and influence them and convince them and maybe introduce workable systems they may adopt, but, as you say, we are all interconnected and if we did not import manufacturing - the knowledge is there - they would have done it themselves, albeit at a slower rate. I would also add that doing well by the environment and society takes prosperity - the kind businesses deliver. Pouya: I'm still not convinced that most of our business community has grasped that adoption of ESG and better conduct with respect to society and environment is beyond altruism and is actually necessary to succeed. I agree with you that the players that stand to benefit from existing arrangement set the rules. That's bad for business and worse for the economy. I hope that they understand that for the level of commitment that strategy requires; it is better to help co-create a business and economic landscape that is less volatile. I think that is where and how good strategy long-term success is created. David Kunsch is an associate professor of strategy at St. John Fisher College. Pouya Seifzadeh is an assistant PDF GENERATED BY PROQUEST.COM Page 2 of 4 professor of strategy at SUNY Geneseo. DETAILS Subject: Social responsibility; Environmental impact; Success; Prosperity; Coronaviruses; Securities markets; Pandemics; Society; Sustainability; COVID-19 Business indexing term: Subject: Social responsibility Prosperity Securities markets Location: China United States--US India Publication title: Rochester Business Journal; Rochester Volume: 36 Issue: 29 Pages: 40,43 Publication year: 2020 Publication date: Oct 30, 2020 Publisher: Rochester Business Journal Place of publication: Rochester Country of publication: United States, Rochester Publication subject: Business And Economics ISSN: 08963274 Source type: Trade Journals Language of publication: English Document type: Commentary ProQuest document ID: 2462452538 Document URL: https://sea rch.proquest.com/trade-journals/strategy-sustainability-csr-haspandemic-caused/docview/2462452538/se-2?accountid=13598 Copyright: Copyright Rochester Business Journal Oct 30, 2020 Last updated: 2020-11-20 Database: Business Premium Collection PDF GENERATED BY PROQUEST.COM Page 3 of 4 LINKS Check for full text via OCLC Link Resolver Database copyright 2021 ProQuest LLC. All rights reserved. Terms and Conditions Contact ProQuest PDF GENERATED BY PROQUEST.COM Page 4 of 4