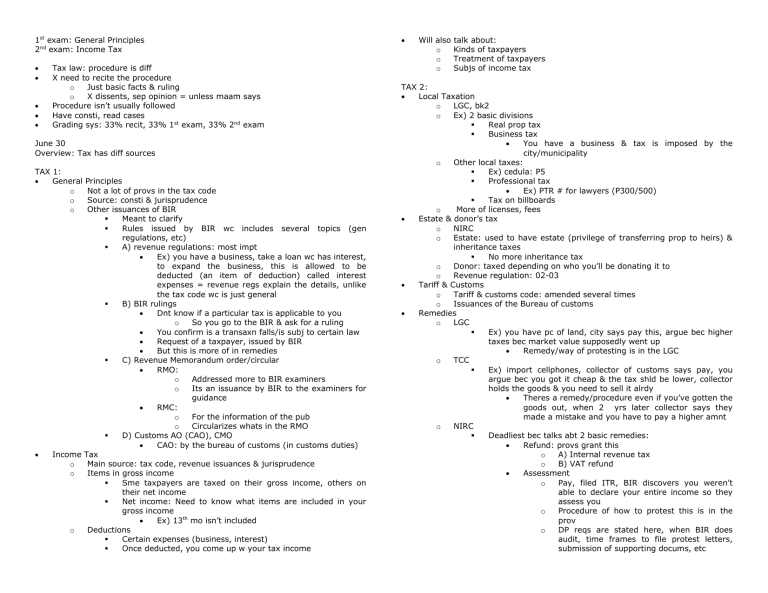

1st exam: General Principles 2nd exam: Income Tax Tax law: procedure is diff X need to recite the procedure o Just basic facts & ruling o X dissents, sep opinion = unless maam says Procedure isn’t usually followed Have consti, read cases Grading sys: 33% recit, 33% 1st exam, 33% 2nd exam June 30 Overview: Tax has diff sources TAX 1: General o o o Principles Not a lot of provs in the tax code Source: consti & jurisprudence Other issuances of BIR Meant to clarify Rules issued by BIR wc includes several topics (gen regulations, etc) A) revenue regulations: most impt Ex) you have a business, take a loan wc has interest, to expand the business, this is allowed to be deducted (an item of deduction) called interest expenses = revenue regs explain the details, unlike the tax code wc is just general B) BIR rulings Dnt know if a particular tax is applicable to you o So you go to the BIR & ask for a ruling You confirm is a transaxn falls/is subj to certain law Request of a taxpayer, issued by BIR But this is more of in remedies C) Revenue Memorandum order/circular RMO: o Addressed more to BIR examiners o Its an issuance by BIR to the examiners for guidance RMC: o For the information of the pub o Circularizes whats in the RMO D) Customs AO (CAO), CMO CAO: by the bureau of customs (in customs duties) Income Tax o Main source: tax code, revenue issuances & jurisprudence o Items in gross income Sme taxpayers are taxed on their gross income, others on their net income Net income: Need to know what items are included in your gross income Ex) 13th mo isn’t included o Deductions Certain expenses (business, interest) Once deducted, you come up w your tax income Will also o o o talk about: Kinds of taxpayers Treatment of taxpayers Subjs of income tax TAX 2: Local Taxation o LGC, bk2 o Ex) 2 basic divisions Real prop tax Business tax You have a business & tax is imposed by the city/municipality o Other local taxes: Ex) cedula: P5 Professional tax Ex) PTR # for lawyers (P300/500) Tax on billboards o More of licenses, fees Estate & donor’s tax o NIRC o Estate: used to have estate (privilege of transferring prop to heirs) & inheritance taxes No more inheritance tax o Donor: taxed depending on who you’ll be donating it to o Revenue regulation: 02-03 Tariff & Customs o Tariff & customs code: amended several times o Issuances of the Bureau of customs Remedies o LGC Ex) you have pc of land, city says pay this, argue bec higher taxes bec market value supposedly went up Remedy/way of protesting is in the LGC o TCC Ex) import cellphones, collector of customs says pay, you argue bec you got it cheap & the tax shld be lower, collector holds the goods & you need to sell it alrdy Theres a remedy/procedure even if you’ve gotten the goods out, when 2 yrs later collector says they made a mistake and you have to pay a higher amnt o NIRC Deadliest bec talks abt 2 basic remedies: Refund: provs grant this o A) Internal revenue tax o B) VAT refund Assessment o Pay, filed ITR, BIR discovers you weren’t able to declare your entire income so they assess you o Procedure of how to protest this is in the prov o DP reqs are stated here, when BIR does audit, time frames to file protest letters, submission of supporting docums, etc Other o o o o *docket fees: based on the amnts stated in the complaint/claim, thus have the amnt go down while still in the BIR internal Revenue Taxes A) DST B) excise: alcohol, cigarettes, etc C) percentage tax: races, etc D) VAT Since 1996 not asked in the bar, last yr it was asked Long provs, but revenue regs are more difficult I. General Principles of Taxation Meaning of tax: o Power by wc the sovereign, thru the law making body, to raise revenue It’s the legis who makes the tax laws Distinguish it from other terms: License fee Taxes Emanates from police power Levied in the exer of the taxing power Regulatory To generate revenues Amng of charge must only be sufficient to include expenses of issuing the license & the cost of necessary inspection or police surveillance o License Fee: Limit in the amnt: only that reqd to cover the license & cost of inspection Ex) have a business, don’t pay tax, is it an illegal business? No, just subj to certain penalties o Tax: Amnt depends on what you earn Operated for revenues (purpose) Gen principle But there are sme regulatory purposes on why they’re imposed PAL v Ebro Progressive Devt: if the exaction is really to raise revenue & regulatory purposes are incidental = TAX if regulatory purposes is the primary purpose = License (to regulate conduct) Special assessment Taxes Levied only on land Imposed on persons, prop & excises Cant be made a personal liab of the Can be made such person assessed Based wholly on benefit Not Exceptional bth as to time & locality o spcl assessment: shld inure to the benefit of the land cant be made a personal liab ex) pub improvement construction wc wld improve the value of the prop ex) highway created near a farm LGU will assess you bec you’ve benefited from it even if its for the benefit of the entire community Cant charge more than 50% of the cost An imposition/exaction on the prop, not on the person Toll Demand of ownership Tax Demand of sovereignty purpose of raising revenue for the Amnt charged for the cost & maintenance of the prop used o Toll: For cost & maintenance of pub works Not only the govt wc can impose, so can a priv entity Penalty Punishment for the commission of a crime Tax civ liability Person criminally liable in taxation only bec he fails to satisfy his civ oblig to pay taxes o o Penalty: Can be liable to this for non-payment of taxes Ex) can be charged surcharge & interest for failure to pay Tax: Dsnt arise necessarily from a crime Tariff/customs duties Tax Duties charged upon commodities on Broader term wc includes custom their being imported into or exported duties & other taxes from a country Are regulatory imposts on goods Are taxes o T/C duties: Imposed on goods imported/exported Tariff: can mean the rate itself or the book/list of amnts you need to pay Diff from tax but similar = governed by diff provs/law But they have the same purpose = revenue Oblig to pay tax: o Taxpayer is obliged to pay o Consent isn’t necessary o No offsetting bec no creditor-debtor rel o Consequence: surcharge & interest, imprisoned for tax evasion Oblig to pay a debt: o Existing C-D rel o Consent is given o Can offset o Consequence: interest, cant be imprisoned (consti) Gen rule: No offsetting under the law o But in practice, you can o Exception: Domingo v Garlitos Only exception When the claim of the taxpayer & whats due to the govt is alrdy overdue, demandable & liquidated = compensation takes place by operation of law Philex Not subj to compensation bec not creditor & debtor of each other Debts: due to the govt in their corp capacity Taxes: due to the govt in their sovereign capacity Contention of Philex here is always the contention of taxpayers Essential Characteristics: Forced charged o Oblig by law o Not dependent on the will or consent Generally payable in money o 2 kinds of refund: Money or tax credit certificates o Tax credit cert: Once this is given, can be used for tax liabilities as payments Usually if you don’t need the TCC, you sell it to some1 on a discount 2002 scandal: bec of this BIR issued a reg wherein the sale of the TCC became difficult (stricter reqs) o What if theres a civ war, money loses its value Sm1 says instead of paying money, just pay me rice – is this constitutional? Can congress enact a law wc says just pay taxes w rice? Valid? Basic principles of a sound tax sys Administrative feasibility: 1 of the hallmarks of a sound tax sys is that its capable of being implemented o Its not the law wc will allow payment of rice instead of money, but itll run counter to the basic principle of admin feasibility Legislative in charac o Created by the legis body o Oblig created by law Assessed on all w reasonable rule of apportionment o Taxes are based on one’s ability to pay Imposed on subjs w/in jurisdiction For a pub purpose o The pub purpose shld exist when the law is enacted Not at the time of disbursement Theory & basis Necessity theory o Operations of the govt needs funds, thus need taxes as contributions o CIR v Algue: Taxes are what we pay for a civilized society bec wo taxes govt wont have nay motive power to operate = paralyzed Benefit-received theory o Foundation to pay taxes isn’t the privileges enjoyed or protection given o Cant object to paying bec no personal benefit can be pointed out *Q: is it necessary to have a govt to impose taxes? Purpose Gen: to raise revenue & provide funds for the govt to meet its mandate of promoting welfare & protection of citizens Non-revenue purpose: o To enhance the exer of police power o To rehabilitate & stabilize threatened industries of pub interest o Control the exchange importations: how ds taxation paly a role so that the loc industries are protected? o Added price on imported goods to encourage buying loc products Spcl laws passed: o To regulate certain industries o Has spcl incentives Ex) call centers: located in an eco zone so granted spcl privileges (lower taxes for a certain yr or given an income tax holiday) Classification A.scope Natl taxes: o Imposed by the natl govt o Those implemented by BIR o Ex) income tax, excise tax, percentage tax Loc taxes: o Imposed by the loc govt o Ex) real prop tax, cedula, business tax B. who shoulders the burden Direct o Incidence & liability falls on 1 person Indirect o Incidence & liability falls on 1 person but the impact/burden falls on anthr o Ex) VAT Memorize: incidence, liability v impact or burden o Incidence, liability = statutory taxpayer NPC: no longer an issue bec new VAT law says they aren’t subj to 12 % VAT Commissioner v Gotamco o Contractors tax: indirect tax No more today, just VAT Q: what if you entered into a contract & lease a prop wc is subj to taxes. What if you dnt what to shoulder the DST & say the renter shld pay for it bec they got the place cheap – direct or indirect tax? o Still a direct tax bec the person who issued the contract is subj to the tax, you just try to pass the burden o DST dsnt really discriminate btwn the buyer/seller Prov: if says 1 is exempt from DST (i.e. IRRI), if it enters into a contract wc is subj to DST, other party shld pay for it Can stip that the burned of paying is passed o This dsnt destroy its charac as a direct tax = X prohib by law C. Obj/Subj Matter a. Prop Are assessed on all prop of a certain class w/n the jurisdiction of the taxing power Ex) real prop tax & conditional levels on real prop, except spcl assessments under the LGC Tax of a fixed amnt a.k.a. poll/capitation Excise: o Ex)income tax, VAT, estate & donor tax o Diff from excise tax under NIRC wc are “sins taxes” (excise taxes in the strict sense) b. Personal Aka capitation or poll taxes Taxes of a fixed amtn upon all persons of a certain class w/in the jurisdiction of the taxing power, wo regard to the amtn of their prop or to the occupations or businesses in wc they’re engaged LGC: residence tax aka community tax c. Poll/capitation Aka personal tax d. Excise Excise or privilege taxes are laid upon the manufacture, sale or consumption of commodities w/n the country Upon licenses to pursue certain occups & upon corporate privileges D. manner of Computing: Ad valorem: needs the intervention of assessors o Ex) real prop tax (assess the FMV of the prop), automobiles Spcfc: dnt need assessors or valuation, just pay E. Graduation/rate Proportional: fixed percentage Progressive: depends if theres an inc in the tax base o Tax rate increases as the tax bases increases o Ex) income tax Regressive o Tax rate decreases as the tax base increases * distinguish progressive & regressive against the sys Ability to pay principle: means more direct taxes than indirect taxes (wc are regressive) Bar Q: what are the aspects of taxation? o Levy or imposition: Congress dets what to tax o Collection: BIR sees the law & collects based on the law o Payment: Pay as you earn: ex) income tax Pay as you’re assessed: ex) real prop tax (once assessed by an assessor, you need to pay) Pay as you file: ex) donors/estate/DST Pay as you transact: ex) VAT Basic Principles Fiscal adequacy: o Usually in the cases involving VAT Theoretical justice & equality o Tax burden shld be equal to the taxpayers ability to pay Administrative feasibility July 7 II. NATURE & LIMITATIONS OF THE POWER OF TAXATION Nature & Power of Taxation a) Power of taxation being inherent in sovereignty o No need for a law to grant the power o Consti prov are merely limitations on the power to tax Memorize: Auth: who exers power Taxation May be exerd only by the govt or its pol’t subdivisions Eminent domain May be exerd by the govts or its pol’t subdivisions or granted to pub service Cos or PUs Prop is “taken” for pub use & must be compensated Purpose Prop is taken for the support of the govt Persons affected Operates upon a community/class of indivs Money contributed becomes part of the pub funds Operates on an indiv as the owner of a parti prop There’s transfer of the right to the prop Assumed that the indiv rcvs the equivalent of the tax in the form of protection & benefits from the govt Generally there’s no limitation on the amnt of tax that may be imposed He rcvs the mrkt value of the prop taken from him Effect Benefits rcvd Amnt of imposition Rel to consti Is subj to certain consti limitations, including the prohib against impairment of oblig of contracts No amnt imposed but rather the owner is paid the mrkt value of the prop taken Inferior to the impairment prohib; govt cant expropriate priv prop, wc under contract it had, previously bound itself to purchase from the other contracting party Police power May be exerd only by the govt or its pol’t subdivisions Use of the prop is regulated for the purpose of promoting the gen welfare; not compensable Operates upon a community/class of indivs Theres no transfer of title. At most there’s restraint on the injurious use of prop Person affected rcvs indirect benefits as may arise from the maintenance of a healthy eco standard of society Amnt imposed shldnt be more than sufficient to cover the cost of the license & necessary expenses Relatively free from consti limitations. Its superior to the impairment provs; subj to the consti bec you cant just take prop wo it being subj to limitations *rem: If arguing for the govt: Commissioner v Algue (lifeblood theory) If arguing for the taxpayer: Roxas v CTA (golden egg rule) Incidental benefits to a priv indiv: Dsnt make the tax invalid so long as the initial stages are for a pub purpose Wnt affect validity for as long as its for a pub purpose Prohibition against delegation o Gen rule: only legis has the power to tax o Exceptions: Pres, LGU, admin agencies o Can congress remove the power to tax granted to LGUs? Cant do this wo the consti being violated But Congress can limit the power thru publication of the LGC o Power of the LGU to tax isn’t inherent Its only bec its placed in the consti, it can be remeoved o City govt v Bayantel: LGC affected several agencies B4 passed, these agencies has several exceptions o Pres: Provided in the consti & the Flexible Tariff Clause Grants the pres the power to: Increase or remove rates of import duties Estab import quota or ban imports Impose addtl duty on all imports Very limited power to tax – only whats stated is the consti & tax code o Admin agencies Actual imposition of taxes, extent, etc = congress What can be delegated: Power to value the prop/valuation Computation/assessment Collection BIR can issue regulations to provide guidelines But these issuances cant go beyond the legis intent o Commissioner v CA Loc brand: less taxes than imported RMC 37-93: sought to reclassify the brands as foreign brands Issued 2 days b4 promulgation of RA7654 wc increased the tax on cigs from 40 to 55% for foreign brands If this law was being passed, whats the need for the RMC? So BIR can collect more taxes from fortune tobacco They were forcing to include it as foreign brands Sc: RMC is void! Reclassification was dne wo notice 7 hearing Admin rule: merely interpretative of a primary legi Just needs issuance No rights affected Legis rule: in the nature of a subordinate legis designed to implement a primary legis Needs hearing & notice Rights are involved Exemptions of govt entities o Reason: fxn is for pub use/purpose o Sec27(c): everyone is subj to income tax, except: GSIS SSS PHIC PCSO PAGCOR o Roxas v CA: The power to tax is also called the power to destroy o Why? Meaning? Golden egg rule: lest the tax collector kill the hen that lays the golden egg LTO v Butuan Power to tax is inherent so not necessary that it be stated in the consti LTFRB still has J over the reg, etc LTO’s interpretation of the LGC was too exaggerated b) exclusively legislative in nature Only congress has the power to tax but there are exceptions Commissioner v Santos Jewelers assailing the taxes imposed on them o RTC judge declared the law unconsti Jewelers: taxes imposed on them were the highest in asia – wanted them reduced SC: judge encroached on the power of the legis to impose taxes o Bec the legis has the power to det certain details: Nature (kind) Extent (rate) Obj (purpose) Coverage (subjs) Situs (place) of tax o Judge did judicial legislation wc is prohibited c) taxpayer’s suit Lozada v Commissioner No standing For a taxpayer to file a case: act complained of shld involve the illegal disbursement of pub funds o If dnst involve this, not a taxpayers suit o In order for a case to be properly labeled as a taxpayers suit, this has to be present o But in every other case, there MUST be standing Bayan v Exec Sec Assailing the constitutionality of the VFA Taxpayer suit shld involve illegal disbursement of pub funds o Shld also show that the taxpayer will sustain or in danger of sustaining a direct inj Not really a taxpayer suit bec no illegal disbursement in the VFA d) inherent limitations Purpose is pub in nature o Taxes shld be imposed for a pub purpose o Ex) providing health care, infrastructure, support of govt itself (salaries, etc) o When ds pub purpose need to exist? Shld be present when the law is created & when money is disbursed (initial stages) o Even if upon disbursement, the pub purpose disappears, still leg so long as during the initial stages it had a pub purpose * but after the passage of RA _____ Pagcor is no longer included in the exemption o Mactan Cebu: Not exempt from taxes since their exemption had been w/drawn Not an agency or instrumentality, Mactan is a GOCC o Diff of Mactan v MIAA Mactan wasn’t exempt MIAA were exempt Prop was owned by the state but operated by a GOCC Considered as a govt instrumentality wc is why they’re exempt (since LGC says LG catn tax the Natl govt) And bec the props were owned by the state & under LGC, LG cant impose real prop tax on the natl govt & can only be taxed on taxable entities o BIR Ruling No 013-04 WON LGUs are subj to tax on their passive income? Can be taxed since dsnt fall under govt fxns International commity o Mitsubishi: Dissent is impt It wsnt their intention to do this, but this was the set-up *real world: ppl use the provs of the contract/treaty may be used to evade taxes Limitations to territorial jurisdiction o Taxes cant operate beyond the J/territorial limits of the state o Commissioner v BOAC: Asked in the bar bec of the Air Canada case (wc confirmed this ruling) Issue now: only those subj to income tax are flights from the phils to anthr place – cant tax those who dnt pass thru the phils CTA case: Air Canada o Dsnt matter if dsnt pass thru the phils, so long as they earn income in the phils, its taxable o Smith: Any person resident/alien, is covered by the NIRC He didn’t fall under the spcl law, wsnt a business /entity Argument: since there, you cant tax me But the exemption only covers the businesses Constitutional Limitations DP o Sison: a tax measure may be assailed for DP concerns o SC: a person can attack a tax on the basis of DP EP o Tan: shld be in the sme class Taxing auth can make valid classifications if the 4 reqs are satisfied Here, there was a valid classification o Phil Rural Electric Valid classification bec there’s a substantial distinction btwn cooperatives under the PP & RA 4 tests were applied o 4 tests: classification must (1) rest on substantial distinctions; (2) be germane to the purposes of the law; (3) not be limited to existing conditions only; and (4) apply equally to all members of the same class. Uniformity & Equity o Uniformity: invoked only for articles of the sme class, sme rate o Equity: tax shld be just Those w more shld pay more, those w less pay less = based on ability to pay Poll tax: fixed amtn w/in a spcfc territory o Cant be imprisoned but can be penalized for not paying on time o Exceptions: Franchises: bec congress can alter or amned this 2 reqs: (Phil Rural) o Impairs the oblig of the contract o Impairment is susbtnatial If the govt enters into a contract w a priv entity/indiv w consideration Govt cant just impair this July 14 Prohibition against infringement of religious freedom S5, A3: establishment clause o Prohibits govt from interfering w rel profession & worship ABS v City Mla: govt cant impose a license fee on the privilege of the exer of rel freedom o Tax exempt o But today, all the Christian bkstres are subj to tax = not considered disseminating info but for profit Appropriation of proceeds of taxation Prohibits appropriation for anything other than for a pub purpose If theres a purpose, tax shld be for that purpose only & any excess goes to the gen fund of the govt What is exempt from tax? All lands, bldgs, improvements actively, directly & exclusively (ADE) used for rel, charitable & educ purposes Only for prop/relaty taxes under LGC o Dsnt include other taxes Abra (landmark case) o “Used exclusively” extends to facilities wc are incidental to & necessary for the accomplishment of the purpose of the institution o “incidental” – SC expanded the meaning of the word “exclusive” If the activity is incidental to the primary purpose then its still considered exempt What ds the Consti say abt the tax exempt status of non-stock, non-profit…? Consti: ALL REVENUES & ASSETS those used ADE are tax exempt Prob: dept of finance issued several orders & BIR also made its own interpretation (why?) RMC 76-2003 o Any entitly w an EE is a w/holding agent for purposes of the w/holding tax o Passive income: exempt from the 20% final tax & 7 1/2 % tax on interest income except if they cant comply w the conds Dept Finance Order o Hospitals owned by schs & w/in sch premises are exempt from tax as an indispensable req to the operation of the schs RMC & DFO have similar provs o Aren’t these admin issuances against the consti prov wc says ALL revenues & taxes? o RMC & DFO say if conducted for profit – but all work for profit & all profit goes to the sch/used for educ purposes – but the admin issuances say otherwise (they say that if for profit, its taxable) o Ex) passive income – not in the consti o Consti says ADE – this is the only cond placed o But the issuances prescribe other conds – what abt this apparent conflict? RMC & DFO talk abt non-stock & non-profit o But a lot of schs operate for profit but they’re mostly proprietary schs (ex. Pre-schs) & its just proper that they’re taxed If non-stock, non-profit (ex UP, ADMU, La Salle, Poveda), dnt have stock corps, they dnt declare dividends o Its clear in the consti that ALL revenues & assets, ADE wc include incidental use are exempt o So what abt the issuances? o Issue nowadays bec all these schs have tax assessments (2004-2005) when BIR assessed them large amnts o All these schs have concessionaires who are taxed Regardless of how they got it, as long as its purposes are educational – exempt bec of the consti prov Its an industry issue Commissioner v CA: o So whats YMCA? It’s a recreation center o Definitely NOT an educational institution III. SITUS Place of taxation – shld be w/in J It’s a limitation to taxing power S42: enumerates the kinds of taxes wc can be taxed w/in or wo o To be levied w/ the tax, shld be w/in the J of the taxing power = but s42 seems to make exceptions o Ex) items purchased abroad = still taxed It appears that there’s really no just 1 rule Tangible prop: no longer where its located S42 seems to show that there are diff situs & diff rules apply as to what country/auth can tax it RULES: Income o o o tax Nationality principle: income is taxed based on citizenship Domiciliary principle: where he’s a resident Wc shld be followed? Bth are followed! If resident citizen = taxed worldwide Citizen, but OFW – Xtaxed outside, just w/in the phils Properties o Personal: mobilia suquuntur personam Prop follows the person bec it follows its principal Exception: s42, s104: wc estab the situs of shares of stock It follows the corps bonds – situs is the place where the corp is located/actually located = lex rei sitae o Real: where the prop is located = lex rei sitae A415: these are real prop Ex) if sell share of stock in Apple in the Phils This sale will be subj to tax in the US Results in multiplicity Fil, so taxed worldwide income but also taxed int eh US bec of the sale DST o Has diff rules o Supposedly taxed on the docum but under NIRC, also taxed on the transaction Fees o Situs – Gr: place where the payor resides bec that’s where the source is o But if resident of the Phils, taxed worldwide Metro Alliance Adapted the BOAC case Test of source: place where the source of income originates dets who’s the taxing J Source is the test when speaking of income Source: activity, industry that produced the income Multiplicity There are certain instances where the transaxn is taxed several times Course of axn of the got is to make sure that particular transaxns are protected: o Make a law to provide exemption or deductions o Enter into tax treaties Best way to less the burden of the tax payer What governs? The tax treaty or tax code? o Pacta sun servant principle o When we enter into treaties, we shld respect it & let it have the force & effect of law o Use the more beneficial prov GR: go 1st to the tax code o Since its what gives us the correct rate, etc o If you think the transaxn may be covered by a tax treaty prov, you can go to that prov Can you use the tax treaty wo getting any consent from the govt/BIR? o Since it’s a law anyway? o Need to get consent in order to apply the prov to you case? For 1 to avail of the tax treaty prov? o Ex) X, Ee of Co-A (a US Co); Co B (Phil Co) gets the services of CO A to install certain software Prob: CoA sends X to go to the Phils to install the software, X stays for 80 days RP-US treaty: business profit derived by a resident/permanent establishment (PE) If that treaty country has a PE or detd to be a PE in the Phils, that treaty Co will be taxed in the Phils & vv PE: an ofc, branch, business put up If that entity has done business in the Phils for 183 days (this # can change based on the treaty) X stayed in the Phils for 80 dys only – ds CoA have a PE? NO CoB pays CoA 1M Will the 1M be subj to w/holding b4 given to CoA? NO, bec no PE so can give the full amnt to CoA bec A isn’t subj to tax Wc do we use? *expanded w/holding tax: domestic or has a business in the Phils *final w/holding tax: if person is a non-resident If use the tax code prov: use the EWT If use the tax treaty: certain rate is applied FWT Taxpayer based it on the treaty, so paid FWT rate…BIR assessed them & said you shldve clarified 1st w the BIR to see if the transaxn is subj to the tax treaty CTA: you cant use it unilaterally – gotta check if you’re using the correct rate w the BIR & get a ruling In order to avail of a tax treaty prov, need to avail of an ITAD (intl tax affairs division) *for Maam: bad law *case is pending w the SC Ex) CoA got a ruling, CoB had the EXACT same transaxn & ddnt get a ruling anymore & instead applied the ruling CoA got CTA said this isn’t allowed, still need to get a ruling Maam: pt is its suppose to be precedents, so why do they still need to get anthr ruling? Impractical! CTA ruling: need to get a ruling for yourself Maam: kawawa yung taxpayer if he uses the treaty unilaterally bec BIR can suddenly assess them for millions/billions Is using it in GF bec believe it to be applicable & backed up by anthr ruling – what then? Maam: btr to just get a ruling now bec everyone is being assessed by the BIR – so best defense is that you have a ruling to back you up o o o o Double taxation Strict sense Same prop is taxed twice when it shld only be taxed once Elems: Same taxing auth Same purpose Same J Same pd Same kind/charac Broad sense Taxed twice, but permissible bec 1 elem is missing Not unconstitutional to have DT in the strict sense, but not obnoxious is used in the broad sense o Not unconsti bec theres no prov in the consti wc prohibits it But if you have DT in the strict sense, other consti provs may be hit = EP, DP, uniformity, etc o Thus, in this sense, it seems to still be unconsti o So may be unconstitutional for other reasons, but not for being DT China & Solidbank cases Asked in the bar – ppl said unfair bec speaks of GRT & FWT & percentage tax was said not to be included But what the examiner was really asking was DT & not the percentage tax I: WON the 20% w/holding tax forms part of gross rcpts? Saying they’ll be taxed twice, they only constrictively rcvd income Ct: even if constructive, still part of the income of the banks, still part of the taxable income of banks The 2 taxes are diff, taxed in diff pds = thus no DT in the strict sense but in the broad sense wc isn’t invalid IV. MEANS OF AVOIDING OR MINIMIZING THE BURDEN OF TAXATION Shifting: o Transferring the burden, passes it to someone else o Whats being shifted is the TAX BURDEN not the tax liab Tax evasion: o Use of illegal fraudulent means to lessen payment of tax o Tax dodging o 3 elems: Purpose/end to be achieved: to avoid or minimize tax Intent/state of mind: evil, willful or in BF Course of axn: unlawful o If any of these 3 elems are missing, not tax evasion Tax avoidance: o Uses legally permissible alternative tax rates or methods o Tax minimization o Not punishable by law o Ex) Delpher: transferred the props btwn owners to1 of their Cos o Ex) estate planning; investing in an IT business in an eco zone; get BIR incentives Exemption: An immunity & a privilege o Freedom from a charge or burden to wc others are subjected Tax remission/condonation o Surigao: state desists/refrains from exacting Tax amnesty o IVAP o 15-06: abatement only pertains to penalties o 9480: tax amnesty law Ex) if you pay a contractor, theres a w/holding tax of the contractor So you’re a w/holding agent of the govt, if don’t comply – disqualified Exclusion v deduction – distinction? o Exclusion: no longer added to GR income Not part of the items of GRI wc is added to come up w GRT o Deduction: add the total GRI then when tallied, you deduct Items the law allows to be deducted to come up w your net income Kinds of tax exemption: Implied: hard to rely on this If the law says exempt, this only covers direct taxes bec exemptions from indirect taxes aren’t favored o But if the law says direct & indirect, then both are exempt Nature of power to grant tax exemption Natl govt: wider than municipal o Bec the LG has no inherent power to tax & no inherent power to exempt Rationale for exemption Bec of the pub interest involved By giving exemptions, the ppl are benefitted Nature of tax exemption Considered odius Doctrine is stictissimi juris: strictly against the taxpayer & in favor of the govt Taxpayer shld show the law wc grants the exemption Personal in nature, cant be transferred PLDT v City of Davao o Removal was restored by the RA wc grants PLDTs franchise o RA came later – why ddnt this govern? Bec there was no spcfc prov o GR: tax exemptions are strictly construed, taxpayer shld pt out clearly the law Why wld the govt allow certain tax exemptions? o Bec of its purposes, thru exemptions, the govt achieves such purposes exception: exemption granted to rel, charitable & govt agencies o exemptions are applied liberally to them GR: Misamis Oritental Nestle o Just bec granted a tax refund for advance sales tax, dsnt mean you get a refund for custom duties as well July 21 V. SOURCES, APPLICATION, INTERPRETATION & ADMINSTRATION OF TAX LAWS Revenue rules & regulations Issued by the BIR They have diff purposes (RA00-01-03) RTAO: most popular now Revenue regs, BIR ruling, RMC = most impt ones Revenue Regulations: o Interpret a rule o Issued by the sec of finance (s244) But since usually busy, it comes from the BIR & he just signs o May be an admin or legis rule o Purpose: to clarify, put in effect tax laws & measures o Reqs b4 its issued: Procedural DP complied w: notice & hearing Must be published (A2,CC) Not contrary to law Reasonable w/in auth conferred ex) VAT: a lot of revenue regs were issued after this, they had particular hearings for particular sections/industries *Regional Revenue Memorandum Circular: issued by the Regional director BIR 018-05 Act is ultra vires bec not sanctioned by law RRMC was taxing the condos Regional Dir had no J to issue such, wsnt 1 of the powers delegated to him o CIR v Seagate technology Seagate is exempted – PEZA law is clear Seagate failed to submit an application, reqd by the BIR reg, for effective zero rating o Wc is why the CIR was trying to tax them But the PEZA law is clear that the equipt & capital goods are exempted from internal revenue laws & regs BIR reg cant prevail over the law – cant amend the law, it can only interpret Good case for taxpayers: bec says that just bec a reg adds a req, this cant defeat a law wc is lcear o No issuance can change a law wc is clear in order for BIR to justify its failure to refund Tuzon v CA Resolution No9 falls as a tax measure bec was obligatory o Obligatory effect & cond precedent to issuance of a permit Thus, since a tax ordinance/measure, to be valid, shld have notice, hearing, issued by the sec of finance, etc Hagonoy Filed a case 1 yr after the ordinance was enacted Law reqs that an appeal be filed w/in 30 dys Filed out of time so time barred, shld be dismissed Tax ordinances Issued by the local govt (sanggunian) Shld be patterned to the provs of the LGC LG is given a leeway by the LGC wc only prescribes a ceiling, thus LG can det for themselves what shld be imposed To Q it, appeal shld be filed w/in 30 dys from effectivity of the ordinance & even during its pendency Appeal shld be filed w the DOJ Jardine Davis Ddnt file the appeal w/in 30 dys Validity of the tax ordinance shldnt be uncertain for an unreasonable length of time Thus oppositions to such, shld be filed asap Nature of internal revenue laws Not political or penal in nature They’re civil Hilado v Collector: o Effectivity of such laws dnt depend on the sovereign power but continues until competent legis power changes this o Tax laws aren’t political but civil Ex) Taxpayer fails to pay taxes, one of the remedies of the govt are administrative remedies (ex. Levy, garnishment) thus, BIR/LGU has to follow certain notice reqs/procedures Directive: o Non-compliance wont render it void o Wont affect the rights or prop of taxpayers Thus no need for notice & hearing o Ex) BIR ruling addressed to industrial inspection – stated that its just directive o Ex) reportorial reqs of examiners – they have to comply w internal rules of the BIR; taxpayer cant say they ddnt follow it so cant be taxed = WRONG! Its an internal rule for guideline only o Construction of tax laws When legit intent is clear o Shld give the law reasonable construction w a view to carry out the intent o Commissioner v Solidbank Taxing act will be construed, intent & meaning of legi shld be ascertained, from its lang When there’s doubt o Collector v Todena: When theres doubt, shld be construed in favor of taxpayers, strictly against the govt bec taxes are burdens wc shldnt be imposed beyond what the statutes provide *Exception: tax exemptions shld be strictly construed against the taxpayer & liberally against the govt bec exemptions aren’t favored Tax measure: liberally against the taxpayer Application of revenue regs/rulings S246: IMPT!! GR: rulings cant be given retroactive effect o revocation, modification or reversal or rules & regs wont be given retroactive effect if prejudicial to the taxpayer exception: o misstates, omits facts o facts gathered by the BIR are diff from wc rulings are based taxpayer gets a favorable ruling, then later assessed – bec BIR commissioner ppl check if the facts represented are true & if they’re diff, despite the ruling, they’re assessed = difficult sit o acted in BF Commissioner v Telefunken: o S246: GR – not retroactive if prejudicial o Since there’s a qualifier, if its not prejudicial, then it can be retroactively applied Commissioner v Lhullier: o Diff btwn a legis & interpretative rule o Legis rule: subordinate legis Purpose: to implement a primary legis by providing details Needs notice & hearing o Interpretative rule: provides guidelines Just needs issuance o Bth admin issuances Commissioner v Benguet Corp: o Sale of gold to BSP/CB is zero percent o Prejudicial to taxpayer, so cant be given retroactive effect Mandatory v Directory provs Mandatory: o Relate to substantive laws If not followed, whole act is illegal or void o Effect of non-compliance: renders the act null & void o Reqs of notice & hearing o Ex) publication of revenues & regs (MIDTERM)