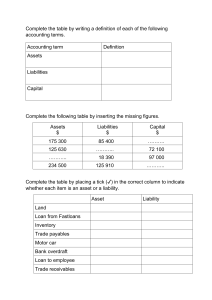

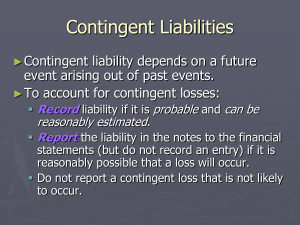

BM2019 LIABILITIES, PROVISIONS, AND CONTINGENCIES NATURE AND RECOGNITION OF LIABILITIES The IAS 37/PAS 37 Provisions, Contingent Liabilities, and Contingent Assets defines liability as “a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.” Based on the definition, a liability possesses the following essential characteristics: 1. Present obligation - This states that liability arises from a responsibility assumed by the enterprise. Present obligation can be either be legal or constructive. Legal obligation arises from contracts or any statutory requirements, while constructive obligation arises from established business practices that aim to maintain a good relationship with customers, as well as the community. 2. Past event - This states that liability originates from a past event or transaction. This past event is commonly known as an obligating event. This event puts an entity into a position to settle the present obligation, with no alternative courses of action. 3. Outflow of future economic benefits - This states that all accounting liability requires the payment of money, non-cash assets, or the performance of a certain service. Initial Recognition of Financial Liabilities PFRS 9 Financial Instruments provides that an entity shall measure a financial liability at its fair value minus, in the case of a financial liability, not at fair value through profit or loss, transaction costs that are attributable to the issue of the financial liability. Subsequent Recognition of Financial Liabilities After initial recognition, an entity shall measure a financial liability in accordance with the following (International Financial Reporting Standards, 2017): • An entity shall classify all financial liabilities as subsequently measured at amortized cost, except for: a. Financial liabilities at fair value through profit or loss. Such liabilities, including derivatives that are liabilities, shall be subsequently measured at fair value. b. Financial liabilities that arise when a transfer of a financial asset does not qualify for derecognition or when the continuing involvement approach applies. c. Financial guarantee contracts. After initial recognition, an issuer of such a contract shall (unless [a] or [b] applies) subsequently measure it at the higher of: I. the amount of the loss allowance determined in accordance with the rules on impairment; and II. the amount initially recognized less, when appropriate, the cumulative amount of income recognized in accordance with the principles of IFRS 15 Revenue from Contracts with Customers. d. Commitments to provide a loan at a below-market interest rate. An issuer of such a commitment shall (unless [a] applies) subsequently measure it at the higher of: I. the amount of the loss allowance determined in accordance with impairment; and 01 Handout 1 student.feedback@sti.edu *Property of STI Page 1 of 7 BM2019 II. the amount initially recognized less, when appropriate, the cumulative amount of income recognized in accordance with the principles of IFRS 15 Revenue from Contracts with Customers. e. Contingent consideration recognized by an acquirer in a business combination to which IFRS 3 Business Combinations applies. Such contingent consideration shall subsequently be measured at fair value with changes recognized in profit or loss. • An entity may, at initial recognition, irrevocably designate a financial liability as measured at fair value through profit or loss, or when doing so results in more relevant information, because either: a. It eliminates or significantly reduces a measurement or recognition inconsistency (sometimes referred to as ‘an accounting mismatch’) that would otherwise arise from measuring assets or liabilities or recognizing the gains and losses on them on different bases; or b. A group of financial liabilities is managed, and its performance is evaluated on a fair value basis, in accordance with a documented risk management or investment strategy. Information about the group is provided internally on that basis to the entity’s key management personnel (as defined in IAS 24 Related Party Disclosures), for example, the entity’s board of directors and chief executive officer. CLASSIFICATION OF LIABILITIES PAS 1 Presentation of Financial Statements provides two (2) classifications for liability: current liability and non-current liability. Current Liabilities As discussed in PAS 1, an entity shall classify a liability as current when (International Financial Reporting Standards, 2001): • It expects to settle the liability in its normal operating cycle; • It holds the liability primarily for the purpose of trading; • The liability is due to be settled within 12 months after the reporting period; or • It does not have an unconditional right to defer settlement of the liability for at least 12 months after the reporting period. Terms of a liability that could, at the option of the counterparty, result in its settlement by the issue of equity instruments do not affect its classification. Some current liabilities, such as trade payables and some accruals for employee and other operating costs, are part of the working capital used in the entity’s normal operating cycle. An entity classifies such operating items as current liabilities even if they are due to be settled more than 12 months after the reporting period. The same normal operating cycle applies to the classification of an entity’s assets and liabilities. When the entity’s normal operating cycle is not clearly identifiable, it is assumed to be 12 months (International Financial Reporting Standards, 2001). Other current liabilities are not settled as part of the normal operating cycle, but are due for settlement within 12 months after the reporting period or held primarily for trading. Examples of these liabilities are as follows (International Financial Reporting Standards, 2001): • Financial liabilities that meet the definition of held for trading; • Bank overdrafts; • Current portion of non-current financial liabilities; 01 Handout 1 student.feedback@sti.edu *Property of STI Page 2 of 7 BM2019 • Dividends payable; • Income taxes; and • Other non-trade payables. Financial liabilities that provide financing on a long-term basis (i.e. not part of the working capital used in the entity’s normal operating cycle) and are not due for settlement within 12 months after the reporting period are non-current liabilities (International Financial Reporting Standards, 2001). Non-Current Liabilities All other liabilities not qualified for recognition under current liability shall be classified as non-current. Non-current liabilities include (Valix, Peralta, & Valix, 2017): • Non-current portion of long-term debt; • Finance lease liability; • Deferred tax liability; • Long-term obligation to entity officers; and • Long-term deferred revenue. Rules on Classifying Long-Term Debt due within 12 Months An entity classifies its financial liabilities as current when they are due to be settled within 12 months after the reporting period, even if (International Financial Reporting Standards, 2001): • The original term was for a period longer than 12 months; and • An agreement to refinance, or to reschedule payments, on a long-term basis is completed after the reporting period and before the financial statements are authorized for issue. If an entity expects, and has the discretion, to refinance or roll over an obligation for at least 12 months after the reporting period under an existing loan facility, it classifies the obligation as non-current, even if it would otherwise be due within a shorter period. However, when refinancing or rolling over the obligation is not at the discretion of the entity (e.g. there is no arrangement for refinancing), the entity does not consider the potential to refinance the obligation and classifies the obligation as current (International Financial Reporting Standards, 2001). Rules on Breaches of Provision in a Long-Term Loan Arrangement As discussed in PAS 1, paragraph 74, when an entity breaches a provision of a long-term loan arrangement on or before the end of the reporting period with the effect that the liability becomes payable on demand, it classifies the liability as current, even if the lender agreed, after the reporting period and before the authorization of the financial statements for issue, not to demand payment as a consequence of the breach. An entity classifies the liability as current as the entity does not have an unconditional right to defer settlement of the liability for at least 12 months after the reporting period. However, an entity classifies the liability as non-current if the lender agreed by the end of the reporting period to provide a period of grace ending at least 12 months after the reporting period, within which the entity can rectify the breach and during which the lender cannot demand immediate repayment (International Financial Reporting Standards, 2001). 01 Handout 1 student.feedback@sti.edu *Property of STI Page 3 of 7 BM2019 ACCOUNTING FOR PROVISIONS A provision is an account maintained by an entity to cover an expected liability even though the amount and timing are uncertain. The uncertainty in provision is its salient feature that makes it distinct from the other types of liabilities. Provision is not a form of savings; instead, it serves as the repository account for the upcoming outflow of economic resources. Provisions, being considered as liability, require some essential characteristics for its recognition. As stated in PAS 37, a provision shall be recognized when (International Financial Reporting Standards, 2001): a. An entity has a present obligation (legal or constructive) as a result of a past event; b. It is probable that an outflow of resources embodying economic benefits will be required to settle the obligation; and c. A reliable estimate can be made of the amount of the obligation. If these conditions are not met, no provision shall be recognized. In rare cases, it is not clear whether there is a present obligation or not. In those cases, a past event is deemed sufficient to give rise a present obligation if, taking account of all evidence, it is more likely than not that a present obligation exists at the end of the reporting period. For example, in a lawsuit, it may be disputed whether certain events have occurred or whether those events result in a present obligation. An entity determines the recourse for this action by taking account all pieces of evidence that exist at the end of the reporting period, such as the opinions of experts (International Financial Reporting Standards, 2001). Based on such evidence, the following are the rules for recognition: Existence of Present Obligation More likely than not (Probable) Possible Remote Classification Provision (if recognition criteria are met) Contingent Liability None Accounting Treatment Recognize by debiting an expense or loss account and crediting a liability Disclose Ignore (Neither recognize nor disclose) Measurement of a Provision According to PAS 37, the amount recognized as a provision shall be the best estimate of the expenditure required to settle the present obligation at the end of the reporting period. Best estimate is the conclusion done by any technical or legal experts, which is usually based on past experiences and similar courses of events or circumstances. As stated in PAS 37, the risks and uncertainties that inevitably surround many events and circumstances shall be taken into account in reaching the best estimate of a provision. The following are the rules in arriving at the best estimate of a provision: • If a single obligation is measured, the most likely outcome is the best estimate of a provision. Where there is a continuous range of possible outcomes and each point in that range is as likely as any other, the midpoint of the range is used (Valix, Peralta, & Valix, 2017). • If a group of items is being measured, the expected value is the best estimate of a provision. 01 Handout 1 student.feedback@sti.edu *Property of STI Page 4 of 7 BM2019 Expected value is a statistical method of estimating provisions, which weighs all possible outcomes by their associated possibilities (Valix, Peralta, & Valix, 2017). Illustrative Problem 1 - Adapted (Putra, 2018) Perfectly Inc. is an entity that explores oil off the shores of Sea Oil Islands. It has employed oil exploration experts from around the globe. Despite all efforts, a major oil spill has grabbed the attention of the media. Because of several protests, the entity has engaged lawyers to address any legal repercussions. In the past, other oil entities have had to settle with the environmentalists by paying huge amounts in out-of-court settlements. The legal counsel of Perfectly Inc. has advised it that no law would require it to pay anything for the oil spill. The Government of Sea Oil Islands is currently considering such legislation, but that legislation would probably take another year to be finalized as of the date of the oil spill. However, in its television advertisements and promotional brochures, Perfectly Inc. often has clearly stated that it is very conscious of its responsibilities toward the environment and will make good any losses that may result from its exploration. This policy has been widely publicized, and the chief executive officer had acknowledged this policy in official meetings when members of the public raised questions to him on this issue. Requirement: Is there any obligating event that requires Perfectly Inc. to make provision? Illustrative Problem 2 - Adapted (Putra, 2018) ABC Enterprises owns a workshop for servicing cars under warranty. In preparing its financial statements, ABC needs to ascertain the provision of warranty that it would be required to provide at year-end. The entity’s past experience with warranty claims are the following: • • • 60% of cars sold in a year have zero defects; 25% of cars sold in a year have normal defects; and 15% of cars sold in a year have significant defects. The cost of rectifying a “normal defect” in a car is P10,000 while the cost of rectifying a “significant defect” is P30,000. Requirement: Compute the amount of provision for warranty at year-end. Illustrative Problem 3 - Adapted (Robles & Empleo, 2016) JKL Company is charged with multiple lawsuits from the stampede incident that caused the death of 80 persons. The said incident was due to the sales promotion they featured on ABC channel on Feb. 10, 2X16. JKL’s legal counsels believe that it is probable that JKL would be found liable for the incident. 01 Handout 1 student.feedback@sti.edu *Property of STI Page 5 of 7 BM2019 As of the date of the issuance of 2X16 financial statements, a reasonable estimate of the obligation is between P16,000,000 to P24,000,000. Each point within the range is as likely as any other. Requirement: Compute the amount of provision at year-end. ACCOUNTING FOR CONTINGENCIES PAS 37, paragraph 10 defines a contingent liability in two (2) ways (Valix, Peralta, & Valix, 2017): • • A contingent liability is a possible obligation that arises from past event, and whose existence will be confirmed only by the occurrence or non-occurrence of one (1) or more uncertain future events not wholly within the control of the entity. A contingent liability is a present obligation that arises from past event. It is not recognized for financial statement purposes because (1) it is not probable that an outflow of resources will be required to settle the obligation or (2) the amount of the obligation cannot be measured reliably. Accounting Treatment for Contingent Liability A contingent liability shall not be recognized in the financial statements but shall be disclosed only. The required disclosures concerning this type of liability are as follows (Valix, Peralta, & Valix, 2017): a. Brief description of the nature of the contingent liability; b. An estimate of its financial effects; c. An indication of the uncertainties that exist; and d. Possibility if any reimbursement. If contingent liability is remote, no disclosure is necessary. REQUIRED DISCLOSURES For each class of provision, an entity shall disclose: • The carrying amount at the beginning and end of the period; • Additional provisions made in the period, including increases to existing provisions; • Amounts used (i.e. incurred and charged against the provision) during the period; • Unused amounts reversed during the period; and • The increase during the period in the discounted amount arising from the passage of time and the effect of any change in the discount rate. Comparative information is not required. An entity shall disclose the following for each class of provision: • A brief description of the nature of the obligation and the expected timing of any resulting outflows of economic benefits; • An indication of the uncertainties about the amount or timing of those outflows. Where necessary to provide adequate information, an entity shall disclose the major assumptions made concerning future events; and • The amount of any expected reimbursement, stating the amount of any asset that has been recognized for that expected reimbursement. 01 Handout 1 student.feedback@sti.edu *Property of STI Page 6 of 7 BM2019 References International Financial Reporting Standards. (2001). IAS 1 Presentation of Financial Statements. Retrieved on April 1,2019, from https://www.ifrs.org/issued-standards/list-of-standards/ias-1presentation-of-financial-statements International Financial Reporting Standards. (2001). IAS 37 Provisions, Contingent Liabilities and Contingent Assets. Retrieved on April 1,2019, from https://www.ifrs.org/issued-standards/listof-standards/ias-37-provisions-contingent-liabilities-and-contingent-assets International Financial Reporting Standards. (2017). IFRS 9 Financial Instruments. Retrieved on April 1,2019, from https://www.ifrs.org/issued-standards/list-of-standards/ifrs-9-financialinstruments Putra, L. D. (2018). Recognition and measurement of provision. Retrieved on April 1,2019, from http://accounting-financial-tax.com/2009/04/recognition-and-measurement-of-provisionadapted-from-ias-37 Robles, N. S. & Empleo, P. M. (2016). Intermediate accounting (Vol 1). Mandaluyong: Millenium Books, Inc. Valix, C. T., Peralta, J. F., & Valix, C. A. (2017). Financial accounting (Vol. 1). Manila: GIC Enterprises & Co., Inc. 01 Handout 1 student.feedback@sti.edu *Property of STI Page 7 of 7