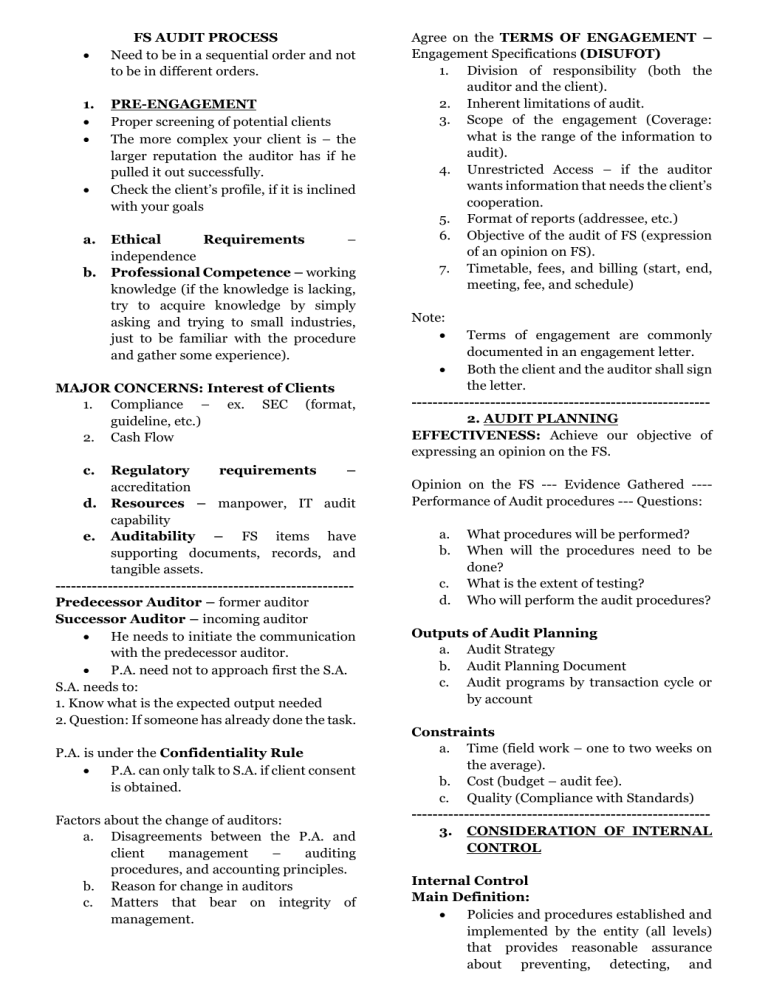

1. a. b. FS AUDIT PROCESS Need to be in a sequential order and not to be in different orders. PRE-ENGAGEMENT Proper screening of potential clients The more complex your client is – the larger reputation the auditor has if he pulled it out successfully. Check the client’s profile, if it is inclined with your goals Ethical Requirements – independence Professional Competence – working knowledge (if the knowledge is lacking, try to acquire knowledge by simply asking and trying to small industries, just to be familiar with the procedure and gather some experience). MAJOR CONCERNS: Interest of Clients 1. Compliance – ex. SEC (format, guideline, etc.) 2. Cash Flow c. Regulatory requirements – accreditation d. Resources – manpower, IT audit capability e. Auditability – FS items have supporting documents, records, and tangible assets. --------------------------------------------------------Predecessor Auditor – former auditor Successor Auditor – incoming auditor He needs to initiate the communication with the predecessor auditor. P.A. need not to approach first the S.A. S.A. needs to: 1. Know what is the expected output needed 2. Question: If someone has already done the task. P.A. is under the Confidentiality Rule P.A. can only talk to S.A. if client consent is obtained. Factors about the change of auditors: a. Disagreements between the P.A. and client management – auditing procedures, and accounting principles. b. Reason for change in auditors c. Matters that bear on integrity of management. Agree on the TERMS OF ENGAGEMENT – Engagement Specifications (DISUFOT) 1. Division of responsibility (both the auditor and the client). 2. Inherent limitations of audit. 3. Scope of the engagement (Coverage: what is the range of the information to audit). 4. Unrestricted Access – if the auditor wants information that needs the client’s cooperation. 5. Format of reports (addressee, etc.) 6. Objective of the audit of FS (expression of an opinion on FS). 7. Timetable, fees, and billing (start, end, meeting, fee, and schedule) Note: Terms of engagement are commonly documented in an engagement letter. Both the client and the auditor shall sign the letter. --------------------------------------------------------2. AUDIT PLANNING EFFECTIVENESS: Achieve our objective of expressing an opinion on the FS. Opinion on the FS --- Evidence Gathered ---Performance of Audit procedures --- Questions: a. b. c. d. What procedures will be performed? When will the procedures need to be done? What is the extent of testing? Who will perform the audit procedures? Outputs of Audit Planning a. Audit Strategy b. Audit Planning Document c. Audit programs by transaction cycle or by account Constraints a. Time (field work – one to two weeks on the average). b. Cost (budget – audit fee). c. Quality (Compliance with Standards) --------------------------------------------------------3. CONSIDERATION OF INTERNAL CONTROL Internal Control Main Definition: Policies and procedures established and implemented by the entity (all levels) that provides reasonable assurance about preventing, detecting, and correcting material misstatements in a timely manner. Keywords: Policies (concept or idea) and procedures (action to implement idea) Ex. Only authorized personnel are in the company (Policy), No ID no entry (Procedure) Established and implemented by the entity (all levels) Provides reasonable assurance about achievement of entity objectives (financial reporting, efficiency and effectiveness of operations, compliance) Broad in scope – FS audits are concerned – controls about preventing, detecting, and correcting material misstatements in a timely manner. (to reduce the chance of mistakes). Related to FS is the only needed to be checked. Note: If controls are strong or reliable (can prevent, can detect and correct misstatements in a timely manner) – the unaudited FS is expected to contain less amount of material misstatements – update our audit plan to reflect less amount of planned audit tests. If controls are weak or unreliable or missing (cannot prevent, cannot detects and correct misstatements in a timely manner) – the unaudited FS is expected to contain a lot of material misstatements – update our audit plan to reflect more amount of planned audit tests. ---------------------------------------------------------Sir George’s Tip: AUD – Aud theory – AAP, AAP-SI, Enhancement Review FAR – Basic, IA1-3, Auditing Problems, Enhancement review AFAR MAS Tax – Tax 1 & 2, Enhancement review, constant update. RFBT Policies and procedures Tax – read the latest textbook in tac (every day, 5 pages of tax, 2 problems) AUD – read and record our handouts in Auditing, 10 theory questions) Purchasing Cycle 1. Request for goods Any department Purchase requisition form (prenumbered, date, requesting department, quantity and description of goods requested, date needed) o Necessity Test (is it needed? Is it urgent? Do we have a budget?) o It is not sufficient that the company has a lot of money, monitory of control is necessary. o Approved by appropriate level of management (department manager, counter-signed by someone higher than department manager) o Approved purchase requisition form forwarded to the purchasing department 2. Prepare and send a purchase order to the vendor Purchasing Department Received Purchase requisition form – o Not asked with the necessity test since it is done in the first part. o What is asked here, who is the authorized vendor? Check authorized vendor list (vendors must be accredited based on reputation and past experience) approved by top management Request for quotations from qualified vendors. Select the appropriate vendor and prepare the purchase order form (prenumbered, date, supplier name and contact, quantity and description of goods ordered, date needed, offered price, offered terms) – PO must be approved by purchasing manager. PO is sent to the vendor (inform the vendor), another copy of the PO (without quantity) shall be sent to the receiving department, another copy of the PO (with quantity) shall be sent to the accounting department (AP). Lead Time – time waiting for the ordered foods to arrive. 3. Receive ordered goods from the vendor Receiving Department Receive the “blind” PO from the purchasing department – aware that goods are coming. Goods arrived o Receiving department shall check the PO and check identity of delivery personnel o Count the goods, fill up the blind copy PO (essence of the without quantity, is to oblige the personnel to count the items delivered), inspect the goods for any damage. o Vendor shall request receiving department to sign a delivery receipt (DR) Receiving report (date received, who received the goods, name of delivery personnel, quantity and description of goods received, time of receipt) vs purchase order (asking first if there is a purchase order before receiving items) Blind copy of PO (filled-up), receiving report – filed in the receiving department Goods will be sent to the warehousing department (if inventory) or to the department that requested for the goods (ex. Supplied). Receiving report duplicate – sent to the accounting department (AP terms, Freight terms) AP Subdepartment – receives the receiving report from the receiving department 4. Receive the vendor’s invoice Receptionist’s Area Vendor’s invoice (pre-numbered, date of sale, name of the customer, quantity and description of goods sold by vendor, amount due, due date, credit terms, and freight terms (shipping point or destination) Vendor’s invoice is forwarded to the Accounting Department (AP subdepartment) AP-subdepartment – o Reconciliation: Purchase order + receiving report + vendor’s invoice (If all the same amounts from these three sources, we can record the transaction) Record the purchase in the purchase journal, P10,000 o Update the AP subsidiary ledger of the vendor, P10,000 (subsidiary ledger – individual record for each supplier) o Weekly or monthly, the totals of all recorded purchases shall be forwarded to the General Ledger sub-department (Accounting) GL-subdepartment (Accounting) o Gets the totals of recorded purchases from APsubdepartment. Record summary entry in the General Journal: o Ex. Purchases P10,000 AP P10,000 Posting is done to the General Ledger Monthly or more frequently, reconciliation is done between GL and SL. 5. Pay the amount due to the vendor Before you pay the amount due, there is an authorization in a form of voucher 3 types of vouchers 1. Journal vouchers – to authorize journal entries 2. Check vouchers – to authorize check disbursements 3. Petty cash voucher – to authorize small disbursements from the petty cash fund. Treasury Department Prepares check for the amount due (date, vendor’s name, amount in figures and words, signature) – the treasurer will put the signature in the check. Forwarded to check releasing department. Receive official receipt from the vendor (pre-numbered, date of collection, customer’s name, amount received). Ex. AP P10,000 Cash P10,000 Note: If we will notice, where is the accounting department? It is not present in the façade of the business but the backoffice workers, recording the transactions. All events in the company should be authorized by the manager. 09-22-2022 AP – Specialized Industry 1. Banking Industry Compliance Major Concern of specialized industry: to understand what the users looking for (information) Hardest Fraud to Detect: Fraud that is no record, no document Note: Always get a receipt 90% the auditor cannot detect of fraud. 10% part of the employees will told the auditor (possible he has something negative intention to the company). 2. Real Estate 3. Insurance 4. Telco 5. Transport and Logistics 6. Hotels Scapegoating Someone who has a problem with the company and in return he will drag the company down. 1. COST CENTER To minimize cost, no income (Goal) Maintain or exceed quality Ex. Certifications, quotas on trainings 2. REVENUE CENTER Goal: Maximize income, sales target. 3. PROFIT CENTER Revenue and cost are handled by this center. Ex. Departments in Schools 4. INVESTMENTS CENTERS Ex. Facilities Steps: 1. Determine the cost Ex. AL G. DRIX V. Budget 1M 1M Actual (900k) (1,050M) Favorable 100k Unfav. (50k) BOD: JJ URO – Pilinas First GEORGE J – Knights of Rizal JULIUS A – Stat. Int’l Inc. JJ Uro and George J will invest correlating to the values or purpose of the budget of Drix. Auditor’s Work Is to track inconsistent expenses of the company Common misleading evidence is the personal expenses charged to the company. Even if there is a receipt, ask or know what is the purpose of the purchase. Technique to talk to client: 1. Have a good approach with the client, have an approachable intro, and disclosing what is done by the auditor. 2. Give the client a chance to talk with his side. 3. Give the possible recommendation, if there is a problem. Auditors should talk to: Secretary, Janitors, and Drivers – Ask for their permission to have a recording with their statements. Know your client (background, culture and others). BSP – Manual Regulation for Banks Products of the Bank 1. Deposits; and 2. Loans – can be paid through non-cash asset. ROPOA (Real and Other Properties Owned and Acquired) Cash xx Deposit Liability xx Loans Rec. xx Cash xx Interest Inc. xx Credit loss (bad debt) xx Allow. – CL xx DOSRI (Director, Officer, Shareholders and Other Related Interest) --------------------------------------------------------REAL ESTATE How the company earns w/ Real Estate – Malls will purchase land beside it and sell it high (creating subdivisions). Buy them low and sell them high. It also allows traffic (customers) 1. Rent of Tenants 2. Products in supermarket (consignment) 3. Peripheral Income – Parking Fees