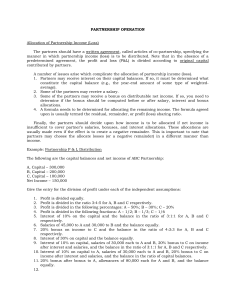

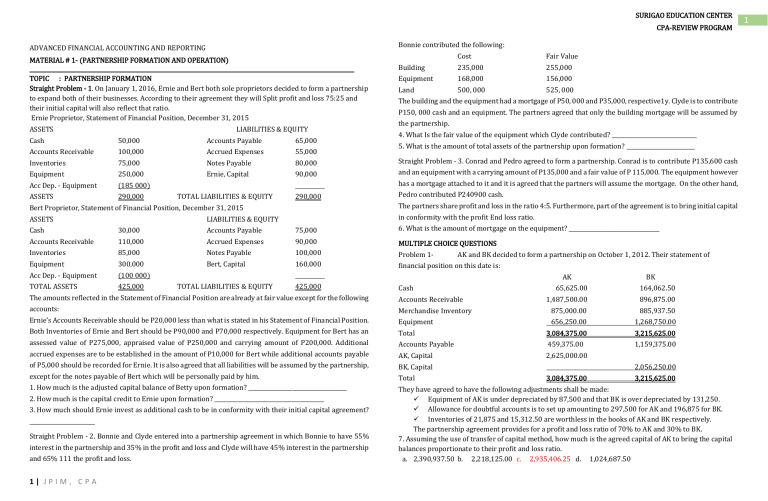

SURIGAO EDUCATION CENTER CPA-REVIEW PROGRAM Bonnie contributed the following: ADVANCED FINANCIAL ACCOUNTING AND REPORTING MATERIAL # 1- (PARTNERSHIP FORMATION AND OPERATION) TOPIC : PARTNERSHIP FORMATION Straight Problem - 1. On January 1, 2016, Ernie and Bert both sole proprietors decided to form a partnership to expand both of their businesses. According to their agreement they will Split profit and loss 75:25 and their initial capital will also reflect that ratio. Ernie Proprietor, Statement of Financial Position, December 31, 2015 ASSETS LIABILITIES & EQUITY Cost Fair Value Building 235,000 255,000 Equipment 168,000 156,000 Land 500, 000 525, 000 The building and the equipment had a mortgage of P50, 000 and P35,000, respective1y. Clyde is to contribute P150, 000 cash and an equipment. The partners agreed that only the building mortgage will be assumed by the partnership. 4. What Is the fair value of the equipment which Clyde contributed? _______________________________ Cash 50,000 Accounts Payable 65,000 Accounts Receivable 100,000 Accrued Expenses 55,000 Inventories 75,000 Notes Payable 80,000 Straight Problem - 3. Conrad and Pedro agreed to form a partnership. Conrad is to contribute P135,600 cash Equipment 250,000 Ernie, Capital 90,000 and an equipment with a carrying amount of P135,000 and a fair value of P 115,000. The equipment however Acc Dep. - Equipment (185 000) ASSETS 290,000 5. What is the amount of total assets of the partnership upon formation? _________________________ has a mortgage attached to it and it is agreed that the partners will assume the mortgage. On the other hand, TOTAL LIABILITIES & EQUITY 290,000 Pedro contributed P240900 cash. Bert Proprietor, Statement of Financial Position, December 31, 2015 The partners share profit and loss in the ratio 4:5. Furthermore, part of the agreement is to bring initial capital ASSETS in conformity with the profit End loss ratio. LIABILITIES & EQUITY Cash 30,000 Accounts Payable 75,000 6. What is the amount of mortgage on the equipment? _________________________________ Accounts Receivable 110,000 Accrued Expenses 90,000 MULTIPLE CHOICE QUESTIONS Inventories 85,000 Notes Payable 100,000 Problem 1- Equipment 300,000 Bert, Capital 160,000 financial position on this date is: Acc Dep. - Equipment (100 000) TOTAL ASSETS 425,000 TOTAL LIABILITIES & EQUITY 425,000 Cash AK and BK decided to form a partnership on October 1, 2012. Their statement of AK BK 65,625.00 164,062.50 1,487,500.00 896,875.00 875,000.00 885,937.50 The amounts reflected in the Statement of Financial Position are already at fair value except for the following Accounts Receivable accounts: Merchandise Inventory Ernie’s Accounts Receivable should be P20,000 less than what is stated in his Statement of Financial Position. Equipment 656,250.00 1,268,750.00 Both Inventories of Ernie and Bert should be P90,000 and P70,000 respectively. Equipment for Bert has an Total 3,084,375.00 3,215,625.00 assessed value of P275,000, appraised value of P250,000 and carrying amount of P200,000. Additional Accounts Payable 459,375.00 1,159,375.00 accrued expenses are to be established in the amount of P10,000 for Bert while additional accounts payable AK, Capital 2,625,000.00 of P5,000 should be recorded for Ernie. It is also agreed that all liabilities will be assumed by the partnership, BK, Capital except for the notes payable of Bert which will be personally paid by him. Total 1. How much is the adjusted capital balance of Betty upon formation? ____________________________________ They have agreed to have the following adjustments shall be made: Equipment of AK is under depreciated by 87,500 and that BK is over depreciated by 131,250. Allowance for doubtful accounts is to set up amounting to 297,500 for AK and 196,875 for BK. Inventories of 21,875 and 15,312.50 are worthless in the books of AK and BK respectively. The partnership agreement provides for a profit and loss ratio of 70% to AK and 30% to BK. 7. Assuming the use of transfer of capital method, how much is the agreed capital of AK to bring the capital balances proportionate to their profit and loss ratio. a. 2,390,937.50 b. 2,218,125.00 c. 2,935,406.25 d. 1,024,687.50 2. How much is the capital credit to Ernie upon formation? ________________________________________ 3. How much should Ernie invest as additional cash to be in conformity with their initial capital agreement? ________________________ Straight Problem - 2. Bonnie and Clyde entered into a partnership agreement in which Bonnie to have 55% interest in the partnership and 35% in the profit and loss and Clyde will have 45% interest in the partnership and 65% 111 the profit and loss. 1| JP I M , C P A 2,056,250.00 3,084,375.00 3,215,625.00 1 SURIGAO EDUCATION CENTER CPA-REVIEW PROGRAM Problem 2On March 15, 2012, Kung Fu Panda and Beauty Gerone formed a partnership, agreeing to share for profits and losses in the ratio of 1:1. Kung Fu Panda invested 100,000 cash and Beauty Gerone contributed a land costing 50,000. The land has a zonal value of 75,000. However, on the same date, three hours after the formation, the land was sold for 60,000. 8. After the land was sold, what is the capital balance of Beauty Gerone? a) 50,000 b) 75,000 c. 60,000 d) none of the above 9. On March 16, 2012, what are the total assets of the partnership provided no other transactions took place other than the sale of the land? a. 100,000 b. 150,000 c. 175,000 d) none of the above Problem 3 - Rea Mie and Dixie formed a partnership with each contributing the following assets: Rea Mie Dixie Cash……………………………………… 300,000 700,000 Machinery and Equipment……… 250,000 750,000 Building………………………………… 2250,000 Furnitures and Fixtures………… 100,000 The Building has a historical cost of 2250,000, a zonal value of 2,000,000 but with a fair market value of 3,000,000. It is also subject to a mortgage loan of 800,000, which is to be assumed by the partnership. The Machinery & Equipment of Rea has a book value of 250,000 and an appraised value of 400,000. Rea Mie and Dixie agreed to share profits and Losses of 30% and 70% respectively. 10. On the date of partnership formation, what is the capital balance of Rea Mie? a. 650,000 b) 800,000 c) 1,000,000 d) none of the above 11. On the date of Partnership formation, what is the capital balance of Dixie? a) 3,700,000 b) 3,450,000 c) 4,450,000 d) none of the above 12. What is the capital balance of Dixie if the mortgage is not assumed by the partnership? a) 2,900,000 b) 2,650,000 c) 4,450,000 d) none of the above 13. What is the total assets of the partnership if the mortgage loan stated is not assumed by the Partnership? a) 5,250,000 b) 4,350,000 c) 5,100,000 d) 4,250,000 14. What is the total assets of the partnership if the mortgage loan stated is assumed by the Partnership? a) 5,250,000 b) 4,350,000 c) 5,100,000 d) 4,250,000 15. What is the Total Liabilities of the Partnership if mortgage Loan is assumed by the partnership? a) 0 b) 800,000 c) 900,000 d) none of the above 16. On August 1, AA and BB pooled their assets to form a partnership, with the firm to take over their business assets and assume the liabilities. Partners capitals are to be based on net assets transferred after the following adjustments. (Profit and Loss are allocated equally.) BB’s inventory is to be increased by 4000; an allowance for doubtful accounts of 1000 and 1500 are to be set up in the books of AA and BB respectively; and accounts payable of 4,000 is to be recognized in AA’s books. The individual trial balances on August 1, before adjustments, follow: AA BB Assets…………………………………. 75,000 113,000 Liabilities…………………………….. 5000 34,500 2| JP I M , C P A What is the capital of AA and BB after the above adjustments? a) AA, 68,750; BB, 77,250 b) AA, 75,000; BB 81,000 c) AA, 65,000; BB 76,000 d) AA, 65,000; BB 81,000 17. CC admits DD as a Partner in business. Accounts in the ledger for CC on November 30,2012, just before the admission of DD, show the following balances: Cash………………………………………………………………….. 6,800 Accounts Receivable………………………………………… 14,200 Merchandise Inventory…………………………………… 20,000 Accounts Payable…………………………………………….. 8,000 CC capital………………………………………………………….. 33,000 It is agreed that for the purposes of establishing CC’s interest, the following adjustments shall be made: An allowance for doubtful accounts of 3% of the accounts receivable is to be established. The merchandise inventory is to be valued at 23,000 Prepaid salary expenses of 600 and accrued rent expense of 800 are to be recognized. CC’s adjusted capital balance is: a) 35,174 b.) 35,374 c. )36,374 d.) 28,174 18. If DD is to invest sufficient cash to obtain a 1/3 interest in the partnership, what is the amount of cash investment by DD? a) 11,971 b.) 17,687 c.) 18,487 d) 14,087 PARTNERSHIP OPERATIONS Straight Problem – 1 Alexander, Javier and Gabriel formed a partnership on January 1, 2011 with initial capital contribution 450,000, 562,500 and 675,000 respectively. The partnership agreement provides that income be shared among the partners as follows: Salaries are to be provided for Alexander, Javier and Gabriel amounting to 67,500, 54,000 and 40,500 respectively. Interest of 12% on the average capital during 2011 are to be given to Alexander, Javier and Gabriel. Bonus of 5% of the net income before salaries and interests is to be given to Alexander. Any remainder is to be divided among the partners using the ratio 1:2:2 respectively. The partnership treats the partner’s salaries as part of their operating expenses. The net income reported for the year ending December 31, 2011 amounted to 234,000. Alexander contributed additional capital of 67,500 on July 1 and made a withdrawal of 22,500 on October 1; Javier contributed additional capital of 45,000 on August 1 and made a withdrawal of 22,500 on October 1 and Gabriel made a withdrawal of 67,500 on November 1. 1. Compute the share of the net income of Alexander: ___________________________. 2. 3. Compute the share of the net income of Javier: ___________________________. Compute the share of the net income of Gabriel: ___________________________. 2 SURIGAO EDUCATION CENTER CPA-REVIEW PROGRAM Straight Problem 2. A, B, and C are engaged in a merchandising business. The capital accounts in the ABC Partnership in 2016 are as follows: A B C January 1 100,000 150,000 120,000 April 1, withdrawal 5,000 May1, investment 10,000 15,000 August1, investment 15,000 December 1, withdrawal 6,500 30,000 The partners agreed on the following terms: a. 8% interest on the average capital balances. b. Quarterly salaries of P75,000, P55, 000, P68, 000 A, B, C, respectively. c. Bonus of 5% of income before tax after his interest, his salary and bonus is given to B. d. The remainder will be divided in the ratio 2: 3: 4. For the year ended, the partnership has a credit balance in the income summary account of P550,000. The relevant tax rate during the year is 20%. 4. How much 13 the share of partner B in the net income? ____________________________________ 5. How much is the capital ba1ance of partner A on December 31,2016? ______________________________ Straight Problem 3. M, N, and O are partners sharing profit and loss. The combined salaries of M and 0 amount to P175,000 while the combined salaries of M and N total P165,000. The partners paid total interest of P33,500 of which M and 0 received P21,700 in total which is P2,600 less than what M and N received in total. M as the managing partner received a bonus of P10,500. The partners share the remainder in the ratio 25:35:40. Partner O’s share in the remainder is P10,400. Partner N received a share in the net income of P105,900. 6. What is the share in the net income received by partner M? _______________________________ 7. What is the net income of the partnership? _______________________________________ 8. What is the amount of monthly salaries of the partners M, N and 0, respectively? ___________________________ Straight Problem 4 - The following information relates to the capital accounts of partners Dan and Don for fisca1 year ending June 30: Deduct: Drawings Monthly amounts 75,350 75,300 Additional drawings, June 12,000 2,015 Balance, June 30 771,750 763,585 Bonus is based on net income after salaries, interest and bonus. The net income remains the same the following fiscal year. There is no change in the partnership agreement. No additional investment is made by the partners. 9. What is the total share of Don in the net income in the following year? _________________________________ Comprehensive Multiple Choice Questions A partnership began its first year of operations with the following capital balances: Mooney, Capital: P143,000 Prongs, Capital: P104,000 Padfoot, Capital: P143,000 The Articles of Partnership stipulated that profits and losses be assigned in the following manner: o Mooney was to be awarded an annual salary of P26,000 with P13,000 salary assigned to Padfoot. o Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year. o The remainder was to be assigned on a 5:2:3 bases, respectively. o Each partner was allowed to withdraw up to P13,000 per year. Assume that the net loss for the first year of operations was P26,000 with net income of P52,000 in the second year. Assume further that each partner withdrew the maximum amount from the business each year. 10. What was Mooney's share of income or loss for the first year? A) (P3,900) B) (P10,400) C) (P11,700) D) (P24,700) 11. What was Prongs's share on income or loss for the first year? A) (P3,900) B) (P10,400) C) (P11,700) D) (P24,700) Dan Don Balance, July 1 432,000 576,000 Add: Additional investment, January 192,000 96,000 13. What was the balance in Mooney's Capital account at the end of the first year? Salaries 102,500 72,500 14. What was the balance in Prongs's Capital account at the end of the first year? Interest 39,600 46,800 Bonus 18,600 - Remainder 74,400 49,600 Total 859,100 840,900 Net income for the year: 12. What was Padfoot's share of income or loss for the first year? A) (P3,900) A) P120,900. A) P120,900. B) P126,100. B) P126,100. C) (P11,700) C) P118,300. C) P118,300. D) (P24,700) D) P80,600. D) P80,600. 15. What was the balance in Padfoot's Capital account at the end of the first year? A) P120,900. B) P126,100. C) P118,300. D) P80,600. 16. What was Mooney's share of income or loss for the second year? A) P17,160 income. 3| JP I M , C P A B) (P10,400) B) P28,080 income. 3 SURIGAO EDUCATION CENTER CPA-REVIEW PROGRAM C) P4,160 income. D) P17,290 income 17. What was Prongs's share of income or loss for the second year? A) P17,160 income. B) P19,760 income. C) P4,160 income. D) P17,290 income. 3. 18. What was Padfoot's share of income or loss for the second year? A) P17,160 income. B) P19,760 income C) P4,160 income. D) P17,290 income. 19. What was the balance in Mooney's Capital account at the end of the second year? A) P133,380. B) P105,690. C) P84,760. D) P132,860. 20. What was the balance in Prongs's Capital account at the end of the second year? A) P133,380. B) P71,760. C) P84,760. D) P132,860. 21. What was the balance in Padfoot's Capital account at the end of the second year? A) P133,380. B) P105,690 land was sold for 50,000 on the same date, three hours after formation of the partnership. How much should be the capital balance of EE right after formation? a. 25,000 b) 60,000 c. 30,000 d) 50,000 On March 1, 2012, II and JJ formed a partnership with each contributing the following assets: II JJ Cash……………………………………………… 300,000 700,000 Machinery and Equipment………….. 250,000 750,000 Building………………………………………… 2,250,000 Furnitures and Fixtures………………. 100,000 - C) P84,760. D) P132,860. The partnership agreement of ROGER, REGGIE and BOBBY provides for the division of net income as follows: 4. The building is subject to mortgage loan of 800,000, which is to be assumed by the partnership agreement provides that II and JJ share profits and losses 30% and 70%, respectively. On march 1, 2012, the balance in JJ’s capital account should be: a) 3700,000 b) 3,050,000 c) 3140,000 d) 2,900,000 The same information in previous number, except that the mortgage loan is not assumed by the partnership. On March 1, 2012, the balance in JJ’s capital account should be: a) 3,700,000 b) 3,050,000 c) 3,140,000 d) 2,900,000 REGGIE, who manages the partnership is to receive a salary of P3S,200 per year. Each partner is to be allowed interest. at 20% on beginning capital. Problem 2 - Albert and Bryan have just formed a partnership. Albert contributed cash of P2,346,000 and Remaining profits are to be divided equally. office equipment that cost P1,170,000. The equipment had been used in the sole proprietorship and had been During 2017, ROGER invested an additional P12,800 in the partnership. REGGIE and BOBBY had permanent 80% depreciated. The current fair value of the equipment is P756,000. An unpaid mortgage loan on the capital withdrawals of P16,000, and P12,800, respectiveiy. REQGIE had a temporary drawing of P4,500. No equipment of P252,000 will be assumed by the partnership. Albert is to have a 60% interest in the other investments or withdrawals were made during 2017. On January 1, 2017, the capital balances were partnership net assets. ROGER, P208,000; REGGIE, P240,000; and BOBBY, P224,000. Total capital at year-end was P806,400. Bryan is to contribute, only, merchandise with a fair value of P1,890,000. Both partners agreed on a profit 22. Compute the capital balance of partner Roger at year-end: and loss ratio of 55% to Albert and the balance to Bryan. a. P257,000 b. 258,300 c. 250,665 d. 257,500 23. Compute the capital balance of partner Reggie at year-end: a. P297,000 b. 297,800 c. 292,800 5. To finalize the partnership agreement, Albert should make additional investment (withdrawal) of cash in the amount of. d. 302,300 a. P (36,000) b. P(S40,000) c. P264,000 24. Compute the capital balance of partner Bobby at year-end: a. P251,100 b. 258,300 c. 244,266 d. 258,300 25. Compute the income earned by the partnership for the year a. P134,400 b. 150,400 c. 169,600 d. 154,900 Problem 1On December 1, 2012, AB invited MZ to join him in his business. MZ agreed provided that AB will adjust the accumulated depreciation of his equipment account to a certain amount and recognize additional accrued expenses of 50,000. After that, MZ is to invest additional pieces of equipment to make her interest equal to 45%. 1. If the capital balances of AB before and after adjustment were 695,000 and 605,000 respectively, what is the effect in the carrying value of the equipment as a result of the admission of MZ? a. 495,000 b. (40,000) c. 455,000 d. (405,000) 2. On December 1,2012, EE and FF fomed a partnership, agreeing to share for profits and losses in the ration 2:3 respectively. EE invested a parcel of land that cost him 25,000. FF invested 30,000 cash. The 4| JP I M , C P A DO-IT-YOURSELF DRILLS s d. P (15,000) The YES Partnership started operations on January 2, 2017 with the following capital balances: YVES P 88,000 ERNIE 64,000 SERGE 90,000 Their profit and loss -agreement has the following provisions: YVES will be given an annual salary of P16,000 and SERGE P8,000. All partners will be given 10% interest on beginning capital balances every year. 4 SURIGAO EDUCATION CENTER CPA-REVIEW PROGRAM The balance of the profit, or the loss, will be divided on a 5:213 to YVES, ERNIE, and SERGE, respectively. Each partner is allowed to withdraw up to P8,000 every year In 2017, partnership operations resulted In. a net loss of P16,000, while in 2018, it was a net profit of P32,000. All partners withdrew the maximum amount of P8,000 each year. 6. Calculate the balance of YVES’ capital at the end of 2017 a. P 72,700 b. P 77,600 c.P49,600 d.P64,900 7. Calculate the balance of Ernie’s capital at the end of 2018. a. P 82,080 b. P 44,076 c. P81,760 d. P77,600 8. Calculate the balance of Serge capital at the end of 2017 a. P84,054 b. P81,760 c. P77,600 d. P79,740 9. Compute the total interest received by the partners in 2018 a. P24,200 b. P12,200 c. P24,000 d. P20,200 A, B, C, a partnership formed on January 1, 2013 had the following initial investment: A ……………………………………… 100,000 B ……………………………………… 150,000 C ……………………………………… 225,000 The partnership agreement states that the profits and losses are to be shared equally by the partners after consideration is made for the following: Salaries allowed to partners: 60,000 for A, 48,000 for B and 36,000 for C. Average partner’s capital balances during the year shall be allowed 10% Additional Information: On June 30, 2013, A invested an additional capital of 60,000. C withdrew 70,000 from the partnership on September 30, 2013. They agreed to share the remaining partnership profit was 5,000 for each partner. 10. Interest on average capital balances of the partners totaled: a. 48,750 b. 53,750 c. 57,625 d. 60,625 11. Partnership net profit at December 31, 2013 before salaries, interests and partner’s share on the remainder was: a. 199,750 b. 207,750 c. 211,625 d. 222, 750 12. Mr. Zoom and his very friend Mr. Boom formed a partnership on January 1, 2018 with Zoom contributing P16, 000 cash and Boom contributing equipment with a book value of P6,400 and a fair value of P8,000. During 2018, Boom made additional investments of P1,600 on April 1 and P1,600 on June 1, and on September 1, he withdrew P4,000. Zoom had neither additional investments nor withdrawals during the year. The average capital balance at the end of 2013 for Mr. Boom is: A. 9, 600 B. 8, 000 C. 8, 800 D. 7, 200 13. Luz, Vi, and Minda are partners when the partnership earned a profit of P30,000. Their agreement provides the following regarding the allocation of profits and losses: I. 8% interest on partner’s ending capital in excess of P75,000. 5| JP I M , C P A II. Salaries of P20,000 for Luz and P30,000 for Vi. III. Any balance is to be distributed 2:1:1 for Luz, Vi, and Minda, respectively. Assume ending capital balances of P60,000, P80,000, and P100,000 for partners Luz, Vi, and Minda, respectively. What is the amount of profit allocated for Minda, if each provision of the profit and loss agreement is satisfied to whatever extent possible using the priority order shown above? A. (3, 600) B. 3,000 C. (2,000) D. 2,000 14. Maxwell is trying to decide whether to accept a salary of P40,000 or salary of P25,000 plus a bonus of 10% of net income after salaries and bonus as a means of allocating profit among partners. Salaries traceable to the other partners are estimated to be P100,000. What amount of income would be necessary so that Maxwell would consider choices to be equal? A. 165,000 B. 290,000 C. 265,000 D. 305,000 15. Roy and Sam was organized and began operations on March 1, 2018. On that date, Roy invested P150,000 and Sam invested computer equipment with current fair value of P180,000. Because of shortage of cash, on November 1, 2018 Sam invested additional cash of P60,000 in the partnership. The partnership contract includes the following remuneration plan: Monthly salary (recognized as expense) Annual interests on beginning capital Bonus on the net profit before salaries and interest but after bonus Balance equally Roy P10,000 12% 20% Sam P20, 000 12% The salary was to be withdrawn by each partner in monthly instalments. The partnership net profit for 2013 is P120, 000. What are the capital balances of the partners on December 31, 2018? Roy A. P243,500 C. P86,000 Sam P266, 500 P154, 000 Roy B. P136, 000 D. P7, 000 Sam P350; 000 P155, 000 Score on 1st Try: __________ Score on 2nd Try: __________ Score on 3rd Try: __________ Answers: 1. 6. 11. 16. 2. 7. 12. 17. 3. 8. 13. 18. 4. 9. 14. 19. 5. 10. 15. 20. 5