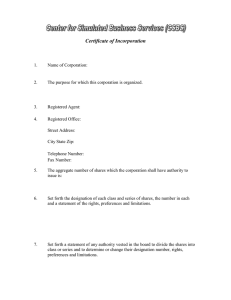

Business Organizations Fall 2020 Professor Miller I. Law of Agency a. Guides relationships between principals, agents and third parties i. “an agency relationship is created when a principal and agent mutually agree that the agent will act on behalf on the principal and subject to the principal’s control” ii. Restatement of Agency (3d) § 1.01 – agency defined 1. There must be a mutual agreement 2. The agent must be acting on behalf of the principal; and 3. The agent must act subject to the principal’s control iii. The agent owes fiduciary duties to the principal 1. The principal may be liable for the agent’s actions in contract and tort 2. Relationship sometimes but not always created by contract 3. Consideration not required in contract to create the relationship iv. Irrelevant whether the parties understood that they were creating an agency relationship or desired to create it. v. Restatement § 1.02 1. An agency relationship arises only when the elements stated in § 1.01 are present. 2. Whether a relationship is characterized as agency in an agreement between parties or in the context of industry or popular usage is not controlling b. Agency vs. gratuitous bailment i. Gorton v. Doty 1. Whether the coach was the agent of the appellant while and in driving her car to a football game 2. A principal-agent relationship exists when two persons agree that one person will act on behalf of, and subject to, the control of the other person ii. § 1.03 manifestation 1. A person manifests assent or intention through written or spoken words or other conduct a. Spoken included because of costs/ liability iii. Justice 1. Insurance would likely pay c. Agency vs. creditor-debtor relationship i. Gay Jenson Farms Co. v. Cargill 1. Whether Cargill, by its course of dealing with Warren, became liable as a principal on contracts made by Warren with plaintiffs 2. “existence of agency may be proved by circumstantial evidence – and in these cases, the principal must be shown to have consented to the agency since one cannot be an agent of another except by consent of the latter.” ii. Restatement 2nd of agency § 140 1. A creditor who assumes control of his debtor’s business may become liable as principal for the acts of the debtor in connection with the business 2. “the point at which the creditor becomes a principal is that at which he assumes de facto control over the conduct of his debtor, whatever the terms of the formal contract with his debtor may be” iii. Restatement (Third) § 1.01, Agency Defined 1. Mutual Assent 2. Agent is acting on behalf of another (principle) 3. Agent must act subject to the principles control d. Liability in contract i. A principal will be liable to third parties in contract if his agent has the authority to effect the contract ii. Authority can be 1. Express actual authority a. Principal has expressly communicated to an agent in spoken words or writing i. Asks: what is the reasonable belief of the agent? b. Test: Whether a reasonable person in the agent’s position would interpret the principal’s communication to encompass a particular act i. Williams v. Dugan 1. Plaintiff lent agent $375 to pay the taxes on her property 2. Rstmt(3d) § 1.04 – a power of attorney is a formal manifestation from principal to agent as well as third parties with whom the agent interacts that evidences the agent’s appointment and the nature or extent of the agent’s authority 2. Implied actual authority a. Actual authority circumstantially proven when the principal actually intended the agent to possess b. Mill St. Church v. Hogan i. Hogan had the implied authority to hire his brother as his helper. ii. As the agent, he reasonably believed that the principal wanted him to act a certain way because of present or past conduct c. Includes the authority to do acts that are incidental to or reasonably necessary to achieve the principal’s objectives 3. Apparent authority a. Arises from communications between the principal and a third party i. Asks: what is the reasonable belief of the third party? b. Through words or conduct, principal makes clear that the agent could enter into such contracts that the agent did enter into c. Agent has apparent authority when the third party reasonably believes the actor has the authority to act on behalf of the principal and that belief is traceable to the principal’s manifestations d. Watteau v. Fenwick i. A principal is liable for the acts of an agent who proceeds within the scope of authority typically given to an agent with similar duties, regardless or limitations the principal imposes on that agent 4. Inherent authority a. The power of an agent which exists solely from the agency relation and exists for the protection of persons harmed by or dealing with a servant or other agent b. Agent has the power to bind principal simply due to existence of agency relationship i. Applies only to GENERAL, not specific agents c. Not adopted in the 3rd restatement of agency iii. General vs. specific 1. General agent a. An agent authorized to conduct a series of transactions involving a continuity of service 2. Special agent a. An agent authorized to conduct a single transaction or a series of transactions not involving continuity of service iv. Disclosure of principal 1. Disclosed principal Rstmt (3d) § 1.04(2) a. 3rd party has notice agent is acting for a principal, and has notice of the identity of the principal 2. Undisclosed principal a. 3rd party has no notice that agent is acting for a principal b. Agent is liable on contracts entered into for undisclosed principal c. When agent enters into transactions usual for the business, and on the principal’s account, the principal is liable 3. Unidentified principal a. when an agent and a third party interact, the third party has notice that the agent is acting for a principal but does not have notice of the principal's identity. b. Agent is liable on contracts entered into for unidentified principal i. Van D. Costas, Inc. v. Rosenberg 1. For an agent to avoid personal liability on a contract negotiated on his principal’s behalf, he must disclose not only that he is an agent but also the identity of his principal, regardless of whether the third person might have known that the agent was acting in a representative capacity e. Liability in Tort i. Scope of employment 1. A principal who is a “master” is responsible for the torts of “servants” acting within the scope of their employment a. A “master” is a principal who employs an agent to perform service in his affairs and who controls or has the right to control the physical conduct of the other in the performance of the service b. Rstmt (3d) § 2.04 – an employer is liable for torts committed by employees acting in the scope of their employment c. An employee is an agent whose principal control or has the right to control the manner and means of the agent’s performance of work 2. Principals are always liable for their own misconduct a. Negligent hiring or negligent supervision b. Agents are responsible for their own torts 3. Parker v. Domino’s Pizza, Inc. a. Whether one party is a mere agent rather than an independent contractor as to the other party is to be determined by measuring the right to control and not by considering only the actual control over the former b. If the employer’s right to control the activities of an employee extends to the manner in which a task is to be performed, then the employee is not an independent contractor 4. Scope of employment a. Wilson v. Joma, Inc. i. An employee is within the scope of his employment if the conduct 1. Is of a kind he is employed to perform 2. It occurs substantially within the authorized time and space limits 3. It is actuated, at least in part, by a purpose to serve the master ii. Dual purpose rule – where the servant is combining his own business with that of his master f. Estoppel i. Detrimental reliance 1. A principal who misleads a third party into believing that an agent has authority to effect a particular transaction is liable with respect to that transaction 2. The third party must have justifiably relied on the agent’s purported authority 3. RULE a. Estoppel is when a 3rd party shows that they were justifiably induced to make a detrimental change in position and the purported principal has acted carelessly or intentionally or failed to correct a mistaken belief of the third party once on notice of that belief. 4. Hoddeson v. Koos Bros a. A proprietor has a duty of care to customers and is liable for a customer’s monetary loss caused by an unauthorized person posing as the proprietor’s agent, if the proprietor could have prevented the loss but failed to do so 5. Rstmt (3d) § 2.05 a. A principal is liable to a third party who is justifiably induced to make a detrimental change in position because the transaction is believed to be on the person’s account if i. The person intentionally or carelessly caused such belief, or ii. Having notice of such belief and that it might induce others to change their positions, the person did not take reasonable steps to notify them of the facts g. Ratification i. A principal may ratify the conduct of an agent who acted without authority 1. Principal may do so unless allowing ratification would be unfair to the third party as a consequence of changed circumstances 2. May be express or implied as long as there is affirmance of contract by the principal 3. Once a principal manifests affirmance, contract is ratified a. Validates the contract from the moment of its original formation b. Evans v. Ruth i. If A assumes to act for B without precedent authority, and B subsequently affirms A’s act, it is a ratification which relates back and supplies original authority for the act c. Botticello v. Stefanovicz i. Marital status cannot prove the agency relationship II. ii. Did not ratify the circumstances of the sale of real property when it had been executed by a person owning one half interest in the property h. Agent’s duty to the principal i. Agent is a fiduciary of the Principal 1. Duties of loyalty, care, and obedience 2. Complete and accurate information ii. Agent must 1. Account to the principal for all profits from the transaction that have not been promised to them by contract 2. Refrain from using principal’s property or confidential information for personal purposes or for a 3rd party 3. Refrain from competing with the principal 4. Refrain from acting as or on behalf of an adverse party 5. Disclose relevant information to the principal 6. Segregate principal’s property and keep and lender accounts 7. Act in accordance with a general duty of good conduct iii. Remedy 1. Tarnowski v. Resop a. Principal is entitled to damages from breaching agent even if he has recovered from a 3rd party and was made whole b. Principal may recover profits made by the agent, irrespective of his recovery against the sellers 2. Termination of agency a. By death, cessation by other means, or mutual agreement b. Principal or agent may terminate the relationship at will, even when termination constitutes a breach of contract 3. General Autho Manufacturer v. Singer a. Singer’s independent activities were in competition with automotive and were in violation of his obligation of fidelity to that corporation, and Singer must account for his profits so obtained The Partnership a. An association of two or more persons to carry on as co-owners a business for profit i. Four factors determine existence of partnership 1. An agreement to share profits 2. An agreement to share losses 3. A mutual right of control or management of the enterprise 4. A community of interest in the venture b. Formation i. governed by the Uniform Partnership Act and Revised UPA 1. Courts will apply the law of the state with the most significant relationship to the partnership and transaction at issue 2. Revised UPA provides that the state in which the partnership has its chief executive office governs internal partnership affairs ii. UPA § 6,7 1. No written agreement is required to form a partnership, and may be created without filing any organizational documents with the state 2. Joint property ownership does not of itself establish a partnership 3. The sharing of gross returns does not of itself establish a partnership 4. Receipt of a share of the profits is prima facie evidence that he is a partner in a business, unless such payments were a. A debt repaid by installments b. Wages of an employee or rent to a landlord c. As an annuity d. Interest on a loan e. Consideration for the sale of the good will of a business iii. Martin v. Peyton 1. A partnership is not formed unless two or more parties are closely associated so as to be co-owners carrying on a business for profit 2. In order for a creditor to be a partner in a firm, the creditor must be closely enough associated with the firm so as to make it a coowner carrying on the business for profit iv. Beckman v. Farmer 1. Whether a partnership exists is an issue of fact turning less on the presence or absence of legal essentials than on the intent of the parties gathered from their agreement, conduct, and the circumstances surrounding their transactions a. Farmer contributed nothing but his personal services to the firm, bore no risk of loss and received guaranteed compensation whether the firm showed profit or not 2. Partner by estoppel a. When a person by words or by conduct represents himself or consents to another representing him to anyone as a partner in an existing partnership or with people he is not partners – He is liable to any such person relying on this apparent partnership b. Can only be invoked by 3rd parties c. General rules – parties may contract out of these rules i. Every partner has the right to perform the partnership’s business and to participate in the management of the partnership – partners have equal voting power ii. Partners share equally in the profits and losses of the partnership iii. The partnership is liable for contracts entered into by partners acting with actual or apparent authority 1. Also liable for torts committed by partners acting with authority or in ordinary course of business 2. Liable to 3rd parties for obligations iv. Admission of new partners only permitted by unanimous agreement v. Partners owe fiduciary duty to each other vi. Every partner may dissolve an at-will partnership. d. Management and control i. Summers v. Dooley (1971) 1. In a general partnership each partner has equal rights regarding the management of the ordinary affairs of the partnership ii. UPA § 9 1. Every partner is an agent of the partnership for the purpose of its business a. The act of every partner binds the partnership for carrying on in the usual way the business of the partnership, unless the partner has no authority and the person with whom he is dealing has knowledge that he has no authority 2. Unless authorized, partners have no authority to a. Assign partnership property in trust for creditors b. Dispose of the good-will of the business c. Do any other act which would make it impossible to carry on the ordinary business of a partnership d. Submit a partnership claim or liability to arbitration or reference iii. UPA § 13 1. The partnership is liable to the same extent as a partner acting wrongfully in the ordinary course of business of the partnership iv. UPA § 15 1. All partners are liable jointly and severally for everything chargeable to the partnership – for all other debts and obligations of the partnership v. UPA § 18 – Rights and duties of partners to each other 1. Each partner shall be repaid his contributions, and share equally in the profits and surplus remaining after all liabilities are satisfied, and must contribute towards the losses 2. The partnership must indemnify every partner with respect to payments made and personal liabilities reasonably incurred 3. A partner who makes any payment or advance beyond the amount of capital which he agreed to contribute Shall be paid interest 4. A partner shall receive interest on the capital contributed by him only from the date when repayment should be made 5. All partners have equal rights in the management and conduct of the partnership business 6. No partner is entitled to renumeration for acting in the partnership business – except that a surviving partner is entitled to reasonable compensation for his services in winding up the partnership affairs 7. No person can become a member of a partnership without the consent of all the partners 8. Any difference arising as to ordinary matters connected with the partnership business may be decided by a majority of the partners; but no act in contravention of any agreement between the partners may be done rightfully without the consent of all the partners vi. Nat’l Biscuit Co. v. Stroud 1. National sought to recover $ from Stroud & Freeman, Stroud could not restrict Freeman from buying bread for the partnership because it was an “ordinary matter connected with the partnership business” for the purpose of its business and within its scope e. Liability to third parties i. A partnership is liable for contracts entered into by partners acting with actual or apparent authority ii. UPA § 13 1. Partnership liable to 3rd parties in tort for wrongful acts or omissions of partners acting with authority or in the ordinary course of business 2. Partnership is not sued directly because UPA doesn’t recognize the partnership as an entity 3. UPA provides for suits against the individual partners to enforce obligations iii. Liability in Contract 1. Burns v. Gonzalez (1969) a. Since the evidence does not disclose that Bosquez was performing an act for carrying on in the usual business of the partnership, the note sued on was NOT a partnership obligation iv. Liability in Tort 1. Sheridan v. Desmond a. Desmond’s actions were not in furtherance of the partnership business, and Defendant did not authorize his actions b. Tort during ordinary course of partnership’s business: i. The kind of thing a partner would do ii. Occurred substantially within authorized time & space limits of partnership iii. Was motivated at least in part by a purpose to serve the partnership iv. See UPA § 9(2) – act of a partner not apparently for the carrying on of the business of the partnership in the usual way does not bind the partnership unless authorized by the other partners c. UPA § 13 – Liability in tort i. Acting in the ordinary course of business of the partnership ii. Or acting with the authority of his co-partners, loss or injury is caused to any person … the partnership is liable therefor f. Financial Rights and Obligations i. Capital Contributions – UPA § 18(a) 1. Capital contribution does not necessarily control the sharing of gain and loss 2. Partners can agree that losses are to be shared by the partners in accordance with their initial capital contributions 3. Profit does not necessarily generate any spare cash 4. Draw – term used to describe cash distributions to partners, the amount of the draw of each partner is determined by majority vote of the partners a. Deductions added to the draw, for depreciation so that it can be equally allocated among partners b. Draw reduces the capital accounts contributed by the partners 5. Capital accounts reflect the relative claims of the partners to the assets of the partnership a. Of importance when a partner withdraws or liquidation of the partnership 6. Personal services are not capital contributions unless otherwise agreed a. Schymanski v. Conventz i. In the absence of an agreement to such effect, a partner contributing only personal services is ordinarily not entitled to any share of the partnership capital pursuant to dissolution. Personal services may qualify as capital contributions to a partnership where an express or implied agreement to such effect exists ii. Capital Accounts Balance 1. RUPA § 401 a. Each partner has an account that is credited with an equal amount that they contributed and their share of the profits b. Each partner is entitled to an equal share of the partnership profits and is chargeable with a share of partnership losses i. DEFAULT RULE – Parties can contract out of this c. Partner not entitled to renumeration for services performed for the partnership except for reasonable compensation for services rendered in winding up the business of the partnership 2. Kessler v. Antinora a. Where one party contributes money and the other services, in the event of a loss, each loses his own capital- one in the form of money, the other in labor. b. Where a partner contributes services only, he does not need to contribute toward losses c. “Service only partner exception” i. RUPA § 401 rejects this + - iii. Indemnity and Contribution – UPA § 18 1. If a partner pays a partnership obligation, he is entitled to be indemnified by the partnership 2. If the partnership is unable to pay, the other partners must contribute and pay according to their loss shares a. If a loss was caused by the wrongful act of one of the partners, under agency law principles the culpable partner ultimately bears the entire loss and must indemnify the Capital contribution partnership or any partner who paid the 3rd party’s claim distribution (draw) profits g. Ownership Interests and Transferability losses i. Partnership property Capital Account Balance 1. UPA §8 – all property originally brought into the partnership stock or subsequently acquired by purchase or otherwise, is partnership property 2. Property bought with partnership funds is partnership property a. Ownership as “tenants in partnership” 3. RUPA specifies that the partnership, not the individual partners, owns partnership property a. Partner is not a co-owner and has no transferrable interest in the partnership property ii. Admitting new partners vs. assigning partnership interests 1. Rapoport v. 55 Perry Co. (1975) a. No person can become a member of a partnership without The consent of all the partners b. An assignee of an interest in the partnership is not entitled to interfere in the management or administration of the partnership business , they are merely entitled to receive the profits the partner would receive c. The plaintiffs could not transfer a full partnership interest to their children and their children only have the rights as assignees to receive a share of the partnership income and profits h. Fiduciary Duties i. Benefits for the interest of the partnership 1. Meinhard v. Salmon (1928) a. Authority is abundant that one partner may not appropriate to his own use a renewal of a lease, though its term is to begin at the expiration of the partnership b. By the position one occupies as a partner, he is bound by his obligation to his co-partners in such dealings not to separate his interest from theirs, but if he acquires any benefit, to communicate it to them. 2. UPA § 21 a. Every partner must account to the partnership for any benefit, and hold as trustee for it any profits derived by him without the consent of other partners from any transaction connected with the formation, liquidation, conduct of the partnership or from any use by him of its property b. RUPA declines to impose fiduciary duties on partners during the formative stage of a partnership 3. Singer v. Singer a. Partner has fiduciary duty not to compete with other partners, or with the partnership itself, in the absence of a partnership agreement stating otherwise. b. Partners may agree to directly compete with each other and the partnership itself 4. UPA § 20 a. Partners shall render on demand true and full information of all things affecting the partnership to any partner 5. RUPA § 404 a. General standards of conduct b. Refrain from dealing with the partnership in the conduct or winding up as or on behalf of a party having an interest adverse to the partnership c. Partner may further his own interest and not violate his duties to the partnership ii. The Duty of Loyalty 1. Enea v. Superior Court a. Partners may not take advantages for themselves at the expense of the partnership b. RUPA says that a partner does not violate a duty or obligation merely because the partner’s conduct furthers the partner’s own interest – meant to excuse partners from accounting for incidental benefits obtained in the course of partnership activities without detriment to the partnership 2. UPA § 21 a. Absolute prohibition against self-dealing transactions by partners without unanimous consent iii. The Duty of Disclosure 1. UPA § 20 a. UPA requires partnership to keep books and make them available to partners for inspection and copying 2. RUPA § 403 a. Requires partnership to give every partner access to the partnership’s books and records, and partners have an affirmative obligation to make certain disclosures of information concerning the partnership’s business and affairs b. Partners may not “unreasonably restrict the right of access to books and records” 3. Waiver of duty of loyalty a. UPA – silent, unclear to what extent duty may be waived by partners b. RUPA – partnership agreement may NOT eliminate the duty of loyalty entirely but may identify specific types or categories of activities that do not violate duty of loyalty so long as not “manifestly unreasonable” 4. Walter v. Holiday Inns, Inc. (1993) a. In order to set aside sale of partnership on ground of breach of fiduciary duty, the misrepresentation must be in regard to a fact material to the contract. What is material must be evaluated in the context in which the statements or omissions occurred b. Omitted fact is material if there is a substantial likelihood that under all the circumstances the omitted fact would have assumed actual significance in the deliberations of the reasonable shareholder iv. The Duty of Care 1. RUPA § 404(c) a. Duty of care is limited to refraining from engaging in grossly negligent or reckless conduct, intentional misconduct, or a knowing violation of law 2. Bane v. Ferguson a. Partners have no authority to do any act which would make it impossible to carry on the ordinary business of the partnership 3. A partner cannot successfully sue his copartners based on the substance of negligent decisions under the business judgment rule a. Conducting an adequate investigation prior to making a decision is thought to be a prerequisite to applying this rule b. UPA says that a partner acting in ordinary course of business of the partnership is liable only to “any person not being a partner in the partnership” i. RUPA omits this language v. Duties on leaving the partnership 1. Meehan v. Shaughnessy a. Partners owe each other a fiduciary duty of the “utmost good faith and loyalty” b. Meehan and Boyle breached their fiduciary duties by unfairly acquiring consent from client to remove their cases from Parker-Coulter c. Meehan and Boyle must reimburse the partnership for time billed and expenses incurred at that firm on all cases which were fairly removed 2. Under common law and UPA, an accounting action is the exclusive means by which a partner can seek recourse against his co-partners for breach of fiduciary duty i. Dissolution i. Events causing dissolution 1. Page v. Page a. A partnership at will may be dissolved by the express will of any partner when no definite term or particular undertaking is specified b. The power to dissolve a partnership at will must be exercised in good faith i. Must not dissolve a partnership to gain the benefits of the business for himself, unless he fully compensates his copartner for his share of the prospective business opportunity 2. UPA § 29 – Dissolution defined a. The dissolution of a partnership is the change in the relation of the partners caused by any partner ceasing to be associated in the carrying on as distinguished from the winding up of the business b. The separation of any partner from the partnership causes dissolution 3. UPA § 31 – causes of dissolution a. Default rule that a partnership is terminable at will by any partner b. The partners may agree, formally or informally, that the partnership will continue for a definite term or particular undertaking c. Partnership is automatically dissolved by i. Any event that makes it unlawful to carry on the partnership business ii. The death of any partner or iii. The bankruptcy of any partner or the partnership iv. Judicial decree 4. UPA § 32 – Dissolution by decree of court a. Partner can petition for dissolution where another partner behaves in such a manner that is not reasonably practicable to carry on the business in partnership with him or if the partnership can only be carried on at a loss, or if other circumstances render a dissolution equitable 5. An assignee of partnership interest or charging order foreclosure purchaser may obtain judicial dissolution after the termination of the specified term or particular undertaking or by express will if the partnership was one at will when the interest was assigned or when the charging order was issued ii. Consequences of dissolution. 1. Commences the winding up of the partnership’s affairs, partnership must complete transactions that have begun and sell its assets 2. Proceeds from sale distributed as such a. To nonpartner creditors b. To partner creditors c. Partners receive back capital contribution d. Partners receive any remaining profits according to profit shares 3. If assets are insufficient to satisfy liabilities, partners must contribute according to loss shares 4. A partner’s authority to act for the partnership terminates a. Upon dissolution when dissolution occurs other than by the act, bankruptcy, or death of a partner b. Upon knowledge of dissolution when dissolution is caused by the death or bankruptcy of a partner 5. UPA requires that dissolution occurs whenever any partner leaves the partnership a. Dissolution does not always lead to liquidation, partners can agree to continue unanimously and must include the consent of any departing partners b. RUPA – not every partner dissociation causes a dissolution of the partnership, only certain departures trigger a dissolution 6. Dreifuerst v. Dreifuerst a. Each partner, upon dissolution unless otherwise agreed, may have the partnership property applied to discharge its liabilities, and the surplus applied to pay in cash the net amounts owing to the respective partners b. Each partner has the right to have the business liquidated and his share of the surplus paid in cash iii. Wrongful Dissolution 1. Drashner v. Sorenson (1954) a. A partner who dissolves a partnership in contravention of the partnership agreement is not entitled to a valuation that includes the going concern or good will value of the business 2. UPA § 38 a. Penalty for wrongfully dissolving a partnership includes i. Expulsion from the partnership business ii. Damages for breach of contract, and iii. A distributive share that does not reflect the goodwill of the business III. 3. RUPA a. Dissociation rather than dissolution i. Dissociation does not necessarily cause the dissolution and winding up of the partnership ii. Dissociated partner still has some residual rights, duties, powers, and liabilities b. § 601 – a partner becomes dissociated from partnership when i. A partnership has notice of partner’s express will to withdraw ii. Agreed upon dissociation event occurs iii. Partner is expelled pursuant to agreement iv. Partner expelled for misconduct by court order v. Partner becomes debtor in bankruptcy vi. Partner dies The Corporation a. Distinct features i. May only be created by filing a certificate of incorporation with the state in accordance with statute ii. Corporation is an entity distinct from its owners in all jurisdictions iii. A corporation has perpetual existence until and unless it is dissolved iv. Dissolution requires approval by the corporation’s board of directors and shareholders v. Ultimate decision making power traditionally resides in a board of directors 1. Directors may or may not be shareholders vi. Shareholders of a corporation enjoy limited liability – his losses are limited to the value of his investment vii. Corporate creditors usually have no recourse against shareholders individually when seeking payment of debts viii. Ownership interest shares are freely transferable 1. Makes it easy for corporation to acquire new investors and needed capital ix. Corporation is taxed as a separate legal person, based on its income for the year x. Shareholders dividends are taxed individually b. Incorporation and Formation i. Incorporation 1. Internal affairs of the corporation are governed by the jurisdiction of incorporation a. Most fortune 500 companies are incorporated in Delaware b. Most closely held corporations incorporate in the state in which they do most of their business ii. Formation 1. Filing certificate of incorporation with state official (typically secretary of state) 2. Articles of incorporation a. Must include i. the corporate name ii. the number of shares the corporation is authorized to issue, iii. the mailing address, iv. and name and address of each incorporator. b. May set forth i. who is to serve as a director, ii. the purpose of the corporation, iii. provisions for managing the corporation, iv. provisions for the power of the board of directors and the shareholders, v. a par value for shares or classes of shares, or the imposition of interest holder liability on shareholders. c. After certificate of incorp. Is filed, incorporators or initial directors call an organizational meeting c. Financing the Corporation i. Shares 1. Can be issued in exchange for cash or property a. It is not necessary for all shares to have voting rights, but at least one class of shares must have voting rights. MBCA § 6.01 b. A corporation may only issue the number of shares authorized by the articles of incorporation. MBCA § 6.03 c. Shares that are issued are outstanding until they are reacquired, redeemed, converted, or cancelled. d. Par Value. i. the minimum price at which a corporation may issue its shares, and it does not need to have any relation to market value. ii. Par value is not a minimum or limit for how much a shareholder may resell the shares, it is only a limit on the corporation 2. Common Shares a. Represent residual or ultimate ownership, not necessarily entitled to dividend b. Common shareholders possess voting rights and elect the board of directors 3. Preferred Shares a. Typically have preference over common shares with respect to dividends b. If the board does not pay the preferred dividend, it may not declare any dividend on the common shares. c. Typically carries no voting rights 4. Bond a. A loan secured by the corporation’s assets 5. Debenture a. Unsecured loan to a corporation 6. Subscription for Shares a. A subscription for shares entered into before incorporation is irrevocable for 6 months under MBCA 6.20, unless the agreement provides a longer or shorter period of time or all the subscribers agree to revocation. 7. Preemptive Rights MBCA § 6.30 a. Preemptive rights permit an existing shareholder to purchase more shares when more shares are issued. b. They enable shareholders to preserve their proportionate stake in the corporation’s assets, earnings, and voting power. c. More purposeful in closely held corporations where protection against dilution is important d. To preserve preemptive rights, shareholder must make a further cash contribution to the corporation e. If minority owner doesn’t want to make contribution, majority may issue new shares at bargain price to pressure i. NY court invalidated this strategy 8. Options a. A right to purchase shares of stock at a certain price at a future time ii. Dodge v. Ford Motor Co. (1919) 1. A business corporation is organized and carried on primarily for the profit of the stockholders. The powers of the directors are to be employed for that end. 2. The discretion of the directors does not extend to a change in the end itself, to the reduction of profits or to the non-distribution of profits among stockholders in order to devote themselves to other purposes iii. Promoters Contracts 1. Promoter – someone who helps to found and organize a corporation a. Will often make contracts for the corporation’s benefit with the intention of causing the corporation to adopt the contracts after it is formed b. A promoter is personally liable for pre-incorporation contracts unless the corporation adopts the contract or creates a new contract with the party. c. Adoption can be expressed by the board at a meeting or implicitly. d. Ratification is not possible until the corporation is formed 2. Jacobson v. Stern a. If a pre-incorporation contract made by a promoter is within the corporate powers, the corporation may, when organized, expressly or impliedly ratify the contract and thus make it a valid obligation of the corporation 3. Novation a. the act of substituting a valid existing contract with a replacement contract, where all concerned parties mutually agree to make the switch. 4. Corporations not liable for pre-formation torts of a promoter where a. There is no agency relationship between promoter and nonexistent corporate entity b. The injured party is not denied a remedy because the promoter is liable for his own tort, and c. A contrary rule might harm innocent investors and stifle investment d. Defective Incorporation i. De Facto Corporation 1. A court will find a de facto corporation existed when the person contracting for the de facto corporation complied with the statute of incorporation and the other party dealt in a manner as if they were dealing with a corporation. ii. Cantor v Sunshine Greenery, Inc. 1. The mere fact that there were no formal meetings or resolutions or issuance of stock is not determinative of the legal or de facto existence of the corporate entity 2. Since Sunshine had a de facto existence, there can be no personal liability of Brunetti on the fact that he was a promoter iii. Ultra Vires Doctrine 1. A transaction beyond the purposes specified by the corporation’s certificate 2. any acts that lie beyond the authority of a corporation to perform under its corporate bylaws, or anything that is specifically prohibited by the corporate charter. e. Shareholder Action Votes i. Annual meeting 1. Corporation required to hold an annual meeting of shareholders at which directors are elected 2. Shareholders must be sent notice of an annual or special meeting that specifies the date, time, and place at least 10 days and no more than 60 days before the meeting ii. Special Meeting 1. Notice for special meeting must include a description of the purpose of the meeting 2. Only business within the purpose of the special meeting may be conducted at a special meeting iii. Quorum iv. X= number of shares needed to elect a given # of directors S=total number of shares at the meeting N= number of directors needed D= total number of directors to be elected v. X=SN +1 D+1 vi. vii. 1. A majority of shares entitled to vote on a matter must be represented in person or by proxy 2. Once a share is represented for any purpose at a meeting, it is deemed present for quorum purposes for the remainder of the meeting 3. An amendment that adds, changes, or declares a quorum or voting requirement shall meet the same quorum requirement and be adopted by the same vote required under the quorum 4. Only shareholders as of the record date are eligible to vote at a meeting Director Voting 1. Straight Voting a. Every shareholder votes the entire number of shares that he owns for as many directors as there are seats up for election b. Default rule 2. Cumulative voting a. Every shareholder has a number of votes equal to the number of shares he owns multiplied by the number of board seats up for election b. Gives minority shareholders a voice 3. Directors are elected by a plurality of the votes cast Action by written consent 1. Action may be taken without a meeting if the action is taken by all the shareholders entitled to vote on the action. 2. The action must be evidenced by one or more written consents bearing the date and signature and describing the action taken, signed by all the shareholders entitled to vote and delivered to the corporation for filing. 3. A consent signed has the effect of a vote taken at a meeting. Proxy voting 1. A shareholder may vote their shares in person or by proxy. The shareholder may appoint a proxy by signing an appointment form or by electronic transmission. Voting agreements 1. Ringling Brothers – Barnum & Bailey Combined Shows, Inc. v. Ringling a. An agreement between two shareholders in a closely held corporation to vote jointly is as binding and enforceable as a contract b. A group of shareholders may lawfully contract with each other to vote in the future as they determine 2. Voting trusts a. One or more shareholders may create a voting trust, conferring on a trustee the right to vote or act for them, by signing an agreement setting out the provisions of the trust and transferring their shares to the trustee. f. Management & Control – Directors i. Board of directors shall consist of one or more individuals in accordance with the articles of incorporation 1. Directors are elected at the first annual shareholders meeting and at each annual shareholders meeting thereafter 2. Terms a. typically one year unless they are staggered b. MBCA § 8.06 i. Divided into groups, each group’s term lasts a different amount of time 3. Vacancy on Board of Directors a. The term of a director elected to fill a vacancy expires at the next shareholders meeting at which directors are elected b. If a vacancy occurs, the vacancy may be filled i. By a shareholder vote ii. By a board vote iii. By an affirmative majority vote of all the directors remaining 4. Removal of Director by Shareholders a. Shareholders may remove one or more directors with or without cause unless the articles of incorporation provide otherwise b. Director may be removed if the number of votes cast to remove exceeds the number of votes cast not to remove the director c. Director may be removed by the shareholders only at a meeting called for that purpose 5. Removal by judicial proceeding a. If director engaged in fraudulent conduct with respect to the corporation, abused his position, or intentionally inflicted harm on the corporation b. Gearing v. Kelly (1962) i. A court may order a new election for corporate directors as justice may require. ii. Board Meetings 1. Regular meetings MBCA § 8.20 a. Directors can participate by any means of communication by which all directors may hear each other during the meeting 2. Action without meeting MBCA § 8.21 a. Action may be taken without a meeting if each director signs a consent describing the action and delivers it to the corporation b. A consent signed under this section has the effect of action taken at a meeting of the board of directors 3. Notice of meeting MBCA § 8.22 a. Meetings may be held without notice of the date, time, place, or purpose of the meeting b. Special meetings shall be preceded by at least two days notice of the date, time, and place of the meeting 4. Waiver of Notice MBCA § 8.23 a. A director may in writing, waive notice b. A director’s attendance at or participation in a meeting waives any required notice to the director of the meeting unless the director objects to holding the meeting 5. Quorum and voting MBCA § 8.24 a. A quorum of board of directors consists of a majority of the number of directors specified in the articles of incorporation b. May not consist of less than one third of the specified or fixed number of directors c. A director present at a meeting is deemed to have assented to the action taken unless he explicitly objects iii. Controlling Matters within Board’s Discretion 1. McQuade v. Stoneham a. A contract is illegal and void so far as it precludes the board of directors, at the risk of incurring legal liability, from changing officers, salaries, or policies or retaining individuals in office, except by consent of the contracting parties 2. Clark v. Dodge a. If the enforcement of a contract between directors that are the sole stockholders in a corporation damages no one, not even the public, it is not illegal. iv. Fiduciary Duty of Directors 1. Oversight a. Directors are obligated to use care in monitoring the activities of the officers and the general affairs of the corporation as a whole b. Francis v. United Jersey Bank (1981) i. A director should acquire at least a rudimentary understanding of the business of the corporation. Otherwise, they may not be able to participate in the overall management of corporate affairs. ii. Directors should regularly review the corporation’s financial statements c. Directors are generally immune from liability if in good faith they rely upon the opinion of counsel or financial statements prepared by a CPA 2. Decision making 3. 4. 5. 6. a. Directors obligated to use care in making decisions that affect the corporation’s welfare b. Directors and officers consider whether to authorize a transaction or activity c. The Business Judgment Rule i. If a director or officer’s decision is made in 1. Good faith 2. With a reasonable decision making process, and 3. With no conflict of interest, then a court will uphold the decision so long as the decision can be attributed to a rational business purpose ii. Shlensky v. Wrigley (1968) 1. Courts of equity will not undertake to control the policy or business methods of a corporation, although it may be seen that a wiser policy might be adopted and the business more successful if other methods were pursued 2. The judgment of the directors of corporations enjoys the benefit of a presumption that it was formed in good faith and was designed to promote the best interests of the corporation they serve 3. There must be fraud or a breach of good faith which directors are bound to exercise toward the stockholders in order to justify the courts entering into the internal affairs of corporations Exculpation Statutes. a. 35 States have adopted legislation aimed at limiting exposure of directors to personal liability b. MBCA § 2.01 (b)(4) Charter option statutes a. Authorizes corporation to adopt provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty Self executing statutes a. A director is only liable if the director has breached or failed to perform his duties in compliance with the statutory standard of care and “the breach or failure to perform constitutes willful misconduct or recklessness” Loyalty issues arise when a. Directors or officers enter into contracts or other transactions with the corporation b. When directors or officers take potential corporate opportunities for themselves c. Cookies Food Products, Inc. v. Lakes i. Corporate directors and officers may under proper circumstances transact business with the corporation but it must be done in the strictest good faith and with the full disclosure of the facts to, and the consent of, all concerned. 7. Contracts with corporation and directors not voidable if: a. The fact of such relationship is disclosed or known to the board of directors which approves the contract without counting the votes of the interested director b. The fact of such relationship or interest is disclosed or known to the shareholders entitled to vote c. The contract is fair and reasonable to the corporation i. Fair dealing ii. Fair price g. Executive compensation i. Reasonable compensation paid to an employee is a deductible expense for a corporation, but a dividend paid to a shareholder is not ii. Compensation in closely held corp 1. Sums representing the value of the labor provided by the shareholder-employee 2. Sums representing a “disguised” or de facto dividend iii. Wilderman v. Wilderman 1. When the amount of executive compensation is fixed by its recipient, and the recipient’s vote as a director is necessary to fix the amount of his compensation, the recipient director bears the burden of showing that the compensation is reasonable iv. Waste doctrine 1. Prohibits an exchange that is so one sided that no business person of ordinary, sound judgment could conclude that. the corporation has received adequate consideration 2. Applicable where a corporation has irrationally overpaid one or more of its executives h. Indemnification and insurance i. Provides financial protection by the corporation for its directors against exposure to expenses and liabilities that may be incurred by them in connection w legal proceedings based on an alleged breach of duty i. Piercing the corporate veil i. A shareholder of a corporation is not personally liable for any liabilities of the corporation except where the shareholder may become personally liable by reason of the shareholder’s own acts or conduct. 1. Walkovsky v. Carlton a. Whenever anyone uses control of the corporation to further his own rather than the corporation’s business, he will be liable for the corporation’s acts “upon the principle of respondeat superior applicable even where the agent is a natural person” 2. Minton v. Cavaney (1961) a. The equitable owners of a corporation are personally liable if they provide inadequate capitalization and actively participate in the conduct of corporate affairs ii. Undercapitalization 1. Measured at the time of formation a. Disregard of corporate norms must be causally linked to harm to the creditors to justify piercing the corporate veil iii. Alter-ego doctrine – shareholder is personally liable when: 1. They treat the assets of the corporation as their own and add or withdraw capital at will 2. They hold themselves out as being personally liable for the debts of the corporation, or 3. When they provide inadequate capitalization and actively participate in the conduct of corporate affairs iv. Contract cases 1. Perpetual Real Estate Services, Inc. v. Michaelson Properties, Inc. a. Plaintiff must establish that the corporate entity was the alter ego, alias, stooge, or dummy of the individual, the individual exercised undue domination and control over the corporation, and the corporation was a device or sham used to disguise wrongs, obscure fraud, or conceal crime. v. Vertical veil piercing 1. Creditor seeks to hold a shareholder liable for corporate obligations 2. A parent corporation is not liable for the acts of its subsidiaries 3. Corporate veil may be pierced when the corporate form would otherwise be misused to accomplish certain wrongful purposes, like fraud vi. Reverse Piercing 1. Where a creditor of a shareholder seeks to hold the corporation liable for the shareholder’s debts 2. A shareholder’s creditor may obtain a judgment and seize the shareholder’s stock in the corporation where: a. The controlling insider and the corporation are alter egos of each other, b. Justice requires recognizing the substance of the relationship over the form because the corporate fiction is utilized to perpetuate a fraud or defeat a rightful claim, c. and An equitable result is achieved by piercing j. Problems specific to Closely Held Corporations i. The majority owes a fiduciary duty to the minority in a closely held corporation 1. Closely held corps often distribute de facto dividends to their employee-shareholders in the form of enhanced salary and benefits ii. Shareholder oppression 1. In re Kemp & Beatley, Inc. a. Oppressive conduct by majority shareholders arises only when the majority conduct substantially defeats expectations that, objectively viewed, were both reasonable under the circumstances and were central to the petitioner’s decision to join the venture 2. Shareholders sue for dissolution to accomplish: a. Withdraw investments from the firm b. Induce other shareholders to sell out to him; or c. To use the threat of dissolution to induce the other shareholders to agree to a change in power balance or policies iii. Minority Oppression 1. Gallagher v. Lambert a. Stock buy-back agreements are commonly used by closely held corporations as employment incentives. Where the language is clear and no procedural irregularities exist, courts should not intervene to change the terms of the agreement iv. Dissolution for deadlock 1. An order to dissolve a corporation is not automatically granted even when competing factions are totally at odds with one another. 2. The court must further determine that cooperation is actually necessary to conduct the business of the corporation and that dissolution would be equitable 3. Appointment of custodian or provisional director is often remedial option for court dealing with deadlock or other dissension in closely held corp 4. Provisional director a. Neutral 3rd party who is appointed by the court and vested with the rights and powers of a director to vote at board meetings v. Share transfer restrictions 1. Permitted by statutes, major categories: a. First Option i. Obligation to offer to corp or other shareholders at specified price b. First Refusal i. Obligation to offer to corporation or shareholders at same price offered by 3rd party c. Consent Agreement i. Obligation to obtain consent before selling to third party d. Buy-sell agreement i. Obligation or agreement to sell upon happening of certain events e. Prohibition of transfer to designated classes of persons 2. Consent to transfer may not be unreasonably or arbitrarily withheld k. Derivative suits and Direct Suits i. Derivative suit 1. An action brought by one or more shareholders to vindicate rights belonging to the corporation 2. Provides a remedy for many corporate wrongs that would not otherwise be addressed 3. Any harm to the shareholder is derivative of harm to the corporation a. Frequently breach of duty 4. NY BCL § 626. a. Shareholders' derivative action brought in the right of the corporation to procure a judgment in its favor. b. (a) An action may be brought in the right of a * * * corporation to procure a judgment in its favor, by a holder of shares * * * of the corporation * * *. c. (b) In any such action, it shall be made to appear that the plaintiff is such a holder at the time of bringing the action and that he was such a holder at the time of the transaction of which he complains, or that his shares or his interest therein devolved upon him by operation of law. d. (c) In any such action, the complaint shall set forth with particularity the efforts of the plaintiff to secure the initiation of such action by the board or the reasons for not making such effort. e. (d) Such action shall not be discontinued, compromised or settled, without the approval of the court having jurisdiction of the action. * * * f. (e) If the action on behalf of the corporation was successful, in whole or in part, or if anything was received by the plaintiff or plaintiffs or a claimant or claimants as the result of a judgment, compromise or settlement of an action or claim, the court may award the plaintiff or plaintiffs, claimant or claimants, reasonable expenses, including reasonable attorney's fees, and shall direct him or them to account to the corporation for the remainder of the proceeds so received by him or them. * * * 5. Demand excused for futility where a. Majority of control group interested in alleged underlying wrongdoing IV. b. Board members failed to take reasonable steps to inform themselves of underlying decision OR c. Board actions egregious on their face 6. MBCA § 7.42 - Universal Demand Requirement a. Written demand must be made before derivative suit can proceed and b. 90 days have expired from the date the demand was made ii. Vs. Direct Suit 1. Involves enforcement of rights belonging to a shareholder 2. The individual stockholders have no separate and independent right of action for injuries suffered by the corporation which merely result in the depreciation of the value of their stock 3. If corporation brings suit, each individual stockholder will be made whole 4. Includes actions to a. Compel the declaration or payment of a dividend b. Prevent interference with the shareholder franchise or a particular shareholder’s voting power c. Vindicate preemptive rights d. Permit a shareholder to examine the corporation’s books and records e. Enforce a shareholders’ agreement f. Challenge ultra vires conduct and effect dissolution iii. Demand on the Board of Directors 1. Johnson v. Steel, Inc. a. When filing a complaint for a derivative action, plaintiff must allege the efforts, if any, to obtain the action he desires from the directors, and the reasons for his failure to obtain the. action or for not making the effort. b. A well-recognized exception to the demand requirement is where the demand would be futile, where the board participated in the wrongful act or is controlled by the principal wrongdoer, it is less likely that the action will be vigorously prosecuted. The Limited Partnership a. Comprised of at least one general partner and at least one limited partner i. Limited partner has no liability for the debts of the venture beyond the loss of his investment b. NYPL § 90 i. A partnership formed by two or more persons – general and limited partner ii. General partner – shall have all the rights and powers and be subject to all the restrictions and liabilities of a partner in a partnership without limited partners c. Transferability V. VI. i. General partners need unanimous vote of partners, including limited partners ii. Limited partners rule still the same d. Duration i. Same as general partnership, except that no dissolution when limited partner dies e. Control i. A limited partner can lose his limited liability protection if he participates in the “Control” of the business 1. RUPLA exception where the limited partner’s participation in control of the business is not substantially the same as the exercise of the powers of a general partner ii. Control of the “entity” general partner 1. When the general partner is an entity itself (a corporation) a. Delaney v. Fidelty Lease Limited i. “personal liability which attaches to a limited partner when he Takes part in the control and management of the business cannot be evaded merely by acting through a corporation b. Control may be shifted from one group to another without apparently affecting the corporate general partner’s continuous existence Limited Liability Partnership a. General partnership that provides the partners with limited liability for the firm’s tort obligations or for both its tort and contract obligations i. RUPA § 306 1. An obligation of a partnership incurred while the partnership is a limited liability partnership is solely the obligation of the partnership 2. A partner is not personally liable for a partnership obligation b. In NY, only available to “professional partnerships” i. Must be registered with the state ii. No partner in LLP is liable for debts or wrongful conduct of the LLP solely because they are a partner in the LLP. LLC – Limited Liability Company a. Non-corporate business structure that offers: i. Limited liability for the obligations of the venture, even if a member participates in control of the business ii. Pass through tax treatment iii. Tremendous freedom to contractually arrange the internal operations of the venture 1. Often reflective of a combination of corporation, partnership, and limited partnership principles b. Formation i. Filing of certificate of formation, certificate of organization, or articles of organization with secretary of state c. d. e. f. 1. Details on governance of LLC contained in separate document known as “operating agreement” – contains specifics on rights, duties and obligations of the LLC’s members and managers ii. LLC members typically required to make a contribution to the capital of the company 1. Cash, property, and services count as contributions iii. Duray Development, LLC v. Perrin 1. The de facto corporation doctrine applies to LLC. iv. Formation in NY 1. Publication of notice of formation in newspapers designated by the county clerk 2. Filing with secretary of state that publication has occurred 3. Adoption of operating agreement Management and operation i. Member managed 1. Resembles a general partnership, each of the owners has management rights ii. Manager Managed 1. Management entrusted to a separate manager or group of managers, who may or may not be members 2. Resembles a corporation iii. Some LLC statutes allow management functions to be divided between managers and members Voting i. Can be on per capita basis (one vote per member) ii. Or pro rata basis (by financial or other contribution to the firm) iii. Majority vote iv. On extraordinary matters, some statutes require a supermajority vote Authority i. Members in a manager-managed LLC usually have no authority to bind the venture at all ii. No member solely by reason of being a member, shall be an agent of the LLC iii. LLC statutes provide either a partnership-like allocation or a corporation/LP like pro rata allocation based on contributions Fiduciary Duties i. Members in member-managed and managers in manager-managed LLCs owe fiduciary duties of care and loyalty to the LLC and to the individual members ii. McConnell v. Hunt Sports Enterprises 1. An LLC operating agreement may limit the scope of the fiduciary duties of its members. iii. Pappas v. Tzolis (2012) 1. The test for whether fiduciary duty has been breached is whether, given the nature of the parties relationship at the time of the release, the principal is aware of information about the fiduciary that would make reliance on the fiduciary unreasonable. g. Dissolution i. NY LLC law §702 1. The Supreme Court in the judicial district where the LLC is located may decree dissolution company whenever it is not reasonably practicable to carry on the business in conformity with the articles of organization or operating agreement. 2. A certified copy of the order of dissolution shall be filed by the applicant with the department of state within thirty days of its issuance. h. Limited Liability i. Debts, obligations, liabilities are solely the debts of the company ii. Water, Waste, & Land Inc. v. Lanham 1. The members of an LLC are not excused from personal liability on a contract where the other party did not have notice that the members were negotiating on behalf of an LLC at the time the contract was made, unless the members are being sued solely based on their status as members. i. Piercing the veil i. Kaycee Land & Livestock v. Flahive 1. An aggrieved party may pierce the LLC veil in the same manner it would pierce the corporate veil. 2. If the members and officers of an LLC fail to treat it as a separate entity as contemplated by statute, they should not enjoy immunity from individual liability for the LLC’s acts that cause damage to third parties. j. Some issues with LLCs i. Filing and other statutory fees in some states are higher for LLC than comparable business forms ii. Federal social security and self employment taxes may be higher in LLCs and partnerships iii. More flexibility presents a need for a more detailed operating agreement iv. Sparse case law and judicial guidance v. LLC statutes provide little guidance on member’s ability to dissociate, dissolve, or recover invested capital vi. Cannot merge with a corporation without paying taxes