Bond Markets, Analysis, and Strategies, Tenth Edition Textbook

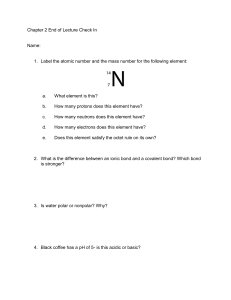

advertisement