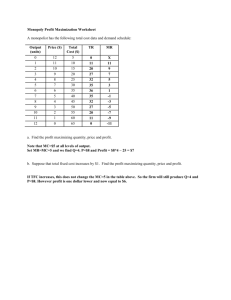

Problem set 1-2 Problem 1 (warm up) A monopolist faces a demand curve 𝑄 = 120 − 2𝑝 and has costs given by 𝐶(𝑄) = 20𝑄 + 100. (a) Write the monopolist's profits in terms of the price it charges. Use the derivative (with respect to 𝑝) to determine the monopolist's profit-maximizing price. (b) Now, derive the monopolist's inverse demand based on the demand equation above. Write out the monopolist's profits in terms of quantity. Use the derivative with respect to 𝑄 to determine the monopolist's optimal quantity. What price does the monopoly charge? Problem 2 Monopolist’s output can be produced with constant marginal (and average) cost of 10. Assume there may be three different shapes of the market demand curve the firm faces: (i) 𝑄 = 60 − 𝑝 (ii) 𝑄 = 45 − 0.5𝑝 (iii) 𝑄 = 100 − 2𝑝 For each situation calculate and graph the firm’s profit-maximizing price–quantity combination and profits. Using your results, explain why there is no real supply curve for a monopoly. Problem 3 A monopolist faces the following demand curve: 𝑄 = 144𝑝−2 . Its average variable cost is 𝐴𝑉𝐶 = √𝑄 and its fixed cost is 5. (a) What are its profit-maximizing price and quantity? What is the resulting profit? (b) Suppose the government regulates the price to be no greater than $4 per unit. How much will the monopolist produce? What will its profit be? (c) Suppose the government wants to set a ceiling price that induces the monopolist to produce the largest possible output. What price will accomplish this goal? Problem 4 A monopolist faces the following demand curve: 𝑄 = 10000𝑝−2 . The firm’s short-run cost is 𝑇𝐶𝑆𝑅 = 2000 + 5𝑄, and its long-run cost is 𝑇𝐶𝐿𝑅 = 6𝑄. (a) What price should the firm charge to maximize profit in the short run? What quantity does it sell, and how much profit does it make? Would it be better off shutting down in the short run? (b) What price should the monopolist charge in the long run? What quantity does it sell and how much profit does it make? Would it be better off shutting down in the long run? (c) Can we expect the monopolist to have lower marginal cost in the short run than in the long run? Explain why. Problem 5 Suppose a monopoly sells its goods in two different markets separated by some distance. Demand for these markets are given by 𝑄1 = 55 − 𝑝1 and 𝑄2 = 70 − 2𝑝2 , respectively. Monopolist’s output can be produced with constant marginal (and average) cost of $5 per unit. (a) If the monopolist can maintain the separation between the two markets and practice 3rd degree price discrimination, what level of output should be produced in each market, and what price will prevail in each market? What are total profits in this situation? (b) If the price differential between two markets found in part (a) would be so much, then it may induce the arbitrage among consumers. Suppose the delivery and transportation costs for them are only $5. How can the monopolist prevent the arbitrage? How would your answer change? What would be the monopolist’s new profit level in this situation? (c) Now suppose that there are no transportation costs and then the firm is forced to follow a single-price policy. What are price, output and profit levels? Problem 6 A monopolist is deciding how to allocate output between two geographically separated markets (market 1 and market 2). The demand functions for these two markets are 𝑝1 (𝑄1 ) = 15 − 𝑄1 and 𝑝2 (𝑄2 ) = 25 − 2𝑄2. The monopolist’s total cost is 𝑇𝐶 = 5 + 3(𝑄1 + 𝑄2 ). What are price, output, profits, marginal revenues, and deadweight loss if (i) the monopolist can price discriminate? (ii) the law prohibits charging different prices in the two regions? Problem 7 A monopolist is deciding to practice 2nd degree price discrimination according to quantity consumed, i.e. pricing in blocks. Without price discrimination he charges 120. Price elasticity of demand he faces is equal to −1,5. Marginal cost is 𝑀𝐶 = 𝑄 + 20. Fixed costs are 0. (a) What are price, output, and profits if there is no price discrimination. Also define the demand function (assume it is linear) (b) Now monopolist uses 2nd degree price discrimination. Calculate the size and price for each block if 1st block is 10. What the total quantity of blocks? Use the demand function from (a). Hint: use Stackelberg rule. Also see Гребенников, гл.5 (c) What are the profit and consumer’s surplus? Show it on the graph. (d) Suppose the total quantity of blocks is that of (b), but the size and price for each block is not defined. What are the optimal size and price for each block. What is profit? Problem 8 A monopolist faces two consumer groups. Demand function for the first group is given by 𝑄1 = 20 − 4𝑝, for the second group is given by 𝑄2 = 16 − 4𝑝. Marginal cost is equal to 2.5, and does not depend on output. I. Monopolist engages in third degree price discrimination. I.a. Find the price for the first consumer group. I.b. Find the price for the second consumer group. I.c. Calculate profit of the firm. II. Suppose monopolist applies a two-part tariff (fixed entry fee and price per unit) and can distinguish between two consumer groups. II.a. Find optimal entry fee and price per unit for the first consumer group. How many units of product will be sold in this case? II.b. Find optimal entry fee and price per unit for the second consumer group. How many units of product will be sold in his case? II.c. Calculate profit of the firm. III.Suppose, monopolist applies a two-part tariff pricing strategy (fixed entry fee and price per unit), however it cannot distinguish between two consumer groups. III.a. Find optimal entry fee and price per unit. III.b. How many units of product will be sold to each group? III.c. Calculate profit of the firm. Problem 9 (see a theoretical model in presentation: 1st degree Price Discrimination. 2nd degree Price Discrimination. More formal analysis ) A monopoly is facing two groups of consumers, A and B. Consumers have the utility functions 𝑢𝐴 (𝑥𝐴 , 𝑤𝐴 ) = 4√𝑥𝐴 + 𝑤𝐴 and 𝑢𝐴 (𝑥𝐴 , 𝑤𝐴 ) = 6√𝑥𝐵 + 𝑤𝐵 , where 𝑥 is the quantity of good 𝑥 , 𝑤 is aggregate of all the other goods measured in dollars. A monopoly has the cost function 𝑐(𝑥) = 𝑥/2 and offers no more than two packages (𝑥, 𝑡) with quantity 𝑥 at price 𝑡. Let the number of consumers in both groups be the same and be offered a positive amount of good 𝑥. (a) Write down the monopolist's profit maximization problem and indicate which of the constraints in the above problem will be satisfied as equalities. Explain. Hint: there are participation and self-selection constraints for both groups of consumers. (b) Find optimal packages and illustrate them graphically. (c) Suppose now that the monopolist has the ability to distinguish between the types of consumers. Which packages will the monopolist offer in this case? Illustrate the solution graphically. (d) If discrimination of any kind were prohibited, how and by how much would the monopolist's profits change compared to part (b)? Illustrate the equilibrium when price discrimination is prohibited.