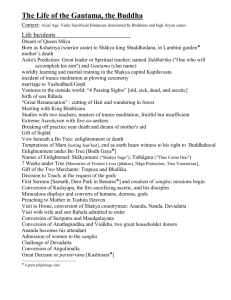

Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Introduction Dr. Shree Raj Shakya 2022 Course Objectives This course aims to provide sound and comprehensive coverage of engineering economics especially the following: • To explain how business operates, how engineering project decisions are made within the business, and how engineering decisions can affect profit of the firm. • To build a thorough understanding of theoretical and conceptual basis of financial analysis of project. • To help engineer for making correct/informed financial decisions when acting as a team member or project manager for an engineering project. • To introduce use of computer based critical decision-making tools (software) so that engineers can make correct/informed decision under different constraints and uncertainty. Course outline • • • • • • • • • • Introduction to engineering economics Cost concepts and behavior Understanding financial statements Time value of money Project Evaluation Techniques Depreciation Income Tax & Discounted Cash-flow models Project risk analysis Economic analysis in public sector Course Presentation Text books and software • Chan S. Park. “Contemporary Engineering Economics”, Fifth Edition. Prentice Hall of India Pvt. Ltd., New Delhi. 2011 • Other Related books • Excel inbuilt financial analysis packages, Solver, Crystal ball Pro etc. Evaluation Criteria Internal Evaluation Assessment : Case Study Project + Presentation : (3-4 students in one group) Attendance : 10 8 Total : 20 2 Engineering Economics • Engineers have to participate in various decisionmaking process in a business firm or industry. • They get involved in various economic decisions related to engineering projects such as development of a product, purchase of an equipment, construction of plant, dams, building etc. • Economics is the study of how people use their limited resources to try to satisfy unlimited wants. • Engineering Economics is the study of how to make economic decisions in engineering projects. Rational Decision-Making Process: Example Car to Lease ▪ ▪ ▪ ▪ ▪ Recognize the decision problem Collect all needed (relevant) information Identify the set of feasible decision alternatives Define the key objectives and constraints Select the best possible and implementable decision alternative • Need to lease a car • Gather technical and financial data Select cars to consider Wanted: small cash outlay, safety, good performance, aesthetics,… Choice/ Select a car (i.e., Honda, Saturn or another brand) • • • 7 Engineering Economic Decisions Needed e.g. in the following (connected) areas: Profit! Then continue at the next stage… Manufacturing Design Financial planning Investment and loan Marketing 8 What Makes Engineering Economic Decisions Difficult? Predicting the Future • Estimating the required investments • Estimating product manufacturing costs • Forecasting the demand for a brand new product • Estimating a “good” selling price • Estimating product life and the profitability of continuing production 9 The Role of Engineers in Business Create & Design • Engineering Projects Analyze Evaluate Evaluate • Production Methods • Engineering Safety • Environmental Impacts • Market Assessment • Expected Profitability • Timing of Cash Flows • Degree of Financial Risk • Impact on Financial Statements • Firm’s Market Value • Stock Price 10 Accounting vs. Engineering Economy Evaluating past performance Accounting Evaluating and predicting future events Engineering Economy Past Future Present 11 Key Factors in Selecting Good Engineering Economic Decisions ❑ Objectives ❑ ❑ Profit Maximization, Cost Minimization Capital Investment, Human Resource, Raw materials, etc. ❑ Available Resources ❑ Time ❑ Short Term, Medium Term, Long Term ❑ Uncertainty ❑ Cost (Investment, O&M cost), Revenue, other 12 externalities Large-Scale Engineering Projects These typically • require a large sum of investment • can be very risky • take a long time to see the financial outcomes • lead to revenue and cost streams that are difficult to predict All the above aspects (and some others not listed here) point towards the importance of Engineering Economic Analysis 13 Types of Strategic Engineering Economic Decisions in the Manufacturing Sector ❑ Service Improvement ❑ Equipment and Process Selection ❑ Equipment Replacement ❑ New Product and Product Expansion ❑ Cost reduction or profit maximization can be seen as generic (common, eventual) objectives ❑ In the most general sense, we have to make decisions under resource constraints, and in presence of uncertainty 14 Example 1: Healthcare Service Improvement 1 Traditional Plan: Patients visit the service providers ◼ 2 New Strategy: Service providers visit the patients Which one of the two plans is more economical? The answer typically depends on the type of patients and the services offered. Examples? ◼ service providers patients 1 2 15 Example 2: Equipment and Process Selection • How do you choose between using alternative materials for an auto body panel? • The choice of material will dictate the manufacturing process and the associated manufacturing costs 16 Example 3: Equipment Replacement Problem • Key question: When is the right time to replace an old machine or equipment? 17 Example 4: New Product and Product Expansion • Shall we build or acquire a new facility to meet the increased (increasing forecasted) demand? • Is it worth spending money to market a new product? 18 Example 5: MACH 3 Project • R&D investment: $750 million(!) • Product promotion through advertising: $300 million(!) • Priced to sell at 35% higher than the preceding Sensor Excel model (i.e., about $1.50 extra per razor) • Question 1: Would consumers pay $1.50 extra for a shave with greater smoothness and less irritation? • Question 2: What happens if the blade consumption drops more than 10% – due to the longer blade life of the new razor?... 19 Example 6: Cost Reduction • Should a company buy new equipment to perform an operation that is now done manually? • Should we spend money now, in order to save more money later? • The answer obviously depends on a number of factors. 20 Further Areas of Strategic Engineering Economic Decisions in the Service Sector ❑ ❑ ❑ ❑ ❑ ❑ ❑ ❑ Commercial Transportation Logistics and Distribution Healthcare Industry Electronic Markets and Auctions Financial Engineering and Banking Retail Hospitality and Entertainment Customer Service and Maintenance 21 The Four Fundamental Principles of Engineering Economics 1: An instant dollar is worth more than a distant dollar… 2: Only the relative (pair-wise) difference among the considered alternatives counts… 3: Marginal revenue must exceed marginal cost, in order to carry out a profitable increase of operations 4: Additional risk is not taken without an expected additional return of suitable magnitude 22 Principle 1 An instant dollar is worth more than a distant dollar… Today 6 months later 23 Principle 2 Only the cost (resource) difference among alternatives counts Option Monthly Fuel Cost Monthly Maintenance Cash paid at signing (cash outlay ) Monthly payment Salvage Value at end of year 3 Buy $960 $550 $6,500 $350 $9,000 Lease $960 $550 $2,400 $550 0 The data shown in the green fields are irrelevant items for decision making, since their financial impact is identical in both cases 24 Principle 3 Marginal (unit) revenue has to exceed marginal cost, in order to increase production Marginal cost Manufacturing cost 1 unit Marginal revenue Sales revenue 1 unit 25 Principle 4 Additional risk is not taken without a suitable expected additional return Investment Class Potential Risk Expected Return Savings account (cash) Lowest 1.5% Bond (debt) Moderate 4.8% Stock (equity) Highest 11.5% A simple illustrative example. Note that all investments imply some risk: portfolio management is a key issue in finance 26 Summary • The term engineering economic decision refers to any investment or other decision related to an engineering project • The five main types of engineering economic decisions are (1) service improvement, (2) equipment and process selection, (3) equipment replacement, (4) new product and product expansion, and (5) cost reduction • The factors of time, resource limitations and uncertainty are key defining aspects of any investment project • All listed decision types can be seen and modeled as a constrained decision (optimization) problem 27 THANK YOU Types of Business Organizations • Proprietorship • Partnership • Corporation • Their negative and positive sides ? Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Cost Concepts and Behavior Dr. Shree Raj Shakya 2022 Various types of manufacturing costs incurred by a manufacturer Costing Systems Costing systems aim to report costs of products, services in using the resources of the firms. In engineering economics, the term cost is used in many different ways. • there are many types of costs, each is classified differently according to the immediate needs of management. •eg, engineers may want cost data to prepare external reports, to prepare planning budgets, or to make decisions. • also, each different use of cost data demands a different classification and definition of cost. •eg, the preparation of external financial reports requires the use of historical cost data, whereas decision making may require current cost data or estimated future cost data. Manufacturing Costs • In converting raw materials into finished goods, a manufacturer incurs various costs associated with operating a factory. • Most manufacturing companies divide manufacturing costs into three broad categories: – direct raw material costs, – direct labor costs, – and manufacturing overhead. Manufacturing Costs • Direct Raw Materials: – Direct raw materials are any materials that are used in the final product and that can be easily traced to it. – Eg, wood in furniture, steel in bridge construction, paper in printing firms, and fabric for clothing manufacturers. – finished product of one company can become the raw materials of another company. • Direct Labor: – Direct labor incurs costs that go into the production of a product. – Eg, labor costs of assembly-line workers, labor costs of welders in metal-fabricating industries, carpenters or bricklayers in home building, and machine operators in various manufacturing operations. Manufacturing Costs • Manufacturing Overhead : – the third element of manufacturing cost, includes all costs of manufacturing except the costs of direct materials and direct labor – not easily traceable to specific units of output • Eg, costs of indirect materials; indirect labor; maintenance and repairs on production equipment; heat and light, property taxes, depreciation, and insurance on manufacturing facilities; and overtime premiums – finished product of one company can become the raw materials of another company. • Sometimes it may not be worth the effort to trace the costs of materials that are relatively insignificant in the finished products. Materials such as solder and glue (indirect materials) Non-Manufacturing Costs • Two additional costs incurred in supporting any manufacturing operation are 1. 2. Marketing or selling costs and Administrative costs. • Overhead: Heat and light, property taxes, and depreciation or similar items associated with the company’s selling and administrative functions. • Marketing: Advertising, shipping, sales travel, sales commissions, and sales salaries. Marketing costs include all executive, organizational, and clerical costs associated with sales activities. • Administrative functions: Executive compensation, general accounting, public relations, and secretarial support, associated with the general management of an organization. Classifying Costs for Financial Statements • For purposes of preparing financial statements, we often classify costs as either period costs or product costs • Period costs: costs charged to expenses in the period in which they are incurred. – assumption is that associated benefits are received in the same period the cost is incurred. – Eg, all general and administrative expenses, selling expenses, and insurance and income tax expenses. Therefore, advertising costs, executives’ salaries, sales commissions, public-relations costs, and other nonmanufacturing costs discussed earlier would all be period costs. – not related to the production and flow of manufactured goods, but are deducted from revenue in the income statement. In other words, period costs will appear on the income statement as expenses during the time in which they occur Classifying Costs for Financial Statements • Product costs: Some costs are better matched against products than they are against periods. – consist of the costs involved in the purchase or manufacture of goods. – In the case of manufactured goods, product costs are the costs of direct materials, direct labor costs, and manufacturing overhead. Product costs are not viewed as expenses; rather, they are the cost of creating inventory. Thus, product costs are considered an asset until the associated goods are sold. At the time they are sold, the costs are released from inventory as expenses (typically called cost of goods sold) and matched against sales revenue. – Since product costs are assigned to inventories, they are also known as inventory costs. Classifying Costs for Financial Statements How the period costs and product costs flow through financial statements from the manufacturing floor to sales. Classifying Costs for Financial Statements Cost flows and classifications in a manufacturing company *Based on an annual volume of 185,000 cones. Product costs: Costs incurred in preparing 185,000 ice cream cones per year Period costs: Costs incurred in running the shop regardless of sales volume Job and Process Costing System Job Costing System In this system, the cost of a product or service is obtained by assigning costs to a distinct, identifiable product or service. Process Costing System In this system, the cost of a product or service is obtained by assigning costs to masses of similar units and then calculating units costs on an average basis. Job Costing System in Manufacturing Direct cost Direct Material cost Direct Manufacturing labor cost Indirect cost Manufacturing overhead Process Costing Systems in Manufacturing Direct Material cost Conversion cost Total costs Manufacturing Unit cost Conversion costs: All manufacturing costs other than direct materials costs. Cost Behaviors Fixed cost: A cost that remains Constant, regardless of any change in a company’s activity (production volume). Eg: the annual insurance premium, property tax, and license fee are fixed costs, since they are independent of the production volume per year for manufacturing company or number of miles driven per year for transport company, building rents; depreciation of buildings, machinery, and equipment; and salaries of administrative and production personnel. Variable cost: A cost that changes in proportion to a change in a company’s activity or business. Eg: Gasoline is a good example of a variable automobile cost, because fuel consumption is directly related to miles driven. Similarly, the cost of replacing tires will increase as a vehicle is driven more. Cost Behaviors Mixed cost: Costs are fixed for a set level of production or consumption, becoming variable after the level is exceeded. Eg: In automobile example, depreciation (loss of value) is a mixed cost. On the one hand, some depreciation occurs simply from the passage of time, regardless of how many miles a car is driven, and this represents the fixed portion of depreciation. On the other hand, the more miles an automobile is driven a year, the faster it loses its market value, and this represents the variable portion of depreciation. A typical example of a mixed cost in manufacturing is the cost of electric power. Some components of power consumption, such as lighting, are independent of the operating volume, while other components (e.g., the number of machine-hours equipment is operated) may vary directly with volume. Cost Behaviors Average Unit Cost: We often use the term average cost to express activity cost on a per unit basis. In terms of unit costs, the description of cost is quite different: •Variable cost per unit of volume is a constant. • Fixed cost per unit varies with changes in volume: As the volume increases, the fixed cost per unit decreases. • Mixed cost per unit also changes as volume changes, but the amount of change is smaller than that for fixed costs. . Cost–volume relationships pertaining to annual automobile costs Depreciation Tax, insurance Fuel Average cost per mile of owning and operating a car OM Cost Driver Any factor that affects costs is called cost driver. Variable cost It is a cost that changes in total in proportion to changes in a cost driver. Fixed cost It is a cost that does not change in total despite changes of a cost driver. Capitalized cost A cost that is first recorded as an asset and then becomes an expense such as depreciation of machines, computers, equipment etc. Inventoriable cost Cost associated with purchase of materials and other manufacturing inputs. Period cost A cost that is reported as an expense in a particular period. Product cost A cost of creating inventory and is considered an asset until the associated good is sold where it is released from inventory as expenses and matched against sales revenue. Differential (incremental) costs: Costs that represent differences in total costs, which result from selecting one alternative instead of another. Opportunity costs: Benefits that could have been obtained by taking an alternative action. Sunk costs: Past costs not relevant to decisions because they cannot be changed no matter what actions are taken. Marginal costs: Added costs that result from increasing rates of outputs, usually by single units. Cost Concepts Relevant to Decision Making 1. Method Change Variable costs: Materials Current Die Better Die Differential Cost $150,000 $170,000 + $20,000 Machining labor 85,000 64,000 - 21,000 Electricity 73,000 66,000 - 7,000 Supervision 25,000 25,000 0 Taxes 16,000 16,000 0 Depredation 40,000 43,000 + 3,000 $389,000 $384,000 - $5,000 Fixed costs: Total Cost Concepts Relevant to Decision Making 2. Operation Planning (Break-Even Volume Analysis) • 24,000 initial order • 4,000 extra • Option 1 – extra time or Saturday running with 12,000 ($36 extra per unit) • Option 2 – Second shift operation with 21,000 (13,500 + 31.5 Q) Cost Concepts Relevant to Decision Making 3. Make or Buy Decision Make Option Buy Option Differential Cost Variable cost Direct materials 100,000 - 100,000 Direct labor 190,000 -190,000 35,000 -35,000 Power and water Gas filters 340,000 340,000 Fixed costs Heating light 20,000 20,000 0 Depreciation 100,000 100,000 0 -35,000 -35,000 $445,000 $425,000 -$20,000 $22.25 $21.25 $1.00 Rental income Total cost, Unit cost Marginal versus average cost per kWh Marginal versus average cost per kWh Marginal versus average cost per kWh Profit Maximization Problem : Marginal Analysis Example 8.7 THANK YOU Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Financial Statement and Ratio Analysis Dr. Shree Raj Shakya 2022 The accounting system and flow of information Summary of major factors affecting stock prices Financial Statements • These are statements of financial information to the managers and the shareholders. – Income Statement (Profit and Loss Statement) – Balance Sheet – Cash Flow Statement 6/14/2022 4 Financial Status for Business Beginning of fiscal period How much profit did the company make during the fiscal period? Income Statement How much cash did the company generate and spend during the period? Cash Flow Statement What is the company’s financial position at the end of fiscal period? Balance Sheet End of fiscal period Balance Sheet • It gives snapshot summary of the firm's financial position at a single point in time. • The balance sheet shows the net worth of shareholders at a point in time, whereas income statement measures changes in net worth. • Liabilities indicate what money has been made available to the firm. • Assets show how the firm has used the money made available to it. 6/14/2022 6 Balance Sheet 6/14/2022 7 Balance Sheet • Current Liabilities are the short -term debt obligations of a firm, with maturities of less than one year. • Fixed liabilities are firm's long-term finance such as long-term debts from banks and the public. • Shareholders' equity is the money invested by the shareholders and the retained earnings. 6/14/2022 8 Balance Sheet • Fixed Assets are acquired for long-term uses in the firm such as plant, building, land, and equipment. • Current Assets are cash, accounts receivables, and inventories of finished goods and raw materials. 6/14/2022 9 Balance Sheet • Depreciation is the allocation of cost of an asset to different time periods. • Working Capital is composed of firm's current assets. • Net Working Capital is the difference between current assets and current liabilities. 6/14/2022 10 Balance Sheet Fixed Assets 6/14/2022 Land Buildings Plant and Machinery Fixtures and fittings Motor vehicles 11 Balance Sheet Cash in hand Cash in bank Marketable securities Accounts receivables Prepaid expenses Deposits CURRENT ASSETS Finished Products Work in progress Raw materials Other supplies 6/14/2022 12 Balance Sheet ASSETS = LIABILITIES + OWNERS’ EQUITY Balance Sheet Balance Sheet Statement – Dell Computer Corporation (in millions) 28-Jan-00 29-Jan-99 Change Percent ASSETS Current assets: Cash $ 3,809 $ 1,726 $ 2,803 121% 323 923 (600) -65% 2,608 2,094 514 25% Inventories 391 273 118 43% Other 550 791 (241) -30% 7,681 5,807 1,874 32% 765 523 242 46% Long-term investments 1,048 532 516 97% Equity securities and other investments 1,673 - 1,673 304 15 289 1927% $ 11,471 $ 6,877 $ 4,594 67% Short-term investments Account receivables, net Total current assets Property, plant and equipment, net Goodwill and others Total assets Balance Sheet Balance Sheet Statement – Dell Computer Corporation (in millions) 28-Jan-00 29-Jan-99 Change Percent LIABILITIES AND STOCKHOLDERS'EQUITY Current liabilities: Accounts payable $ 3,538 $ 2,397 $ 1,141 48% Accrued and other 1,654 1,298 356 27% 5,192 3,695 1,497 41% Long-term debt 508 512 (4) -1% Other 463 349 114 33% 6,163 4,556 1,607 35% 3,583 1,781 1,802 101% 1,260 606 654 108% 465 (66) 531 5,308 2,321 2,987 129% $ 11,471 $ 6,877 $ 4,594 67% Total current liabilities Total liabilities Stockholders' equity: Preferred stock Common stock and capital in excess of $0.01 par value Retained earnings Other Total stockholders' equity Total liabilities and stockholders' equity - Income Statement • It shows the record of financial events between two points in time. It has revenue from sales and expenses incurred during the period. • Net Worth The value of total assets minus total liabilities or the value of the owners' claim on the assets. 6/14/2022 16 Income Statements (P/L statement) • Expenditures are all cash outflows – Expenses are only those expenditures that affect net worth of the shareholders and appear in the Income Statement. • Receipts are all cash inflows. – Revenues are only those receipts that affect net worth and thus appear in the income statement. 6/14/2022 17 Income Statement Revenue Costs of Goods Sold (COGS) Gross Profit Expenses Net Income 6/14/2022 18 Income Statement Income Statement – Dell Computer Corporation (in millions, except per share amount) Net Revenue 28-Jan-00 29-Jan-99 $25,265 $18,243 20,047 14,137 5,218 4,106 2,387 1,788 568 272 2,955 2,060 2,263 2,046 188 38 2,451 2,084 785 624 $1,666 $1,460 Basic $0.66 $0.58 Diluted $0.61 $0.53 Basic 2,536 2,531 Diluted 2,728 2,772 606 607 1,666 1,460 Repurchase of common stocks (1,012) (1,461 Balances at end of period $1,260 $606 Cost of revenue Gross margin Operating expenses: Selling, general and administrative Research, development and engineering Total operating expenses Operating income Other income Income before income taxes Provision for income taxes Net income Earnings per common share: Weighted average shares outstanding: Retained Earnings: Balances at beginning of period Net income Cash Flow Statement • Source- and -use-of-funds Statement (cash flow statement) is a summary of the flow of the financial activity of the firm. It shows where the firm obtains cash and how it uses it. • Sources of funds – Increase in liabilities – Increase net worth through retained earnings or capital contribution by the shareholders – Reduction in assets through sales of assets • Uses of funds – reduction in liabilities – reduction in net worth through payment of dividends or losses – increase in assets 6/14/2022 21 Cash Flow Statement • Cash flow from operating activities – Net profit – Depreciation – Decrease in account receivables – Increase in accounts payables • Cash flow from investing activities – Sales of fixed assets – Investment in new fixed assets 6/14/2022 22 Cash Flow Statement • Cash flow from financial activities – Increase in debt (cash inflow) – Issuance of new shares (cash inflow) – Dividend payment (cash outflow) 6/14/2022 23 Cash Flow Statement – Dell Computer Corporation (in millions) Net income 28-Jan-00 29-jan-99 $1,666 $1,460 156 103 2,104 873 3,926 2,436 (3,101) (1,938) 2,319 1,304 397 (296) (1,183) (930) (1,061) (1,518) 289 212 Proceeds from issuance of long-term debt 20 494 Cash received from sale of equity options and other 63 Repayment of borrowings (6) Depreciation and amortization Changes in working capital Net cash provided by operating activities Cash flows from investing activities: Marketable securities: Purchase Sales Capital expenditures Net cash used in investing activities Cash flows from financing activities: Purchase of common stock Issuance of common stock under employee plans Net cash used in financing activities (695) (812) Effect of exchange rate changes on cash 35 (10) $2,083 $684 1,726 1,042 $3,809 $1,726 Net increase in cash Cash at beginning of period Cash at end of period Ratio Analysis • In ratio analysis, we relate various items from the firm's financial statements to each other with the aim of assessing and analyzing the firm's financial position. • By comparing the financial ratios of the same company over different periods, or by comparing with that of other companies in the industry, or the industry average, we can compare the relative performance of the company. • Common comparisons are: 1. Same company over several years. 2. An industry leader or "best practice." 3. Industry norms found in publications. 4. A self-developed set of comparable companies. 5. International variations on 2, 3, and 4. 6. Rules of "thumb." Types of ratios used in evaluating a firm’s financial health Profitability Ratios Profitability ratios assess the profitability of the firm. Profit Margin = Net income / Revenue Return on assets = Net income / Total Assets Return on equity (Return on Investment) = Net income / Owners' Equity Normally profitability ratios higher than comparables are good news. Asset management/ Activity Ratios These ratios help in evaluating the managerial efficiency of the firm. Asset Turnover = Revenue / Total Assets Days' receivables = Accounts receivables / Average Days Sales Average days sales = Revenue / 365 Any turnover ratio: Normally higher than the comparable ratios are good news, although for plant and equipment one may worry if necessary repairs and maintenance are being carried out if substantially higher turnover than industry. Number of days sales in a current asset: Normally higher than comparables is bad news as your conversion of the asset into cash is slower than the reference industry. For inventory: higher ratios may indicate old, slow moving inventory; for accounts receivable: a higher ratio may indicate problems collecting A/R. Debt management / Leverage Ratios Leverage ratios measure the degree to which a firm relies on bank debts and other debt securities Debt ratio = Total Liabilities / Total Assets Debt to equity ratio = Total Liabilities / Owners' Equity Times interest earned = (Income before taxes + Interest Expense - Equity in earnings of affiliates) / Interest Expense (Equity in earnings of affiliates are earnings NOT available to pay interest with so many analysts remove it before calculating times interest earned) Days payables = Accounts payable / Average operating expenses Average operating expenses = Operating expenses / 365 The amount of debt relative to equity is a major management decision that is discussed in great detail in finance courses. The higher any debt ratio is the greater the company's risk as fixed interest expenses are increasing. Thus, higher debt ratios than comparables may indicate more risk than comparables. However, if the company is well managed, this risk may be offset with higher returns to shareholders. Times interest earned ratios that are higher than comparables indicate greater ease in paying interest, therefore, less risk. Liquidity ratios These ratios reflect a firm's short-term ability to pay its debts. Current ratio = Current assets / Current liabilities Quick ratio = (Cash + Accounts receivable) / Current liabilities Higher liquidity ratios than comparables are subject to two interpretations dependent on context. Higher liquidity may indicate better ability to pay short term debts as they come due or alternatively may indicate inadequate controls over credit granting (for A/R) or inventory buildup. Market trend/ ratios These ratios reflect the data from the financial statements to financial market data. These ratios provide some insights into investors' perception of the firm and its securities. Price/earnings ratio = Year end market price per share / Fully diluted earnings per share Dividend yield = Dividend per share / Year end price per share It is a very controversial ratio not easily subject to interpretation. Research shown that of all ratios, P/E is most context specific in its interpretation. For example, a high P/E has been cited as being an indication of a highly risky stock, a stock with high growth potential, and a stock with an unusually bad current year that is not "normal." Exercise 2.3, 2.5, 2.6, 2.7 THANK YOU Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Time Value of Money, Interest Rate and Economic Equivalence Dr. Shree Raj Shakya 2022 Time Value of MONEY • Money has a time value. • The economic value of an amount depends on when it is received. • Money has earning power over time. 2 Lecture 4 - Dr. Shree Raj Shakya Time Value of MONEY A rupee received today has more value than a rupee received at some future time 3 Lecture 4 - Dr. Shree Raj Shakya Time Value of MONEY • Gains achieved or losses incurred by delaying consumption 4 Lecture 4 - Dr. Shree Raj Shakya Cost of money => Interest The cost of money is measured by an interest rate, a percentage that is periodically applied and added to an amount of money over a specified length of time 5 Financial terms • Principal: initial amount of money in transactions of debt or investment • Interest rate: measures the cost of money, expressed as percentage per period of time • Interest period: a period of time when interest is frequently calculated (usually one year) • Number of periods: specified length of time when transaction is done • Future amount: amount of money resulted from cumulative effects of interest rate over a number of several interest periods 6 Lecture 4 - Dr. Shree Raj Shakya Some Notations An = Discrete payment or receipt at the end of interest period i = interest rate per interest period N = number of interest periods P = A sum of money at a time chosen for analysis, or called present value (PV) or present worth F = A future sum of money at the end of analysis period, or Fn ,at the end of some interest period A = An end- of -period payment or receipt in a uniform series Vn = An equivalent sum of money at the end of specified period, considering time value of money; V0 =P ; Vn = F 7 Lecture 4 - Dr. Shree Raj Shakya Cash flow Diagrams It is a convenient way of representing problems involving time value of money in graphic forms. The cash flow diagram shows net flows at the end of interest periods. 8 Lecture 4 - Dr. Shree Raj Shakya Cash flow Diagrams Repayment Plans for Example Given in Text (for N = 5 years, and i = 9%) 9 Lecture 4 - Dr. Shree Raj Shakya Simple Interest Under simple interest, the interest earned during each interest period will not earn an additional interest on interest amount in the remaining periods. I=(iP)N F =P+I=P(1+iN) 10 Lecture 4 - Dr. Shree Raj Shakya Compound Interest Under this interest, the interest earned in each period is based on the total amount owed at the end of the previous period. This means interest will be earned on the interest charged in the previous period as well. At the end of first year, F = P + iP = P(1+i) At the end of 2nd year, F = P (1+i) + i [ P (1+i) ] = P (1+i)2 A the end of n periods, F = P (1+i)n 11 Relationship between simple interest and compound interest 12 Lecture 4 - Dr. Shree Raj Shakya Economic Equivalence Economic equivalence exists when cash flows have the same economic effect and thus could be traded for one another in the financial market. 13 Lecture 4 - Dr. Shree Raj Shakya Suppose you are offered the alternative of receiving either Rs 3,000 at the end of 5 years or Rs P today. There is no question that the Rs 3,000 will be paid in full (no risk). Having no current need for the money, you would deposit the P rupees in an account that pays 8% interest. What value of P would make you indifferent in your choice between P rupees today and the promise of Rs 3,000 at the end of 5 years from Now? 14 You borrowed $ 1,000 from a bank for 3 years at 10% annual interest. The bank offered you two options (a) repaying the loan all at once at the end of 3 years, or (b) repaying the interest charges for each year at the end of that year. 15 Lecture 4 - Dr. Shree Raj Shakya Since two interest payments are equivalent, the bank would be economically indifferent to a choice between the two plans 16 Five Types of Cash flows • • • • • Single cash flow Uniform Cash flows Linear Gradient Series Geometric Gradient Series Irregular series 17 Lecture 4 - Dr. Shree Raj Shakya Single cash flow 18 Lecture 4 - Dr. Shree Raj Shakya Single cash flow F =P(1+i)N =P (F/P, i, N) where, (1+i)N is called single payment compound amount factor. P =F(1+i)-N=F (P/F, i, N) where, (1+i)-N is called single payment present value (worth) factor. 19 Lecture 4 - Dr. Shree Raj Shakya Single cash flow (Example) If you had $2,000 now and invested it at 10%, how much would it be worth in eight years? 20 Lecture 4 - Dr. Shree Raj Shakya Single cash flow (Example) 21 Lecture 4 - Dr. Shree Raj Shakya Single cash flow (Example) 22 Lecture 4 - Dr. Shree Raj Shakya Single cash flow (Example) 23 Lecture 4 - Dr. Shree Raj Shakya Uniform Cash flows 24 Uniform Cash flows = A(F/A, i, N) = F(A/F, i, N) where [(1+i)N –1] / i is called equal payment series compound amount factor or uniform series compound amount factor. where i/ [(1+i)N –1] is called equal payment series 25 sinking - fund factor. Uniform Cash flows = A (P/A, i, N) = P (A/P, i, N) where [(1+i)N –1] / i(1+i)N is called equal payment series present value (worth) factor. where i(1+i)N / [(1+i)N –1] is called equal payment series capital recovery factor or annuity factor. 26 A person now 35 years old. he plan to invest an equal sum of Rs. 10,000 at the end of every year for next 25 years starting from the end of the next year. The bank gives 20% interest rate compounded annually. Find maturity value when he is 60 years old. uniform series compound amount factor 27 Linear Gradient Series 28 Linear Gradient Series 29 Linear Gradient Series Gradient series is to be taken as composite series, or as a set of two cash flows – one as uniform series and another as gradient series. P =P1+ P2 P2 =G [(1+i)N –iN-1]/ i2(1+i)N =G(P/G,i,N) where (P/G, i, N) is called gradient series present value (worth) factor. 30 Linear Gradient series A = G [(1+i)N - iN -1] / i[(1+i)N -1] =G(A/G, i, N) where (A/G, i, N) is called Gradient to equal payment series conversion factor. 31 Lecture 4 - Dr. Shree Raj Shakya A person has 10 years of service. He would like to deposit 20% of his salary, which is Rs. 4,000, at the end of the first year, and thereafter he wishes to deposit the amount with an annual increase of Rs. 500 for the next 9 years with an interest rate of 15%. Find the total amount at the end of the 10th year of the above series? 32 Lecture 4 - Dr. Shree Raj Shakya Geometric Gradient Series 33 Geometric Gradient Series 34 Geometric Gradient Series Geometric gradient Present worth factor (P/A1, g, i, N) 35 Geometric Gradient Series F = A1[(1+i)N - (1+g) N ] / (i - g) if i≠g =N A1 / (1+i)N-1 if i=g = A1(F/ A1, g, i, N) where (F/ A1, g, i, N) is called future value (worth) equivalent of geometric gradient series. 36 Lecture 4 - Dr. Shree Raj Shakya 37 38 Irregular series 39 Lecture 4 - Dr. Shree Raj Shakya Irregular series 40 Irregular series 41 Assignment L4 3.3, 3.5, 3.6, 3.17, 3.21, 3.30, 3.38, 3.45, 3.51, 3.68 Lecture 4 - Dr. Shree Raj Shakya 42 Practice Lecture 4 - Dr. Shree Raj Shakya 43 Lecture 4 - Dr. Shree Raj Shakya 44 Practice Lecture 4 - Dr. Shree Raj Shakya 45 Lecture 4 - Dr. Shree Raj Shakya 46 Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Effective Interest and Cash Flow Dr. Shree Raj Shakya 2022 Lecture 5 Nominal Interest rate • If a financial institutions uses a unit of time other than a year, i.e. a quarter, a month, half-year, then it quotes interest rate on annual basis such as r% compounded monthly, quarterly, or half-yearly • The interest rate or Annual Percentage Rate (APR) is called the nominal interest rate. Lecture 5 - Dr.Shree Raj Shakya 2 Effective Interest rate • The effective interest rate is the one rate that truly represents the interest earned in a year. ia = (1+r/M)M -1 where, ia = effective annual interest rate M =the number of compounding period per year r/M = the interest rate per compounding period Lecture 5 - Dr.Shree Raj Shakya 3 Nominal and Effective Interest Rates with Different Compounding Periods Lecture 5 - Dr.Shree Raj Shakya 4 Effective Interest rate per payment period • If the transaction occurs more than one time a year then, effective interest rate per payment period becomes. i = (1+r/(CK))c -1 where, i = effective interest rate per payment period C = No. of compound period per payment period K = No. of payment period per year r/CK = the interest rate per compounding period Lecture 5 - Dr.Shree Raj Shakya 5 Continuous compounding interest rate • As the number of compounding periods 'M' becomes large, then r/M becomes too small, hence as M approaches infinity, r/M tends to '0', we comes to the situation of continuous compounding. ic = er/k -1 where, ic = effective interest rate per payment period r = nominal interest rate K = No. of payment period per year Lecture 5 - Dr.Shree Raj Shakya 6 Calculating an Effective Interest Rate with Quarterly Payment i = (1+r/(CK))c -1 Lecture 5 - Dr.Shree Raj Shakya 7 Calculating an Effective Interest Rate with Quarterly Payment Lecture 5 - Dr.Shree Raj Shakya 8 Calculating an Effective Interest Rate with Quarterly Payment Lecture 5 - Dr.Shree Raj Shakya 9 Examples 1 Suppose you make equal quarterly deposits of Rs 1,000 into a fund that pays interest at a rate of 12% compounded monthly. Find the balance at the end of year '1' Quarterly Amount deposited, A = Rs 1,000 Nominal interest rate, r = 12% per year No. of compounding period per year, M = 12 No. of payment period per year, K = 4 Compounding period per payment period, C = M/K = 3 Effective interest rate per payment period, i = (1+r/CK)C -1 No of payment period, N = K x 1 = 4 F = A x (F/A, i, N) Lecture 5 - Dr.Shree Raj Shakya 10 Examples 1 F = A x (F/A, i, N) Lecture 5 - Dr.Shree Raj Shakya 11 Lecture 5 - Dr.Shree Raj Shakya 12 Interpolate for 3.03% Lecture 5 - Dr.Shree Raj Shakya 13 Examples 2 A series of equal quarterly receipts of Rs 500 extends over a period of 5 years. What is the present value of this quarterly payment series at 8% interest compounded continuously? Equal quarterly receipt, A = Rs 500 Nominal interest rate, r = 8% No. of compounding period per year = continuous No. of receipts per year, K = 4 Effective interest rate per quarter, Ic = er/k -1 No of quarterly receipt, N = 4 qtr/yr x 5yrs = 20 P = A(P/A, ic, N) Lecture 5 - Dr.Shree Raj Shakya 14 Examples 2 P = A(P/A, ic, N) Lecture 5 - Dr.Shree Raj Shakya 15 Lecture 5 - Dr.Shree Raj Shakya 16 Lecture 5 - Dr.Shree Raj Shakya 17 Examples 3 Suppose you make Rs 1,000 monthly deposit to a registered retirement savings plan that pays interest at a rate of 10% compounded quarterly. Compute the balance at the end of 8 years Monthly Amount deposited, A = Rs 1,000 Nominal interest rate, r = 10% No. of compounding period per year, M = 4 No. of payment period per year, K = 12 Compounding period per payment period, C = M/K = 1/3 Effective interest rate per payment period, i = (1+r/CK)C -1 No of payment period, N = K x 8 = 96 F = A x (F/A, i, N) Lecture 5 - Dr.Shree Raj Shakya 18 Examples 3 Equivalent monthly interest i = (1+r/CK)C -1 = (1+0.10/(1/3)12)1/3 -1 = 0.826% per month F = A x (F/A, i, N) 96 Lecture 5 - Dr.Shree Raj Shakya 19 Lecture 5 - Dr.Shree Raj Shakya 20 Lecture 5 - Dr.Shree Raj Shakya 21 Cash Flow Example 1 If you win a lottery you have the choice of either accepting • Rs I million now or • taking the 20 annual installments (Rs 100,000 each year, a total of Rs 2 million). A local bank offers an annual interest rate of 10% Which option would be more desirable? Lecture 5 - Dr.Shree Raj Shakya 22 Cash Flow Example 2 To help you reach Rs 5,000 goal in 5 years from now, your father 'offers to give you Rs 500 now. You plan to get a part-time job and make additional deposits at the end of each year. ( The first deposit is made at the end of first year.). If all your money is deposited in a bank that pays 7% interest, how large must your annual deposits be? Lecture 5 - Dr.Shree Raj Shakya 23 Cash Flow Example 3 A small firm has borrowed Rs 100,000 to purchase certain equipment. The loan carries an interest rate of 15% and is to be repaid in equal installments over the next 5 years. Compute the amount of this annual installment. Lecture 5 - Dr.Shree Raj Shakya 24 Cash Flow Example 4 Ram and Sita just opened two savings accounts at a bank. The accounts earn 10% annual interest. Ram wants to deposit Rs 1000 in his account at the end of first year and increase this amount by Rs 300 for each of the following 5 years. Sita wants to deposit an equal amount each year for next 6 years. What should be the size of Sita's annual deposit so that two accounts would have equal balances at the end of 6 years? Lecture 5 - Dr.Shree Raj Shakya 25 Cash Flow Example 5 A self-employed individual, Krishna, is opening a retirement account at a bank. His goal is to accumulate Rs 1,000,000 in the account by the time he retires from work in 20 years. A local bank is willing to open such a retirement account that pays 8% interest compounded annually, throughout the 20 years. Krishna expects his annual income will increase at a 6% annual rate during his working career. He wishes to start with a deposit at the end of year '1' of A, and increase the deposit at a rate of 6% each year thereafter. What should be the size of his first deposit A? The first deposit will occur at the end of year ‘1', and the subsequent deposits will he made at the end of each year. The last deposit will be made at the end of year'20'. Lecture 5 - Dr.Shree Raj Shakya 26 Lecture 5 - Dr.Shree Raj Shakya 27 Lecture 5 - Dr.Shree Raj Shakya 28 Assignment L5 • Problems from Chan S Park, Contemporary Engineering Economics, Fourth Edition Book ➢4.1, 4.2,4.3, 4.9, 4.14, 4.16, 4.26, 4.28, 4.31, 4.51, Lecture 5 - Dr.Shree Raj Shakya 29 Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Project Evaluation Techniques Dr. Shree Raj Shakya 2022 Lecture 6 Project Cash flows In most of the engineering economic decision problems, we usually make an initial investment at the beginning of the project. Then this investment will make a series of cash benefits over a period of future years. The representation of future earnings along with the initial capital expenditure and annual expenses such as wages, raw material costs, operating costs, maintenance costs, and income taxes is called the project cash flows. Project Evaluation techniques With the background of knowledge of interest rate and time value of money, we can evaluate whether a project is feasible or not on the basis of cash flow equivalence methods. These techniques are also called Capital Budgeting techniques in finance. Evaluation of Project We can evaluate a project or select a project from different alternatives by the following methods: a) Equivalent Present Value (worth) method b) Equivalent Future Value (worth) method c) Equivalent Annual Value (worth) method Equivalent Present Value (worth) method Equivalent Future Value (worth) method Equivalent Annual Value (worth) method Apart from the above, we can evaluate a project on the basis of Payback Period and Internal Rate of Return (IRR) Payback Period Method The payback period is the number of years required to recover the investment made in a project. Example: Initial Investment = Rs 300,000 Annual Net benefits = Rs 75,000 Payback period = Initial investment/ Uniform Annual benefit =4 years Benefits & flaws of Payback period method Benefit: simplicity Flaws: failure to measure profitability of project & no time value of money consideration Discounted Payback Period To modify the payback period method, we may consider the cost of fund (interest) used to support the project. This modified method is called discounted payback period. Discounted Payback period N occurs, when N Discounted Annual Benefit Initial Investment 0 By hit and trial method we determine the value of N Present Value Analysis Until 1950s, the payback period method was widely used as a means of making investment decisions. As there are flaws in this method, businessmen began to search methods for improving the project evaluations. This led to the development of Discounted Cash Flow (DCF) techniques, which take account of time value of money. One of the DCF methods is Net Present Value (NPV) method. Net Present Value (NPV) method Under NPV method, PV of all cash inflows are compared with PV of all cash outflows. The difference between these PV's is called Net Present Value (NPV). NPV Criterion The basic procedure for applying this criterion: 1. Determine the required rate of interest the firm wants. This interest rate is called required rate of return (ROR) or minimum attractive rate of return (MARR). 2. Estimate the service life of the project 3. Estimate the cash inflow for each period of the service life 4. Estimate the cash outflow for each period of service life 5. Determine the net cash flows 6. Find the present value of each net cash flow discounted at the MARR. 7. Add up the PV's including the initial investment. Their sum is defined as the NPV of the project NPV = A0/(1+i)0 + A1/(1+i)1 + 2 n A2/(1+i) + ….. +An/(1+i) N NPV = An (P / F, i, n ) n =0 If NPV > 0, accept the investment If NPV = 0, remain indifferent If NPV< 0, reject the investment. A micro-hydro project example Calculate the NPV for the scheme assuming a 12% discount factor Revenue: NRs. 300,000 each year for 15 years Initial Investment: NRs. 1,200,000. Yearly expenditure (O & M, salary and others): NRs. 80,000. Solution, The annual net income is NRs. 220,000. The total present value (PV) of receiving this annuity amount for 15 years is n (1 + i) - 1 PV = A = A ( P / A, i, n) n i (1 + i) = NRs.1,496,000 NPV (r=12%) = PV – investment = NRs.1,496,000 – 1,200,000 = NRs. 296,000 > 0 Example 1 If a project's initial investment is Rs 300,000 and gives an equal annual savings of Rs 75,000 for next 10 years. If the company wants MARR of 15%, determine the NPV of the project. Example 2 Tiger Machine Tool Company is considering the proposed acquisition of a new metal-cutting machine. The required initial investment of Rs 750,000 and the projected cash benefits for three years are as follows: End of year Cash flow 0 - Rs 750,000 1 Rs 244,000 2 Rs 273,400 3 Rs 557,600 If the company wants MARR is 15%, determine the NPV of the project? Example 3 A textile company is considering two independent investment proposals. Their expected cash flow streams are given as follows: Year Proj. A Proj. B Year Proj. A Proj. B 0 -250,000 -350,000 6 72,500 70,000 1 72,500 60,000 7 70,000 2 72,500 60,000 8 70,000 3 72,500 60,000 9 70,000 4 72,500 70,000 10 70,000 5 72,500 70,000 If the company wants MARR is 12%, which proposals should be accepted to the company? Perform NPV analysis Practice • 5.2, 5.3, 5.4, 5.5, 5.6, 5.7, 5.9 Lecture 7 - Dr.Shree Raj Shakya 24 Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Project Evaluation Techniques Dr. Shree Raj Shakya 2022 Lecture 7 Future Value Analysis The NPV or NPW measures the surplus in an investment project at time '0'. Sometimes we might need to find the equivalent worth or value of a project at the end of the investment period. Hence, the Net Future Value (NFV) or Net Future Worth (NFW) measures the surplus at the end of the investment period. Lecture 7 - Dr.Shree Raj Shakya 2 NFV Criterion NFV = A0(1+i)n + A1(1+i)n-1 + A2/(1+i) n-2 + ….. +AN = N A n =0 n (1 + i ) N −n NFV = An (F / P, i, N − n ) If NFV >0, accept the project If NFV = 0, remain indifferent If NFV<0, reject the project Lecture 7 - Dr.Shree Raj Shakya 3 NET FUTURE VALUE Lecture 7 - Dr.Shree Raj Shakya 4 NET FUTURE VALUE Lecture 7 - Dr.Shree Raj Shakya 5 Robot manufacturing facility Compute the equivalent worth of this investment at the start of operation. Assume that the company's expected MARR is 15%. Lecture 7 - Dr.Shree Raj Shakya 6 Method 1 Method 2 Horton Corporation would set the price of the plant at $43.98 million ($18.40 + $25.58) at a minimum. 7 Example 1 An investment company is considering two independent investment proposals. Their expected cash flow streams are given as follows: Year Proj. A Proj. B Year Proj. A Proj. B 0 -250,000 -350,000 6 72,500 70,000 1 72,500 60,000 7 70,000 2 72,500 60,000 8 70,000 3 72,500 60,000 9 70,000 4 72,500 70,000 10 70,000 5 72,500 70,000 If the company wants MARR is 13%, which proposals should be accepted to the company? Perform NFV analysis Lecture 7 - Dr.Shree Raj Shakya 8 Lecture 7 - Dr.Shree Raj Shakya 9 Capitalized Equivalent Method Another method of PV criterion is useful when the life of project is perpetual or planning horizon is very long (say, 40 years or more). Capitalized Equivalent (CE) for Perpetual Service life Project CE(i) = A / i The process of calculating PV cost for infinite period is called capitalization of project cost. The cost is known as the Capitalized cost i.e. the amount of money to be invested now to get a certain return 'A' at the end of each and every Lecture 7 - Dr.Shree Raj Shakya 10 year forever. Lecture 7 - Dr.Shree Raj Shakya 11 Lecture 7 - Dr.Shree Raj Shakya 12 Hydro Power Plant Service life = 50, MARR = 8% Lecture 7 - Dr.Shree Raj Shakya 13 Lecture 7 - Dr.Shree Raj Shakya 14 Mutually Exclusive Projects Mutually exclusive means that any one of several alternatives will fulfill the same need and that selecting one alternative means that others will be excluded. Lecture 7 - Dr.Shree Raj Shakya 15 Revenue Projects and Service Projects Revenue projects are those projects whose revenues depend on the choice of the alternative. Service projects are those projects whose revenues do not depend on the choice of the project. For revenue projects, we use NPV of revenues and choose the project which has the highest NPV. For service projects, we use the NPV of costs and choose the project which has the least negative NPV. Lecture 7 - Dr.Shree Raj Shakya 16 Analysis Period It is the time-span over which the economic effects of an investment will be evaluated. It is also called as study period or planning horizon. It may be taken as the required service period. Situations when analysis period and project life differ 1. Equal lives 2. Project life longer than analysis period 3. Project life shorter than analysis period 4. Analysis period not specified Lecture 7 - Dr.Shree Raj Shakya 17 1. Equal Project Lives Automation option Given: Cash flows for three projects, i = 12% per year Find: The NPW of each project, select best option Lecture 7 - Dr.Shree Raj Shakya 18 Option 3 has the greater PW and thus would be preferred Lecture 7 - Dr.Shree Raj Shakya 19 2. Project life longer than analysis period Ripper-bulldozer to dig and load radio active material within two year Lecture 7 - Dr.Shree Raj Shakya 20 Model A has the greater PW (least negative) and thus would be preferred Lecture 7 - Dr.Shree Raj Shakya 21 3. Project life shorter than analysis period Installation of an automatic mailing system to handle product announcements and invoices Semi-Automatic Full-Automatic Given: Cash flows for two alternatives as shown, analysis period of 5 years, i = 15% Find: The NPW of each alternative, select which option Lecture 7 - Dr.Shree Raj Shakya 22 Operating Cost Leasing Cost Since these are service projects, model B is the better choice. Lecture 7 - Dr.Shree Raj Shakya 23 4. Analysis period not specified Lowest common multiple criteria (3 x 4) Lecture 7 - Dr.Shree Raj Shakya 24 Model B is a better choice 25 Exercise 1 Consider the following two mutually exclusive investment projects, each with MARR = 15%: (a) On the basis of the NPW criterion, which project would be selected? (b) Study for MARR = 7%, 30% and 50%. Lecture 7 - Dr.Shree Raj Shakya 26 Lecture 7 - Dr.Shree Raj Shakya 28 Lecture 7 - Dr.Shree Raj Shakya 29 Lecture 7 - Dr.Shree Raj Shakya 30 Exercise 2 Consider the following two mutually exclusive investment projects On the basis of the NPW criterion, which project would be selected if you use an infinite planning horizon with project repeatability (the same costs and benefits) likely? Assume that i = 12%. Lecture 7 - Dr.Shree Raj Shakya 31 Practice • 5.10, 5.11, 5.14, 5.17, 5.27, 5.29, 5.30, 5.31, 5.36, 5.38, 5.40, 5.46, ST5.1. Lecture 7 - Dr.Shree Raj Shakya 33 Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Project Evaluation Techniques Dr. Shree Raj Shakya 2022 Lecture 8 Annual Equivalent Value Analysis The annual equivalent value (AE) criterion is a basis for measuring investment value by determining equal payments on an annual basis. First, we have to find the NPV of the project and then convert it to equal annual payments. AE(i) = PV (i)(A / P, i, n ) If AE>0, accept the project If AE =0, remain indifferent If AE <0, reject the project Lecture 8 - Dr.Shree Raj Shakya 2 Annual Equivalent Value Lecture 8 - Dr.Shree Raj Shakya 3 Benefits of AE analysis 1. Consistency of report format: Financial and engineering managers may prefer to work on yearly costs rather than overall costs. 2. Need for unit costs: In many situations, project must be broken down into unit costs for comparison and ease. 3. Unequal project lives: Comparing projects with unequal service lives is complicated in calculations, but using AE analysis, this problem can be easily solved. Lecture 8 - Dr.Shree Raj Shakya 4 Example: Make or Buy Option Ampex Corporation currently produces both videocassette cases and metal particle magnetic tape for commercial use. An increased demand for metal particle tapes is projected, and Ampex is deciding between • increasing the internal production of empty cassette cases and magnetic tape or • purchasing empty cassette cases from an outside vendor. If it purchases the cases from a vendor, the company must also buy specialized equipment to load the magnetic tapes, since its current loading machine is not compatible with the cassette cases produced by the vendor under consideration. The projected production rate of cassettes is 79,815 units per week for 48 weeks of operation per year. The planning horizon is seven years. MARR is 14%, calculate the unit cost under each option. Lecture 8 - Dr.Shree Raj Shakya 5 Example: Make or Buy Option Lecture 8 - Dr.Shree Raj Shakya 6 Example: Make or Buy Option Lecture 8 - Dr.Shree Raj Shakya 7 Example: Make or Buy Option CR(i%) = (I - S)*(A/P, i%, n) + i * S Lecture 8 - Dr.Shree Raj Shakya 8 Example: Make or Buy Option Lecture 8 - Dr.Shree Raj Shakya 9 Example: Unit cost/saving Tiger Machine Tool Company is considering the proposed acquisition of a new metal-cutting machine. The required initial investment of $75,000 and the projected cash benefits' over the project's 3-year life are as follows. Suppose that the machine will be operated for 2000 hours per year. Compute the equivalent savings per machine hour at i = 15%. Given: NPW = $3553, N = 3 years, i = 15% per year, 2000 machine hours per year Find: Equivalent savings per machine hour Solution, NPW(15%) = -75,000 + 24,400 (P/F, 15%, 1) + 27,340 (P/F, 15%, 2) + 55,760 (P/F, 15%, 3) = 3,553 Lecture 8 - Dr.Shree Raj Shakya 10 If Annual Operating Hours Fluctuate, then we have to find out the effective Annual Operating Hours Suppose: 1st Year= 1,500, 2nd Year= 2,500 and 3rd Year = 2,000 Effective Annual Operating Hour = [ (1,500)(P/F, 15%, 1) + (2,500)(P/F, 15%, 2) + (2,000)(P/F, 15%, 3) ] (A/P, 15%, 3) =1,976.16 Lecture 8 - Dr.Shree Raj Shakya 11 Operating costs and capital costs Operating costs are incurred by the operations of the plant or factory. Capital costs are incurred during the start of the project like initial investment or initial borrowing. s Capital costs are incurred only one time in the project life, where as operating costs incur annually. The annual equivalent of the capital cost is capital recovery cost 'CR'. Initial Investment CR(i) = P(A/P,i,n) – S(A/F,i,n) CR(i) = (P-S)(A/P,i,n) + i x S Lecture 8 - Dr.Shree Raj Shakya 12 Example 1 Consider a machine that costs $5000 and has a 5-year useful life. At the end of the 5 years, it can be sold for $1000 after tax adjustment. If the firm could earn an after-tax revenue of $1100 per year with this machine, should it be purchased at an interest rate of 10%? Find: AE, and determine whether to purchase Given: I = $5000, S = $1000, A = $1100, N = 5 years, i = 10% per year Lecture 8 - Dr.Shree Raj Shakya 13 Method 1: Lecture 8 - Dr.Shree Raj Shakya 14 Lecture 8 - Dr.Shree Raj Shakya 15 Method 1: Lecture 8 - Dr.Shree Raj Shakya 16 Method 2: Lecture 8 - Dr.Shree Raj Shakya 17 Lecture 8 - Dr.Shree Raj Shakya 18 Method 2: Lecture 8 - Dr.Shree Raj Shakya 19 Lecture 8 - Dr.Shree Raj Shakya 20 Example: Break-even point-per unit of Equipment use Sam purchased van worth $11,000 for office work use. If I = 6%, what should be the reimbursement rate per kilometer that should be claimed to his office so that Sam can break even? 21 Suppose Company pays Sam $X per kilometer for his personal car the annual equivalent reimbursement would be AE(6%) 22 Example: Comparison of projects i = 15% per year Find: AE, and which alternative is preferred Lecture 8 - Dr.Shree Raj Shakya 23 Example: Comparison of projects i = 15% per year Find: AE, and which alternative is preferred Model B Model A Lecture 8 - Dr.Shree Raj Shakya 24 Lecture 8 - Dr.Shree Raj Shakya 26 Lecture 8 - Dr.Shree Raj Shakya 27 Solve Lecture 8 - Dr.Shree Raj Shakya 28 Lecture 8 - Dr.Shree Raj Shakya 29 Practice • 6.3. 6.5, 6.6, 6.11, 6.16, 6.20, 6.24, 6.27, 6.28, 6.39 Lecture 7 - Dr.Shree Raj Shakya 30 Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Project Evaluation Techniques Dr. Shree Raj Shakya 2022 Lecture 9 Limitation of NPV only A1 A2 Initial investment - 1,00,000 - 5,00,000 n 5 5 NPV(10%) 50,000 1,00,000 NPV high so we select What about high Rate of return? 2 Internal Rate of Return (IRR) IRR is the interest rate earned on the unrecovered project balance of investment such that, when the project terminates, the unrecovered project balance will be zero. NPV = A0/(1+i*)0 + A1/(1+i*)1 + A2/(1+i*)2 …….+ An/(1+i*)n =0 If IRR>MARR, accept the project If IRR = MARR, remain indifferent If IRR < MARR, reject the project Lecture 9 - Dr. Shree Raj Shakya 3 Generalized cash flow diagram Present worth (NPV) function graph 4 Simple Investments and Non-simple investment Simple Investments A simple investment is defined as that investment, when the sign change in the project cash flow occurs only once. Non-simple Investments A non-simple investment is that investment where the sign change in the project cash flow occurs more than once Lecture 9 - Dr. Shree Raj Shakya 5 NPV profile for a simple investment Single IRR Lecture 9 - Dr. Shree Raj Shakya 6 NPW profile for a typical non-simple investment Multiple IRR Lecture 9 - Dr. Shree Raj Shakya 7 Multiple IRR When there are multiple values of IRR, we can predict unique value of IRR by examining its cash flows. 1.Net cash flow rule of sign 2.Accumulated net cash flow rule of sign Lecture 9 - Dr. Shree Raj Shakya 8 Net Cash flow rule of sign The number of real i* that are greater than -100% for a project with 'n' periods is never greater than the number of sign changes in the sequence of the An values. There are 3 sign changes in the cash flow sequence, so there are 3 or fewer real positive i*s. 9 Accumulated Cash flow rule of sign If the net cash flow sign test shows multiple values of i*, then we should proceed to this sign test. If the series of cumulative cash flows start negatively and changes the sign only once, then there exists a unique positive i*. 10 Predict the number of real positive rate(s) of return (IRR) for each cash flow series: Lecture 9 - Dr. Shree Raj Shakya 11 The cash flow rule of signs indicates the following possibilities for the positive values of IRR (i*) For project A there is only once sign change therefore there is only one real IRR value Lecture 9 - Dr. Shree Raj Shakya 12 For cash flows B, C, and D, we would like to apply the more discriminating cumulative cash flow test to see if we can specify a smaller number of possible values of real IRR (i*): Only project D begins negatively and passes the test; we may predict a unique i* value, rather than 2, 1, or 0 as predicted by the cash flow rule of signs. Projects B and C fail the test and we cannot eliminate the possibility of multiple Lecture 9 - Dr. Shree Raj Shakya 13 i*s. Methods for determining IRR 1. The direct-solution method 2. The trial-and-error method, and 3. The graphic method Lecture 9 - Dr. Shree Raj Shakya 14 1. The direct-solution method For project with two-flow transaction (Investment with single future payment) or project with a service life of 2 years of return. Use direct Mathematical Solution Lecture 9 - Dr. Shree Raj Shakya 15 For Project 1 If PW(i*) = 0 then FW(i*) = 0 PW(i*) = - $1000 + $1500 ( P/F, i*, 4 ) =0 $1000 = $1500 / ( 1 + i* ) 4 $1000 (1 + i* ) 4 (1 + i* )4 = $1500 = 1.5 1.5 = (1 + i* ) 4 Taking a natural log on both sides, we obtain Lecture 9 - Dr. Shree Raj Shakya 16 For Project 2: 17 Lecture 9 - Dr. Shree Raj Shakya 18 2. The trial-and-error method Agrotech Corporation is considering a proposal to establish a facility to manufacture an electronically controlled "intelligent" crop sprayer. This project would require an investment of $10 million in assets and would produce an annual after-tax net benefit of $1.8 million over a service life of 8 years. When the project terminates, the net salvage value of the assets would be $1 million. Compute the rate of return of this project. Lecture 9 - Dr. Shree Raj Shakya 19 Given: Initial investment (I) = $10 million, A = $1.8 million, S = 1 million, N = 8 years Find: Internal Rate of Return (i*) Lecture 9 - Dr. Shree Raj Shakya 20 We start with a guessed interest rate of 8%. The present worth of the cash flows in millions of dollars is Since this NPV is positive, we must raise the interest rate to bring this value toward zero. When we use an interest rate of 12%, we find that PW(i) will be zero at i somewhere between 8% and 12%. Using straight-line interpolation, we approximate Lecture 9 - Dr. Shree Raj Shakya 21 If we compute the present worth at this interpolated value, we obtain As this is not zero, we may recompute the i* at a lower interest rate, say 10%. With another round of linear interpolation, we approximate At this interest rate, 22 3. The graphic method 23 Lecture 9 - Dr. Shree Raj Shakya 24 Solve Consider two independent investments, A and B, with the following sequences of cash f lows: Compute the IRR (i*) for each investment. Lecture 9 - Dr. Shree Raj Shakya 25 Incremental IRR Analysis • General IRR Ranking ignores the scale of the investment. • Incremental IRR Method address this n A1 A2 0 - 1,000 - 5,000 1 2,000 7,000 IRR 100% 40% PW(10%) $818 $1364 Initial Investment high for A2 A1 is better with respect to IRR A2 is better with respect to NPV or PW MARR = 10% Lecture 9 - Dr. Shree Raj Shakya 26 Incremental IRR Analysis • General IRR Ranking ignores the scale of the investment. • Incremental IRR Method address this n A1 A2 A2 - A1 0 - 1,000 - 5,000 -4,000 1 2,000 7,000 5,000 IRR 100% 40% 25% PW(10%) $818 $1364 $545 MARR = 10% Incremental IRR Method measures the rate of return value for difference in the investment amount Lecture 9 - Dr. Shree Raj Shakya 27 Incremental IRR Testing Procedure • Generate the Incremental cash flow by subtracting higher initial investment project cash flow (B) with smaller one's (A) so that the initial investment cash flow becomes negative (B-A). • Calculate the IRRB-A • Selection Criteria If IRRB-A MARR, select B If IRRB-A = MARR, select either one If IRRB-A MARR, select A Lecture 9 - Dr. Shree Raj Shakya 28 Example n B1 B2 B2 – B1 0 1 2 - 3,000 1,350 1,800 - 12,000 4,200 6,225 - 9,000 2,850 4,425 3 1,500 6,330 4,830 MARR = 10% NPV ( i) = - 9000 + 2850(P/F, I, 1) + 4425(P/F, I, 2) + 4830(P/F, I, 3) 0 = - 9000 + 2850 / (1 + i*) + 4425 / (1 + i*)2 + 4830 / (1 + i*)3 Solving, i*B-A = 15% Select project B Lecture 9 - Dr. Shree Raj Shakya 29 Perform Incremental IRR Analysis and Select the best option n D1 D2 D3 0 -2000 -1000 -3000 1 1500 800 1500 2 1000 500 2000 3 800 500 1000 IRR 34.37% 47.76% 24.81% Lecture 9 - Dr. Shree Raj Shakya 30 Practice • 7.6, 7.8, 7.11, 7.20, 7.27, 7.29, 7.37, 7.39, 7.41, 7.45, 7.49 Lecture 9 - Dr. Shree Raj Shakya 31 Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Depreciation Dr. Shree Raj Shakya 2022 Lecture 10 1 Asset Depreciation Depreciation is the gradual decrease in utility of fixed assets with use and time. Physical Depreciation It is the reduction in an asset's capacity to perform its service due to physical impairment. Functional Depreciation It occurs as a result of changes in the organization or in technology that decrease or eliminate the need for an asset. 2 Economic Depreciation Economic Depreciation = purchase price - market value Both physical and functional depreciation are categories of economic depreciation. 3 Accounting Depreciation It is the systematic allocation of the initial cost of an asset (machine or equipment) in parts over a time known as its depreciable life. (Financial statements, Balance Sheet and Income Statement) In engineering economic analysis, we use the concept of accounting depreciation exclusively. This is because accounting depreciation provides a basis for determining the income taxes associated with any project undertaken. 4 Depreciable Property For the purposes of tax, any depreciable property has the following Characteristics. 1. It must be used in business or must be held for the production of income. 2. It must have a definite service life, and that life must be longer than 1 year. 3. It must be something that wears out, decays, gets used up, becomes obsolete, or loses value from natural causes. Depreciable property includes buildings, machinery, equipment, and vehicles. Inventories are not depreciable property, because they are held primarily for sale to customers in the ordinary course of business. If an asset has no definite service life, the asset cannot 5 be depreciated (For example, Land) Physical Depreciation Economic Depreciation A gradual decrease in utility of asset Functional Depreciation Depreciation Book Depreciation Accounting Depreciation The systematic allocation of an asset's value in parts over its depreciable life Tax Depreciation 6 Net Income When a project's revenue exceeds its expenses, we say that the project generated a profit or income. If the project's revenue is less than its expenses, then we say that the project resulted in a loss. Revenue - Expenses (cost of goods sold) Gross Profit - Operating expenses - Depreciation Taxable Income (Income before tax) - Income Tax Retained Income Net Income Cash flow = net income + depreciation 7 Depreciation Methods The most widely used methods are: 1. Straight-line Method 2. Declining Balance Method, and 3. Sum-of-years'- digit method 8 1. Straight-Line Method In this method, it is assumed that the fixed asset is depreciated in a uniform way. Where D n P −S = N Dn = the depreciation charge during n year P = the cost of the asset, including installation expenses S = salvage value at the end of the useful life of asset N = the useful life The book value = cost base - total depreciation charges Bn = P - (D1 + D2 +……….+ Dn) 9 2. Declining Balance Method In this method, a fixed fraction of the initial book balance is deducted each year. The fraction or declining balance rate is obtained by d = 1/N The most common multiplier is '1'. If this is '2', then it is called double-declining balance method. D1 = dP D2 = d(P - D1) D3 = d(P - D1- D2) For 'n' year, = dP(1-d) =dP(1-d)2 Dn = dP(1-d)n-1 10 We can also compute the total DB depreciation at the end of 'n' years TDB = D1 + D2 + D3 + D4 + …….. + Dn = dP +dP(1 -d) +dP(1-d)2+ ……. +(1-d)n-1 TDB = P[1-(1-d)n] 11 3. Sum-of-years'-Digit Method (SOYD) In this method, SOYD = 1 +2 +……. +N =N(N +1)/2 Where, N = the useful life Dn =(N - n +1)(P - S)/SOYD 12 EXAMPLE: Straight-Line Depreciation 13 EXAMPLE: Double Declining-Balance Depreciation declining balance rate d = 2/N , For 'n' year, Dn = dP(1-d)n-1 14 EXAMPLE: Double Declining-Balance Depreciation for Final Book Value (Bn) Salvage Value (S) 15 Useful Life 16 Tax Depreciation Rates Houses & Building 5% Transportation equipment Car, Jeep, Van & Motorcycle Cycle 15 % 20 % Furniture Metal Wooden 10 % 15 % Equipment & Machinery Machinery Computers Laboratory equipment X-Ray machine Typewriter, photocopy machine 15 % 20 % 15 % 20 % 15 % 17 Equivalence between declining balance and straight-line depreciation method Declining 5% 7% 10 % 15 % 20 % 25 % 50 % Straight line 1.65% 2.60 % 3.40 % 5.30 % 7.30 % 9.60 % 19.20 % Corporate Income Tax (manufacturing) 20 % Other Industries 25 % Value Added Tax 13 % 18 https://thepoabookworm.wordpress.com/2019/01/08/depreciation/ 19 Example https://www.dummies.com/article/business-careers-money/business/accounting/general-accounting/depreciation-methods-175280/ 20 Example https://learn.financestrategists.com/explanation/depreciation-and-disposal-of-fixed-assets/comparison-of-various-depreciationmethods/ 21 Example https://learn.financestrategists.com/explanation/depreciation-and-disposal-of-fixed-assets/comparison-of-various-depreciationmethods/ 22 Calculate depreciation in Excel https://www.journalofaccountancy.com/issues/2021/may/how-to-calculate-depreciation-in-excel.html 23 Calculate depreciation in Excel 24 Depreciation formula 25 Practice 9.1, 9.2, 9.6, 9.7, 9.8, 9.9, 9.10, 9.11, 9.12, 9.13 26 Department of Mechanical Engineering, Pulchowk campus, Institute of Engineering, Tribhuvan University ENGINEERING ECONOMICS Benefit-Cost Analysis Dr. Shree Raj Shakya 2022 Lecture 11 Benefit-Cost Analysis The objective of private investment is to increase the net worth of the company. In the public sector, government spend a lot of money in projects such as education, road construction, hydro-power plants etc. to increase net public benefits. Benefit-Cost Analysis is a decision-making tool for systematically developing useful information about the desirable or undesirable effects of a public project. Benefit-Cost Analysis tries to determine whether the social benefits are greater than social costs. Lecture 11 - Dr. Shree Raj Shakya 2 There are three types of benefit-Cost Analysis problems 1. to maximize benefits over any costs 2. to maximize net benefits when benefits and costs vary 3. to minimize costs to get a certain level of benefits Lecture 11 - Dr. Shree Raj Shakya 3 Benefit-Cost Ratio Analysis 1. 2. 3. 4. 5. Identify users' benefits from the project Quantify, as much as possible, in Rupee term Identify sponsors' costs Quantify, as much as possible, in Rupee term Determine the equivalent benefits and costs at the base period using the social interest rate Lecture 11 - Dr. Shree Raj Shakya 4 Social benefits and Social costs Social Benefits 1. 2. 3. Benefits due to reduction of deaths Benefits due to reduction of damage to property Primary users' disbenefits B = B + B − DB 2 1 1 Social Costs 1. 2. Primary Sponsors' costs Primary Sponsors' savings C = C −S 1 1 B - C should be positive Lecture 11 - Dr. Shree Raj Shakya 5 Benefit-Cost Ratio Analysis sponsor's costs (C) consist of the equivalent capital expenditure ( I ) and the equivalent annual operating costs (C') accrued in each successive period 6. If BC (i) >1 we should accept a public project Lecture 11 - Dr. Shree Raj Shakya 6 Net B/C Ratio • considers only the initial capital expenditure as a cash outlay, and uses annual net benefits. If we are to accept a project, the B'C(i) must be greater than 1 some analysts prefer this measure because, it indicates the net benefit (B') expected per dollar invested Lecture 11 - Dr. Shree Raj Shakya 7 Example A public project being considered by a local government has the following estimated benefit-cost profile Assume that i = 10%, N = 5. Compute B, C, I, C', BC(10%) and B'C(10%). Lecture 11 - Dr. Shree Raj Shakya 8 Lecture 11 - Dr. Shree Raj Shakya 9 Benefit-Cost Ratio Net Benefit-Cost Ratio Project is economically viable or profitable Lecture 11 - Dr. Shree Raj Shakya 10 Relationship Between B/C Ratio and NPW Both gives same result Lecture 11 - Dr. Shree Raj Shakya 11 Incremental Analysis based on BC(i) Consider three investment projects, A1, A2, and A3. Each project has the same service life, and the present worth of each component value (B, I, and C') is computed at 10% as follows. (a) If all three projects are independent, which projects would be selected based on BC(i) and B'C(i) criteria, respectively? (b) If the three projects are mutually exclusive, which project would be the best alternative? Show the sequence of calculations required to produce the correct results, using (1) the aggregate BIC 12 ratio, and (2) the netted BIC ratio. Solution (a) Since PW(i)1, PW(i)2, and PW(i)3 are positive, all projects would be acceptable if they were independent. Also, BC(i) and B'C(i) values for each project are greater than 1, so the use of either ratio will lead to the same accept-reject conclusion under the NPW criterion. Lecture 11 - Dr. Shree Raj Shakya 13 (b) If these projects are mutually exclusive, we must use the principle of incremental analysis. 1. Remove any alternatives with a BIC ratio less than 1 2. Arrange the remaining alternatives in the increasing order of the denominator (I + C'). Thus, the alternative with the smallest denominator should be first (j), the alternative with the next smallest second (k), and so forth. Lecture 11 - Dr. Shree Raj Shakya 14 3. Compute the incremental differences for each term (B, I, and C') for the paired alternatives j, k) in the list. Select A1 and A3 as they have least denominator (cost) 4. Compute the BC(i) on incremental investment by evaluating Since the ratio is greater than 1, we prefer A3 over A1. Therefore, A3 becomes the "current best" alternative. 15 5. Compare the selected alternative with the next one on the list by computing the incremental benefit-cost ratio. Continue the process until you reach the bottom of the list. The alternative selected during the last pairing is the best. Therefore, we need to compare A2 and A3 as follows: The incremental B/C ratio again exceeds 1, and therefore we prefer A2 over A3. With no further projects to consider, A2 becomes the ultimate choice. Lecture 11 - Dr. Shree Raj Shakya 16 Using the net B/C (B'C(i)) ratios: If we had to use the net BIC ratio on this incremental investment decision, we would obtain the same conclusion. Since all B'C(i) ratios exceed 1, there will be no do-nothing alternative. By comparing the first pair of projects on this list, we obtain Project A3 becomes the current best. Next, comparing A2 and A3 yields Therefore, A2 becomes the best choice by the net BIC criterion. Lecture 11 - Dr. Shree Raj Shakya 17 Solve 1 A city government is considering town-dump sanitary system. The project requires an initial outlay of $400,000, with annual operating and maintenance costs of $50,000 for the next 15 years. Fee collections from the residents would be $85,000 per year. The interest rate is 8%, and there is no salvage value associated with either system. Determine economics feasibility of the project using the benefit-cost ratio and net benefit-cost ratio. Lecture 11 - Dr. Shree Raj Shakya 18 Lecture 8 - Dr.Shree Raj Shakya 19 Solve 2 A city which operates automobile parking facilities is evaluating a proposal that it erect and operate a structure for parking in a city's downtown area. Three designs for a facility to be built on available sites have been identified. (All dollar figures are in thousands.) At the end of the estimated service life, whichever facility had been constructed would be torn down and the land would be sold. It is estimated that the proceeds from the resale of the land will be equal to the cost of clearing the site. If the city's interest rate is known to be 10%, which design alternative would be selected based on the benefit-cost criterion? 20 Lecture 8 - Dr.Shree Raj Shakya 21 Practice • 16.6, 16.7, 16.8, 16.9, 16.10, 16.11, 16.12, 16.13. 22