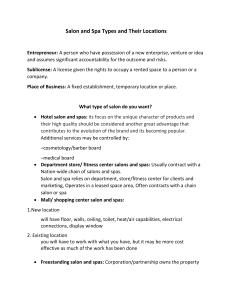

Salon and Spa Types and Their Locations Entrepreneur: A person who have possession of a new enterprise, venture or idea and assumes significant accountability for the outcome and risks. Sublicense: A license given the rights to occupy a rented space to a person or a company. Place of Business: A fixed establishment, temporary location or place. What type of salon do you want? Hotel salon and spas: its focus on the unique character of products and their high quality should be considered another great advantage that contributes to the evolution of the brand and its becoming popular. Additional services may be controlled by: –cosmetology/barber board –medical board Department store/ fitness center salons and spas: Usually contract with a Nation-wide chain of salons and spas. Salon and spa relies on department, store/fitness center for clients and marketing, Operates in a leased space area, Often contracts with a chain salon or spa Mall/ shopping center salon and spas: 1.New location will have floor, walls, ceiling, toilet, heat/air capabilities, electrical connections, display window 2. Existing location you will have to work with what you have, but it may be more cost effective as much of the work has been done Freestanding salon and spas: Corporation/partnership owns the property – “rent” goes to pay for the property –landlord/salon and spa owner arrangement –if owner lives in the structure, possible tax deductions Medical Spas: Was introduce by a group of doctors in 1997. Western and holistic medicine combined with spa services Must have a physician’s license or partner with a physician Services may include Botox, laser hair removal, chemical peels, Restylane, and dermatological services Who Own the Salon and Spa? Sole Proprietorships: A single member owns all the assets of the business Advantages: least expensive, complete control, keep all income, profits flow to owner’s personal tax return, easy to dissolve Disadvantages: Unlimited liability and legal responsibility (Personal assets are at risk), Limited funding, employee benefits are not directly deductible from business income Partnerships: Two or more people share ownership of a single business Advantages: easy to establish, increased ability to raise funds, partnership opportunity may attract employees, complementary skills Disadvantages: Jointly and individually responsible for the actions of the other, profits must be shared, decisions must be shared, which may cause disagreements, may have limited life Types to consider 1. General Partnership 2. Limited/ Limited liability 3. Joint Venture Corporations Advantages: shareholders have limited liability, shareholders can only be held accountable for their investment in stock of the company, can raise funds through sale of stock, can deduct cost of benefits to officers and employees, S corporations can be elected Disadvantages: more time and money than other forms of organization, monitored by state and federal agencies, higher overall taxes Franchised Salons: Successful due to marketing and organizational strengths, Offers standardization Advantages: strong consumer marketing, group purchasing power, uniform bookkeeping systems, centralized training, noncompetition from same franchise, exclusivity of product line, help with interior design, legal and business assistance programs, group insurance rates, group health insurance Disadvantages: high initial costs, restrictions in franchise agreement, franchisor might go out of business, other franchisees could hurt your reputation, may be difficult to sell, profits shared with franchisor, high continuing costs Employee-Owned Corporations: Employee owns stock in the company, only works if the personalities are compatible Advantages: motivated employees, align employees’ interests with shareholders recruit/retain key employees, compensate for lower salaries, pay employees in a tax, efficient way, increase loyalty, raise working capital, realize owners’ investment Disadvantages: falling morale if share price falls, administration costs, dilution of share ownership, unrealistic expectations Leased space and Booth rental: Owner contracts a given area of space, Owner subdivides the space into several areas, each space is rented to a different practitioner Advantages: you do not pay workers’ compensation or federal and state employment taxes, you do not offer training and education, you do not provide liability insurance, you do not advertise for new customers, you do not manage employees Disadvantages: minimal or nonexistent business growth, high staff turnover, unable to manage and educate staff, no quality control, lack of teamwork, exposure to audits, unable to sell other salon and spa services Naming a Salon and Spa Your salon and spa name must: –be easy to spell –be short enough that people can remember it –clearly identify services offered Your salon and spa name should not: –be so trendy that it becomes outdated when trends change Summary Each state has its own laws for salon and spa ownership All technicians need to be licensed by the appropriate board There are five types of salons and spas Salons and spas can vary in types of ownership Corporation style of ownership offers greatest financial security against lawsuits Franchised salons and spas allow for easier startup Your salon and spa name should be easy to spell and remember