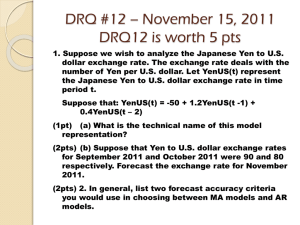

Economics 213 Principles of Macroeconomics Practice Question Set for Exam 3 KEY 3. Capital or financial markets serve a) b) c) d) e) Savings, Investment and the Financial System Consider the following transactions and use them for the next two questions: i) Bruce Wayne borrows $1,000,000 from Gotham Bank in order to build his new home, Wayne Manor ii) Clark Kent has $10,000 he is not using at the moment and he buys a bond sold by Lex Luther iii) Natalia Romanova decides to raise money for her business, SpyTrainingAcademy, and issues $40,000,000 worth of stock in its Initial Public Offering (IPO) iv) Steve Rogers buys $50,000 of SpyTrainingAcademy stock v) Dick Grayson goes to Walmart and spends $10 on a new cape vi) update its infrastructure vii) Raven Darkhölme issues $1,00,000 in bonds in order to expand her business and open a second store viii) Sam Wilson takes 15% of his paycheck from his employer, Stark Enterprises, and puts it into his 401k ix) Gamora Z. W. B. Titan takes out a loan from Xandar National Bank in order to purchase new equipment and update the technology in her business 4. Investment, in economics, refers to a) the purchase of stocks and bonds by households. b) the purchase of additional capital by firms. c) your retirement portfolio. d) the purchase of goods and services. e) All of the above refer to investment. 5. Which of the following actions would an economist consider as an investment? Check all that apply. a) Moe buys a new house. b) Larry purchases stock in IBM. c) Curley buys a new van for his catering business. d) Shemp puts $500 into his retirement fund each month 6. Ken purchases a bond issued by Ford Motor Company. Ford uses the money to buy new machinery for one of its factories. a) Ken and Ford are both saving. b) Ken and Ford are both investing. c) Ken is investing while Ford is saving. d) Ken is saving while Ford is investing. 7. The market for loanable funds determines the ___. a) inflation rate b) nominal interest rate c) real interest rate d) corporate risk return rate e) equity/debt ratio of a company 8. The real interest rate (r) is a) the nominal interest rate times the inflation rate. b) the nominal interest rate plus the inflation rate. c) the nominal interest rate minus the inflation rate. d) the nominal interest rate divided by the inflation rate. e) the price level divided by the money supply. 1. In the scenarios above, who is Saving? a) b) c) d) e) Bruce Wayne, Natalia Romanova, Dick Grayson and Raven Darkhölme Clark Kent and Sam Wilson Bruce Wayne, Natalia Romanova, Raven Darkhölme and Gamora Titan Clark Kent, Raven Darkhölme, Sam Wilson and Gamora Titan 2. In the scenarios above, who is Investing? a) Natalia Romanova, Steve Rogers, Sam Wilson and Gamora Titan b) Bruce Wayne, Clark Kent, Steve Rogers and Sam Wilson c) Bruce Wayne, Natalia Romanova, Raven Darkhölme and Gamora Titan d) e) 1 9. Consider the market for loanable funds. In that market, what does r represent? i) ii) iii) iv) v) vi) a) b) c) d) e) The cost associated with saving money The benefit/reward associated with saving money The real interest rate The inflation rate The cost associated with borrowing money The benefit/reward associated with borrowing money Only i and ii are correct i, iv and vi ii, iii and v i, ii and iii ii, iii and v only to sell shares of companies to the public. to coordinate domestic and foreign savings. to bring savers and investors together. equate the nominal and real interest rate. to promote business investment. 2 13. Consider the market for loanable funds. If there is an increase in the supply of loanable funds, the equilibrium interest rate would _____ and the amount of savings and investment would _______. a) increase; increase b) increase; decrease c) increase; no effect d) no effect; no effect e) decrease; increase 14. Consider the market for loanable funds. If there is a decrease in the demand for loanable funds, the equilibrium interest rate would _____ and the amount of savings and investment would _________. a) increase; increase b) decrease; decrease c) increase; no effect d) no effect; no effect e) decrease; increase 10. In the market for loanable funds, the demand for loanable funds is made up of ___ and is ___ related to the real interest rate. a) borrowers; negatively b) borrowers; positively c) savers; negatively d) savers; positively e) both savers and borrowers; positively 15. Consider the market for loanable funds. If there is a decrease in the supply of loanable funds, 11. In the market for loanable funds, the supply of loanable funds is made up of ____ and is ____ related to the real interest rate. a) borrowers; negatively b) borrowers; positively c) savers; negatively d) savers; positively e) both savers and borrowers; positively the equilibrium interest rate would _____ and the amount of savings and investment would __________. a) increase; increase b) increase; no effect c) increase; decrease d) no effect; no effect e) decrease; increase 16. Suppose the government introduces a new incentive for individuals to save money for 12. Consider the market for loanable funds. If there is an increase in the demand for loanable funds, the equilibrium interest rate would _____ and the amount of savings and investment would __________. a) increase; increase b) increase; decrease c) increase; no effect d) no effect; no effect e) decrease; increase 3 retirement (say, people can save more money for retirement that is tax-deferred until later). How would this affect the market for loanable funds and the interest rate? The _______ curve would ______, causing the equilibrium interest rate to ________. a) Supply; decrease; rise b) Supply; increase; fall c) Supply; increase; remain unchanged d) Demand; decrease; fall e) Demand; increase; rise f) Demand; increase; remain unchanged 4 17. Suppose a new tax plan is passed that eliminates tax breaks on firms that purchase new physical capital. How would this affect the market for loanable funds? What would happen to the equilibrium interest rate (r*) and the amount of Savings (S) and Investment (I) in the country? a) Fall in r*; increase in S & I b) Fall in r*; decrease in S & I c) No change in r*; increase in S & I d) Rise in r*; decrease in S & I e) Rise in r*; increase in S & I 18. Tom Sayer loves to go mountain biking. While shopping for a new bike, he notices that the new GHOST Kata FS 5 mountain bike is around $2,000. He knows that this 1 bike is valued about the same as 200 movie tickets or 100 decent bottles of wine or 2 new iPhones. This is an example of the ______ function of money. a) trading b) store of value c) medium of exchange d) value added e) unit of account 22. Which of the following is fiat money? a) b) c) d) e) cigarettes paper money gold sugar rum 23. Demand deposits are also known as ____. a) b) c) d) e) savings accounts checking accounts time-deposits U.S. government bonds 24. Time deposits are also known as ____. a) b) checking accounts c) savings accounts d) e) U.S. government bonds 19. Huckleberry Finn is a local electrician. On his next payday, he sets aside $100 of his paycheck into his savings account, to be used at some later date for about the same $100. This is an example of the _____ function of money. a) trading b) store of value c) medium of exchange d) value added e) unit of account 25. Which of the following assets is the most liquid? a) b) c) d) e) savings account checking account gold a U.S. government bond share of IBM stock 26. Which of the following assets is the most liquid? 20. Becky Thatcher teaches school. On her next payday, she trades $100 for food at Kroger. This is an example of the _________ function of money. a) trading b) store of value c) medium of exchange d) value added e) unit of account savings account gold real estate stock of IBM U.S. government bond 27. Which of the following statements about money is (are) correct? a) b) c) d) e) 21. Which of the following could NOT be commodity money? a) b) c) d) e) a) b) c) d) e) gold precious stones cigarettes paper money silver Money is a more efficient form of trade than barter. Money allows greater specialization. The purpose of money is to create wealth. All of the above are correct. Only a and b are correct. 5 6 28. What is the largest component of M1? a) b) c) d) e) 34. How are checking accounts at commercial banks (SunTrust) classified as money? a) b) c) d) Total Checking Accounts Savings Accounts Currency (held outside of banks) Gold Included in M1 only Included in M2 only Included in both M1 and M2 Not counted as money 35. How are checking accounts at thrifts (Tennessee Credit Union) classified as money? spring 2022? 29. a) b) c) d) e) $500 Million $1.5 Billion $450 Billion $900 Billion $20.7 Trillion a) b) c) d) e) 2) over the last 20 or 30 years? It has increased tremendously it is 3 or 4 times larger than it was a few decades ago It has increased somewhat it is about double what it was a few decades ago It has stayed about the same It has fallen somewhat it used to be twice as much as it was a few decades ago It has fallen tremendously it used to be 5 times larger than it was 30. a) b) c) d) Included in M1only Included in M2 only Included in both M1 and M2 Not counted as money 36. How is gold classified as money? 31. What is the largest component of M2? a) b) c) d) e) Checking Accounts M1 all cash, checking and savings accounts Savings Accounts Certificate of Deposits Gold a) b) c) d) e) f) $100 Billion $2.5 Trillion $21.8 Trillion $150 Trillion $500 Trillion One gazillian! Included in M1 only Included in M2 only Included in both M1 and M2 Not counted as money 37. How are U.S. Government Bonds classified as money? a) b) c) d) Included in M1 only Included in M2 only Included in both M1 and M2 Not counted as money 38. How are savings accounts classified as money? spring 2022? 32. a) b) c) d) a) b) c) d) Included in M1 only Included in M2 only Included in both M1 and M2 Not counted as money 39. Which of the following is NOT included in M2? a) b) c) d) e) Cash (in pockets, purses, cash registers, etc.) savings accounts time deposits (certificate of deposits) retail money market mutual funds All of the above are included in M2. 33. How is currency (outside of banks) classified as money? a) b) c) d) Included in M1 only Included in M2 only Included in both M1 and M2 Not counted as money 40. Which of the following is NOT included in M1? a) b) c) d) e) 7 currency held by the public. small time deposits checking accounts savings accounts All of the above are included in M1. 8 41. Which of the following is NOT a component of M1? a) b) c) d) e) 46. Suppose that Clark Kent deposits $1,000 cash into checking account. What are the travelers' checks cash held by the public checking accounts (demand deposits) reserves (currency in bank vaults) All of the above are included in M1. immediate effects on M1 and M2? (Assume no lending) a) M1 and M2 both rise b) M1 rises while M2 falls c) M1 rises and M2 remains unchanged d) No change in either M1 or M2 e) M1 falls while M2 rises 42. Suppose you own 50 shares of Apple stock (@ around $165 per share, that is about $8,250!) How is this $8,250 a) Part of M1 only b) Part of M1 and M2 c) Part of M2 only d) Neither M1 nor M2 47. Suppose that Bruce Wayne takes $10,000 out of his checking account and purchases U.S. government bonds. What are the immediate effects on M1 and M2? (Assume no lending) a) Both M1 and M2 rise b) M1 rises while M2 falls c) M1 falls while M2 remains unchanged d) M1 remains unchanged while M2 falls e) Both M1 and M2 fall Suppose there is a small, isolated island known as incredibly shallow people. Suppose that the total assets for the island consists of the following: $250,000 in cash; $50,000 in coins; $400,000 in savings accounts; $75,000 in gold; $200,000 in checking accounts; $125,000 held in government bonds; $300,000 in certificates of deposits; and 43. What is the total amount of M1 on the island? a) b) c) d) e) $250,000 $300,000 $450,000 $500,000 $900,000 What will your bond be worth? That is, if you wanted to sell it in the open market, what could you sell it for its price? a) $6,667 b) $5,150 c) $5,000 d) $4,050 e) $150 49. Suppose you buy a bond for $8,000. The Coupon rate is 4%. Next year, interest rates rise to 5%. What will your bond be worth, if you wanted to sell it in the open market? a) $320 b) $6,400 c) $8,000 d) $8,320 e) $8,800 44. What is the total amount of M2 on the island? a) b) c) d) e) 48. Suppose you buy a $5,000 bond. The coupon rate is 4%. Next year interest rates fall to 3%. $700,000 1,275,000 $1,200,000 $1,400,000 $1,400,001 50. What is the point of the previous two questions? 45. Suppose that Peter Parker transfers $1,000 from his savings account to his checking account. What are the immediate effects on M1 and M2? (Assume no lending) a) M1 and M2 both rise. b) M1 rises and M2 falls. c) M1 rises and M2 remains unchanged. d) No change in either M1 or M2 e) Both M1 and M2 fall. a) b) c) d) Bond prices are not related to interest rates Bond prices and interest rates are positively related Bond prices and interest rates are negatively related I have no idea! 9 10 51. Which of the following vehicles for saving would most likely show the greatest increase in value over time? a) U.S. Government Savings Bonds b) c) Under your mattress d) Savings account at SunTrust e) Low-risk corporate bonds 56. Which of the following is NOT a function performed by the Federal Reserve? a) b) c) d) e) serve as a lender of the last resort serve as the bank for the United States keep inflation and unemployment low convert gold into paper currency regulate and stabilize the banking industry and credit markets 57. On a bank's balance sheet, how are deposits, loans and reserves categorized? Money Creation and the Federal Reserve 52. How many semi-autonomous central banks does the U.S. have? a) b) c) d) e) 0 the U.S. does not have a central bank 1 7 12 14 a) b) c) d) e) 1 5 7 12 15 reserves are assets; loans and deposits are liabilities loans and reserves are assets; deposits are liabilities loans are assets; reserves and deposits are liabilities deposits are assets; reserves and loans are liabilities deposits and reserves are assets; loans are liabilities 58. Suppose that Boringsville Bank has $200,000 in checking deposits. It also has $130,000 out in Governors? 53. a) b) c) d) e) loans. Finally, the reserve requirement is 10%. How much is the bank holding in total reserves? How much in required reserves? How much in excess reserves? a) Total Reserves = $70,000; Required reserves = $20,000; Excess reserves = $50,000 b) Total reserves = $200,000; Required reserves = $130,000; Excess reserves = $70,000 c) Total reserves = $200,000; Required reserves = $20,000; Excess reserves = $180,000 d) Total reserves = $330,000; Required reserves = $33,000; Excess reserves = $297,000 e) Total reserves = $70,000; Required reserves = $7,000; Excess reserves = $63,000 59. Consider the following groups listed below. Which of these does the Federal Reserve typically lend to? Check all that apply. 54. The current Federal Reserve System was established in ____. a) b) c) d) e) i) ii) iii) iv) v) vi) 1776 1805 1865 1913 1933 Commercial banks (such as SunTrust) Thrift banks (such as credit unions) Foreign governments U.S. government Private citizens Private corporations 55. Who makes up the Federal Open Market Committee (FOMC)? a) b) c) d) e) The 7 members of the Board of Governors The 7 members of the Board plus all 12 regional bank presidents the 12 regional bank presidents 5 regional bank presidents The 7 member Board plus 5 rotating regional bank presidents 11 60. The simple money (deposit) multiplier is equal to: (rr = required reserve ratio) a) b) c) d) e) rr-1 1-rr rr/(1-rr) 1/rr (1-rr)/rr 12 65. Suppose that Estella deposits $400 in cash into her checking account in Kent Bank. After the 61. Suppose that Ebenezer Scrooge deposits $4,000 in cash into his checking account. Suppose further that the reserve requirement is 10% and that banks hold no excess reserves. After the lending process is completed, the final change in bank deposits is ___ while the total change in the money supply is _____. a) $400; $400 b) $4000, $3,500 c) $40,000; $36,000 d) $36,000; $40,000 e) $46,000; $40,000 a) b) c) d) e) lending process is complete, final bank deposits rise to $5,000. Assuming that banks hold no excess reserves and the public holds no cash, what was the require reserve ratio? 5% 8% 10% 12.5% 15% 66. Which of the following are sources of leakages to the money multiplier? a) b) c) d) e) 62. Suppose that Jacob Marley deposits $500 in cash into his checking account. If the required reserve ratio is 10%, what happens to final bank deposits after the lending process is completed? (assume no money leakages) a) No change in bank deposits. b) Bank deposits rise by $500 c) Bank deposits rise by $5,000 d) Bank deposits rise by $4,500 e) Bank deposits rise by $1,000 67. Suppose that the reserve requirement is set at 15%. In addition, banks hold an extra 10% in excess reserves. How does this affect the money multiplier? a) The money multiplier rises from 15 to 25 b) It rises from 3 to 5 c) It rises from 4 to 6.66 d) It falls from 25 to 15 e) It falls from 6.66 to 4 63. Refer to question above. How much money did banks (through the fractional banking system and the lending process) create? a) b) $500 c) $1,000 d) $4,500 e) $5,000 Banks choosing to hold excess reserves Individuals and businesses holding money in the form of cash Cash held by foreign consumers, businesses and governments All of the above are sources None of the above are sources 68. into your checking account. Suppose that the required reserve is 8% and there are no money leakages. After the lending process is completed, what will be the final increase in checking accounts? How much money did banks create through the lending process? a) Checking accounts increase $200; Banks created $150 b) Checking accounts increase $625; Banks created $575 c) Checking accounts increase $50; Banks created $0 d) Checking accounts increase $100; Banks created $50 e) Checking accounts increase $500; Banks created 64. Suppose that the reserve requirement is 20% and that banks hold no excess reserves and the public holds no cash. Miss Havisham makes a new deposit and this leads to an ultimate increase in the money supply to $5,000. How much was her initial deposit? a) $25,000 b) $5,000 c) $4,000 d) $1,000 e) $500 69. into your checking account. Suppose that the required reserve is 8%, banks hold an additional 7% in excess reserves, and the public holds 10% of their money in the form of cash. After the lending process is completed, what will be the final increase in checking accounts now? How much money did banks create through the lending process? a) Checking accounts increase $200; Banks created $150 b) Checking accounts increase $625; Banks created $575 c) Checking accounts increase $50; Banks created $0 d) Checking accounts increase $100; Banks created $50 e) Checking accounts increase $500; Banks created 13 Consider the following policy tools: I) II) III) IV) V) VI) 14 74. What can the Fed do to decrease the money supply? Changes in government spending Changes in the tax rate Changes in the discount rate Changes in the required reserve ratio Open market operations Lending to businesses in fiscal trouble a) b) c) d) e) 75. To increase the money supply, the Fed could a) b) c) d) e) 70. Which of the above are tools used by the Federal Reserve to increase or decrease the money supply? a) V only b) II, III, IV and V c) III, IV and V d) III, IV, V and VI e) All of the above are tools used by the Fed to make changes in the money supply. buy and sell corporate bonds in the open market buy and sell U.S. govt. bonds in the open market buy U.S. govt. bonds at a special price directly from the govt. buy and sell stocks in the open market buy and sell commodities in the open market a) b) c) d) e) a) b) c) d) e) Reserve sells $50 billion worth of government bonds. What ultimately happens to the Money supply increases by $50 billion Money supply increases by $417 billion Money supply decreases by $6 billion Money supply decreases by $50 billion Money supply decreases by $417 billion 15 The Prime Rate The Mortgage Rate The Discount Rate The National Rate The Federal Funds Rate 78. When the Federal Reserve lends money to banks, what interest rate do they charge? a) b) c) d) e) 73. Suppose that the required reserve ratio is set at 15%. Suppose further that the current money supply is set at $700 billion. If the Federal Reserve wished to increase the money supply to $900 billion, what should it do? a) Buy $900 billion of government bonds b) Buy $200 billion of government bonds c) Sell $200 billion of government bonds d) Sell $60 billion of government bonds e) Buy $30 billion of government bonds buys bonds. decreases the discount rate. decreases the required reserve. sells securities (U.S. govt. bonds). raises taxes. 77. Banks often make short-term loans to other banks. What interest rate do they charge? 72. Suppose that the required reserve ratio is set at 12%. Suppose further that the Federal a) b) c) d) e) purchase government securities. increase the reserve requirements. lower the discount rate. All of the above are correct. Only a and c are correct. 76. When the Fed wishes to raise interest rates, then it 71. a) b) c) d) e) open market sales, raise the discount rate, lower the reserve requirement open market purchases, raise the discount rate, raise the reserve requirement open market purchases, lower the discount rate, lower the reserve requirement open market sales, raise the discount rate, raise the reserve requirement open market sales, lower the discount, raise the reserve requirement The Prime Rate The Mortgage Rate The Discount Rate The National Rate The Federal Funds Rate 79. interest rate are they talking about? a) The Prime Rate b) The Mortgage Rate c) The Discount Rate d) The National Rate e) The Federal Funds Rate 16 80. Which of the following tools is the Fed most likely to use to address a macroeconomic problem? a) Adjusting the reserve requirement b) Changing the discount rate c) Using open market operations d) Raising the deposit limit protected by the FDIC (Federal Deposit Insurance Corporation) e) All of the above are equally likely 85. According to the quantity theory of money, if real output is 1,000 units, the price level is $6, and the supply of money is $1,500, what is the velocity of money? a) 3 b) 4 c) 5 d) 6 e) 7 86. What is the purpose of the quantity equation (equation of exchange)? Monetary Policy 81. mean that the Fed actually did? a) they increased lending to large corporations b) they increased the money supply c) they decreased the money supply d) they bought stocks on the open market e) 82. they do it? a) they lowered the discount rate b) they raised the discount rate c) they raised the required reserve rate d) they bought U.S. govt. bonds on the open market e) they sold U.S. govt. bonds on the open market 83. In response to the COVID pandemic, the Federal Reserve decreased interest rates. How would this affect the U.S. economy - prices (P), output (Y) and unemployment (U) in the short-run? Hint, an AD-AS graph would help! a) No effect on the economy b) An increase in P and Y, decrease in U c) An increase in P, Y and U d) A decrease in P and Y, an increase in U e) A decrease in P, Y and U 84. What is meant by the velocity of money? a) b) c) d) e) how often the Federal Reserve replaces money the rate at which money loses value due to inflation how many times money changes hands (is spent) during the year how many times the Federal Reserve increases the money supply each year how fast money moves around the globe 17 a) b) c) to d) e) 87. Using the quantity equation (equation of exchange), if the money supply increases by 4%, output increases by 3%, and velocity of money is held constant, what is the increase in the price level? a) 1% b) 7% c) 1% d) 12% e) cannot be determined 88. According to the concept of monetary neutrality, which of the following should NOT be affected by changes in the money supply (in the long-run)? a) nominal GDP b) nominal interest rates c) real GDP d) the price level e) All of the above are affected by monetary factors. 89. Suppose that the Federal Reserve sets the required reserve ratio at 20%. Suppose further that you deposit $500 into your checking account at Bank of America (BOA). BOA must hold at least ______, and can lend out at most ______ a) $0; $500 b) $50; $500 c) $100; $400 d) $400; $100 e) $450; $50 18 Use the following to answer the next three questions. 93. Which school of economic thought believes that increasing the money supply will lead to Kristen is a journalist. In 2010 she was paid $1,500 per month. Kristen loves shoes. She really, really loves shoes. In fact, she spends all her money on shoes. In 2010, a pair of shoes cost on average $100. Between 2010 and 2015, suppose that the Federal Reserve doubles the money supply. Suppose further that the doubling of the money supply works its way through the economy and wages and prices have also doubled. So, by 2015, Kristen is paid $3,000 per month, while shoes cost on average $200. a) b) c) d) nominal money wage from 2010 to 2015? her nominal wage increased her nominal wage stayed constant her nominal wage decreased there is not enough information to tell a) b) c) d) real wage from 2010 to 2015? her real wage increased her real wage stayed constant her real wage decreased there is not enough information to tell 90. 91. 92. What concept do your answers to the questions above demonstrate? a) b) c) d) e) the liquidity of money the velocity of money the neutrality of money the costs of inflation that Kristen should probably buy less shoes 19 long-run inflation? a) Keynesian b) Monetarists c) Classical d) Classical and Monetarists e) All three believe in the long-run link between money supply and inflation 94. Which school of thought believes that increasing the money supply will have no impact on GDP or employment, in both the short-run and long-run? a) Keynesian b) Monetarists c) Classical d) Keynesian and Classical e) All three believe that 95. Which school of thought believes that links in the monetary policy chain can be weak in certain situations, and therefore would advocate in favor of fiscal policy instead? a) Keynesian b) Monetarists c) Classical d) Classical and Keynesian e) Monetarists and Keynesian 96. Which school of thought believes that monetary policy can be effective in the short-run, while fiscal policy is generally not effective? a) Keynesian b) Monetarists c) Classical d) Keynesian and Classical e) All three schools believe that 20 Use the following scenario to answer the next four questions. Suppose that the economies of several large U.S. trading partners experience a significant slowdown. Suppose further that up until then, the U.S. was operating at its potential level of output, with unemployment equal to the natural rate. 97. How would we expect this to affect our economy in the short-run? a) b) c) d) e) fall in the general price level; no effect on output or unemployment rise in the general price level; fall in real output and unemployment rise in the general price level; rise in real output, fall in unemployment fall in the general price level; fall in real output; rise in unemployment no change in the general price level; fall in real output; rise in unemployment 98. Suppose we take no action (no fiscal or monetary action). Eventually, what do we expect will happen to the economy over the long run (if we allow it to self-stabilize)? a) No change in anything; prices, output and unemployment all return to their original values b) Price returns to its original level; output will be lower than the potential level and unemployment will be lower than the natural rate c) Rise in prices; rise in output, fall in unemployment d) Fall in the price level; output and unemployment return to the original values e) Fall in the price level; fall in output; fall in unemployment 99. If the government wished to correct the situation above (assume no monetary policy), what would be the appropriate AD policy (fiscal policy)? a) Raise personal income taxes b) Increase the money supply c) Lower personal income taxes d) Increase government spending e) Both c and d are appropriate Suppose the Federal Reserve wished to correct the situation from above (assume no fiscal policy). What would be the appropriate monetary policy? a) Lower personal income taxes b) Raise government spending c) Lower interest rates d) Sell government bonds e) Increase loans to businesses 100. When the federal government implements policy aimed at improving macroeconomic conditions, it is called ______. When the Federal Reserve implements policies aimed at improving macroeconomic conditions, it is called ________. a) Fiscal policy; monetary policy b) Monetary policy; contractionary policy c) Expansionary policy; contractionary policy d) Monetary policy; fiscal policy e) Meddlesome interference; worthless intrusion 101. 102. a) b) c) d) What do Fiscal Policy and Monetary Policy have in common? Nothing, they are completely different They are both conducted by the government (White House / Congress) They are both conducted by the Federal Reserve They both attempt to smooth short-run fluctuations that occur during normal economic growth Under which conditions would monetary policy be most effective in accomplishing its twin goals of low inflation and full-employment? a) When there is an AD shock b) When there is a SRAS shock c) When there is a LRAS shock d) Under any of the above 3 scenarios 103. 104. a) b) c) d) e) What can the Fed do to increase interest rates? Sell govt. securities; lower rr; lower discount rate Sell govt. securities; raise rr; lower discount rate Sell govt. securities; raise rr; raise discount rate Buy govt. securities; lower rr; lower discount rate Buy govt. securities; raise rr; raise discount rate 21 (article from WSJ 4/19/15) China's central bank cut the reserve requirement on bank deposits in a move to let banks lend more of their funds to struggling companies as the economy slows. The People's Bank of China said it was cutting the bank reserve requirement ratio by one full percentage point while it also made other targeted cuts in bank reserves, effective Monday. The move followed a half-point reduction in February and would mean that the nation's bigger banks now need to keep a still hefty 18.5% of their deposits on reserve with the central bank. 105. a) b) c) d) e) Basically, the Central Bank of China _______ in order to _____ the Chinese economy. Sold Chinese govt. bonds; speed up Raised the discount rate; slow down Lowered the reserve requirement of banks; speed up Lowered the discount rate; speed up Raised the reserve requirement of banks; slow down 106. a) Chinese banks are being char b) Chinese banks are paying lower interest rates on their checking/savings accounts c) Chinese banks are paying higher interest rates on their checking/savings accounts d) money at the bank, leaving less money to lend out e) money to lend out 107. a) b) c) d) e) 22 THE OPEN ECONOMY 108. a) b) c) d) e) 109. a) b) c) d) e) What is the largest global market? oil gold currency automobiles Wheat What currency is the most traded in the global FX market? The Euro The U.S. Dollar The English Pound The Chinese Yuan The Japanese Yen Suppose that over time, a Euro buys more Yen than it used to. What does this mean? a) The Euro has appreciated against the Yen and the Yen has appreciated against the Euro b) The Euro has appreciated against the Yen and the Yen has depreciated against the Euro c) The Euro has depreciated against the Yen and the Yen has appreciated against the Euro d) The Euro has depreciated against the Yen and the Yen has depreciated against the Euro e) The Euro has depreciated against the Yen, and the Yen has neither appreciated nor depreciated against the Euro 110. The above is an example of _______. Contractionary monetary policy Expansionary monetary policy Contractionary fiscal policy Expansionary fiscal policy Expansionary monetary and fiscal policy 23 24 Fill in the blanks for the table below and use it to answer the next several questions. Foreign Currency to Currency 1$ = U.S. Dollars South African Rand 7.14 $0.14 Singapore Dollar 1.30 $0.77 Swiss Franc 0.99 $1.01 Euro 0.72 $1.39 Danish Krone 5.26 $0.19 111. a) b) c) d) e) 112. a) b) c) d) e) 113. a) b) c) d) e) 114. a) b) c) d) e) 115. a) b) c) d) e) Consider trade between Germany and Mexico. The graph below shows the exchange rate between the two countries. Use it for the next several questions. What currency is worth the most? S. African Rand Singapore Dollar Swiss Franc Euro Danish Krone What currency is worth the least? S. African Rand Singapore Dollar Swiss Franc Euro Danish Krone Which of the following below ranks the currencies from most valuable to least valuable? Rand, Singapore Dollar; Franc; Euro; Krone; U.S. Dollar Euro; Franc; U.S. Dollar; Singapore Dollar; Krone; Rand U.S. Dollar; Euro; Krone; Franc; Rand; Singapore Dollar Krone; Rand; Euro; U.S. Dollar; Singapore Dollar; Franc Rand; Krone; Singapore Dollar; U.S. Dollar; Franc; Euro Which of the following below ranks the currencies from least valuable to most valuable? Rand, Singapore Dollar; Franc; Euro; Krone; U.S. Dollar Euro; Franc; U.S. Dollar; Singapore Dollar; Krone; Rand U.S. Dollar; Euro; Krone; Franc; Rand; Singapore Dollar Krone; Rand; Euro; U.S. Dollar; Singapore Dollar; Franc Rand; Krone; Singapore Dollar; U.S. Dollar; Franc; Euro How many Danish Krones will one Singapore Dollar buy? 4.05 1 5.26 0.25 1.30 116. a) b) c) d) e) 117. a) b) c) d) e) 118. a) b) c) d) e) What currency does Germany use? The German dollar The German mark The euro The U.S. dollar The peso What currency does Mexico use? The Mexican dollar The U.S. dollar The euro The peso The yen In this particular scenario, w German buyers of Mexican goods/services/assets. German buyers of German goods/services/assets. Mexican buyers of German goods/services/assets. Mexican buyers of Mexican goods/services/assets. Aggregate supply of new, final Mexican goods and services 25 119. a) b) c) d) e) 120. a) b) c) d) e) 121. a) b) c) d) 122. a) b) c) d) In this particular scenario, w German buyers of German goods and services German buyers of Mexican goods/services/assets Mexican buyers of German goods/services/assets Mexican buyers of Mexican goods/services/assets Aggregate supply of new, final German goods and services. 26 Consider trade and the exchange rate between England (the Pound) and Japan (the Yen). Suppose that over the course of the year, the inflation rate in England is substantially higher than in Japan. Use that for the next several questions. 123. Which of the graphs below shows the correct model of this event? C 124. So, what happened to the exchange rate between Japan and England? The Yen and the Pound have both depreciated The Yen and the Pound have both appreciated The Yen has appreciated against the Pound, the Pound is unchanged The Yen has appreciated against the Pound, the Pound has depreciated The Yen has depreciated against the Pound; the Pound has appreciated What does the 22 represent? 1 Mexican peso is worth 0.045 Euros 1 Euro is worth 0.045 Mexican pesos 1 Euro is valued at 22 Mexican pesos 1 Mexican peso is worth 22 Euros Both a and c are correct What are the only ways, using the graph above, for the Euro to appreciate? Demand for Euros increases and/or Supply of Euros increases Demand for Euros decreases and/or Supply of Euros decreases Demand for Euros increases and/or Supply of Euros decreases Demand for Euros decreases, and/or Supply of Euros increases What are the only ways, using the graph above, for the Peso to appreciate? Demand for Euros decreases and/or Supply of Euros increases Demand for Euros decreases and/or Supply of Euros decreases Demand for Euros increases and/or Supply of Euros decreases Demand for Euros increases and/or Supply of Euros increases a) b) c) d) e) 27 28 Given the change in exchange rates, what does this do to the prices of English and Japanese items? English items _______ to Japanese buyers and Japanese items _____ to English buyers. a) become cheaper; become more expensive b) become cheaper; become cheaper c) become more expensive; remain the same relative price d) become more expensive; become cheaper e) become more expensive; become more expensive 125. How might this affect trade between England and Japan? a) English exports to Japan will fall; Japanese exports to England will rise b) English exports to Japan will fall; Japanese exports to England will also fall c) English exports to Japan will be unaffected; Japanese exports to England will also be unaffected d) English exports to Japan will rise; Japanese exports to England will fall e) English exports to Japan will rise; Japanese exports to England will also rise 126. Current Federal Reserve Policy: The Federal Reserve has begun to raise interest rates in the U.S. Consider the case of the U.S. and any of its trading partners, say Mexico. What effect would this have on the DollarPeso exchange rate? a) The dollar and the peso would both appreciate b) The dollar and the peso would both depreciate c) The dollar would appreciate against the peso while the peso would depreciate against the dollar d) The dollar would depreciate against the peso while the peso would appreciate against the dollar e) The dollar would appreciate against the peso, while the value of the peso against the dollar would be unaffected 129. The Federal Reserve has begun to raise interest rates in the U.S. Assume no other global events. Overall, how would this affect the value of the dollar? What would this do to U.S. imports and exports? What overall effect would we expect this to have on the U.S. economy? a) The dollar should appreciate; exports should rise and imports fall; this should speed up the economy b) The dollar should appreciate; Exports should fall and imports rise; this should slow the economy c) The dollar should appreciate; exports and imports should both rise; this should speed the economy up d) The dollar should depreciate; exports should fall and imports rise; this should slow the economy down e) The dollar should depreciate; exports should rise and imports fall; this should speed the economy up 130. How might this affect consumers and businesses in Japan? Who would benefit and who would lose? a) Japanese consumers of English products are better off; Japanese businesses who export to England are also better off b) Japanese consumers of English products are better off; Japanese business who export to England are worse off c) Japanese consumers of English products are unaffected; Japanese businesses who export to England are better off d) Japanese consumers of English products are worse off; Japanese businesses who export to England are better off e) Japanese consumers of English products are worse off; Japanese businesses who export to England are also worse off 127. How might this affect consumers and businesses in England? Who would benefit and who would lose? a) English consumers of Japanese products are better off; English businesses who export to Japan are also better off b) English consumers of Japanese products are better off; English business who export to Japan are worse off c) English consumers of Japanese products are unaffected; English businesses who export to Japan are better off d) English consumers of Japanese products are worse off; English businesses who export to Japan are better off e) English consumers of Japanese products are worse off; English businesses who export to Japan are also worse off 128. 29 30 Suppose that a laptop in Japan sells for 75,000 Yen. Also suppose that the same laptop sells for 600 Canadian Dollars. Finally, suppose that currently 1 Canadian Dollar is worth 140 Yen. The country of Econostan is a small country in Central Asia that uses the Lira as their currency. Below shows the historical exchange rate between the Lira and the U.S. Dollar. Use that information for the next several questions Use this for the next several questions 131. a) b) c) d) e) 132. a) b) c) d) e) 133. a) b) c) d) e) What should the exchange rate be between the Yen and Canadian Dollar? 1 Yen for 125 Canadian dollars 1 Yen for 1 Canadian dollar 1 Canadian dollar for 1 Canadian dollar for 0.008 Yen 1 Canadian dollar for 125 Yen Which currency is over-valued? Which currency is under-valued? The Yen is over-valued; the Canadian Dollar is under-valued The Yen is under-valued; the Canadian Dollar is over-valued The Yen and Canadian Dollar are both over-valued The Yen is overvalued; the Canadian dollar is correctly priced The Yen and the Canadian Dollar are both correctly priced What should happen over time in the FX market to correct the situation? Since both currencies are correctly priced, nothing should change The Yen should depreciate and the Canadian Dollar should appreciate The Yen should appreciate and the Canadian Dollar should depreciate The Yen and Canadian Dollar should both appreciate The Yen and the Canadian Dollar should both depreciate From 2000-2005 what happened to the value of the Econostani Lira compared to the Dollar? What happened to the value of the Dollar compared against the Lira? a) The Dollar and the Lira both appreciated b) The Dollar and the Lira both depreciated c) The Dollar appreciated against the Lira and the Lira depreciated against the Dollar d) The Dollar depreciated against the Lira and the Lira appreciated against the Dollar e) The Dollar appreciated against the Lira and the value of the Lira remained constant 134. From 2005 to 2012, what happened to the value of the Econostani Lira compared to the Dollar? What happened to the value of the Dollar compared against the Lira? a) The Dollar and the Lira both appreciated b) The Dollar and the Lira both depreciated c) The Dollar appreciated against the Lira and the Lira depreciated against the Dollar d) The Dollar depreciated against the Lira and the Lira appreciated against the Dollar e) The Dollar appreciated against the Lira and the value of the Lira remained constant 135. 31 32 Over the entire time frame, what happens to Econostani consumers who buy American products? a) b) worse off c) From 2000 to 2005 Econostani consumers became worse off but from 2005 to 2012 they became better off d) From 2000 to 2005 they became better off, but from 2005 to 2012 they became worse off e) During the entire period they were not affected 136. Over the entire time frame, what happens to Econostani businesses who export to the U.S.? a) Throughout the entire period, Econostani businesses who sold to the U.S. became better off b) Throughout the entire period they became worse off c) From 2000 to 2005 they became worse off, but from 2005 to 2012 they became better off d) From 2000 to 2005 they became better off, but from 2005 to 2012 they became worse off e) During the entire period they were not affected 137. What affect would we expect this to have on American exports and imports, and GDP? a) From 2000 to 2005, exports and imports both rose with no effect on GDP; from 2005 to 2012 exports and imports both fell with no effect on GDP b) From 2000 to 2005 exports and imports both fell with no effect on GDP; from 2005 to 2012 exports and imports both rose with no effect on GDP c) From 2000 to 2005 exports rose and imports fell, GDP rose; from 2005 to 2012 exports fell and imports rose, GDP fell d) From 2000 to 2005 exports rose and imports fell, GDP fell; from 2005 to 2012 exports fell and imports rose, GDP rose e) From 2000 to 2005, exports fell and imports rose, GDP fell; from 2005 to 2012 exports rose and imports fell, GDP rose 140. Over the entire time frame, what happens to Econostani businesses who buy inputs, raw materials and resources from the U.S.? a) Throughout the entire period, Econostani businesses who imported raw materials and inputs from the U.S. became better off b) Throughout the entire period, they became worse off c) From 2000 to 2005 they became worse off, but from 2005 to 2012 they became better off d) From 2000 to 2005 they became better off, but from 2005 to 2012 they became worse off e) Throughout the entire period they were not affected 138. What affect would we expect this to have on Econostani exports and imports, and GDP? a) From 2000 to 2005, exports and imports both rose with no effect on GDP; from 2005 to 2012 exports and imports both fell with no effect on GDP b) From 2000 to 2005 exports and imports both fell with no effect on GDP; from 2005 to 2012 exports and imports both rose with no effect on GDP c) From 2000 to 2005 exports rose and imports fell, GDP rose; from 2005 to 2012 exports fell and imports rose, GDP fell d) From 2000 to 2005 exports rose and imports fell, GDP fell; from 2005 to 2012 exports fell and imports rose, GDP rose e) From 2000 to 2005, exports fell and imports rose, GDP fell; from 2005 to 2012 exports rose and imports fell, GDP rose 139. 33 34