Business Finance: Intro to Financial Management (Senior High)

advertisement

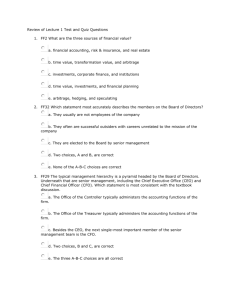

SENIOR HIGH SCHOOL BUSINESS FINANCE Quarter 3 – Module 1: Introduction to Financial Management Business Finance – Grade 12 Alternative Delivery Mode Quarter 3 – Module 1: Introduction to Financial Management First Edition, 2021 Republic Act 8293, section 176 states that: No copyright shall subsist in any work of the Government of the Philippines. However, prior approval of the government agency or office wherein the work is created shall be necessary for exploitation of such work for profit. Such agency or office may, among other things, impose as a condition the payment of royalties. Borrowed materials (i.e., songs, stories, poems, pictures, photos, brand names, trademarks, etc.) included in this module are owned by their respective copyright holders. Every effort has been exerted to locate and seek permission to use these materials from their respective copyright owners. The publisher and authors do not represent nor claim ownership over them. Published by the Department of Education Secretary: Leonor Magtolis Briones Undersecretary: Diosdado M. San Antonio Development Team of the Module Writer: Louell E. Bodios, Maricris C. Cancino and Mara Ellyn H. Lacson Editors: Reviewers: Illustrator: Layout Artist: Louell E. Bodios Management Team: Printed in the Philippines by ________________________ Department of Education – Bureau of Learning Resources (DepEd-BLR) Office Address: Telefax: E-mail Address: ____________________________________________ ____________________________________________ ____________________________________________ ____________________________________________ SENIOR HIGH SCHOOL BUSINESS FINANCE Quarter 3 – Module 1: Introduction to Financial Management Introductory Message For the facilitator: Welcome to the Business Finance Alternative Delivery Mode (ADM) Module on Introduction to Finance Management! This module was collaboratively designed, developed and reviewed by educators both from public institutions to assist you, the teacher or facilitator in helping the learners meet the standards set by the K to 12 Curriculum while overcoming their personal, social, and economic constraints in schooling. This learning resource hopes to engage the learners into guided and independent learning activities at their own pace and time. Furthermore, this also aims to help learners acquire the needed 21st century skills while taking into consideration their needs and circumstances. In addition to the material in the main text, you will also see this box in the body of the module: Notes to the Teacher This contains helpful tips or strategies that will help you in guiding the learners. As a facilitator, you are expected to orient the learners on how to use this module. You also need to keep track of the learners' progress while allowing them to manage their own learning. Furthermore, you are expected to encourage and assist the learners as they do the tasks included in the module. For the learner: Welcome to the Business Finance Alternative Delivery Mode (ADM) Module on Introduction to Financial Management! This module was designed to provide you with fun and meaningful opportunities for guided and independent learning at your own pace and time. You will be enabled to process the contents of the learning resource while being an active learner. This module has the following parts and corresponding icons: What I Need to Know What I Know This will give you an idea of the skills or competencies you are expected to learn in the module. This part includes an activity that aims to check what you already know about the lesson to take. If you get all the answers correct (100%), you may decide to skip this module. What’s In This is a brief drill or review to help you link the current lesson with the previous one. What’s New In this portion, the new lesson will be introduced to you in various ways; a story, a song, a poem, a problem opener, an activity or a situation. What Is It What’s More This section provides a brief discussion of the lesson. This aims to help you discover and understand new concepts and skills. This comprises activities for independent practice to solidify your understanding and skills of the topic. You may check the answers to the exercises using the Answer Key at the end of the module. What I Have Learned This includes questions or blank sentence/paragraph to be filled in to process what you learned from the lesson. What Can I Do This section provides an activity which will help you transfer your new knowledge or skill into real life situations or concerns. Assessment This is a task which aims to evaluate your level of mastery in achieving the learning competency. Additional Activities In this portion, another activity will be given to you to enrich your knowledge or skill of the lesson learned. Answer Key This contains answers to all activities in the module. At the end of this module you will also find: References This is a list of all sources used in developing this module. The following are some reminders in using this module: 1. Use the module with care. Do not put unnecessary mark/s on any part of the module. Use a separate sheet of paper in performing the exercises. 2. Don’t forget to answer What I Know before moving on to the other activities included in the module. 3. Read the instruction carefully before doing each task. 4. Observe honesty and integrity in doing the tasks and checking your answers. 5. Finish the task at hand before proceeding to the next. 6. Return this module to your teacher/facilitator once you are through with it. If you encounter any difficulty in answering the tasks in this module, do not hesitate to consult your teacher or facilitator. Always bear in mind that you are not alone. We hope that through this material, you will experience meaningful learning and gain deep understanding of the relevant competencies. You can do it! What I Need to Know This module was designed and written with you in mind. It is here to help you the basics of finance, its definition and the activities of the financial manager. The scope of this module permits it to be used in many different learning situations. The language used recognizes the diverse vocabulary level of students. The lessons are arranged to follow the standard sequence of the course. But the order in which you read them can be changed to correspond with the textbook you are now using. The module has only one lesson, namely: • Lesson 1 - Defining finance; - Describing who are responsible for financial management within an organization; - Describing the primary activities of the financial manager and how the financial manager helps in achieving the goal of the organization. After going through this module, you are expected to: 1. explain the major role of financial management and the different individuals involved. (ABM_BF12-IIIa-1) What I Know The following multiple-choice items are for you to answer. Choose the letter of the correct answer and write your answers in your answer sheet. 1. The main aim of financial management is to increase _________. a. sales revenue c. shareholders’ wealth b. market share d. profit 2. Who is the one responsible in making investment, financial and dividend policy-making decisions of the firm? a. Creditors c. Employees b. Finance manager d. Supplier 3. One right goal for managers is to _________. a. maximize their own remuneration and perks b. improve working condition of employees c. maximize shareholders’ wealth d. increase the market share 4. Which is a part of top management of the company? a. Chief Executive Officer c. Creditors b. Suppliers d. Vice President in Finance 5. Which is one of the ultimate goals of the finance manager? a. Maximize market price of shares of stocks c. Maximize profit b. Maximize liabilities d. Maximize asset 6. Which of the following is part of financial decision making? a. financing decision c. investment decisions b. dividend decisions d. all of the above 7. Which is concerned with allocating, raising, and controlling of the funds of the firm? a. finance c. financial management b. budgeting d. accounting 8. Which is an efficient allocation of funds to specific assets? a. financing c. dividends b. assets d. investing 9. The finance manager is responsible in maximizing the value of the utility owned by a. creditors c. board of directors b. investors d. banks 10. Which is a NOT a factor that influence market price? a. Profitability b. Competent management c. Political stability d. Marketing strategy Lesson 1 Explaining the Major Role of Financial Management and the Different Individuals Involved. This module will help you will learn what is finance and explain the major role of financial management and the different individuals involved. It aims to build basic concepts defining finance, the activities of the financial manager and other individuals involved. So, ready your working space to make this lesson more meaningful. What’s In Recently, the world has been affected with the pandemic, COVID-19. During this time most of the households are quarantined and are not allowed to get out. How were your family able to manage the needs of the family? Below is an inventory form of the need and wants of your family during this time. List down all your needs and wants and the amount in a monthly basis Needs Amount in Pesos Wants Amount in Peso 1 2 3 TOTAL 1 2 3 TOTAL Net Amount Guide Questions: 1. What are the needs of your family during the pandemic? How about the wants? 2. What are the sources of income of your parents? 3. Did your parents manage the resources they have? How can you say so? What’s New Most of the families during the pandemic received assistance from the government as a help to affected areas. Assuming your family received an amount of PhP 8,000. Based on the first activity we had, using the same needs and wants and listed amounts. Answer the following questions: 1. How much is the total peso amount for needs? How about for wants? 2. How much is the excess? 3. If you are to cross-out an item to cover the given amount, what will you cross-out? 4. If you are to purchase all the items on the list including the ones you crossed-out, how much cash would you need to support all the expenses? 5. What other sources of cash you know? ? What Is It To fully understand the concepts in finance, read and understand carefully the concepts that will be presented to you. FINANCE IN DAILY LIFE Based on the activity that we have previously, you were able to separate the needs and wants of your family. You as well decided on what to prioritize based on the given amount. You were also able to determine whether you need to have more funds or cross-out some items to cover the amount given. Mostly, your activities at home involves decisions on how to use your funds, thus it is called a finance decision. In business, finance decision deals with racing or acquiring of funds from outside sources and not from the ordinary results of business operation. In other words, financing decisions are made when the business needs to borrow money. Finance, on the other hand is defined as the science and art of managing money. (Gitman & Zutter, 2012). It is also defined as the management of money and includes activities such as investing, borrowing, lending, budgeting, saving, and forecasting. (https://corporatefinanceinstitute.com) Income Allocation of a Household in a Month 13% 3% 12% 10% 62% Electricity Water Foods Internet Savings Table 1. Income Allocation of a Household in a Month Given an allowance cap of PhP 8,000 in our previous activity, you were able to list down expenses (needs and wants) and accumulated a certain amount. If you exceed with the given amount you tend to drop some items from the list until such time that your will meet the needed required amount to buy all your family’s needs and wants. What you did is called budgeting. Budgeting is the act of estimating revenue (in from the allowance cap) and expenses over a period of time (in our case, in a monthly basis). In our case you have savings or excess of cash as shown in Table 1, you can use them to purchase other items that will arise on the next day or you can have it saved. Take note that these excess money presents opportunity for investments. Investments come in many forms that will generate more income or appreciate in the future. Instead of hiding your cash under your bed or in the piggy banks have it deposited in the bank to earn interest. In some instances, family’s needs exceed to the allowance cap for the month. Therefore, your parents would tend to seek for other ways to suffice the needed amount. Your parents would either borrow from neighbors, private individuals, from a lending institution or pawn a jewelry, thus this is called sources of funds. When faced with financial difficulties, we look for people or institutions that will give us the money we need. Take note that finance is mostly concerned with decisions about: • • • • How much of their earnings the spend How much they save of how much they need How much they invest their savings How they raise additional funds they need (Gitman) Furthermore, some families have their own businesses as a source of additional income for the family. These businesses could be in different forms: • • • Sole Proprietorship – a business owned by one person and operated for his or her own profit. Partnership – a business owned by two or more people and operated for profit. Corporation – an entity created by law owned by shareholders. In this lesson, we will mainly focus on corporation. Corporations may either be privately owned or publicly owned. Privately owned corporations are often owned by family members whose stocks may not be offered to outsiders unless consent by the family members secured. Companies which are publicly listed are owned by unrelated investors and are traded in organized exchanges like the Philippine Stock Exchange. While there are many stockholders, there is generally a group of investors or a family which controls each listed company. For example, in the case of BPI, the biggest stockholder is Ayala Corporation and in the case of Banco de Oro, it is SM Investment Corporation. Prices of stocks of listed corporations are driven by several factors such as the earnings of the companies, the prospects of the industry where these companies operate, general market sentiment, and the economic prospects of the country, among others. Buying stocks from a corporation will make you a shareholder of the company. According to Investopedia, a shareholder, also referred to as a stockholder, is a person, company, or institution that owns at least one share of a company’s stock, which is known as equity. Because shareholders are essentially owners in a company, they reap the benefits of a business’ success. These rewards come in the form of increased stock valuations, or as financial profits distributed as dividends. Conversely, when a company loses money, the share price invariably drops, which can cause shareholders to lose money, or suffer declines in their portfolios’ values. Being an owner of the company, one of the objectives that one wants to achieve is of course to be profitable and have a lot of cash. Can success be attributed to profitability alone? Profits can be a metric of measuring business’ success but there are other factors to consider. Remember in the first year of operation, business is not earning profit but it can still be considered successful. What is essential is that it can survive even the business is not earning profit. Having a lot of cash has also an advantage for a business, it also signals unhealthy company practices. It may entail that the management has not been putting the company’s resources into good use. Also, keeping too much cash in the books is like hiding your extra money under your bed. They will be missing out on investment opportunities. So, as a shareholder your overall objective is wealth maximization. Let us go over with the sample situations below to fully understand wealth maximization. Sample Problem 1: Fina, a Grade 12 ABM student bought 10 shares of Globe Telecom at PHP2,510 each on September 9, 2019. This bring her investments to PHP25,100. What happens to the value of her investment if the price goes up to PHP2,600 per share or it goes down to PHP2,300 per share? An increase of the share price to PHP2600 per share means that people are willing to buy the shares for that amount. If Fina were to sell her share at this point, it will result to a profit of PHP90 per share or PHP900 on their whole investment. Hence, the value of investment increased from PHP25,100 to PHP26,000. Therefore, there is an increase in shareholder’s wealth. On the other hand, a decrease in the share price to PHP2,300 per share means that people are only willing to buy the shares for PHP2,300. If Fina were to sell her investment at this point, she will receive PHP23,000 which would result to a loss of investment leads to a loss of PHP2,100. The decrease in value of her investment leads to decrease in shareholder’s wealth. FACTORS THAT INFLUENCE MARKET PRICE There are two factors that affects market price and it can be grouped into factors that the management can control and external factors that cannot be controlled by the management. Controllable by Management • Profitability • Having a good liquidity and reasonable leverage position • Dividends • Competent management which affects the company’s operating efficiency Coming up with corporate plans that improve the business prospects of the company. • Uncontrollable External Factors • Macroeconomic conditions • Political stability • Prospects of the industry where the company operates • General market sentiment • Flow of foreign funds invested in the Philippine stock market Profitability Profit is a measure of the financial performance of a company for a period of time. Although it is a major driver for increasing the value of stock, an investor should not rely on profits alone. As discussed earlier, it is possible that the company has profits but its cash flow is negative. Let us try the sample problem below. Sample Problem 2 Suppose the following Income Statements and Cash Flow Statements of companies A, B and C were presented to you. Which do you think is a more attractive company? Company A Income Statement Sales Less: Costs Profits P 100,000 50,000 P 50,000 Cash Flows Collection from Customers Payment of Expenses Net Cash Flow P 100,000 150,000 (P 50,000) Cash Flows Collection from Customers Payment of Expenses Net Cash Flow P 100,000 50,000 P 50,000 P 100,000 70,000 P 30,000 Cash Flows Collection from Customers Payment of Expenses Net Cash Flow P 100,000 70,000 P 30,000 P 0 50,000 (P 50,000) Company B Income Statement Sales Less: Costs Profits Company C Income Statement Sales Less: Costs Profits Company A is profitable but generated negative cash flows which resulted from the uncollected accounts receivable of PHP100,000. Without adequate cash inflows to meet its obligations, the company will face liquidity problems, regardless of its level of profits. Company B on the other hand has a positive cash flow but is unprofitable. This is a result of the company’s delay in payment of its costs. Accordingly, the Company will soon have to pay the remaining PHP100,000 liability and its cash will no longer be sufficient. Again, without adequate cash inflows to meet its obligations, the company will face liquidity problems. Company C is profitable and has a positive cash flow. Based on the information provided, Company C seems to be the best. Good liquidity and reasonable leverage position. Liquidity and leverage refer to the company’s management of the type and amount of assets and liabilities that it will hold in the course of its operations. Dividends. Holders of shares receive dividends from a corporation as returns on their investments in form of cash or other properties. Companies which have better dividend policies are generally more attractive than companies who do not pay out dividends. Note that there may be times that companies do not pay out dividends because of future expansions. Same with the other factors affecting share price, dividend policies should go hand in hand with other factors in determining market price. Competent management. Competent managers may have any of the following attributes: 1) visionary 2) decisive 3) people-oriented, 4) inspiring, 5) innovative, 6) respected and 7) experienced/seasoned manager A competent management looks attractive for it builds trust and confidence that the money invested is in the good hands of the persons involved in the company. Corporate Plans that Improve the Business Prospects. Sample Problem 3: Company A which is in the business of selling Halo-halo in the Brgy. Robles area for 5 years. Company A is consistently earning profits and has a positive cash flow. When asked how Company A sees itself after 5 more years, Company A answered that it would continue to sell Halo-halo in Brgy. Robles. On the other hand, Company B sells Buko Juice in Brgy. Cabacungan area for 5 years. Company B is consistently earning profits and has a positive cash flow. When asked how Company B sees itself after 5 more years, Company B answered that it has generated enough cash to expand its business to La Granja area to take advantage of the growing demand of Buko Juice in La Granja. Which of the two company’s would you invest? Between Company A and Company B, which would be a better investment? Company B. Since it has more concrete future prospects allowing investors to hope for better revenues and net income. External Factors These factors influence the general reaction of investors in making an investment decision. Its effect is not only to a specific company but on all companies or a group of companies under similar circumstances. Such factors are a result of the environment a company operates in rather than the decisions of the company’s management. Given the factors that influence market price the next challenge that shareholders will face is on how they are going to achieve their objectives, thus it can be made true through financial management. Financial Management Financial management deals with the decisions that are supposed to maximize the value of shareholders’ wealth. (Cayanan) These decisions will ultimately affect markets perception of the company and influence the share price. The goal of financial management is to maximize the value of shares of stocks. It also is focused on capital budgeting decision or investment decision on acquisition of assets and its corresponding financing scheme. The Role of Financial Management • • • • • To ensure regular and adequate supply funds. To ensure returns to shareholders through capital gains which is which are dependent upon the earning capacity and the market price of the share. To ensure optimum funds utilization at least cost. To ensure investment of funds in safe venture so that adequate rate of return can be achieved. To design a sound capital structure by maintaining a fair composition of capital through a balance between debt and equity capital. (De Guzman, A.A., 2019) Individuals Involved in Financial Management 1. The senior leaders of an organization are responsible for all aspects of its financial health. They are the ones understands the unit’s financial situation and do not allow unintended deficits to occur. They are accountable for the resources entrusted to them that includes the funds, facilities and recruitment of employees, even if the control and tasks have been delegated to their staff, under command of responsibilities. Example: Shareholders, and Board of Directors. 2. Unit heads are responsible for their internal financial management and to develop budgeting, financial reporting and management practices. Units are encouraged to develop an oversight process that builds on best practices. (De Guzman, 2019) Managers of the corporation are responsible for making the decisions for the company that would lead towards shareholders’ wealth maximization. Example: Chief Executive Officer, VP for Production, Marketing, Finance, Administration and the likes. On the next lessons you will fill in the shoes of a Chief Financial Officer (CFO) and every problem that you will encounter for this course should be dealt with having shareholders wealth maximization in mind. What’s More Read and understand the following situation and answer it in your answer sheet. Company D has been operating in La Castellana for 7 years now by selling coffee. It is consistently earning profit and has a positive cash flow. It plans to expand its operation to a nearby town since it has enough cash and trying to venture out to new menus using coffee to add variety to its offerings. Company E is in the business for 10 years now. It is a leading company in selling face masks. Due to the current situation, they should increase the production to meet current demand for the said product. The company earns profit and has a positive cash flow but having problems with the tax regulation authority due to poor management. Company F is a company that is planning to invest for a new business venture considering Company D and Company E as a future investment. Questions: 1. If you are the owner of Company F: a. What factors will you consider in investing with: 1. Company D? 2. Company E? b. Which company would you choose to invest? Why? What I Have Learned Finance is defined as the science and art of managing money. (Gitman & Zutter, 2012). It is also defined as the management of money and includes activities such as investing, borrowing, lending, budgeting, saving, and forecasting. (https://corporatefinanceinstitute.com) Financial management deals with the decisions that are supposed to maximize the value of shareholders’ wealth. (Cayanan). The goal of financial management is to maximize the value of shares of stocks. The Role of Financial Management • • • • • To ensure regular and adequate supply funds. To ensure returns to shareholders through capital gains which is which are dependent upon the earning capacity and the market price of the share. To ensure optimum funds utilization at least cost. To ensure investment of funds in safe venture so that adequate rate of return can be achieved. To design a sound capital structure by maintaining a fair composition of capital through a balance between debt and equity capital. (De Guzman, A.A., 2019) Individuals Involved in Financial Management 1. The senior leaders of an organization are responsible for all aspects of its financial health (De Guzman, A.A., 2019). Example: Shareholders, and Board of Directors. 2. Unit heads are responsible for their internal financial management and to develop budgeting, financial reporting and management practices (De Guzman, A.A., 2019). Example: Chief Executive Officer, VP for Production, Marketing, Finance, Administration and the likes. What Can I Do Company G is a company whose main operation is Saba Sticks production located in La Castellana, Negros Occidental. They have been in the business for 5 years now with good financial records and flow of cash. The company aims to sell their product across nearby provinces like Negros Oriental, Panay and Cebu in 5 years. The company is also innovating their products for more variations and flavors. With this dream in mind, they wished to sell shares of stocks to increase capitalization. They are also planning to invest through the Philippine Stock Exchange to generate more funds in the future. At present, the company is facing some problems that somewhat affects its operation. They are facing with the delivery of goods due to the pandemic happening in the area. Production is slowing down due to skeletal reporting of the employees; delivery is also affected due to border closures and banana and other raw materials are taking time to arrive. Prices of raw materials also tries to increase that affects the product’s selling price. In spite of this adversities, the management is visionary and determined to provide high quality products and services to its loyal consumers. 1. What are the attributes of the company that contributes to their maximization of wealth? 2. As a learner, would you invest to this company? Explain your answer. 3. If you are the owner of Company G, how will you address the problems at sight? Assessment The following multiple-choice items are for you to answer. Choose the letter of the correct answer and write your answers in your answer sheet. 1. The main aim of financial management is to _________. a. increase sales revenue c. increase market share b. increase stockholders’ wealth d. increase profit 2. Which is one of the ultimate goals of the finance manager? a. Maximize market price of shares of stocks c. Maximize profit b. Maximize liabilities d. Maximize asset 3. One right goal for managers is to _________. a. maximize their own remuneration and perks b. improve working condition of employees c. maximize shareholders’ wealth d. increase the market share 4. Which is concerned with allocating, raising and controlling of the funds of the firm? a. Finance c. Finance Management b. Budgeting d. Accounting 5. Who is the one responsible in making investment, financial and dividend policy-making decisions of the firm? a. Creditors c. Employees b. Supplier d. VP for Finance 6. Which of the following is part of financial decision making? a. financing decision c. investment decisions b. dividend decisions d. all of the above 7. Which is a part of top management of the company? a. Chief Executive Officer c. Creditors b. Suppliers d. Vice President in Finance 8. Which is an efficient allocation of funds to specific assets? a. financing c. dividends b. assets d. investing 9. The finance manager is responsible in maximizing the value of the utility owned by a. creditors c. shareholders b. investors d. banks 10. Which is NOT a factor that influence market price? a. The company is incurring loss to its operation b. The company has a competent management c. The tax policies in the area is unstable d. The promotional campaign is effective and efficient Additional Activities Answer the following questions on a separate piece of paper. 1. Aside from the factors mentioned in our discussion, what other factors can influence the investor’s perception on the company’s performance which would ultimately affect share price? 2. Why is the study of finance important to you? What’s In Possible Answer: Your answer may vary depending on you family’s situation. Needs 1 Rice 2 Sardines 3 Pork TOTAL Wants 1 Internet fee 2 Cellphone load 3 Soft drinks TOTAL Net Amount • Amount in Pesos 3,600 300 600 4,500 Amount in Pesos 1,699 1,000 500 3,699 7,699 Amount is for monthly consumption 1. Most of my family’s needs are food. The wants are more on loads and internet. 2. Salary. 3. Yes, because they can manage to provide us with our basic needs and wants that are essential in our studies. What I Know 1) C 2) B 3) C 4) A 5) A 6) D 7) C 8) A 9) B 10) D Answer Key Assessment 1. B 2. A 3. C 4. C 5. D 6. D 7. A 8. A 9. B 10. D What Can I Do Possible answers. Answers may vary. 1. The attributes of Company G that will contribute to maximization of the company’s wealth are: a.) profitability as evidenced by good financial records and flow of cash; b.) the clear plans/objectives; and c.) good management. 2. As a learner, Yes, I will invest in company G. Due to the fact that it possesses attractive attributes I am certain that my money will gain and go far. It will also yield a higher market price in the future that will allow my investment to gain in some instance that I will sell my share. . 3.) As an owner of Company G, I will ensure that the delivery of the products will still be on time by providing an online scheme of ordering to fast track the delivery. Invest in delivery equipment to keep the movement of the product from the plant to the consumers with ease. I will also ensure that the production will be at the most number to supply the much-needed demands of the consumers. Ensure employees welfare by providing safety measures, provide private vehicles for their transportation and that they can report and prepare the needed quantity of production with utmost quality assured. What’s More Possible answers. Answers may vary. A. 1. Profitability and Clear corporate plans. 2. Poor management of funds and Inability to cope with the current situation. B. I will choose Company D because their market price is higher due to good financial stability as characterized by good profitability and good cash flows. And they have a clear corporate plan that provides me as an investor a clear path unto where my investment is going. • Teaching Guide for Senior High School BUSINESS FINANCE – Published by Commission on Higher Education, 2016 ©, Chairperson: P.B. Licuanan, Ph. D. • Business Finance for Senior High School, De Guzman, A.A., (2019), Lorimar Publishing, Inc. • Business Finance in the Philippine Setting for Senior High School, Aduana, N.L., (2017), C&E Publishing, Inc. • Harper, D. R. (2019, November 19). www.investopedia.com. Retrieved from www.investopedia.com: https://www.investopedia.com/articles/basics/04/100804.asp References Additional Activities Possible answers. Answers may vary. 1. The factors that can influence the investor’s perception on the company’s performance which ultimately affect share price are: 1. Stock prices are driven by a variety of factors, but ultimately the price at any given moment is due to the supply and demand at that point in time in the market. 2. Fundamental factors drive stock prices based on a company's earnings and profitability from producing and selling goods and services. 3. Technical factors relate to a stock's price history in the market pertaining to chart patterns, momentum, and behavioral factors of traders and investors. – (Investopedia, Harper, D.H., 2019) 2. Answers may vary For inquiries or feedback, please write or call: Department of Education - Bureau of Learning Resources (DepEd-BLR) Ground Floor, Bonifacio Bldg., DepEd Complex Meralco Avenue, Pasig City, Philippines 1600 Telefax: (632) 8634-1072; 8634-1054; 8631-4985 Email Address: blr.lrqad@deped.gov.ph * blr.lrpd@deped.gov.ph