Child Tax Credit Debate: Christian Leaders & Poverty Reduction

advertisement

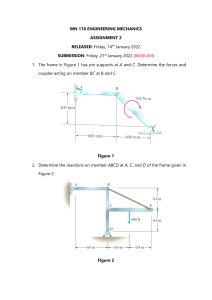

Christian Leaders Lobby To Extend Child Tax Credit Lawmakers allowed the increased child tax credit, that was passed during the pandemic, to expire at the end of December 2021 when President Biden’s “Build Back Better” plan fell apart in the Senate. The Democrats blamed Senator Joe Manchin for blocking the passage of the bill after he said he would only support the plan if the extension of the child tax credit was tied to a work requirement for families whose income fell below the level to incur federal income taxes (Jack Jenkins). Many Christian leaders and organizations began their pressure campaign on Congress and the White House by running an ad in Politico Magazine on May 26, 2022. They are seeking the permanent extension of the credit to help low-income families. The credit which was up to $300 per month per child had been hailed by many Christian leaders as a remarkable success at reducing child poverty. According to research from Columbia University, child poverty increased by 41% after the expiration of the credit expired (Jack Jenkins). In their new letter to leaders, they are asking for the credit to be fully refundable which would allow families to receive the full amount without proof of income or the requirement to pay income taxes. They claim this forgiveness will reduce the poverty level by 20%. Opponents of the extension and permanent placement of the child tax credit estimate that it would cost US taxpayers $100 billion dollars in the first year alone (Greg Heilman). Senator Manchin also worried about how families will spend the money, if they spend it on their families at all. Republican Senators Marco Rubio (FL) and Mike Lee (UT) have put forth a proposal that has been backed by other Republicans such at Mitt Romney, but their proposal is a scaled amount version based on the child ages and has a work requirement, which most Democrats, especially the progressive Democrats, will not approve of. I believe it is our duty as a country, society, and individuals to help those in need. But there need to be some check and balance to these programs. To blindly cut check to families for the purpose of saying we are combating poverty does not solve the issue. It is a much more complex topic than to say, “Throw money at it and it will go away”. The financial state of this country is dire and to be fiscally irresponsible in any fashion cannot be tolerated. Works Cited Greg Heilman. What Does the Democrats’ Proposed Extension of the Child Tax Credit Have to Pass? Diario AS, 8 May 2022, https://en.as.com/latest_news/what-does-the-democratsproposed-extension-of-the-child-tax-credit-have-to-pass-n/. Accessed 6 June 2022. Jack Jenkins. Christian Leaders Press Lawmakers to Extend Child Tax Credit for Poor Families. Religion News Service, 25 May 2022, https://religionnews.com/2022/05/25/christianleaders-press-lawmakers-to-extend-child-tax-credit-to-poor-families/. Accessed 6 June 2022.