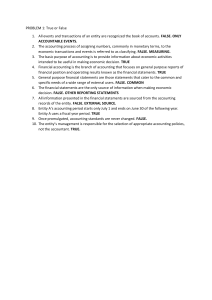

CHAPTER 1: THE ACCOUNTANCY PROFESSION DEFINITION of Accounting: (ACCOUNTING STANDARDS COUNCIL) ■ Accounting is a service activity ■ Its function is to provide quantitative information, primarily financial in nature, about economic entities, that is intended to be useful in making economic decisions (AMERICAN INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS) ■ Accounting is the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which are in part at least of a financial character and interpreting the results thereof (AMERICAN ACCOUNTING ASSOCIATION) ■ Accounting is the process of identifying, measuring and communicating economic information to permit informed judgment and decision by users of the information Components of Accounting (based on its definition) ■ Take note that not all business activities are accountable ■ Subject matter of accounting: Economic Activity/ies CLASSIFICATION OF ECONOMIC ACTIVITIES EXTERNAL TRANSACTIONS – also known as exchange transactions. - these are events that involves one entity and another entity INTERNAL TRANSACTIONS – it involves the entity only. MEASURING ■ It is the process of assigning peso amounts to accountable economic transactions and events. ■ Measurement bases are the historical cost, current cost, realizable value and present value COMMUNICATING a. Identifying as the analytical component b. Measuring as the technical component c. Communicating as the formal component ACCOUNTING AS AN INFORMATION SYSTEM ■ Information System of Accounting measures business activities, processes information into reports and communicates the reports to decision makers ■ Its key product is a set of financial statements IDENTIFYING ■ ■ It is the recognition or non-recognition of business activities as accountable events. Accountable event or Quantifiable event – it is an event that has an effect/s on assets, liabilities and equity. It is the process of preparing and distributing accounting reports to potential users of accounting information This process is the reason why accounting is called the “Universal Language of Business.” This process contains the recording, classifying and summarizing aspects of accounting. OVERALL OBJECTIVE OF ACCOUNTING “The overall objective of accounting is to provide quantitative financial information about a business that is useful to statement users particularly owners and creditors in making economic decisions.” ■ Under the new BOA resolution, all CPA (regardless of area or sector of practice) shall be required to comply with 120 CPD units for a period of 3 years. ■ Here is the initial implementation of the 120 CPD credit units: The Accountancy Profession ■ Republic Act No. 9298 ■ Known as the “Philippine Accountancy Act of 2004” ■ BOARD OF ACCOUNTANCY – a body authorized by law to promulgate rules and regulations affecting the practice of the accountancy profession in the Philippines. - it is also responsible for preparing and grading the Philippine CPA Examination ■ PRC shall issue the Certificate of Registration to practice public accountancy which shall be valid for 3 years and renewable every 3 years upon payment of required fees. 3 MAIN AREAS OF ACCOUNTANCY: YEAR CPD CREDIT UNITS 2017 80 credit units 2018 100 credit units 2019 120 credit units ■ The excess credit units shall not be carried over for the next three (3) year period, except of masteral and doctoral degree CPD units. ■ It has become mandatory for all Certified Public Accountants and it is also required for the renewal of CPA license and accreditation of CPA to practice the accountancy profession. EXEMPTION FROM CPD: ■ 1. Public Accounting 2. Private Accounting If a CPA has reached the age of 65 years old. (this only applies to the renewal of the CPA license) 3. Government Accounting GENERAL ACCEPTED ACCOUNTING PRINCIPLES (GAAP) CONTINUING PROFESSIONAL DEVELOPMENT (CPD) ■ Republic Act No. 10912 ■ CPD refers to the inculcation and acquisition of advanced knowledge, skill, proficiency, and ethical and moral values after the initial registration of CPAs for the assimilation into professional practice and lifelong learning. ■ It represents the rules, procedures, practice and standards followed in the preparation and presentation of financial statements. ■ It is like laws that must be followed in financial reporting. PURPOSE OF ACCOUNTING STANDARDS: ■ To identify proper accounting practices for the preparation and presentation of financial statements. ■ These standards create a common understanding between preparers and users of financial statements particularly the measurement of assets and liabilities. FINANCIAL REPORTING STANDARDS COUNCIL (FRSC) ■ It is the accounting standard setting body created by the PRC upon recommendation of the BOA to assist them in carrying out of its powers and functions provided under R.A. No. 9298. ■ Its main function is to establish and improve accounting standards that will be generally accepted in the Philippines. ■ The standard promulgated by FRSC constitute the highest hierarchy of the GAAP in the Philippines. ■ FRSC approved standards are the Philippine Accounting Standards (PAS) and Philippine Financial Reporting Standards (PFRS). PHILIPPINE INTERPRETATION COMMITTEE (PIC) ■ It was formed by the FRSC in August 2006. ■ Its role is the preparation of interpretations of PFRS for the approval by the FRSC and to provide timely guidance on financial reporting issues not specifically addressed in current PFRS. INTERNATIONAL ACCOUNTING STANDARDS COMMITTEE (IASC) ■ It was formed in June 1973. ■ It is an independent private sector body, with the objective of achieving uniformity in the accounting principles which are used by business and other organizations for financial reporting around the world. OBJECTIVES OF IASC: 1. To formulate and publish in the public interest accounting standards to be observed in the presentation of financial statements and to promote their worldwide acceptance and observance. 2. To work generally for the improvement and harmonization of regulations, accounting standards and procedures relating to the presentation of financial statements. INTERNATIONAL ACCOUNTING STANDARDS BOARD (IASB) ■ It replaces the International Accounting Standards Committee (IASC) ■ It publishes the International Financial Reporting Standards (IFRS), a standard in a series of pronouncements. ■ the pronouncements of the IASC continues to be designated as “International Accounting Standards” or IAS. ■ It has adopted the body of standards issued by the IASC. ■ The standard-setting process of the IASB includes (in the correct order) research, discussion paper, exposure draft and accounting standard. PHILIPPINE FINANCIAL REPORTING STANDARDS (PFRS) ■ It is a series of pronouncements issued by the Financial Reporting Standards Council. ■ It collectively include all of the following: 1. PFRS which corresponds to International Financial Reporting Standards. 2. PAS which corresponds to International Accounting Standards. 3. Philippine Interpretations which correspond to the Interpretations of the IFRIC and Standing Interpretations Committee, and Interpretations developed by the PIC. CHAPTER 2: THE CONCEPTUAL FRAMEWORK Definition: ◦ ◦ ◦ It is a complete, comprehensive and single document which is promulgated by the International Accounting Standards Board (IASB) It is a summary of the terms and concepts that underlie the preparation and presentation of financial statements for external users. It is intended to guide standard-setters, preparers and users of financial information in the preparation and presentation of statements. PURPOSES OF CONCEPTUAL FRAMEWORK: ◦ To assist the FRSC in developing accounting standards and reviewing existing standards. ◦ To assist preparers of financial statements in applying accounting standards and in dealing with issues not yet covered by GAAP. ◦ To assist the FRSC in the review and adoption of International Financial Reporting Standards. ◦ To assist users of financial statements in interpreting the information contained in the financial statements. ◦ To assist auditors in forming an opinion as to whether financial statements conform with Philippine GAAP. ◦ To provide information to those interested in the work of the FRSC in the formulation of PFRS. USERS OF FINANCIAL INFORMATION PRIMARY USERS these are the parties to whom the general purpose financial reports are primarily directed. It includes the existing and potential investors, lenders and other creditors. OTHER USERS these are the users of financial information other than the existing and potential investors, lenders and other creditors. it includes the employees, customers, governments and their agencies, and the public. SCOPE OF CONCEPTUAL FRAMEWORK a. Objective of financial reporting b. Qualitative characteristics of useful financial information c. Definition, recognition and measurement of the elements from which financial statements are constructed d. Concepts of capital and capital maintenance OBJECTIVE OF FINANCIAL REPORTING ◦ “It is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders and other creditors in making decisions about providing resources to the entity.” ◦ It is the “why” , purpose or goal of accounting SPECIFIC OBJECTIVES OF FINANCIAL REPORTING 1. To provide information useful in making decisions about providing resources to the entity. 2. To provide information useful in assessing the cash flow prospects of the entity 3. To provide information about entity resources, claims and changes in resources and claims. USEFULNESS OF FINANCIAL PERFORMANCE ◦ ◦ ◦ ◦ It helps users to understand the return that the entity has produced on the economic resources. The return of the entity provides an indication of how well management has discharged its responsibilities to make efficient and effective use of the entity’s economic resources. The past financial performance information is helpful in predicting the future returns on the economic resources of the entity. Also, the information about financial performance during a period is useful in assessing the entity’s ability to generate future cash inflows from operations. ACCRUAL ACCOUNTING ◦ ◦ It depicts the effects of transactions and other events and circumstances on an entity’s economic resources and claims in the periods in which those effects occur even if the resulting cash receipts and payments occur in a different period. It is to recognize the effects of transactions and other events when they occur and not as cash is received or paid. ◦ “Income is recognized when earned regardless of when cash is received and expense is recognized when incurred regardless of when cash is paid.” LIMITATIONS OF FINANCIAL REPORTING a. General purpose financial reports do NOT and cannot provide all of the information that existing and potential investors, lenders and other creditors need. b. General purpose financial reports are not designed to show the value of an entity but the reports provide information to help the primary users estimate the value of the entity. c. General purpose financial reports are intended to provide common information to users and cannot accommodate every request for information. d. To a large extent, general purpose financial reports are based on estimate and judgment rather than exact depiction. UNDERLYING ASSUMPTIONS ◦ These are the fundamental premises, which is the basis of the accounting process. ◦ It is also known as postulates. ◦ These serves as the foundation or bedrock of accounting. ◦ Only ONE assumption is stated in the Conceptual Framework for Financial Reporting, which is going concern. ◦ Other BASIC ASSUMPTIONS: accounting entity, time period and monetary unit. OTHER BASIC ASSUMPTIONS ACCOUNTING ENTITY ◦ ◦ It is the specific business organization (proprietorship, partnership or corporation) “The entity is separate from the owners, managers, employees who constitute the entity.” TIME PERIOD ◦ “it requires that the indefinite life of an entity is subdivided into accounting periods which are usually of equal length for the purpose of preparing financial reports on financial position, performance and cash flows.” MONETARY UNIT ◦ Two Aspects: 1. Quantifiability Aspect – the assets, liabilities, equity, income and expenses be measured in Philippine peso. 2. Stability of the Peso – the purchasing power of peso is constant or stable. CHAPTER 3: CONCEPTUAL FRAMEWORK (QUALITATIVE CHARACTERISTICS) QUALITATIVE CHARACTERISTICS Definition: these are the qualities or attributes that make financial accounting information useful to the users. It is classified into two: 1. fundamental qualitative characteristics 2. enhancing qualitative characteristics APPLICATION OF THESE CHARACTERISTICS: a. Identify an economic phenomenon that has the potential to be useful. b. Identify the type of information about the phenomenon that would be most relevant and can be faithfully represented. c. Determine whether the information is available. A. RELEVANCE It is the capacity of the information to influence a decision. For a financial information to be relevant, it must be capable of making a difference in the decisions made by users. To be relevant, it requires that the financial information should be related or pertinent to the economic decision, but if it does not bear an economic decision, the information is deemed useless. INGREDIENTS OF RELEVANCE: 1. Predictive value – can be used as an input to processes employed by users to predict future outcome. 2. Confirmatory value B. MATERIALITY It is a practical rule which dictates that strict observance of the GAAP is not necessary when the items are NOT significant enough to affect the evaluation, decision and fairness of the financial statements. This concept is also known as the Doctrine of Convenience It is a “subquality” of relevance based on the nature or magnitude or both of the items to which the information relates. WHEN IS AN ITEM MATERIAL? an item is material if knowledge of it would affect or influence the decision of the informed users of the financial statements. Information is material if its omission or misstatement could influence the economic decision that the users make on the basis of the financial information about an entity “to be neutral is to be fair.” 3. FREE FROM ERROR It means that there are no errors or omissions in the description of the phenomenon or transaction. The concept of free from error does not necessarily mean perfectly accurate in all respects. D. SUBSTANCE OVER FORM FACTORS OF MATERIALITY 1. RELATIVE SIZE – it is in relation to the total of the group to which the item belongs is taken into account. 2. NATURE OF AN ITEM – it may be inherently material because by its very nature it affects economic decision. C. FAITHFUL REPRESENTATION It means that financial reports represent economic phenomena or transactions in words and numbers. The descriptions and figures must match what really happened or existed. The actual effects of a transaction or event must be accounted properly and reported in the financial statements. INGREDIENTS OF FAITHFUL REPRESENTATION: 1. COMPLETENESS 2. NEUTRALITY A neutral depiction is without bias in the preparation or presentation of financial information. To be neutral, the information in the financial statements must be free from bias. If the transactions events faithfully represents information it purports to represent, it is necessary that the transactions and events are accounted in accordance with their substance and reality and not merely their legal form. It is not considered a separate component of faithful representation because it would be redundant. Faithful representation – it represents the substance of an economic phenomenon or transaction rather than merely representing the legal form. E. CONSERVATISM It means that when alternatives exist, the one chosen should be the one which has the least effect on equity. “In case of doubt, record any loss and do not record any gain.” Contingent Loss – it is recognized as a “provision” if the loss is probable and the amount can be reliably measured. Contingent Gain – it is not recognized but disclosed. Expressions of Conservatism “Anticipate no profit and provide for probable and measurable loss.” “Don’t count your chicks until the eggs hatch.” F. PRUDENCE 2. Indirect Verification – it is checking inputs to a model, formula or other technique and recalculating the inputs using the same methodology. 4. TIMELINESS It is the desire to exercise care and caution when dealing with the uncertainties in the measurement process. ENHANCING QUALITATIVE CHARACTERISTICS 1. COMPARABILITY It is one of the enhancing qualitative characteristics that enables users identify and understand the similarities and dissimilarities among items. HORIZONTAL COMPARABILITY – it is comparability within an entity. INTERCOMPARABILITY OR DIMENSIONAL COMPARABILITY – it is comparability across entities. 2. UNDERSTANDABILITY CHAPTER 4: CONCEPTUAL FRAMEWORK (ELEMENTS OF FINANCIAL STATEMENTS) Elements of financial statements Measurement of financial position: Asset Liability Equity Measurement of financial performance: Income Expense COMPARABILITY CONSISTENCY - Uniform application of accounting method from period to period within an entity. - It helps to achieve the goal. It means that the information should be presented in a form that is understandable to the user. - Uniform application of accounting method between and across entities in the same industry. The presentation of the information must be clear and concise. - It is the goal. This characteristic is very essential because a relevant and faithfully represented information may prove useless if it is not understood by users. 3. VERIFIABILITY RECOGNITION OF ELEMENTS 1. ASSET RECOGNITION PRINCIPLE Two conditions to consider: It implies consensus. 1. It is probable that future economic benefits will flow to the entity. A financial information is verifiable if it is supported by evidence. 2. The cost or value of the asset can be measured reliably. TYPES OF VERIFICATION: 1. Direct Verification – verifying an amount through direct observation COST PRINCIPLE – it requires that the assets be measured initially at original cost or acquisition cost. 2. LIABILITY RECOGNITION PRINCIPLE Two conditions to consider: 1. It Is probable that an outflow of economic benefits will be required for the settlement of a present obligation 2. The amount of obligation can be measured reliably. 3. INCOME RECOGNITION PRINCIPLE • Basic principle: income shall be recognized when earned. Two conditions to consider: 1. It is probable that future economic benefits will flow to the entity as a result of an increase in an asset or a decrease in a liability. 2. The economic benefits can be measured reliably. POINT OF SALE: 4. EXPENSE RECOGNITION PRINCIPLE • Basic principle: expenses are recognized when incurred. TWO conditions to consider: 1. It is probable that a decrease in future economic benefits has occurred as a result of a decrease in an asset or an increase in a liability. 2. The decrease in economic benefits can be measured reliably. MATCHING PRINCIPLE • It is applied in expense recognition principle. • It requires that costs and expenses incurred relating to a revenue shall be reported in the same period. Three applications of matching principle: 1. CAUSE AND EFFECT ASSOCIATION • Legal title to the goods passes to the buyer at point of sale Expense is recognized when the revenue is already recognized • It is usually the point of delivery (actual or constructive) It is commonly referred to as matching of cost with revenue. Example: cost of merchandise inventory, doubtful accounts, warranty expense and sales commissions EXCEPTIONS TO THE POINT OF SALE: 1. INSTALLMENT METHOD – revenue is recognized at point of collection. 2. COST RECOVERY METHOD OR SUNK COST METHOD – revenue is recognized at point of collection. 3. PERCENTAGE OF COMPLETION METHOD – contract revenue and contract costs be recognized as revenue and expenses based on the stage of completion of the contract. 2. SYSTEMATIC AND RATIONAL ALLOCATION Costs are expensed by simply allocating them over the periods benefited. “when economic benefits are expected to arise over several accounting periods and the association with income can only be broadly or indirectly determined, expenses are recognized on the basis of systematic and allocation procedures.” Examples: depreciation of ppe, amortization of intangible assets, 4. PRODUCTION METHOD – revenue is recognized at the point of production. allocation of prepaid rent, insurance and other prepayments 3. IMMEDIATE RECOGNITION Expense is recognized immediately when: 1. An expenditure produces no future economic benefit 2. Cost incurred does not qualify or ceases to qualify for recognition as an asset • Examples: salaries of officers, administrative expenses, advertising and selling expenses MEASUREMENT OF ELEMENTS 1. HISTORICAL COST (past purchase exchange price) 2. CURRENT COST (current purchase exchange price) 3. REALIZABLE VALUE (current sale exchange price) 4. PRESENT VALUE (future exchange price)