Succession Handbook: Managing Deceased's Financial Assets

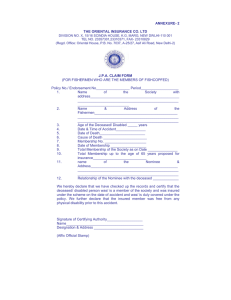

advertisement