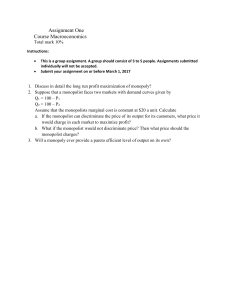

EconS 301 Homework #8 – Answer key Exercise #1 – Monopoly Consider a monopolist facing inverse demand function 𝑝𝑝(𝑞𝑞) = 15 − 3𝑞𝑞, where 𝑞𝑞 denotes units of output. Assume that the total cost of this firm is 𝑇𝑇𝑇𝑇(𝑞𝑞) = 5 + 4𝑞𝑞. a) Find the monopolist’s marginal revenue, and its marginal cost. Answer: 𝑀𝑀𝑀𝑀 = 𝑑𝑑(𝑝𝑝(𝑞𝑞) ∗ 𝑞𝑞) 𝑑𝑑(15𝑞𝑞 − 3𝑞𝑞2 ) = = 15 − 6𝑞𝑞 and 𝑑𝑑𝑑𝑑 𝑑𝑑𝑑𝑑 𝑀𝑀𝑀𝑀 = 𝑑𝑑�𝑇𝑇𝑇𝑇(𝑞𝑞)� 𝑑𝑑(5 + 4𝑞𝑞) = =4 𝑑𝑑𝑑𝑑 𝑑𝑑𝑑𝑑 b) Set marginal revenue equal to marginal cost, to find the optimal output for this monopolist 𝑞𝑞 𝑀𝑀 . Answer: Let MR=MC, we obtain the optimal output for monopolist: 15 − 6𝑞𝑞 = 4 11 ⇒ 𝑞𝑞 𝑀𝑀 = 6 c) Find the monopoly price, and profits. Find the consumer surplus, and total welfare. Answer: Given the optimal output above, we plug into demand function to obtain the optimal price, that is 11 30 11 19 𝑝𝑝𝑀𝑀 = 15 − 3𝑞𝑞 𝑀𝑀 = 15 − 3 ∗ = − = = 9.5 2 2 2 6 Therefore, the consumer surplus is the triangular area between 𝑝𝑝0 when 𝑞𝑞 = 0 and 𝑝𝑝𝑀𝑀 , that is 1 1 11 60.5 𝐶𝐶𝐶𝐶 = (𝑝𝑝0 − 𝑝𝑝𝑀𝑀 ) ∗ 𝑞𝑞 𝑀𝑀 = (15 − 9.5) ∗ = ≈ 5.04167 2 2 12 6 And finally, because MC curve is constant, meaning the producer surplus is rectangular the area between 𝑝𝑝 𝑠𝑠 when 𝑝𝑝 𝑠𝑠 = 𝑀𝑀𝑀𝑀 and 𝑝𝑝𝑀𝑀 ,so 11 𝑃𝑃𝑃𝑃 = (𝑝𝑝𝑀𝑀 − 𝑝𝑝 𝑠𝑠 ) ∗ 𝑞𝑞 𝑀𝑀 = (9.5 − 4) ∗ ≈ 10.083 6 Therefore, the total welfare is CS + 𝑃𝑃𝑃𝑃 = 10.083 + 5.04167 = 15.125. See Figure 1 below. 1 d) Assume now that the market operated under perfect competition. Find the equilibrium output. Answer: If market operated under perfect competition, we must have optimal price equals to marginal cost. That is, 𝑝𝑝𝑀𝑀 = 𝑀𝑀𝑀𝑀 = 4 . Then we plug it back into demand function and obtain the optimal output, 𝑝𝑝𝑀𝑀 = 15 − 3𝑞𝑞 = 4 11 ⇒ 𝑞𝑞 𝑀𝑀 = 3 e) Find equilibrium price, profits, consumer surplus, and total welfare, under the perfectly competitive market you analyzed in part (e). Answer: The consumer surplus is, 1 1 11 121 𝐶𝐶𝐶𝐶 = (𝑝𝑝0 − 𝑝𝑝𝑀𝑀 ) ∗ 𝑞𝑞 𝑀𝑀 = (15 − 4) ∗ = ≈ 20.167 2 2 6 3 And finally, because MC curve is a constant, meaning producer surplus is zero. So W = CS+0 = 20.167 f) Compare your results under a monopoly (part c) and those under a perfectly competitive market (part e). Answer: Compared with the results in part c and part e, we can see that the monopoly captured more consumer surplus than in the perfectly competitive market, causing a deadweight loss. 𝐷𝐷𝐷𝐷𝐷𝐷 = 𝑊𝑊𝑃𝑃𝑃𝑃 − 𝑊𝑊𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 = (𝐶𝐶𝐶𝐶𝑃𝑃𝑃𝑃 + 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃 ) − (𝐶𝐶𝐶𝐶𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 + 𝑃𝑃𝑃𝑃𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 ) Exercise #2 – Monopoly with constant elasticity demand curve Consider a monopolist facing a constant elasticity demand curve 𝑞𝑞(𝑝𝑝) = 12𝑝𝑝−3. a) Assume that the total cost function is 𝑇𝑇𝑇𝑇(𝑞𝑞) = 5 + 4𝑞𝑞. Use the inverse elasticity pricing rule (IEPR) to obtain the profit-maximizing price that this monopolist should charge. Answer: Since given above is the constant elasticity demand curve, then we know that 𝜀𝜀𝑄𝑄,𝑃𝑃 = −3. Using IEPR rule, we obtain: 1 1 𝑃𝑃 − 𝑀𝑀𝑀𝑀 =− = −3 3 𝑃𝑃 And, 2 Therefore, 𝑀𝑀𝑀𝑀 = Therefore, 𝑀𝑀𝑀𝑀 = 𝑑𝑑�𝑇𝑇𝑇𝑇(𝑞𝑞)� 𝑑𝑑(5 + 4𝑞𝑞) = =4 𝑑𝑑𝑑𝑑 𝑑𝑑𝑑𝑑 𝑃𝑃 − 4 1 = 3 𝑃𝑃 ⇒ 𝑝𝑝𝑀𝑀 = 6 b) How would your result in part (a) change if the demand curve changes to 𝑞𝑞(𝑝𝑝) = 12𝑝𝑝−5 , but still assuming the same cost function as in part (a)? Interpret. Answer: Since given above is the constant elasticity demand curve, then we know that 𝜀𝜀𝑄𝑄,𝑃𝑃 = −5. Using IEPR rule, we obtain: 𝑃𝑃 − 𝑀𝑀𝑀𝑀 1 1 =− = 𝑃𝑃 −5 5 And, 𝑑𝑑�𝑇𝑇𝑇𝑇(𝑞𝑞)� 𝑑𝑑(5 + 4𝑞𝑞) = =4 𝑑𝑑𝑑𝑑 𝑑𝑑𝑑𝑑 𝑃𝑃 − 4 1 = ⇒ 𝑝𝑝𝑀𝑀 = 5 𝑃𝑃 5 The results above can be interpreted as 𝜀𝜀𝑄𝑄,𝑃𝑃 gets bigger the price that monopoly charge will become smaller. In other words, 𝜀𝜀𝑄𝑄,𝑃𝑃 and 𝑝𝑝𝑀𝑀 has negative relationship. c) Assume that the total cost function is 𝑇𝑇𝑇𝑇(𝑞𝑞) = 5 + 2(𝑞𝑞)2. Use the inverse elasticity pricing rule (IEPR) to obtain the profit-maximizing price that this monopolist should charge. Answer: Since given above is the constant elasticity demand curve, then we know that 𝜀𝜀𝑄𝑄,𝑃𝑃 = −3. Using IEPR rule, we obtain: 1 1 𝑃𝑃 − 𝑀𝑀𝑀𝑀 =− = −3 3 𝑃𝑃 And, Therefore, 𝑀𝑀𝑀𝑀 = 𝑑𝑑�𝑇𝑇𝑇𝑇(𝑞𝑞)� 𝑑𝑑(5 + 2(𝑞𝑞)2 ) = = 4𝑞𝑞 𝑑𝑑𝑑𝑑 𝑑𝑑𝑑𝑑 1 𝑃𝑃 − 4𝑞𝑞 = ⇒ 4𝑃𝑃 − 20𝑞𝑞 = 0 3 𝑃𝑃 Solving for price 𝑃𝑃, we plug into demand function to obtain 𝑃𝑃4 − 72 = 0 Solving it, 𝑝𝑝𝑀𝑀 = 2.9130 d) How would your result in part (c) change if the demand curve changes to 𝑞𝑞(𝑝𝑝) = 12𝑝𝑝−5 , but still assuming the same cost function as in part (c)? Interpret. Answer: Since given above is the constant elasticity demand curve, then we know that 𝜀𝜀𝑄𝑄,𝑃𝑃 = −5. Using IEPR rule, we obtain: 3 1 1 𝑃𝑃 − 𝑀𝑀𝑀𝑀 =− = −5 5 𝑃𝑃 And, 𝑀𝑀𝑀𝑀 = Therefore, 𝑑𝑑�𝑇𝑇𝑇𝑇(𝑞𝑞)� 𝑑𝑑(5 + 2(𝑞𝑞)2 ) = = 4𝑞𝑞 𝑑𝑑𝑑𝑑 𝑑𝑑𝑑𝑑 𝑃𝑃 − 4𝑞𝑞 1 = 𝑃𝑃 5 ⇒ 4𝑃𝑃 − 20𝑞𝑞 = 0 We plug demand function into above function and finally have, 4𝑃𝑃 − 20(12𝑝𝑝−5 ) = 0 ⇒ 4𝑃𝑃6 − 240 = 0 Solving it, 𝑝𝑝𝑀𝑀 =1.9786 The results above can be interpreted as 𝜀𝜀𝑄𝑄,𝑃𝑃 gets bigger the price that monopoly charge will become smaller. In other words, 𝜀𝜀𝑄𝑄,𝑃𝑃 and 𝑝𝑝𝑀𝑀 has negative relationship. Exercise #3 - Multiplant monopoly Consider a monopoly facing inverse demand function 𝑝𝑝(𝑄𝑄) = 10 − 𝑄𝑄, where 𝑄𝑄 = 𝑞𝑞1 + 𝑞𝑞2 denotes the monopolist’s production across two plants, 1 and 2. Assume that total cost in plant 1 is given by 𝑇𝑇𝐶𝐶1 (𝑞𝑞1 ) = (3 + 2𝑞𝑞1 )𝑞𝑞1, while that of plant 2 is 𝑇𝑇𝐶𝐶2 (𝑞𝑞2 ) = [3 + (2 + 𝑑𝑑)𝑞𝑞2 ]𝑞𝑞2 , where parameter 𝑑𝑑 ≥ 0 represents plant 2’s inefficiency to plant 1. When 𝑑𝑑 = 0, the total (and marginal) cost of both plants coincide; but when 𝑑𝑑 > 0, plant 2 has a higher total and marginal cost than plant 1. a) Write down the monopolist’s joint profit maximization problem 𝜋𝜋 = 𝜋𝜋1 + 𝜋𝜋2 . Answer: First, we find our profit for plant 1. In this setting, our profit can be defined as 𝜋𝜋1 = 𝑝𝑝(𝑄𝑄)𝑞𝑞1 − 𝑇𝑇𝐶𝐶1 (𝑞𝑞1 ) Similarly, for plant 2, 𝜋𝜋1 = (10 − 𝑞𝑞1 − 𝑞𝑞2 )𝑞𝑞1 − (3 + 2𝑞𝑞1 )𝑞𝑞1 𝜋𝜋2 = 𝑝𝑝(𝑄𝑄)𝑞𝑞2 − 𝑇𝑇𝐶𝐶2 (𝑞𝑞2 ) 𝜋𝜋2 = (10 − 𝑞𝑞1 − 𝑞𝑞2 )𝑞𝑞2 − (3 + (2 + 𝑑𝑑)𝑞𝑞2 )𝑞𝑞2 To find the joint profit, we add our profit functions together 𝜋𝜋 = 𝜋𝜋1 + 𝜋𝜋2 𝜋𝜋 = (10 − 𝑞𝑞1 − 𝑞𝑞2 )𝑞𝑞1 − (3 + 2𝑞𝑞1 )𝑞𝑞1 + (10 − 𝑞𝑞1 − 𝑞𝑞2 )𝑞𝑞2 − (3 + (2 + 𝑑𝑑)𝑞𝑞2 )𝑞𝑞2 𝜋𝜋 = (10 − 𝑞𝑞1 − 𝑞𝑞2 )(𝑞𝑞1 + 𝑞𝑞2 ) − (3 + 2𝑞𝑞1 )𝑞𝑞1 − (3 + (2 + 𝑑𝑑)𝑞𝑞2 )𝑞𝑞2 b) Differentiate with respect to the output in plant 1, 𝑞𝑞1 , and then in plant 2, 𝑞𝑞2 . Set each expression equal to zero and use your results to find the optimal production in each plant. 4 Answer: Differentiating our profit function with respect to 𝑞𝑞1 gives us Solving for 𝑞𝑞1 , we obtain 𝜕𝜕𝜕𝜕 = 10 − 2𝑞𝑞1 − 𝑞𝑞2 − 3 − 4𝑞𝑞1 − 𝑞𝑞2 = 0 𝜕𝜕𝑞𝑞1 4𝑞𝑞1 + 2𝑞𝑞1 = 10 − 3 − 𝑞𝑞2 − 𝑞𝑞2 6𝑞𝑞1 = 7 − 2𝑞𝑞2 7 − 2𝑞𝑞2 6 𝑞𝑞1 = Next, we differentiate our profit function with respect to 𝑞𝑞2 , Solving for 𝑞𝑞2 , we find 𝜕𝜕𝜕𝜕 = −𝑞𝑞1 + 10 − 𝑞𝑞1 − 2𝑞𝑞2 − 3 − 4𝑞𝑞2 − 2𝑑𝑑𝑞𝑞2 = 0 𝜕𝜕𝑞𝑞2 2𝑞𝑞2 + 4𝑞𝑞2 + 2𝑑𝑑𝑞𝑞2 = 10 − 3 − 𝑞𝑞1 − 𝑞𝑞1 6𝑞𝑞2 + 2𝑑𝑑𝑞𝑞2 = 7 − 2𝑞𝑞1 𝑞𝑞2 (6 + 2𝑑𝑑) = 7 − 2𝑞𝑞1 7 − 2𝑞𝑞1 6 + 2𝑑𝑑 𝑞𝑞2 = To find our optimal consumption of 𝑞𝑞1 and 𝑞𝑞2 , we will substitute 𝑞𝑞1 = 𝑞𝑞1 function. Thus, 𝑞𝑞1 = 7−2𝑞𝑞2 6 that we found into our 7 1 7 − 2𝑞𝑞1 − � � 6 3 6 + 2𝑑𝑑 We seek to solve for 𝑞𝑞1 . In order to do that, we first multiply both sides of the above expression by (18 + 6𝑑𝑑) to get rid of the fraction, as follows, 7 𝑞𝑞1 (18 + 6𝑑𝑑) = (18 + 2𝑑𝑑) − (7 − 2𝑞𝑞1 ) 6 18𝑞𝑞1 + 6𝑑𝑑𝑞𝑞1 = 21 + 7𝑑𝑑 − 7 + 2𝑞𝑞1 𝑞𝑞1 (16 + 6𝑑𝑑) = 14 + 7𝑑𝑑 𝑞𝑞1 = Next, we plug the optimal output in plant 1, 𝑞𝑞1 = 14 + 7𝑑𝑑 16 + 6𝑑𝑑 the optimal amount of production in plant 2. 14+7𝑑𝑑 , 16+6𝑑𝑑 back into our 𝑞𝑞2 = 14 + 7𝑑𝑑 14 + 7𝑑𝑑 � 7 − 2 �2(8 + 3𝑑𝑑)� 7 − 2� 16 + 6𝑑𝑑 = 𝑞𝑞2 = 6 + 2𝑑𝑑 6 + 2𝑑𝑑 5 7−2𝑞𝑞1 6+2𝑑𝑑 expression to find 7(8 + 3𝑑𝑑) − (14 + 7𝑑𝑑) 42 + 14𝑑𝑑 7 8 + 3𝑑𝑑 = = = (8 + 3𝑑𝑑)(6 + 2𝑑𝑑) 8 + 3𝑑𝑑 6 + 2𝑑𝑑 c) How does your result in part (2) change in the inefficiency of plant 2, 𝑑𝑑. What is the optimal production in each plant if 𝑑𝑑 = 0? Answer: Since 𝑑𝑑 is in the denominator for 𝑞𝑞2 , we know that as 𝑑𝑑 increases, or our inefficiency in plant 2 increases, the quantity produced in plant 2 decreases. We also see that as 𝑑𝑑 increases, our optimal production in 𝑞𝑞1 is increasing. In summary, the monopolist produces more in plant 1 and less in plant 2 as the inefficiency of plant 2 increases. For illustration purposes, the next figure plots output 𝑞𝑞1 (increasing red line) and 𝑞𝑞2 (decreasing yellow line). When 𝑑𝑑 = 0, our optimal production in plant 1, 𝑞𝑞1 , becomes 𝑞𝑞1 = 14 + 7𝑑𝑑 14 + (7 ∗ 0) 14 7 = = = 16 + 6𝑑𝑑 16 + (6 ∗ 0) 16 8 which coincides with that in plant 2, since 𝑞𝑞2 = 7 7 7 = = 8 + 3𝑑𝑑 8 + (3 ∗ 0) 8 Hence, when 𝑑𝑑 = 0, both plants have the same total cost function, leading the monopolist to produce the same amount in plant 1 and 2. This is depicted in the vertical intercept of the figure where 𝑑𝑑 = 0. However, when 𝑑𝑑 > 0, production in plant 2 becomes more expensive than in plant 1, leading the monopolist to reduce its output on plant 2 but increase its output on plant 1. 1.0 0.8 0.6 0.4 0.2 2 4 6 8 10 As a curiosity, note that the aggregate production in both plants is 𝑄𝑄 = 𝑞𝑞1 + 𝑞𝑞2 = 7(4 + 𝑑𝑑) 16 + 6𝑑𝑑 which is decreasing in the inefficiency of firm 2, since its derivative with respect to 𝑑𝑑 is 6 14 𝜕𝜕𝜕𝜕 =− (8 + 3𝑑𝑑)2 𝜕𝜕𝜕𝜕 which is negative for all values of 𝑑𝑑. In words, aggregate production decreases in the inefficiency of firm 2. That is, while an increase in 𝑑𝑑 decreases 𝑞𝑞2 and increases 𝑞𝑞1 , the decrease in 𝑞𝑞2 dominates, producing a reduction in the total amount that this monopolist produces. Exercise #4 - Monopsony with linear supply curve Consider a firm who is the only employer in a small town (a labor monopsony). It faces an international price 𝑝𝑝 > 0 for each unit of output that it produces, its production function is 𝑞𝑞 = 𝐿𝐿𝛼𝛼 where 𝛼𝛼 > 0, and the labor supply is given by 𝑤𝑤(𝐿𝐿) = 𝐴𝐴 ∗ 𝐿𝐿 where 𝐴𝐴 > 0. Intuitively, the firm’s production function is concave (when 𝛼𝛼 < 1), linear (when 𝛼𝛼 = 1), or convex (when 𝛼𝛼 > 1). a) Find the monopsonist marginal revenue product, and its marginal expenditure on labor. Answer: 𝜕𝜕𝜕𝜕𝜕𝜕 𝜕𝜕(𝑝𝑝 ∗ 𝐿𝐿𝛼𝛼 ) = = 𝛼𝛼𝛼𝛼𝐿𝐿𝛼𝛼−1 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝜕𝜕𝜕𝜕 𝜕𝜕𝜕𝜕 And, 𝜕𝜕𝜕𝜕𝜕𝜕 𝜕𝜕(𝑤𝑤(𝐿𝐿)) = 𝑤𝑤(𝐿𝐿) + 𝐿𝐿 = 𝐴𝐴𝐴𝐴 + 𝐴𝐴𝐴𝐴 = 2𝐴𝐴𝐴𝐴 𝑀𝑀𝑀𝑀𝐿𝐿 = 𝜕𝜕𝜕𝜕 𝜕𝜕𝜕𝜕 b) Set the marginal revenue product and marginal expenditure on labor equal to each other to find the optimal number of workers that the firm hires. Answer: Let 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝑀𝑀𝑀𝑀𝐿𝐿 , we can find: 𝛼𝛼𝛼𝛼𝐿𝐿𝛼𝛼−1 = 2𝐴𝐴𝐴𝐴 1 𝛼𝛼𝛼𝛼 2−𝛼𝛼 ⇒ 𝐿𝐿 = � � 2𝐴𝐴 c) Find the equilibrium wage in this monopsony. Answer: Given the optimal number of workers that firm hires, we can find: ∗ 1 1 1−𝛼𝛼 𝛼𝛼𝛼𝛼 2−𝛼𝛼 𝛼𝛼𝛼𝛼 2−𝛼𝛼 𝑤𝑤(𝐿𝐿 = 𝐴𝐴 ∗ 𝐿𝐿 = 𝐴𝐴 ∗ � � = 𝐴𝐴2−𝛼𝛼 � � 2𝐴𝐴 2 d) Assume now that the labor market was perfectly competitive. Find the optimal number of workers the firm hires, and the equilibrium wage in this setting. Answer: If the labor market was perfectly competitive, then we have 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝑤𝑤(𝐿𝐿), so 𝛼𝛼𝛼𝛼𝐿𝐿𝛼𝛼−1 = 𝐴𝐴 ∗ 𝐿𝐿 ∗) ∗ 1 𝛼𝛼𝛼𝛼 2−𝛼𝛼 ⇒ 𝐿𝐿 = � � 𝐴𝐴 1 1−𝛼𝛼 1 𝛼𝛼𝛼𝛼 2−𝛼𝛼 ∗) = 𝐴𝐴2−𝛼𝛼 (𝛼𝛼𝛼𝛼)2−𝛼𝛼 ⇒ 𝑤𝑤(𝐿𝐿 = 𝐴𝐴 ∗ � � 𝐴𝐴 ∗ e) Find the deadweight loss of the monopsony. Answer: The DWL is the area below the marginal revenue product and above the supply curve, 1 𝛼𝛼𝛼𝛼 2−𝛼𝛼 ), 𝐴𝐴 between 𝐿𝐿∗ and 𝐿𝐿𝑃𝑃𝑃𝑃 workers ( 𝛼𝛼𝛼𝛼𝐿𝐿𝛼𝛼−1 = 𝐴𝐴𝐴𝐴 ⇒ 𝐿𝐿𝑃𝑃𝑃𝑃 = � � 7 so 𝐿𝐿𝑃𝑃𝑃𝑃 𝐿𝐿𝑃𝑃𝑃𝑃 𝐷𝐷𝐷𝐷𝐷𝐷 = ∫𝐿𝐿∗ 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 − 𝑤𝑤(𝐿𝐿) 𝑑𝑑𝑑𝑑 = ∫𝐿𝐿∗ 𝛼𝛼𝛼𝛼𝐿𝐿𝛼𝛼−1 − 𝐴𝐴𝐴𝐴 𝑑𝑑𝑑𝑑 𝐴𝐴𝐿𝐿2 𝐿𝐿𝑃𝑃𝑃𝑃 |∗ 2 𝐿𝐿 = 𝑝𝑝𝐿𝐿𝛼𝛼 − 𝛼𝛼 𝛼𝛼 2 2 1 2−𝛼𝛼 𝛼𝛼𝛼𝛼 2−𝛼𝛼 1 2−𝛼𝛼 𝐴𝐴 𝛼𝛼𝛼𝛼 2−𝛼𝛼 = �1 − � � � 𝑝𝑝 � � − �1 − � � � � � 2 𝐴𝐴 2 2 𝐴𝐴 f) Evaluate your results in parts (a)-(e) at parameter values 𝐴𝐴 = 1, and 𝑝𝑝 = $2. Then, evaluate your results at 𝛼𝛼 = 1/2, at 𝛼𝛼 = 1, and at 𝛼𝛼 = 2. How are your results affected as 𝛼𝛼 increases (that is, as the firm’s production function becomes more convex ) Answer: 1. 𝛼𝛼 = 1/2, 𝐴𝐴 = 1, and 𝑝𝑝 = $2 1 1 2 1 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝛼𝛼𝛼𝛼𝐿𝐿𝛼𝛼−1 = 𝑝𝑝𝐿𝐿−2 = 𝐿𝐿−2 and 𝑀𝑀𝑀𝑀𝐿𝐿 = 2𝐴𝐴𝐴𝐴 = 2𝐿𝐿; ∗ When 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝑀𝑀𝑀𝑀𝐿𝐿 , 𝐿𝐿 = ∗) 𝑤𝑤(𝐿𝐿 1 𝛼𝛼𝛼𝛼 2−𝛼𝛼 � � 2𝐴𝐴 = 𝐴𝐴 1−𝛼𝛼 2−𝛼𝛼 1 2−𝛼𝛼 𝛼𝛼𝛼𝛼 𝐴𝐴 When 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝑤𝑤(𝐿𝐿), 𝐿𝐿∗ = � � ∗) 𝑤𝑤(𝐿𝐿 1 2 1 2−𝛼𝛼 𝛼𝛼𝛼𝛼 � � 2 𝑝𝑝 2𝐴𝐴 2 3 ≈ 0.62996 and optimum wage is = 𝐴𝐴 1 3 2 𝑝𝑝 3 � � 4 ≈ 0.62996; = � � = 1 and optimum wage is = 𝐴𝐴 𝛼𝛼 2−𝛼𝛼 And finally, 𝐷𝐷𝐷𝐷𝐷𝐷 = �1 − � � = 2 𝑝𝑝 3 � � 4𝐴𝐴 1−𝛼𝛼 2−𝛼𝛼 1 2−𝛼𝛼 (𝛼𝛼𝛼𝛼) 𝛼𝛼𝛼𝛼 𝛼𝛼 2−𝛼𝛼 � 𝑝𝑝 � 𝐴𝐴 � 1 = 𝐴𝐴 1 3 2 𝑝𝑝 3 � � =1; 2 2 4 1 2 1 2−𝛼𝛼 𝐴𝐴 𝛼𝛼𝛼𝛼 2−𝛼𝛼 � 2 � 𝐴𝐴 � 2 − �1 − � � 4 1 3 𝑝𝑝 3 1 3 𝐴𝐴 𝑝𝑝 3 = �1 − � � � 𝑝𝑝 � � − �1 − � � � � � 2 2𝐴𝐴 2 2 2𝐴𝐴 1 2. 4 𝑝𝑝 3 𝑝𝑝 3 ≈ 0.206𝑝𝑝 � � − 0.30157𝐴𝐴 � � = 0.11043 2𝐴𝐴 2𝐴𝐴 𝛼𝛼 = 1, 𝐴𝐴 = 1, and 𝑝𝑝 = $2 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝛼𝛼𝛼𝛼𝐿𝐿𝛼𝛼−1 = 𝑝𝑝 = 2 and 𝑀𝑀𝑀𝑀𝐿𝐿 = 2𝐴𝐴𝐴𝐴 = 2𝐿𝐿; ∗ When 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝑀𝑀𝑀𝑀𝐿𝐿 , 𝐿𝐿 = 1 𝛼𝛼𝛼𝛼 2−𝛼𝛼 � � 2𝐴𝐴 ∗) 𝑤𝑤(𝐿𝐿 𝛼𝛼𝛼𝛼 𝐴𝐴 = = 𝑝𝑝 𝐴𝐴 = 𝐴𝐴 1 2−𝛼𝛼 When 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝑤𝑤(𝐿𝐿), 𝐿𝐿∗ = � � 1 𝑝𝑝 2 � � 2𝐴𝐴 𝑤𝑤(𝐿𝐿∗ ) = 𝐴𝐴 𝛼𝛼 1−𝛼𝛼 2−𝛼𝛼 = 1 and optimum wage is = 𝑝𝑝 2 = 1; = 2 and optimum wage is 1−𝛼𝛼 2−𝛼𝛼 1 (𝛼𝛼𝛼𝛼)2−𝛼𝛼 = 𝑝𝑝 = 2; 𝛼𝛼 1 2−𝛼𝛼 𝛼𝛼𝛼𝛼 2−𝛼𝛼 � 𝑝𝑝 � 𝐴𝐴 � 2 And finally, 𝐷𝐷𝐷𝐷𝐷𝐷 = �1 − � � 1 𝛼𝛼𝛼𝛼 2−𝛼𝛼 � � 2 2 1 𝑝𝑝 1 𝐴𝐴 𝑝𝑝 2 = �1 − � 𝑝𝑝 − �1 − � � � 2 𝐴𝐴 4 2 𝐴𝐴 8 2 1 2−𝛼𝛼 𝐴𝐴 𝛼𝛼𝛼𝛼 2−𝛼𝛼 � 2 � 𝐴𝐴 � 2 − �1 − � � 3. = 0.5 𝑝𝑝2 𝑝𝑝2 𝑝𝑝2 − 0.375 = 0.125 = 0.5 𝐴𝐴 𝐴𝐴 𝐴𝐴 𝛼𝛼 = 2, 𝐴𝐴 = 1, and 𝑝𝑝 = $2 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝛼𝛼𝛼𝛼𝐿𝐿𝛼𝛼−1 = 2𝑝𝑝𝑝𝑝 = 2𝐿𝐿 and 𝑀𝑀𝑀𝑀𝐿𝐿 = 2𝐴𝐴𝐴𝐴 = 2𝐿𝐿; ∗) 𝑤𝑤(𝐿𝐿 2 = � � = 1.5874 and optimum wage is 𝛼𝛼𝛼𝛼 2−𝛼𝛼 𝐴𝐴 = � � = 1 and optimum wage is = 𝐴𝐴 When 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝑤𝑤(𝐿𝐿), 𝐿𝐿∗ = � � ∗) 𝑤𝑤(𝐿𝐿 And finally, 𝐷𝐷𝐷𝐷𝐷𝐷 = �1 − 1 𝛼𝛼𝛼𝛼 2−𝛼𝛼 2𝐴𝐴 When 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝑀𝑀𝑀𝑀𝐿𝐿 , 𝐿𝐿∗ = � � 1−𝛼𝛼 2−𝛼𝛼 1 𝛼𝛼𝛼𝛼 2−𝛼𝛼 � � = 2 1 𝑝𝑝 ∞ = 𝐴𝐴 𝛼𝛼 𝑝𝑝 3 𝐴𝐴 1−𝛼𝛼 2−𝛼𝛼 2𝐴𝐴 1 𝐴𝐴 1 3 2 𝑝𝑝 3 � � 4 1 = 0.62996; 𝑝𝑝 2 ∞ (𝛼𝛼𝛼𝛼)2−𝛼𝛼 = 𝐴𝐴3 � � = 1; 𝛼𝛼 1 2−𝛼𝛼 𝛼𝛼𝛼𝛼 2−𝛼𝛼 � � � 𝑝𝑝 � � 2 𝐴𝐴 − �1 − 2 2 1 2−𝛼𝛼 𝐴𝐴 𝛼𝛼𝛼𝛼 2−𝛼𝛼 � � � � � 2 2 𝐴𝐴 𝑝𝑝 ∞ 1 ∞ 1 ∞ 𝐴𝐴 𝑝𝑝 ∞ = �1 − � � � 𝑝𝑝 � � − �1 − � � � � � 2𝐴𝐴 2 2𝐴𝐴 2 2 = 𝑝𝑝 − 𝐴𝐴 = 1.5 2 Therefore, as 𝛼𝛼 increases, a) 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 increases and 𝑀𝑀𝑀𝑀𝐿𝐿 is unchanged. b) When 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝑀𝑀𝑀𝑀𝐿𝐿 , 𝐿𝐿∗ , and wage 𝑤𝑤(𝐿𝐿∗ ) both increases if 1/2 ≤ 𝛼𝛼 ≤ 1; but decrease if 1 ≤ 𝛼𝛼 ≤ 2. When 𝑀𝑀𝑀𝑀𝑀𝑀𝐿𝐿 = 𝑤𝑤(𝐿𝐿), 𝐿𝐿∗ and wage 𝑤𝑤(𝐿𝐿∗ ) increase if 1/2 ≤ 𝛼𝛼 ≤ 1 but decrease if 1 ≤ 𝛼𝛼 ≤ 2 . c) 𝐷𝐷𝐷𝐷𝐷𝐷 increases. Exercise #5 - Cournot vs. Stackelberg models of quantity competition Consider a market with two firms selling a homogeneous good, and competing in quantities. The inverse demand function is given by 𝑝𝑝(𝑞𝑞1 , 𝑞𝑞2 ) = 1 − (𝑞𝑞1 + 𝑞𝑞2 ), and both firms face a common marginal cost 1 > 𝑐𝑐 > 0. a) b) c) d) e) f) g) Cournot model. Set up the profit-maximization problem of firm 1. Differentiate with respect to 𝑞𝑞1 . Solve for 𝑞𝑞1 to obtain firm 1’s best response function 𝑞𝑞1 (𝑞𝑞2 ). Depict firm 1’s best response function 𝑞𝑞1 (𝑞𝑞2 ). Interpret. Repeat steps (a)-(b) for firm 2, so you obtain firm 2’s best response function 𝑞𝑞2 (𝑞𝑞1 ). Find the point where the above two best response functions cross each other. What is the equilibrium price? And the equilibrium profits for each firm? Stackelberg model. Consider now that firm 1 acts as a leader and firm 2 as the follower. Find the optimal production for firm 1 and 2 in this sequential competition (Stackelberg model). Then find the equilibrium price, and the profits that each firm makes. h) Comparison. Compare the individual output for each firm, price, and profits in the Cournot model (where firms simultaneously select their output levels) and in the Stackelberg model (where firms sequentially choose their output). 9 Answer: a) With Cournot, our profit function is 𝜋𝜋1 = 𝑝𝑝(𝑄𝑄)𝑞𝑞1 − 𝑐𝑐𝑞𝑞1 = (1 − 𝑞𝑞1 − 𝑞𝑞2 )𝑞𝑞1 − 𝑐𝑐𝑞𝑞1 b) Taking the derivative with respect to 𝑞𝑞1 gives us 𝜕𝜕𝜋𝜋1 : 1 − 2𝑞𝑞1 − 𝑞𝑞2 − 𝑐𝑐 = 0 𝜕𝜕𝑞𝑞1 Solving for 𝑞𝑞1 we find firm 1’s best response function 𝑞𝑞1 (𝑞𝑞2 ) = 1 − 𝑐𝑐 − 𝑞𝑞2 2 This best response function is often rearranged as follows 1 − 𝑐𝑐 1 𝑞𝑞1 (𝑞𝑞2 ) = − 𝑞𝑞2 2 2 The first term does not depend on 𝑞𝑞2 , and represents the vertical intercept of the best response 1 2 function, while the second term represents the negative slope of the best response function, − . In words, an increase in firm 2’s production 𝑞𝑞2 by one unit induces firm 1 to reduce its output 𝑞𝑞1 by half a unit. c) Firm 1’s best response function can be depicted as: In this setting, the best response function originates at with a slope of 1 − . 2 1−𝑐𝑐 2 (when 𝑞𝑞2 = 0), and decreases in 𝑞𝑞2 d) Firm 2 has a symmetric profit function as firm 1 (only the subscripts change). Hence, firm 2’s best response function is symmetric to that of firm 1 as follows: 10 𝑞𝑞2 = 1 − 𝑐𝑐 − 𝑞𝑞1 2 e) Since firms are symmetric, we can say that, in equilibrium they must produce the same amount of output 𝑞𝑞1 = 𝑞𝑞2 . Plugging this information in firm 1’s best response function, we obtain 1 − 𝑐𝑐 − 𝑞𝑞1 𝑞𝑞1 = 2 Rearranging, yields 2𝑞𝑞1 = 1 − 𝑐𝑐 − 𝑞𝑞1 Solving for 𝑞𝑞1 gives us the equilibrium output for firm 1 1 − 𝑐𝑐 𝑞𝑞1 = 3 Because 𝑞𝑞1 = 𝑞𝑞2, we can say that firm 2’s equilibrium output coincides with that of firm 1 1 − 𝑐𝑐 𝑞𝑞2 = 3 f) To obtain the equilibrium price, we insert the values of 𝑞𝑞1 and 𝑞𝑞2 that we found in part (e) into our price function to find the optimal price 1 − 𝑐𝑐 1 − 𝑐𝑐 3 − 1 + 𝑐𝑐 − 1 + 𝑐𝑐 1 + 2𝑐𝑐 𝑝𝑝(𝑄𝑄) = 1 − 𝑞𝑞1 − 𝑞𝑞2 = 1 − � �−� �= = 3 3 3 3 We then plug this back into our profit function. In this setting: 1 + 2𝑐𝑐 1 − 𝑐𝑐 1 − 𝑐𝑐 𝜋𝜋1 = 𝑝𝑝(𝑄𝑄)𝑞𝑞1 − 𝑐𝑐𝑞𝑞1 = � �� � − 𝑐𝑐 � � 3 3 3 Simplifying: =� (1 + 2𝑐𝑐)(1 − 𝑐𝑐) (3𝑐𝑐)(1 − 𝑐𝑐) �− 9 9 1 + 𝑐𝑐 − 2𝑐𝑐 2 − 3𝑐𝑐 + 3𝑐𝑐 2 (1 − 𝑐𝑐)2 = 9 9 By symmetry, the profit of firm 2 is also: (1 − 𝑐𝑐)2 𝜋𝜋2 = 9 𝜋𝜋1 = g) Using our best response function above from firm 2, 𝑞𝑞2 = function to obtain Simplifying, yields 𝜋𝜋1 = �1 − 𝑞𝑞1 − 1−𝑐𝑐−𝑞𝑞1 2 1 − 𝑐𝑐 − 𝑞𝑞1 � 𝑞𝑞1 − 𝑐𝑐𝑞𝑞1 2 1 + 𝑐𝑐 − 𝑞𝑞1 𝜋𝜋1 = � � 𝑞𝑞1 − 𝑐𝑐𝑞𝑞1 2 Differentiating with respect to firm 1’s output, 𝑞𝑞1 , we obtain 11 , we plug it into firm 1’s profit 𝜕𝜕𝜋𝜋1 1 𝑐𝑐 : + − 𝑞𝑞1 − 𝑐𝑐 = 0 𝜕𝜕𝑞𝑞1 2 2 Rearranging, and solving for 𝑞𝑞1 , we find the equilibrium output of firm 1 𝑞𝑞1 = 1 − 𝑐𝑐 2 We then plug this back into firm 2’s best response function: Simplifying 𝑞𝑞2 = 1 − 𝑐𝑐 − 𝑞𝑞1 1 − 𝑐𝑐 − 𝑞𝑞2 = = 2 2 1 − 𝑐𝑐 2 1 𝑐𝑐 1 1 − 𝑐𝑐 2 − 2𝑐𝑐 − 1 + 𝑐𝑐 1 − 𝑐𝑐 − − � �= = 2 2 2 2 4 4 We insert this back into our price function to find the equilibrium price. (1 − 𝑐𝑐) (1 − 𝑐𝑐) 4 − 2 + 2𝑐𝑐 − 1 + 𝑐𝑐 1 + 3𝑐𝑐 𝑝𝑝 = 1 − − = = 2 4 4 4 Finally, we plug these back into firm 1’s profit function, to obtain firm 1’s equilibrium profit 1 + 3𝑐𝑐 1 − 𝑐𝑐 1 − 𝑐𝑐 1 − 𝑐𝑐 + 3𝑐𝑐 − 3𝑐𝑐 2 (𝑐𝑐 − 𝑐𝑐 2 ) 𝜋𝜋1 = � �� � − 𝑐𝑐 � �= − 8 4 2 2 2 = 1 + 2𝑐𝑐 − 3𝑐𝑐 2 − 4𝑐𝑐 + 4𝑐𝑐 2 (1 − 𝑐𝑐)2 = 8 8 Similarly, we find firm 2’s profit in equilibrium 1 + 3𝑐𝑐 1 − 𝑐𝑐 1 − 𝑐𝑐 1 − 𝑐𝑐 + 3𝑐𝑐 + 3𝑐𝑐 2 (𝑐𝑐 − 𝑐𝑐 2 ) 𝜋𝜋2 = � �� � − 𝑐𝑐 � �= − 4 16 4 4 4 = 1 + 2𝑐𝑐 + 3𝑐𝑐 2 − 4𝑐𝑐 + 4𝑐𝑐 2 (1 − 𝑐𝑐)2 = 16 16 h) First, we start with our quantity. From above we have the following: 1 − 𝑐𝑐 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶: 𝑞𝑞1 = 𝑞𝑞2 = 3 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆: 𝑞𝑞1 = 1 − 𝑐𝑐 1 − 𝑐𝑐 𝑎𝑎𝑎𝑎𝑎𝑎 𝑞𝑞2 = 2 4 Thus, we can see that the leader produces more in Stackelberg than in Cournot, whereas the follower produces more in Cournot than in Stackelberg. Next, we compare our profits. From above: 12 𝐶𝐶𝐶𝐶𝐶𝐶𝑟𝑟𝑛𝑛𝑛𝑛𝑛𝑛: 𝜋𝜋1 = 𝜋𝜋2 = 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆: 𝜋𝜋1 = (1 − 𝑐𝑐)2 9 (1 − 𝑐𝑐)2 (1 − 𝑐𝑐)2 and 𝜋𝜋2 = 8 16 Again these profits follow the same pattern as above. The leader obtains a higher profit under Stackelberg than under Cournot, whereas the follower’s profit is larger under Cournot than Stackelberg. Finally, we compare price 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶: 𝑝𝑝 = 1 + 2𝑐𝑐 3 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆: 𝑝𝑝 = To compare which is higher, we set up an inequality. 1 + 3𝑐𝑐 4 𝑝𝑝𝑆𝑆 < 𝑝𝑝𝑐𝑐 Rearranging, 1 + 3𝑐𝑐 1 + 2𝑐𝑐 < 4 3 3 + 9𝑐𝑐 < 4 + 8𝑐𝑐 𝑐𝑐 < 1 Thus, as long as 𝑐𝑐 < 1, the Stackelberg price is lower than the Cournot price. This condition must hold, as otherwise firms would be producing negative output levels. 13