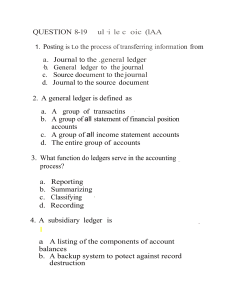

TRENDS Get your NEW TRENDS in PRINCIPLES OF ACCOUNTING FORM 3 New Curriculum Now Available!! Can be accessed online via https://www.akellobooks.com/eLibrary/#/register Hard-copies can be accessed on the address below: “Together in Education” NEWTRENDS in Principles of Accounting Form 3 LEARNER’S BOOK Updated Curriculum i G. Chigiji B. Mugoni Edulight Books 3 rd Floor, Room 312 Throgmorton House Cnr Samora Machel Ave/Julius Nyerere Way Tel: 0242 749195 Cell: 0773 452 208 0715263466 0772 669 134 0715 263 467 0773 441 322 0773 224 131 Email: edulightpbc@gmail.com/wadzambamhazo@gmail.com First Print: 2019 Editor: Design and Layout: Thabiso Moyo Cover Design: E. Ngandu ISBN Printed By:Edulight All rights reseved. No part of this publiccation may be reproduced, stored in retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without the prior permission of the publishers ii AIMS OF THE BOOK The aims of the New Trends in Principles of Accounting Book 3 are: (i) (ii) (iii) (iv) Expose learners to new trends of processing accounting data. Develop the nature, concepts and principles of accounting. Develop enterprise skills that will assist learners to be self-reliant. Apply practical modern skills, techniques and procedures in carrying out bookkeeping and accounting activities. (v) Instil accounting control procedures in learners. (vi) Appreciate the use of computers in accounting. v CONTENTS CHAPTER 1: DATA PROCESSING ........................................................1 Processing the data.........................................................................................2 Manual method ..............................................................................................5 Electronic method ..........................................................................................6 Glossary .........................................................................................................9 END OF CHAPTER QUESTIONS ...............................................................9 CHAPTER 2: ACCOUNTING CONCEPTS.......................................... 10 Accounting concept...................................................................................... 11 Going Concern Concept ............................................................................... 12 Historical cost concept ................................................................................. 12 Business entity concept ................................................................................ 13 Money measurement concept....................................................................... 13 Accounting period concept .......................................................................... 14 Accruals (or matching concept) ................................................................... 14 Prudence Concept also known as Conservatism ......................................... 15 Materiality concept ...................................................................................... 16 Dual aspect concept ..................................................................................... 17 Glossary ....................................................................................................... 18 END OF CHAPTER QUESTIONS ............................................................. 19 CHAPTER 3: SUBSIDIARY BOOKS ..................................................... 21 Use of the general journal/journal proper ....................................................22 Purpose of the Journal .................................................................................22 Glossary .......................................................................................................28 END OF CHAPTER QUESTIONS ............................................................. 29 CHAPTER 4: CLASSIFYING THE LEDGER....................................34 Classification, posting and balancing ledger accounts. ................................ 36 Types of the ledger ....................................................................................... 36 Trade receivables ledger ............................................................................... 36 vi Trade payables ledger ................................................................................... 43 General ledger ..............................................................................................48 Use of folio columns .................................................................................... 49 Interpretation of ledger accounts ................................................................. 52 Glossary ....................................................................................................... 55 END OF CHAPTER QUESTIONS ............................................................. 55 CHAPTER 5: THE TRIAL BALANCE AND ERRORS ...................... 62 Correction of errors ......................................................................................64 Effect of errors on trial balance .................................................................... 65 Glossary ....................................................................................................... 74 END OF CHAPTER QUESTIONS ............................................................. 75 CHAPTER 6: FINANCIAL STATEMENTS ..........................................80 Income statement ......................................................................................... 81 Statement of financial position ..................................................................... 85 Glossary .......................................................................................................90 END OF CHAPTER QUESTIONS ............................................................. 91 CHAPTER 7 : ADJUSTMENT TO FINAL ACCOUNTS ...................95 Accruals .......................................................................................................96 Prepayments .................................................................................................99 Bad debts and provision for bad debts ....................................................... 106 Provision for bad debts ............................................................................... 108 Provision for depreciation .......................................................................... 120 Glossary ..................................................................................................... 139 END OF CHAPTER QUESTIONS ........................................................... 140 CHAPTER 8: CLASSIFICATION OF EXPENDITURE.................... 160 Accounting for capital and revenue expenditure in financial statements ... 162 Effects of incorrect classification ............................................................... 162 Glossary ..................................................................................................... 164 PRACTICE QUESTIONS.......................................................................... 165 vii CHAPTER 9: CONTROL ACCOUNTS ............................................... 168 Control accounts ........................................................................................ 168 Sources of information ............................................................................... 168 Glossary ..................................................................................................... 177 END OF CHAPTER QUESTIONS ........................................................... 177 CHAPTER 10: BANK RECONCILIATION ........................................ 185 The Bank Statement ................................................................................... 187 Differences between Cash book and Bank statement balances.................. 189 Bank Reconciliation ................................................................................... 190 Bank reconciliation statements and errors ................................................. 192 Comprehensive example ............................................................................ 195 Glossary ..................................................................................................... 205 END OF CHAPTER QUESTIONS ...........................................................206 CHAPTER 11: DEPARTMENTAL ACCOUNTS ............................... 217 Departmental trading accounts .................................................................. 218 Combined profit and loss account .............................................................. 224 Glossary ..................................................................................................... 229 END OF CHAPTER QUESTIONS ........................................................... 229 viii CHAPTER DATA PROCESSING 1 Objectives By the end of the chapter, learners should be able to: • • apply manual methods of processing data demonstrate the use of electronic methods INTRODUCTION Data processing is the manipulation of raw items of collected facts and convert them into something that has a meaning to users. In its raw or unprocessed state, data will not be meaningful to the intended user. For example, individual O level results may not give a clear picture about the performance of the 2020 O level class of a school. If these results are processed into a percentage of those who scored Grade C or better against the total number of candidates, the percentage pass rate will be known. This pass rate will clearly show whether the school performed better or worse than the previous year. This knowledge will be very useful to the school management as they can use it to make informed decisions. In this chapter we will consider the definitions of some key words and how they are applied in processing accounting data into usable accounting information. KEY WORDS Manual method Electronic method Data is a collection of raw facts that have not been processed or arranged in any meaningful order. Examples of data may include the number of cars passing through a road junction or the colour of cars in a car park over a given time period. The raw facts will still be in their natural state of collection. Information on the other hand, refers to data that has been processed into something meaningful. This includes summarised data or data which has been 1 Electronic method The electronic method is found in an electronic environment where computers are used to process the data. Human labour is mostly needed to input data into the system. This is done by keying in data using the keyboard and other means of inputting data. The processing of this data into information is done by the computer. The data can be sorted into the desired format by the computer. The computer can also carryout various calculations. There are a number of computer packages that are being used to manipulate accounting data. Such computer software include excel, and packages such as Pastel and QuickBooks. These packages are capable of producing reports that summarise the results of accounting transactions into usable information. Analyses and performance measurement can also be done using computers in a matter of seconds. The electronic method uses computers of different sizes and arrangements to process data. Since more than one computer may be used, networks will have to be established for easy accessibility of data and information. This may call for the establishment of Local Area Networks (LAN) and Wide Area Networks (WAN). WAN is a local network where only localised computers for an organisation can share the information internally while WAN is where local computers are connected to outside computers in a different location. Intranets are internet technologies where data and information are made available to employees on one organisation only and none is available to the outsiders. Extranets, on the other hand, are computers connected such that data and information of an organisation is available to both internal and external users. THE COMPONENTS OF A COMPUTER A computer is made up of two essential parts; the hardware and the software. Hardware Components Hardware refers to the physical components of a computer and any accessories. Such components include the monitor, central processing unit (CPU), mouse, keyboard, and other components that may be attached to a computer. The accessories are basically used as input devices, external backing devices and output devices. Task (i) Name any three data input devices. (ii) List any four external data back-up devices. (iii) Name any three output devices of a computer. 6 Glossary Data is a collection of raw facts that have not been processed or arranged in any meaningful order. Hardware refers to the physical components of a computer and any accessories. Information is data that has been processed into something meaningful. Software refers to programs or packages which instructs the computer to carryout desired functions such as processing the ledger or posting the journals. END OF CHAPTER QUESTIONS 1. Define the terms (a) data (b) information 2. Draw and label the data processing system. 3. Distinguish between the manual and the electronic methods of processing data. 4. List 6 advantages of using computers for data processing. 5. List 6 disadvantages of using computers to process data. 9 CHAPTER ACCOUNTING CONCEPTS 2 Objectives By the end of the chapter, you should be able to: • • • define accounting concepts discuss the application of accounting concepts in the compilation of financial statements apply accounting concepts in the compilation of financial statements INTRODUCTION Accounting is described as the blood circulatory system of any business, without it, the business collapses. To save in the central role, accounting statements should be prepared in a closely controlled environment that will ensure the survival of the business. There are many stakeholders who are affected by the accounting information that comes out of the data processing systems of every business. Due to the varied nature of the users and their locations, there were commonly accepted approaches and assumptions that were agreed and now applied during the preparation of financial statements. This common ground ensures comparability of businesses performance over time. The ground rules or common approaches used to ensure this is achieved are called accounting concepts. KEY WORDS Matching/ accrual Prudence Going concern Consistency Historical cost Double entry 10 Implication The same depreciation method is applied for similar items in the same period and from one period to another. Dual aspect concept This concept takes into account the two aspects of accounting represented on one side by the assets of the business and on the other by the claims against those assets. This duality is also explained by the accounting equation as follows: Assets = Capital + Liabilities Implication Transactions are recorded using the double entry system whereby each transaction has a debit entry and a corresponding credit entry. Task Garikayi has an accounting year ending on 31 December each year. The following amounts have been paid during the year ended 31 December 20X7: $ (i) (ii) (iii) (iv) Wages 35 000 Rent 6 600 Rates 1 400 Insurance 2 200 Motor expenses 14 300 Wages due to workers for the work completed during the last week of the year but unpaid amount to $900. Rent for December 20X7 $500 was paid on 11 January 20X8. Rates have been paid $400 relating to the period 01 January – 31 March 20X8. Insurance includes a premium $250 for the period 01 January – 28 February 20X8. 17 CHAPTER SUBSIDIARY BOOKS 3 Objectives By the end of the chapter, you should be able to: • • • • state the uses of the general journal prepare journal entries explain the entries in the general journal post journal entries INTRODUCTION In Book 1 of this series, we discussed the concept of accounting cycle. The second stage of the accounting cycle was given as subsidiary books. In this chapter we will discuss the last part of this stage as the first part was discussed in Book 1 and Book 2. These earlier discussions centred on the cash book, petty cash book, sales journal, purchases journal, sales returns journal, and purchases returns journal. The general journal was not discussed in detail in the previous studies. It is the objective of this chapter to explore this very important subsidiary book. KEY WORDS General journal/journal proper Interpretation of entries Do you still remember the uses of the above subsidiary books? Do you remember the source documents used to write the subsidiary books? Task 1. 2. Give the use of each of the named subsidiary books above. Name the source document from which the subsidiary book is prepared. 21 $ 80 000 30 000 12 000 4 500 3 000 1 900 800 240 Shop buildings Fixtures and fittings Motor vehicles Inventory Receivables Payables Cash at bank Cash in hand The assets and liabilities will be used to calculate the capital as the balancing figure when the total of liabilities is deducted from the total assets as shown in the opening statement below. Opening statement of assets and liabilities: James Lizard 2015 Debit October 1 Shop buildings Fixtures and fittings Motor vehicles Inventory Receivables Cash at bank Cash in hand Payables Capital (balancing fig) $ 80 000 30 000 12 000 4500 3 000 800 240 130540 Credit $ 1 900 128 640 130540 Closing entries Expenses and income accounts are closed off to the income statement to ascertain gross and net profit figures. Expenses are matched to the revenue generated in the years and accounts are closed at the end of the year as in the example below. 23 END OF CHAPTER QUESTIONS Select the correct option from the questions below. 1. Which one of the following is not a subsidiary book? A. Cash book B. Sales returns journal C. Purchases ledger D. Petty cash book 2. Only one of the following is a purpose of the Journal. A. Recording goods returned by a customer B. Recording credit purchases C. Recording cash sales D. Writing off a dab debt 3. A narration in the journal helps to A. explain what triggered the entries just made B. show who borrowed from us C. which account was not recorded D. show the owner of the books 4. The general journal is another name for A. the journal B. sales day book C. purchases returns journal D. cash book 5. Journalising in the accounting system means A. training journalists B. recording transactions in journals C. posting transactions to the ledger D. preparing source documents 29 CHAPTER CLASSIFYING THE LEDGER 4 Objectives By the end of the chapter, you should be able to: • • • • • • define the term account. classify ledger accounts post entries from subsidiary books to appropriate divisions of the ledger. explain the entries in the ledger accounts. use reference numbers in the folio columns interpret the final balances in the accounts. INTRODUCTION The third and fourth stages of the accounting cycle involve the use of a ledger. After recording transactions in the appropriate books of original entry, the subsidiary books will have to be posted to an appropriate ledger. It is very important for this posting to be made in the correct ledger otherwise if a posting is made to the wrong ledger, this will cause wrong reports made in the final accounts prepared on the bases of these wrong postings. In this chapter we will analyse the different sections of the ledger and discuss the different postings that are made to each type of ledger. KEY WORDS Classification Posting Balancing ledger accounts Trade receivables ledger Trade payables ledger General ledger Use of folio columns Interpretation of ledger accounts 34 Sales invoice Financial statements Sales journal Trial balance Sales ledger General ledger Fig 5.2 Credit sales cycle A sales invoice is the source document used to write up the sales journal. The sales journal is the subsidiary book from which the sales ledger will be recorded. Let us look at an example of credit sales, from the transaction right down to the sales ledger. 20 x 9 November 1 3 8 15 20 22 29 Credit sales to M. Chaundura $2 500 Credit sales to T. Dura $5 300 Credit sales to M. Laura $4 200 Credit sales to Q. Moses $6 000 Credit sales to M. Laura $5 300 Credit sales to Q. Moses $3 100 Credit sales to T. Dura $7 900 37 Debit side side Date Details 2017 May 1 Balance Sales June 1 Balance Chelsea Account Folio b/d GL Amnt $ X X b/d X X Credit Date Details 2017 May 1 Sales returns 14 Sales returns 31 Cash 31 Balance Folio GL GL CB c/d Amnt $ 120 300 X X X Posting the sales returns to the General ledger Debit side Date Details 2017 May 31 Sundry receivable Chelsea Account Folio Amount Date $ 2017 SL 1 530 Details Credit side Folio Amount $ Trade payables ledger These are accounts of all credit suppliers. Credit purchases are evidenced by a purchases invoice which is received from the supplier when goods are purchased on credit. Thus a purchases invoice is the source document of credit purchases. Trade payables are also called trade creditors. These are amounts which we owe to outside organisations and individuals. Whenever we buy goods on credit, the supplier will raise (prepare) a document that will record this transaction. This document is issued to us together with the goods bought. We will call this source document a purchases invoice since we will have received it after purchasing goods. We will use this purchases invoice to start recording the credit purchases. The purchases invoice is the source document for credit purchases. It will be recorded in the purchases journal (also called purchases day book). The rest of the cycle is shown in the diagram below. It is important that you acquaint yourself with the credit purchases cycle diagram. 43 Notes: - In the folio column we show the ledger where the account appearing in the details section is kept. CB stands for Cash Book, GL stands for General ledger, SL stands for Sales Ledger and PL stands for Purchases Ledger. Interpretation of ledger accounts When a ledger account is prepared, it should send some clear information to the users of accounts. Let us interpret two of the ledger accounts above. The cash account and the Muchadei Furnitures accounts are reproduced here for easy analysis. Cash Account 20X4 Oct Details 3 Bank Microfinance: 9 loan 12 Sales Folio CB $ 20X4 640 Oct GL 7 000 GL 2 300 Details Folio 6 Purchases GL 31 Balance c/d 9 940 Nov 1 Balance b/d $ 400 9540 9940 9 540 Interpretation: - The entry on Nov 1 20X4 shows that there is $9 540 cash on the premises. A debit balance is an asset, remember! Muchadei Furnitures Account 20X4 Oct Details 26 Bank Folio CB $ 20X4 2 000 Oct 5 31 Balance c/d 2 500 Details Furniture Folio GL 4 500 4 500 Nov 52 $ 4 500 1 Balance b/d 2 500 CHAPTER THE TRIAL BALANCE AND ERRORS 5 Objectives By the end of the chapter, you should be able to: • • • • recognise the errors that do not affect trial balance agreement state the errors that affect trial balance agreement correct the errors by means of journal entries prepare the suspense account correct the trial balance INTRODUCTION Preparation of the trial balance is stage five on the accounting cycle. A trial balance helps in the preparation of other summary statements and needs to be well prepared with little or no errors. The accounting process is prone to unintentional mistakes. Whether the accounting process is operating on a manual or electronic system, errors cannot be ruled out. Man is prone to conditions such as stress, fatigue, ignorance and other conditions that facilitate the commission of errors in the recording of accounts and preparation of financial statements. Some errors will cause the trial balance not to balance while others do not manifest themselves in the trial balance. If not corrected, the errors cause the final accounts to be misleading as they will not show a true and fair view of the business finances. To avoid this, every error should be investigated and corrected so that adjustments are done to the wrongly reported statements. KEY WORDS Correction of errors Suspense account Correction of the trial balance 62 END OF CHAPTER QUESTIONS Multiple Choice Questions 1. Which two of the following do not affect the trial balance? (i) Sales $105 to A Hondo were entered in A Hombe’s account (ii) A cheque payment of $44 for Motor expenses entered only in Cash Book (iii) Purchases $440 from C Moyo entered in both accounts as $404 (iv) Wages account added up incorrectly, being totalled $120 too much. A. (i) and (iv) B. (i) and (iii) C. (ii) and (iii) D. (iii) and (iv). 2. Which two of the following are not errors of principle? (i) Motor expenses entered in Motor Vehicles account (ii) Purchases of machinery entered in Purchases account (iii) Sale of $50 to C Philemon completely omitted from books (iv) Purchases from A Smiles entered in A Semili’s account. A. (ii) and (iii) B. (i) and (ii) C. (iii) and (iv) D. (i) and (iv). 3. We correct errors through the Journal so that A. we save the bookkeeper’s time B. we do not clutter the ledger C. we create work for the unemployed D. we provide a good record explaining the double entry records. 4. Cash discount allowed to customers totalling $100 was completely omitted from the books. If the reported net profit before this error was discovered was $10 400, the correct profit is A. $10 400 B. $10 300 C. $10 500 D. $10 200 75 CHAPTER FINANCIAL STATEMENTS 6 Objectives By the end of the chapter, you should be able to: • • prepare income statements draw up statements of financial position INTRODUCTION Preparation of financial statements is stage six on the accounting cycle. This stage is critical because most users of accounting information will only be able to interface with the output of the business activities through financial statements. In this chapter we will discuss the preparation of the income statement and the statement of financial position. The preparation of financial statements follows specific formats as dictated by international accounting standards. You are encouraged to learn and follow these formats whenever you are asked to prepare financial statements. KEY WORDS Income statements Statements of financial position Now that most of the bookkeeping tasks have been learnt, we now move on to the Reporting Part of the course. The accountant needs to report to the owners of the business periodically and one way of reporting is the preparation of financial statements. Financial statements are made up of the Income statement, Statement of Changes in Equity, the Statement of financial position, Statement of Cash flows, Notes to the statements. However at this level you will only learn about the income statement, statement of changes in equity and statement of financial position. 80 Role Play Get into groups of five learners per group. a) b) Prepare an income statement for the year ended 31 December 20X5 Prepare a statement of financial position as at 31 December 20X5 Trial balance as at 31 December 20X5 $ $ Capital 30000 Furniture 10000 Inventory 1500 Buildings 14000 Inventory on 1 January 20X5 1000 Sales 24000 Freight carges 2100 Customs duty 1200 Packaging cost 3000 Purchases 18000 Returns outwards 1100 Returns inwards 700 Discounts 250 Stationery 170 Accounts payable 140 4450 Rent 370 Wages and salaries 5800 Insurance 1500 Bank overdraft 4300 Accounts receivable 3000 Drawings 1400 63990 63990 Additional information i) Inventory on 31 December 20X5 was $1 200 Task Use your answer to practice question above to prepare the statement of financial position for Munashe. 89 CHAPTER ADJUSTMENT TO FINAL ACCOUNTS 7 Objectives By the end of the chapter, you should be able to: • • • • • • • • • explain the effect of closing entries record closing entries in the journal and ledger define depreciation compute depreciation prepare ledger accounts for depreciation, non-current assets and non-current assets disposal draw up ledger accounts for prepaid and accrued income and expenses construct ledger accounts for provisions for doubtful debts and discounts allowable compile income statements and statement of financial position showing effects of the adjustments interpret balances in the ledger accounts INTRODUCTION When the trial balance is extracted at the end of a financial period, there may be some information which may not be known about the current year. This information may come to management’s knowledge some days after the last day of the financial period. Since this information relates to the current year’s accounts, it will be used to make adjustments to the balances in the trial balance so that financial statements are prepared to reflect a true and fair view of the financial position of the business. This information is called post balance sheet information. An example of such information is the closing inventory which may only be known after the stock take has been done possibly some weeks after the financial period has ended. This chapter will explore the treatment of a number of post balance sheet items and the adjustments required to make the accounts correct. 95 BAD DEBTS AND PROVISION FOR BAD DEBTS BAD DEBTS In some cases, businesses sell their products on credit. A customer who takes the goods and promises to pay later is called a debtor. Some of such debtors may fail to pay at all. A customer who fails to pay is called a bad debtor. The amount which the firm fails to collect from a customer is known as a bad debt. Such an amount is cancelled from the total amount owed by debtors and becomes an expense to the firm, that is, it is debited in the income statement. Customers may be taken as bad debtors when: i. They Run away and change address without the knowledge of the firm. ii. They become insane (crazy) that they are no longer able to cooperate. iii. They become insolvent or bankrupt (when liabilities are more than one’s assets.) iv. They die before payment is done. v. The company dissolves away such that it is unable to pay. When a customer is declared bankrupt by the firm, the bookkeeping entries will be: Debit Bad debts account Credit Customer/debtor’s account At the end of the year the bad debts account is closed off by transferring the amount to the profit or loss account, thus: Debit the bad debts account Credit the profit or loss account. Note: i) If the bad debt awareness is given as a note to the trial balance, it means no record has been made in the books (unless it is stated that it was recorded). This means the amount of bad debts must be deducted from the debtor’s amount supplied in the trial balance and debited to the profit or loss account. 106 The provision for bad debts account will be as follows. Provision for Bad Debts Account 20X8 $ 20X8 Dec 31 Income statement 300 Jan 1 Balance b/d Dec 31 Balance c/d 950 1 250 20X8 Balance b/d Jan 1 $ 1 250 1 250 950 Example S. Sithole, a sole trader maintains a provision for doubtful debts of 2½% every year on its total receivables. The following are the receivables for the three years to 31 December 20X5. 31 December 20X3 31 December 20X4 31 December 20X5 $2 500 $3 400 $2 900 It has been found that one of the receivables for the year 20X5 owing $200 has become insolvent. Prepare the provision for bad debts accounts for the three years indicating the amounts transferred to the income statements. Answer Provision for bad debts account-20X3 20X3 Dec 31 Balance c/d $ 20X3 62.50 Dec 31 $ Income statement 62.50 62.50 62.50 20X4 1 Jan Bal b/d 62.50 Provision for bad debts account-20X4 20X4 Dec 31 $ Balance c/d 20X4 85.00 Jan 1 Dec 31 $ Balance b/d 62.50 Income statement 22.50 85.00 85.00 20X5 Jan 113 Balance b/d 85.00 ii) Loan interest has not been listed in the trial balance that means no payment was made for interest during the year. This means the entire figure is owinghence it is a current liability in the statement of financial position. iii) Purchases were subtracted by $4 000 with respect to the goods taken by the owner for personal use at cost. The same amount was added to drawings. If they were taken at selling price, we could have added (credited) it to sales account. Students normally wrongly deduct drawings of inventory from the closing stock amount. iv) In the income statement, provision for bad debts is a change between two years while the current year’s provision is deduction from the debtors in the statement of financial position. DISPOSAL OF NON-CURRENT ASSETS The contact of business normally calls for the need to buy non-current assets. Business organisations buy different types of non-current assets depending on type and size of business, type of products dealt with, capital investments and technology used. These assets include motor vehicles, computers, buildings, equipment, fridges, stoves and various other types of equipment. At the end of predetermined period of use or when the asset is no longer useful to the organisation, firms may decide to dispose of such assets. Disposing of an asset refers to the selling of a non-current asset. If an asset is sold, it has to be cancelled from the firm’s asset register. When an asset is disposed of, profit or loss arises. This affects calculation of profit for the period. Profit on disposal is income added to profit in the profit or loss account (credited) while loss is in expense (debited). With profit on disposal: Debit the Asset Disposal account Credit the Income Statement With loss on disposal: Debit the Income Statement Credit the Asset Disposal account Profit or loss on disposal is calculated in the asset disposal account. Profit on disposal is the difference between selling price and the net book value of a noncurrent asset. Net book value is cost of an asset less accumulated depreciation on the date the asset is being sold, i.e. 133 CHAPTER CLASSIFICATION OF EXPENDITURE 8 Objectives By the end of the chapter, you should be able to: • • • • define revenue and capital expenditure classify expenditure into revenue or capital expenditure show revenue and capital expenditure appropriately in the financial statements state the effects of incorrect classification of expenditure on profit, non-current assets and working capital INTRODUCTION Businesses incur expenditures of different types in their day to day operations. These expenditures need to be properly classified so that financial statements will be correctly prepared. If this classification is not properly done, profits will be wrongly reported and the value of assets and liabilities will be inaccurate. The expenditure is classified into revenue expenditure and capital expenditure. This chapter will define the terms capital expenditure and revenue expenditure. The learner is encouraged to learn these definitions and try to classify various expenditures into their appropriate categories. KEY WORDS Capital expenditure Revenue expenditure CAPITAL EXPENDITURE Capital expenditure is where money is incurred in acquiring or improving the value of non-current assets. This expenditure includes the following costs incurred in: 160 PRACTICE QUESTIONS Multiple choice questions 1. Capital expenditure refers to A. money used to acquire non-current assets B. money used or spent on inventory C. annual charges on depreciation D. all costs of starting a business 2. Revenue expenditure is A. money used to acquire non-current assets B. money used or spent the maintenance of non-current assets C. money used on increasing the operational capacity of non-current assets D. money used to pay workers installing non-current assets 3. Only one of the following is not an example of revenue expenditure A. cost of installing a new machine B. repainting a classroom block C. purchasing a new engine for the school bus D. repairing the air conditioning system 4. If furniture repairs of $1 200 were debited to the Furniture account in error, the impact is A. There is not impact on net profit since a debit entry was made B. Net profit is overstated by $1 200 while non-current assets understated by $1 200 C. Net profit is overstated by $1 200 while non-current assets are overstated by $1 200 D. Net profit is understated by $1 200 while non-current assets are understated by $1 200 The salaries for workers constructing the new office block were recorded in the salaries account. The impact was to A. Understate net profit and overstate non-current assets B. Understate net profit and understate non-current assets C. Overstate net profit and overstate non-current assets D. Overstate net profit and understate non-current assets 5. 165 CHAPTER CONTROL ACCOUNTS 9 Objectives By the end of the chapter, you should be able to: • • • • • define control accounts state the purposes of control accounts name the types of control accounts identify sources of information for control accounts prepare control accounts INTRODUCTION A control account is an account in the general ledger which summarise the transactions passing through the accounts it controls. Control accounts are also called Totals accounts. There are basically two accounts we will cover, the Creditors Ledger Control account and the Debtors Ledger Control account. CONTROL ACCOUNTS A control account is an account in the general ledger which summarises the transactions passing through the accounts it controls. Control accounts are also called Total accounts. A control account acts as a summary of the ledger it controls. There are basically two types of control accounts namely: i) ii) the Creditor Ledger Control account /Trade Payables account/Purchases Control account the Debtors Ledger Control account/Sales Ledger Control account/Trade Receivables account Sources of information for constructing control accounts The information used to construct control accounts is extracted from personal accounts of credit customers (receivables) and suppliers (payables) as well as information from subsidiary books. 168 Credit balances in Sales Ledger Control accounts Since debtors are technically assets of an organisation, according to the accounting equation they must have a debit balance. However, there are instances where debtors can also have credit balances. This arises due to the following reasons: i) An overpayment to a creditor ii) Returning goods to the creditor after paying the full amount iii) Paying the creditor in advance for goods iv) Cash discount not being deducted before payment was made Thus for the above reasons the control account may have two opening balances, a debit and a credit balance. ICT ASSIGNMENT Using the search engine www.google.com or any search engine of your choice, list the source documents used to provide the information for: payments to creditors discount received from creditors goods returned to suppliers set-offs purchases bank refunds Reasons for preparing control accounts • • • • • • They assist in locating errors when trial balance fails to balance, They are proof of the arithmetical accuracy of the ledgers they control, They provide the amounts for receivables and payables immediately, They help in the preparation of draft financial statements, They reduce fraud as they are prepared by a person not involved in the preparation of the controlled ledger, They provide a summary of transactions affecting debtors and creditors for each financial period. 171 CHAPTER BANK RECONCILIATION 10 Objectives By the end of the chapter, you should be able to: • • • • identify causes of differences between cash book and bank balances identify errors in the cash book and bank statement draw up an updated cash book prepare bank reconciliation statement INTRODUCTION In normal business circumstances, any firm should have a business bank account in which it keeps its large amount of cash. This is because of the need for money to circulate in the economy than it being held in the cash tills by firms. This chapter looks into the differences that normally occur between the records that are kept by the firm and the firm’s bank regarding the periodic banking transactions of the firm. The business will keep a cash book where it records it banking transactions while the bank will also keep a record of its transactions with its client business. At the end of the month when the two parties balance off their respective records, they should ideally come up with the same balance. However, this may not be the so. This chapter will explore the reasons for these differences and how businesses prepare documents to reconcile these differences. KEY WORDS Bank reconciliation statements Errors Updated cash book Bank overdraft If a business opens a bank account with any bank, say, ZB Bank limited, the bank shall keep a record of all payments into or out of the account. Every time the firm deposits or withdraws money from its account, the bank records. This means at 185 CHAPTER DEPARTMENTAL ACCOUNTING 11 Objectives By the end of the chapter, learners should be able to: • • • • • state the purpose of departmental trading accounts prepare departmental trading accounts in columnar form apportion expenses appropriately among departments draw up a combined profit and loss account prepare statements of financial position INTRODUCTION Departmental accounts are prepared by organisations with more than one trading unit. An organisation may have the hardware department and clothing department under the supervision (or management) of different people. To see how the two managers are performing, departmental accounts should be prepared. The departmental accounts will ensure that the profitability of each department will be calculated and each manager will be appropriately appraised. Corrective measures may be taken for the poorly performing department so that profitability may be increased. At times, drastic measures such as closing the loss making departments may be recommended although more facts need to be considered before this decision is taken. This chapter will explore the preparation of departmental accounts. KEY WORDS Departmental trading accounts Combined profit and loss account. Apportionment of expenses 217 Glossary Apportioned costs – are jointly incurred costs that have to be shared by benefiting departments. Direct costs – are costs that can be traced directly to a particular department. Indirect costs – are costs that cannot be directly traced to a particular department. END OF CHAPTER QUESTIONS Multiple Choice Questions 1. The most appropriate purpose of preparing departmental accounts is to A. provide information used to evaluate the profitability and cost effectiveness of each department, B. show how much each department contributes to the overall profits of the country C. identify departments that that must be closed by management D. help in management expressing their skills 2. Simba Stores has two departments, Toys Department and Clothing Department. Toys Department occupies 200m2 and the Clothing Department occupies 500m2. Simba Stores pays combined rentals of $4 500 for the premises housing the two departments. The portion of rental apportioned to the Toys Department to the nearest $1 is A. $1 285 B. $1 286 C. $6 425 D. $2 570 3. Apportioned costs are A. Shared between departments B. That are not shared by departments 229 Structured Questions 1. Chindove Supermarket has two departments, the Groceries and Butchery departments. The following list of balances was extracted from their books on 31 December 20X1. $ Capital Fixtures and fittings at cost Provision for depreciation: 1 Jan 20X1 Motor vehicles Furniture Returns outwards Drawings Purchases Butchery Groceries Sales Butchery Groceries Rent Land and buildings Furniture, at cost Motor vehicles, at cost Carriage inwards: Butchery Salaries Advertising Trade receivables Provision for doubtful debts: 1 Jan 20X1 Trade payables Rates Discounts Bank Inventory: 1 Jan 20X1 Butchery Groceries 231 $ 834 800 275 000 10 000 5 000 30 000 60 000 187 000 240 000 290 000 570 000 18 000 470 000 105 000 160 000 7 000 25 000 4 000 25 000 3 000 65 000 58 000 1 300 85 000 35 000 90 000 1 827 300 1 500 1 827 300