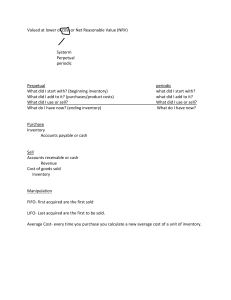

INVENTORY VALUATION LECTURE Inventory refers to goods 1. Held for sale in the ordinary course of business 2. To be (or being) used in the production of finished goods (or services) to be available for sale later. Merchandising firms have merchandise inventory, which refers to items being held for sale. Manufacturing firms have raw materials, work in process, and finished goods. Inventory includes goods in transit and goods out on consignment. Perpetual and Periodic Systems Perpetual System Inventory can be valued using either the perpetual or the periodic system. Perpetual means continuous, so in theory, the value of inventory on hand and cost of goods sold for the period can be determined after every transaction involving inventory. Under the perpetual inventory system, the journal entries are as follows: When goods are bought: Debit Inventory Credit Accounts Payable When goods are sold: Debit Accounts Receivable Credit Sales and Debit Cost of Goods Sold Credit Inventory One of the difficulties of the perpetual system was that the calculation of inventory values could get complex very quickly. However, the decrease in the cost of computing power and the widespread use of computers have led to the increasing use of the perpetual inventory system. Periodic System In contrast, under the periodic system, the value of inventory on hand and the cost of goods sold for the period are determined at the end of each period. Under the periodic inventory system, when goods are purchased they are recorded in the purchases account. In the perpetual inventory system, the journal entries are as follows: When goods are bought: Debit Purchases Credit Accounts Payable When goods are sold: Debit Accounts Receivable Credit Sales At the end of the period, ending inventory is determined by a physical count. The cost of goods sold can be calculated by using information about the beginning inventory, ending inventory, and purchases. Inventory Systems: Periodic - does not keep a continuous record of inventory on hand - physical inventory is required at least once a year Perpetual - keeps a continuous record of inventory on hand - an annual physical inventory is still required Journal entries for Purchases and Sales of Inventory: Credit Purchases Perpetual System Periodic System Inventory Purchases Accounts Payable Credit Sales Accounts Payable To record sale of merchandise: Accounts Receivable Accounts Receivable Sales Sales To record cost of merchandise: Cost of Goods Sold No entry required Inventory End of Period Transfer Beg. Inv. Bal. To COGS: Entries Cost of Goods Sold Inventory No entries required Record End. Physical Inventory: Inventory Cost of Goods Sold Transfer cost of purchases to COGS: Cost of Goods Sold Purchases