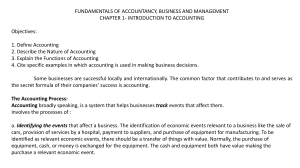

SENIOR HIGH SCHOOL DEPARTMENT FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 1 LESSON 1 HANDOUT TOPIC: INTRODUCTION TO ACCOUNTING ACCOUNTING - Process of IDENTIFYING, RECORDING and COMMUNICATING economic events of an organization. - It is considered as language of business ➔ IDENTIFYING - Things that affect business - This involves selecting economic events that are relevant to a particular business transaction. - (TRANSACTION- economic events of an organization) ➔ RECORDING - Record all transactions involved in the operation of the business - This involves keeping a chronological diary of events that are measured in pesos. ➔ COMMUNICATING - Reporting to the customers and management the gains, etc - Occurs through the preparation and distribution of financial and other accounting reports NATURE OF ACCOUNTING ● Systematic recording of financial transactions and the presentation of the related information. ● It is a service activity by providing financial reports. ● It is a process because it refers to the methods used to make financial reports ● It is an art and discipline, certain way to make financial reports ● Deal with financial information and transactions. It involves transaction with monetary value. ● Information system- it is the storehouse of information in a company. FUNCTION OF ACCOUNTING IN BUSINESS 1.) Provide information for managers and owners to use in operating the business. 2.) Allows business owners to assess the efficiency & effectiveness . 3.) Helps the users of the financial reports to see the true picture of the business. HISTORY OF ACCOUNTING Cradle of Civilization ●Mesopotamia- they used clay tablets in recording their accounts receivable and accounts payable. - Luca Pacioli- known as the “Father of Accounting “ and wrote Summa De Arithmetica (contained a detailed chapter on double-entry bookkeeping) 19th Century ● In England, industrial revolution transformed accounting into an actual profession ● In Scotland, Queen Victoria granted a royal charter to the Institute of accountants to create the profession of Chartered Accountants. ● In year 1887, the American Association of Public Accountants was founded and provided a formal certification process for accountants. 20th Century ● American Institute of Certified Public Accountants (AICPA) was formed. ● Securities and Exchange Commission (SEC) was formed ● Financial Accounting Standards Board (FASB) and Government Accounting Standards Board (GASB) established Generally Accepted Accounting Principles Information Age ● Manual, tedious, and time-consuming tasks in accounting were replaced by faster and more accurate computer methods. 21st Century ● Establishment of International Accounting Standards Board ● Implementation of Sarbanes Oxley Act ● Creation of International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) Accounting in the Philippines ● Financial Reporting Standards Council ● Philippine Institute of Certified Public Accountant ● Republic Act No. 9298 “Philippine Accountancy Act of 2004” BRANCHES OF ACCOUNTING ➔ Financial Accounting - is primarily concerned with the recognition, measurement, and communication of economic activities. This information is communicated in a complete set of financial statements. - Assumed under the branch that the users have one common information need. It conforms with accounting standards developed by standard setting bodies. In the Philippines, there is a council created to set these standards. Sample of Financial Reports/ Statements 1. Statement of financial position (Balance Sheet) 2. Statement of Profit and Loss (Income Statement) 3. Statement of Changes in Equity 4. Statement of Cash Flows 5. Notes to Financial Statement ➔ Management (or managerial) accounting Analysis or interpretation of financial statement to produce a management decision. ➔ Government accounting - Process of recording, analyzing, classifying, summarizing, communicating, and interpreting financial information about the government in aggregate and in detail reflecting transactions and other economic events involving the receipt, spending, transfer, usability and disposition of assets and liabilities. ➔ Cost Accounting - considered as a subset of management accounting, cost accounting refers to the recording, presentation, and analysis of manufacturing costs. Very useful in manufacturing businesses since they have the most complicated costing process. Also analyzes actual and standard costs to help managers determine future courses of action regarding the company's operation ➔ Auditing (2 Types) ● External auditing - refers to the examination of financial statements that has been produced. - 3rd party company usually conducts external auditing ● Internal auditing - checks operation of the business if it is following the company's policy ➔ Tax Accounting - helps clients follow the rules set by tax authorities. It refers to the filing and payment of tax to the government. ➔ Accounting Education Practiced by accountants who teach in schools. ➔ Accounting Research Refers to the research conducted on how to improve and develop accounting standards. -