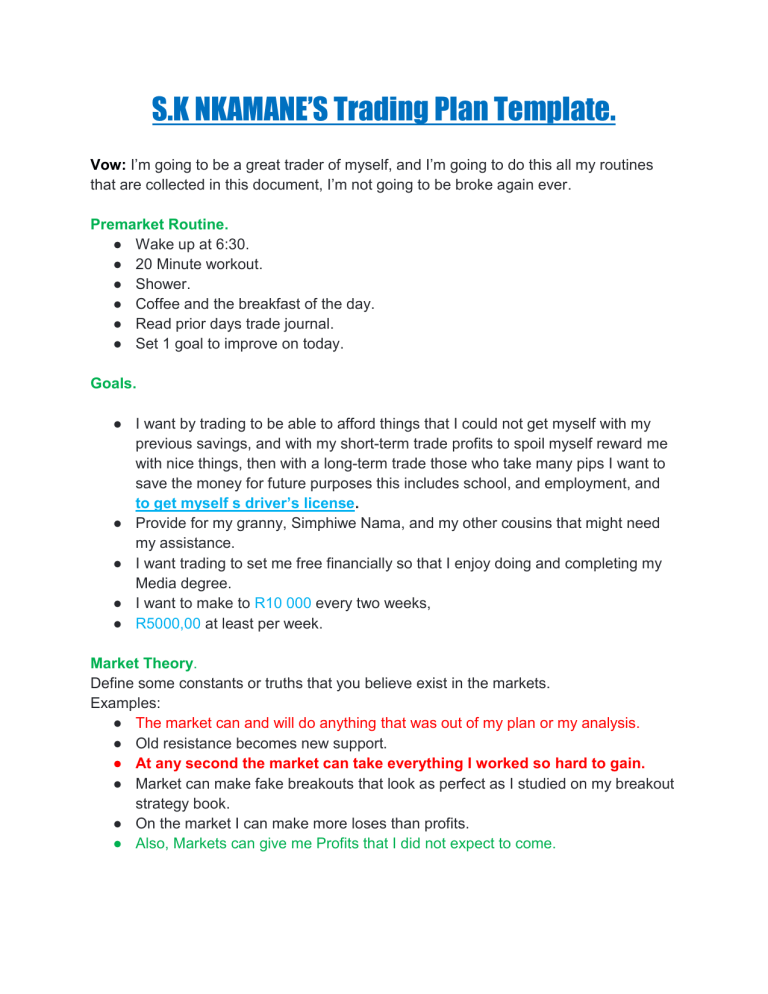

S.K NKAMANE’S Trading Plan Template. Vow: I’m going to be a great trader of myself, and I’m going to do this all my routines that are collected in this document, I’m not going to be broke again ever. Premarket Routine. ● Wake up at 6:30. ● 20 Minute workout. ● Shower. ● Coffee and the breakfast of the day. ● Read prior days trade journal. ● Set 1 goal to improve on today. Goals. ● I want by trading to be able to afford things that I could not get myself with my previous savings, and with my short-term trade profits to spoil myself reward me with nice things, then with a long-term trade those who take many pips I want to save the money for future purposes this includes school, and employment, and to get myself s driver’s license. ● Provide for my granny, Simphiwe Nama, and my other cousins that might need my assistance. ● I want trading to set me free financially so that I enjoy doing and completing my Media degree. ● I want to make to R10 000 every two weeks, ● R5000,00 at least per week. Market Theory. Define some constants or truths that you believe exist in the markets. Examples: ● The market can and will do anything that was out of my plan or my analysis. ● Old resistance becomes new support. ● At any second the market can take everything I worked so hard to gain. ● Market can make fake breakouts that look as perfect as I studied on my breakout strategy book. ● On the market I can make more loses than profits. ● Also, Markets can give me Profits that I did not expect to come. Trade Theory. Define what thoughts, attitudes, and rules you believe are critical to being a successful trader. Examples: ● Consistency is the key to long-term success. ● 4 basic outcomes: big winner, little winner, little loser, and big loser. Eliminate big losers for success. ● There will always be another trade. ● Taking trades outside of my trade plan will destroy me. Sometimes they work which is one of the worst things. ● There are other trading strategies that will look better that the one I’m using, and they are tempting. ● Using any other strategy that I have known before and that I will see during the will take me back to a losing trader that was. Define Your Trading Strategy Step by Step. 1. I look for an area where the market disrespects the resistance trendline when breaks that’s my strong to place trade. 2. After it broke the trendline I wait and see if it retests if it that is my win trade. 3. Since the market can do anything for me to see if the market is going to break, I CHECK THE FOLLOWING THE CONFIRMATIONS. 4. (1) The double top before the breakout, it’s a confirmation that the market has lost the momentum of pushing more higher in an uptrend vise-versa in a downtrend. 5. (2) the second one is to look for the trend change pattern. 6. (3) In an uptrend I look for a Lower high or a Lower Low before the trendline breaks. 7. (4) Same as the uptrend, in a downtrend I look for a Higher high or a higher low before the market breaks. Trade Management. 1. 2. 3. Risk Management. 1. Max of 3 Net Losses in a day 2. Two max loss days in a row done trading for the week 3. Risk 2/3% per trade Aftermarket Routine. Every trader makes mistakes. The question is whether you will learn from those mistakes or just keep paying repeatedly to experience them. Keeping a trade journal throughout the day of all your trades as well as what you did right and wrong on every trade is essential to growing as a trader. Make sure to take screenshots of every trade so you can go back and review your trades. 1. Workout. 2. Review Trades. 3. Update Journal. Weekend Routine. Typically, I perform my weekend routine on Sunday evening. Examples: ● Review trade journal notes. ● Review trades from the week. ! BY ALL MEANS I WILL STAY AWAY FROM BLOWING MY ACOUNT.

![[Link]High probability trading take the steps to become a successful trader(rasabourse.com)](http://s2.studylib.net/store/data/027047264_1-734ebab7bb90f55a1d047ec661d67623-300x300.png)