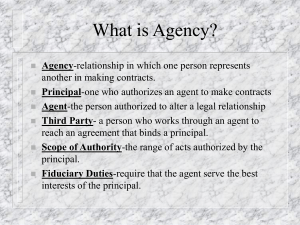

Agency & Partnership Law Outline - Ricks, Fall 2010

advertisement