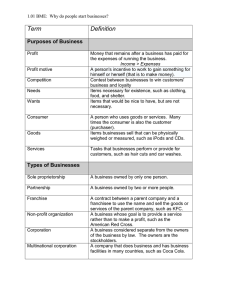

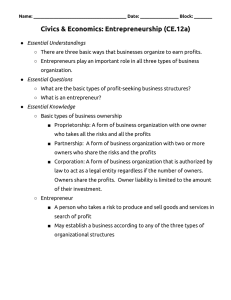

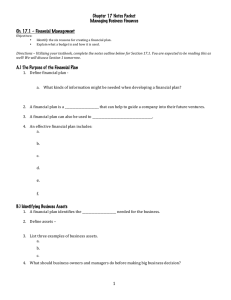

BUSINESS NOTES NATURE OF BUSINESS A business can be defined as the organised effort of individuals to produce and sells usually for profit, the product that satisfy individuals needs and wants ROLE OF BUSINESS - Producing goods and services Good: a product that you can see and touch (e.g. phone) Service: intangible things done for you (e.g. hairdressing) Need: vital to your survival (e.g. food, shelter) Want: a product that you can desire but is not essential (e.g. jewellery) - Profit, employment, incomes, choices, innovation, entrepreneurship and risk, wealth and quality of life Profit: - If the businesses sales revenue is greater than its operating expenses, it has earned a profit. - PROFIT = SALES REVENUE- EXPENSES Employment: - To be able to purchase products, consumers need money. They usually earn money by working at jobs provided by businesses. Income: - Income is the amount of money received by and individual for providing their labour. - A business income is the amount of money it earns after covering all of its expenses. Choice: - a primary function of a business is to produce goods and services for consumers to satisfy their needs and wants - this provides consumers with choice and stimulates competition Innovation: - the development of new products or improvements to existing products - Research and development Entrepreneurship: - People who transform their ideas into a new business - They start, operate and assume the risk of business venture Wealth creation: - By increasing sales and developing strategies to promote brand awareness to increase the value of an organisation Quality of life: - Refers to the overall wellbeing as an individual and as a combination of both material and non-material benefits. TYPE OF BUSINESSES Classification of business - Size Characteristics # of ee’s Small Manufacturing = less than 100 Service based = less than 20 Independent 1-2 owners Medium Service = 20-199 Large Service = 200+ A few owners or private shareholders Most common legal structure Decision making Sole trader/ partnership Owner responsible Private company Large private company or public share ownership Public company Source of finance Owners own funds Type of Ownership - Owner responsible as it becomes complicated with increased shareholders Private share holder investment Complex decision: board of directors/ senior management team Many sources - Share sales - Loans - Overseas investment Geographical spread Geographical spread is the presence of a business and the range of its products across a suburb, city, state, country or globe LOCAL Restricted geographical spread Serves the surrounding area ad does not have the resources to offer a range of products to another suburb or town - Industry NATIONAL Operates in one country but caters for a range of cities/suburbs within that country e.g. David Jones, Coles GLOBAL Transnational Corporation A large business with a home base in one country that operates E.g. Nike, Apple An industry consists of businesses involved in similar types of production Industry Sector Primary Secondary Tertiary Quaternary Quinary Definition Businesses which production is directly associated with natural resources Involves taking raw materials and making it into a semi/finished product Involves performing a service for other people Services that involve the transfer and processing of information and knowledge Services that have been traditionally performed in the home Example Mining, farming Coal turned to steel used to manufacture cars Retailers, dentist, nurses Telecommunications, finance, education, internet based sales Childcare, take away, cleaning, hotels - Legal structure Sole trader Partnership # of owners One person Liability Unlimited Establishment Most simple Major advantages Major disadvantages Public company (L.td) 2-20 people Private company (Pty. Ltd) 2-50 shareholders (owner has a large degree of control) Unlimited Limited Limited Incorporation Must go through Australian security exchange -shareholders have limited liability protection - continue after death - owner can chose shareholder - no restrictions on transfer of share money - limited liability - continue after death -closing the business is extremely complex as all shareholders must agree - publish annual accounts -Complicated to set up - cant chose the share holders Recommend a document with partnership agreement -Low cost of entry -shared -Complete control- responsibility and owners right to workload keep all profits -pooled funds and -no tax on profits talent - minimal government regulation -unlimited liability -unlimited liability -difficult to -liability for all debts operate if sick -divided loyalty and -need to carry all authority loses - burden of management Infinite amount Factors influencing choice of legal structure - Size, ownership, finance SIZE - Most appropriate legal structure for opening business would be sole trader or partnerships As the business increase, it will require more equipment etc. that requires the injection of more money. Businesses make the change from unincorporated to incorporated due to wanting limited liability Forming private companies allows for extra finance, skills and enterprise For larger companies, limited liability is wanted for the protection of individuals funds If a company becomes public, a prospectus is issued inviting the public to buys shares which allows for company expansion OWNERSHIP - If an owner is after complete control they should become a sole trader Private companies allow the owner to have a large degree of control (over who can become shareholders) Offers limited liability so that the owner is not at a level of personal financial risk In public companies, more shares = more ownerships FINANCE - Business expansion requires injections of finance used to purchase new equipment, undertake research and development and exploit new markets Sole traders and partnership are at greater financial risk due to unlimited liability Venture capital = money that is invested in a small businesses with the potential to success - To avoid difficulty of raising finance, business owners decide to sell their shares INFLUENCES IN THE BUSINESS ENVIRONMENT External influences - Economic Economic influence is experienced through economic cycles of booms and busts BOOM RECESSION Higher level of employment Unemployment levels rise Inflation may increase Inflation may remain stable or fall Wages increase Wages are less likely to rise The level of spending by consumers The level of spending usually decreases The state of the economy has a great impact on businesses. The policies implemented by the government are aimed at keeping the economy growing steadily, without putting pressure on prices and wages. The economy is also affected by overseas trends: Changes in trade Changes in investment Foreign exchange - Financial Deregulation is the removal of government regulation from industry, with the aim of efficiency and improving competition. Due to globalisation of the world’s financial markets, it is no longer necessary for many large Australian businesses to use only domestic financial institution for raising of finance. Increased competition = better products and services for business - Geographic Globalisation: the process that sees people, goods, money and ideas moving around the world faster and more cheaply than before Globalisation has influenced the number of products Australian buys and sells on the world market. National borders no longer limit the world. Major effects that have an enormous effect on business activity: - Australia’s geographical location within the Asia-Pacific region - The economic growth in a number of Asian nations - Changing demographics (changes in demand levels and the nature of products and services, biggest issue for Australia is the ageing population) - Social Changes in taste, fashion and culture can lead to sales and profit opportunities and business growth. Failure to respond to changes can threaten business stability, sales, profit and viability. Social issues leading to change: - Environmental awareness (making sure products are recyclable, waste disposal, fuel efficiency) Work-life balance (flexible work arrangements) Workplace diversity (gender equality, cultural diversity) - Legal Legislation has been introduced to cover taxation, industrial relations, work health and safety, equal employment opportunity, anti-discrimination and protection of the environment. TOO MUCH GOVERNMENT INTERFERENCE. Small businesses are currently facing levels of regulation similar to larger organisations. Compliance with regulations is often costly and time consuming, confusing and contradictory - Political There are element of politics in most major issues that affect the business environment. Dominanat political issues affecting business - Labour market reforms (free trade policies) - Social reforms (paid pparental leave) - Environmental management (emissions trading scheme) - Taxation (GST) - Institutional Technological Competitive situations Markets Internal influences - Products The main product influences are: - - The type and range of goods and services provided: if goods are physically large the business will need to structure its operational system differently to a business that provides a service The type of business: the business structure will be different for retailer, service provider or manufacturer The size of the business: the larger the business, the more goods and services produced, the more complex the operational structure Location If a business is not convenient and visible, customers may not make the effort to find the business therefore optimum customer flow will not be achieve. A complementary business is one that sells a similar range of goods and services. Locating next to a complementary business may be beneficial, attracting more customers to a single site e.g. food court - Resources The four main resources available to a business are: - Human resources (employees of the business) - Information resources (knowledge and data, market research) - Physical resources (equipment, machinery, buildings) - Financial resources (funds) - Management and business culture Business culture refers to the values, ideas, expectations and beliefs shared by the members of staff of a business. It covers: - Official policies, goals and slogans Informal rules on how to dress, behave etc. In order to sustain a god business culture, managers need to be role models for staff in those values their business considers important Less fluid organisational structure - Structure - Clear rules - Doesn’t like change - Strict uniform - Doesn’t encourage creativity More fluid organisational structure - Relaxed - Adaptable to change - Promotes individuality Stakeholders STAKEHOLDER DESCRIPTION Shareholders – purchase shares in a company so they are partial owners Employees- manufacture or produce the product that the organisation sells Managers – responsibility of running a profitable or successful organisation Customers- people purchasing products Society- members of society Environment- the natural environment surrounding business THEIR INTERST IN THE BUSINESS -purchase shares, partial owners -voting rights on major business decisions -able to voice their concerns and ask questions - ensure the business is profitable as they receive a proportion of profits -manufacture or produce the product the organisation sells -they want to be values, paid fairly, trained properly and treated ethically -responsibility of running a profitable or successful organisation -understand legal issues and is their responsibility to introduce policies -increase sales -best value for money, fairly treated, product performs as promised -concerns about organisations using valuable land resources or showing disregard for carbon emissions -businesses to adopt ecologically sustainable operating practices, response to concerns about climate change and the destruction of natural environment BUSINESS GROWTH AND DECLINE Stages of the business life cycle Sales Establishment - initially low and slow Growth -rising customer awareness - new products - spending increases - wider range of promotion - new products - mass marketing - growing too fast = pressure on cash flow - low budget inexpensive options word of mouth social media local paper high out flow low revenue Customers - small based local positive relationships - Cost - very high to start - Profit - Low if any Main Problems - Employees - Advertising Cash flow - need to monitor expenses to maintain cash flow loyal customers recruiting new customers get more efficient - customs may feel impersonal - Grows quickly with strong sales - Competition reduces growth until it reaches a steady amount Low income Poor cash flow - - Keep up with competition Few employees Initially informal - May grow too fast Move away from core business Recruitment and training needs to be formal - Work teams Performance appraisals POST MATURITY Steady state- business isn’t growing but still keeping loyalty of customers - rarely continues for long periods - sales will fall due to changing fashion/ trends/ technology - revenue fall due to competition - eventually will lead to decline Decline - Maturity - steady sales - competition - brand loyalty - product quality cash flow/ revenue declines banks are reluctant to lend money suppliers are cautious in selling people inventory products become obsolete customers can’t rely on service in the long term Renewal - can occur is business can reinvent its product and image - requires and investment in market research - requires an investment in research and development - requires risk and innovations - Responding to the challenges at each stage of the business life cycle ESTABLISHMENT - deciding location types of products sols finding motivated staff suitable legal structure GROWTH - increasing sales and revenue have to increase market share MATURITY - business growth and market share begins to slow increased competition Factors that can contribute to business decline - cash flow or revenue fails away banks are reluctant to lend money suppliers are cautious in selling people inventory products become obsolete customers cannot rely on service in long term Voluntary and involuntary cessation – liquidation Voluntary cessation: when a business owner chooses to stop operating the business. Due to -retiring of owner -change of lifestyle -sole trader has died With debts increasing and a negative cash flow, a business owner will realise if their business is underperforming, to prevent accumulation of debt, the owner will need to cease operating the business Involuntary cessation: the owner is forced to cease trading by the creditors of the business Creditors are the people or businesses who are owed money if a business carries on after debt. The creditors worry about the money they are owed forcing the business to close. BUSINESS MANAGEMENT NATURE OF MANAGEMENT Management is a fundamental activity that makes the business function. Management is the process of (i) coordinating a business’s resources to achieve its goals, (ii) working with and through other people to achieve business goals in a changing environment. Whether the goals of the business are achieved largely depends on the skills and expertise of the management team in coordinating the business’s resources. Features of effective management An effective manager needs to be good at many thing. The role of effective management is to make sure the joint efforts of employees are directed towards achieving the business goals. Effective management is usually the major factor influencing the success or failure of a business PLANNING ORGANISING LEADING CONTROLLING The preparation of a predetermined course of action for a business The structuring of the organisation to translate plans and goals into actions the process of influencing or motivating people to work towards the achievement of the organisation’s objectives Compares what was intended to happen with what actually occurred Skills of management Skill Interpersonal Communication Strategic Thinking Vision Problem Solving Decision-Making Flexibility Adaptability to Change Definition Skills needed to work and communicate with other people and to understand their needs. Exchange of information between people, the sending and receiving of messages. Can be verbal & nonverbal Characteristics Ability to relate to other people Appreciating needs of others Showing genuine understanding Motivation and guidance of workers Clear communication so employees understand what is expected of them Sharing thoughts and plans Manager seeing the business as a Visualise how work teams & whole and being able to take the broad, individuals interrelate long-term view in managing the Seeing the ‘big picture’ business Thinking about the direction of the business Clear, shared sense of direction that Need to know where the business is allows people to attain a common goal. heading Communication with employees Guidance Need to think about how current decisions will affect the business in the future Broad set of activities involved in 1. Identify the problem searching for, identifying and then 2. Gather relevant information implementing a course of action to 3. Develop alternative solutions correct an unworkable situation 4. Analyse the alternatives 5. Implement one solution 6. Evaluate the situation Identifying the options available and Identifying available options and then choosing a specific course of choosing which is best action to solve a specific problem Make decisions within a particular time frame Understanding implications of decisions Refers to being responsive to change Important as it is impossible to and able to adjust to changing predict spontaneous events that will circumstances occur in the future Risk taking Being proactive (making changes before damage is done) not reactive Being able to deal with changes in the Having a contingency in case of internal and external business emergency environments. Reconciling the Conflicting Interests of Stakeholders Each stakeholder has their own reason for having an interest in the business What one stakeholder hopes to achieve may conflict with the desires of other stakeholders Managers need to reconcile the conflicting interests of various stakeholders. Senior managers must attempt to satisfy as many stakeholder expectations as possible Achieving Business Goals What is a Goal? Desired outcome (target) that an individual or business intends to achieve within a certain time frame Carefully prepared goals benefit managers by: - serving as targets - measuring sticks -motivation -commitment. The best method of writing effective goals is by using the S.M.A.R.T. technique. (specific, measurable, achievable, realistic, timebound) Types of Goals Financial Social Environmental Maximise profit o Continue to increase profit o Profit maximisation - when there is a maximum difference between the total revenue into the bus and total costs. One way to achieve is increasing sales Improve share price o A share is a part ownership of a public company. o People buys shares in the hope of selling them for a higher price, or because owning shares in a company entitles an investor to a part of the company’s profits - distributed in the form of dividends. o Maximise the returns their shareholders, achieved by keeping the share price rising — constantly improving the share price — and paying back healthy dividends. Increase market share o Refers to the businesses share of the total industry sales for a particular product o important goal for bus’ that dominate the market, because small market gains often translate into large profits o Larger customer base increased sales increased profits Maximise growth o expansion o Achieve growth internally or externally o Internally – employing more people, increasing sales, introducing innovative products, purchasing new equipment or establishing more outlets o Externally – merging with or acquiring other businesses Community service o Business sponsorship of a wide range of community events, promotions and programs Provision of employment o Most large businesses do not see employment of people as a main goal. Many small business owners, employing family members who otherwise might be unemployed. Social justice o Adopting a set of policies to ensure that employees or other community members are treated equally and fairly. Developing products and creating ideas that are environmentally friendly Sustainable development o Economic growth must be achieved sustainably o There needs to be a balance between economic and environmental concerns Achieving a Mix: Businesses generally have a range of goals because they have different stakeholders who each have different needs. Therefore managers have a mix of goals that they try to achieve simultaneously Goals are interdependent E.g. strategies employed by a bus. to achieve the goal of maximising growth may simultaneously help that bus. achieve the goals of maximising profits and increasing market share. Staff Involvement: Involving employees in the decision-making process and giving them the necessary skills and rewards. Type of decentralisation that involves allowing ee’s some authority to make decisions. Only successful if a bus. provides ee’s with the necessary expertise & recognises the importance of: Innovation: when a new idea is applied to improving an existing product or idea Motivation: individual internal process that directs, energises & sustains a person’s behaviour Mentoring: the process of developing another individual through tutoring, coaching & modelling acceptable behaviour Training: the process of teaching staff how to perform their job more efficiently by boosting their knowledge & skills. Allow employees to upgrade skills and become multi-skilled employees MANAGEMENT APPROACHES Classical management approach Classical management approaches have a high level of specialisation and division of labour to increase productivity. They use a strict pyramid organisational structure with a rigid chain of command and a narrow span of control. It places an emphasis on the management functions of planning, organising and controlling. It also encourages managers to use an autocratic leadership style. They use financial rewards are a key motivators for employees. Planning is the preparation of a predetermined course of action for a business. It involves showing how th business will achieve its state mission and business goals. Organising is where management puts into practice the goals that were determined in the planning stage. It determined what is to be done, who needs to do it and how it is to be done. Controlling is when it attempts to evaluate performance and take corrective action to ensure that objectives are being achieved. Behaviours approach Behavioural management approaches place an emphasis on the need for management to work with people. It realises that an effective two-way communication process is needed between management and workers. It sees a manager’s role of leadership as paramount and focuses on motivation using a range of intrinsic and extrinsic rewards. It uses a flatter organisational structure with work teams and encourages managers to use a participative or democratic leadership styles with employee participation in descion making. Employees are considered a key part of the whole business. Leading: a range of effective leadership skills is necessary Motivating: creating collegiality and including staff in decision-making are significant motivators as well as understanding the different needs of different individuals and using these as motivators Communicating: two-way communication between managers, team leaders and staff will ensure that they are successful in sharing information. Contingency approach Contingency management approaches emphasise the need for a more flexible structure, varied leadership styles and greater mounting of the business environment Definition Stresses how best to manage and organise workers so as to improve productivity (output) Scientific: best way to perform a job Bureaucratic: rules & regulations that control a business Planning Organising Controlling Stresses that people (employees) should be the main focus of the way in which the business is organised Leading Motivating Communicating BOTH Organisational structure Hierarchical – tall Teams - flat BOTH Leadership Style Autocratic “Do it the way I tell you” Participative/ democratic BOTH “Any suggestions for this task?” Management styles Example Stresses the need for flexibility and adaptation of management practices to suit changing circumstances MANAGEMENT PROCESS Coordinating key business functions and resources Key functions: o o o o Finance Human resources Marketing Operations Strategies: A series of actions undertaken to achieve specific goals Outsourcing key business functions: not required all the time and expensive Interdependence between key business functions: mutual dependence that the key functions have on one another. This means that the various business functions work best when they work together Separation of key business functions: because they require difference skills and knowledge o Reduces complications regarding the business functions and promotes efficiency within the business Overlapping: when duties in the business fall under more than one of the 4 business functions Operations Operations: the business processes that involve transformation or ‘production’. The production of a good or the provision of a service Transforming inputs into outputs Goods and/or Services: Goods tangible – can be touched e.g. clothing or car Serviceintangible – include service that can’t be touched, e.g. a training course Production Process: o Inputs o Processes o Outputs Inputs resources used in the transformation (production) process. 6 types: 1. Material– raw materials that are transformed into products 2. Capital equipment – major, expensive equipment used to process the input into output 3. Labour – human resources needed to complete a job 4. Information – information readily available to the company 5. Time – coordinating all resources within a specific timeframe 6. Money – used to continue the production process Transformed resources those inputs that are changes or converted in the operations process -Materials – raw materials that are transformed into products -Information – the knowledge gained from research, investigation and instruction which results in increased understanding -Customers – customers become transformed resources when their choices shape inputs Transforming resources those inputs that carry out the transformation process -Human resources – the people that are employed by the business -Facilities – the plant (factory or office) and machinery used in the operations process ProcessesConversion of inputs (resources) into outputs (g’s & s’s) Operations in the manufacturing process: Operations in service businesses: Outputs the end results of a business’s efforts - finished goods or services Quality Management: strategy a business uses to make sure that its products meet customer expectations -benefits of implementing quality management practices include: reduced waste and defects reduced variance in final output The improved reputation and customer satisfaction reduced costs Marketing Marketing is the process of developing a product and implementing a series of strategies aimed at correctly promoting, pricing and distributing the product to a core group of customers. The role of marketing is to increase market share - Identification of the target market A target market is a group of customers with similar characteristics who presently, or who may in the future, purchase the product. Most businesses must select specific groups of customers on which to concentrate their marketing efforts. TYPES OF TARGET MARKETS Mass marketing approach – a large range of customers. In mass markets the seller mass-produces, mass-distributes and mass-promotes one product to all buyers Marketing segmentation – segments the market to better direct its marketing strategies to a specific group of customers. This occurs when the total market is subdivided into groups of people who share one or more common characteristics Niche markets – narrowly selected target market selection. It is also known as a micro market - Marketing mix Marketing mix refers to the combination of the FOUR p’s that make up the marketing strategies. The emphasis place on various aspects of the Marketing mix will be determined by the position or stage of the Product life cycle or target markets. Product – the element of the marketing mix which looks at the products quality, packaging, design, labelling, name, exclusive features, warranty and guarantees. Packaging involves the development of a container and the graphic design of the product. It helps promote the product but also helps preserve, inform and protect. Brand and brand logo are a powerful marketing tool that conjures up feelings and perceptions. Place – the place refers to the distribution. This refers to activities that make the products available to customers when and where they want to purchase them. A distribution channel is a way of getting the product to the consumers. Finance Finance: concerned with where the business sources its funding. Accounting: A management tool concerned with providing information on the financial affairs of a business - Accounting provides info. that is valuable to managers. Also provides info. to ee’s, owners and shareholders (if it is a company), suppliers, lenders, customers, government (including regulators), competitors and the general public. Cash Flow Statement: Shows the movement of cash receipts & cash payments Liquidity refers to the amount of cash a business has access to and how readily it can convert its assets into cash so that debt can be paid Opening cash + inflows-outflows = cash balance Jan Feb March Opening balance 3000 3300 1800 + Revenue (Cash inflows) 1000 1000 1000 -Expenses (Cash inflows) 700 2500 600 Closing Balance 3300 1800 2200 Important terms: -opening balance: cash balance for the bus. at the start of the month -revenue: cash flowing into the bus. during that month -expenses: cash flowing out of the bus. that month -closing balance: cash balance at the end of the month (& opening balance for next month) Income Statement (revenue statement/profit & loss): Summary of the income earned & expenses incurred over a period of trading. Gross profit = sales – COGS COGS= opening stock + purchases – closing stock Net profit = gross profit – expenses - Sales $1 000 000 COGS $ 400 000 Opening stock 60 000 +purchases 410 000 -closing stock 70 000 = Gross Profit $600 000 - Expenses $35 0000 = Wages 195000 Rent 155000 Net Profit 25 0000 Balance Sheet: Represents a business’s assets and liabilities at a particular point in time and represent the net worth of the business Traditional T format or narrative format Assets – physical items of value, owned by the business -Current assets: things of value that are kept for about 12 months, e.g. accounts receivable (or debtors-money owed to the bus), cash in the bank, inventory etc. -Non-current assets: items that have a more lasting value to the bus. >12 months, e.g. motor vehicles, buildings, plant & equipment Liabilities – anything owed to people or other businesses outside the business entity -Current liabilities: monies owed within the near futures, e.g. accounts payable (creditors) & bank overdraft -Non-current liabilities: monies owed by the bus over a longer period, e.g. bank loans - & mortgages CLAD: creditors a liability, debtors an asset Owner’s equity – also called capital or proprietorship, it is the net worth of the bus, and represents what the bus owes to the proprietor. Represents what is left of the bus. after all outside liabilities have been paid. A = L + OE or OE = A – L TERMS Sales Opening stock Closing stock COG’s Gross Profits Net Profits Operating expenses DESCRIPTION Is the total value of goods sold Is the value of stock the business had at the beginning at the accounting period Is the value of stock the business had at the end of the accounting period As the costs the business incurred in order to sell products to customers. The amount of profit calculated by subtracting the cost of goods sold from the total sales revenue. It does not take into account other income or expenses. The amount of final product calculated by subtracting the cost of expenses in running the business from the total gross profit. A business’s expenses are usually divided into 3 sections: 1. Selling expenses: salaries, wages, advertising, delivery, expenses, electricity, freight outwards 2. Administrative expenses: stationary, office salaries, rent, rates, telephone, accountant’s fees 3. Financial expenses: discounts to customers, bad debts, interests on loan, dividends Human resources HR is defined as the effective management of the formal relationship between the employer and employees. Most businesses that are successful in the long term maintain a balance between concern for success and regard for their employees. Effective HRM involves hiring the best staff, develop cooperative and effective relationships, motivate staff and provide opportunities. The HUMAN RESOURCE CYCLE refers to the various stages of Human Resources management. These include: 1. Acquisition: identify needs, recruitment, selection - Planning: identifying staffing needs; job analysis (determining the exact nature of the position to be filled) Recruitment: attracting people to apply for the position in the business ; internal and external recruitment Selection: choosing and hiring the most qualified; testing and interviewing 2. Development: training and development - Induction and training: teaching employees new skills and heling them learn tasks associated with their new job - Development: the process of improving the skills, abilities and knowledge of staff 3. Maintenance – benefits monetary and non-monetary - Monetary benefits: rewarding employees efforts through financial compensation; pay rates - Non-monetary benefits: such as conditions; fringe benefits 4. Separation – voluntary and involuntary - Voluntary: employees leaving on own accord; retirement and resignation - Involuntary: employees being asked to leave; retrenchment, dismissal Ethical business behaviour Behaviour that is considered consistent with the behaviour standards set by society. This includes acting honestly in marketing, providing value for money, promoting social justice and being environmentally friendly. Managers are expected to manage the resources of the business in a responsible manner while considering the potential impacts of their decision on all stakeholders and the environment. MANAGEMENT AND CHANGE Responding to internal and external influences Types of Change Change: any alteration in the internal or external environments Transformational Change: results in complete restructure of the whole organisation. A transformed business will have: A different (usually flatter) organisational structure New work systems & procedures A change ee’ structure Incremental change: results in minor changes usually only involving a few employees. E.g: Change from using a fax to email when sending information to customers -Managers should be proactive rather than reactive in order to adapt to change Structural response to change: Structural changes: refers to changes in the business’s structure- that is the organisation chart e.g. outsourcing, flatter organisation structure, work teams -Outsourcing: the contracting of some organisational operations to outside suppliers Impact on arrangement of workforce i.e. Part time/full time May mean that job losses occur within the organisation and other jobs need to be created. + The organisation may be able to produce its goods, or supply its service, more efficiently than before. -Flat Structure: As middle-management positions are abolished, greater levels of accountability and responsibility to frontline staff Impact seen through reporting controls -Work Teams: Coupled closely with the emergence of the flatter organisational structure is the development of work teams. Allows businesses to be more flexible &responsive Teams also motivate employees to be more creative, to develop a broader view of goals, and to contribute across the entire business Impacts on: Business Culture Managers and ee’s must develop a new mindset and way of thinking- a new business culture in order to adapt to new environments Human Resource Organisational change will ultimately have a profound impact Management on ee’s at all levels within a business Main human resources changes: -Recruitment and selection must be altered to reflect the need for individuals who possess the knowledge and skills required to handle the changing circumstances. -If ee’s are made redundant, appropriate termination procedures must be put in place. -Training must be offered to existing ee’s in the areas of teamwork, problem solving, decision-making and change management. -Performance appraisal and reward systems that reinforce the new behaviours must be put in place. Operations Main operations management changes are: Management -bus’ have refitted and reorganised their factories to take advantage of improvements in technology. They are also pursuing efficiencies in process design and materials management. -new advances in production technology have been accompanied by changes in the way the production process is organised, including flexible manufacturing. -Flexible manufacturing allows production plants to be smaller, more specialised, and closer to important markets. -Emphasis on quality management — an organisation-wide system of procedures to ensure that the products satisfy consumers. -Human relations are being improved so that ee’s will approach their work more intelligently. Managing Change Effectively Identifying the Need for Change: Effective manager who has the ability to scan the business environment, attempting to understand the factors that will have an impact on the business Holistic view of the outside world Business information systems: gathers, organises and summarises data into practical information to be used by managers who use them to make decisions Setting Achievable Goals: A vision statement states the purpose of the business. It indicates what the firm does, and states its key goals. In conjunction with the vision statement, a business establishes specific company goals that are measurable Resistance to Change: Reason Definition Management Some managers make hasty decisions that are unclear and poorly timed. Some managers are indecisive and put off making a decision creating uncertainty. Employees will eventually lose confidence in the manager’s decision-making abilities. Fear of Job Employees become fearful of changes that threatens job security and therefore resist the new Loss processes because they feel the result will be loss of power and control. Disruption to Routine Time Fear of the Unknown Inertia Cost Employees worried they are worried about adapting to new procedures that threaten established work routines Not enough time is provided for employee’s to think about the change, accept it and implement it. Sometimes timing is poor. Change can create feelings of lack of control, fear of the unknown and uncertainty about the future. The unenthusiastic response to proposed changes. Some managers and employees resist change because it involves them moving out of their comfort zone. The financial cost of implementation of change. Must weigh up the costs and benefits of the change. Driving and Resisting Forces: Driving – forces that support change Resisting – forces that work against change Managers who are trying to implement a change must analyse the situation to identify and balance the driving and restraining forces. Strategies for reducing resistance to change: Build trust among ee’s, provide constant feedback, offer support – this reduces fear and anxiety, and clearly articulate the purpose of the change Creating a culture of change: For ee’s & managers to be prepared to take such risks, the bus. culture needs to be supportive. One method to assist, is for the bus. to identify individuals who could act as supportive change agents . Change agents: person/group of people who act as catalysts, assuming responsibility for managing the change process. Positive leadership: How a manager treats their ee’s will largely determine their acceptance of or resistance to change A successful leader will need to: -market and promote the change in a manner that will achieve cooperation and acceptance -resolve conflicts, which often arise when change is implemented -keep an open mind, seek out new ideas and freely share information Management Consultants: A management consultant is someone who has specialised knowledge and skills within an area of business. Bus’ hire the services of management consultants because they provide: -A wide range of business experiences -Specialised knowledge and skills -An objective (external) viewpoint -Access to the latest research -Awareness of industry best practices. especially helpful in providing change management advice- a methodical approach to dealing with change, both from the perspective of a business and on the individual level Can provide strategies to smoothly manage the introduction of business changes by: -undertaking change readiness reviews -creating a supportive business culture -actively involving all stakeholders in the change process -gaining and recognising early achievements. BUSINESS PLANNING SMALL TO MEDIUM ENTERPRISES Definition A small to medium enterprise can be difficult to define due to their dynamic nature, however the following quantitate measures can give an indication as to what a small to medium enterprise is. Quantitative Measure Number of employees Type of ownership Sources of finance Legal structure Market share Management structure Content Small: <20 employees or <100 for manufacturing businesses Medium: up to 200 Independently owned and operated Bulk provided by owner (owners’ equity) (internal) and some debt from financial institutions (external). Sole trader or partnershipUnincorporated businessesunlimited liability Small market share Owner responsible for making all decisions and it is closely controlled by the owner/operator. Role Employ about 73% of all the people working in the private sector (51 per cent in small businesses and 22% in medium businesses) Have created 80% of Australia's employment gains during the past 10 years Produce approximately 50% of all the products produced each year Generate an increasing amount of our total exports Account for 20% of all money spent on R&D Provide a wide range of products used by large businesses Earn more profits and pay more taxes than do large businesses. Economic Contribution Contribution to GDP (gross domestic product- total money value of all g’S & s’s produced in Australia over a 1-year period) - Economic growth (when a nation increases the real value of goods and services over time) - Contribute 50% to GDP Contribution to Employment -employment keeps the economy healthy -SMEs employ around 8 mil people, which represents about 70% of total private sector employment. -last 20 years, the SME sector has been the major generator of new jobs in the Australian economy. Contribution to Invention and Innovation -mains source of inventions and innovations - Around 40% of SMEs are actively engaged in some form of innovation. - Finding new ways to do things has resulted in improved efficiency and increased productivity. -Increase in levels of R&D from SME’s Contribution to Balance of Payments -BOP – record of the country’s trade and financial transactions with the rest of the world over time, usually 1year -overseas markets - no. of SME Australian exporters is growing faster than large exporters. Success and/or Failure Success 1. Focus on market niche. Small businesses can concentrate their efforts on a few key customers or a specific segment of the market. This provides the opportunity for the SME to become more specialised and able to deliver a high level of service. 2. Reputation. Because the SME is servicing a narrow market niche, it can develop enviable reputations for quality and service. 3. Entrepreneurial abilities. The people in SMEs are crucial to the success of the enterprise. Attitudes and personalities of owners will vary enormously. Some will have drive and enthusiasm, many will set targets, and some will take big risks. 4. Flexibility. The small size of the business allows the owner to adapt quickly to changes in the external environment. Because there are fewer levels of management, decisions can be made quickly. In addition, the close contact between owners and their customers allows the establishment of personal relationships. 5. Access to information. Its difficult for a SME owner to choose relevant info. & to gauge the quantity of info. needed. As a bare minimum, the SME operator must have information regarding profitability, the quality of products and services, and the performance of employees. Accurate and up-to-date information will allow the SME owner to make better decisions. Failure The failure rate of SME’s is around 70% in the first 5 years, due to: risk, psychological pressure & financial pressure A SME is classified as a failure when it is: -Unincorporated and declared bankrupt - a legal process of distributing among the creditors the property of a business or person who cannot/will not pay their debts -Incorporated and either forced into liquidation or voluntarily closes down because it cannot pay its debts and faces a cash flow problem. Reasons for Failure: Failure to plan Economic downturn Inaccurate record keeping Complacency Insufficient capital INFLUENCES IN ESTABLISHING A SMALL TO MEDIUM ENTERPRISE INFLUENCE 1. Personal Qualities 2. Sources of Information 3. The business idea 4. Establishment options 5. Market 6. Finance 7. Legal 8. Human Resources 9. Taxation Qualifications Skills Motivations Entrepreneurship Cultural background Gender Professional advisors/government agencies Competition New Existing Franchise Goods/services Location Price Source and cost Business name Zoning Health and other regulations Skills Costs – wage and non-wage Federal, state, local 1. PERSONAL QUALITIES All types of people own and operate a business however not everyone is suited to the role of business owner as certain skills and personal qualities are required to succeed. It is important for people to recognise their strengths and weaknesses, decide if they have the right personal characteristics to be a business owner, and learn the skills they do not presently have. There is no simple checklist of skills and personal characteristics however starting a business does require courage, determination and energy QUALIFICATIONS Exceptional grades or previous qualifications in business are not essential. The most important aspect is the eagerness to work long hours. For some SMEs there are few or no formal academic requirements needed to commence operating however, there are many courses such as Business Studies that provide further knowledge and understanding to assist in successfully owning a SME. SKILLS Skills can be obtained through experience, education and or training - Experience: working provides you with valuable experience and well-developed skills Education and or training: is another way to gain skills All of these avenues provide skills in o Accounting o Computing o Staff management o Business administration o Marketing MOTIVATION Motivation is the reason or reasons for acting a certain way. Most businesses use monetary and non-monetary benefits to motivate workers to be efficient and effective ENTREPRENEURSHIP An entrepreneur is someone who starts, operates and assumes the risk of a business venture in the hope of making a profit. A range of personal characteristics is required to be successful in creating business opportunities. These include - Setting realistic goals Taking risks Motivated by achievement Confident Takes responsibility High levels of energy Tolerates failure skilled organiser CULTURAL BACKGROUND Cultural influence can arise from a communitys traditions and beliefs, such as the work ethic – the willingness to work long and hard in an effort to be successful – which is strong in many European and Asian culture. Their determination translates into business success/ cultural influences can come from experience and or specialist knowledge in specific trades or services GENDER An entrepreneur’s gender will not determine whether his or her business will be successful. Changes in the social acceptance of women in the workplace have increased, with many women setting up their own businesses at three times the rate of men. 2. SOURCES OF INFORMATION - Accurate and up-to-date information can help entrepreneurs make better plans to establish a business and gain a competitive advantage SME owners can receive assistance from a large number of government and private support agencies SOURCES of advice - Networks - Trade associations Federal, state and local government departments Small enterprise association of Australia and New Zealand Accountants Solicitors Bank Managers Australian Chamber of Commerce and Industry TAFE colleges Universities Other business contacts Community-based services AusIndustry Australian Bureau of Statisics Business Enterprise Centre Chambers of commerce PROFESSIONAL ADVISERS Professional advisers deal with a large number of business and are therefore able to adopt a much wider view of individual businesses The FOUR MAIN professional advisers are 1. 2. 3. 4. ACCUNTANTS: advice on financial management issues and taxation obligations SOLICITORS: advice on business structures, registration, contracts, leases and partnership agreements BANK MANAGERS: advice on financial services, sources of finance and basic management MANAGEMENT CONSULTANTS: advice on problems from and outside and unbiased perspective GOVERNMENT AGENCIES LOCAL GOVERNMENTS This level of government is becoming more involved in encouraging business because it creates employment. Local councils offer advice on land zoning, assist with subsidised land and consider development applications. STATE GOVERNMENTS NSW Trade and Investment – Provides information and advice on starting and managing a small business Provides interactive tools to assist owners to start and run their business Provides programs to develop key business skills Business Enterprise Centres Australia – is a peak body for business enterprise centres and it is non-for-profit organisation that assists home based business owners, business intenders FEDERAL GOVERNMENTS www.business.gov.au offers access to all government departments, with advice on everything from fair-trading to taxation. Technological advice establishing an online business presence, networking a number of computers within the business premises or making maximum use of mobile devices can all improve business efficiency. CHAMBERS OF COMMERCE Chambers of commerce are local associations of business people, usually centred around a suburb or region. They provide legal and financial help, taxation advice, an explanation of legislation, and industrial relations information. The chambers also organise training seminars, arrange industry conference and liaise with government departments SMALL BUSINESS ASSOSCIATION OF AUSTRALIA AND NEW ZEALAND This lobby group has a membership consisting of thousands of individual small business owners. The association provides a forum for exchanging news and views relating to small business matters. It only organises raining days and promotes the role of small business and its importance in the total economy TRADE ASSOCIATIONS Trade associations offer specific industry information and assistance. Examples include: - Australian Retailers Association Plastics and Chemical Industries Association Australian Medical Association Each association is made up of organisations that are in the same line of business, so it can provide specific details about product development and industry trends LIBRARIES AND REFERENE MATERIAL Libraries are a valuable source of information because they have access to vast amounts of reference material. Most libraries have online access to large databases with search facilities that help locate specific material. Librarians are high trained and will undertake a search of the literature available. Most libraries also subscribe to trade and industry journals. AUSTRALUAN BUREAU OF STATISITCS The Australia bureau of statistics provides valuable data on social, economic and demographic trends. It also provides specialised data on business activities. Information useful to business owners can be obtained from the following - Census on population and housing Demographic trends and statistics Household Expenditure Surveys Having access to such information assists the business owner in analysing and understanding changes to the external environment 3. THE BUSINESS IDEA All the businesses in the word must have started from an intial idea and then grown according to their success. The successful identification of a gap in the market (demand currently not being satisfied) is a key to establishing a lucrative business IDENTIFYING BUSINESS OPPORTUNITIES A business opportunity – is something an entrepreneur can see as an avenue to success. Identified when a person believes they can provides goods or services in a better or different way from those already in the market. TWO main ways to identify an opportunity 1. Analyse and review particular parts of the market to find an opening for good or service 2. Identify whether many other people share a particular interest or hobby. Making a profit is not always the catalyst, belief in the product itself is sometimes what drives entrepreneurs COMPETITION Once a business opportunity is identified, consideration of competition needs to be investigated. The type of market in which the business chooses to operate in will ultimately determine its competitors. A niche market may have minimal or no competitors whereas a mass market will require extensive planning. 2 WAYS TO ACHIEVE COMPETITIVENESS 4. ESTABLISHMENT OPTION There are three ways of establishing a new business 1. Setting up a new business from scratch Sometimes conditions are more favourable for starting a new business than for buying an existing operation - When a person has created something unique and starts a business to market their own innovation or invention When a person recognises a gap in the market, where it is clear that customers needs are not satisfied by existing business When the market has grown and existing businesses cannot supply all customers If these conditions do not exist, then starting from scratch could be more difficult because existing SMEs will provide considerable competition ADVANTAGES - The owner has the freedom to set up the business exactly as they wish - The owner is able to determine the pace of growth and change - There is no goodwill for which the owner has to pay - If funds are limited, it is possible to begin on a smaller scale DISADVANTAGES - There is high risk and a measure of uncertainty. Without a previous business reputation, it may prove difficult to secure finance - Time is needed to set up the business, create procedures, develop a customer base, employ and train staff and develop lines of credit - If the start-up period is slow, then the business may not generate profits for some time 2. Purchasing an existing business When an existing business is purchased, the business is already operating and everything associated with the business is included in the purchase - Stock and equipment Staff Premises Location - Existing customer base Reputation and good will When purchasing an existing business, it is essential for the potential purchaser to know why the business is for sale. If the business has been struggling, it may not be very good to purchase. It is also important to examine detailed accounts for at least the previous three years to determine the financial health of the business. The true value of goodwill is one aspect of the financial statements that is often hard to estimate. The seller of the business may overestimate the value of the businesses reputation; therefore, consultation with an accountant is important to confirm the accuracy of the value laced on goodwill of the seller ADVANTAGES - Sales to existing customers will generate instant income - A good business history increases the likelihood of business success - A proven track record makes it easier to obtain finance - Stock has generally been acquired and is ready for sale - The seller may offer advice and training - Equipment is available for immediate use - Existing employees can provides valuable assistance DISADVANTAGES - The existing image and policies of the business may be difficult to change, especially if the business had a poor reputation - The success of the business may have been due to the previous owners personality and contacts, so may be lost when the business is sold - It may be difficult to assess the valur of goodwill, with the likelihood that is the worth - There may be hidden problems - Some employees may resent any change to the business operation 3. Purchasing a franchise Under a franchise agreement, a person buys the rights to use the business name and distribute the products or services of an existing business. The business that grants the right to others to use its name and products is known as a franchisor, while the business that buys those rights is known as a franchisee. The franchisor supplies a known and advertised business name, the required training and staff development, a method of doing business, management skills and materials. The franchisee supplies the start-up money and labour, operates the franchise business and agrees to abide by the terms and conditions of the franchise agreement. ADVANTAGES - Immediate benefit is derived from the franchisors goodwill because the name is established - The franchisor provides training and management backup - A franchisee can succeed despite having limited experience - Equipment and premises design are usually established and operational - Well-planned advertising often exists - Volume buying is possible, often resulting in cheaper stock - A business plan and proven business methods already exist DISADVANTAGES - The franchisor control the operations, with the little scope for franchisee individuality - Profits must be shared with the franchisor through the payment of ongoing franchise fees - The franchisee is often required to purchase stock from the franchisor and cannot shop around for cheaper supplies - Contracts may be biased in favour of the franchisor - The franchisee must share any burden of the franchisor’s business mistakes 5. MARKET CONSIDERATIONS 6. FINANCE Finance refers to the funds required to carry out the activities of a business. Debt financing is the most popular form of finance as the owner does not have to sell any ownership in the business and there are taxation advantages. There are THREE main terms for debt financing: Short term: less than 1 year Day-to-day workings (working capital = CA - CL) E.G’S include bank overdraft, bank bills and trade credit Medium term: between 1-5 years Used for expansion of business, new equipment E.G’S include term loans, personal loans, leasing Long-term: greater than 5 years Purchase buildings, land, plant and equipment E.G’S include a mortgage (loan secure loan on an asset) Equity finance, also called equity capital, refers to the funds contributed by the business owner(s) to start and then expand the business Cost of finance The cost of finance will depend on the type of finance, the source and the term of finance. For example, Debt finance is borrowed money from an external sources (such as a bank) which requires interest to be charged. Before finance is obtained, owners need to consider establishing costs and operating costs when starting a business. Establishment costs include those costs involved in setting up the business (expenses) Operating costs include those costs involved in the ordinary day-to-day running of the business (expenses) Legal – business name, zoning, health and other regulation All business owners have a legal obligation to observe the statutory regulation when commencing and operating a business. Businesses that do not obey the law risk losing customers and their reputation, being fined, or losing the right to continue trading. Some of the main laws and regulation that SME owners need to comply with are: - Business name registration Zoning Health regulations Trade practices Human resources – skills, costs – wage and non-wage Employees are the most valuable resource of any business. Hiring the right people at the right time, with the right skills in the right quantity is crucial for business success. It an SME owner decides to hire staff, many sources are available. The source chosen will depend on the size of the business, the type of position available and the nature of the labour force. The main sources of employees of for businesses are word of mouth, ads, schools and job searching services. Skills: the business owner has two options - Provide training to improve the skill level of existing employees Recruit people who have the required skills Wage and Non-wage: on-costs are payment for non-wage benefits, including long-service leave, workers compensation and annual leave loading Taxation – federal and state taxes, local rates and charges Taxation is the compulsory payment of a proportion of earnings to the government. There are a number of federal and state taxes that apply to different businesses, and it is important that a person starting a business becomes familiar will all tax requirements if they wish to continue to operate. Businesses pay taxes to their federal and state governments based on what they earn, what they own, and even what they purchase. One of the most important tax obligations is the goods and services. PAYG = imposed on the employee, taken from the employee’s salary or wage directly, taken from the employee’s salary or wage directly, lodged with the tax department by the business, detailed in a group certificate that the employee receives at the end of the financial year, FBT (fringe benefits) = tax on the provision off a benefit to an employment in place of the salary or wage GST = 10% Capital gains = calculated on the profit made on the sale of assets acquired after 19 September 1985, including on the sale of a business or properties bought and resold within 12 months Company Tax – paid on the earning of a company and calculated on the company’s taxable income – calculated at 30 per cent of taxable income Stamp duty – a tax levied on the transfer of property Land Tax – a ta on land owned by individuals or businesses over a certain value Payroll Tax – payable on wages paid by an employer to their employees on payrolls that exceed $750,000 THE BUSINESS PLANNING PROCESS All SME owners must have a good understanding of the role of the business plan and process of business planning. A business plan is the road map for future growth and development within a business. It sets out the desired goals and direction of the business. ELEMENT 1. Executive summary 2. Goals 3. Strategies 4. Business description and outlook 5. Management and ownership 6. Operational plans 7. Marketing plans 8. Financial plans 9. Human resources plans PURPOSE Overview of the plan Hopes to achieve How will the business achieve its goals Overview of the industry and situational analysis Nature and type of organisation Production process and people required for this process Marketing details Description of the businesses financial needs and methods of evaluation of its performance Details of both represent present and future staff requirements Business planning is the process of setting goals and deciding how to achieve them. It acts as a link between the business owners ideas and the actual operation of the business. Sources of planning ideas - Situational analysis in order to develop a business plan and initiate action, business owners need ideas. These ideas or information can come from a variety of sources. These sources can be divided into two categories Internal business environment This covers the factors within the direct control of the owners. It represents what occurs within the business External business environment This is the larger environment within which the business operates. It consists of factors over which the business has little control and represents what occurs on a larger scale of the business INTERNAL STRENGTH WEAKNESS What is the organisation Do we have competent good at? managers and staff? Is our product popular? Is our computer system Are our customers loyal? obsolete? Are workers skilled and Have we experienced past motivated? failure? Do we function efficiently? Have we been updating Are we in a solid financial our facilities to keep at position? pace with others? EXTERNAL OPPOURTUNITIES THREATS What will new technology What trends have been bring for us? evident in our market? Is the national economy Are there any new legal strong? regulations? Are interest rates slow? Are there any new What are our possible new competitors? markets? Are current competitors What other business can taking over our market we acquire to expand? share? Another type of situational analysis is market analysis/research. This should be undertaken to determine if there is a demand for the product or service being produced and if the target market is large enough to support the business. Vision, goals and objectives - Vision A vision statement broadly states what the business aspires to become; its purpose and its function. The main purpose of the vision statement is to guide and direct business managers, owners and employees. Once the business has created a vision statement and analysed its position in the market through a situational analysis, it can determine its business goals and or objectives. - Business goals TERM Vision Goal Objective DEFINITION Broad statement of overall purpose More specific statement of what is intended to be achieved Very specific statement of how the goal is to be achieved Typical goals may be – o o To improve market share To become the largest business in the market Once goals have been established a SME owner must decide how to achieve them. This involves breaking the goals down into specific objectives that will help achieve the business vision. Generally, the senior manager will establish strategic goals. Middle managers will then use strategic goals to establish tactical objectives, followed by supervisors who determine operational objectives. STRATEGIC GOALS TACTICAL GOALS OPERATIONAL GOALS - Determined by senior management Broad aims Long term – years Determined middle management Specific aims Midterm – month Determined by front-line management Specific arms Short term – days/weeks Most business owners try to achieve THREE broad gals – financial, social and personal FINANCIAL GOALS Profit, Market Share, Growth and Diversification and Share Price SOCIAL GOALS: These goals relate to the role of the business in the community. Businesses must be aware of their responsibilities to society and the expectations a community has of the business Community service, employment, social justice and ecological sustainability PERSONAL GOALS: the nature and operation of a business tends to reflect the owners personal goals. Higher income, financial security - Long-term growth If a business wishes to achieve long-term growth it needs to increase sales, profit and market share. To do this it needs a comprehensive strategic plan, which will allow it to produce quality goods and services so that it can achieve a sustainable competitive advantage and strong customer loyalty. Strategies, which may be used to help achieve longterm growth, include: o o o o Customer feedback: customer feedback is important so that the business is consistently upgrading Supplier/customer partnership: provides customer with the opportunity to develop products in consultation with the business designers Product innovation: trying to create new and innovative products Sigma six: the business management approach aims to improve business performance by improving quality, reducing costs and new opportunity Organising resources Once the SME owner had formulated the vision, goals and objectives, the next stage in the planning process is to organise the resources needed to fulfil the plan. This requires resource allocation, which is the efficient distribution of resources so that they successfully meet the set goals STEP 1: develop plans and establish goals STEP 2: determine activities STEP 3: group activities STEP 4: assign work tasks and delegate authority STEP 5: design a hierarchy of relationships o o o o o Operations Involves transforming things What type of equipment and materials What suppliers do we use How much money should we allocate What storage, warehouse and delivery system are required o o o Marketing Adequate resources Additional training Coordination o o o Finance Use debt capital and equity Investors Grants o o Human resources Use good recruitment and selection process Comply with legislation relation to anti-discrimination and equal employment opportunities Forecasting Forecasting means trying to predict what will happen in the future to facilitate forward planning. In most cases it involves giving values or financial projections for sales, output, expenses, quantity and/or quality of resources, time growth or market share. Forecasting tools included break-even analysis and cash flow projections. - Total revenue, total cost: When trying to determine whether a business will be financially successful, a SME owner can attempt to forecast the amount of money the business may receive as sales – its total revenue, and how much it has to pay for business expenses – its total cost TOTAL REVENUE FORCASTING Selling price (P) by the quantity (Q) of goods sold PXQ = TR TOTAL COST FORECASTING Fixed costs and variable costs equals total costs FC+VC= TC - Break-even analysis Break even analysis is used to determine the level of sales needed to be generated to cover the total costs of production. Sales about the breakeven point will make a profit; sales made below the break-even point will incur a loss. This planning tool is used in the strategic planning stage A business that does not cover its costs will make a loss. The breakeven occurs when the revenue of the business equals total costs. After the business has reached the break-even point, every product sold will lead to more profit. Quantity = total fixed costs /unit price - variable costs per unit Fixed costs do not change as sales increase or decrease. They included rent, insurance, salaries of management and office staff, rates depreciation, interest on loans and office expenses. Variable costs increase as sales increase or decrease Total costs are the sum of the fixed costs and the variable costs - Cash flow projections Cash flow projections involve establishing future cash flows and future cash outflows for the business. Forecasts need to be made to show how much money is needed by the business, when it will be needed and where it will come from. The projections should show the changes in the cash made available that are necessary for the business to continue its operations. They should also highlight periods of cash shortage or surplus and therefore giving management time to organise additional funding or develop strategies to cope with the shortfall. Past records provide guide for forecasting Cash flow projections show the changes to the cash position brought about by operating, investing and financial activities of the business. It offers the SME owner a clear indication of how much capital investment the business idea requires. Monitoring and evaluations A good business plan will not guarantee the achievement of the business goals. The plan will be consistently monitored and evaluated so the business can make modifications when necessary. Monitoring is the process of measuring actual performance against planned performance. Evaluating is the process of assessing whether the business has achieved stated goals. 1. 2. 3. 4. Establish goals and objectives (what do we want to achieve) Monitor performance (what actually happens) Evaluate performance (is what is happening good or bad and why is it happening) Take corrective action (what should be done about it) The three most common areas requiring monitoring and evaluation are sales, budgets and profits - Sales Sales are important because they generate revenue for the business. If a new marketing campaign is launched, the owners would expect sales to increase, so if actual sales do not meet expectations the owners would want to know why - Budget Budgets specify the finance needed for the resources required to implement the business’s plans. They outline how the business will use its resources to meet its goals. There are many different kinds of budgets, including project budgets which relate to the development of a new product; cash budgets for cash low and cash flow projections; and marketing budgets for spending on advertising and promotion. Budgets allow managers to compare what actually happens with what had been budgeted and give an indication if plans need to be modified - Profit Profit is crucial to business success and is based on the relationship between costs and revenue. Monitoring and evaluating profit may reveal important information about business costs as well as revenue Taking corrective actions Modifying is the process of changing existing plans, using updated information to shape future plans. Sometimes the PLANNED performance standards are unrealistic when they are first formulated or changes to the external environment make the standards unattainable. Whatever the reason, you cannot continue until the business undertakes some corrective action/modification. - Slowing sales = use promotion strategies Lower profit – investigate methods of reducing costs Poor returns – lower prices Cash flow problems – investigate leasing of equipment CRITICAL ISSUES IN BUSINESS SUCCESS AND FAILURES When a business commences operation, the SME owner is optimistic of success. Most business people are aware of the general pitfalls but all businesses must pay close attention to a number of critical issues Importance of a business plan A business plan should contain said goals – strategies, clear concise goals and reliable control standards for measuring performance. Just like businesses, business plans need to be adjusted to suit changes that occur. Failure to adjust the plan may result in failure. The presentation and preparation of the business plan will reflect the effort and commitment of the business owners Who uses the business plans? Banks, accountants, investors, government and customers Management – staffing and teams Management can be seen as coordinating business resources to achieve its goals. The employees within a business are considered ‘potential’; it is the role of the manager to use this potential to achieve success. A manager’s skill is the most critical factors in determining a business’s success or failures. If an SME owner wants the business to succeed then it is essential to have employees who are satisfied and motivated, as they will be more productive. Overall, the most important accomplishments a skilful manager will achieve for a business include the ability to: - Solve difficult problems Set and help attain important goals Develop attitudes of commitment and ownership Create a positive business culture through their words and actions Monitor the business’s external and internal environments Plan and allocate resources Monitor the performance of teams or individuals Successfully put workplace and business changes into actions Outsourcing this function (HR) can ensure the hasty recruitment and selection decisions are not made. Hiring an expert ensures that eh best person for the job is hired. STAFFING - Positive valued: high productivity, low absenteeism and low staff turnover Therefore the management of the Human Resource must be undertaken with care When employing staff, some business wish to outsource recruitment A community employment agency such as Mission Australia Employment Solutions provides this service at no charge to the business EMPLOYEE SKILLS DATABASES - A skills audit is a process that establishes the current skills levels of employees and future skills requirements The aim of A SKILLS AUDIT is to a. Give a competitive advantage b. Identify weaknesses that threaten the business survival - A skills inventory is a database containing information on the skills, abilities and qualifications of existing staff TEAMS - Very common nowadays – flatter organisational structures Investing time and money in the development of teams to improve productivity How these teams are managed is a critical issue determining a businesses success Trend analysis A trend analysis is a process of investigating changes overtime and looking for a pattern in order to predict the future. A trend analysis will assist a business owner is forecasting factors such as - Potential sales Operating costs Gross net profits Availability of labour A trend analysis is used by businesses to implement appropriate strategies and avoid poor performance. Identifying and sustaining competitive advantage Competitive advantage refers to the strategies used by a business to gain an edge over its competitors. There are 2 key strategies used to gain and sustain a competitive advantage. These are: 1. Price/cost strategy This is best accomplished by achieving the lowest production costs, which in turn allow it to reduce the product price. - Efficiency of operations o Max output while minimising inputs - Low costs labour o Decrease size of workforce and use technology or more operations overseas - Technology o Technology assists the businesses efficiency and therefore minimises costs - Economies of scale o Reduce the cost of inputs by increasing the level of outputs 2. Differentiation strategy - Offering something that is not already offered by another business - This can be achieved through high quality product, design and quality service - Other strategies include celebrity endorsements Once a business gains competitive advantage, they must then sustain this advantage. The ability to sustain competitive advantage is as important as gaining it. For a business to sustain competitive advantage management must - Be dynamic Predict trends and changes Act on these predictions Businesses must also ty to reduce opportunities available for competitors to gain an advantage. This can be done through - Research and development Patents and copyrights Exclusive contracts Lobbying government to restrict imports Avoiding over-extension of finance and other resources Some business owners overextend their capacity in the establishment or takeover stage, resulting in excess expenditure that is financed primarily by external sources such as banks. A business can overextend financially by: - - Using hire purchase and/or leasing commitments made on o Cars o Equipment o Office furniture o Plant and machinery o The premises Purchasing excess stock Employing too many staff for the business’s current need. These expenditures are fixed. Leasing is an effect option but a lot of owners decide to buy the premises and over borrow. This means it harder for the business to make a profit due to the capital and interest repayments. There are many tips for a business of any size and type to avoid overextending financially, including - Business planning Avoiding overdependence on debt financing Long-term financial planning A small start Finance is not the only area in which a business can overextend. Other ways include: Stock: a business that overextends in terms of stock has invested too much money in goods or raw materials. Stock is unrealised sales and a business with too much stock not only ties up its own cash but also potentially loses revenue. Staff: a business many find itself with too many staff. This may be due to over-optimism about sales levels, or just poor job allocations and hiring. There are many ways a business can decrease its dependence on these resources and reduce cots in the long term. These options include - Outsourcing Redefining current job descriptions Using more equipment and machinery Using technology Technological changes have affected upon the internal and external business environments. Communication time delays have been reduced. The integration of technology into the business is essential to succeed in contemporary society. Accessing electronic information services via the internet One of the main advantages of accessing material electronically is that specific information can be located quickly, 24/7. The internet is an easy and cheap way of collecting information. You can use it for individual requests such as legal requirements, techniques, changes (taxation) and WHS. Some disadvantages include expenses in terms of hardware, connection and software, slowness, viruses, spam and information overload E-business An electronic business uses the internet to conduct business. They use the internet to find information, use email to communicate with customers and supplier and working E-commerce Electronic commerce is the buying and selling of goods and services via the internet. Due to the perceived cost and complexity of e-commerce, some small business owners are tentative in their use of it. Economic conditions Economic conditions that promote business success When an economy is in a boom, it will most likely mean that consumers are prepared to increase their spending because consumer confidence is high. In periods of strong economic activity the economy will experience: 1. High levels of consumer spending. 2. Falling unemployment 3. Increased production Economic conditions that lead to business failure When an economy is in a downturn, it will most likely mean that consumers are not spending as much. This is because consumer confidence is low. In periods of weak economic activity the economy will experience 1. Low levels of consumer spending 2. Rising unemployment 3. Decreased production