Management of Financial Institutions

Anthony Saunders and Marcia Cornett

Teaching Notes

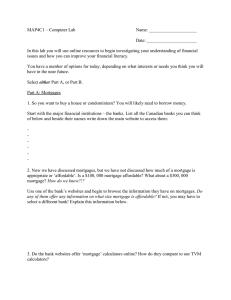

Chapter 01 - Introduction

Chapter One

Introduction

I. Chapter in Perspective

This chapter has three major sections and one minor section. It first provides a general

overview of the major types of U.S. financial markets, focusing primarily on terminology

and descriptions of the major securities, market structures and regulators. Market

microstructure is not discussed. Foreign exchange transactions are also briefly

introduced. The second major goal of the chapter is to describe the various types of

financial institutions, explain the risks they face and the services they provide to funds’

users and funds’ suppliers. The chapter concludes by providing some statistics about the

rapid growth of globalization of both markets and institutions.

II. Notes

1. Why Study Financial Markets and Institutions?

For an economy to achieve its potential growth rate, mechanisms must exist to effectively

allocate capital (a scarce resource) to the best possible uses accounting for the riskiness of

the opportunities available. Markets and institutions have been created to facilitate

transfers of funds from economic agents with surplus funds to economic agents in need of

funds. For an economy to maximize its growth potential it must create methods that

attract savers’ excess funds and then put those funds to the best uses possible, otherwise

idle cash is not used as productively as possible. The funds transfer should occur at as

low a cost as possible to ensure maximum economic growth. Two competing alternative

methods exist: direct and indirect financing. In direct financing the ultimate funds

supplier purchases a claim from the funds demander with or without the help of an

intermediary such as an underwriter. In this case, we rely on primary markets to

initially price the issue and then secondary markets to update the prices, monitor any

contractual conditions and provide liquidity. In indirect financing, the funds demander

obtains financing from a financial intermediary. The intermediary and the borrower

negotiate the terms and cost. The intermediary obtains funds by offering different claims

to fund suppliers. In this case the intermediary is usually responsible for monitoring the

contractual conditions of the financing agreement and perhaps updating the cost if needed

or appropriate.

With the pace of globalization and increasing deregulation of financial institutions,

managing risk and maintaining profits in a rapidly changing, increasingly competitive

global market is of paramount importance. Institutions continue to merge within and

across traditional financial product lines in an attempt to exploit perceived economies of

scale and scope and to prevent others from gaining similar advantages over them. The

pace of innovation of new technology, new financial products and services has not

abated. In particular, we are on the cusp of many technological advances that may

change traditional methods of offering financial services at the wholesale and perhaps

eventually at the retail level. Job opportunities for finance students in markets and

institutions are likely to be excellent in the next twenty years as managing risks at

1-2

Chapter 01 - Introduction

intermediaries in increasingly complex and competitive businesses will grow in

importance. The text provides an introductory examination of the functions and

characteristics of markets and risk and profitability management at major financial

institutions in order to help students understand the workings of the financial system in

today’s global economy.

Fallout from corporate and Wall Street scandals continues, underscoring the failure of

corporate governance and regulatory agencies to limit managerial misbehaviors as the

pressure to meet short term earnings targets created need and opportunity for managers of

corporations and financial institutions to act unethically. Measuring the cost of the

resulting loss in investor confidence from managerial misdeeds (often aided by Wall

Street’s elite banking and investment banking firms) is difficult at best, but must be

several billions of dollars at least. The scandals and failure of corporate governance led

to the passage of the Sarbanes-Oxley Act (S-O Act). The S-O Act is an attempt to

reduce conflicts of interest and increase management and board accountability for

financial information disclosed by firms. Laws by themselves are insufficient to ensure

proper behavior. Practitioners and academics also need to increase the emphasis placed

on applications of corporate ethics and individual accountability.

2. Overview of Financial Markets

a. Primary Markets vs Secondary Markets

b. Money Markets vs Capital Markets

The two alternative mechanisms of fund raising are direct financing, where the saver

directly purchases a claim from the ultimate funds user in the primary market, or

indirect financing where savers place their money in a FI and the FI lends money to the

ultimate borrower. In the cases where savers desire to place their money directly in the

markets, institutions such as investment bankers (asset brokers) have evolved to assist in

this process. The first time a firm issues securities to the public is referred to as its initial

public offering (IPO). Issuing additional stock of a firm that already has stock publicly

traded is referred to as a seasoned offering. In some cases firms offer the issue to one or

only a few institutional buyers. This is termed a private placement. Until recently

secondary trading of private placements was restricted. Institutions may now trade

privately placed securities among themselves and high net worth individuals.

The primary markets are the markets where firms (and other borrowers) create and sell

new securities in order to raise cash to fund positive NPV projects (or to meet some other

social goals in the case of non profit fund raisers).

Ethics Tip:

There have been serious breaches of ethics by investment bankers in allocating IPO

business such as ‘spinning’ and ‘laddering.’ Many IPOs are oversubscribed, allowing

the investment banker to choose who will receive the issue. Spinning is allocating the

new issue to firms or private accounts of the CEOs of client firms in exchange for IB

business later on or some other perk. Laddering is allocating IPO shares to those who

agree to buy more shares in the aftermarket, driving IPO prices up, which the buyers then

dump shortly thereafter after the price run-up. Since the short term performance of IPOs

1-3

Chapter 01 - Introduction

is often quite good, the favored clients who receive the allocations often get abnormally

high gains. Investment bankers were also apparently guilty of issuing overly optimistic

stock research reports to help support the underwriting business. At some firms bonuses

paid to research analysts were based on the level of underwriting business generated by

the institution.

The secondary markets exist to provide liquidity and price information to investors.

These functions make the primary market more attractive. Investors would be far less

likely to invest in risky long term primary securities unless investors believe they can

remain apprised of the current value of their claims and have the ability to sell these

claims quickly at low cost if they choose. Hence the efficiency of operation of the

secondary markets affects the growth rate in the overall economy through their effect on

the primary markets. Secondary market trading volume has risen dramatically in the last

several decades, particularly with the creation of wholesale and retail electronic trading

mechanisms that have substantially reduced trading costs.

Money markets evolved to meet the short term investment needs (1 year or less) of

corporations and institutions desiring to earn a small positive rate of return on cash that

would be needed shortly, hence they have evolved with high denomination safe securities

that have little risk of principle loss. Capital markets are markets where borrowers raise

cash for long term investment needs. These are generally riskier than money markets and

hence, capital market securities must promise to pay a higher rate of return to attract

funds. Savers willing to take the associated risk are attracted to these markets.

Selected Money Market Instruments, billions of dollars, amounts outstanding

% Total

3rd Qtr 2007 % Total

3rd Qtr 2004

$1,676.2

32%

$2,799.1

35%

Fed Funds & Repos

$1,316.4

25%

$1,857.3

24%

Commercial Paper

$ 961.0

19%

$ 954.0

12%

T-bills

$

4.3

0%

$

0.3

0%

Banker’s Acceptances

$1,221.8

24%

$2,284.0

29%

Negotiable CDs

$5,179.7

100%

$7,894.7

100%

Totals

Sources: Federal Reserve Board, Flow of Funds Accounts, Levels Tables and GAO-08-168 Schedules of Federal Debt

Commercial paper has rebounded from declines in the early 2000s while the amount of

negotiable CDs is up appreciably over the period.

Selected Capital Market Instruments, billions of dollars, amounts outstanding

3rd Qtr 2004

% Total

3rd Qtr 2007

% Total

Common Equity

$15,627.1

35%

$22,445.0

37%

Corporate Bonds

$ 6,879.4

16%

$10,581.8

18%

Municipal Securities

$ 2,012.0

5%

$ 2,370.6

4%

Mortgages

$10,127.8

23%

$14,360.2

24%

Treasury Securities*

$ 3,308.2

8%

$ 3,473.8

6%

Agency/GSE Securities**

$ 6,090.0

14%

$ 7,107.1

12%

Totals

$44,044.5

100%

$60,338.5

100%

1-4

Chapter 01 - Introduction

* Marketable, excluding T-bills ** 2004 data for this account is year end

Sources: Federal Reserve Board, Flow of Funds Accounts, Levels Tables and GAO-08-168 Schedules of Federal Debt

While mortgages have grown in absolute terms between 2004 and 2007, as a percentage

of the given capital market instruments mortgages have remained approximately stable.

Equity market values increased by about 44% over the time period.

c. Foreign Exchange Markets

The majority of the world’s business involves international business transactions. It is

increasingly important for firms to recognize that the appropriate investment may be

located in Europe, the lowest cost source of funds may be found in Britain instead of the

U.S., or the highest potential growth rates for sales of a firm’s product may be in Asia.

As corporations and institutions have increased their international transactions, foreign

exchange risk has become a major source of risk for many firms today and much hedging

with spot and forward foreign exchange trades occurs.

Historically, when a nation’s current account deficit surpasses 5% of GDP a correction

occurs in currency value. The U.S. has been able to consistently run current account

deficits above 5% because foreigners have been willing to supply funds to U.S. markets.

For instance, foreign central banks continue to purchase dollars to keep local currencies

down to foster their export sectors. Moreover, the U.S. economy and the dollar remain

key generators of global growth; these factors help the dollar maintain its value in the

global market. Nevertheless over the last six years the dollar has dropped about 40%

against the euro and about 20% against a broader basket of currencies.1 The dollar’s drop

is fueling inflation concerns and increasing commodity prices because most commodities

are priced in dollars regardless of where they are traded globally.

d. Derivative Security Markets

A derivative security is a contract which derives its value from some underlying asset or

market condition. In general, the main purpose of the derivatives markets is to transfer

risk between market participants. Some participants, called hedgers, enter derivatives

contracts to reduce their risk exposure in the underlying cash market. Other participants,

called speculators, use derivative contracts to bet on price movements. Derivatives are

highly leveraged instruments. This allows hedgers to reduce risk with a low capital

investment and the leverage also allows speculators to attempt to earn high rates of return

with low capital investments. The two main types of derivatives markets are the market

for exchange traded derivatives and the over the counter (OTC) derivatives markets.

Exchange traded derivatives are generally liquid and involve no counterparty risk,

whereas OTC contracts are custom contracts negotiated between two counterparties and

have default risk.

e. Financial Market Regulation

1

Dollar's Dive Deepens as Oil Soars: Power of Greenback Faces Severe Test, But No Rivals Loom By

Craig Karmin and Joanna Slater, February 29, 2008; Page A1.

1-5

Chapter 01 - Introduction

Financial markets are regulated by the SEC, the exchanges, the Commodity Futures

Trading Commission (CFTC) and the National Association of Security Dealers (NASD).

The primary purposes of regulations are to prevent fraud, to ensure performance as

promised, and to ensure that the public has enough information to evaluate the riskiness

of an investment. The regulators do not attempt to ensure investors earn a minimum rate

of return. Recently, some specialists on the NYSE agreed to pay fines because of

allegations of front running customer orders. In front running, specialists transact their

own orders ahead of customer orders for the specialists’ advantage. Decimalization,

automation and competition from electronic communications networks (ECNs) have

reduced specialist profits creating temptations to find other ways to generate revenue.

3. Overview of Financial Institutions

Many savers today are willing to risk some of their funds in the capital markets, but not

all. For at least some of their wealth, savers typically desire a different type of claim than

the ultimate borrower wishes to offer. Asset transformers, such as banks, have evolved

to meet this need by offering low risk claims to savers while granting higher risk, more

illiquid investments (e.g., loans) to the funds demanders. Other types of institutions have

evolved to meet special needs of savers such as life insurance firms to eliminate certain

risks, pension funds to transfer wealth through time, money market mutual funds to pool

investors’ savings, etc.

NUMBER OF

TOTAL

FEDERALLY

ASSETS

INSTITUTION

INSURED

(BILL $)

INSTITUTIONS

Commercial Banks

$10,793

7,303

Savings Associations

$ 1,914

1,257

Credit Unions

$ 748

8,362

Insurance Companies

$ 6,334

Private Pension Funds

$ 5,875

Finance Companies

$ 1,397

Mutual Funds

$ 7,967

Money Market Mutual Funds

$ 2,802

Investment Bankers

$ 3,201

Data from September 2007, data sources include Federal Reserve Board, Flow of

Funds Accounts, Levels Tables, FDIC Stats at a Glance,” and the NCUA website. The

mutual funds category excludes money market funds.

Deposit-Type Institutions -- Offer liquid, government insured claims to savers, such as

demand deposits, savings deposits, time deposits, and share accounts.

• Commercial Banks -- Make a variety of consumer and commercial loans (direct

claims) to borrowers.

• Savings and Loan Associations -- Make mortgage loans (direct claim) to borrowers.

• Mutual Savings Banks -- Purchase various securities and make loans -- mortgages,

consumer loans, government bonds, etc.

• Credit Unions -- Receive share account deposits and make consumer loans.

Membership requires a common bond, such as a church or labor union.

1-6

Chapter 01 - Introduction

Non-depository institutions:

• Life Insurance Companies -- Provide life insurance and long-term savings

opportunities for savers.

• Casualty Insurance Companies -- Provide auto, home insurance, purchase direct

financial securities with paid-in-advance premiums from insurance purchasers.

• Pension Funds -- issue claims to savers or provide investment plans that allow savers

to transfer wealth through time and to future generations.

Other Types of Financial Intermediaries:

• Finance Companies -- Borrow (issue liabilities) directly from banks and directly from

savers (commercial paper) and make/purchase riskier consumer and business loans.

• Mutual Funds -- Offer indirect mutual fund shares to savers and purchase direct

financial assets (e.g. stocks and bonds).

• Money Market Mutual Funds -- Offer (indirect) shares and purchase direct

(commercial paper) and indirect (bank CDs) money market financial assets.

• Investment Bankers -- Purchase securities from borrowers and repackage the payment

streams, creating new securities to sell to savers. Assist borrowers in selling direct

claims to savers.

• E-brokers -- E-brokers provide securities trading services over the Internet. Actually,

E-brokers are following one of four business models. A few, such as Schwab, seek to

be an online financial supermarket providing banking, insurance, portfolio

management and brokerage under one brand. Hybrids provide discount commissions

but provide some investment advice and research, some pure discount firms seek to

compete only on price and a few E-brokers are providing specialized services such as

access to special markets or extended credit.

a. Unique Economic Functions Performed by Financial Institutions (FIs)

Relative to the choices available to many savers who invest directly in the markets, FIs

provide savers with very safe, liquid claims with fairly small denominations. FIs then in

turn lend money to funds demanders. The ultimate borrowers, say corporations, issue

risky claims (loans or bonds) held by FIs. The individual savers need not investigate the

riskiness of the corporate borrowers, the FI will do that. Consequently, FIs allocate

capital in an economy. FIs must then be able to accurately assess, price and monitor

risks of borrowers for an economy to achieve its potential growth rate. FIs must also

carefully manage their own risk since they are borrowing money from savers at low risk

and then investing the money in higher risk loans and securities in order to earn a profit.

By carefully evaluating the riskiness of potential investments and by diversifying their

loan and investment portfolios, lending institutions employ the law of large numbers to

reduce their risk exposure.

The instructor should note that both markets and institutions assess, price and monitor

risk. In some cases however, institutions can perform these functions better than the

markets. In this sense the institution is serving as a delegated monitor. For instance, in

situations where the borrower is reluctant to make information public or frequent

1-7

Chapter 01 - Introduction

monitoring is needed or when special additional financing requirements may be

necessary, bank loans may be preferable to a public bond issue.

The federal government insures deposits of certain intermediaries. Because of deposit

insurance, depositors do not require a risk premium to place money in an insured

institution. In effect, government insurance subsidizes risk taking at depository

institutions. The government insurance liability requires that insured depository

institutions be regulated to limit the government’s liability and to limit imprudent risk

taking at these institutions.

b. Additional Benefits FIs Provide to Suppliers of Funds

Funds suppliers who place their money in a FI generally get the following benefits:

Reduced transaction costs due to economies of scale in information production2

o Maturity Intermediation (Intermediation is investing in a financial intermediary

(FI) and maturity intermediation is accomplished when a FI grants a saver a

different maturity investment than the maturity of the FI’s own claims on

borrowers)

o Denomination Intermediation

o Improved liquidity

o Reduced default risk due to deposit insurance and/or the FI’s equity.

Note that a low rate of return is the cost of the safety and convenience of investing in a FI

as opposed to a capital market instrument.

c. Economic Functions FIs Provide to The Financial System as a Whole

Depository Institutions (DIs) also have a unique role in the transmission of monetary

policy because their claims are part of the money supply and because they assist in

providing large amounts of payments services such as check clearing and wire transfers

in the economy. As mentioned above, DIs allocate credit in an economy. If DIs perform

the credit allocation function poorly long term economic growth will not be maximized.

Certain FIs are also granted special tax status to assist individuals in transferring wealth

through time or to the next generation.

d. Risks Incurred by Financial Institutions

All FIs face a variety of risks, but generally speaking all FIs face

• Default risk on at least a portion of their assets

• Market risk, or the risk that the value of FI investments may change

• Liquidity risk, due to mismatch in maturity of assets and liabilities

• Interest rate risk due to the same mismatch above

• Foreign exchange risk due to foreign currency assets and liabilities or changing

competitive conditions with foreign FIs as currency values fluctuate

• Operating cost risk because there are fixed costs involved in providing all

financial services

• Insolvency risk, any of the stated risks may result in insolvency at a FI.

2

Economies of scale (EOS) indicate that a firm’s unit profits grow as it becomes larger. Fixed costs lead to

EOS.

1-8

Chapter 01 - Introduction

Some FIs face:

• Sovereign risk on overseas investments

• Off balance sheet risks due to contingent assets and liabilities

• Technology and Operational risk due to either overinvestment in a technology

relative to customer demand, or a failure of technology respectively.

e. Regulation of Financial Institutions

FIs hold savers’ funds. Should even one FI default many people’s wealth could be

destroyed unless the government intervenes. Government institutions such as the Federal

Deposit Insurance Corporation (FDIC) can handle a limited number of simultaneous

failures. Systemic risks or system wide failures, perhaps due to contagion, among any

group of FIs could not be handled by our existing regulatory structures. Contagion

occurs when failure of one or a few institutions causes widespread failures, at an extreme

resulting in an economic crash similar to the Depression of the 1930s. Part of the fear of

contagion arises because most FIs are 1) highly leveraged and 2) operate on the principle

that the majority of claimants will not seek to withdraw their funds at the same time as

FIs don’t keep all of the savers’ funds in the vault available for immediate withdrawal.

The government must regulate DIs because of the deposit insurance liability. Regulation

is also necessary to prevent fraud and discriminatory practices. Regulations impose a

cost on society by adding to the cost burden of FIs, which must be passed on to either

borrowers in the form of higher costs, or as reduced rates of savings for investors in FIs.

Recent regulatory changes have allowed FIs to engage in more activities and increased

the level of competition among institutions. As a result regulators have been forced to

develop more sophisticated measures of risk and incentives for institutions to limit risk.

4. Globalization of Financial Markets and Institutions

Recent decades have witnessed the globalization of financial markets to an

unprecedented degree. For instance, at times trading in foreign equities exceeded trading

in U.S. equities and to a greater extent than ever, events ‘there’ affect markets ‘here’ and

vice versa. Although the U.S. markets are still the largest, the advent of the Euro (the

common currency in Europe) has already led to rapid growth in Euro financing. For

instance, Eurobonds are a significant source of financing for many U.S. firms and they

represent an alternative to a domestic bond issue. Eurobonds are bonds issued outside the

home country but are in the home currency. The growth in foreign financial markets has

five ongoing causes:

1. Greater pool of savings in foreign countries.

2. Better investment prospects outside of countries with large savings.

3. The Internet has improved information availability on foreign markets and securities.

4. Low cost methods to invest in foreign securities have proliferated (such as ADRs).

5. Deregulation around the world has allowed investors to purchase more foreign

securities.

1-9

Chapter 02 – Determination of Interest Rates

Chapter Two

Determination of Interest Rates

I. Chapter in Perspective

This is the first of several chapters that familiarize students with the determinants of

valuation of bonds and related securities. In this chapter the authors first focus on the

economic determinants of interest rates using the flow of funds theory of interest rates.

Subsequently, unique characteristics of securities that give rise to different interest rates

are discussed. This chapter has four major sections. The first section provides a review

of basic time value calculations. The authors present the annuity equations in summation

form (they do not present the closed form equations). Closed form versions are provided

in the IM. The second major topic covers interest rate formation in a ‘loanable funds’

framework. The loanable funds theory is the most basic explanation of real interest rate

formation in the economy and is easily understood by students. The loanable funds

theory describes general economic forces in the economy that determine the opportunity

cost of funds which may be thought of as the real, riskless rate. The next section explains

why individual investments have different interest rates because of their unique

characteristics. The effect of maturity on interest rates is explained in greater detail in the

term structure discussion. The three main theories of the term structure are presented.

The chapter concludes with a brief example of using term structure mathematics to

forecast interest rates.

1. Interest Rate Fundamentals: Chapter Overview

The interest rates that you actually see quoted are nominal interest rates; as a result,

nominal rates are sometimes called ‘quoted rates.’ The purpose of the chapter is to

examine the components of the nominal interest rate. They are a) the real riskless rate of

interest that is compensation for the pure time value of money, b) an expected inflation

premium that is time dependent and c) a risk premium for liquidity, default and interest

rate risk.

2. Time Value of Money and Interest Rates

a. Time Value of Money

b. Lump Sum Valuation

c. Annuity Valuation

The real rate of interest is the additional compensation required to forego current

consumption. This is the essence of the time value of money. That is, the value we place

on money depends upon when the money is received (paid) and the time preference for

consumption. Simple interest is earned if the investor spends the interest earnings each

period; compound interest assumes the interest earned per period is reinvested. Present

and future values of lump sums and annuities are covered but the closed form formulas

for the annuities are not presented. If the instructor wishes to include them they are:

PV = PMT × (1 – (1+i/M)–N×M) / i

FV = PMT × ((1 + (i/M))N×M – 1) / i

i = nominal rate

PMT = annuity payment

2-1

Chapter 02 – Determination of Interest Rates

N = number of years

M = number of compounding periods per year

Comparative statics for lump sum and annuity calculations are discussed in the text.

d. Effective Annual Rate

For investments with maturities other than annual one may need to calculate an

equivalent annual return (EAR) in order to compare rates among investments with

different maturities (compounding frequencies). The EAR is the equivalent annual rate

that would give the same future value if the investment had only annual compounding.

3. Determinants of Interest Rates For Individual Securities

a. Inflation

b. Real Interest Rates & Fisher Effect

Inflation is the rate of change in the overall price level. The Consumer Price Index

(CPI) is the most commonly quoted measure of inflation. The CPI purports to measure

the price level of a market basket of goods and services purchased by the typical urban

consumer.

The Fisher effect states that nominal rates equal real rates plus a premium for expected

inflation. This relationship is the basis for the term structure. Differences in annual

expected inflation rates cause differences in bond rates with different maturities.

The nominal interest rate is the additional dollars earned from an investment. The real

interest rate is the additional purchasing power earned from an investment. The real

interest rate refers to the marginal gain in units purchased rather than in dollars.

Sometimes we think that ex-ante real rates cannot be negative, but they can because of

the convenience yield of liquidity. They have been negative in recent years in both the

U.S. and Japan.

The Fisher Effect relates nominal and real interest rates.

The approximate Fisher effect is given as

i = RIR + Expected (IP)

where i = nominal interest rate, RIR = real interest rate and Expected (IP) = expected

inflation.

The actual Fisher Effect is given as

(1+i) = (1+RIR)*(1+Expected(IP))

2-2

Chapter 02 – Determination of Interest Rates

The following example illustrates why the actual Fisher Effect is multiplicative:

Suppose “It” originally cost you $1. You have $10 so could buy 10 of “it.”

If inflation is 5%, in one year “it” will cost $1 + .05 =$1.05.

If you invest your $10 and earn 10% + 5% = 15% (the approximate Fisher Effect)

you will get back $10 * 1.15 = $11.50.

Can you buy $10% more of “it?” I.E. can you now buy 10 * 1.1 or 11 of “it?”

11 * $1.05 = $11.55; so you are short 5 cents.

In order to buy 10% more of it you must earn an interest rate equal to (1.10 * 1.05) 1 = 1.155 - 1 = 15.5% nominal interest.

Then your $10 will grow to $10 * 1.155 = $11.55 and you CAN buy 10% more of it!

Since both P & Q are rising, the rate charged must reflect the increments to both P

and Q.

The difference matters little if inflation is low and/or the time period under

consideration is not very long. In international investing environments where

inflation is much higher than the U.S. is currently experiencing, the difference can

be material.

c. Default or Credit Risk

Default risk premiums (DRPs) are increases in required yield needed to offset the

possibility the borrower will not repay the promised interest and principle in full or as

scheduled. According to the Wall Street Journal Online, May 5 edition, credit risk

premiums on Aa rated corporate debt relative to Treasuries were 1.95% and were 2.77%

on Baa rated debt. DRPs on high grade debt were about 6.60%. DRPs are cyclical, and

rise in periods of weak economic conditions such as the U.S. was experiencing in 2008.

d. Liquidity Risk

Liquidity risk premiums are increases in required or promised yields designed to offset

the risk of not being able to sell the asset in timely fashion at fair value. These are similar

to, but not the same as, the liquidity premiums in the term structure discussion. Liquidity

risk can be more significant for some debt instruments than for stocks as many bonds

trade in thin markets.

e. Special Provisions of Covenants

♦ Municipal bond (Muni) rates are lower than similar corporate bonds because interest

(but not capital gains) is exempt from federal taxation. In most states the holder of a

muni bond issued in that state is also exempt from state taxes.

Why munis are granted special tax status. What do they think about industrial

development bonds which allow private corporations to issue tax advantaged munis

for certain projects? Note that usage of IDBs has been restricted in recent years due

to over usage by private firms seeking to exploit the tax advantage of munis.

♦ Callable bonds have higher required yields than straight bonds because the issuer will

normally call them when rates have dropped, forcing the bondholders to reinvest at

lower interest rates. Although it varies with interest rate expectations the premium on

a callable bond might be 30 to 50 basis points.

2-3

Chapter 02 – Determination of Interest Rates

♦ Convertible bonds have lower yields than straight bonds because the bondholder has

the right to convert them to preferred or common stock at their choice. Offering a

conversion feature may save 100 to 200 basis points, ceteris paribus. In most cases

however, the stock has to appreciate 15%-25% over the at issue price in order to

make conversion attractive.

f. Term to Maturity

The term structure depicts the relationship between maturity and yields for bonds

identical in all respects except maturity. In practice, ‘identical’ means same rating,

liquidity and hopefully the same coupon (or differential tax effects will be present). The

graph of the term structure can take on any shape, but upward sloping is most common

(meaning longer term bonds promise higher nominal yields). The yield curve was

inverted in Nov 2000 and in parts of 2006 and 2007. Note that for Treasuries, ‘on the

run’ (newly issued) securities often carry price premiums over ‘off the run’ (previously

issued) securities.

g. Summary

ij* = f(Riskless real rate, Expected inflation, Default risk premium, Liquidity risk

premium, Special covenant premium, Maturity risk premium)

The maturity risk premium is explained in Section 6 where it is defined as the premium

for holding a price volatile asset (confusingly called a liquidity premium).

4. Term Structure of Interest Rates

a. Unbiased Expectations Theory (UET)

The UET states that the long term interest rate is the geometric average of the current and

expected future short term rates. A simple arbitrage proof can be used to show this when

interest rates are known with certainty under perfect markets:

If the expected one year rates are 6%, 7% and 8% for the next three years respectively,

and the three year rate is 5%, how could one make money on this relationship?

Using the text’s terminology: 0R1 = 6%, 1R1=7% and 2R1 = 8% but 0R3=5%

The average of the short term one year rates is 7%, but the three year rate is only 5%.

One could borrow any given amount such as $1000 for the full three years and invest that

money one year at a time and rolling over the investment for three years. The borrowing

cost per year is 5% and the average rate of return is 7%. This is a riskless arbitrage under

the given assumptions that would force the three year rate and the average of the one year

rates to converge.

The instructor may wish to show this relationship first using simpler arithmetic averages

as above since students often seem to struggle with the concept of geometric averages.

Geometric averages are used to account for compounding; for examples of two or three

years where the rates are similar, the use of arithmetic averages will give almost identical

results if the returns are similar to one another.

2-4

Chapter 02 – Determination of Interest Rates

For a series of holding period returns (HPRs) the geometric average can be found as:

N

Geometric Average =

(1 + HPRT )

T =1

∏

1/ N

−1

For example if we have a time series of three returns of 10%, -15% and 12% the

arithmetic and geometric averages are 2.33% and 1.55% respectively:

(10% + −15% + 12%)

= 2.33%

3

1/ 3

Geometric Average = [1.10 × 0.85 × 1.12] − 1 = 1.55%

Arithmetic Average =

++

The critical concept to understand is that under the UET an investor is indifferent

between how one arrives at an N year investment. For example, one can invest for N

years all at once, or invest for 1 year and roll the investment over N-1 times.

b. Liquidity Premium Theory

If investors prefer shorter maturities to long, they will require a premium to invest for N

years all at once instead of investing for 1 year and rolling the investment over N-1 times.

In other words, the long term rate cannot be the average of the expected short term rates.

The long term rate must equal the average of the short term rates plus what is illogically

called a ‘liquidity premium.’ (It is an illiquidity premium.) The rationale for the shorter

maturity preference is that with uncertainty about future rates, it is riskier to invest long

term rather than investing for a shorter time and rolling the investment over because it is

harder to forecast rates further in the future and longer term investments are more price

volatile. This is a modification of the UET, but it does not invalidate the logic of the

UET. It does imply that long term rates are biased forecasters of expected future short

term rates. We don’t know very much about the size of the liquidity premiums. They

increase with maturity, and probably do not get much over 100 to 200 basis points.3

c. Market Segmentation Theory

Market segmentation or preferred habitat theory claims that there are two or three distinct

maturity segments (the segments are ill-defined) and market participants will not venture

out of their preferred segment, even if favorable rates may be found in a different

maturity. A less extreme version posits that a sufficient interest rate premium may

induce investors to switch maturity segments. The idea behind segmentation is that

institutions naturally have liabilities of a distinct maturity, e.g., life insurers have long

term liabilities, so they will not invest short term. Hence, there is no or only a very weak

relationship between interest rates of different maturities and supply and demand of a

given maturity sets the individual interest rates. By inference, there is no reason to

construct a term structure as there is no relationship between long term rates and expected

future short term rates. This is unlikely to strictly hold because it suggests that

opportunities to take advantage of mispricing of securities will not be exploited. For

3

Although not often recognized, it is possible for liquidity premiums to be negative. If investors have long

investment horizons it is actually less risky for them to hold long duration bonds (as opposed to short

duration) to minimize their interest rate risk. If the majority of investors have long time horizons then it

would be riskier to hold short term, low duration investments. This could make long term investments

preferable to short term, implying that the liquidity premium would have to be negative.

2-5

Chapter 02 – Determination of Interest Rates

example if the 10 year bond rate is much higher than warranted by expectations, one

could buy the 10 year bond and short a 9 year bond. If the rates on different maturities

get far enough out of line with expectations, some entity will seek to exploit the profit

opportunity. If existing investors will not exploit the opportunity, new investors will

emerge to do so in a capitalist system. On the other hand, daily changes in supply and

demand and changes in non-price conditions can certainly cause long term rates to

diverge from the average of expected future short term rates. These create profit

opportunities for astute bond traders. If bond markets are reasonably efficient, these

profit opportunities should not last long.

5. Forecasting Interest Rates

A forward rate is a rate that can be imputed from the existing term structure. It is a

mathematical tautology that given a set of long term spot rates one can find the set of

individual one year forward rates. For instance using the books terminology:

(1+1R6)6 = (1+1R5)5 * (1+5F1)

(1+1R5)6 = (1+1R4)4 * (1+4F1) …

where 1R6 and 1R5 are the long term spot rates from today to year 6 and 5 respectively and

F stands for a forward rate. The first subscript refers to the loan origination date, but the

textbook confusingly uses 1 instead of 0 as is normal to represent today. The second

subscript refers to the term to maturity. Since all the spot rates are known one can

construct the full set of forward rates, iF1, from them.

Interpreting the forward rates If the UET strictly holds then forward rates are an

unbiased estimate of expected future annual rates. If there are liquidity premiums, one

should subtract the liquidity premium from the forward rate before using it as an estimate

of the expected future spot rate. If segmentation strictly holds, the forward rate has no

economic meaning.

2-6

Chapter 03 - Interest Rates and Security Valuation

Chapter Three

Interest Rates and Security Valuation

I. Chapter in Perspective

This is the second chapter that is designed to familiarize the students with the

determinants of fixed income valuation. This chapter has seven closely related sections

which focus primarily on bond pricing and the bond price formula. From the first three

sections of the chapter readers should learn how to calculate a bond’s price, the

difference between the required rate of return, the expected rate of return and the realized

return and how to calculate each. Efficient markets are briefly introduced by relating the

expected and required rates of return and by comparing market prices to calculated fair

present values. Section 4 introduces bond price volatility and illustrates how changing

interest rates can affect FIs. Sections 5 and 6 discuss the effects of maturity and coupon

on bond price volatility. Section 7 introduces the concept of duration and illustrates how

to calculate Macauley duration. Appendix 3A provides an example of immunization

using duration and Appendix 3B explains more about the concept of convexity and

demonstrates the effect of convexity on bond price predictions.

1. Interest Rates as a Determinant of Financial Security Values: Chapter Overview

This chapter applies the time value of money concepts developed in Chapter 2 to explain

bond pricing and rates. The determinants of bond price volatility, duration and convexity

are also discussed. Financial intermediaries are subject to risk from changing interest

rates (termed interest rate risk) because changing rates can cause changes in profit flows

and in market values of both assets and liabilities. This chapter provides the building

blocks needed to understand how to measure and manage interest rate risk.

2. Various Interest Rate Measures

a. Coupon Rate

b. Required Rate of Return

c. Expected Rate of Return

d. Required Versus Expected Rates of Return: The Role of Efficient Markets

The bond’s coupon rate is the annual dollar coupon divided by the face value. Although

the coupon rate is quoted annually, bonds usually pay interest semiannually. If a bond

has no periodic interest payment it is a zero coupon bond. The required rate of return

(rrr) is the annual compound rate an investor feels they should earn on a bond given the

risk level of the investment. The rrr is used as the discount rate in the bond price formula

to calculate the fair present value (PV) of the security. The PV is then compared to the

existing market price to ascertain whether the security is over, under or correctly valued.

The expected rate of return (Err), or promised yield to maturity, is the annual

compound rate of return the investor can expect to earn if he/she 1) buys the bond at the

current market price, 2) holds the bond to maturity and 3) reinvests each coupon for the

remaining time to maturity and earns the Err on each coupon. The Err may be

calculated using the current market price as the present value and the expected cash flows

in the bond price formula. Note that this definition of the Err assumes that either there is

3-1

Chapter 03 - Interest Rates and Security Valuation

zero possibility of default risk, or the expected cash flows used in the bond price formula

are probability weighted according to the expected probability of default. If the Err is

greater than the rrr, the security is overvalued. If the bond markets are efficient any

divergences between the market price and the PV (or the rrr and Err) are quickly

arbitraged away.

Calculating PV:

For a $90 annual payment coupon corporate bond, with rrr = 10% maturing in n = 6

years:

1

1 −

n

Par

(1 + rrr)

PV = $C ×

+

(1 + rrr)n

rrr

1

1

−

(1.10)6 $1000

+

$956.45 = $90 ×

6

0

.

10

(1.10)

Equation 1

If this same bond has an actual market price of $945, what is the Err?

1

1 − (1 + Err)6

$1000

+

$945 = $90 ×

6

Err

(1 + Err)

Err = 10.27%

Equation 2

This bond would be a good buy since the market price is less than the fair PV. If the

appropriate opportunity cost (rrr) is 10%, the investor can expect to earn more than he or

she should (10.27%) for the risk level the investor is bearing.

The third assumption underlying the investor’s expectation of earning the Err is that the

coupons have to be reinvested at the Err. Students may become confused over this point.

For instance, if you buy a $1000, 8% coupon bond at par and receive $80 per year that

appears to be an 8% annual return regardless of what the investor does with the money.

It is in fact an 8% simple interest return, but not an 8% annual compound return. This

concept can be easily demonstrated. If you invest $1000 for 5 years and expect to earn an

8% compound rate of return per year, at the end of five years you must have a pool of

assets worth $1,000 × 1.085 = $1,469.33. If you stash the cash in the mattress and do not

reinvest any coupons you will have only ($80 × 5) + $1,000 = $1,400 at the end of five

years and your realized annual rate of return will be 6.96%. Likewise, at any

reinvestment rate less than 8%, you will wind up with less than $1,469.33 and have less

than an 8% realized return. (See Gardner, Mills and Cooperman, Managing Financial

Institutions: An Asset/Liability Approach 4th ed. Dryden Press, 2000.)

The current yield is the annual dollar coupon divided by the bond’s closing price. It is

akin to the dividend yield on the stock and it measures the simple interest annual rate of

return on the bond if you do not sell the bond. For bond investors who use a buy and

hold strategy and spend the coupons, (the prototypical grandmother living off the coupon

income for example) the current yield is a better measure of the annual rate of return they

are earning than the promised yield to maturity.

3-2

Chapter 03 - Interest Rates and Security Valuation

The price calculations are ‘clean’ prices, not ‘dirty’ prices. That is, they do not include

accrued interest.

e. Realized Rate of Return

The realized rate of return (rr) is the rate of return actually earned over the investment

period. It can be above or below the Err and the rrr and can be negative. The naïve

method to calculate the rr is to find the interest rate using the realized cash flows in the

bond price formula. If the investor knows the actual reinvestment rate on the coupons the

modified internal rate of return (MIRR) method should be used to calculate the realized

rate of return.4 For example, suppose an investor buys a par bond at 6% and holds it for

three years before selling it at $1,050. However, each $60 coupon was actually

reinvested at an interest rate of 5%. Solving the bond price formula gives an rr of 7.55%.

The future value of the three $60 coupons is actually $189.15, so the actual future value

of all the cash inflows is $1,050 + $189.15 = $1,239.15. With a $1,000 initial

investment, the actual rate of return is 7.41%, much less than implied by the bond price

formula. Anytime you solve the bond price formula for the discount rate you are

implicitly assuming the cash flows were reinvested at that discount rate. Only by

coincidence will this be correct. Only if you have no other information about the

reinvestment rate is solving the bond price formula to find the realized rate of return

reasonable. Expost, you should know the reinvestment rate; exante, you should use the

term structure to estimate the expected reinvestment rate.

3. Bond Valuation

a. Formula Used to Calculate Fair Present Values

To calculate the PV of a bond with semi-annual compounding, divide the coupon rate and

the rrr by two and multiply the number of periods by two. Note that the rrr (or promised

yield) is an APR for bonds that pay interest semi-annually. The effective annual return

for the bond is larger than the bond’s APR.

For the same bond used above, the PV with semiannual compounding would be:

{$C = 90 per year, rrr = 10%, n = 6 years, m = 2 compounding periods per year}

1

1 −

n

×

m

Par

(1 + (rrr/m))

+

PV = $C/m×

(1 + (rrr/m))n × m

rrr/m

1

1 − (1.05)12 $1000

+

$955.68 = $45 ×

0.05 (1.05)12

Equation 3

Premium bonds are priced above par, discount bonds are priced below par.

If a fixed income bond is paying a 12% coupon and has a 10% required (and expected)

rate of return, the only way the investor will earn less than the coupon rate in a given year

is if they have a capital loss to offset the extra 2% interest they are earning. This tells us

that when the coupon rate is above the rrr the bond is selling at a premium to par and that

this premium disappears as maturity approaches. Likewise, a bond paying only an 8%

4

The MIRR method is not in the text.

3-3

Chapter 03 - Interest Rates and Security Valuation

coupon that has a 9% required yield must be selling below its redemption value (discount

bond), and must be expected to increase in price as maturity approaches because this is

the only way one can expect to get the 8% interest yield up to a 9% total rate of return. If

the bond’s coupon rate and required rate are equal, the price will equal par regardless of

maturity because the entire rate of return is received through the coupon and no price

adjustment is needed.

The normal annual discount or premium amortization due to approaching maturity is

taxed as ordinary income (loss), not as a capital gain or loss.

b. Formula Used to Calculate Yield to Maturity

Assuming away default risk and noting the reinvestment assumption above, this is the

same as calculating the bond’s required rate of return using the bond price formula. It

cannot be solved algebraically in the multiperiod case, but most business calculators are

preprogrammed to find the promised yield. Note that on the Hewlett-Packard and Texas

Instrument business calculators either the left hand side or all of the right hand side of the

bond price formula must be negative. A common mistake students make is to enter only

part of the right hand side as negative (either the coupon or the future value, but not

both.).

c. Equity Valuation Models

The text presents the zero growth, the constant growth and the two stage dividend

discount growth models for equities.

P = D / rrr in the zero growth case

(Dt = Dividend in time t)

P = D1 / (rrr – g) in the constant growth case and

n

P= ∑

Dt

t = 1(1 + rrr )

t

+

Dn +1

(r − g 2 )

(1 + r )n

for the two stage growth model where D1 to Dt must be

estimated, using individual growth rates or an average growth rate g1 and g2 is the long

term steady state growth rate that applies from time n through ∞.

4. Impact of Interest Rate Changes on Security Value

Open market interest rates fluctuate daily due to the actions of traders. Buying, selling

and issuing securities all affect interest rates, which in turn affect security prices.

Mathematically, as required rates rise, PVs fall since the required rate is in the

denominator of the bond price formula. Conceptually, the actions of traders force market

prices to act in similar fashion. If you are holding a bond expected to yield 10% and

identical new bonds are issued that pay 12%, you are not happy! Enough traders begin to

sell the low yield bond so that its price begins to fall and at the lower price its yield rate

rises to 12%. Hence, prices and interest rates move inversely. Since the cash flows are

discounted at a compound rate of return (rates raised to an exponent) the bond price is not

linear with respect to interest rates.

Take the same bond above and let the rrr rise to 11%

The new PV is

3-4

Chapter 03 - Interest Rates and Security Valuation

1

1

−

(1.055)12

$1000

+

$913.81 = $45 ×

0.055 (1.055)12

This is a drop in PV of $41.87 (=$955.68 – $913.81). A financial intermediary (FI)

primarily holds financial assets (such as loans and bonds) and financial liabilities.

Consequently the FI must manage the relative price changes of its financial assets and

liabilities. If interest rates rise and the PV of the assets fall by more than the PV of their

liabilities, the PV of the equity will decline. Because most FIs employ very large

amounts of leverage and little equity, an institution that fails to manage its interest rate

risk can quickly face insolvency due to unfavorable interest rate moves.

5. Impact of Maturity on Security Values

a. Maturity and Security Prices

Fixed income security prices approach par as maturity nears (the so called ‘pull to par’)

even if interest rates don’t change. The discount or premium on non par bonds decreases

slightly each year.

b. Maturity and Security Price Sensitivity to Changes in Interest Rates

Price sensitivity or price volatility is the percentage change in a bond’s price for a given

current change in interest rates. Note the specificity of this definition. Students will often

think that a longer term bond is more price volatile because over a longer time period

rates are more likely to change. Their logic is correct but this belies the definition. Price

sensitivity measures how much a bond’s price will change if rates change right now.

Longer term bonds are more price

Coupon

6.00%

sensitive because the current worth

Par

$ 1,000

yield rate old

7.00%

of distant cash flows is very

yield rate change

0.50%

yield rate new

7.50%

sensitive to the discount rate. The

Absolute

price sensitivity increases at a

Maturity

Price old Price new Rate of change

1 $ 990.65 $ 986.05

0.47%

decreasing rate, so a twenty year

5 $ 959.00 $ 939.31

2.05%

10 $ 929.76 $ 897.04

3.52%

bond is not twice as price sensitive

15 $ 908.92 $ 867.59

4.55%

as a ten year bond. See IM Figure

20 $ 894.06 $ 847.08

5.25%

25 $ 883.46 $ 832.80

5.74%

3.1 below from an Excel

30 $ 875.91 $ 822.84

6.06%

35 $ 870.52 $ 815.91

6.27%

spreadsheet:

IM Figure 3.1 illustrates the limit of

the price change for a given coupon

rate and a yield rate increase of 50

basis points for bonds of different

maturity. Notice that as maturity is

increased from 1 to 5 to 10 years,

the price volatility increase is quite

large on a percentage basis.

However as maturity is increased

beyond 30 years there are only

40 $ 866.68 $ 811.08

45 $ 863.94 $ 807.72

50 $ 861.99 $ 805.38

55 $ 860.60 $ 803.75

60 $ 859.61 $ 802.61

65 $ 858.90 $ 801.82

70 $ 858.40 $ 801.27

75 $ 858.04 $ 800.88

80 $ 857.78 $ 800.61

85 $ 857.60 $ 800.43

90 $ 857.47 $ 800.30

95 $ 857.37 $ 800.21

100 $ 857.31 $ 800.14

105 $ 857.26 $ 800.10

Predicted limit price change =

1 - (r old / r new)

6.42%

6.51%

6.57%

6.61%

6.63%

6.65%

6.66%

6.66%

6.66%

6.67%

6.67%

6.67%

6.67%

6.67%

6.67%

IM Figure 3.1

3-5

Chapter 03 - Interest Rates and Security Valuation

small increases in price volatility.5 At the limit, the price change is equal to 1 – (rr old /

rr new). This limit formula is correct for all coupon paying bonds, with higher coupon

bonds reaching the limit more quickly, and low coupon bonds reaching the limit price

change much more slowly.

Extreme examples often help to illustrate a concept. For example, if you are holding a

5% coupon bond that you can’t get rid of for 30 years and suddenly rates rise from 5% to

10%, you might expect that you and other investors in the bond are not very happy and its

price will drop a large amount. However, if the bond matures tomorrow, would you

expect its price to move much?

Any security that pays more money back sooner, ceteris paribus, will be less price

volatile. Specifically, the value of any security that returns a greater percentage of the

initial investment sooner will be less sensitive to interest rate changes. Text Tables 3-7

through 3-10 can be used to illustrate this simple concept for different coupons and

different maturity.

6. Impact of Coupon Rates on Security Values

a. Coupon Rate and Security Price

Ceteris paribus, the higher the coupon rate the higher the bond’s price. See for instance

the in 3.a.

b. Coupon Rate and Security Price Sensitivity to Changes in Interest Rates

A higher coupon results in lower bond price sensitivity to interest rate changes, ceteris

paribus. The bigger the coupon the greater the percentage of your initial investment that

is recovered in the near term (5.b.), or the bigger the coupon the sooner you recover the

investment. Suppose you are comparing two five year bonds, one with a zero coupon and

one with a 15% coupon. If interest rates rise the 15% coupon bond pays you a much

larger sum of money quickly with which you can reinvest and earn the new higher

interest rate. The zero coupon bond gives you no money with which you can reinvest and

earn the higher rate so the zero drops more in value. IM Figure 2 below illustrates the

effect of coupon on price volatility for a 10 year maturity bond with a yield rate change

from 7% to 6.5% for bonds with different coupons. Notice that lower coupon bonds

exhibit a greater price change for the given rate change. The greatest volatility is

exhibited by the zero coupon bond, but as with maturity, the price change increases at a

decreasing rate for a declining coupon rate. At this point in the development an investor

needs to consider both maturity and coupon to understand their exposure to interest rate

risk. One of the purposes of developing the duration concept in the next section is that

duration reduces the analysis to one dimension by incorporating the effect of coupon into

the maturity effect on price volatility.

5

As maturity increases the bond price formula converges to the present value of a perpetuity where PV = $

Coupon / r. This allows one to develop the predicted limit price change as (C/rnew / C/rold) – 1.

3-6

Chapter 03 - Interest Rates and Security Valuation

Coupon

Par

rate old

rate change

rate new

Varies

$1,000

7.00%

-0.50%

6.50%

Maturity

10 years

Absolute

Rate of

Coupon rate

Price old

Price new

change

6.00%

$ 929.76

$ 964.06

3.69%

5.50%

$ 894.65

$ 928.11

3.74%

5.00%

$ 859.53

$ 892.17

3.80%

4.50%

$ 824.41

$ 856.22

3.86%

4.00%

$ 789.29

$ 820.28

3.93%

3.50%

$ 754.17

$ 784.34

4.00%

3.00%

$ 719.06

$ 748.39

4.08%

2.50%

$ 683.94

$ 712.45

4.17%

2.00%

$ 648.82

$ 676.50

4.27%

1.50%

$ 613.70

$ 640.56

4.38%

1.00%

$ 578.59

$ 604.61

4.50%

0.50%

$ 543.47

$ 568.67

4.64%

0.00%

$ 508.35

$ 532.73

4.80%

IM Figure 2 Coupons and Price Volatility

7. Duration

a. A Simple Illustration for Duration

Duration is the weighted average time to maturity on a financial security using the

relative present values of the cash flows as weights. This definition will initially mean

very little to students. To understand the concept implied by the definition, think of an N

year annual payment coupon bond as a portfolio of N zero coupon bonds where the first

N-1 of the bonds pay the coupon amount and the last one pays the coupon plus the par

amount. The coupon bond’s duration is the average maturity of the portfolio of zero

coupon bonds. However, we cannot take a simple average because not all the cash flows

in each year are identical. Moreover, Chapter 2 tells us that we cannot compare a cash

flow in year 1 with a cash flow in year N. So we construct a series of weights that tell us

what percentage of our money (in today’s dollars) we recover in each year. To do this

take the present value of each cash flow divided by the purchase price of the bond. For

instance, for a 5 year bond suppose we recover in present value terms 5% of our

investment in year one , 4% in year two, 3% in year three, 2% in year four and 86% in

year five. We receive cash in each of the next five years (or a zero matures in each of the

next five years): 1, 2, 3, 4 and 5. Thus, the bond’s duration is the weighted average

maturity of the zeros or (5%×1) + (4%×2) + (3%×3) + (2%×4) + (86%×5) = 4.6 years.

Duration may perhaps be slightly better defined as a weighted average of the times in

which cash is received, a slightly different wording than the more common definition

above.

The above 5 year maturity coupon bond has the same price sensitivity as a 4.6 year

maturity zero coupon bond (ignoring convexity).

b. A General Formula for Duration

n

∑

Dur =

$45 × t $1045 × 12

+

t

(1.05)12

t =1 (1.05)

9.46 years =

$955.68

11

CFt × t

t =1 (1 + rrr)

PV

t

∑

3-7

Equation 4

Chapter 03 - Interest Rates and Security Valuation

{$C = 90 per year, rrr = 10%, n = 6 years, m = 2 compounding periods per year, PV =

$955.68}

Closed form duration equation:

(1 + r)n + 1 − (1 + r) − (r × n) Par × n

+

$C ×

(1 + r)n

r 2 × (1 + r)n

Dur =

PV

Equation 5

$C = Periodic cash flow in dollars

r = periodic interest rate

n = Number of compounding or payment periods

Par = Maturity Value or Terminal Cash Flow (if any)

Dur = Duration = # Compounding or payment periods

Variations of the basic duration formulae can be used. The versions shown above may be

used for annual or semiannual payment bonds or for amortizing loans. In the case of a

fully amortized loan the Par term must be set to zero and the $C is the loan’s installment

payment. The duration answer obtained from these equations will be in the number of

compounding or payment periods. For instance, if you use Equation 4 or 5 to find the

duration of a semiannual payment bond, you will get an answer in terms of the number of

semi-annual periods, rather than years. If one replaces PV in Equations 4 and 5 with

m*PV, then the resulting duration answer will be in years.6 Alternatively, Equation 4

could be modified as follows to give an annual duration result for a semiannual payment

bond:

n

Dur =

PVCFt × t

PV

t =1 / 2

∑

Equation 4a

where PVCFt is the present value of the cash flow in time t, where t = ½, 1, 1½ , … n.

c. Features of Duration

Duration is a time measure, usually presented in years. The greater the coupon; the

shorter the duration. With a greater coupon the percentage weights on the early years are

increased, thus reducing the average maturity. The duration of a zero coupon bond is its

maturity because it has a 100% weight on the year in which the terminal cash flow occurs

and a 0% weight on all other years. Except for certain deep discount bonds, the longer

the maturity of a bond the longer the bond’s duration (see the charts below). Notice that

duration increases at a decreasing rate as maturity increases. Duration has a limit with

respect to maturity for a given interest rate. The maximum duration of a bond can be

found as (1/ r) +1 where r is the periodic rate and the solution is the maximum number of

payment periods. As you can see in the chart, for a premium bond, the duration increases

monotonically towards this maximum (26 periods or 13 years found as (1/0.04)+1) as N

is increased.

6

Recall that m = number of compounding periods per year.

3-8

Chapter 03 - Interest Rates and Security Valuation

Premium Bond

Bond Terms

$C

N (# years)

m

# of periods

ytm or k

PAR

PRICE

$

$

Bond

10.00%

4

2

8

8.00%

1,000 $

1,067.33 $

Terms for calculating duration

$C/2

$

r or k/2

T = n*m

r

2

(1+r)

50 $

0.04

8

0.0016

T

T+1

10.00%

16

2

32

8.00%

1,000 $

1,178.74 $

10.00%

32

2

64

8.00%

1,000 $

1,229.69 $

10.00%

64

2

128

8.00%

1,000 $

1,248.35 $

10.00%

128

2

256

8.00%

1,000 $

1,249.99 $

10.00%

200

2

400

8.00%

1,000 $

1,250.00 $

10.00%

400

2

800

8.00%

1,000

1,250.00

50 $

0.04

16

50 $

0.04

32

50 $

0.04

64

50 $

0.04

128

50 $

0.04

256

50 $

0.04

400

50

0.04

800

0.0016

0.0016

1.36856905 1.87298125 3.50805875

12.3064762

151.4493558 22936.9074

6506324.497 4.23323E+13

12.7987352

467.169434

23,358.47

5200.51387

28,558.99

1229.68549

23.224626

11.61231

157.50733 23854.3837

624.5789609 649.692635

31,228.95

32,484.63

845.1670155 11.1610513

32,074.12

32,495.79

1248.349283

1249.9891

25.693222

25.996861

12.84661

12.99843

6766577.477 4.40255E+13

649.9983631

650

32,499.92

32,500.00

0.061478643 1.88981E-08

32,499.98

32,500.00

1249.999962

1250

25.999985

26.000000

12.99999

13.00000

1.423311812

28.91332575

1,445.67

5845.52164

7,291.19

1067.327449

6.831257

3.41563

26

13

(1+r)

term in brackets

$C/2 * bracket

Par term

Numerator

Denominator

Duration ( m periods)

Duration in years

Duration limit | r

Duration limit | r

10.00%

8

2

16

8.00%

1,000 $

1,116.52 $

0.0016

1.9479005

3.6483811

89.3964155 236.665987

4,469.82

11,833.30

8542.53081 9121.85408

13,012.35

20,955.15

1116.52296 1178.73551

11.654352

17.777655

5.82718

8.88883

periods

years

0.0016

0.0016

0.0016

0.0016

For a deep discount bond, the duration initially rises with maturity and then declines as

illustrated below:

Discount Bond

Bond Terms

$C

N (# years)

m

# of periods

ytm or k

PAR

PRICE

$

$

Bond

1.00%

4

2

8

8.00%

1,000 $

764.35 $

Terms for calculating duration

$C/2

$

r or k/2

T = n*m

r

2

(1+r)

5 $

0.04

8

0.0016

T

T+1

(1+r)

term in brackets

$C/2 * bracket

Par term

Numerator

Denominator

Duration ( m periods)

Duration in years

Duration limit | r

Duration limit | r

1.00%

8

2

16

8.00%

1,000 $

592.17 $

1.00%

16

2

32

8.00%

1,000 $

374.43 $

1.00%

32

2

64

8.00%

1,000 $

196.10 $

1.00%

64

2

128

8.00%

1,000 $

130.78 $

1.00%

128

2

256

8.00%

1,000 $

125.04 $

1.00%

200

2

400

8.00%

1,000 $

125.00 $

1.00%

400

2

800

8.00%

1,000

125.00

5 $

0.04

16

5 $

0.04

32

5 $

0.04

64

5 $

0.04

128

5 $

0.04

256

5 $

0.04

400

5

0.04

800

0.0016

0.0016

1.36856905 1.87298125 3.50805875

12.3064762

151.4493558 22936.9074

6506324.497 4.23323E+13

12.7987352

467.169434

2,335.85

5200.51387

7,536.36

196.100776

38.431062

19.21553

157.50733

624.5789609

3,122.89

845.1670155

3,968.06

130.7775089

30.342081

15.17104

6766577.477 4.40255E+13

649.9983631

650

3,249.99

3,250.00

0.061478643 1.88981E-08

3,250.05

3,250.00

125.0001345

125

26.000398

26.000000

13.00020

13.00000

1.423311812

28.91332575

144.57

5845.52164

5,990.09

764.3539294

7.836799

3.91840

26

13

0.0016

1.9479005

3.6483811

89.3964155 236.665987

446.98

1,183.33

8542.53081 9121.85408

8,989.51

10,305.18

592.169654 374.425698

15.180638

27.522641

7.59032

13.76132

periods

years

0.0016

0.0016

23854.3837

649.692635

3,248.46

11.1610513

3,259.62

125.038148

26.069038

13.03452

0.0016

0.0016

Students should be aware that although duration is a modified measure of maturity, it is

still a measure of maturity. The higher the promised yield to maturity the shorter the

duration. Using a higher interest rate decreases the percentages weights on more distant

cash flows (because of the compounding effect the present value of more distant cash

flows drops (%) more than the present value of near term cash flows).

3-9

Chapter 03 - Interest Rates and Security Valuation

d. Economic Meaning of Duration

Taking the partial derivative of the bond price formula with respect to interest rates for a

zero coupon bond yields a simple relationship:

%∆

∆P = - Maturity × ∆r / (1 + r) (r = yield to maturity)

%∆

∆P = elasticity

Maturity can be used to predict the price change for small interest rate changes when

there are no coupons. This equation does not work for coupon bonds; its use in this case

would overestimate the volatility since coupons dampen a bond’s price volatility.

Duration is however a modified measure of maturity that reflects the reduced maturity

due to the early payment of interest (coupons) prior to maturity. In particular the duration

of a coupon bond has the same price sensitivity as a zero coupon bond that has a maturity

equal to the coupon bond’s duration (ignoring convexity). Thus it follows (without

calculus even) that %∆

∆P = - Duration × ∆r / (1 + r) for a coupon bond. Duration may

be used to predict price changes for small interest rate changes for coupon bonds. For

convenience, practitioners sometimes calculate what is called ‘modified duration’ which

is Duration / (1 + rsemi) so that the only variable to be added to predict the price change is

∆r.

Important Note: Modified duration is Duration / (1 + rperiod). The ‘period’ would be

semiannual for most bonds and monthly for most loans. However when modified

duration is used to predict the price change in the formula, the rate change used is an

annual rate: %∆

∆P = - Modified Duration / (1 + rannual). This can be a confusing point

for students.

Why should students have to learn duration when today one can easily predict the bond

price change via a hand calculator, or better yet, with a spreadsheet? Two reasons:

1) Duration can be used as a strategic tool in trying to earn a higher rate of return, or to

minimize the risk associated with earning the promised yield to maturity. For

instance, for a given investment horizon one can try to lock in the current promised

yield to maturity by choosing a bond with a duration equal to the investment horizon.

This is a standard institutional bond investment strategy called immunization and it is

described in Appendix A. However, one can also try to beat the promised yield. If

interest rates are projected to fall one could choose a bond with a duration greater than

the investment horizon. If the investor is correct and rates fall, the gain in sale price of

the bond will more than outweigh the lost reinvestment income caused by the lower

reinvestment rate and the overall realized rate of return will be greater than the

promised yield. Conversely, one who is projecting rising rates can beat the promised

yield by choosing a bond with a duration shorter than the investment horizon.

2) Given the individual bond durations, the duration of a portfolio is a simple linear

weighted average of the durations of the bonds in the portfolio. Using the portfolio’s

duration makes it very easy to predict the net value change of the portfolio for a given

change in interest rates.

3-10

Chapter 03 - Interest Rates and Security Valuation

e. Large Interest Rate Changes and Duration

Duration is an accurate predictor of price changes only for very small interest rate

changes. For day to day fluctuations duration works quite well but when interest rates

move significantly, such as when the Fed makes an announcement of a rate change, the

predicted pricing errors can become significant. The prediction errors arise because bond

prices are not linear with respect to interest rates. At lower yield rates, bond prices are

more sensitive to interest rate changes than at higher initial promised yields. A given