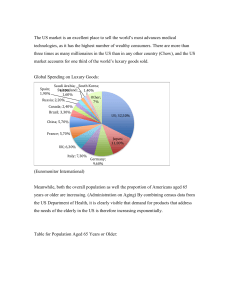

Personal Luxury in the US Euromonitor International January 2021 PERSONAL LUXURY IN THE US LIST OF CONTENTS AND TABLES KEY DATA FINDINGS.................................................................................................................. 1 2020 IMPACT ............................................................................................................................... 1 Store closures and other restrictions decimate foot traffic to key retail channels...................... 1 Lack of consumer need amid increased time spent at home further weighs on sales .............. 1 Hurt by reduction in tourism, leading players shift strategies .................................................... 2 RECOVERY AND OPPORTUNITIES .......................................................................................... 2 Recovery of value sales expected over forecast, but volume recovery will be slower .............. 2 Accelerating e-commerce growth will demand additional capabilities....................................... 2 Burgeoning resale market to weigh on primary market sales over the forecast period ............. 3 CATEGORY DATA ....................................................................................................................... 3 Table 1 Table 2 Table 3 Table 4 Table 5 Table 6 Table 7 Sales of Personal Luxury by Category: Value 2015-2020 ............................ 3 Sales of Personal Luxury by Category: % Value Growth 2015-2020 ........... 4 NBO Company Shares of Personal Luxury: % Value 2015-2019 ................. 4 LBN Brand Shares of Personal Luxury: % Value 2016-2019 ....................... 5 Distribution of Personal Luxury by Format: % Value 2015-2020 .................. 6 Forecast Sales of Personal Luxury by Category: Value 2020-2025 ............. 6 Forecast Sales of Personal Luxury by Category: % Value Growth 2020-2025 .................................................................................................... 6 © Euromonitor International Passport i PERSONAL LUXURY IN THE US PERSONAL LUXURY IN THE US KEY DATA FINDINGS ▪ Store closures and travel restrictions amid COVID-19 weighed on personal luxury sales in 2020 ▪ Personal luxury declined 22% in 2020 to reach USD65.2 billion ▪ Luxury writing instruments and stationery posted the least decline within personal luxury in 2020 ▪ At the brand level, Michael Kors led personal luxury in 2019 ▪ Personal luxury is expected to register a current value CAGR of 6% (4% at constant 2020 prices) over the forecast period 2020 IMPACT Store closures and other restrictions decimate foot traffic to key retail channels Following a decade of continued retail value sales growth, personal luxury registered significant declines in both retail value and volume sales in 2020 as efforts to mitigate the spread of COVID-19 disrupted both demand for and availability of all of its respective product categories. With lockdowns lasting from mid-March until at least May or June in many states, the closure of mixed retailers and non-grocery specialist retailers prevented consumers from purchasing designer apparel and footwear (ready-to-wear), luxury jewellery, luxury timepieces, luxury leather goods and other personal luxury products in stores during this time, while increased hygiene and social distancing protocols in stores, as well as boarded-up storefronts during periods of civil unrest, led to a reduction in foot traffic to stores throughout the remainder of the year. While e-commerce, at times the only available sales channel for personal luxury, experienced a dramatic boost in its percentage value share of multiple personal luxury categories as a result, while also registering growth in actuals in certain categories including luxury timepieces and designer apparel and footwear (ready-to-wear) as many consumers purchased personal luxury products online for the first time, the limited availability of certain leading brands and popular products for sale online, as well as a reduction in tourism, economic constraints and changed consumer lifestyles, meant that gains in e-commerce were not enough to significantly mitigate declines in personal luxury overall. Lack of consumer need amid increased time spent at home further weighs on sales Further reducing demand for personal luxury goods across product categories was a lack of consumer need amid not only lockdowns and quarantines, but also throughout the rest of the year as remote work, e-learning, travel restrictions and the cancellation of special in-person events led consumers to spend significantly more time at home than in a typical year. Without a need to dress up for work, dining out, or large social events and gatherings, consumers with discretionary income purchased goods and services to help make their increased time spent at home more comfortable, such as food and alcohol delivery, furniture, home décor and home entertainment systems, in addition to allocating more of their money to savings, instead of © Euromonitor International Passport 1 PERSONAL LUXURY IN THE US personal luxury products such as luxury jewellery, luxury timepieces, luxury leather goods, and more. Hurt by reduction in tourism, leading players shift strategies Despite having strong presences across e-commerce and digital marketing platforms, enabling them to advertise and sell to domestic consumers while in-store shopping is restricted, leading personal luxury players including Michael Kors, Louis Vuitton, Ralph Lauren and Coach, the top four brands in the US in terms of 2019 retail value sales, respectively, saw sales in 2020 especially impacted by the reduction in foreign expenditure brought about by travel restrictions. While international retail expenditure typically represents over 39% of total personal luxury sales, this fell to just over 28% of a much lower total in 2020 as international and domestic travel restrictions alike, as well as limitations to the in-store shopping experience, prevented wealthy international students and travellers, key drivers of luxury goods sales, from visiting large cities and other tourist destinations across the US. As a result, leading players focused their efforts on courting such travellers in their home markets, such as China, throughout the year instead, either through digital engagement or through opened stores there, while prioritising domestic consumers through their digital and in-store engagements in the US. RECOVERY AND OPPORTUNITIES Recovery of value sales expected over forecast, but volume recovery will be slower While store closures, travel restrictions, increased time spent at home and the postponements or cancellations of large, in-person social events significantly lowered personal luxury sales across the category in 2020, the overall category is expected to recover to pre-pandemic retail value sales levels over the forecast period, returning to 2019-level value sales by 2024/2025 (current terms). However, multiple product segments, including designer apparel (ready-towear), designer footwear, luxury timepieces, and luxury writing instruments and stationery, are not expected to recover 2019-level volume sales over the forecast period as a result of shifting consumer spending priorities and shopping habits. In the wake of the pandemic, consumers with less disposable income are expected to increasingly trade down to non-luxury products in order to save money and prioritise spending in other areas, at the same time that those with more disposable income are expected to prioritise purchasing fewer yet higher quality, and often more expensive, personal luxury goods. As a result, average unit prices for multiple personal luxury product categories are expected to increase over the forecast period, resulting in a later recovery for volume sales than for retail value sales. Accelerating e-commerce growth will demand additional capabilities As many consumers’ only available sales channel for personal luxury goods throughout much of 2020, the dramatic boost in both e-commerce penetration came as consumers, often motivated by free shipping and returns, became increasingly comfortable researching, shopping for, and purchasing high-priced products online, with many doing so for the first time. With more consumers than ever before now comfortable shopping for personal luxury across product categories online through pure play e-commerce retailers and marketplaces such as Farfetch and Richemont’s Net-A-Porter, which also offer helpful sizing and styling guides, luxury brands’ own e-commerce sites and the e-commerce sites of department stores such as Nordstrom and Neiman Marcus, the growth of the online sales channel is only expected to accelerate moving forward, largely at the expense of store-based retailers such as department stores, classified as © Euromonitor International Passport 2 PERSONAL LUXURY IN THE US Passport mixed retailers. Therefore, just as they have throughout 2020, brands and retailers will have to continue to make significant investments in their digital marketing, e-commerce, logistics and reverse-logistics capabilities in order to provide a satisfactory experience to consumers as digital channels become increasingly important to both drive sales and facilitate product discovery. Meanwhile, they must also integrate digital tools and capabilities, such as BOPIS, to the in-store shopping experience as physical retail stores remain a significant driver of sales across the category. Burgeoning resale market to weigh on primary market sales over the forecast period In addition to increasing average unit prices, as well as the growing importance of ecommerce in driving both sales and product discovery, the outlook for personal luxury will also be impacted by the expansion of the resale market. Offering value for money, environmental merits, and the opportunity to find unique or hard-to-find pieces, the resale market has been growing in popularity across both luxury and non-luxury product categories in recent years. While thrift stores, vintage shops and other store-based resale channels have faced many of the same challenges as apparel and footwear specialist retailers, department stores, and other store-based, primary market personal luxury retailers throughout 2020, the pandemic brought about increased interest in resale as consumers not only re-assessed their spending priorities, but also had additional time to clean out their closets and browse online resale marketplaces such as Depop, Poshmark and Grailed, to both purchase and sell personal luxury products from a wide range of brands. Resale companies sought to expand their presence in the market as a result, with TheRealReal opening a store on Chicago’s Michigan Avenue in October 2020, and Rebag beginning to sell authenticated, pre-owned luxury jewellery and luxury timepieces online for the first time, also in October 2020. With both buying and selling second-hand personal luxury goods accelerating in popularity amid the pandemic, primary market sales as tracked by Euromonitor International will be impacted moving forward as consumers increasingly turn their time and money towards shopping second-hand instead. CATEGORY DATA Table 1 Sales of Personal Luxury by Category: Value 2015-2020 USD million Designer Apparel and Footwear (Ready-to-Wear) Luxury Eyewear Luxury Jewellery Luxury Leather Goods Luxury Portable Consumer Electronics Luxury Timepieces Luxury Writing Instruments and Stationery Super Premium Beauty and Personal Care Personal Luxury Source: 2015 2016 2017 2018 2019 2020 29,332.3 30,025.6 30,535.0 31,022.2 31,549.0 24,942.9 7,202.5 11,346.2 15,606.0 52.7 7,419.0 10,675.9 15,882.9 50.2 7,479.6 10,274.4 16,341.4 53.2 7,685.9 10,866.8 17,392.8 65.3 7,864.3 11,082.2 17,765.0 82.3 6,115.9 8,647.7 12,641.8 64.6 5,445.9 112.4 4,874.1 109.8 4,768.2 113.4 4,964.8 119.8 4,956.8 114.4 3,787.5 99.8 8,943.8 9,218.6 9,579.9 10,200.7 10,573.3 8,934.6 78,041.9 78,256.1 79,145.1 82,318.2 83,987.2 65,234.8 Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources © Euromonitor International 3 PERSONAL LUXURY IN THE US Table 2 Passport Sales of Personal Luxury by Category: % Value Growth 2015-2020 % current value growth Designer Apparel and Footwear (Readyto-Wear) Luxury Eyewear Luxury Jewellery Luxury Leather Goods Luxury Portable Consumer Electronics Luxury Timepieces Luxury Writing Instruments and Stationery Super Premium Beauty and Personal Care Personal Luxury Source: Table 3 2019/20 2015-20 CAGR 2015/20 Total -20.9 -3.2 -15.0 -22.2 -22.0 -28.8 -21.5 -23.6 -12.7 -3.2 -5.3 -4.1 4.1 -7.0 -2.4 -15.1 -23.8 -19.0 22.5 -30.5 -11.2 -15.5 -22.3 0.0 -3.5 -0.1 -16.4 Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources NBO Company Shares of Personal Luxury: % Value 2015-2019 % retail value rsp Company LVMH Moët Hennessy Louis Vuitton Inc Capri Holdings Ltd Ralph Lauren Corp Tapestry Inc Luxottica US Holdings Corp Gucci America Inc Chanel USA Inc Estée Lauder Cos Inc PVH Corp Tiffany & Co Cartier International Inc L'Oréal USA Inc Hermès International SCA Kate Spade & Co Inc Rolex Watches USA, Inc Safilo USA Inc Burberry USA Tory Burch LLC Shiseido Americas Corp Coty Inc Yves Saint Laurent America Inc Richemont North America Inc LVMH Perfums & Cosmetics USA Inc Marchon Eyewear Inc Prada USA Corp Hugo Boss AG Valentino Fashion Group © Euromonitor International 2015 2016 2017 2018 2019 6.8 6.4 6.8 7.5 7.6 6.2 3.0 5.3 3.0 4.5 3.2 3.0 5.1 4.1 3.1 3.0 4.8 4.0 3.0 3.0 1.5 2.2 1.9 2.3 2.1 1.4 1.3 1.0 1.2 1.3 1.7 1.1 1.0 0.4 0.7 0.4 1.7 2.2 2.1 2.4 2.0 1.5 1.3 1.1 1.3 1.1 1.7 1.1 1.0 0.9 1.0 0.6 2.3 2.3 2.2 2.4 2.0 1.6 1.4 1.1 1.2 1.0 1.2 1.1 1.0 1.0 1.0 0.7 2.8 2.3 2.2 2.3 1.9 1.7 1.4 1.2 1.2 1.1 1.1 1.0 1.0 1.0 1.0 0.8 2.9 2.3 2.2 2.1 1.9 1.7 1.4 1.3 1.1 1.1 1.1 1.0 1.0 1.0 1.0 0.8 0.8 0.8 0.8 0.8 0.7 0.6 0.7 0.7 0.8 0.7 0.7 0.7 1.2 0.5 0.7 0.7 1.0 0.5 0.7 0.6 0.9 0.6 0.7 0.6 0.8 0.6 0.7 0.6 0.6 0.6 4 PERSONAL LUXURY IN THE US Passport SpA Kering SA Van Cleef & Arpels Inc Tumi Inc Michael Kors Holdings Ltd Coach Inc Tumi Holdings Inc Others Total Source: Table 4 0.6 0.5 6.5 3.2 0.6 46.6 100.0 0.5 0.5 0.6 5.7 3.3 47.6 100.0 0.5 0.5 0.6 5.4 47.7 100.0 0.5 0.6 0.6 47.4 100.0 0.6 0.6 0.6 47.9 100.0 Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources LBN Brand Shares of Personal Luxury: % Value 2016-2019 % retail value rsp Brand (GBO) Michael Kors Louis Vuitton (LVMH Moët Hennessy Louis Vuitton SA) Ralph Lauren Coach Gucci (Kering SA) Chanel (Chanel SA) Calvin Klein Tiffany & Co Cartier (Richemont SA, Cie Financière) Hermès Kate Spade (Tapestry Inc) Rolex (Rolex SA) Tory Burch Burberry (Burberry Group Plc) Hugo Boss Valentino Van Cleef & Arpels (Richemont SA, Cie Financière) Tumi (Samsonite International SA) Yves Saint Laurent (Kering SA) Prada (Prada SpA) Givenchy (LVMH Moët Hennessy Louis Vuitton SA) Giorgio Armani (L'Oréal Groupe) Salvatore Ferragamo TAG Heuer (LVMH Moët Hennessy Louis Vuitton SA) Redken (L'Oréal Groupe) Aveda © Euromonitor International Company (NBO) 2016 2017 2018 2019 Capri Holdings Ltd LVMH Moët Hennessy Louis Vuitton Inc 3.5 3.8 5.1 4.5 4.8 4.6 Ralph Lauren Corp Tapestry Inc Gucci America Inc Chanel USA Inc PVH Corp Tiffany & Co Cartier International Inc 5.3 1.7 2.2 2.4 2.0 1.5 4.5 3.2 2.3 2.3 2.4 2.0 1.6 4.1 3.1 2.8 2.3 2.3 1.9 1.6 3.9 3.0 2.9 2.3 2.1 1.9 1.6 Hermès International SCA Kate Spade & Co Inc 1.1 - 1.1 1.2 1.1 1.2 1.3 1.1 Rolex Watches USA, Inc Tory Burch LLC Burberry USA 1.1 1.0 1.1 1.0 1.0 1.0 1.1 1.0 0.9 1.1 1.0 0.9 Hugo Boss AG Valentino Fashion Group SpA Van Cleef & Arpels Inc 1.0 0.5 0.9 0.6 0.8 0.6 0.6 0.6 0.5 0.5 0.6 0.6 Tumi Inc 0.6 0.6 0.6 0.6 Yves Saint Laurent America Inc Prada USA Corp LVMH Moët Hennessy Louis Vuitton Inc 0.4 0.5 0.6 0.6 0.6 0.5 0.5 0.5 0.5 0.5 0.5 0.5 L'Oréal USA Inc 0.5 0.5 0.5 0.5 Salvatore Ferragamo SpA TAG Heuer International SA 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 L'Oréal USA Inc 0.4 0.4 0.4 0.5 Estée Lauder Cos Inc 0.4 0.4 0.4 0.4 5 PERSONAL LUXURY IN THE US Armani Tom Ford Bottega Veneta (Kering SA) Céline (LVMH Moët Hennessy Louis Vuitton SA) Michael Kors Coach Kate Spade Others Total Source: Passport Giorgio Armani SpA Estée Lauder Cos Inc Bottega Veneta Inc 0.6 0.4 0.5 0.5 0.4 0.4 0.5 0.4 0.4 0.4 0.4 0.4 LVMH Moët Hennessy Louis Vuitton Inc 0.3 0.3 0.4 0.4 5.7 3.3 1.3 59.0 100.0 5.4 59.1 100.0 58.9 100.0 59.4 100.0 Michael Kors Holdings Ltd Coach Inc Kate Spade & Co Inc Others Total Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources Table 5 Distribution of Personal Luxury by Format: % Value 2015-2020 % retail value rsp Store-Based Retailing - Grocery Retailers - Non-Grocery Specialists - Mixed Retailers Non-Store Retailing - E-Commerce Total Source: 2015 2016 2017 2018 2019 2020 88.1 0.2 44.4 43.4 11.9 11.9 100.0 86.4 0.2 43.8 42.4 13.6 13.6 100.0 84.6 0.2 43.4 41.0 15.4 15.4 100.0 83.0 0.2 43.4 39.4 17.0 17.0 100.0 80.8 0.2 43.1 37.5 19.2 19.2 100.0 72.6 0.2 39.9 32.4 27.4 27.4 100.0 Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources Table 6 Forecast Sales of Personal Luxury by Category: Value 2020-2025 USD million Designer Apparel and Footwear (Ready-to-Wear) Luxury Eyewear Luxury Jewellery Luxury Leather Goods Luxury Portable Consumer Electronics Luxury Timepieces Luxury Writing Instruments and Stationery Super Premium Beauty and Personal Care Personal Luxury Source: Table 7 2020 2021 2022 2023 2024 2025 24,942.9 27,210.6 28,396.0 28,947.5 29,354.4 29,633.7 6,115.9 8,647.7 12,641.8 64.6 6,726.6 9,725.9 13,803.9 78.8 7,132.6 10,475.3 15,521.9 91.4 7,331.1 10,889.1 16,364.7 102.4 7,398.2 11,047.2 16,671.7 113.2 7,413.3 11,052.1 16,699.9 122.3 3,787.5 99.8 4,014.8 106.0 4,454.4 107.6 4,563.1 107.2 4,608.7 106.0 4,613.7 104.5 8,934.6 8,353.1 8,164.2 8,194.4 8,228.7 8,383.3 65,234.8 70,019.8 74,343.5 76,499.4 77,528.2 78,022.9 Euromonitor International from trade associations, trade press, company research, trade interviews, trade sources Forecast Sales of Personal Luxury by Category: % Value Growth 2020-2025 % constant value growth © Euromonitor International 6 PERSONAL LUXURY IN THE US Designer Apparel and Footwear (Readyto-Wear) Luxury Eyewear Luxury Jewellery Luxury Leather Goods Luxury Portable Consumer Electronics Luxury Timepieces Luxury Writing Instruments and Stationery Super Premium Beauty and Personal Care Personal Luxury Source: Passport 2020/2021 2020-25 CAGR 2020/25 Total 9.1 3.5 18.8 10.0 12.5 9.2 22.0 6.0 6.3 3.9 5.0 5.7 13.6 4.0 0.9 21.2 27.8 32.1 89.4 21.8 4.8 -6.5 7.3 -1.3 3.6 -6.2 19.6 Euromonitor International from trade associations, trade press, company research, trade interviews, trade sources © Euromonitor International 7