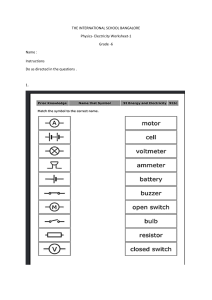

Casebook 2020-21 Volume 10 (B) ICON – Consulting Club, IIM Bangalore 1 Foreword This casebook documents the interview experiences of IIM Bangalore to help students in preparation for case interviews during placements. The aim of sharing these experiences is to inform students about the case interview experiences of past batch and to help them prepare for their placements accordingly. The experiences listed below are not necessarily the best way to handle case interviews. They only serve to give students an idea as to what to expect when they walk into a case interview. Every individual could have his/her unique way of tackling consulting interviews, each of which could be correct. This document has contributions from students who appeared for campus interviews conducted by consulting firms during the summer placement process over the last year. The interview experiences have been sorted based on the type of case, consulting firm, difficulty and the round in the selection process. Special thanks to all the contributors. Team ICON wishes you all the very best for your final placements! ICON, IIM Bangalore 2 Contents - I S.No Particulars Difficulty Company Page S.No IV. Particulars I. Introduction 5 II. Profitability Framework 7 18. Toll Collection 19. New Medicine Launch Difficulty Company Pricing Framework Page 44 Easy BCG 45 Moderate McKinsey 47 1. Two Wheeler Manufacturer Easy Bain 8 2. Retail Supermarket Chain Easy Bain 10 3. Energy Major Firm Easy McKinsey 12 20. Coffee Production Easy Kearney 50 4. IT Services Firm Easy McKinsey 15 21. OTT Service Launch Easy Strategy& 52 5. Pharmacy Moderate A&M 17 22. Convenience Store at Gas Station Moderate Kearney 55 6. Skiing Resort Moderate BCG 19 23. US Tyre Manufacturer Difficult BCG 58 7. Quick Service Chain Restaurant Moderate Kearney 21 8. Electricity Company Moderate McKinsey 23 24. Time to Market Moderate Accenture 60 9. E-Commerce Firm Difficult Bain 25 25. Customer Experience Improvement Moderate Bain 62 27 26. Home Services : Fall in NPS Moderate Bain 64 III. Market Entry Framework 10. Apple Farming Supplement 11. V. VI. Growth Strategy Framework 49 Unconventional Easy Kearney 28 27. Movie Release : Theatre or OTT Moderate Bain 66 Air Purifier – COVID disinfectant Moderate Bain 30 28. Business Process Outsourcing Moderate BCG 68 12. Cybersecurity Software Provider Moderate Bain 32 29. Pharmaceutical Firm Moderate Kearney 70 13. Metro Line - I Medium BCG 34 30. Unhappy Friend Moderate Kearney 72 14. LCD Screen Manufacturer Moderate KPMG 36 31. Movie Launch Difficult Bain 74 15. Car Manufacturer Moderate McKinsey 38 32. Wood Manufacturer Difficult BCG 77 16. Asset Management Firm Difficult Bain 40 17. Metro Line - II Difficult BCG 42 Easy Accenture 80 VII. 33. ICON, IIM Bangalore Guesstimates Automobile – Electric 2-wheeler 3 Contents - II S.No Particulars Difficulty Company Page 34. Food Delivery App Moderate Bain 81 35. Food Delivery Customer Service Moderate Deloitte 84 36. Four-Wheeler Tyres Moderate GEP 87 37. Automatic Vacuum Cleaner Moderate McKinsey 88 38. COVID Tests Difficult GEP 89 ICON, IIM Bangalore 4 Introduction – Case Interviews Case Interviews ❖ Personality based ques. (5 min); Case discussion (20-30 min); Closing ques. for interviewer (2 min) ❖ Know your CV well→ personality ques are based on CV to break ice and getting to know you ❖ Case discussions don’t have a predetermined answer. Evaluation is based on approach, exercising judgements and steering through the problem statement Business Case ❖ Real life consulting project, that the interviewer was involved in → basis of case discussion ❖ Consult projects can vary from 2-3 months to even a year → condensed into minutes for interviews ❖ Provided as a 3-5 statement caselet introducing the client and problem faced by them ❖ Can be number based or strategy driven; guesstimates can be a part as well Why Case Interview? ❖ Test the ability to perform on the job in a similar setup as the case-interview (consult-fit) ❖ Understand thought process of the candidate and capability to make decisions/ prioritize ❖ Put you under same pressure, like any consult project, to assess your poise, self confidence and communication skills (interpersonal skills) ❖ Drawing on personal experiences, if any, can come very handy – appreciated by interviewer ICON, IIM Bangalore 5 Introduction – Case Interview Process Interview Stage What to expect? Skills Tested Case Interview Question ❖ Interviewer tells about the business problem and objective ❖ Ask clarifying questions; ensure you heard the question correctly ❖ Ability to listen and synthesize Developing the structure ❖ Ask for time to structure the problem at hand ❖ Come-up with a structured MECE approach quickly ❖ Structured thinking ❖ Communication ❖ Use a hypothesis driven approach for case solving ❖ Ask relevant questions, use 80-20 rule appropriately ❖ Case can get number intensive ❖ Problem solving ❖ Analytical skills ❖ Communication ❖ Summarize the case with recommendations backed up by insights discovered in the case ❖ Creativity ❖ Concision ❖ Communication Case Analysis Summary/ Recommendation Questions for Interviewer ❖ Opportunity to show enthusiasm towards consulting ❖ Ask relevant, non-generic question ICON, IIM Bangalore ❖ Consulting fit 6 Profitability Framework Profits Revenue Price Production Cost Volume Distribution Product Mix Customer (What product in the portfolio; apply 80/20) (Can use customer journey for services) Fixed Variable (Can use value chain analysis for cost reduction too) Value Chain Volume per customer # of customers Loyalty program Place Cross selling Product Bulk discounts Promotion Think about journey of product/ service R&D In-bound Mfg/ Srvc delivery After sales Sales & Mktg Outbound (Covering the 4Ps) ICON, IIM Bangalore 7 Two Wheeler Manufacturer Profitability | Easy | Bain (Buddy) Case Statement : Your client is a 2-wheeler manufacturer, and the company has seen a significant drop in the market share in the last 2 quarters. Find the issue and recommend solutions. Before we delve deeper into the case, I would like to get some context about our client. Can I ask a few questions on the same? Sure, please go ahead. Since it is an OEM, the value chain starts from the procurement of raw materials from the suppliers. We have inbound logistics and the manufacturing happens at the plant. We have warehouses to store the finished models and these models reach the dealers / distributors through outbound logistics. We have post-sales services as the final element in the value chain. Which element of the value chain do I need to focus on? Focus on the post-sales services. Where is our client located and what is the geography in which they operate? What are their products? Our client’s R&D centre is in Bangalore and they have 8 manufacturing plants across India and also have pan-India distribution. They have products in 3 segments: sports, scooty and motorbikes where they have 5 models in the 100-200cc segment. I would like to know if the dip in market share is in a specific segment or throughout segments? I would also like to know if this dip is across India or concentrated to a specific geography? The dip in market share is in the 100-200cc motorcycle segment and is concentrated in the Punjab and Haryana location. I think I have enough information to start the case. Since it is an issue with the market share, is it fair to assume that the revenue has fallen down for our client and that we can neglect the cost aspect? It is a fair assumption to make. You can proceed now. I would like to break the revenue into two major factors: No. of bikes sold x Average price per bike. Did any of these go down or is it a combination of both? The number of bikes sold has gone down in the geographies mentioned above. Since the volume of bikes being sold have gone down, is it a demand side issue or a supply side issue? It is actually a combination of both. But for now, focus on the supply side. I would like to break down the value chain of our client and investigate each element of the value chain. Does it sound like a reasonable approach? There can be multiple reasons with respect to Post-sales services: 1. Lesser number of service centres, lesser opening hours. 2. Lesser number of free services. 3. More service time (Turnaround Time) 4. Service assistants behaviour Do I need to look for more reasons? No you don’t need to. Apparently, a few service centres in Punjab & Haryana were shut down due to non-conformance with the government waste disposal regulations. Because of this, the vehicle owners had to travel longer distances to get their services done. Moreover, this created dent in the reputation of our client. So I am assuming that the combination of both these factors pushed the end consumers to switch to other OEMs because of which our client’s demand has gone down. Is this the reason for the demand problem that you mentioned at the beginning of the case? You are correct. Now what can our client do to salvage the market share? I would like to give a few recommendations. 1. Incentivise the service centres to follow the rules and reopen the centres as soon as possible. 2. If the service centres are company-led, try to move to franchise model and increase the number of service centres in the short run. 3. Our client can also get into a revenue sharing agreement with other OEM service centres. 4. Lobby the government to approve the reopening of the centres. 5. Rebuild the brand reputation by providing additional free services for the vehicle owners. That is pretty much it. Thank you! Yes, you may do that. ICON, IIM Bangalore 8 Two Wheeler Manufacturer Case statement Interviewee Notes Profitability | Easy | Bain (Buddy) • Market share of 2-Wheeler manufacturer has reduced over the last two quarters • Analyse the reason for the drop and recommend solutions to capture the market share again Structure/Framework • 8 manufacturing plants, Pan-India distribution • 3 segments, dip in 100-200cc segment in Punjab and Haryana • Focus on supply side issue • Post-sales services deteriorated • Few service centers shutdown Revenue No. of bikes sold Demand Suppliers Inbound logistics Average price / bike Supply Plant Warehouse Post-sales services Dealers Outbound logistics Reduced no. of service centres Key Takeaways • Used the profitability framework – Supply side issue • Understanding of value chain is required to list down the possible reasons • Think of recommendations to open service centers at the earliest, comply with regulations and lobby with the Government ICON, IIM Bangalore 9 Retail Supermarket Chain Profitability | Easy | Bain (Partner) Case Statement : Your client is a retail supermarket chain based out of Mumbai. It owns about 50 stores. The EBITDA has been negative for the past few months. Yes! The inhouse operations costs can be divided into five major heads. Rent, employee salaries, utilities, technical infrastructure and security costs. Have I missed anything else? Thank you for the problem statement! I would start by asking a few questions. What are the target consumers of the client? Is it high end supermarket like Godrej’s or something like a Big Bazaar? You did consider the major costs. Wastage/Shrinkage costs is also a major component for the company and has been increasing for the past few months. Let us analyse core revenue now. You can consider to be it like a Big Bazaar chain, but focusing solely on groceries. Thank you! Could you let me know the product mix of client, whether the company sells private label goods or large FMCG labelled goods? The client has both type of products. Additionally, it also deals in fresh products like milk, fruits, vegetables etc. Okay. Do we have any area specific issue or is it across all stores? Great question. So, we have been facing lower profitability than the industry standards. The issue has cropped up over the last year and is across all the stores I would like to further break down profit as a function of revenue and costs. Is it a fair approach? Please go ahead with the approach. Kindly analyse both the factors for me. Thank you! Revenue can be broken down into core and non-core revenues. Core revenue will mainly include the revenue generated from sales at the stores. Non-core revenue would be advertisement expenses, parking charges, value added service charges etc. That is a good way to structure the Revenue components. Let us also analyse the costs involved. I would like to analyse costs across the value chain: Sourcing and procurement costs, logistics & warehousing costs, inhouse operations costs, and after sales costs if any. Oh yes, Wastage costs will form a major part since the client has significant proportion of perishable items in the total sales. The core revenue can be a function of no of customers and Average basket size per customer. Do you have issue with any of this? The footfall at the stores has been decreasing. How would you analyse this? Sure. We can go through the entire consumer journey of purchasing goods via retail chain, and understand the pain points. Can you think of dividing the customers on some parameter, given we have equal number of consumers from all income segment. Customers can be divided into frequency of visit: first time visitors, occasional visitors and frequent visitors Yes you have correctly identified. Due to lack of time, I would tell you that we face issues with both New and Old customers (varies according to region). Please think of recommendations that you can give to your client. Sure, I would like to divide my recommendations on a 4x4 matrix of short term/long term on x axis and frequent/new visitors on y axis. for new visitors, area specific marketing campaigns and discount schemes can be launched in short term. In the long term, company can look to employ practices like ELDP. For frequent customers, in the short term it can focus on better in house experience and in the long term, the client can focus on introducing attractive loyalty scheme. Thank you, it was nice interacting with you, All the best! What are the possible inhouse operations costs that you can think of? ICON, IIM Bangalore 10 Retail Supermarket Chain Case statement Interviewee Notes Profitability | Easy | Bain (Partner) • Your client is a retail supermarket chain based out of Mumbai. • It owns about 50 stores. • The EBITDA has been negative for the past few months. Structure/Framework Profits • The supermarket chain is like that of Big Bazaar, dealing in groceries. • It also holds large amounts of perishable goods. • Stores in different area have different sets of problems. Revenue Core Costs Non-Core Number of customers* Avg. Basket Size Demand (Number of customers) Security Costs Infrastructure Salaries Rental Frequent New Utilities Shrinkage Key Takeaways • Interviewer was impressed by spilt of core and non-core revenue. It is not necessary, but surely fetches brownie points • Incorporate the given context while coming up with the cost heads, and do not blindly follow set patterns • Interviewer appreciated the structuring of recommendations section ICON, IIM Bangalore 11 Energy Major Firm Profitability | Easy | McKinsey (Partner) Case Statement : Client is an energy major based in the USA, facing declining profitability for past couple of years and wants our help in diagnosis. So, let’s do a case. We will discuss about a power and energy client. Do you have any idea about power industry? Okay, what else? We should check whether the decline in units sold is due to declining demand or our client’s incapability to fulfil the demand. Sure, the power sector is quite vast, electricity can be generated from various sources like coal, nuclear, hydro and wind. Then, it is distributed to through the grid. Supply is not an issue. What factors can drive the demand down? That’s right, a typical power value chain has 4 parts: Generation, transmission and distribution, wholesale and retail. So, our client is a major US based energy sector player. They have been experiencing declining profits from their coal-based power business for past couple of years. Demand = No. of customers (HH connections)* No. of units/HH So, we can look at either of these. Further, the decline in either can be driven by internal like their client specific issues affecting the consumption or external macro factors like competition, economy etc. Okay. So, I’ll like to ask a few questions to understand the problem better. Fair enough. Let’s look at costs. Sure, go ahead. For costs, we will look at the value chain: Raw material (coal), thermal power production, transmission and sale to the whole-seller and further distribution to the end consumer. What part of the value chain does the client operate in? Client owns the entire value chain till the distribution. Okay, electricity consumers can be divided into 3 segments: Individual, commercial and industrial right? Is the problem prevalent across all? Okay. Let us look at some data. The player has 10 coal power plants, with average output of 4.5 million Megwatt-hrs/year per plant. The wholesale price is $40/ MWhr and the costs is $10 / MWhr. Now the current utilization is 80 % and client is looking to increase to 90%. How much extra income will this generate? Assume price & costs remain same. Okay, sure. Can I take a moment to do the calculations? Let us focus on household customers. Is this trend common to any other players in the industry? We do not have any information on that presently. Okay, sure I’d like to approach this problem solving by expressing profits as a function of revenues less costs. We can look at whether the declining profitability is due to decreased revenues or increased costs or both. Output Revenue Costs Income Current =4.5*10 million MWhr = 45 million MWhr $1800 M $450 M $1350 M New = 45*(90/80) million MWhr ~50 million MWhr $2000 M $500 M $1500 M Extra income = $150 M on the venture Okay, what factors can drive down revenues? Firstly, revenue = no. of units sold * unit price. We can check for any decrease in unit price. Very well. Walk me through your calculations. ICON, IIM Bangalore 12 Energy Major Firm Profitability | Easy | McKinsey (Partner) Fine, so it seems like a good opportunity, what can be the bottlenecks in increasing the output to 90%? Can I take some time to think? Sure, go ahead. The bottlenecks can be: Supply issues 1. Regulatory licenses/ requirements 2. Safety/Advised %utilization 3. Increased wear and tear of equipment 4. Quality issues – coal efficiency, etc Demand issues – demand may be highly variable, hence extra capacity buffer is required, mean cannot be increased Good. I think that is all. ICON, IIM Bangalore 13 Energy Major Firm Case statement Interviewee Notes Profitability | Easy | McKinsey (Partner) Power sector client facing declining profits Structure/Framework • Coal based plants • Full VC • HH customers only Profits Revenue No of units Calculations: 10 plants- all coal based 4.5 mil MWhr/yr/plant – current output Wholesale price – $40/MWhr Cost – $10/MWhr No of connections x x Costs Price/unit Raw material Avg no. of units/HH Generation Internal External Transmission Need Competition/ Substitution Wholesale distribution Regulatory Retail Awareness Accessibility Affordability Cust. experience Social Technological Environmental Calculations: Output Revenue Costs Income Current = 4.5*10 million MWhr = 45 million MWhr $1800 M $450 M $1350 M New = 45*(90/80) million MWhr ~50 million MWhr $2000 M $500 M $1500 M Key Takeaways • The interviewer mostly wanted me to list as many factors as possible in each scenario without going in too much depth. ICON, IIM Bangalore 14 IT Services Firm Profitability | Easy | McKinsey (Partner) Case Statement : Your client is an IT services company based out of Bangalore and has been facing declining profitability. Diagnose the problem and suggest possible solutions. Thanks a lot, Sir, for the problem statement. I would like to confirm that our client is an IT services company facing declining profitability. We must find the problem and suggest possible ways to mitigate it. Correct. So, before starting with the analysis, I would like to ask a few clarifying questions to get a better understanding about the problem and our client. Is that okay? Revenues have been steady. Let’s focus on the costs. Sure, Sir. Since our client is an IT services company, their main costs would be HR costs, infrastructure costs and any miscellaneous costs. What do you mean by infrastructure costs? Infrastructure costs would be the costs associated with maintaining hardware like servers, and computers/laptops or costs associated with licensing software. Are there any other costs I need to consider? Sure, go ahead. Let’s start with the HR costs and then come back to others. What all factors do you think contributes to the HR cost? As I understand that we are facing declining profitability. I wanted to understand if the problem is specific to our client or whether it is an industry-wide problem. Also, for how long have we been facing this problem? I believe HR costs can be a component of the number of employees in the organization, the salary paid to each employee and the employee mix, or the number of employees at different roles. Are any of these the issue? The problem is specific to our client. The issue has been around for a while. Let’s analyze the employee mix. Why do you think this could contribute towards increasing costs? Can I know where the customers of the client are based? The clients customers are mainly based in the US. Thanks for the information. One last clarifying question. I wanted to understand the competitive landscape of the industry. For the sake of simplicity, you can assume that our client is the market leader in the industry. The HR costs will depend heavily on the number of employees at different roles. For example, in any project team, there might be a manager and developers at 2-3 roles, each commanding different salary. So even with relatively lesser number of employees, if there are a greater number of employees at senior roles, the costs will be higher. Is there any other way in which different employees could receive different salaries? If the company has different onshore and offshore teams, there could also be a problem with the onshore-offshore mix, resulting in higher costs. I would like to take a minute to gather my thoughts and come up with a structure for the analysis. Would that be Okay? Yes, that was one of the major issues our client was facing. Thanks. We are out of time. Let us wind up here. Sure, go ahead. Thanks. Since we are facing issue of decreasing profitability, I would like to start the analysis basis revenue and cost. Could you help me with the trends in revenue and cost? ICON, IIM Bangalore 15 IT Services Firm Case statement Interviewee Notes Profitability | Easy | McKinsey (Partner) • IT service client facing declining profitability Structure/Framework • The problem has been going on for a while • Client is a market leader in IT services Profitability Costs Revenue HR Costs Infrastructure Costs Number of employees Hardware costs Employee Salary Software costs Misc. Employee mix Key Takeaways • Segmenting people cost by number of employees, salary and mix was important • Think on various aspects around how employee mix can affect HR costs ICON, IIM Bangalore 16 Pharmacy Profitability | Moderate | A&M Case Statement : A pharmacy present inside a multi-specialty hospital has been facing declining profits since past one year. You have been hired to identify the root cause of the issue. Interesting. I would like to begin with a few clarifying questions on our client. Is it the only pharmacy store our client is operating? And do they sell only prescription drugs or OTC drugs as well? Yes, the client just had one pharmacy inside the hospital, and they sell both prescription and OTC drugs. Since it’s a multispecialty hospital, I would like to understand what kind of drugs are being sold by the client. As in do they specialize in some particular drugs or they sell all kinds of drugs? Yes. The stocks are enough, although the store doesn’t keep the prescribed medicines. I see. Since you already mentioned that they keep different types of medicines already since it’s a multispecialty hospital. So is it because the doctors are not sticking to few brands and are prescribing different brands to different patients? Yes indeed. Can you think of a reason why this might be happening? Sure. So, one reason that I can think of is maybe in the last few months the sales representative visits from different brands have increased and doctors are just switching from one brand to another more fluidly. They sell all kinds of drugs. Alright, so, profit can be broken down into revenue and cost. I would like to understand if the declining profits is due to declining revenues or increasing costs? Great, you have identified the root cause of the issue. Now, can you identify major cost heads for the store? Revenues have declined and costs have also gone up. Let’s focus on revenues for now. So, revenue from the product can be thought of as Price X Ticket Size X Frequency of buying. I will look at each of these components individually to understand the problem area. Has there been a decline in the volume of our product sold or have there been some pricing changes? There has been a fall in volumes. Okay, so if there has been a fall in volumes it is a demand issue. It is important to understand if it is due to the falling demand or there are supply related constraints at the store. The demand is doing okay, but there are supply side constraints which is leading to a fall in volumes sold. But just list down the factors which might affect the demand before moving on to the supply side. Alright, so looking at the customer journey, some of the key factors affecting the demand at the pharmacy are shop awareness, visibility of the shop, payment options, staff quality, service time, opening up of new pharmacies nearby or in the hospital and promotional discounts. Great, go on to analyze supply side now. So, coming to the supply side – availability of prescribed medicines, stockout of medicines, salesforce availability and its efficiency are some of the key factors. Yes. So, we can break costs into the fixed costs and variable costs. Fixed costs would comprise of rental space, employee wages, marketing costs and other administrative costs. Variable costs will comprise of MDR on payments, inventory holding costs (pilferages and product expiration), and cost of products. Correct. I would now analyze the issue with the increasing costs. It can be either due to increasing fixed costs or the increase in variable costs. My initial hypothesis would be that our client needs to keep various multiple brands of the same medicines, this might be leading to increased costs due to loss of negotiation power basis volumes with one brand. But I would still like to check each cost head. That’s fine. Your hypothesis seems correct. Let's close the case here. ICON, IIM Bangalore 17 Pharmacy Case statement Interviewee Notes Profitability | Moderate | A&M • Declining Profitability of Pharmacy Structure/Framework Declining Profitability of Pharmacy • Declining Revenues and Increasing costs • Demand is fine • Supply side issues Revenue Price Costs Ticket Size Frequency Supply issues Medicines Availability Stockout Fixed Costs Demand issues Sales Staff Availability Efficiency Awareness Rental costs MDR on payments Salaries and wages Inventory holding costs Visibility Service experience Variable Costs Marketing Costs COGS Administrati ve costs Discounts Key Takeaways • Structuring of the problem by the candidate was strong to identify possible factors impacting the problem • Utilization of real world understanding to identify practical problems in a case like this ICON, IIM Bangalore 18 Skiing Resort Profitability | Moderate | BCG (Manager) Case Statement : A Skiing resort in Switzerland a decline in sales since a year. You have been hired to find what is wrong and solve the problem. You decide. I have a few questions about our client, may I do ahead? Okay, I will go ahead with supply first. I want to look at supplies for skiing business and then non-skiing business. Is that fine? Sure You can focus on the skiing business. When we are talking about Sales, do you mean revenues or volume? Sure. For skiing business, the major players in the supply chain are – Training personal/guides and skiing equipment. Is there a dearth of training personal or the equipment quality and quantity? Volume. Is the client facing declining volumes in all resorts or a particular resort? No, no issues in these. You can move to the demand side. The client has a single resort. What kind of customers does the client have – local/foreigners? And in which type has there been a decline? The decline has been in external customers. Are the competitors in the region also facing a similar issue? Okay, as the number of foreigners visiting the resort are decreasing, I would like to look at the customer’s journey. The customer journey will first involve booking the resort which includes search and payment, then travelling from the respective locations to Switzerland, moving from train/air/sea-port to the resort, resort services(stay/food), enjoying skiing and then checking out to the resort and the reverse journey. Do you want me to look at any particular head? There has been a decline in the people travelling by air Yes. Okay. I will analyze this based on availability of flights to Switzerland and affordability. Are enough number of flights available? Have the prices of flights increased in the past year? I have enough information. May I take a few seconds to structure my thoughts? Yes sure. As the competitors are also facing, I would like to look at the factors external to the client affecting the company as a whole? Does this approach seem fair to you? Yes, go ahead. Have there been any changes in the government regulations, environmental laws/factors(like there is not enough snow or any restrictions imposed) or licensing in the last year? Yes, price is the issue. People are not preferring to go to Switzerland because prices of flights have increased. Can you suggest what can be done to mitigate this problem? For this I would look at the reasons why the prices increased in the first place. It can be because of the fuel charges or a general price increase among all the airlines. For solving the price issue, our client or the tourism department/union can lobby the airlines to decrease the prices or the resorts can introduce more tour packages decreasing the prices on their end so that the whole experience is within the budget of the customer. No, no changes. I will look from supply and demand side. Which side do you want me to look at first? Great! It was a good discussion. ICON, IIM Bangalore 19 Skiing Resort Case statement Interviewee Notes Profitability | Moderate | BCG (Manager) • Skiing Resort in Switzerland • Decline in sales since a year • Find problem Structure/Framework Volume Decrease • Sales = Volumes • Single Resort • Decline in external customers Local customers Foreigners External Factors Supply – Demand PESTEL Supply Training Personnel Customer Journey Booking Resort Travel to Switzerland Internal Factors Demand Equipment Customer Journey Move to resort Resort Services Skiing Experience Reverse Journey Key Takeaways • If the client as well as the competition is affected then it is not necessary that PESTEL or Porter analysis works. • Always check customer journey when volume decreasing and be comprehensive in that ICON, IIM Bangalore 20 Quick Service Chain Restaurant Profitability | Moderate | Kearney (Buddy) Case Statement : Let's get into the case. . Your client is a QSR chain restaurant. Their manpower costs have increased tremendously. You need to analyse and give recommendations Okay. So, I should focus only on manpower costs or is there any other specific costs/ revenue issues which I need to consider? I wanted to know more about the company and industry before going ahead. Where does our client operate in? What are the products being produced, in the sense is it like burger and pizzas? How long has this cost increase situation been and what is its quantum? So, our client operates in India. You can consider it as similar to Dominos kind of thing w.r.t products. So, they are facing this cost increase b/w 2017 to 2019 and current increase is at 50% compared to 2017 costs. Is the cost increase specific to our chain of restaurants or is it across all restaurants in the industry? Other similar restaurants have also experienced these kind of increases. Not to 50% , but to certain extent yes though we don’t have the exact data Okay, thank you. Manpower costs increase can be either due to increase in salary per employee or due to increase in number of employees. Do we have any data which says which of these parameters have increased over last 2 years? Both of them have increased. Before you go this path, when you refer salary per employee which salary are you considering? So, the other 25% increase is due to increase in number of number of employees. Possible reasons for both could be a) These contract workers will have certain minimum wages as per govt regulations. That might have increased in these 2 years increasing in avg salary. b) The customer intake might have increased leading to more revenue and also hiring more employees. That might have contributed to increase in number of employees Both of them are correct. They explain only partial increase though. The minimum wages did increase as 2019 was election year and it contributed roughly 10%; the revenue growth directly contributing to increase in number of employees could be another 10%; there is still 30% we are yet to explain. Let me take one minute. Was there some sort of incentives required to keep employees from leaving as we were having higher revenue and we didn’t want trained workers to leave ? Yes. As you can see 2019, lot of other competitors had turned up in online delivery channels like Swiggy, Zomato. So, client had to give more incentives which contributed to 15% increase. Got it. I think I missed asking a basic question in starting. How much of our business is from delivery chains and how much is from inhouse and takeaway at restaurants? Have they changed in these 2 years? Yes. I was wondering when you would ask this or tell your assumptions on this. So, online delivery business has picked up in these 2 years. I guess that explains remaining 15% increase contributed by increase in number of employees. Number of employees working in one delivery order are generally more than that of inhouse or takeaway system. The overall avg salary considering salaries of all employees This would not help you to find the root cause. Could you think of dividing it further? In general, these restaurants will have 3 types of employees. Mainly Blue colllars who are temporary workers or contract workers, white collars at restaurants like cashiers and admin employees who are part of central administration. I guess salary of the admin people contributes the highest percentage of overall salary, but we must check data to confirm which salaries have increased over these 2 years Yes. The blue collars / contract workers avg salary has increased by 25%. So what do you think the reasons are? Good. Can you quickly list out 1 or 2 recommendations? On short term, a) Consider reducing the employees in the take-away/ inhouse business as those business haven't grown that much. b) Think of other non-monetary incentives like free food from restaurant instead of direct monetary incentives. On long term, a) Since all chains are facing this minimum wage problem, they can club together and lobby with the government. But that would be seen in the bad light by consumers. Instead of this, they all collectively can increase prices of their food. b) They can also think of having strategic tie ups with Swiggy or Zomato and let them take care of delivery business. ICON, IIM Bangalore 21 Quick Service Chain Restaurant Case statement Interviewee Notes Profitability | Moderate | Kearney (Buddy) • Manpower costs increased by 50% from 2017 to 2019 • Both avg salary and number of employees have increased by 25% • Online delivery portion of revenue has increased more and more online competitors have popped up. Structure/Framework • Qualitative analysis • Contract workers had increase costs • 2019 – election year, increase in online deliveries, incentives and revenue growth contributed to the increase Manpower costs (increase by 50% over 2 yrs) Contract workers workers (roughly 50% increase) Number of employees (25%) (25%) Avg Salary per employee (25%) Minimum wages (10%) White collars at Admin White White collars at restos Variable incentives (15%) Revenue growth (10%) Increase in online deliveries (15%) Key Takeaways • The candidate directly went to the split between avg salary and number of employees without considering different categories of employees. It is better to state assumptions upfront regarding the way you are approaching rather than interviewer asking you to explain. • Few preliminary questions were asked in later stage and they were related to the final answer. It would have been easy if this was asked in the beginning which would have given right hypothesis to test during the approach. ICON, IIM Bangalore 22 Electricity Company Profitability | Moderate | McKinsey (Partner) Case Statement : Your client is an electricity generation company based in US. They are experiencing declining profits. Analyse how would you approach the solution. Before you go ahead, I want you to tell me what do you think is the value chain for such companies? I am assuming they work for 16 hours per day and approx. 300 days in a year. Electricity generated would be 10 * X * 10 * 0.3 * 16 * 300 = 144000X units Good. What do you think can be improved here? Revenues have remained constant whereas the costs have increased. The first obvious thing would be the efficiency. As indicated earlier, we could think of buying new machines which have better efficiency which will improved the units generated. And also, based on my previous experience, we can have heat recovery system installed at every turbine. These will help in efficient usage of output gases which are at high temperature and can be used to heat steam. This will add additional revenue stream. Okay. I will try to analyse the costs across the value chain activities. Should I focus on generation first? And also, what kind of turbine do they use? Interesting. How about we focus on transmission now. What do you think is the trade off that exists here? The three major value chain activities in such a company would be Generation, Transmission and Distribution. These will be supported by other activities like sourcing fuels etc. I wanted to know if revenues were decreasing, or costs were increasing or both for the client Sure. They are currently using Gas Turbine generators. Tell me the various cost drivers which you think are in generation. The major costs in generation would be input fuel costs, machine operating costs, manpower costs, conversion costs, repair and maintenance costs. Among these various costs, which of them do you think is more controllable from the client’s perspective? Transmission losses occur more as there are long distances between generating and consuming units. To reduce losses, we need to have more hubs. But having hubs requires huge capital expenses. So we need to find appropriate location for hubs with given capital budget which will minimise transmission losses. We have covered most aspects of the case. It was nice interacting with you. We are delighted to have you on board with us. a) The input fuels used are mostly Naptha or Liquified Natural Gas in Gas Turbines. These fuels have lot of uses in other streams and their prices fluctuate based on crude oil prices. Client will have little control over these prices b) All other costs like Manpower costs based on operation, supervision and maintenance personnel; Machine operating costs; Repair and Maintenance costs, Conversion costs and Efficiency of machines based on type of machine used are controllable in nature. There are machines with efficiency ranging from 30% to 60%. A more capital investment would lead to better efficient machines which reduces costs of running. They will also require less maintenace. We should focus more on these controllable costs to analyse which of them have increased. Ok. Our client has 10 turbines with each turbine requiring throughput of X units of naptha per hour. 1 unit of naptha gives approx. 10 units of electricity. Calculate electricity generated in a year if efficiency is 30% ICON, IIM Bangalore 23 Electricity Company Case statement Interviewee Notes Profitability | Moderate | McKinsey (Partner) • Client is facing declining profits. Revenues have stayed same. Costs have increased • Analyse the value chain and indicate the costs associated with it Structure/Framework • Generation, Transmission and Distribution is the value chain. Client operates only in G and T • Costs that are controllable in nature need to be analysed further to find root cause • Trade off between number of hubs and transmission losses. Declining Profits Profits Declining Constant Revenue Revenue Constant Value Chain Increasing costs Generation Controllable costs Controllable costs Machine Operating costs Manpower costs Transmission Non Controllable costs like Fuel Number of hubs Conversion costs Efficiency v/s Transmission losses Repair and Maintenance costs Key Takeaways • The candidate has previous experience working at power generation industry. Hence this case was asked to check work exp knowledge as well as the approach in analysing • Efficient understanding of value chain and various cost drivers is critical in qualitatively analysing such problems. ICON, IIM Bangalore 24 E-Commerce Firm Profitability | Difficult | Bain (Partner) Case Statement : Your client is an E-Commerce player like an AJio/ Myntra which is facing a problem of very high returns. For every 100 Rs order, they are facing returns worth Rs 30. Along with the revenue loss there are additional return costs involved which need to be brought down. You have been hired to help them with the same Okay. I had few questions to understand the problem more clearly. Is the problem specific to particular geography/ product type/ customer segment? Also, are our competitors facing the same issue or is it only specific to the client? The problem is specific to our client but not specific to any geography/ product type/ customer segment. For this case, you can assume whatever you can think of can go wrong, is going wrong. I would want to listen to what all recommendations you have for every problem you can think of I will begin by addressing the problem of higher returns first and then move on to analyzing ways of reducing costs. Does that sound good? Why don’t you start with the costs first and then we shall come to the returns. If I look at the steps involved in the process and try to think of cost heads which would be involved in it, first would be a delivery agent coming and collecting the parcel from me (Labour cost). Second that parcel travels back to the fulfilment centre (Transportation cost). Third the parcel is stored as inventory in the warehouse (Inventory Costs). Should I go ahead with these three cost heads or have I missed out on any? These are pretty comprehensive and you came up with these following a good structured return journey approach, please go ahead. To begin with transportation costs. I would want to divide them into # of trips * Avg distance per trip * Freight rate. I would further divide the # of trips into (# of return parcels / Avg # of parcels / trip). While for reducing the # of trips, the major driver would be to reduce the # of returns itself but apart from this, the client could look at efficient return pickups to probably pickup return parcels in the same area/locality together to club multiple parcels in a single trip. Moving onto Avg distance per trip, this can be done in two ways, On a short term basis the client could employ network optimization software to ensure the orders get fulfilled from the nearest fulfilment centre and a long term recommendation would be to increase the # of fulfilment centres in India which would reduce the average lead distance and time per order. On a short term basis for freight rate, the client should negotiate with their delivery partners to bargain for a better rate. On a long term basis, the client could award the contract for the next term on an L1-T1 basis to a new delivery partner which provides better rate. Third option could be to acquire an existing player which is in the last mile delivery business or to have a long term strategic partnership with some Courier company. Excellent. Why don’t you move onto Inventory costs now. In the inventory management process, there would be three steps involved Unloading – Storage –Loading (during order dispatching). Considering these three stages, I would again divide the recommendations basis their ease of implementation and investment required to be either on a Short-term basis or Long-term basis. Under Short term recommendations - 1. Provide training for upskilling of material handlers to ensure minimum damage 2. For reducing material related damages, the client should ensure the place is properly sealed and maintained to avoid problems like rodents etc. damaging the stored products. Frequent clean-ups of the fulfilment centre to be done using rodent repellents etc. 3. To reduce instances of pilferage, increase vigilance both in and around the fulfilment centres and deploy a detailed SOP for security guards to check all the employees while they go out. Under Long term recommendations - 1.Upgrade the inventory management system to deploy a more automated technique (like a RFID based management system which reduces human intervention) 2. Deploy CCTV cameras across all the fulfilment centres and have a tracking team to keep 24x7 eye on the same. This will ensure lower instances of pilferage. 3. Change the inventory management practice to follow a FIFO basis to reduce the damages. 4. For disposal of damaged products, the client should recycle to the maximum extent possible or could even partner with a firm to whom we can sell the scrap and recover some salvage value from the disposed products. Perfect, your recommendations for controlling costs are pretty comprehensive and we have covered most of it. Why don’t you just tell me the approach you will follow for looking at ways to reduce the # of returns. Sure. I would want to look at 6 major factors (Product, Price, Promotions, Place, Process, People) and give my recommendations under each of these heads for reducing the # of returns Sounds good. We are happy to extend an offer to you. ICON, IIM Bangalore 25 E-Commerce Firm Case statement Interviewee Notes • Consider all possible scenarios • Transport costs recommendations to reduce number of trips, avg distance and freight rate • Inventory costs recommendations to reduce storage costs and loading/unloading costs. Loading costs also include damage costs due to mishandling • 6P analysis approach to analyse high returns Profitability | Difficult | Bain (Partner) • Client is facing high returns and as a result, facing huge costs associated with the same. • List all possible costs associated and recommendations to control the same. Think of all possibilities. Structure/Framework Costs associated with returns Transportation costs Avg distance per trip # of trips # of return parcels Factors for analysing ÷ Inventory costs Frieght rate Unloading costs People Promotions Labour costs Storage costs Loading costs Avg no of parcels/ trip Product Prices Place Process Key Takeaways • The candidate divided every cost into appropriate MECE categories on every aspect. This structured the approach also helped in recommending solutions as there was no overlap between solutions. • Short term and Long-term recommendations were given in most cases which is very important as it considers both the budget and implementation effort constraints. ICON, IIM Bangalore 26 Market Entry Framework Good to know frameworks Basic structure Market Entry Strategic Objective - Why to enter? - Target Metric Industrial Conditions How to Enter? Market Attractiveness - Addressable market - Growth rate - Profit Margin Customers - Market structure - Reaction to entry - Segments Competition - Price, Product, Place Promotion Barriers to Entry - Organic Inorganic Using 2 by 2s for final decision like degree of control vs investments; competition vs 1 own capabilities or your own set of parameters 2 Porter’s 5 forces: Good to get the context of industry as a whole - Joint venture - Acquisition Financial constraints Capabilities/Resources Suppliers Govt. Regulations Patents, IP ICON, IIM Bangalore 5Cs: Company, Competitors, Customers, 3 Context, Collaborators → very useful in scoping Value Chains for various industries to 4 understand nuances of market entry and objective metrics 27 Apple Farming Supplement Market Entry | Easy | Kearney (Buddy) Case Statement : Your client is an Indian conglomerate who has acquired a US-based Biotech firm. The US firm has developed a chemical which improves the ripening of apple in agriculture. It allows apple to be harvested earlier and gives it a better quality. The client wants to commercialize this product for the Indian market. They have hired you to figure out if they should do so. Yes, you can assume similar benefits here. Sir, before moving forward, I would like to prepare a list of some preliminary questions to get a deeper insight into the case, may I? So, we would have the first mover advantage. I think I have all the data needed to proceed further. I would like to divide my analysis into three buckets. First, I would assess Industry attractiveness, then I’ll check the financial viability of launching the product and finally I’ll look at its operational feasibility. Sure, go ahead. So, I would like to start with the client. What kind of business they are operating in and in what geography? The client is a conglomerate which operates in multiple businesses with a diversified portfolio and they are spread across India. Sure. Is there any existing competition in the Indian market? No, we would be the first ones to launch such a product. Sure, go Ahead. What are the factors you’ll look upon to check the attractiveness of the industry? I would check the presence of any regulatory barriers and look at the customer buying behaviour to see if both of these favour the product launch. Also I will estimate the market size. So, how will you estimate the market size. And before that, who do you think is our customer? So, is it fair to assume that they acquired this firm to diversify their portfolio further? Yes, you can go ahead with it. Now, I would ask some questions about the US-based firm. How credible this firm is and have they had any experience in the Indian market? It is a very credible firm in the US and has a good understanding of the market there. They have not had any experience in India yet. Sure. About the product, what kind of a product is it and how is it used? It is a powder-like product which is sprinkled on the field during the sowing season. What are the exact benefits of the product? I understand that it improves the quality but do we have a metric to assess it? Are there any side effects? Yes. It makes the crop to get harvested 10 days earlier, improves the yield by 10% and sweetness by 5%. There are no side effects Since this product has been developed in the US, do we have any information if it would have the same results in the Indian farming? Our customer would be the farmers and their cooperatives. To calculate the market size of the Indian market, I’d take the population of the states of Himachal Pradesh, J&K, Punjab, Uttar Pradesh and Haryana since apple needs a cold climate, so I believe that our major customer segment would be in North India. Then, I’d divide the population according to expected percentage of people involved in agriculture. I’ll take an estimate of proportion for farmers involved in apple farming in each state and finally multiply it by an average acre of land owned by each farmer. That sounds good. So, we have some data regarding that. We are currently focussing on a sample of 200 orchards. Each orchard has 100 acres of land and each acre generates $30000 per harvest. Assume there is only one harvest per year and estimate the annual farm revenue we are focussing upon. So, we have $3 million per orchard per harvest, which means $600mn per year for the whole sample. Do you think this is a good enough size to launch a new product? Yes, on the face of it, it looks like a good figure. However, it would be relative upon what the client’s goal with this product is and what is the investment required. Okay sure. Sounds good. In the interest of time, we can close the case here. ICON, IIM Bangalore 28 Apple Farming Supplement Case statement Interviewee Notes • Multiple businesses, diversified portfolio • No experience in India • Powder like product • Crop harvests 10 days earlier • Improves the yield by 10%, sweetness by 5% • No side effects Market Entry | Easy | Kearney (Buddy) • Acquire US based bio-tech firm • Developed a chemical which improves the ripening of apple in agriculture. • Better quality and early harvest Structure/Framework New Product launch Industry Attractiveness Market Size Estimation Regulatory Barriers Financial Viability Operational Feasibility Customer Buying Behaviour Calculation Total population Number of orchards % of people in agriculture Acres per orchard % of farmers growing apple Revenue per acre per harvest Aevrage acres of land per farmer Harvest seasons per year Average revenue per acre Key Takeaways • Understand the client well by asking preliminary questions – there can be related business which may help start the new business • Try to MECE at every step • Draw on personal experience and knowledge about the client/industry/situation but do get a buy-in from interviewer ICON, IIM Bangalore 29 Air Purifier – COVID disinfectant Market Entry | Moderate | Bain Case Statement : Your client is an international player and wants to enter the Indian market with an air purifier which kills Coronavirus. The client wants your input on 2 keys: Whether they should the enter the market? If yes, what would be the price range of entry? Okay, before I structure my analysis, I’d like to begin with some preliminary questions. Firstly, what is the exact products characteristic that the client wants to enter with? What part of the value chain would the client own/outsource? Sure. The client will enter with one type of air purifier that would kill the Coronavirus in the room. They will produce the air purifier and then sell it to customers. Do we have any information if the client owns this technology & has patent over it? Also, what are the major segments the client is targeting? Is their any similar product in the market or is our client’s product the first of its kind product? Good questions, The client has to bid for the technology from a 3rd party company. Also, there are no similar products in the market. Coming to the target segment, why don’t you tell me which segment will be most attractive to the client? I would like to break it into 2 parts, B2B and B2C. In B2B the customers will be various corporate offices, Airport, Railway stations which might require such disinfection. In B2C, it would be general retail customer like you and me. That’s a good analysis. Can you give me an approach to decide the price of the purifier keeping into mind all the facts that we have discussed so far? Don’t go into numbers, give me an approach you will follow. Sure, I would basically like to look at various costs that the client would incur, e.g., licensing cost of technology, manufacturing cost, distribution cost. Then I would calculate the breakeven point of sale to get the better understanding of cost per unit. Then if we can source the tender of said number of units, then it makes sense to launch the product. We can also include binding future contracts so that we have a buffer against vaccine announcement in the future. That’s great. Given that you have decided the price and are ready to launch. What should you do next? Sir, I would then analyze for any entry barrier in legality given that it comes under the realm of healthcare. If there are no such restrictions, then I would focus on marketing the product to ensure that people are aware of the product. Great, I think we can close the case here. It was nice discussing this case with you. Thank you, sir. It was indeed an interesting case. Good, Now let’s say the client wants to target B2B, what all risks he must consider before launching? He must consider the following risks: 1. Return on Investment, given that the vaccine might be announced anytime rendering the purifier useless. 2. Legal issues as the claim is that the purifier kills the virus. ICON, IIM Bangalore 30 Market Entry | Moderate | Bain Air Purifier – COVID disinfectant Case statement Interviewee Notes • Consider all factors under the ambit of a product launch • Additional factors such as mode of entry could also be explored • The case should test the soundness of your framework and your ability to apply that to this context • Air purifier that claims to kill the Coronavirus • Looking to enter the Indian market • Want clarity on whether to enter and explore factors related to this Structure/Framework Factors under consideration Market Size B2B B2C Financials Revenue # of customers Price per unit Risks Cost Licensing Financial Legal Manufacturing Distribution Key Takeaways • The customers of the product could be business customers and end consumers • The life of the product is limited, and this factor must be taken into consideration while evaluating financials • One of the most important risks is the legality of such a claim and the availability of a patent ICON, IIM Bangalore 31 Cybersecurity Software Provider Market Entry | Moderate | Bain (Partner) Case Statement : Your client is a cybersecurity software provider that manufactures software for end point protection for corporates. They've recently developed a new product and are deciding whether or not to launch it. Help the firm to go about this problem. Before we begin with discussing the case, I would like to have a slight understanding of the product. Our firm manufactures software for end point protection, that means the antivirus that you and I use on our laptops, right? Can you confirm if my understanding is correct, else please help me understand what end point protection means? Sure, you're thinking along the right track. It's an antivirus, only it can be used beyond your laptop as well. Can you think where else corporates might have use for it? Sure. They may be extending its usage to the employees' phones, tablets and/or Video Conferencing equipment as well. That's correct. Why do you think they might be doing that? I can think of two reasons: 1. Heightened awareness around data protection in today's business environment (gave an example of US firms' paranoia about Chinese apps and software) 2. Nature of the work may be also playing a role – for example, more and more financial services and consulting firms are mandating security nowadays Interesting. You might be onto something here. So now we've got this product. Tell me if we should launch it or not. Now we've arrived at the addressable market. But we discussed about the various devices earlier. Where do you think that comes in? Divided white collar population as owning just laptop, laptop + phone, or laptop + phone + tablet and estimated the number of devices that software would be used in. Excellent. Now, can you think of our main competition? I'm not very familiar with the industry but I do know that other players exist with the same end point protection model. Additionally, my own laptop, for example, came with a free one-year trial for a preinstalled antivirus. Similar models may exist for corporates as well. Perfect. Now what? Should we launch our product or not? There are three things I would like to consider. We have already done the market sizing. Do we expect the market share for this product in line with our overall market share? Yes, if the product is successful, we will get a good market share. Next, I will consider Operational viability. Since the product is already ready and our firm deals in similar products, I think it would be fair to assume operations are viable. Is that right? Also, is the product financially feasible? Yes, that’s a fair assumption. The product is also financially feasible in terms of margins. Well, how does it measure against the competition? Sure, can you help me understand the nature of the product better? Is it more sophisticated/effective than our current offerings? If not, is it differentiated in any other manner? It's definitely more effective. It's more effective than our current products. But we're not sure if that might be needed. Basis this, the drivers mentioned above and the market sizing, I would say we should go ahead and launch the product (gave a quick summary of all the points till now) Well, I can identify some drivers for the business, if any, that would spur this new product launch. Am I right in assuming that more drivers exist besides the two that I mentioned above? Good, we are done. Thank you. Sure, but why don't you do a quick market sizing for me first? Start with the US market. Did an extremely quick calculation to estimate the number of corporates and white-collar population. Got stuck in the middle so the interviewer gave a number as an estimate. (Calculations in appendix) ICON, IIM Bangalore 32 Cybersecurity Software Provider Case statement Interviewee Notes Market Entry | Moderate | Bain (Partner) • Your client is a cybersecurity software provider that manufactures software for end point protection for corporates. They've recently developed a new product and are deciding whether to launch it. Help the firm to go about this problem. Structure/Framework • End point protection antivirus software used in laptops, mobile and tablets • The new product is more effective than current products offerings of the client Market drivers Heightened awareness Mandatory in certain sectors New product launch Market size / share Operational viability Financial feasibility Market Size Product ready and viable Projected Margin under control Market Share • US pop: 300 M • Working % = 50% Expected to capture market share • # of employees / corporate = 5000 • # of corporates = 30K Key Takeaways • Used the product launch framework • Understanding of market drivers is required • Think of market size, drivers for launch and product comparison w.r.t. competitors. ICON, IIM Bangalore 33 Metro Line - I Market Entry | Moderate | BCG (Partner) Case Statement : Your client is a infrastructure company tasked with setting up a metro line. They would like you to look at sources of revenue and operation plan. Also the client wants to know that after investing whether the payback period would be attractive or not. How would you proceed with the situation? Sure, sir! (Summarize the case for clarity). Can I assume this to be a Tier 1 city ? What is the PBP threshold decided by the company? Sure, let’s take New Delhi so that you can get some reference. The client would go ahead with the project if the PBP is below 7 years Perfect sir, I am actually from New Delhi :). When I think of the Delhi metro, the major sources of revenue I can think of are: 1) The tickets 2) Value added services –food outlets on the stations 3) Parking at the stations (minor)? Is there anything else you would like me to consider? I think that’s good. Let’s look at the core revenue from tickets in a bit more detail. Sure, sir! I believe the revenue that can be generated from ticket revenue could be calculated as : No of tickets sold* Average Price of each ticket. (As price of ticket usually depends on the distance travelled, we take average) To start with, I would use the formula of Payback period to determine what all factors need to be considered. It is equal to the number of years in which the initial investment in project is recovered using the cash flows from the project. Hence, I’ll divide the analysis into the initial investment and future cash flows. In initial investments, we can have elements like the license/bidding related costs, costs associated with building infrastructure like tracks, stations, metro sheds, etc. We can divide the future cash flows into revenue and costs which can be further sub-divided into recurring and nonrecurring costs, fixed and variable costs, and also soft costs like interest during construction. Does this seem exhaustive or am I missing out on some aspect? Are you sure you have covered the initial investments completely? You may be missing out on a major component. Sounds good, what could be the average price of the ticket you would assume? So I believe for the Delhi metro, we have 20 Rs as the minimum fare for 3 stations, and then it increases to 40 Rs for 4+ stations and so on to 60 Rs and finally 80 Rs is probably the maximum fare. Given this distribution and considering people use metro for inter-city travel, shall I assume 50 Rs to be the average price? Oh yes, I forgot about the actual metro trains. Thanks. Please wait for further instructions. That sounds reasonable. Can you now go and estimate number of tickets sold? Sir, I would like to approach this from the supply side as I have seen the Delhi metro to be over capacity most of the times. So I assume that end to end a metro takes 1 hr and we would like a frequency of 10 mins for the trains? Is that good? Yes, let’s go ahead with that! In which case we have about 6 trains leaving point A on the line every hour and reaching point B. And 2 hours till our first train comes back, so that would be 12 trains in circulation at the very least. If we assume 10 coaches per train and a capacity of 50 per coach (assuming no over capacity), we would have total seats = 12*10*50 = 6000. We double this to consider B to A journey and then consider 14 hour day ( 7 * 2 hour window ) which gives us total capacity as 6000*2*7 and total revenue = 6000*2*7*50 = 4200000 Rs per day. ICON, IIM Bangalore 34 Metro Line - I Case statement Interviewee Notes • No notes as such because the case was driven by personal experience Market Entry | Moderate | BCG (Partner) • Infrastructure company setting up metro line • Sources of revenue and operation Structure/Framework Metro Line Revenue Sources Core Revenue (tickets) Number of tickets Value Added Services Parking Average price of ticket Number of trains Hours of Operation Number of Coaches in train Seats in a train Key Takeaways • Try to determine revenues and costs using formula which can be easily broken down and analyse the sub parts well • Draw on personal experiences during analysis • Use OPR – Occupany, peak time, replacement in guesstimates ICON, IIM Bangalore 35 LCD Screen Manufacturer Market entry | Moderate | KPMG (Partner) Case Statement : Your client is an LCD screen manufacturer from Sweden. They are a market leader in Europe and now they are evaluating options to enter an emerging market like India, China, Indonesia or South Africa to expand operations. Which country would you prefer to enter and why? Thanks a lot, Sir, for the problem statement. I would like to confirm that our client is a LCD manufacturer and they are evaluating options to enter into either India, China, Indonesia or SA. The client must decide on one country, is that right? Correct. So, before starting with the analysis, I would like to ask a few clarifying questions to get a better understanding about the problem and our client. Is that okay? Sure, go ahead. Sure, go ahead. Sir, for identifying opportunity, we will look at : 1. Major businesses producing LCDs say, TVs, Phones, Machines and equipment etc. and their scale of operations plus order size. 2. The market for products using LCDs in India market and YoY growth of the same. 3. The life-time of the LCD screens within. For evaluating the feasibility we’ll look at: 1. Regulations of land and labor 2. Fixed costs associated with point 1 and 3. the ease of doing business or similar rankings. And finally, in the viability aspect, since we are already a market leader in this LCD technology, client has the required operations capabilities and I assume that they have efficiently leveraged the economies of scale by keeping variable costs low. However, the cross-pollinating would be required to transfer best practices to the native engineers. Good. So what would be your final ordering of attractiveness and why? Is the client only into LCD manufacturing or do they are into ancillaries of the same as well? No. they have a broader portfolio but for expansion purposes, they are looking at LCD only Interesting. Any reasons why only LCD and not ancillaries or other components? They are one of the pioneers in this technology and that’s why they want to set the first foot right. Sir, my order would be: 1. India 2. China 3. Indonesia 4. South Africa. It was a tough call between India and China, but given the current political and pandemic circumstances, the business environment would be slightly more volatile than India and it poses a risk for export to major OEMs. Although India doesn’t rank well in Ease of Doing business ranking, but the situation seems to be improving and many manufacturers, who use LCDs in their products are setting up their operations in the country because of increased adoption of technology and allied devices.. Ok. That’s all. Thankyou. Alright. Sir, first I’ll look into market size, then look at feasibility of setting up operations and finally the viability of the same in these emerging markets. We will conduct this exercise for all the countries individually and then make a final comparison matrix This looks good. Please go ahead and explain each. I do not need calculations. Just mention the 2-3 essential factors that you would consider. I would like to take a minute to gather my thoughts and come up with a structure for the analysis. Would that be okay? ICON, IIM Bangalore 36 LCD Screen Manufacturer Case statement Interviewee Notes Market entry | Moderate | KPMG (Partner) • Swedish LCD manufacturer evaluating expansion into emerging markets Structure/Framework • Client is pioneer in technology • Market leader in Europe Expansion Opportunity Qualitative Market sizing Feasibility PESTEL and PORTER Country Opportunity Feasibility Viability Overall India 7 6.5 8 7.17 China 7 5 9 7 Indonesia 6 5 7 6 South Africa 6 6 7 6.33 Viability Capability analysis (VRIN) Capability development Note: Scores are out of 10 *Score on personal discretion Key Takeaways • Used market entry framework • PESTEL application in GTM • Current affairs knowledge was required and establishing connection with the case ICON, IIM Bangalore 37 Car Manufacturer Market Entry | Moderate | McKinsey (Final) Case Statement : Your client is a car manufacturer and wants to the enter the Indian market in the early 90s, what are the factors you would consider and if you decide to enter how would you establish a distribution network. Before I delve further into the case can I ask a few preliminary questions to understand the client and the market scenario better Great, please proceed with the analysis. As established earlier the growth seems to be good and is it ok to assume that the profit margins for the premier car segment are higher, would you like me to do a guesstimate to look at the potential market size? Yes, the first assumption is fine. You don't have to get into the numbers but just walk me through how would you approach the guesstimate Sure, go ahead Can I know a little about the client, as in where is the client located, what is the prime reason for entering the Indian market, what segment does the client operate in and in what all parts of the supply chain is the client operating in? Sure, the client is located in the United States, and a premier car manufacturer, think of something like Audi or BMW, and the client operates in whole of the supply chain. About why Indian market, what do you think could be the reason from the given data Thank you for the information, from the given context since it is the early 90s, I am thinking of the following 2 reasons: 1. due to the liberalization in India the client believes it would be profitable to venture into the new and growing market, 2. The US market has reached a level of saturation for the existing car brands and Indian market has seen an increase in disposable income That's right, anything else you would like to know? No sir, that would be all for now, I'll get back in case I need anything. I would like to take a min to structure my analysis, is that alright? Yes, please take your time. Sure, So I would take a demand side approach and follow a top-down analysis, I would consider the total population in the 90s, split the population into urban and rural and then split it into families, I would further split the families based on the income range. Since our client is a premier car manufacturer, I would focus only on the high-income bracket and further I would look at the frequency of purchase and based on that further calculate the number of cars demanded in annually. Great Job, I think you've mostly covered what I was looking for, let us now look at the distribution channel. Sure, before we proceed with that, I would like to look at the possibility of opening manufacturing plant in India or if we should import the cars from their existing plants in the US. That's a good observation, what do you think is feasible and profitable? I think in the shorter run there would be low profits or even losses of setting up the plant in India but in the longer run it would be profitable to operate wholly from the location of operation than to importing the cars, also importing the cars would be directly impacted by the volatile government policies around the import/export duties. Ok, let us get back to the distribution channels. So, I would like to proceed with my analysis in the following way, I would like to look at the Market Attractiveness and the Core Competencies on a high level, under Market Attractiveness I would like to look at the Market potential and the Industry attractiveness and under Core competencies I would like to look at the Tangible, Intangible and Human resources the company has which can be leveraged to get competitive advantage in the industry. Under Market Potential I would like to further look at the Market Growth in the new market, Profitability, Market Size and Barriers if any. Under the industry attractiveness, I would like to look at the PESTEL analysis and the Porter’s five forces. Sure, so in the Indian context the customers need the touch and feel of the product they buy and are also very particular about the aesthetics. It would be ideal to have showrooms and dealerships in major cities where there is a higher population of the target segment. The target customers as identified earlier would be the high-income households, hence the dealerships should be located accordingly. Great, Thank you. You may please wait in the breakout room. ICON, IIM Bangalore 38 Car Manufacturer Case statement Interviewee Notes • Located in the US • Premium car manufacturer • Covers whole supply chain Market Entry | Moderate | McKinsey (Final) • Wants to enter Indian market • Establish distribution network Structure/Framework Market Entry Market Attractiveness Market Potential Industry attractiveness Core competency Tangibles Growth PESTEL Intangibles Profitability Porter’s 5 Forces Human Resources Market Size Barriers Key Takeaways • Do not mention the names – Porter’s 5 forces as a term • Whenever starting anything new (like the distribution channel), think in long term and short term ICON, IIM Bangalore 39 Asset Management Firm Market Entry | Difficult | Bain (Partner) Case Statement: Your client is an investment firm, like Blackrock, and is focused on wealth management for HNIs and institutional clients. They manage portfolio worth trillions of dollars. They have approached you in the height of COVID pandemic. They want to make some investments which will deliver in 5-7 years. Can you recommend some countries for them to explore? I would like to ask some preliminary questions to get a better understanding of the case. I would like to start by understanding the investment strategy of our client – do they have expertise in any particular sector or type of investment? Also, do they have any preference between public market or private equity? No they are open for all kinds of investments Do they have any particular exit strategies in mind between IPO, secondary buyout or trade sale? That’s a good point but let’s ignore it for the case. Okay, let me take some time to think of an approach for the case. Firstly, I would like to focus on developing or underdeveloped nations for this exercise. They look like an exciting option to deliver in next 5-7 years. The developed counties would mostly be saturated, and our client would probably not make a good return. Does that sound okay? Yes, that sounds reasonable. I would like to break the analysis in three phases: 1. The over-arching attractiveness can be defined in terms of political and legal environment of a country 2. Then I would look at the organically favorable factors such as natural resources, government attitude to FDI and any announced investments and the country’s response to COVID. The COVID response can give us a good idea about how quickly the country can make changes in their infrastructure 3. Thirdly, I would like to look at what our client can bring to the table to foster inorganic growth through synergies with other portfolio companies or any technological investments That sounds like a good approach. You can ignore the third point in your framework for now. Based on your knowledge can you tell me top 2 countries where our client should invest? Exclude India from your analysis Sure, let’s look at this continent by continent. Going by my previous logic I would ignore North America and Europe as they are developed. Does that sound okay? Yes, let’s proceed. This leaves us with Africa, South America and Asia. Africa is attractive in terms of natural resources and population growth, but based on my approach I would rule it out for political instability. Does that make sense? Okay, sure. That leaves South America and Asia. I do not have a lot of idea about South American countries except Brazil, and their response to COVID was not great which shows government inefficiencies. Hence, I would like to focus on South-east Asia now. Does that sound good? Yes, please proceed. I will start off by listing countries in South East Asia – Singapore, Japan, Australia, New Zealand, Malaysia, Vietnam, Thailand, Koreas come to mind. Out of these I will again exclude Singapore, Japan and ANZ because they are developed. Further, I have past experience working in Malaysia during COVID and know they had a very rapid response. I also know that they are very welcoming towards foreign investments and are growing rapidly. Hence that would be one of my priority countries. The other country, for similar reasons, would be Vietnam Great, thank you. We can end the interview here. ICON, IIM Bangalore 40 Asset Management Firm Case statement Interviewee Notes • Firm is open to all kinds of investments across sectors and markets • No particular exit strategy in mind Market Entry | Difficult | Bain (Partner) • Investment firm looking to expand across geographies during COVID Structure/Framework Evaluating countries Defining country attractiveness 1 Political and Legal environment 2 Organic favorable factors 3 Inorganic favorable factors • Natural resources • • Macroeconomic factors (GDP/capital, population growth etc) Synergies with other portfolio investments • Technological innovation • Government initiatives for any infrastructure projects • COVID response N. America & Europe Rejected as developed countries will be saturated Middle East and Africa Rejected for political instability South America Considered Brazil, rejected basis of COVID response Asia Listed down countries, selected Malaysia and Vietnam Key Takeaways • Interviewer was more interested in approach to case solving than the final answer • Very important to form an initial framework and keep going back to it • Some general information about global happenings in COVID were important ICON, IIM Bangalore 41 Metro Line - II Market Entry | Difficult | BCG (Partner) Case Statement: Your client is an Indian infrastructure development firm. They are contemplating whether to accept an offer to develop a metro line from point A to point B in an Indian city. They want you to find out the number of years in which they will be able to get back their initial investment. We will test your comfort with numbers in this round. For the case, I want you to assume that the operating costs for the metro are zero. I would like you to begin your analysis by looking at the revenue. Okay, Sir. I would start by looking at the annual revenue from the passengers. For this, I would consider the price/ km, the average distance travelled per trip, and the number of trips made per year. The price/km is Rs 5. You can assume that the average trip is from A to B, which are 5 kilometers apart. I would like to know how you would approach the calculation of the number of trips. Starting with the population of the city, I would look at the number of residents commuting from A to B and vice versa daily. For this I would look at the percentage of residents near A and B. I would then apply filters of gender and age, summing across the two routes to get the market size. Would this give us the number of trips? No, Sir. We would estimate the number of commuters who would use the metro. For this, we would divide the market into income segments, and rate the metro on the parameters that each segment values. The sum of market shares from each segment would give us the daily demand. We could then multiply this with the number of working days to get the number of trips in a year. That sounds comprehensive. We do have the numbers for this: the number of unique trips will be 2,00,000 a day. Alright. Assuming that a year has 360 working days, we get revenue from operations to be Rs 180 crores. We could also look at other sources of revenue such as advertising. No, that will not be necessary. Please look at costs now. Alright. I want to look at the total capacity of each coach. I will divide the daily demand by the capacity to get the minimum number of coaches required. How long is one trip? How many hours in a day does the metro run for? One trip takes 30 minutes. The operating hours are 7 AM to 10 PM. In 15 hours, each coach can make 30 trips. It can seat a maximum of 360 people, which gives us a capacity of 10,800. Dividing the daily demand by this capacity, we get a minimum of 19 coaches. What are the assumptions that you made in arriving at this number? I assumed that there would be no down time between each trip. I also assumed that the demand is uniformly distributed. These assumptions are unlikely to hold to a complete extent in real life. So, the true number of coaches should be higher. I would recommend a number 50% higher. So, 30 coaches. This would add 600 crores, resulting in a total investment of 750 crores. That sounds good. Going back to the objective, what would be the payback period for the client? With an annual revenue of 180 crores, we would need a little more than 4 years to recover the investment. With this payback period, would you recommend that the client invest in this project? Sir, that would depend on whether the client have a cutoff period for investment decisions. If the cutoff period is more than 4 years, then they should invest in this project. They could also look at other judgement criteria for investment. Alright, that sounds fair. Let us close the case here. Okay. Given that the operating costs are zero, we will look only at the fixed costs. There would be two major investments: laying the track and buying the coaches. Do we have any numbers for how much these will cost? Yes. Laying the track will need an investment of 150 crores. Each coach costs 20 crores and can seat 360 people. You also have to determine the number of coaches to buy. ICON, IIM Bangalore 42 Metro Line - II Case statement Interviewee Notes • The interviewer was very clear about the purpose of the case: calculation skills. So, it was important for me to be accurate in each calculation. • The interviewer was pleased with the recommendation, although it was not very concrete. Market Entry | Difficult | BCG (Partner) • An infrastructure development firm is trying to calculate the payback period for a project. • The company faced high fixed costs in terms of laying the track and buying coaches. • The number of unique trips is 200,000 each day. Structure/Framework Profit Revenue Revenue from Operations Costs Revenue from Other Activities Fixed Price/km Tracks Average Distance Coaches Variable Number of Trips Key Takeaways • While the percentage values for demographic have been removed for ease of presentation, engaging the interviewer with your rationale might further prove your clarity of thought. • It is important to lay down the logic of your calculation and getting the interviewer’s buy-in before actually starting the calculation. ICON, IIM Bangalore 43 Pricing Framework GAP Market Price Pricing Value to consumer Profit to seller • Brand • Quality • Innovation • New-found utility Cost Inward looking 1 External looking 2 Cost based Comparable/ benchmark Competition based Costs R&D, one-time costs Industry Production costs Customer based Willingness to pay Features of others Opportunity cost Substitutes Variable portion Complements % markup, margins? Value based Structure Fixed portion Extrapolate benefits Or proxy based Other specific costs Returns 3 Features Additional features Breakeven period Differentiating benefits Payback period Price range of existing ICON, IIM Bangalore 44 Toll Collection Pricing | Easy | BCG (Partner) Case Statement: Your client is an infrastructure company which has just built a new road. You need to help them find the right amount of toll to charge for each vehicle which uses the road. That sounds interesting. I would like to know a bit more about the road which the company has built. Where is it located? Is it an alternative route or it the repaired version of an older route? Well, there are a couple of creative ways. We could look at the amount customers are willing to pay to skip queues for services which allow skipping them for a premium. Apart from this, we can look at the extra charge that customers play on delivery apps to get a guaranteed delivery time. Okay, those are definitely some interesting options. It was nice interacting with you. Let’s close the case here. You can assume that the road connects two Indian cities, which were previously only connected by a single bridge. The road is an alternative to the old bridge. I have a couple of questions about the differences between the two routes for potential users before I begin my analysis. Does the new road reduce the travel time between the two cities? Is the build quality of the two roads different? Yes, the new road reduces travel time by 30 minutes, even though it is a longer distance to travel. The build quality is the same as the old road. Alright, great. There are three possible ways to choose a toll to charge. The first is by choosing a time period in which we want to earn back our initial investment. For this, we will divide our costs by the projected demand in the given time period to get the minimum required toll price. The second method is to look at the toll prices charged by other builders. We can record the prices at toll plazas connecting the same cities to other places, and then given our advantages/disadvantages over them, add a premium or a discount. The third method is to look at the value which we provide to our customers and charge an equivalent amount. Okay, that sounds comprehensive. I am interested in the the third method. How would you price the value which we provide to our customers? We can provide for value for travellers on three parameters: distance, time, and convenience. We are at a disadvantage in the first parameter. We can use the extra fuel charge as a proxy. Sounds fair. How will you value the time savings? So, we know that the time savings are 30 minutes. Different segments of consumers value their time differently. For example, lower income classes are perhaps not that affected by time savings when compared to upper income classes. We should consider implementing a price discrimination mechanism, such as charging different tolls to different vehicle categories after doing surveys. Okay, can you arrive at the rupee amount any consumer ascribes to their time without doing surveys? ICON, IIM Bangalore 45 Toll Collection Case statement Interviewee Notes • The interviewer mentioned that he was looking for creativity. • It was also explained that there would be no numbers in the round. Pricing | Easy | BCG (Partner) • An infrastructure company is trying to set a poll charge for its new road, which has a time saving of 30 minutes. • The road requires travelers to cover a longer distance. Structure/Framework Pricing Cost-based Competitor-based Value-based Advantages Distance Disadvantages Time Convenience Key Takeaways • The case was supposed to be done without a pen and paper. The interviewer had mentioned that he was looking for a conversation. Thus, it was important to be quick on my feet and not ask for a couple of minutes to think. ICON, IIM Bangalore 46 New Medicine Launch Pricing | Moderate | McKinsey(Partner) Case Statement : A Pharma company has developed a new product to control diabetes for patients in India and need your help in pricing it Yes, the new product is superior to insulin In that case, we should certainly price our product more than Insulin as we are providing more value than insulin. Again, how much should be the markup depends upon the perceived benefits of our product amongst the consumers That’s an interesting problem. Do you mind if I ask some questions to better understand the client? Sure, go ahead. Yes, that’s correct, anything else you want to consider here? What is the objective of pricing? Is it to maximize the profit or something else Yes, we can also consider substitutes in the form of Ayurveda, Homeopathy which might eat up on our Market share if we price too high. Yes, it is to maximize the profit Can I have more details about the product? Basically, how it is different from normal insulin injection & information on how restricted its availability be i.e.. Will it be available over the counter or requires a prescription? And how is the competitive landscape in the market It's an oral tablet instead of an injection and has lesser side effects. It'll be available over the counter and the market is highly competitive I want to breakdown the Pricing of the tablet into three broad strategies - 1) cost based 2) Competitor based 3) Value based pricing The final price will be dependent on all the three factors That’s a fair assessment. Let's move on. Okay, now I want to consider how much value we are providing to the customer and how much we can capture it. For that we can do price elasticity analysis of the product to arrive at a price which maximizes the profit and can also investigate Supply v/s Demand gap of the existing market to determine the best price of the product. Yes, that’s a detailed enough analysis. Let’s stop the case here. Yes, that sounds fine. Why don’t you list down all the factors. I don’t want you to go into details. Just tell me all the factors Okay, let me start with Cost based approach. Over here Total cost is composed of one-time RnD costs + Cost of production which again can be divided into Fixed cost and Variable cost. This along with our production volumes will give the minimum price for the tablet. We need to now find profit margin in top of that. Profit margin can either be something company is targeting, or we can use some proxy to find it Yes, that’s sound fair. Let’s explore other factors you have listed now So now we can look into competition and substitutes for our product and figure out a price based on our product's position with respect to them. For that, I already have the information on lesser side effects and the fact that medicine is in oral form which makes it superior to the injection-based insulin. Is that fair to assume? ICON, IIM Bangalore 47 New Medicine Launch Case facts Interviewee Notes Pricing | Moderate | McKinsey (Partner) • Oral tablet for diabetes patients • Lesser side affects • High competition in the market Structure/Framework Cost • Follow a qualitive approach rather than a quantitative one Fixed Cost RnD Salaries Variable Cost Depreciation Rent Cost Pricing Competitor Value based Sourcing Manufacturing Distribution 1. 2. Cost of production - fixed cost and variable cost RnD expenses 1. 2. 3. Competition: Insulin injection Substitutes: Ayurveda, homeopathy Value Addition: • Lesser Side affects • oral tablets instead of injection 1. 2. Willingness to Pay: Elasticity analysis Supply and Demand tradeoff Sales and Marketing Key Takeaways • As interviewer hinted for qualitative discussion, I made sure that I’m listing all the factors down before going in detail to any one • The interviewer was trying to speed up the case. Make sure that you are not taken aback by it • My case ended abruptly when interviewer started asking me about one of my resume points, make sure that you are confident in such situations, and be thorough with your resume. Don’t lose the structured approach even if you are asked a question from your resume. ICON, IIM Bangalore 48 Growth Strategy Framework PRODUCTS Existing • • • • • • • Market growth rate in line with management’s growth expectations Low market share w.r.t. market leader Growth rate w.r.t competitor A derived profitability case!! New • 1. Market Development Strategy 4. Diversification Strategy • • • Four Growth Strategies Existing • Market growth rate lower than management’s growth expectations High market share w.r.t. closets competitor Concentrated in a small market Demand in other markets Typical Market Entry Case!! MARKETS • New 2. Market Penetration/ Entry Strategy ICON, IIM Bangalore • 3. Product Development Strategy • • Product - Market growth rate lower than management’s growth expectations Management’s objective High concentration in a single product/ category Diversification strategy case!! Market growth rate lower than management’s growth expectations Product in maturation or decline phase Product Launch Case!! 49 Coffee Production Growth Strategy | Easy | Kearney (Partner) Case Statement : Let's get into the case. I want to understand your approach. You can ask me any questions. Your client is in global coffee production industry. They want to increase their revenues from 1000 Cr to 5000 Cr in 5 years Okay. So is the growth only concern or they are looking for cost aspects also? Also, I wanted to know more about the company and industry before going ahead. So I know of coffee producers who own plantations and some who are just involved in processing the coffee beans. Where does our client operate in? What are the products being produced? Ignore the costs for now. Our client kind of operates both. We have two business units. Oneunit deals with owning plantations, producing green beans and processing them to Roasted ground coffee. The other unit buys high quality green beans from others and then process them to Instant Coffee. Our current share of revenue is composed of 60% from Roasted ground (RG) coffee and the other 40% from Instant coffee (IC) Ok. Do we have any growth data available regarding the industry? And should I focus on RG coffee first since it is 60% of our revenue. I also wanted to understand the bottleneck area in value chain where we are lagging. Is it in plantation or processing or customer side. RG is growing at 4% p.a. and IC is growing at 6% p.a.. But yes, the client is attracted to RG industry and wants to find out what can be done. We have very high demand, and our processing capabilities are also good. You can focus on plantation. So when I think of plantation, I think of land area * yield of area. We can think of increasing the land area or the yield in current area to improve our revenue. But to double our revenue, I don’t think yield can be improved to that extent. It might be dependent on climate conditions also. Okay. Makes sense. I would like to take a minute to gather my thoughts and come up with a structure for the analysis. Would that be Okay? Sure, go ahead. I am thinking we can do below things 1. We don’t need to own land. We need the low-quality beans so that we can produce RG coffee. We can have tie ups with other farmers and ensure we get this 2. We can also think of growing other crops compatible with coffee in our available land. In this way, we can increase the revenue Should we start focusing on IC now we know that it is growing by 6%? We can use current land to produce high quality beans I like your first two options. Nice way to think about the problem. But we are still focusing on RG and not to IC. I think you missed one important part in the entire statement. Can you relook? I am sorry. I am not able to find it exactly Don't you think you are constraining yourself? The land is costlier in India. Ohh, yes. We are thinking of increasing our global revenue. We can think of buying land at other areas like Brazil where the land costs might be cheaper. Sorry. I missed this Yes. This is what we had suggested to the client and it was a success. I really liked your approach to the problem, though you missed one key aspect. Well done Correct analysis. We have only 5% land with us in the coffee area which is cultivable in India. Can you think of strategies on what do we do from here? Why are we not buying more land ? The client has done complete analysis and has found out that it is very costly to buy land in India compared to the revenue gain expected. ICON, IIM Bangalore 50 Coffee Production Case statement Interviewee Notes Growth Strategy | Easy | Kearney (Partner) • Client wants to double the revenue from 1000 Cr to 2000 Cr in 5 years • Client has two products RG and IC. RG involves plantation • Client cannot buy more land in India as it is costly compared to revenue gain Structure/Framework • Qualitative analysis, though numbers were provided • Client is interested in growth of RG products • Problem is with Plantation and root cause is with limited land availability with clients Current Revenue (1000 Cr) RG coffee (600 Cr) growing at 4% Plantation Land Acres Processing * Distribution IC (400 Cr) growing at 6% Customers Yield per acre Key Takeaways • The preliminary questions and the value chain set up before analysing the problem worked in favour of the candidate as he could directly go into the root cause based on this. • The candidate missed a key aspect of problem statement. “Global” revenue. It could have gone horribly wrong as you are expected to note down on all case relevant facts. But approach and other recommendations helped him. ICON, IIM Bangalore 51 OTT service launch Growth Strategy | Easy | Strategy& (Manager) Case Statement : Our client is a regional production house and produces content in Gujarati language. Given the increasing popularity of OTT format, they are looking to launch an OTT platform of their own. I want you to analyse whether they should go ahead with the launch? To make sure I have understood the case statement clearly, our client is a regional production house which produces Gujarati movies and TV shows. They are considering launching their own OTT platform and have, and I need to analyse whether this is a viable option. That’s right! Before I proceed with structuring my analysis, I would like to ask a few preliminary questions. Would that be fine? No, this is reasonable. Please tell me how you would estimate the market size. I would break down the market size into two – number of users and average subscription charges per user. To calculate the number the users, I would further break it down into two – potential market size and percentage conversion. Market size is the total Gujarati speaking population in India, which is around 5% of the total population. That gives us the total market size of 6.5 crores. Given that there would be just one subscription per family and average family size at 4, we get approximately 1.6 crores families. Now, I would like to break them further down basis the income level. Okay, that sounds fine. I shall divide it further into three income levels – low, medium and high with 40% falling in low and medium and 20% in high-income level bracket. This gives us 0.64 crore families in low and mediumincome levels and 0.32 crore families in high-income level. Assuming that subscription to the OTT platform as a luxury service, the affordability would vary across the different income levels. I would like to assume that 100% for high, 50% for medium and 0% for low-income groups. Does this seem fair to you? Sure, go ahead. What kind of content does our client produce? Is it movies, TV shows or both? Great question. They produce both movies and TV shows, but their focus is on TV shows. Okay, and does the client have a particular customer segment such as youth or elderly that they target? No, they don’t have any such specific customer target. Yes, go ahead! This gives us the total market size of 0.64 crore families. To calculate the percentage conversion, I would like to look at two factors – awareness and adoption. I would like to assume that, given the medium and higher income level groups, 75% awareness level and approximately 50% would actually adopt. This would give us the total number of users as 0.24 crore. Does this seem reasonable to you? Alright and what is the primary objective of launching their own OTT service? Client is looking at the OTT service as an alternate source of revenue. What factors led you to consider 50% adoption levels? Thanks for making the objective clear! Can I have a few seconds to structure my analysis? Sure! I would like to approach this problem by evaluating the market attractiveness, financial viability and operational feasibility. Market attractiveness aspect is to assess the market size, growth potential, existing competition and the trends prevailing in the market. The financial viability aspect is to assess the profitability of the venture. Operational feasibility would include factors like regulatory approvals, resource availability and technological capabilities. Does this seem reasonable to you, or should I consider any other aspect? I assumed that given the specific level of technical expertise required for using OTT platforms, a certain population level even though they can afford it would not be that tech-savvy to use it. Further, some customers may not see value in subscribing to an OTT platform just for Gujarati TV shows and movies. Okay, not that we have the total number of users tell me how would you price the services? ICON, IIM Bangalore 52 OTT service launch Growth Strategy | Easy | Strategy& (Manager) Firstly, I would like to look at the pricing of other OTT players in the market – Netflix charges Rs. 499/month for its basic plan and fall in the premium segment, Disney-Hotstar charges around Rs. 399/year which is around Rs. 30/month. Given the extensive range of content they provide to user we can consider this as the ceiling price. Further, I know that DTH services, in an average, charge around Rs. 10 to Rs. 20 per channel per month. Given that the OTT platform would be providing more timing flexibility with no disruption due to advertisements hence it would provide more value to the user. To increase adoption initially, we can price the service at Rs. 15 per month. Does this seem fair to you? That does seem fair and what be the annual revenue that the client would generate if it were to launch the OTT platform? Our total number of users would be 0.24 crore and charging Rs. 15/month, the client can have a potential revenue of Rs. 43 crores. Alright. That makes sense. Let us wrap it up here. All the best! ICON, IIM Bangalore 53 OTT service launch Case statement Interviewee Notes Growth Strategy| Easy | Strategy& (Manager) • Regional production house looking to launch OTT platform • Aim – increase profits and create additional sources of revenue Structure/Framework • Total Gujarati speaking population can be assumed as 5% of the total population • Population can be further broken-down basis income – low (40%), medium (40%) and high (20%) • Identify the characteristics for OTT platform users and use it to further segment OTT service launch Market size Number of users Potential market size Market attractiveness Financial viability Growth potential Existing competition Operational feasibility Average revenue per user % conversion Key Takeaways • Ensure that the you lay out the structure for your analysis at the start • Assume that are easy for calculation and take buy-in from the interviewer on the assumed numbers ICON, IIM Bangalore 54 Convenience Store at Gas Station Growth | Moderate | Kearney (Manager) Case Statement : Our client is the owner of a gas station between towns A and B –10 miles to each town. He is wondering if it would make sense to add a convenience store to the gas station. I have a few questions about our client, may I do ahead? Sure Are there any other gas stations in town A or B? Who are the typical customers of the gas station like? There are no other gas stations in town A or B. The gas stations current customers are residents of town A and B; there are no other customers So, just to visualize the problem a bit more, I am assuming it to be a typical gas station with revenue coming from sale of petroleum and maybe some other service? Yes, that’s a valid interpretation. Gas is 75% of revenue with 10% profit margin and the gas station also offers car washes with 25% of revenue and a 20% profit margin Finally, I would like to ask what would be a valid criterion for the decision to make sense? Is the client targeting certain revenue numbers or profitability? That’s an excellent question! So, the Criteria for “making sense” – 1) making profit, 2) having a better chance to hold off new competitors enter the market, 3) diversifying income I have come up with a structure for my analysis; Firstly, I’ll analyze the decision based on financial factors, whether the convenience store provides incremental profits. Then I’ll jump into the nonfinancial factors like holding off competitors, realizing synergies and diversifying risks. Alright, your structure seems exhaustive, go on, let’s analyze the project from financial perspective. Firstly, I would analyze the current revenue of the gas station. For this, I would need the population of each town, and the percentage of people that own a vehicle. Sure, Assume that there are 1000 people in each town, 80% of the population owns a car. Also let’s assume that 50% of the people buy gas from our client. Alright so that gives us: Per town: 1000 * 80% = 800; 800 * 50% = 400 Total: 400 * 2 = 800-person customer base This seems large enough; do we also have frequency of purchase, and dollar value per purchase data? The market size calculation seems correct. I also have the other information you needCustomers get gas on average 1x/week; Assume 50 weeks/yr and a customer spends $50 each time. Also, Customers make 40% of all gas purchases at the client’s station Sure, I’ll just quickly calculate the profits : 800 customers * $50 * 50 weeks/year = 2M on gas per year 2M * 40% of purchases made at client = $800K client revenue 75% of revenue is gas: $800K * 75% = $600K * 10% profit margin = $60K profit from gas 25% of revenue is other: $800K * 25% = $200K * 20% profit margin = $40K profit from car washes $60K + $40K = $100K profit per year Do we have information on the expected revenues from the new convenience store? Do we expect it to attract more customers, apart from the existing gas customers? Good question! Gasoline customers will spend an additional $20 at the convenience store per purchase but will not increase frequency of purchases. Also, 50% of town population who currently are not customers (the remaining 1200 non-customers, not just the 80% car owners) will spend $5 per week at the convenience store ICON, IIM Bangalore 55 Convenience Store at Gas Station Growth | Moderate | Kearney (Manager) Alright, so that gives us: Revenue – existing customers: 800 customers * 50 weeks * 1 purchase/week * 40% purchases made at our gas station = 16K total purchases 16K purchases * $20 = $320K additional revenue Revenue – new customers: 1200 non-customers * 50% * $5 per week * 50 weeks = $150K Total revenue: $320 + $150 = $470K Do we also have cost information? So, in terms of current customers, the convenience store provides higher revenue, may increase visit frequency and better experience. However, it may increase the wait times. In terms of new customers, It provides conversion opportunities into gasoline customers. It also has the potential to attract customers from other cities. From a competitive aspect, it becomes important to look at other similar offerings and differentiate the service and experience In terms of other factors, We can consider the outside regulations. We can also consider logistic factors like whether there is any space to add another store or not. Shall I also think of it from the macro perspective? Recurring costs for convenience store are: Labor: $75K/year Utilities: $5K/month COGS: 50% of revenue Ignore fixed costs No, I think you have done a thorough analysis. Let’s end this case. Thank you! Okay, so that gives us Costs: COGS: $470K revenue * 50% = $235K Labor: $75K Utilities: 12 months * $5K = $60K Profit: $470K - $235K - $75K - $60K = $100K/year I can see that the convenience store generates profits equivalent to our existing business. This makes it seem attractive Alright, it seems profitable, let’s move on to the nonfinancial factors. What can you think of? For nonfinancial factors, I’ll split my analysis into the following factors: Current and new customers, Competition and others Alright, go on... ICON, IIM Bangalore 56 Convenience Store at Gas Station Case statement Interviewee Notes • Population of each town is 1000 and 80% of them own car and out of these 50% fill gas at the client’s gas station • Customers get gas on average 1x/week; Assume 50 weeks/year and a customer spends $50 each time • The new convenience store will attract new customers as well. 50% of town population who currently are not customers will spend $5 per week at the convenience store Growth | Moderate | Kearney (Manager) • Aim – increase profits, competitive advantage and diversifying income • Gas is 75% of revenue with 10% profit margin; car washes with 25% of revenue and a 20% profit margin • Labor: $75K/year; Utilities: $5K/month; COGS: 50% of revenue Structure/Framework Profitability Revenue Gas Costs Car Wash Fixed costs Variable costs Labour Utilities COGS Key Takeaways • Ensure that the you lay out the structure for your analysis at the start • Ask the interviewer for relevant data instead of getting stuck in your analysis ICON, IIM Bangalore 57 US Tyre Manufacturer Growth Strategy | Difficult | BCG Case Statement : Your client is a tyre manufacturer based in the United States. The problem they face is they are operating at full production capacity. The CEO is worried that if the demand for their product increases, they will not be able to serve it. The board evaluates three options for expansion – increasing capacity in the US itself, expanding production in Mexico, or assessing a production facility in China. They have hired us as a consultant. What would you advise them? Apart from production costs, I would also consider other transaction costs like freight, logistics, import, and customs duty. I would also look at the inflation rates and future projections of these costs. Mapping the production units with the demand locations will help us to find out which location (US, China, and Mexico) gives us the lowest cost. Okay. What next? This is an interesting problem at hand. So, before we deep dive into the case, I would like to ask a few preliminary questions to know more about the client. The second bucket we have is operational feasibility – where I would like to see the entire value chain. So, I would see whether there is an uninterrupted supply of raw material, adequate labor resources are available, capital is available, the latest technical equipment and machines are available. Sure, go-ahead. I would like to know more about the client – what part of the value chain do we operate in, the product lines (different types of tyres) we have, and the competitive landscape. Fair enough. Coming to strategic fit – wherein I will see what the future plan for the company is. From where will the next leg of demand come. Example, is the company intending to expand in Asia – if that is the case, it makes sense to have a factory in China. Also, other qualitative factors like bad economic foreign relations between the US and China are important. And the last bucket is the mode of expansion. Apart from a greenfield factory expansion, I would also explore other options like acquiring local manufacture, a brownfield expansion where a factory is bought, or outsourcing of production, or finally setting up a joint venture. So, for simplicity, let us assume that we have only one type of tyre that we manufacture. The client is the market leader in the US market, and we have a couple of competitors who have around 15-20% market share each. Thank you. Also, I would like to know the objective or evaluation metric that the client is looking at – whether it is lower cost, a certain quality of production, or an uninterrupted supply of raw material. So, if you look at the problem holistically, you will realize that all of these are very important while making a decision. There isn't a single criterion that the client has. True. Also, are there any demand forecasts that we have in the US markets. How fast is the market growing? So, we expect moderate growth in demand in the domestic US market. Sure. Now, I would like to approach the problems looking at four buckets – the first bucket being financial feasibility, second being operational feasibility, third part would be strategic fit and future plans, and the last would be the mode of entry. Interesting, carry on. So, for financial feasibility, I would look at the cost-benefit analysis considering the demand projections and the projected cost of production in all the 3 locations - – the US, Mexico, and China. Good, that was a comprehensive analysis. Say if Mexico is L1, what would you do? I would not jump into a decision based solely on the lowest costs. I will also see the operational feasibility, the strategic fit, and other qualitative factors. If Mexico ticks all the boxes, I would finally decide on the expansion mode – a greenfield factory or outsourcing of production, an acquisition, or a joint venture. Good. Can you summarise the case for me now? Sure, sir. So, our client is a US tyre manufacturer facing a shortage of production capacity and evaluating three options whether to produce in the US, Mexico, and China. We solved this problem by looking at financial factors – costs and other qualitative factors – like strategic fit, operational feasibility, future projections and finally explored the various options available in the form of greenfield factory, outsourcing, or joint venture. Good job. ICON, IIM Bangalore 58 US Tyre Manufacturer Case statement Interviewee Notes • Only 1 type of tyre • Market Leader • Couple of competitors – 15-20% M.S. • Moderate growth in domestic demand Growth Strategy | Difficult | BCG • Leading US Tyre Manufacturer • Operating at full capacity • Exploring expansion options Structure/Framework Expanding production capacity for US Tyre Mfg Financial Feasibility Cost Benefit analysis Operational Feasibility Demand mapping with location Raw material availability Strategic Fit & Future Plan Future global demand and expansion plan Mode of Entry Greenfield expansion Demand Projections Labor resources Production costs Capital Outsourcing Transaction costs Technology & equipment Joint Venture Geo-political factors Acquisition Inflation & future projections Key Takeaways • Case was an open-ended growth strategy case to evaluate the candidates structured approach • Interviewer gave non-verbal cues in the beginning to guide the candidate – important to take note of this during interviews ICON, IIM Bangalore 59 Time to Market Unconventional | Moderate | Accenture Case Statement : Your client is an FMCG firm that is looking for recommendations on improving the time to market for their product. That’s an interesting problem. Do you mind if I ask some questions to better understand the client? What do you think is an important point to consider while having multiple suppliers? Managing multiple suppliers and ensuring timely delivery of raw materials would be essential for achieving a lower time to market, What do you suggest for the same? Go ahead. Can I know the product(s) that our client has and what is their current time to market? Also, do we have any target timeline for a particular product? Time to market may vary a lot among different product families. The firm deals in food products like pickle, ketchup, and sauces. They plan on launching a new variant in their ketchup line and would like to reduce the time to market from 12 to 9 months. All suppliers can be brought on a common platform to achieve greater transparency for resource planning which will further impact the production planning process. We could also use tools like product lifecycle management software and onboard the suppliers and vendors on it. Thank you, that will be all. Alright that is a considerable time reduction. We should analyze the value chain of their business to find out points of improvement. Sure. What do you think comes under the value chain of an FMCG firm? I would analyze activities like research and development, insourcing logistics, production, storage and distribution, marketing. Is there anything else you would like me to consider here? This seems fine. Tell me how you plan to improve each of these to reduce the time to market. Sure. I would like to begin with research and development as it is an important and time-consuming process especially for an FMCG firm. We can leverage technology to speed up R&D. Next. I would look at the marketing arm. Gathering consumer insights and preferences can also be a bottleneck. Using more of digital marketing practices may help in faster data collection and analytics. Training the marketing personnel and ensuring smooth communication between the R&D and marketing arms will also reduce the time for new product development. Sure, lets focus on new product development. Under insourcing logistics, the two most important factors to consider for new product development would be resource planning and supplier onboarding and negotiations. ICON, IIM Bangalore 60 Time to Market Case statement Interviewee Notes • Time to market varies among product families – focus on one product • Look at each step in the value chain to understand points of improvement. • New product development – gathering customer insights and onboarding suppliers Unconventional | Moderate | Accenture • Reduce time to market from 12 to 9 months for a new ketchup variant produced by an FMCG firm Structure/Framework FMCG Value chain Inbound logistics R&D Processing Storage Distribution S&M Inbound logistics Raw materials – resource planning Supplier management Key Takeaways • Focus was on R&D and marketing for FMCG, with attention to activities for new product development like consumer research and supplier onboarding. • Managing multiple suppliers through product lifecycle management software. ICON, IIM Bangalore 61 Customer Experience Improvement - Banking Case Statement : Your client, a private sector bank, is witnessing a decrease in NPS. You need to find out the reason and give recommendations. That’s interesting. May I take a few moments to gather my thoughts before we can proceed? Sure, please go ahead. I would like to understand a bit about the client. What are the segments that the bank operates into, and is there a particular segment facing this issue? Is it a global or domestic bank? It offers corporate banking and retail banking. Only retail banking customers seem to be dissatisfied. It operates only in India. What are the kinds of services offered by the bank? Is there a particular service where customers are facing issue? It offers regular banking services including debit/credit cards, net banking, loans. Issue is across all these services. Are the customers unhappy with the products offered, or the customer services in the branch, or customer support through call centres? It is the call centre that is driving down the NPS. Does the bank have in-house customer support, or does it outsource? If it outsources, are there multiple partners? Is the issue specific to a call centre? It operates its own centralized call centre. Unconventional | Moderate | Bain Good, the issue is with the third category. Now that you have identified the root cause, could you make 2-3 recommendations on how to tackle this issue, considering that you can’t increase the number of agents. The first suggestion would be for more channels of customer support like BOT and human-based WhatsApp chat, and enhanced IVR system to address the most common and trivial concerns not requiring a support executive. That’s a great suggestion given that the bank currently doesn’t have these. Can you also suggest how to improve the existing process? Sure. Since we have identified that the issue is with the time taken by the executive to understand and resolve the issue, I would like to recommend improvement of the existing decision tree to resolve the complaints. The complaints can be first classified into comprehensive categories so that the L1 support teams can be trained on how to identify the type and give first-level support before escalating to L2. Historical records of the frequency of each type of query and required escalations can be used to decide the number of L2/L3 executives required for a category. Executives should be able to instantly fetch recent customer logs to identify possible issues to reduce problem identification time. Also, the average call duration per support executive should be analyzed to identify if there are specific ones who are taking longer time to resolve, and they should be trained to use the decision tree more efficiently. Great, those are some really good recommendations and in fact the actual ones were on similar lines. Thank you, we are done. Thank you, sir. Okay, so since it operates through a centralized call centre, we can rule out a partner or a locationspecific issue. Is the call volume increasing beyond the estimations or is the waiting time and call duration very high? Yes, number of agents are keeping up pace with the estimated call volume. But it the higher call duration is leading to waiting times. Waiting time can be of three types – Connecting to the line, getting to the service executive, and getting the final resolution. Do we have the data to indicate either or all of them is causing higher waiting times? ICON, IIM Bangalore 62 Customer Experience Improvement - Banking Case statement Interviewee Notes Unconventional | Moderate | Bain • Private sector bank is witnessing a decrease in NPS. Need to find out the reason and give recommendations. Structure/Framework • Domestic bank • Issue in the retail segment • Long wait time to get resolution at the call center Decreasing NPS Corporate Banking Retail Banking Customer support Product Branch Call centre Call Volume Connecting to line Duration per call Identification and resolution Reaching support executive Key Takeaways • No conventional framework used • Basic knowledge of banking and call center processes required • Drilldown of wait time and recommendations was the key ICON, IIM Bangalore 63 Home services: Fall in NPS Unconventional | Moderate | Bain (OCR) Case Statement : Your client is a home services solutions company whose Net promoter score (NPS) has been falling. Determine how should the client solve for it. Thanks! I have a few questions to understand the problem statement better – Is this home solutions company similar to an Urban Clap? What kind of services do they provide and where are they providing the service? Yes, similar to Urban Clap – they provide cleaning, beauty and repair services through an App. The client is currently providing services only in Bangalore Alright. Can I also know for which service category the NPS has been falling? Also, is the NPS falling for a particular customer segment? And since when has it been falling? The NPS is falling for the beauty services since 6 months now. What do you mean by customer segment? Customers can be segmented on the basis of gender, location, age and so on. Do we know if the fall in NPS is concentrated in a specific segment? The NPS is falling evenly across gender and age. However, the fall is more prevalent from Tier2 areas in Bangalore than the more urban set up Alright, so this narrows down where the problem exactly lies. At this stage, I also want to know how the client calculates the NPS and which constituents are impacting it ? NPS = % of customers who give positive rating - % of customers who give negative rating. Right now, the former is falling and latter is increasing – so it’s a very bad situation Thanks for the information. I would like to approach this problem from the customer journey angle. We can explore the various steps in the entire process and see in which step there is an issue. What do you think? Sounds good. Why don’t you take some time to build the steps? Yes, so there would be around 8 steps in the process. 1) Professional arrives at the destination 2) Alignment on the nature of service 3) Service professional sets up the equipment 4) Service given 5) Changes suggested by customer 6) Changes incorporated 7) Equipment packed 8) Professional leaves. Do we know at which stage the issue exists? The issue exists in Step 3 and 4 – the actual service delivery Okay, so there can be four categories of sub-issues : Quality of equipment, Technical quality of service, Time required to do the service and softer issues such as communication, behavior etc. Do we know where the issue is? The problem is in the quality of equipment as well as technical quality of the service Okay, for the first issue, probable causes – 1) low quality equipment purchased 2) Professional not able to take care of the equipment 3) The equipment are not serviced regularly/ replaced For the second issue, probable causes - 1) Lack of skill training given to service professionals 2) Lack of confidence/other skills to conduct the service. Do we know the reason among these? Great, so for the first one – it is the professional who is not able to take care of the equipment and the second one – they lack expert skills to deliver the service. Okay, and with the given information we known that these issues persist in only the Tier II areas of Bangalore. That could be because of two reasons – 1) Uneven development strategy by client 2) Lack of expert professionals based in the area. Great, the reason is uneven development – the client first focused on only the Tier I areas and then while expanding to Tier II area, focused on speed rather than quality. Any solutions you can think of – I want to specially now what can the client do right now? Right now, taking a high level cut – Pre service (booking, waiting etc), during service (delivery) and post service (payment, rating etc). Do we know which stage has the issue? In the short term, the client can create create an SOP for professionals to follow, appoint expert professionals from Tier I to Tier II areas. In the long term, specialized training can be conducted. The issue exists in the delivery stage Thank you ICON, IIM Bangalore 64 Home services: Fall in NPS Case statement Interviewee Notes • Understand that problem lies only in one service vertical • Understanding of NPS was not required to solve the case Unconventional | Moderate | Bain (OCR)) • NPS score of home services firm has been falling for beauty services in Bangalore Structure/Framework Service delivery Pre-service Arrival Alignment During service Equipment setup Service delivery Feedback Post service Rework Equipment packed Departure People Equipment Key Takeaways • Be MECE in defining consumer journey • Use People, Process, Technology framework to understand why service quality may not be up to mark ICON, IIM Bangalore 65 Movie Release: Theatre or OTT Unconventional | Moderate | Bain (Partner) Case Statement: Your client is a film production house. They want to launch their next movie which is ready to release. They would like your opinion on whether to release it now on an OTT or to release it in the theatre after 6 months. I would like to understand the client and the movie a little better before analyzing it further. Where is the movie set to release, what is the objective, and do we have any details about the movie itself? Assume the movie is releasing in India with the usual aim of profit maximization. The movie in question is Houseful 5. On what basis would this amount be decided by an OTT assuming your client is an OTT like Netflix? We would take into consideration factors that affect the reach of the platform. We would look at preferences of the existing audience as well as how many new users can be onboarded with the help of new content. We could go and guestimate this number starting with the total population and taking into account various filters of age, income and number of users per household. Right. You are going in the right direction so we can close the case here. Congratulations! Alright. I would like to compare the profits of both the options before taking a decision. To do the same, I would like to dive into the revenues and costs involved in each option. Is this approach okay? Yes, go ahead. Starting with Theatre release, we can look at the various revenue streams. The primary revenue comes from the box office collections, with additional revenues from Sponsorships, Merchandise sale, DVD and Music rights. To estimate the revenue through box office, we can guesstimate through distribution and theatre networks. But an easier way would be to look at past data. Do we have numbers of Houseful 4 or any similar movie? Yes, that’s a good approach. Houseful 4 earned 200cr in the box office. Adding 10%, we can estimate the number of Houseful 5 to be 220 cr. Of this, a percentage would go to the production house as revenue. Do we have any data on the set percentage and on the additional revenue through sponsorships, merch, DVD and music rights 23% goes to the production house. They have sponsorships worth 100cr and assume the rest to be negligible. Alright. So we have 23% of 220 cr, approximately 50 cr and 100 cr from sponsorships. Total revenue from theatre release is 150cr. Let’s go into the costs now. Since the movie is already ready, do we have any data on their budget? Yes. The fixed component is 80cr. There is also a variable component after 150 cr of revenue. 10% of incremental revenue adds to the cost. Alright. Since revenue is at 150cr in this case, we do not have any incremental cost. Accounting for the 80cr spend, projected profit lies at 70cr. Now assessing our other alternative, we can look at the revenue from OTTs like Netflix, Prime Video, and Hotstar. ICON, IIM Bangalore 66 Movie Release: Theatre or OTT Case statement Interviewee Notes Unconventional | Moderate | Bain (Partner) • The movie is Houseful 5, a sequel to Houseful 4 which earned INR 200 cr at the box office. • 23% of box office earnings go to production houses. Other sources of revenue include sponsorships • Theatre releases see a fixed cost of INR 80 cr. Structure/Framework • The interviewer did not want a guesstimate figure under the OTT profits head. It was more important to have a clear flow of thought. Theatre OTT Profits Revenue Profits Costs Costs Reach Box Office Fixed Existing Users Sponsorships New Users Variable Income DVDs Age Merchandise Key Takeaways • It is important to be MECE in recognizing all sources of revenue. The industry was not very familiar, hence buy-in from the interviewer was even more crucial. • Talking about the logic to be followed and bringing in numbers later is also helpful in case the interviewers is only testing clarity of thought. ICON, IIM Bangalore 67 Business Process Outsourcing Unconventional | Moderate | BCG Case Statement: Your client is a BPO who just entered India. How many employees should they hire? We’ll not go into numbers, let’s just discuss the approach. Before proceeding, I would like to ask a few preliminary questions. What exactly does our client do as a BPO? Does it serve as a call center? Yes, it’s a typical call center. Okay, and what would be the implication of choosing a particular percentile value? So, it would involve a trade-off of costs vs service level. As we increase this percentile value, we are planning for high arrival rates, and we would need more employees to meet our service level by maintaining our desired call waiting time. However, more employees would mean higher employee costs. That’s correct. We’ll close the case here. Okay. Does the client already operate outside India? If yes, what clients is it looking to serve from India – new clients or already existing ones? And will this call center have exclusive clients, or is it just capacity expansion to meet growing needs of existing clients? The client operates outside India as well. However, in India, the call center will be used exclusively for serving an Indian Telecom operator, which our client recently partnered with. Okay, the number of employees will equal the estimated number of calls multiplied by the number of shifts per day. The estimated number of calls at any given moment would further depend upon the arrival rate of calls, duration of answering each call, rate of call drop-off during waiting, and desired waiting time for each caller. That sounds good. Let’s say we want to estimate the arrival rate of calls. We have historical data about customer service from the telecom operator. How do we go about it? So, we would have access to the call logs. We can look at the number of calls in a particular time frame and divide it by the duration of the timeframe to get the arrival rate. This rate would also have variability during different hours in a day, so we will have to take that into account. That’s all fine, but how will you actually use the data? Will you consider the mean, median, or something else? Right. So, I would be using a certain percentile value which is higher than the mean. For example, the 90th percentile value, such that 90% of the arrival rates in the data fall below this selected value. ICON, IIM Bangalore 68 Business Process Outsourcing Case statement Interviewee Notes Unconventional | Moderate | BCG • Client would operate for 250 weekdays in a year • Client will serve only one company – an Indian Telecom operator Structure/Framework • Qualitative analysis • Client has historical caller data Number of employees Number of calls to be attended at a given moment Number of shifts per day Call Arrival Rate Call duration Drop-off rate Waiting time Key Takeaways • Listing down all factors affecting number of employees ensuring MECE was a good start to the case • The candidate initially didn’t comprehend the interviewer’s question about the usage of data, where clarification could have been sought ICON, IIM Bangalore 69 Pharmaceutical Firm Unconventional | Moderate | Kearney Case Statement : Your client is a pharmaceutical company that is seeing a lot of its shipments being rejected. Find out why and provide recommendations Before analyzing the case, I’d like to know a bit more about the client and their problem. Where does the client operate and what is the rejection rate of shipments? The client operates in India and ships the drugs to firms in the US. There are two streams of sending shipments: waterways and airways. Airways constitute 80% of the load and has been seeing a 54% rejection rate. Waterways on the other hand has observed only a 3% rejection rate. Shipment through airways seem to be the major issue so I would first like to tackle that. I would like to compare with waterways and find out the cause of such high contrast. Yes sure. In order to understand where exactly in the supply chain are the shipments being rejected, I would break down the supply chain into 3 parts: 1. Rejected before onboarding 2. Rejected post transit 3. Rejected on reaching the customer. The shipments are being rejected post transit during the customs screening. In order to figure out why the shipments are being rejected, I would like to analyze the package based on package contents – is the content being shipped allowed/legal; packaging conditions – shape, weight, size, material used for packaging and are they according to the customs regulations; physical conditions of the package post arriving – is it damaged or rendered ineffective in anyway? That’s right, the packages are rejected because they are being rendered ineffective. The drug shipments need to be maintained within a temperature range of 15 – 25 degrees Celsius and there are thermal sensors on the shipments that track if they have been exposed to temperatures beyond this limit. Even a single exposure can severely degrade the drug efficacy. Hence customs officials strictly monitor the thermal exposure of each package on arrival. That’s interesting. I will now look at various parts during the airways transit where the shipments could be potentially exposed to temperatures beyond the permissible range. Consider shipment happens throughout the year and all air routes go through the Dubai. I’d break the transit down as: Before loading into the flight, during flight, transit through Dubai, offloading in the US. How is the temperature being regulated at each of these places? Before loading into the flight, the shipments are transported in temperature-controlled vehicles. Inside the flight as well the temperatures are controlled. At Dubai, these containers are kept in warehouses that are temperature controlled. Once offloaded, they are again packed in the controlled containers. There seem to be lapses during the shifting of containers from vehicles to flight, in transfer to the warehouses in Dubai, and while offloading. Dubai experiences severe diurnal whether changes so the timing in which the shipments are being sent out should also be looked into. Also, the landing location in the US can experience seasonality in weather with temperatures likely to drop below the lower limit. However, onloading/offloading exposures could also be there in waterways mode. I would like to know why the rejection rate is so low in that case Great point! When the shipments are sent through ships, they are packed in temperaturecontrolled containers and hence do not face any external exposure. You’ve identified the problems correctly now. Why don’t you come up with recommendations for the client. Before I move on to the recommendations, I would like to know what the client is already doing to tackle these issues. Also, why is the client sending only 20% shipment through waterways, is there a possibility to increase that percentage? Since, waterways are a slower mode of transport, for sending shipments through this mode the client needs to plan shipments in advance which is currently not being done by the client. All right, so I will provide recommendations for what can be improved in the air transport and how the client can send more shipments through waterways: For short term, client can send packages through similar temperature-controlled containers in airways. However, there could be space and weight issue which need to be checked with the regulations. They can also look at alternate routes or direct routes that avoid passage through Dubai. Over the long term, the client must shift their operations to waterways. Better demand forecasting and shipment planning should be undertaken. Thanks, we can close the case here. ICON, IIM Bangalore 70 Pharmaceutical Firm Case statement Interviewee Notes • Focusing on airways first – 80/20 rule • Analyze package journey while loading to reaching the end customers • Rejected at customs – internal factors of package like shape, size, weight, damages. External factors like legal, regulations Unconventional | Moderate | Kearney • Shipments of pharmaceutical drugs being sent from India to US. • Two distribution routes – airways and waterways. Airways consist of 80% of the total distribution load and sees 54% rejection rate • Packages sent through waterways have only 3% rejection rate. Structure/Framework Routes Airways Rejected while loading Rejected post transit Waterways Rejected by end customer Internal Factors External Factors Key Takeaways • Packages getting rejected after landing at the customs screening, because of overshooting the permissible temperature range. • Rejection rate is low for waterways as they operate with temperature controlled containers. • Important to ask the interviewer, why only 20% of the shipment is being carried out through waterways. This will uncover the fact that for waterways, distribution planning needs to be done well in advance, which further brings out that the client needs to focus on improving demand forecasting. ICON, IIM Bangalore 71 Unhappy Friend Unconventional | Moderate | Kearney (Buddy) Case Statement : Your client is a friend of yours who is unhappy since some time. You have to figure out why he is unhappy and give some recommendations to change the situation. What I’m looking for can be related to fans. Reasons for the client to be unhappy that relate to fans could be reduced or unsatisfactory album sales, concert attendance, nominations and awards, and some other factors such as merchandise sales or social media engagement. That’s an interesting problem. Do you mind if I ask some questions to better understand the client? Sure, go ahead. Can I know the profession the friend is in, where does he live, since when is he feeling unhappy, and his interests outside work? Great, so the client is unhappy because the band is not winning a particular award since the last 4 years despite being nominated everytime, and the other factors you mentioned are exceeding expectations. So he is a musician based in Ireland, he is feeling unhappy since about 2 years and he has no other interests. Can I know a little about the award? What is the criterion for receiving it and how are bands judged? Can I know if he’s an independent musician or he plays with a band, if if the latter is true do we have any more details about the band? Sure. He is the lead singer of a jazz band which has been around for 7-8 years now. I’d now analyze the possible reasons for our client being unhappy. To begin with, I will look at them from two lenses – personal and professional. Personal reasons for being unhappy can be broken down into interpersonal and intrapersonal. Interpersonal can include reasons relating to family or friends and intrapersonal reasons could be physical, mental, or emotional. Before I look at the possible professional reasons do you think I have covered everything on the personal reasons front? Please let me know if I have missed something. The personal reasons seem fine. Tell me how you plan to look at the professional reasons? There are two components of evaluation for this award. Public voting and the jury’s decision. The band does really well in the public voting but fails to get through in the jury round. Can you think why? The reasons could be that the band actually fails to meet the jury’s criterion and expectations or there is some personal bias involved. To investigate this further can I know the composition of the jury if relevant, is it the same or has it changed over these 4 years, and how any votes does the band get from the jury. Great questions. So the jury is the same and out of 3 members, one always votes against the band due to a personal bias against the Irish. Oh okay. So, is this the root cause of the client being unhappy or do I look at some other aspects as well? Sure. I’d break the professional reasons as monetary and non-monetary. Perfect. Let’s look at the non-monetary reasons. This is the reason why the client is unhappy. Can you quickly give some recommendations? The non-monetary reasons could be internal or external. Internal reasons could include motivation and whether he is still interested in music or the genre he is into. The external factors could be related to the band members, the fans, or other partners such as record labels or sponsors. Sure. In the short-term, the band can apply to other similar awards, and if they are really keen on the award we discussed, in the long-run they can look at exploring another genre of music so that they could get nominated in another category and be evaluated by a different jury. That’s a good breakdown. Could you think of some more external factors? Thanks. That will be all. Sure. Do you want me to look at factors different from what I have mentioned or related to something covered. ICON, IIM Bangalore 72 Unhappy Friend Case statement Interviewee Notes Unconventional | Moderate | Kearney (Buddy) • Client is unhappy • Recommendations to make the client happy Structure/Framework Friend being unhappy reasons • Musician based out of Ireland – lead singer of jazz band – 7-8 years • Unhappy since 2 years • No other interests Personal Interpersonal Professional Intrapersonal Friends Mental Family Physical Monetary Non-Monetary External Team Emotional Labels and Partners Internal Fans Album Sales Motivation Interest Concert Attendance Awards Key Takeaways • Internal and external is always a good MECE option if nothing is working • Try to use MECE in day-to-day situations to practice. Cases can be as random as this one ICON, IIM Bangalore 73 Movie launch Unconventional | Difficult | Bain (Partner) Case Statement : Your client is a movie producer and is contemplating to launch a movie either on OTT platform now or on theatre (six months later). Help the client take this decision. I would want to start with identifying key revenue streams under both the options and then consider any non-monetary factors which are critical. Sure, go ahead. Thank you. I would want to reiterate the problem statement once to confirm my understanding - Our client (film producer) is deciding whether launch a movie on OTT platform immediately or on theatre (six months later) because of Covid-19 restrictions right now. Is that correct? For OTT platforms, I understand there is generally a fixed sum contract for obtaining rights of the movie. However, for blockbuster movie like Housefull 4, other contract mechanism like fixed sum + per view fee can also be explored. Correct. How would you go about agreeing the contract price with OTT platform Before heading towards the core problem, I would want to understand few basic aspects about the client and case. Different methods can be considered for quoting the contract price to the OTT platform: 1. Cost plus margin: Here client may simply add its targeted margin to the total cost (say 20-30% or more; I am not well versed with profitability in movie industry) 2. Benchmarking with collection from Housefull 1/2/3 and adjusting for time period, Covid-19, OTT growth, saving of distribution cost and other factors. 3. Benchmarking with recent OTT launch: Analysing performance of recent movies launched on OTT and adjusting for Housefull and Akshay Kumar fanbase, target audience, etc. However, I am skeptical whether contract value of other movies can be easily sourced. Am I missing any other important aspect here? Sure, go ahead. What is the genre of movie under consideration and demographics of the key target audience? Also, does it have blockbuster cast? Why do you think genre will impact the launch decision? An action movie with high end visual effects, VFX or a 3D movie can do justice to the audience in theatres with big screen, Dolby sound only. However, a comedy or largely non-action movie can be launched on OTT as well. Fair enough. The movie is Housefull 4; a comedy movie targeted to all age groups and profession. It has a known cast line up including Akshay Kumar. Housefull is an interesting movie and has a positive track record of its earlier versions. As the client is in the phase to decide its launch, is it safe to assume all production costs are already incurred? If yes, at what cost? Also, is revenue the only metric to decide between two platforms? Yes, movie production is done and only marketing and launch is pending. The total budget is ₹100 crores. No, you covered different methods properly. Next, tell me briefly, which factors you would consider to decide the OTT platform to partner with? Key factors to be considered shall be userbase of the OTT platform (free and paid both) and its growth rate, demographics (age group), recent Bollywood movie launched, etc. Fair enough. Let us shift to theatres now. For theatres, the key revenue stream would be box office collection. Out of which a portion needs to be shared with the appointed distribution company. In the current scenario, certain aspects would need to be considered: 1. Reduction in theatre footfall due to Covid-19 risk. However, there is also a probability of vaccine being launched and reduction in active cases. Thus, by the time of launch after 6 months, spring effect may also spike the movie viewership. Situational analysis shall be done with different probability. ICON, IIM Bangalore 74 Movie launch Unconventional | Difficult | Bain (Partner) 2. Financial cost due to delayed launch by 6 months. 3. Additional revenue stream by selling rights to OTT platforms for publishing post theatre launch. 4. Marketing costs (launch events, etc.) Did I miss any key aspect or revenue stream? Yes, one additional revenue stream is missing. The fee collected from sponsors/partners of different categories Yes. Partnering with different brands (media, beverage, fashion, etc.) is also a key revenue source. Ok. You analysed it well. We can stop the case here. ICON, IIM Bangalore 75 Movie launch Case statement Interviewee Notes • Think about contract terms with OTT • OTT selection parameters through customer base and content similarity • Be MECE in thinking about various revenue streams Unconventional | Difficult | Bain (Partner) • Movie producer trying to decide launch timeline because of COVID • Comedy movie targeted across all customer segments • Total budget of INR 100 Cr Structure/Framework Box office collection Pricing OTT contract Cost Plus method COVID-19 considerations Margin on top of cost of production Situational analysis for launch of vaccine, spring effect etc Internal benchmarking Returns on previous Housefull movies General considerations • Financial cost of delay of launch Competitor benchmarking Results from other movies on OTTs • Marketing cost • Sponsorship / partnership revenue Key Takeaways • Interviewer was more interested in approach to case solving than the final answer • Very important to form an initial framework and keep going back to it • Some general information about global happenings in COVID were important ICON, IIM Bangalore 76 Wood Manufacturer Unconventional | Difficult | BCG(Partner) Case Statement : Your client is a wood board manufacturer. They manufacture two kinds of boards – 1. Particle Board 2. TSM. A particle board is a commodity product and is very rough. It cannot be used for furniture. TSM is a more enhanced board with better appearance and quality. It has a larger range of use cases and has multiple variants. The industry is moving towards TSM. The partial board is one of the raw materials used in the TSM board. The company has recently bought a plant and has added a TSM line. However, the plant has not been profitable. I have a few clarifying questions before we go ahead. May I ask them? May I please take a minute to understand the data? Sure. But hurry up please. Okay, so the plant is making a profit of Rs. 25 per unit of particle board and Rs. 40 per unit of TSM. However, due to the fixed costs, the plant is making a net profit of Rs. 1 Million in case of the particle board and Rs. 2 Million (Loss) in case of TSM. That’s odd, considering TSM has a higher gross profit per unit. We may need to analyze the fixed cost further here That is fine, we can investigate that. What else? Sure. Could you please share a bit more about the client – where is the client located? Where is the plant located? And what part of the value chain does the client cover? Is this a client specific issue? Do we have a timeframe for the decline in profitability and magnitude of the same. The client is a global company with worldwide operations. It has entered the Indian market using the plant mentioned earlier. The company sources wood externally and then supplies the finished products to other businesses (B2B) and direct to customers (B2C). 90% of its business is B2B. Yes, this is a client specific issue. Other competitors are not facing this. The plant has not been profitable since acquisition. Okay, so I would like to approach this from the plant’s profitability perspective (Absolute profit). I will arrive at profit using revenue and cost from the plant. Do we have any data available with us? (Shares his screen on zoom) Yes, we do have some data. Here is an exhibit for you: Particulars Particle Board TSM # of Units Sold 200K 100K Price per unit 220 380 Cost per unit: Resin 85 40 Paper 30 100 Material Y 80 190 Particle Board Fixed Cost Attribution Available Capacity in Units 10 Rs. 4 Million Rs. 6 Million 250K 300K Also, the capacity utilization of the plant from the TSM line perspective is lower. It is just 33% utilized. Is there any specific reason for this? Yes, let’s take a look at possible reasons on why the utilization is low. We can look at this from the perspective of supply and demand. (Interrupts) The demand for TSM produced by the client is about 200K units. Oh, so even if we were able to meet the demand, the capacity utilization would still remain at 66%. Yes, so – Is that a problem? (Seemed very impatient at this point) It could mean that there just enough demand for TSM for the plant to be profitable. If the plant manufactures 200K units of TSM, then the profit of the plant would be about Rs. 3 million. Okay, so meeting the demand would make the plant profitable. Yes, in fact, the plant does not even need to meet the full 2L demand to be profitable. Anyways, lets move on. In that case, we can look at the supply side. I would want to break this down into a value chain to identify any bottleneck in the process. I would want to limit my analysis until manufacturing since we know the capacity utilization of the plant itself is low. Of course. Let’s focus on the manufacturing process itself. There are no bottlenecks in the sourcing and inward logistics of raw materials. ICON, IIM Bangalore 77 Wood Manufacturer Unconventional | Difficult | BCG (Partner) But I want to know why this is happening. Okay sure. I am not really sure how the manufacturing process of TSM works. Would it be possible for you to explain this a bit? We know that more variants would evidently mean smaller batches. Smaller batches would in turn mean that the machines in the process would have to be changed in terms of configuration repeatedly. Is this happening in our case? Yes. The RM enters the factory line (including the particle board). All the materials are cut as per the required length. There are 3 variants – 3M, 5M and 6M. Then the painting process is conducted depending on the type of color required (brown, blue, black, white, etc.). Finally, a varnish coating is applied – again depends on the application of the TSM – for furniture, outdoor wall, indoor wall, etc. Lastly, the products are packaged depending on the variant and the destination. Yes, that is exactly what I was looking for! The higher number of variants lead to smaller batch sizes. That impacts production planning in case of TSM. It also leads to more unproductive hours which are spent on machine set up. Do you have any recommendations in mind? Okay, so in order to identify why the capacity utilization is low, we would have to look at each part of the process and see which part is utilized the most. Do we have any data on this? We know that the utilization is low across all parts of the process. Okay, I would want to look at the two departments. TSM and particle board. Are there any differences in policies between the two departments? The reason I am asking for this is because the particle board department has a fairly strong utilization ratio despite being in the same plant (thereby eliminating any external factors). I have 3 recommendations in mind – Considering the greater number of variants, the client should try to negotiate longer lead times (Increase 2 weeks). We can identify which of the 25 variants form the tail of the demand curve. Those variants should be scheduled for bulk production during off peak seasons and stored in a warehouse. This will reduce the number of variants in production during BAU. The client can outsource some parts of the process to distributors assuming quality control is feasible – follow a model like the paints industry. Eg. Move the varnish process to distributors. This sounds okay. Please wait here. (Leaves the zoom call) There are two key differences. 1. There are about 25 different variants of TSM which have been specified by the marketing team after months of market research. Particle board is a commodity product. 2. The order to delivery time for TSM is 2 weeks while that of particle boards is 4 weeks. Okay, so we have a greater number of variants which increases complexity, and we have a lower order to fulfillment time Yes, why do you think this led to lower utilization of the plant in case of TSM? I am not sure as of now. I need to think over this. Do we have any date on what kind of fulfillment mechanism we follow? Do we follow FIFO, LIFO or best fulfilment estimate They follow the best estimate method. How does that even matter for capacity utilization? In that case, I would want to delve into the delivery timelines we have selected. We have picked 2 weeks for TSM even though there are more variants. While we have picked 4 weeks in case of Particle board even though there is just 1 variant. Is that causing the bottleneck? ICON, IIM Bangalore 78 Wood Manufacturer Case statement Interviewee Notes Unconventional | Difficult | BCG (Partner) • Wood Manufacturer • 2 kinds of boards – one preferred over other • Plant not profitable Structure/Framework • Data already presented in case Low-capacity Utilization Profits Supply Revenues Demand Costs Raw materials Inward logistics Manufacturing Outward logistics Distribution Key Takeaways • The case can be number heavy so be prepared for that. Without getting intimidated, try to for data relevant to the case • Remain calm even if the interviewer is irritated. ICON, IIM Bangalore 79 Automobile – Electric 2-wheeler Case statement Interviewee Notes • To estimate 2-wheeler EV market, find population who would buy 2-wheeler and multiply by avg. price • Consider only urban because of EV infrastructure facility readiness in 5 years • Age group b/w 18-50 is considered as people above this age generally don’t buy 2 wheelers • Income affordability, preference towards cars and petrol vehicles is considered and 1% was approved by the interviewer • Avg. price of 2-wheeler assumed 1L INR Guesstimate | Easy | Accenture (Partner) Estimate the market size for electric 2-wheeler in India after next 5 years, say 2025. Structure/Framework Population of India in 2025 140 Cr Urban – 30% 42 Cr Age group 18 to 50 – 50% 20 Cr People who can afford and enjoy – 1% 20 L Rural – 70% Other age group – 50% Students, low income who can’t afford, rich people who prefer cars and people who continue with ICE vehicles -99% Assuming avg. price of 2-wheeler is 1 Lakh INR, Market size = 20L *1L = 20000 Cr Key Takeaways • Buy-in from interviewer for all assumptions and percentages is important. • One does not need exact split of various categories and percentages based on stats or data. The candidate groups various categories and indicates a percentage based on those clubbing with appropriate reasoning which was approved by interviewer. This saves a lot of calculation hassle. ICON, IIM Bangalore 80 Food Delivery App Guesstimate | Moderate | Bain Your client is an online food delivery app who has approached you to estimate the market size of such a service and the changes that can be expected by 2025. Before proceeding, I would like to clarify a few aspects of the case. When you say a food delivery app, can I assume the product to be like Swiggy? Also, for the market size, should I estimate the number of users or the dollar-value of the market? Yes, you can assume the product to be similar to Swiggy and for the market size please estimate the dollar value. Also, I would like to see how you would go about estimating the market size and the assumptions that go along with it. We can calculate the exact numbers later if time permits. Thanks. Based on the information, I would like to structure by analysis based on the demographics of India. I will first split India into rural and urban. Considering that this is a food delivery app which requires access to smart phones and internet as well as places that deliver food, we can remove the rural market from our analysis. For the urban market, I would look at the age and income segments to get to the market size. Does this seem like a fair approach to you? Yes. That seems more accurate. Please continue. Again, since this would require the ability to use smart phones and order food of the internet, we can rule out the 60+ age segment. Is that OK? Sure. Continue Each age group can now be divided further into income segments and then average frequency of ordering and purchase value for each group can be determined. Since, we are talking about the urban group, we can assume the following split: 1) Less than 5LPA: 30%, 2) 5LPA-15LPA: 60%, 3) More than 15LPA- 10%. Given the income ranges, we can remove the low-income category from our estimates. Is this alright? Yes. That’s OK. Carry on. Now within the 0-20 age groups, we can cover kids from 0-18 as they would mostly be living with their parents who will be ordering for them. College students from 18-20 will be the ones ordering directly. Based on this we can assume the following numbers for each age group. Yes. Please go ahead. Age Group Alright. Based on the latest census data 70% of the country’s population reside in rural areas and 30% in urban. Even within the urban population, the market for such a product would predominantly be present in Tier-1 and Tier-2 cities which would be around 50% of the overall urban population. After that, I would divide the population in to 4 age segments0-20, 20-40, 40-60 and 60+ and assume an equal split of population among them. 0-20 Does an equal split among age segments feel like a fair assumption to you? 40-60 Actually, no. Considering that India is a young country, population would be skewed towards the younger age groups. So, 0-20 would be 30%, 20-40 would be 40%, 40-60 would be 20% and 60+ would be 10%. 21-40 Income Segment Order Frequency Average Order Value 5-15 LPA 1 time per week INR 150 >15LPA 1.5 times per week INR 200 5-15 LPA 2 times per week INR 300 >15LPA 3 times per week INR 400 5-15 LPA 1 time per week INR 600 (family order) >15LPA 1.5 times per week INR 800 (family order) Should I now calculate the exact numbers or discuss on trends by 2025? ICON, IIM Bangalore 81 Food Delivery App Guesstimate | Moderate | Bain No. That’s OK. No need for exact numbers. Let’s talk about changes by 2025. Great. So based on my understanding, I expect the following changes by 2025: As internet penetration increases, Some of the Tier-3 cities and rural markets might also become a viable market Income levels in India have been rising and middle class is becoming larger. So, we can expect that both the order frequency and average value per order to go up. This is more or less in line with our findings except the rise in average order value which we estimated to be more or less constant. But this was a good analysis. We can close the case now. Thank you. ICON, IIM Bangalore 82 Food Delivery App Case statement Interviewee Notes • Focus on the intersection of the population and income demographics • Population is skewed, more number in the younger age brackets • Spending is dependent on the income level, only those with dispensable income should be considered Guesstimate | Moderate | Bain • Food delivery app which wants to determine the market size today • Also want to see how the market is expected to change by 2025 Structure/Framework Income Segment Population <5 LPA: 30% Rural: 70% 5 – 15 LPA: 60% >15 LPA: 10% Urban: 30% 0-20: 30% 20-40: 40% 1 time per week, Rs. 150 2 times per week, Rs. 300 1.5 times per week, Rs. 200 3 times per week, Rs. 400 1.5 times per week, Rs. 800 40-60: 20% 1 time per week, Rs. 600 60+: 10% Key Takeaways • Estimate consumer spending habits focusing primarily on a younger population with higher incomes • Value of the market will trend upwards given the increased internet penetration and spending by consumers • Mobile phone usage is an important factor to take into consideration ICON, IIM Bangalore 83 Food Delivery Customer Care Guestimate | Moderate | Deloitte Case Statement : We have a food delivery platform like Swiggy in NCR. We are getting a lot of customer care requests and queries and the manpower is not enough right now due to the COVID situation to handle all the queries. What should we do to reduce the load on the current customer care executives? I want to understand your approach. Make your own assumptions for any other information you require. Okay. Since, we are looking at resolving the queries and requests, we can divide the requests into two parts: 1. Requests for information about the order status, location of delivery person, and other similar information 2. Personalized and specific requests and complaints The responses to requests in bucket 1 can be automated through a service or a bot, thereby reducing significant load on the customer care executives. And the customer care executives can just respond to requests in bucket 2. only 10% order every day, that is 7200. I would then divide the day into 4 parts, based on traffic: 8 AM – 2 PM, 2 PM – 7 PM, 7 PM – 12 AM, 12 AM – 8 AM. All times of the day don’t get the same traffic. We can divide daily traffic into these slots. Sounds good. How would you do that? I would assume high traffic in the first slot, medium traffic during the second slot, traffic again peaking in the third slot due to dinner and minimum traffic in the last slot. So, we can assume the distribution of traffic as follows; 8 AM – 2 PM : 35%, 2 PM – 7 PM : 20%, 7 PM – 12 AM : 40%, 12 AM – 8 AM : 5% Of all the traffic, not everyone will create a query about their orders. That should be around 10% maximum. So, by slot it would be 8 AM – 2 PM : 252, 2 PM – 7 PM : 144, 7 PM – 12 AM : 288, 12 AM – 8 AM : 36 How will those request in Bucket 1 be automated? We can categorize the different type of requests that are received into separate classes depending upon their type. For example: status of order, location of delivery person, time for the order to be delivered, cancel the order, modify the order, etc. For each class, we will calculate the volume of such requests and their frequency of occurrence. Requests with high frequency and volume can be directly integrated as options for requests while a person raises a request and can be automated completely. In case, the customer doesn’t feel satisfied with the automated response, he can still request for a customer care executive to talk to. Okay. Let's say if the system is not automated, can you provide a rough estimate how many customer care executives will we need for Delhi NCR? Please make your own assumptions. Alright. So, I would like to begin with the assumption that Delhi’s population is 12 million. And there is 60% internet penetration. Of all the people have internet, I am assuming only 1% people are using our services. That makes it 72,000. Let's say of all the registered users Right, so if we have two shifts of 12 hours, how many people do we need? We have maximum of (288/5) 58 requests per hour. Assuming a request takes 5 min on average to resolve, we need 5 customer care executives simultaneously in case of the 7 PM 12 AM slot. Similarly, in case of the 1st slot, we would have 252/6 = 42 requests per hour. This would require 4 employees. So, we can have 4 employees from 7 AM – 7PM , and 5 employees during 7PM to 7AM slot. Great. So, what will be your recommendations? Automate the simple requests that can be directly answered by the bot without human help. These requests can be decided based on the frequency and volume. Refer to the customer care executive only in cases of complex requests ICON, IIM Bangalore 84 Food Delivery Customer Care Case statement Interviewee Notes Guestimate | Moderate | Deloitte • Client is food delivery platform • Lot of customer care requests; manpower is not enough due to COVID • How to reduce the load on the current customer care executives? Structure/Framework • Delhi Population: 12 mn • Users: 12 mn*0.6*0.01 = 72,000 Current Users (7200/day) • Users/day: 72000 * 0.1 = 7,200 8 AM – 2 PM 0.35*0.1*7200 = 252 2 PM – 7PM 0.2*0.1*7200 = 144 7 PM – 12 AM 0.4*0.1*7200 = 288 12 AM – 8 AM 0.05*0.1*7200 = 36 Key Takeaways • The interviewer was looking for the approach and problem-solving skills rather than the numerical data and assumptions. ICON, IIM Bangalore 85 Four-wheeler Tyres Case statement Interviewee Notes • Total population – 130 Cr • 4 members per family • 32.5 Cr Households • 1 car per MI house • 2 cars per HI house • 350 people/ sq. km • 1 taxi/10 people in metro • 35 cars/ sq. km • Avg tyre usage – 50K kms • Annual car usage – 10K kms • Avg tyre age – 5 years • 5 tyres per car user • Avg tyre purchase = 5 tyres/5 years = 1 tyre/ year Guestimate | Moderate | GEP consulting (Manager) • Calculate the number of 4-wheeler tyres sold in a year Structure/Framework No. of 4-Wheeler tyres Personal Cars Commercial Taxis Metro area: 4250 sq. km 32.5 Cr households Low Income (50%) Middle Income (40%) 13 Cr Cars High Income (10%) 1.5 lac Taxi cars 6.5 Cr cars Total personal: 19.5 Cr Total Cars: 19.515 Cr Total Tyres: 19.515 Cr/ year Key Takeaways • Candidate used 2 different approaches for 2 sub parts of the same problem – demand side for personal cars and supply side for commercial cars. ICON, IIM Bangalore 86 Automatic Vacuum Cleaner Guesstimate | Moderate | McKinsey (Partner) Case Statement : Guesstimate the annual demand for automated vacuum cleaners in India. It sounds interesting. Can you please explain what an automatic vacuum cleaner means? Is it something like a vacuum cleaner, which moves around and cleans automatically. Correct. Assume that it is a new sensor-based vacuum cleaner which cleans the floor automatically. This is the first time it is being launched in India. So, before starting with the analysis, I would like to ask a few clarifying questions to get a better understanding about the product and our client. Is that okay? Sure, go ahead. Do we have any information about the company which is launching the product and the price point? You can assume it to be around INR 10 – 20K and its being launched by a foreign major. Which geography is being targeted and what are the channels of sales? The company is targeting pan India and the sales channel is online for first few years. Amongst the 10 Cr urban households, we can assume that upper, middle and lower class are in the ratio of 1:5:4. This gives us 1 Cr upper class, 5 Cr middle class and 4 Cr lower class urban households. I would now like to assume a conversion factor to get the demand for the vacuum cleaners. We can say that something around 50 % of urban upper class and around 20% of urban middle class will be looking forward to buy this product. Given the price point lower class people would not be interested. Are the assumptions fine with you or do we have any specific data on this? Yes, that’s perfect. Give a final number and some comments. So, this gives us a demand of 1.5 Cr automatic vacuum cleaners. However, this is just an estimate for first year. For any other average year, we need to divide it with the life of the product. And the sales would also depend on the marketing of the product. That’s perfect. Can you just tell an approach for finding the institutional demand. For institutional demand, we can estimate the working population, multiply it with the office surface area required per person and then calculate the vacuum cleaners required for cleaning the surface. Can you think of any other approach for institutional demand ? So just to summarize, I need to estimate the annual demand of a new automated vacuum cleaner in India which is to be sold online. So, the approach I want to go ahead with is to split the demand into two: domestic and institutional sales. That sounds great, let’s move into domestic sales first. So, in domestic, I would like to calculate the number of households in India. Taking 1.3 billion as the population of India and the average household size to around 4, we get around 30 Cr households in India. And dividing it in rural and urban in 2:1 proportion, we get 10 Cr urban households and 20 Cr rural households. Within urban I would like to subdivide in income classes, and an assumption can be made that the rural demand will be zero as it is an expensive new automatic product from a foreign player. Yeah, we can start with Fortune 500 or any other dignified list of companies and see how many offices do they have in India and then find the demand. These companies will probably be the early adopters for this expensive new technology. Thanks. It was nice speaking to you. We can end the case over here. Yes, you can ignore the rural segment. ICON, IIM Bangalore 87 Automatic Vacuum Cleaner Case statement Interviewee Notes • Divided into Domestic Demand and Institutional Demand • For domestic demand, India household: 30 Cr (130 Cr population/ 4 people in household) • Ignore rural segment. Guesstimate | Moderate | McKinsey (Partner) • Client is looking to launch automated vacuum cleaners pan-India • Price point is around INR 10-20K • Client is a foreign MNC. Structure/Framework Domestic Demand Indian households (30 Cr) Rural (20 Cr) Institutional Demand Urban (10 Cr) Ignore Upper class urban (1 Cr) 50% penetration (0.5 Cr) Middle class urban (5 Cr) 20% penetration Lower class urban (4 Cr) Ignore Key Takeaways • Clarify the problem statement clearly, especially for novel products. • Keep validating your assumptions with the interviewer as you proceed. • Since the domestic demand approach was explained clearly with numbers, institutional demand was explained qualitatively. ICON, IIM Bangalore 88 COVID Tests Case statement Interviewee Notes • Focusing on people coming into the city only • Gwalior City – 12.5 Lacs population • 0.4% incoming travelers (validated by interviewer) • 50% symptomatic – needs testing • Considering 2 level chain of contacts • Every person has 4 direct/ primary contacts • Every primary contact has 4 secondary contacts Guestimate | Difficult | GEP consulting (Buddy) • Calculate the number of COVID tests to be conducted in a city daily Structure/Framework No. of COVID tests People coming in city (0.4% of 12.5 Lakh) Airways (20%) Roadways (50%) People who want to travel out of city People within the city with no travel plan Railways (30%) 1000 2500 1500 Symptomatic – 50% 500 1250 750 Asymptomatic – 50% 0 0 0 Primary Contact (4* symptomatic) 2000 5000 3000 Secondary Contact (4* primary) 8000 20000 12000 52,500 Key Takeaways • Candidate could have considered some fraction of voluntary tests by Asymptomatic travelers • All the broad numbers in the case were basis assumptions validated by the interviewer ICON, IIM Bangalore 89 For any queries, reach out to us ICON – Consulting Club, IIM Bangalore